In-Dash Navigation System Market Size, Share, Trends and Forecast by Component, Technology, Screen Size, Vehicle Type, Sales Channel, and Region, 2025-2033

In-Dash Navigation System Market Size and Share:

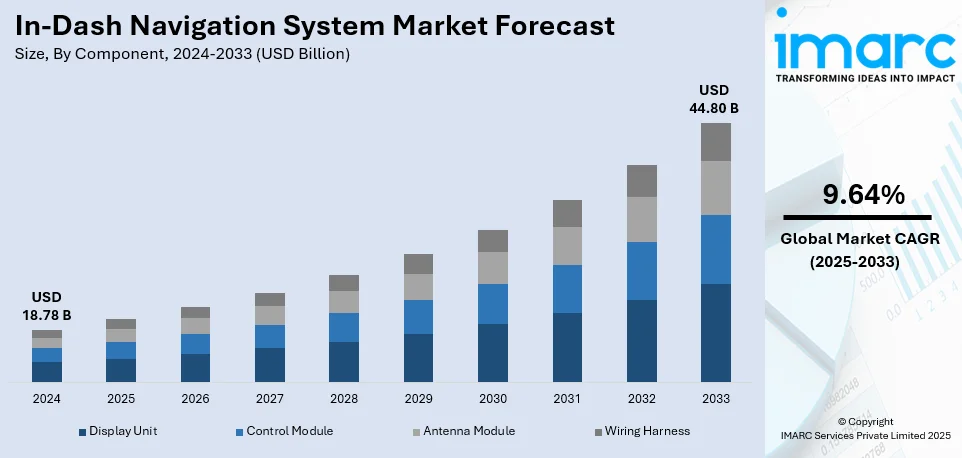

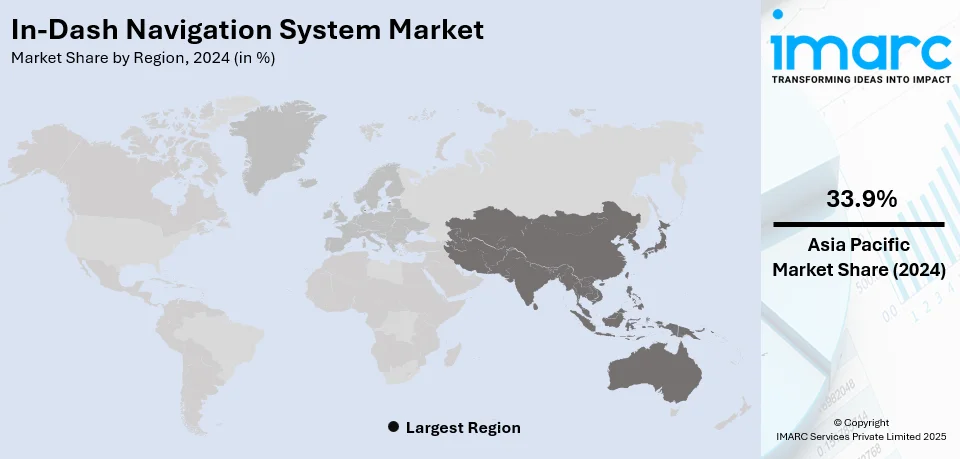

The global in-dash navigation system market size was valued at USD 18.78 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 44.80 Billion by 2033, exhibiting a CAGR of 9.64% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 33.9% in 2024. The growing demand for convenient and safe solutions in vehicles, increasing need for real-time information, and rising demand for technologically advanced feature in single unit represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.78 Billion |

|

Market Forecast in 2033

|

USD 44.80 Billion |

| Market Growth Rate (2025-2033) | 9.64% |

In-dash navigation systems are also experiencing a hike in demand as the production of vehicles increases in developing economies. To enhance the driving experience and safety on the roads, infotainment, and navigation solutions are being introduced in the advanced cars by car manufacturers. Moreover, artificial intelligence (AI) based mapping, real-time traffic information, and route planning is further enhancing the functionality of these in-dash systems. Adoption of electric vehicles grows based on escalated demand for in-dash navigation with optimized charging station locators. Governments introduce norms mandating built-in navigation for better road management and emergency assistance. Penetration of 5G connectivity amplifies, further enhancing system capabilities to ensure seamless real-time updates and cloud-based mapping. With the trend of smart mobility, including autonomous driving and connected vehicles, manufacturers are focusing on in-dash navigation systems as a key component for enhanced vehicle intelligence. For example, in January 2025, BMW unveiled its Panoramic iDrive, featuring a 3D heads-up display spanning the windshield, integrating augmented reality for navigation and driver assistance, eliminating the traditional gauge cluster. Furthermore, continuous advancements in software and hardware are further expanding market opportunities.

In-dash navigation systems are experiencing huge demand in the United States with 82.50% of market share, as connected vehicles and intelligent transportation systems are being highly adopted. The automakers are integrating advanced navigation solutions with voice recognition, augmented reality (AR), and real-time traffic analytics to provide enhanced convenience for drivers. Spectrum allocation for V2X communication has been supported by the FCC to improve the efficiency of the navigation systems. Growing concerns over the congestion of urban areas are motivating municipalities to adapt smart traffic management, and for this reason, in-dash navigation is one of the prominent features. People are also insisting on more seamlessly integrated systems that work with a smartphone, giving rise to factory-fitted Apple CarPlay and Android Auto-infotainment. For instance, in September 2024, Ford launched its Android-based “Digital Experience,” integrating Apple CarPlay and Android Auto with a 48-inch Panoramic Display, ensuring seamless smartphone mirroring and intuitive in-car software for enhanced driver experience. Additionally, new ride-hailing services and companies managing fleets demand precise navigation to optimize routes while saving fuel. With continuous technological innovation and government support for connected vehicle infrastructure, in-dash navigation adoption in the US is expanding.

In-Dash Navigation System Market Trends:

Integration of Advanced Driver-Assistance Systems (ADAS)

The integration of ADAS systems into in-dash navigation systems is changing the experience in automobiles. Navigation systems are increasingly equipping with ADAS features, starting from lane departure warning, collision avoidance, up to adaptive cruise control to enhance safety as well as convenience in driving. These ADAS technologies leverage sensors, cameras, and radar for real-time data relay to drivers to promote safe navigation by providing an alert or automatic responses to potential hazards. For example, the lane departure warning feature integrated with ADAS will alert the driver that he or she has drifted out of lane unintentionally and will also help the driver control his speed by automatically changing the cruise control to suit road conditions. Such features as lane departure warnings, collision avoidance, and adaptive cruise control in ADAS are fast becoming standard. The U.S. National Highway Traffic Safety Administration (NHTSA) claims that the deployment of ADAS technologies can save up to 40% of road fatalities. The push towards autonomous driving is also further driving the implementation of these systems because automakers want to deliver a safer and more efficient ride. The trend further appeals to consumers who want more safety features for cars, hence creating a demand for more developed in-dash navigation systems.

Real-Time Traffic Updates and Cloud Connectivity

Demand for in-dash navigation systems is, therefore, increasing because people now require real-time traffic updates as well as connectivity to the cloud. This makes it impossible to navigate on busy roads where frequent traffic congestion creates delays, requiring dynamic real-time data from such navigation systems to avoid traffic congestions. U.S. Department of Transportation (DOT) estimated 51 hours wasted in traffic during 2022, which brings the need to update navigation to real-time status. These navigation systems use in-dash updates from cloud platforms to provide a relevant traffic input on construction zones, accidents, and sudden jam. These systems provide real-time traffic information and update routes in order to help the driver take the most efficient path. Cloud connectivity also provides live weather updates, personalized route suggestions, and points of interest, making navigation easier. Moreover, cloud integration enables continuous system updates, which ensures that drivers are always up to date with the latest maps and features without the need for manual intervention. This trend not only gives a better driving experience but also increases the demand for connected in-vehicle solutions, which is beneficial to both consumers and automotive manufacturers.

Adoption of Voice-Controlled Navigation

Navigation has fast turned into one of the dominant features in in-dash navigation systems due to the growing popularity of voice assistants such as Amazon Alexa, Google Assistant, and Apple's Siri. A 2024 SoundHound AI survey found 76% of U.S. drivers are likely to use voice assistants with generative AI capabilities if available in their cars. It's an easy-to-use feature - voice control that enables drivers to interact with a navigation device without having to take hands off the wheel or shift one's view away from the road, decreasing distractions while the safety feature is augmented. By speaking commands, drivers can input destinations, change routes, adjust volume, or access other navigation features. This hands-free capability meets the growing consumer demand for convenience, ease of use, and safety while driving. Voice recognition technologies have also become more sophisticated, allowing for natural language processing and better accuracy in understanding diverse speech patterns. Other vehicle functions are also integrated with voice control, further enhancing the overall driving experience. As consumer preference for seamless and intuitive interaction with technology increases, the adoption of voice-controlled navigation continues to expand across the automotive market.

In-Dash Navigation System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global in-dash navigation system market report, along with forecasts at the global, regional and country level from 2025-2033. Our report has categorized the market based on component, technology, screen size, vehicle type, and sales channel.

Analysis by Component:

- Display Unit

- Control Module

- Antenna Module

- Wiring Harness

Display unit are the largest market share of in-dash navigation systems, accounting for 37.9% of the market, driven by consumer demand for high-resolution touchscreens and user-friendly interfaces. Automakers are integrating advanced displays with anti-glare coatings, OLED technology, and haptic feedback to improve usability and visibility under different lighting conditions. Capacitive touchscreens are in increasing demand because they provide enhanced responsiveness and multi-touch capabilities. With the introduction of AR-based navigation, larger, more interactive screens are being put into dashboards to enhance route guidance and assist drivers. As EVs expand, real-time battery optimization display requirements are forcing advanced screen technologies to become essential parts of a navigation system. Innovations, through partnerships between car manufacturers and display manufacturers, are furthering the integration process with infotainment and connectivity features. The growing demand for premium in-car experiences from consumers is driving investments in high-quality display units.

Analysis by Technology:

- 2D Maps

- 3D Maps

2D maps are widely used in in-dash navigation systems because they are simple, have lower processing requirements, and are easier to understand. Automakers continue to add 2D mapping solutions in mid-range and entry-level vehicles, where cost efficiency and quick accessibility are considered. Unlike 3D maps, 2D navigation requires less system memory and computational power, making it ideal for budget-friendly infotainment systems. These maps are also more favored in rural and less urbanized areas where detailed 3D graphics are not required. With real-time data updates, traffic congestion overlays, and predictive route planning, 2D maps provide the most reliable navigation solutions without needing high-end graphics processing. Most OEMs continue to bundle 2D maps with their standard infotainment packages, thereby ensuring that drivers have a working and efficient navigation option. Such integration means that even improved maps include higher accuracy on route directions and adaptable real-time traffic conditions.

Analysis by Screen Size:

- Less Than 6 Inches

- 6 Inches to 11 Inches

- Greater Than 11 Inches

In terms of display sizes, a market leader will remain the screen sizes of between 6-inches to 11-inches because they most precisely balance visual prominence, function, and cosmetic compatibility with vehicle dashboard designs. Passenger cars overwhelmingly opt for it due to clearer mapping and appropriate aesthetic fit onto a dashboard of any car, although manufacturers lately tend to support the use of this size owing to its multifunctional in-dash navigation with infotainment and vehicles diagnostics. Consumers want bigger screens for better visibility and touch functionality, especially with high-definition map graphics and interactive route planning. Voice recognition and gesture control features are also being optimized for this screen range to enhance hands-free navigation. As electric and autonomous vehicles become more prevalent, these screens are further enhanced with AI-driven route suggestions, battery optimization guidance, and adaptive real-time updates. Integration of high-resolution displays with AR-based navigation features is further driving innovation in this segment.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

In-dash navigation system market is primarily dominated by passenger cars, at 70.0%, on account of a growing demand from consumers for infotainment and connectivity features that are smart in nature. To increase the comfort of drivers, automakers have started fitting these systems as a standard or an optional feature inside the vehicle, thus reducing reliance on external devices. Advanced driver assistance systems (ADAS) and real-time traffic updates have been integrated into these systems to enhance road safety and efficiency. The increasing number of electric vehicle (EV) sales is boosting demand further because navigation systems enable the optimization of routes based on charging station availability and battery range. Automakers are also giving importance to integration with smartphones in a seamless way using Apple CarPlay and Android Auto, providing a better experience for users. The premium car segment is more inclined toward AI-powered navigation that includes predictive analytics and AR overlays. With rising urbanization and increasing traffic congestion, in-dash navigation systems have become a critical component in modern passenger vehicles.

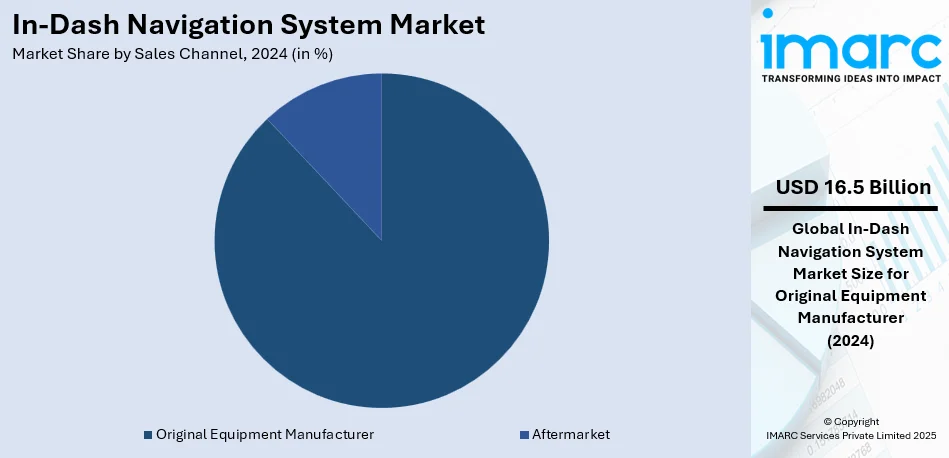

Analysis by Sales Channel:

- Original Equipment Manufacturer

- Aftermarket

Original equipment manufacturers (OEMs) are the leaders in the in-dash navigation system market, with a share of 87.8%, as car manufacturers are increasingly equipping their vehicles with factory-fitted navigation systems. OEM-installed navigation solutions are preferred by consumers because they are integrated seamlessly, reliable, and feature-rich compared to aftermarket options. Automakers are collaborating with technology providers to upgrade the capabilities of the system, including real-time traffic updates, voice recognition, and AI-driven route optimization. OEM-installed systems are far better for aesthetic appeal of the dashboard and provide compatibility with all other in-car features, like climate control, vehicle diagnostics, and infotainment. Built-in navigation is also being enforced by many governments and regulatory bodies to increase safety on the road and emergency response times. Furthermore, high-end car manufacturers have been introducing AR-based navigation high-resolution touch screens to provide improved user experience. Consumer expectations for integrated vehicle technology continue to rise. OEMs update their in-dash navigation systems with cloud-based mapping and over-the-air, or OTA, software updates.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific leads the global in-dash navigation system market with 33.9% share as vehicle production in this region has increased, accompanied by rapid urbanization and high demand for smart mobility solutions. The demand for factory-fitted navigation systems has also been found to be highly demanding in China, Japan, South Korea, and India. Increasing disposable income and changing preferences among consumers are responsible for rising demand for connected vehicles. Government initiatives supporting ITS and smart city projects are further speeding adoption. Automakers in the region are integrating advanced navigation solutions with AI-powered traffic management, real-time road conditions, and predictive analytics to offer enhanced user experience. Moreover, this is fueling demand for navigation systems that assist in optimizing routes based on availability of charging stations, given the booming EV market in the region. Region-specific local tech giants are also investing in mapping and AI-driven navigation technologies. Thus, there will be amplified smartphone integration through Baidu Maps and Google Maps to strengthen market growth.

Key Regional Takeaways:

North America In-dash navigation system Market Analysis

Growth in the North American in-dash navigation system market is being led by the rising adoption of connected vehicles, advanced driver assistance systems (ADAS), and intelligent transportation infrastructure. Automakers are integrating AI-powered navigation with real-time traffic updates, predictive routing, and voice recognition to improve driver convenience. The growing penetration of electric vehicles is further propelling demand because navigation systems can optimize routes according to charging station availability. The U.S. market is dominated by high consumer demand for premium infotainment features and government regulatory support for vehicle connectivity. Automakers are partnering with tech firms to provide OTA software updates; this will improve navigation accuracy and enhance the user experience. The Apple CarPlay and Android Auto adoption is also enhancing system integration. The growing urban congestion and government policies promoting smart transportation solutions are making in-dash navigation systems an integral part of modern vehicles, leading to continued market growth in North America.

United States In-Dash Navigation System Market Analysis

U.S. in-dash navigation system market thrives with the demand for advanced automotive technologies and superior driving experience. Sales of new vehicles in the United States reached over 15.6 million units in 2023, with the majority toting in-dash navigation systems, according to the U.S. Department of Transportation. As GPS navigation becomes the new standard, innovation in the real-time traffic updates and AI-powered navigation solutions continues at the top with Garmin and TomTom at the helm. The inclusion of Apple CarPlay and Android Auto is also pushing the growth because consumers want a painless connectivity experience. Electric vehicles are gaining popularity, and more than 1.1 million have been sold as per reports in 2023, which is pushing the business forward because most EVs come with the latest in-dash technology. The move to make vehicles safer and to give vehicles an autonomous future fuels innovation.

Europe In-Dash Navigation System Market Analysis

Europe's in-dash navigation system market is booming with the expanding automotive sector and increasing consumer demand for infotainment systems. The European Automobile Manufacturers Association indicated that over 10.5 million cars are sold in the EU, 2023 many of which with advanced navigation features. The countries with high uptake of connected car are Germany and the UK whose new vehicles go with an onboard navigation system greater than 70%. Electric cars are on rising demand. Electric vehicles comprised 22.7% of the new car registrations in the EU in 2023, where EVs usually provide very advanced navigation systems in their dashboards. Bosch and Continental are among the leaders in producing more integrated, intuitive navigation solutions. The region is also experiencing an upsurge in regulatory standards related to road safety, which are driving the demand for advanced navigation and driver assistance systems.

Asia Pacific In-Dash Navigation System Market Analysis

Due to the increased automotive industry and smartphone penetration, the in-dash Asia Pacific navigation system market is booming. According to the industrial report, during 2023, China sold more than 22 million cars, many of which contained in-dash navigation systems. With growing disposable income and an amplified interest of people in features like connectivity, especially during the recent past in countries, such as Japan and India, advance navigation solutions are gaining immense ground. The region is seeing popular demand for smart features like real-time traffic updates and voice-assisted navigation. Another driving force behind China's move towards adopting electric vehicles is accelerating the demand for navigation systems installed directly into dashboards tailored to meet the requirements of electric vehicle owners, which pushed sales of more than 7.5 million units of electric vehicles in 2023 according to reports. The local innovations by companies, such as Baidu and Alibaba help the region foster healthy competition in technological advancement for navigation.

Latin America In-Dash Navigation System Market Analysis

The in-dash navigation system market in Latin America is emerging, as connected technologies attract increasingly more interest in the automotive industry. An industrial report indicated that Brazil sold more than 2.5 million new cars in 2023, with navigation systems built into many. The growth in sales of smartphones and mobile-based applications for navigation across the Latin American nations is also driving the market upward. Moreover, the increased middle class is compelling demand for high-end automobiles, which are integrated with advanced infotainment in-car systems. In Mexico and Argentina, greater penetration of the technologies is happening, driven by modernization of the automotive stock. Local players are now incorporating the navigation systems in lower price automobiles, hence widening the scope of the market. Moreover, the increasing market for electric cars in Brazil is likely to drive the demand for sophisticated navigation systems specific to EVs.

Middle East and Africa In-Dash Navigation System Market Analysis

In the Middle East and Africa, in-dash navigation system market growth is steadily rising with an increase in vehicle sales and demand for luxury cars. According to the UAE Government, more than 225,390 new cars were sold in 2023, and a high percentage of those contain in-dash navigation systems. The demand is increasing in the Middle East region, especially Saudi Arabia and UAE, for luxury and high-tech cars fitted with developed navigation facilities. The infrastructure development, especially through smart city initiatives, is adding to the demand for navigation solutions in the region. In-dash electric-vehicle-specific navigation is steadily picking up due to the UAE's push toward electric vehicles. The government has announced that by 2030, electric vehicles are supposed to comprise 10% of all vehicles on the road. Both local and international manufacturers are capitalizing on this investment to develop R&D for these evolving consumer demands.

Competitive Landscape:

The in-dash navigation system market is competitive. Companies are focusing on innovation, partnerships, and software for enhancing the systems' capability. Companies are integrating AI-driven navigation, AR overlays, and real-time traffic analytics for better user experiences. In this aspect, investment is being done toward connected and autonomous vehicles, shifting towards cloud-based mapping, and Over-the-Air updates for fresh navigation data. This includes the development of factory-fitted systems, which create seamless integration with a smartphone, voice recognition, and predictive route planning, all integrated through local collaboration between players in this market and car manufacturers. The demand for electric vehicles has led to specialization in such features as locators of charging stations and battery optimization routes. Customization for regional preferences is also important, which deals with local traffic patterns, regulations, and languages. Competitive differentiation is coming from better user interfaces, higher-resolution displays, and AI-powered personalization to ensure that in-dash navigation will remain an important feature of future vehicles.

The report provides a comprehensive analysis of the competitive landscape in the in-dash navigation system market with detailed profiles of all major companies, including:

- Alpine Electronics Inc. (Alps Electric Co. Ltd.)

- Faurecia Clarion Electronics Co., Ltd.

- Continental Aktiengesellschaft

- DENSO Corporation

- Garmin Ltd.

- Harman International Industries (Samsung Electronics Co. Ltd)

- JVCKENWOOD Corporation

- Luxoft Holding Inc. (DXC Technology Company)

- Mitsubishi Electric Corporation

- Pioneer Electronics (USA) Inc.

- Robert Bosch GmbH

- TomTom International BV

Latest News and Developments:

- September 2024: MapmyIndia launched Mappls Gadgets, which include in-dash Navitainment systems for cars and two-wheelers. These can be bought online and through OEM showrooms in the range of Rs 4,990 and Rs 38,990 (USD 57.29-USD 447.62).

- March 2021: TomTom has unveiled its cloud-native, hybrid in-dash navigation system for vehicle manufacturers, which will provide both online and offline capabilities. The system includes an intuitive interface, voice assistance, and integration with vehicle sensors, ensuring real-time navigation, live traffic updates, and EV charging optimization. It will be implemented by leading global car makers.

In-Dash Navigation System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Display Unit, Control Module, Antenna Module, Wiring Harness |

| Technologies Covered | 2D Maps, 3D Maps |

| Screen Sizes Covered | Less Than 6 Inches, 6 Inches to 11 Inches, Greater Than 11 Inches |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturer, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alpine Electronics Inc. (Alps Electric Co. Ltd.), Faurecia Clarion Electronics Co., Ltd., Continental Aktiengesellschaft, DENSO Corporation, Garmin Ltd., Harman International Industries (Samsung Electronics Co. Ltd), JVCKENWOOD Corporation, Luxoft Holding Inc. (DXC Technology Company), Mitsubishi Electric Corporation, Pioneer Electronics (USA) Inc., Robert Bosch GmbH, TomTom International BV, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the in-dash navigation system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global in-dash navigation system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the in-dash navigation system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in-dash navigation system market was valued at USD 18.78 Billion in 2024.

The in-dash navigation system market is projected to exhibit a CAGR of 9.64% during 2025-2033, reaching a value of USD 44.80 Billion by 2033.

Increasing demand for connected vehicles, real-time traffic updates, and AI-powered navigation is driving market growth. Automakers are integrating augmented reality (AR), over-the-air (OTA) updates, and voice-controlled navigation. The rise of electric vehicles (EVs), smart transportation initiatives, and government regulations supporting built-in navigation further accelerate adoption.

Asia Pacific currently dominates the in-dash navigation system market, accounting for a share of 33.9%. The market is driven due to rising vehicle production, smart mobility adoption, increasing EV sales, government support for intelligent transportation, and growing demand for factory-fitted navigation systems.

Some of the major players in the in-dash navigation system market include Alpine Electronics Inc. (Alps Electric Co. Ltd.), Faurecia Clarion Electronics Co., Ltd., Continental Aktiengesellschaft, DENSO Corporation, Garmin Ltd., Harman International Industries (Samsung Electronics Co. Ltd), JVCKENWOOD Corporation, Luxoft Holding Inc. (DXC Technology Company), Mitsubishi Electric Corporation, Pioneer Electronics (USA) Inc., Robert Bosch GmbH and TomTom International BV, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)