Impact Socket Market Report by Type (Hex Sockets, In-Hex Sockets), Size (1/2 Inch, 3/8 Inch, 1/4 Inch), Distribution Channel (Online, Offline), Application (Automotive, Industrial, Construction, and Others), and Region 2025-2033

Global Impact Socket Market:

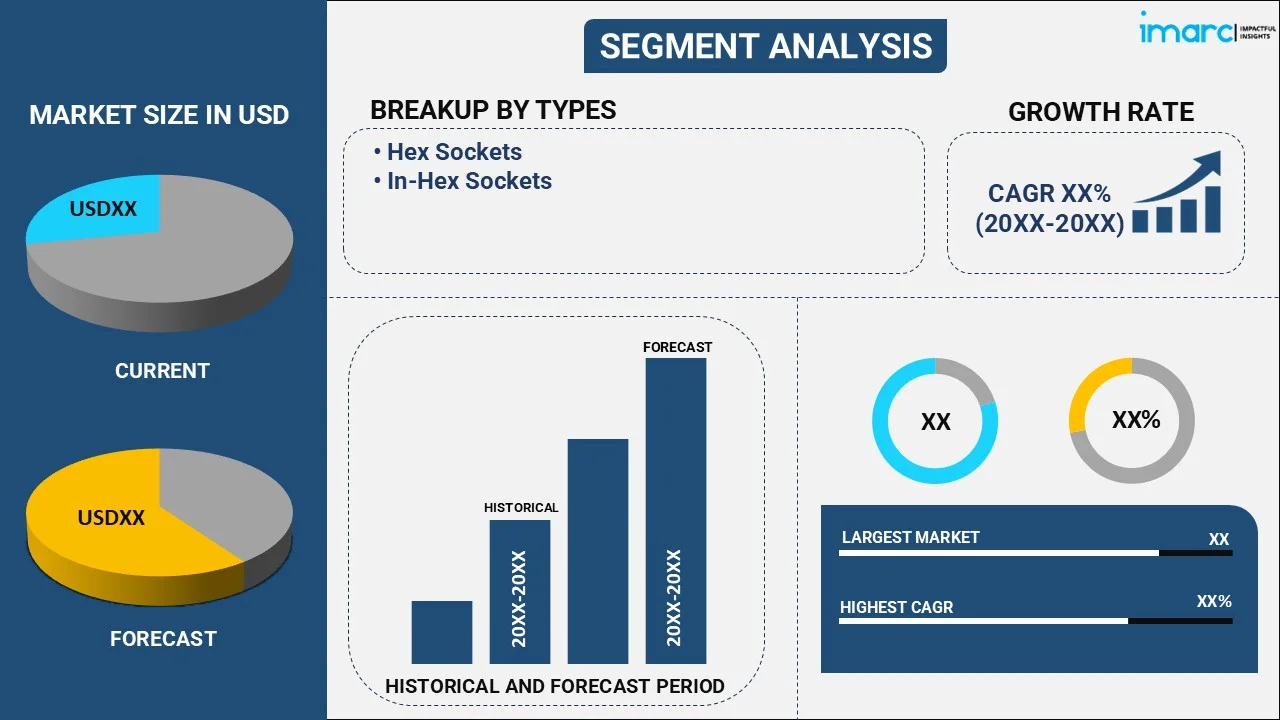

The global impact socket market size reached USD 1,120.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,596.6 Million by 2033, exhibiting a growth rate (CAGR) of 3.82% during 2025-2033. The inflating levels of industrialization, coupled with the merger and acquisition (M&A) activities by key players seeking to gain a competitive advantage through joint ventures, are primarily driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,120.2 Million |

|

Market Forecast in 2033

|

USD 1,596.6 Million |

| Market Growth Rate (2025-2033) | 3.82% |

Global Impact Socket Market Analysis:

- Major Market Drivers: The growing advancements in automobile manufacturing are primarily propelling the impact socket market demand. Moreover, considerable growth in the real estate, construction, and hospitality industries is also positively impacting the global market.

- Key Market Trends: Continuous improvements in material and design and the rising focus on durability and longevity of impact sockets are among the emerging trends bolstering the market growth. Additionally, as sustainability becomes a key concern for consumers and businesses, there is an increasing interest in impact sockets that are environmentally friendly and sustainable. Consequently, manufacturers are exploring eco-friendly materials and manufacturing processes to reduce the environmental impact of their products.

- Geographical Trends: According to the impact socket market analysis, the expanding various industries, including aerospace, manufacturing, and automotive in regions, including North America and Europe, and extensive R&D activities are stimulating the market growth. Moreover, the increasing expenditure capacities in industrial and large-scale infrastructures, particularly across the Asia-Pacific, are further fueling the global market.

- Competitive Landscape: Some of the major market players in the impact socket industry include Apex Tool Group LLC, Deltec Industries Ltd, Grey Pneumatic Corp., IMPERIAL-Newton Corporation, Powermaster Engineers Pvt. Ltd., Stanley Black & Decker Inc., Teng Tools AB, Tien-I Industrial Co. Ltd., and Wright Tool Company Inc. (Federal Resources Supply Company), among many others.

- Challenges and Opportunities: Impact socket manufacturers need to comply with regulatory requirements related to product safety and quality standards. Ensuring compliance can add complexity and cost to manufacturing processes, thereby negatively impacting the global market. However, the widespread adoption of impact sockets in the automotive industry for vehicle assembly and maintenance is providing significant opportunities to the market growth.

Global Impact Socket Market Trends:

Expansion of the Automotive Industry

Impact sockets are specialized tools used in various automotive applications, particularly in tasks requiring high torque and heavy-duty operations, such as tire changes, engine repairs, and suspension work. In line with this, as the automotive industry continues to expand globally, there's a corresponding increase in the need for tools and equipment in vehicle manufacturing, maintenance, and repair. For instance, according to the India Brand Equity Foundation, the sale of total passenger vehicles in November 2023 reached 3,34,130, accounting for the highest sale with a margin of 3.7% as compared to November 2022. The automobile exports from India also reached 47,60,487 in FY2023. Besides this, impact sockets are indispensable tools in aftermarket workshops and garages, thereby acting as another significant growth-inducing factor. For instance, India's automobile Mission Plan FAME-II emphasizes on offering government support to the nation's expanding automobile and component manufacturing sectors. These factors are further expected to proliferate the market growth in the coming years.

Surging Demand for Electrification

The growing demand for electrification in industries, including automotive, is contributing to the growth of the impact sockets market. While impact sockets have traditionally been associated with internal combustion engine vehicles, the rise of electric vehicles (EVs) and other electric-powered machinery has created new opportunities for impact socket manufacturers. For instance, according to the IEA, more than 2.3 million electric cars were sold in the first quarter of 2023, which is 25% more than in the same period last year. While EVs have fewer moving parts than traditional vehicles, they still require regular maintenance, including work on suspension components, battery systems, drivetrain components, etc., all of which require impact sockets for assembly and disassembly. Besides this, the development of wind turbines and solar panels also contributes to the demand for impact sockets. For instance, according to the International Energy Agency (IEA), wind power generation reached over 2,100 TWh in 2022. However, the average annual generation growth rate needs to increase to almost 17% to keep up with the Net Zero Emissions Scenario by 2050, which calls for the generation of over 7,400 TWh of wind electricity in 2030. Consequently, the inflating need for renewable energy technologies will drive the adoption of impact sockets in the coming years.

Growing Focus on Sustainability

Sustainability has become a key consideration for businesses and consumers alike, leading to the growing demand for product variants that are environmentally friendly and sustainable. In the context of impact sockets, sustainability can encompass various aspects, including the materials used in manufacturing, the durability and longevity of the product, and the overall environmental impact of production. Moreover, impact socket manufacturers are also focusing on energy-efficient manufacturing processes to reduce their carbon footprints. They include using energy-efficient equipment and optimizing production processes to minimize energy consumption. For instance, Futina, a manufacturer of switches and sockets, focuses on the development of energy saving features in their product line. It incorporates various technologies, including automatic shut-off switches, motion sensors, and dimming capabilities. These technologies aim to optimize energy consumption, thereby reducing electricity usage and carbon footprints.

Global Impact Socket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, size, distribution channel, and application.

Breakup by Type:

- Hex Sockets

- In-Hex Sockets

The report has provided a detailed breakup and analysis of the market based on the type. This includes hex sockets and in-hex sockets.

Hex sockets, also known as hexagonal sockets or allen sockets, are designed to fit hexagonal (six-sided) fasteners, such as hex bolts and screws. On the other hand, in-hex sockets, also called internal hex sockets or allen key sockets, are produced to fit internal hexagonal (hex) fasteners. Both sockets are essential components for hexagonal fasteners, but they differ in their design and intended applications.

Breakup by Size:

- 1/2 Inch

- 3/8 Inch

- 1/4 Inch

The report has provided a detailed breakup and analysis of the market based on the size. This includes 1/2 inch, 3/8 inch, and 1/4 inch.

1/2-inch impact sockets are commonly used for heavy-duty applications that require higher torque, such as in the construction industry and industrial maintenance. Additionally, 3/8 inch impact sockets are versatile. Consequently, they are adopted for a wide range of purposes, including automotive repair, machinery maintenance, DIY projects, etc. Moreover, 1/4 inch impact sockets are smaller and more compact, thereby suitable for tasks that require precision and access to tight spaces.

Breakup by Distribution Channel:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online, and offline.

Both online and offline channels play important roles in the distribution and sale of impact sockets, catering to the diverse preferences and needs of customers. Some individuals may prefer the convenience and extensive selection of online channels, while others may value the hands-on experience and personal interaction offered by offline channels. Ultimately, the availability of impact sockets through both channels ensures accessibility to a wide range of product variants, contributing to the market growth.

Breakup by Application:

- Automotive

- Industrial

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive, industrial, construction, and others.

Impact sockets are versatile tools widely used in various sectors, including automotive, industrial, construction, etc. These tools are extensively adopted for installing lug nuts when changing tires, assembly lines for manufacturing machinery, repair, securing formwork hardware, etc.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

Strategic merger and acquisition (M&A) activities among leading players across various regions are primarily driving the impact socket market. Moreover, the rising number of oil and gas exploration activities, particularly in the Asia-Pacific region, is propelling the demand for impact sockets, owing to their longevity. Besides this, subsidies by the governments of their respective countries while receiving technology transfers from renowned companies are anticipated to propel the global market in this segmentation over the forecasted period.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Apex Tool Group LLC

- Deltec Industries Ltd.

- Grey Pneumatic Corp.

- IMPERIAL-Newton Corporation

- Powermaster Engineers Pvt. Ltd.

- Stanley Black & Decker Inc.

- Teng Tools AB

- Tien-I Industrial Co. Ltd.

- Wright Tool Company Inc. (Federal Resources Supply Company)

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Global Impact Socket Market News:

- March 2024: The largest renewable energy company in India, Adani Green Energy Ltd. (AGEL), announced that it will invest approximately Rs 1.5 Trillion to increase the capacity of solar and wind power at the Khavda in Gujarat's Kutch to 30 GW from 2 GW currently. Additionally, the company will invest around INR 50,000 crores in 6-7 GW of similar projects elsewhere in the nation.

- December 2023: The railway industry in India started big projects like the Chenab bridge in Jammu & Kashmir, which is the highest railway bridge in the world, and the Mumbai-Ahmedabad Speed Rail Corridor.

Global Impact Socket Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Size, Distribution Channel, Application, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apex Tool Group LLC, Deltec Industries Ltd, Grey Pneumatic Corp., IMPERIAL-Newton Corporation, Powermaster Engineers Pvt. Ltd., Stanley Black & Decker Inc., Teng Tools AB, Tien-I Industrial Co. Ltd. and Wright Tool Company Inc. (Federal Resources Supply Company) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the impact socket market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global impact socket market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the impact socket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The impact socket market was valued at USD 1,120.2 Million in 2024.

The impact socket market is projected to exhibit a CAGR of 3.82% during 2025-2033, reaching a value of USD 1,596.6 Million by 2033.

Rising focus on heavy-duty machinery is driving the demand for durable sockets that can withstand high torque and impact, ensuring worker safety and productivity. Besides this, technological advancements in materials and coatings enhance the strength, corrosion resistance, and lifespan of impact sockets. Moreover, the expansion of automotive repair garages and heavy equipment servicing is stimulating the market growth.

Asia-Pacific currently dominates the impact socket market driven by rapid industrialization activities, the presence of a large manufacturing base, rising automotive production, and increased infrastructure development. The region’s demand for heavy machinery and maintenance tools is leading to the utilization of durable impact sockets across industries.

Some of the major players in the impact socket market include Apex Tool Group LLC, Deltec Industries Ltd, Grey Pneumatic Corp., IMPERIAL-Newton Corporation, Powermaster Engineers Pvt. Ltd., Stanley Black & Decker Inc., Teng Tools AB, Tien-I Industrial Co. Ltd., Wright Tool Company Inc. (Federal Resources Supply Company), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)