Immunohematology Market Size, Share, Trends and Forecast by Product, Technology, Application, End-User, and Region, 2025-2033

Immunohematology Market Size and Share:

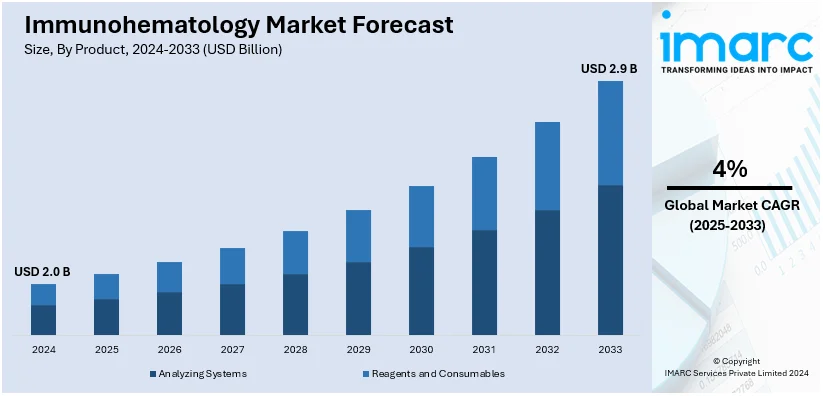

The global immunohematology market size was valued at USD 2.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.9 Billion by 2033, exhibiting a CAGR of 4% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.2% in 2024. This region’s dominance is driven by advanced healthcare infrastructure, strong industry presence, high adoption of innovative technologies, and significant investments in research and development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 2.9 Billion |

| Market Growth Rate (2025-2033) | 4% |

A major driver of the immunohematology market is the increasing demand for advanced blood testing and compatibility solutions driven by the rising prevalence of chronic diseases and the growing volume of surgical procedures. These factors have heightened the need for reliable blood typing, cross-matching, and antibody detection to ensure patient safety during transfusions and transplants. Additionally, advancements in immunohematology technologies, such as automated analyzers and molecular diagnostics, have improved testing accuracy and efficiency, further accelerating adoption in healthcare settings. For instance, in 2024, Thermo Fisher Scientific launched the Axiom PangenomiX Array for disease and pharmacogenomics research. It integrates SNP genotyping, whole-genome copy number detection, blood, and HLA typing. Designed for disease risk, ancestry, wellness, and drug development, it includes PGx markers and pathogenic variants. The array offers enhanced whole-genome imputation and high diversity for testing various ethnicities, making it suitable for diverse genetic research. Expanding healthcare infrastructure in emerging markets and growing awareness of safe blood transfusion practices also contribute to the sustained growth of this market.

The United States is a key player in the immunohematology market, driven by its advanced healthcare infrastructure, robust research and development initiatives, and a high demand for precision diagnostics. The country is home to leading manufacturers and suppliers of immunohematology equipment and reagents, enabling rapid adoption of innovative technologies such as automated analyzers and molecular diagnostics. For instance, in 2024, Beckman Coulter launched DxC 500i Clinical Analyzer, combining chemistry and immunoassay capabilities, delivering efficient, commutable results for hospitals and labs, enhancing patient care, operational models, and inventory management. Additionally, stringent regulatory standards and well-established blood banking systems ensure reliable and efficient blood compatibility testing. The growing prevalence of chronic diseases and an aging population further enhance the demand for immunohematology solutions, positioning the US as a pivotal market for advancements in this sector.

Immunohematology Market Trends:

Increasing Prevalence of Hematological Disorders

With the increasing instances of leukemia and other hematological disorders across the world, the market is witnessing immense growth. Developments in the healthcare infrastructure and the establishment of blood banks and trauma centers in developing countries are also motivating this growth. According to the World Bank, in 2023, approximately 13,300 blood centers across 169 countries reported collecting a total of 106 Million donations. The number of donations collected at these centers varies by income group. In low-income countries, the median annual donations per center was 1,300, while in lower-middle-income countries it was 4,400, and in upper-middle-income countries, it was 9,300. In comparison, high-income countries reported a median of 25,700 donations per center annually. With this increase in mass awareness concerning the activities involved in blood collection, processing, testing, and storage, it further enhances the demand for immunohematology devices.

Rising Adoption of Advanced Diagnostic Technologies

The immunohematology market is experiencing significant growth driven by the integration of advanced diagnostic technologies, including molecular assays and automated blood typing systems. These next-generation immunohematology devices help enhance the effectiveness of the diagnosis, reduce the time taken for analysis and the human error risk factors, and extend immediate care services to patients. Automated systems streamline processes such as cross-matching and antibody screening, which are critical for transfusion safety. For instance, in 2024, QuidelOrtho's VITROS syphilis assay received FDA-clearance, offering automated detection of Treponema pallidum antibodies on VITROS systems (3600, 5600, XT 7600), now globally available, enhancing infectious disease diagnostics. Additionally, molecular diagnostics allow for precise genotyping, aiding in the identification of rare blood groups and antibodies that traditional methods might overlook. Healthcare providers are increasingly adopting these technologies to meet the growing demand for high-quality and rapid diagnostic solutions, particularly in developed markets where healthcare infrastructure supports sophisticated equipment.

Expanding Focus on Personalized Medicine and Rare Blood Disorders

Another emerging trend in the immunohematology market is the growing emphasis on personalized medicine, particularly for individuals with rare blood disorders. Advances in genomic research have paved the way for tailored therapies and precise blood transfusion practices. The identification of unique antigen profiles and rare phenotypes is becoming increasingly important, especially in regions with diverse populations. For instance, in 2024, clinical-stage radiopharmaceutical company CU6 is advancing next-generation theragnostic products using its SAR Technology platform. The company announced promising Phase I/II trial data from the COBRA study. The trial confirmed that its copper-based imaging agent, I64Cu-SAR-bisPSMA, is safe and also highly effective in detecting prostate cancer lesions in patients with biochemical recurrence. By integrating targeted imaging with therapeutic capabilities, this technology could enhance diagnostic accuracy and enable personalized treatment strategies in immunohematology. As awareness of rare blood conditions rises, demand for specialized immunohematology products and services is anticipated to grow, highlighting the market's expanding role in precision healthcare.

Immunohematology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global immunohematology market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, technology, application, and end-user.

Analysis by Product:

- Analyzing Systems

- Reagents and Consumables

Reagents and consumables stand as the largest product in 2024, holding around 65.5% of the market. This large share underlines their critical role in blood typing, antibody screening, and crossmatching procedures that are necessary for transfusion safety and compatibility testing. These products are essential for achieving accurate results in diagnostic laboratories, blood banks, and hospitals. The increasing incidence of chronic and infectious diseases, together with a rise in blood donation activities, adds to the market demand for reagents and consumables. Moreover, the advancement in diagnostic technologies and introduction of high-performance reagents enhance their adoption. This segment's dominance positions it to meet a rising global need for reliable and efficient immunohematology testing solutions.

Analysis by Technology:

- Biochips

- Gel Cards

- Microplates

- Polymerase Chain Reaction

- Erythrocyte-Magnetized Technology (EMT)

- Others

Polymerase chain reaction leads the market with around 38.5% of the market share in 2024. Its dominance underscores its critical role in diagnostics, research, and therapeutic applications. PCR's precision in amplifying DNA and RNA sequences makes it a cornerstone technology for detecting infectious diseases, genetic mutations, and cancer markers. The increasing rate of chronic disease and an emphasis on earlier diagnosis make its widespread use popular among laboratories, clinics, and research institutions. Technological innovation such as the development of real-time PCR and digital PCR enhances its sensitivity and efficiency, creating further success in the marketplace. Finally, its emerging application fields such as in personalized medicine and pharmacogenomics has cemented its position as one of the more dominant technologies in the space of molecular diagnostics and research.

Analysis by Application:

- Blood-Related Diseases

- HIV

- Hepatitis

- Blood Transfusion

- Others

HIV lead the market in 2024. HIV stands as the leading application in the market, reflecting its critical importance in diagnostics, treatment monitoring, and research. The overall interest in the management of HIV/AIDS around the world increases the adoption of advanced diagnostic technologies to enable early detection, viral load monitoring, and antiretroviral therapy efficacy. The rise in the incidence of HIV in underserved areas further escalates the demand for effective testing solutions. Innovations such as point-of-care diagnostics and molecular technologies further facilitate efficient and accurate results. Moreover, the government's initiatives and funds for eradicating HIV enhance market growth. The application leadership has indicated its importance in public health endeavors, improved patient outcomes, and facilitating research toward efficient prevention and cure strategies.

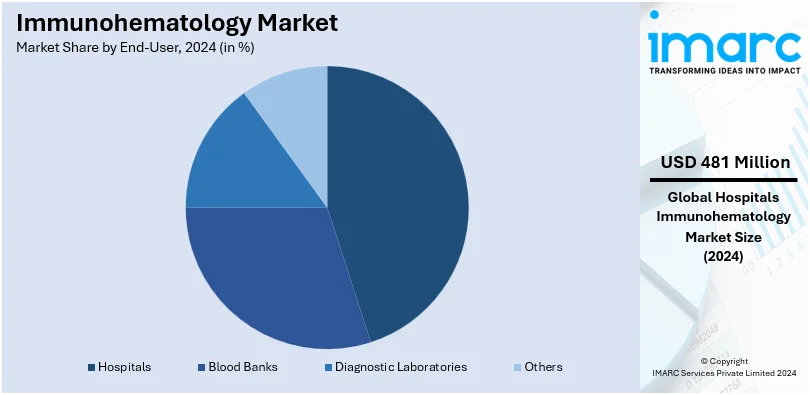

Analysis by End-User:

- Hospitals

- Blood Banks

- Diagnostic Laboratories

- Others

Hospitals lead the market with around 23.8% of the market share in 2024. Hospitals are leading centers for diagnostic procedures, interventions for therapeutic management, and treatment and care. These institutions thus account for the highest number of the market share. A higher need for proper and timely diagnostics of chronic as well as acute diseases promotes the acceptance of advanced technology within the hospitals. Moreover, the increasing incidence of complex diseases and the requirement for state-of-the-art facilities for the comprehensive management of patients contribute to this segment's dominance. Hospitals have the advantage of a high volume of patients, infrastructure, and multidisciplinary expertise, which allows them to provide consistent and efficient services, thereby making them a strong market segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.2%. The dominance of this region is attributed to advanced healthcare infrastructure, strong research and development activities, and high adoption of novel diagnostic and therapeutic technologies. Leadership in the region is also boosted by increased government funding for healthcare initiatives, strong presence of key industry players, and increased demand for advanced medical devices and diagnostics. High level of awareness and access to advanced treatment is a major contributor toward the region's pre-eminent market position. Furthermore, chronic and infectious disease prevalence, coupled with a well-developed regulatory system, encourages the use of advanced health care delivery solutions. It, therefore, points out that North America is an innovation, investment, and development hub in the health and life sciences industries.

Key Regional Takeaways:

United States Immunohematology Market Analysis

US accounts for 73.5% share of the market in North America. The United States market is largely driven by advances in healthcare infrastructure and an increase in demand for blood transfusion services. According to the CDC, 1 in 76 Americans is affected by a blood disorder, creating demand for immunohematology testing. Sickle cell anemia, thalassemia, and hemophilia are some of those that have received diagnostic monitoring and blood management for a prolonged period. The aging population and increasing prevalence of chronic diseases are additional factors increasing the demand for blood transfusions. Cutting-edge immunohematology technologies, especially automated blood-typing and crossmatching systems, increase accuracy of diagnosis and help the growth of the market. Government initiatives directed toward building blood safety standards and regulations provide an essential impetus for the growth of the market. Further, the rise of personalized medicine and genetic testing boosts the adoption of advanced immunohematology products. The increasing demand for high-quality blood products and greater emphasis on donor screening augment market growth. A healthy presence of major companies together with ongoing efforts to enhance blood-testing techniques signifies that the U.S. market is ready for great development, confronting healthcare problems and ensuring transfusion safety.

Asia Pacific Immunohematology Market Analysis

The Asia-Pacific immunohematology market mainly benefited from the growing healthcare needs of an aging population and increasing prevalence of chronic diseases. According to the WHO, noncommunicable diseases (NCDs), especially those of cardiovascular, cancer, diabetes, and chronic respiratory diseases, account for 62% of all deaths in the South-East Asia Region, affecting 9 Million people. The premature mortality from NCDs is a matter of grave concern, with a very notable portion of these deaths occurring before the age of 70. This rising burden of NCDs leads to a growing demand for blood transfusions or immunohematology services. Rapid advancements in medical technology, together with enhanced healthcare investments in the emerging economies of China and India, will further aid market expansion. Moreover, advanced immunohematology technologies, including automation in blood typing and compatibility testing, immensely accelerate their adoption in the region.

Europe Immunohematology Market Analysis

The immunohematology market in Europe is influenced by factors such as a growing need for blood transfusions, improving of tests for diagnosis, and increased patient population base with chronic blood disorders. As per the European Commission on January 1, 2023, the population of the EU was approximately estimated to be 448.8 Million, with 21.3% above 65 years, representing an increase of 0.2% points from the last year and 3.0% points over the last one decade. Changes in demographics point toward higher healthcare needs when it comes to managing age-related blood issues. The high prevalence of cardiovascular diseases and other chronic conditions in older populations further strengthens the need for immunohematology services. Europe’s emphasis on blood safety standards because of stringent regulatory frameworks encourages the adoption of innovative immunohematology products. The availability of advanced technologies such as molecular blood group typing and automated crossmatching systems increases the present market opportunity. Government efforts to improve healthcare services and ensure safe blood transfusions also aid in market growth. The presence of key industry players and ongoing research to improve the accuracy of testing and safety during transfusion ensure continued growth for the immunohematology market in Europe.

Latin America Immunohematology Market Analysis

In Latin America, the immunohematology market is driven by increased healthcare access and blood safety awareness. A PubMed Central study states that 100,000 - 150,000 Latin Americans are afflicted with sickle cell disease (SCD), leading to an increase in blood transfusions and immunohematology services. The prevalence of SCD and thalassemia calls for advanced diagnostic solutions. Improvements in healthcare standards, driven by government initiatives and blood donation programs, also support market growth. Moreover, there is a rising demand for accurate blood screening and testing solutions, as healthcare providers are focusing on better blood transfusion safety and reliability.

Middle East and Africa Immunohematology Market Analysis

The immunohematology market, driven by infrastructural improvements in healthcare, increased investment in biotechnology, and increasing awareness of blood-related safety issues, will grow in the Middle East and Africa area. According to PubMed Central, 30% of the people in the Middle East who suffer from anemia are primarily women, mostly due to iron deficiency or other causes. The high prevalence of blood disabilities such as SCD and thalassemia enables the need for blood transfusions and immunohematology services. Government initiatives to develop the healthcare systems in the region and to ensure that blood products are safe and accurate contribute to regional market growth.

Competitive Landscape:

The immunohematology market is characterized by intense competition among key players focused on innovation, collaborations with key partners, and expansion into new regions to enhance their market footprint. Prominent companies lead the market by offering a broad range of products, including blood typing reagents, analyzers, and software solutions. These players heavily invest in research and development to introduce advanced technologies, such as fully automated systems and molecular diagnostic tools, that enhance testing accuracy and efficiency. Strategic mergers, acquisitions, and collaborations are common, enabling companies to expand their product portfolios and gain access to new markets. Additionally, the presence of regional and local players contributes to market competitiveness, particularly in emerging economies. The growing emphasis on cost-effective and high-quality diagnostics drives innovation, while regulatory compliance and certifications remain key differentiators. For instance, in 2024, Abbott and Big Ten’s "We Give Blood Drive" inspired nearly 20,000 donations, saving 60,000 lives, alleviating blood shortages, and contributing to the collection of blood essential for life-saving transfusions and immunohematology research. The competitive landscape is further shaped by increasing demand for personalized healthcare and enhanced transfusion safety.

The report provides a comprehensive analysis of the competitive landscape in the immunohematology market with detailed profiles of all major companies, including:

- Abbott

- Antisel

- BD (Becton Dickinson and Company)

- Beckman Coulter Inc. (Danaher Corporation)

- Bio-Rad Laboratories Inc.

- F. Hoffmann-La Roche Ltd.

- Grifols S.A.

- Merck KGaA

- MTC Invitro Diagnostics AG

- Ortho-Clinical Diagnostics Inc (The Carlyle Group)

- Siemens Healthcare GmbH

- Thermo Fisher Scientific Inc.

Latest News and Developments:

- November 2024: T&D plans to launch its Centus 5-Part Hematology Analyzer HA-500 at Medica 2024. This new analyzer is designed to enhance accuracy, efficiency, and ease of use in clinical laboratories.

- September 2024: Zoetis Inc., a leader in animal health, launched the Vetscan OptiCell™, an AI-powered, cartridge-based hematology analyzer for advanced Complete Blood Count (CBC) analysis. Released in the U.S., the device offered significant time, cost, and space savings for veterinary teams, improving clinic workflows and patient outcomes. The Vetscan OptiCell utilized cell-focusing and AI-powered classification technology to deliver reference lab-quality accuracy at the point of care, reinforcing Zoetis’ commitment to advancing veterinary medicine through innovative diagnostic solutions.

- June 2024: HORIBA expanded its hematology range with new models, Yumizen H550E, H500E CT, and H500E OT, that provide combined CBC/DIFF and ESR testing from whole blood in 60 seconds, supporting inflammatory disease assessment. Using its patented CoRA technology, HORIBA integrates ESR with CBC and white blood cell differential, calibrated to the Westergren method, reducing costs, turnaround times, and laboratory space usage.

- January 2024: Agappe, based in Kochi, India has launched the HX series haematology analyzers and the Mispa i200 Immunology CLIA analyzer. The HX series, using Nucleic Acid Fluorescence Staining technology, offers faster, more accurate blood tests for conditions like blood counts and haemoglobin levels. The Mispa i200 detects biomarkers for various diseases, including cancer and cardiac conditions. These innovations aim to enhance diagnostic capabilities and healthcare standards in India and beyond.

Immunohematology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Analyzing Systems, Reagents and Consumables |

| Technologies Covered | Biochips, Gel Cards, Microplates, Polymerase Chain Reaction, Erythrocyte-Magenetized Technology (EMT) |

| Applications Covered | Blood-Related Diseases, HIV, Hepatitis, Blood Transfusion, Others |

| End Users Covered | Hospitals, Blood Banks, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott, Antisel, BD (Becton Dickinson and Company), Beckman Coulter Inc. (Danaher Corporation), Bio-Rad Laboratories Inc., F. Hoffmann-La Roche Ltd., Grifols S.A., Merck KGaA, MTC Invitro Diagnostics AG, Ortho-Clinical Diagnostics Inc (The Carlyle Group), Siemens Healthcare GmbH and Thermo Fisher Scientific Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the immunohematology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global immunohematology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the immunohematology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Immunohematology is a branch of hematology focusing on the study of blood group antigens and antibodies. It is essential in blood transfusion, organ transplantation, and diagnosing blood disorders. This discipline ensures compatibility between donors and recipients, preventing adverse reactions and improving the safety and efficacy of transfusion medicine.

The Immunohematology market was valued at USD 2.0 Billion in 2024.

IMARC estimates the global Immunohematology market to exhibit a CAGR of 4% during 2025-2033.

The global immunohematology market is driven by rising demand for safe blood transfusion practices, increasing prevalence of blood-related disorders, advancements in diagnostic technologies, and growing awareness of blood donation. Additionally, expanding healthcare infrastructure, government initiatives for blood safety, and innovation in automated testing systems contribute to the market's growth.

According to the report, reagents and consumables represented the largest segment by product, driven by their critical role in diagnostic accuracy, increased demand for blood typing and crossmatching, and widespread use in laboratories, hospitals, and blood banks for routine and advanced immunohematology testing.

Polymerase chain reaction leads the market by technology as it offers unmatched precision, sensitivity, and efficiency in amplifying DNA and RNA, making it indispensable for detecting infectious diseases, and genetic mutations, and monitoring treatment efficacy.

HIV represented the largest segment by application due to the high global prevalence of the disease, the critical need for accurate diagnostics, widespread adoption of antiretroviral therapy monitoring, and significant government initiatives and funding to combat HIV/AIDS.

Hospitals lead the market by end user as they serve as primary centers for advanced diagnostic testing, therapeutic interventions, and patient care, with high patient volumes and access to state-of-the-art technologies driving their dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global Immunohematology market include Abbott, Antisel, BD (Becton Dickinson and Company), Beckman Coulter Inc. (Danaher Corporation), Bio-Rad Laboratories Inc., F. Hoffmann-La Roche Ltd., Grifols S.A., Merck KGaA, MTC Invitro Diagnostics AG, Ortho-Clinical Diagnostics Inc (The Carlyle Group), Siemens Healthcare GmbH and Thermo Fisher Scientific Inc. etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)