Identity Analytics Market Size, Share, Trends and Forecast by Analytics Type, Component, Deployment, Organization Size, Industry Vertical, and Region, 2025-2033

Identity Analytics Market Size and Share:

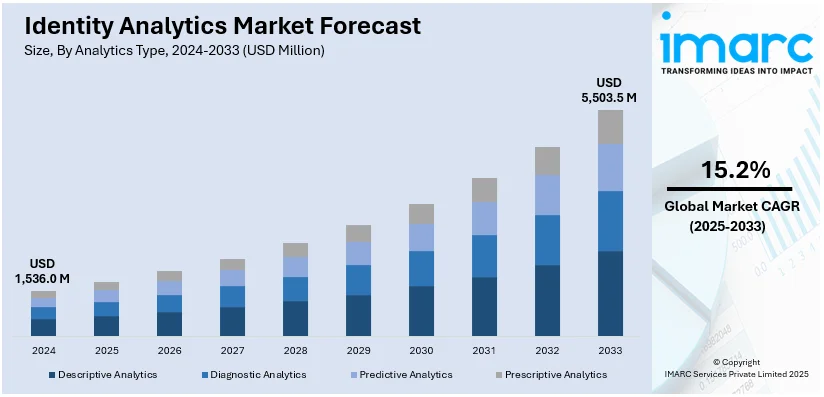

The global identity analytics market size was valued at USD 1,536 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,503.5 Million by 2033, exhibiting a CAGR of 15.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.7% in 2024. The major factors driving the market include increasing cyber threats, stringent regulations, digital transformation, cloud adoption, and advancements in AI and machine learning.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,536 Million |

| Market Forecast in 2033 | USD 5,503.5 Million |

| Market Growth Rate (2025-2033) | 15.2% |

The identity analytics market demand is driven by the rising demand for robust identity security to combat cyber threats and fraud. With increasing digitalization and the proliferation of connected devices, organizations face growing challenges in securing user identities. Regulatory compliance requirements, like HIPAA and GDPR, further push businesses to adopt advanced identity analytics solutions. The surge in remote work and cloud adoption amplifies the demand for real-time identity verification and behavior analytics to prevent unauthorized access. Additionally, advancements in artificial intelligence (AI) and machine learning (ML) enable more accurate detection of anomalies and predictive threat modeling. The demand for seamless user experiences without compromising security, especially in financial services, healthcare, and e-commerce, also contributes to the identity analytics market growth.

To get more information on this market, Request Sample

In the United States, the identity analytics market is driven by the increasing prevalence of cyberattacks, identity theft, and fraud, prompting organizations to strengthen their identity management frameworks. Stringent regulatory requirements, such as the CCPA, HIPAA, and SOX, compel businesses to implement advanced identity analytics to ensure compliance. The rapid adoption of digital transformation initiatives, cloud computing, and remote work solutions has heightened the demand for robust identity verification and access control measures. Additionally, the U.S. government’s emphasis on cybersecurity frameworks, such as NIST guidelines, boosts adoption. Integrating AI and machine learning in identity analytics further enhances threat detection and prevention capabilities. Industries such as healthcare, e-commerce, and finance demand secure yet seamless user authentication, represent key identity analytics market trends. For instance, in December 2024, AKA Identity announced the launch of its innovative platform early access program in response to the increasing need for a revolutionary approach to identity management. This is in line with the oversubscription of its workforce identity baseline assessment program with enterprise clients in the technology, retail, healthcare, energy, education, and financial services verticals.

Identity Analytics Market Trends:

Rising Cybersecurity Threats

The growing sophistication of cyberattacks, such as phishing, ransomware, and identity theft, drives the adoption of identity analytics. According to industry reports, cybersecurity statistics show 2,200 cyberattacks daily, with an average of one occurring every 39 seconds. The average cost of a data breach in the US is $9.44 million, and by 2023, cybercrime is expected to cost $8 trillion. According to IBM's 2023 research, the average cost of a business data breach in 2023 was $4.45 million. Organizations are increasingly leveraging these solutions to detect anomalies, prevent unauthorized access, and mitigate potential breaches. Identity analytics provide real-time monitoring and threat modeling, enhancing security frameworks and safeguarding sensitive data against malicious actors.

Regulatory Compliance Requirements

Stringent regulations like GDPR, HIPAA, and CCPA compel organizations to adopt advanced identity analytics to ensure data privacy and compliance. These solutions enable enterprises to monitor access, detect suspicious activities, and maintain compliance reports, reducing penalties and reputational risks tied to non-compliance. For instance, in January 2024, The European Commission started a project to examine how the EU's primary data protection law, the General Data Protection Regulation ("GDPR"), operates. As a basic right of all EU citizens, the GDPR has been in effect since May 25, 2018, protecting so-called "personal data," or any information that may be used to identify an individual. Additionally, it permits the free exchange of personal information and the growth of the digital economy throughout the Single European Market.

Advancements in AI and ML Technologies

The integration of artificial intelligence and machine learning in identity analytics enhances capabilities like anomaly detection, predictive analysis, and automated decision-making. These advancements improve the accuracy and efficiency of identity solutions, making them indispensable for enterprises seeking proactive threat prevention and improved operational security. For instance, in January 2024, Tuebora, a prominent supplier of intelligent and engaging Identity Governance Administration (IGA) solutions, announced the launch of Ask Tuebora, a natural language query engine intended to streamline intricate processes and automate tedious Identity Access Management (IAM) chores. With each query, Ask Tuebora, a generative AI tool that mimics human interaction, adjusts its functionality to fit user thought processes, incorporate feedback, and enhances cognition.

Identity Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global identity analytics market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on analytics type, component, deployment, organization size, and industry vertical.

Analysis by Analytics Type:

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

Predictive analytics holds the largest share in the identity analytics market because it enables organizations to proactively identify potential threats and mitigate risks before they materialize. Using machine learning and strong AI to perform predictive analytics successfully identifies anomalous behavior, unauthorized access, and other potential insider threats. This capability is important for protection against different types of cyber threats in real-time, protecting millions of users and their data, as well as meeting growing and stringent regulatory requirements. It helps in decision-making because of the historical data analysis as well as of future risks and develops identity management. The increasing role of prevention in cybersecurity, as well as routine activities in the financial sector, healthcare, and e-commerce, ensures the prevalence of predictive analytics.

Analysis by Component:

- Software

- Services

Services leads the market with around 56.5% of market share in 2024 because it has the fundamental role of offering the necessary support that enables the implementation and establishment of infrastructure in identity analytics solutions. Professional services are another component of how organizations achieve their goals as consulting, implementation, and training can always be done to create custom products that match and work well within current frameworks and system infrastructures. Co-located/remote managed services are also pivotal here as they help in continuously monitoring, maintaining, and analyzing threats for them and take a lot off the plate of an internal team. As both explicit and implicit risks become more intricate in terms of identity, services guarantee that organizations can rely on the utilization of advanced analytics applications to strengthen security and compliance as well as ID management.

Analysis by Deployment:

- On-premises

- Cloud-based

Cloud-based leads the market with around 58.0% of market share in 2024. Cloud-based solutions hold the largest share of the identity analytics market due to their scalability, flexibility, and cost-efficiency. Organizations increasingly adopt cloud-based identity analytics to manage growing user data and secure access across distributed networks, especially with the rise of remote work and cloud applications. They allow to address issues such as real-time threat detection, updating, integration of the solution with other cloud platforms, and work productivity. Furthermore, cloud-based models are relatively inexpensive in investments, and the application can be accessed from any location and hence suitable for enterprises of any scale. The capacity to support advanced AI and Machine Learning also propels their acceptance, cementing their share in the market.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises leads the market with around 62.2% of market share in 2024. Large enterprises hold the largest share in the identity analytics market due to their extensive operational scale, complex IT infrastructures, and higher exposure to cyber threats. These organizations manage vast amounts of sensitive data and a large workforce, making robust identity analytics crucial for securing access, detecting anomalies, and preventing data breaches. Regulatory compliance requirements further drive adoption, as large enterprises face stringent legal obligations. Additionally, large organizations often have the resources to invest in advanced technologies like AI-driven identity analytics to enhance security and operational efficiency. The growing need for scalable, enterprise-grade solutions reinforces their dominant position in the market.

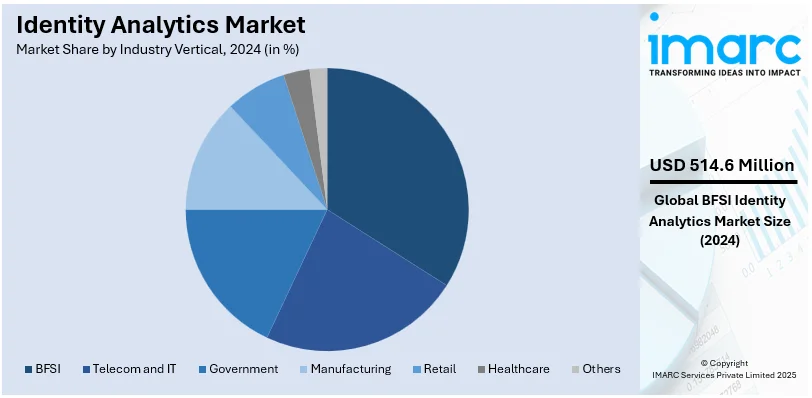

Analysis by Industry Vertical:

- BFSI

- Telecom and IT

- Government

- Manufacturing

- Retail

- Healthcare

- Others

BFSI leads the market with around 33.5% of market share in 2024 due to its high reliance on secure data handling and stringent regulatory requirements. As this sector processes the clients’ data and makes financial transactions and digital services, it can be an attractive target for different cyber incidents like identity theft and fraud. Identity analytics offers solid answers to fraud protection, proactive risk identification, and credential authorization mechanisms. Also, regulations such as PCI DSS and GDPR push the need for extending and adopting identity solutions to the next level. With the increasing adoption of digital banking, and internet-based financial services, BFSI, remains the largest consumer of identity analytics solutions compatible with scaling solutions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.7%. In North America, the identity analytics market is driven by several key factors. The rise in overall and advanced threats including identity theft and data breaches has become rampant, creating the need for effective identity protection. CCPA, GDPR, and HIPAA have become regulatory compliance norms that require businesses to implement high-end identity solutions to ensure that personal data is protected. The advanced usage of digital transformation, the use of cloud services, and services permitting remote work have introduced new threats posing a higher demand for identity verification and management in real-time. Further, identity analytics’ utilization of artificial intelligence and machine learning in North American enterprises increases for better threat identification and automated access management. Industries such as healthcare, finance, and government, which have a lot of sensitive information, are a substantial driving force.

Key Regional Takeaways:

United States Identity Analytics Market Analysis

In 2024, the United States accounted for the largest market share of over 88.30% in North America. The U.S. identity analytics market is primarily driven by the growing adoption of advanced cybersecurity solutions to combat rising identity fraud and cyberattacks as well as ransomware attacks. As per reports, over a fifth of US adults (21%) have experienced a ransomware attack on a personal and/or work device. Additionally, phishing is the most Googled cybersecurity issue in the United States in 2024, with an average of 75,600 monthly searches for the word. Businesses are increasingly prioritizing identity management and analytics tools to secure sensitive data. In line with this, the rapid digitalization across industries, particularly in banking, healthcare, and e-commerce, further fuels demand for these solutions. Banks are prioritizing digital platforms to offer seamless online and mobile banking experiences. These sectors face stringent regulatory compliance, such as HIPAA and PCI DSS, compelling organizations to enhance their identity management practices. Another key driver is the integration of artificial intelligence (AI) and machine learning (ML) in identity analytics solutions. Companies are leveraging these technologies to detect unusual user behaviors, prevent unauthorized access, and enhance operational efficiency. Furthermore, government initiatives like the National Cybersecurity Strategy 2023 emphasize strengthening critical infrastructure, which positively impacts the adoption of identity analytics tools. The rise of remote work and cloud services has also expanded the attack surface, requiring robust identity analytics systems.

Asia Pacific Identity Analytics Market Analysis

In the Asia Pacific region, the identity analytics market is experiencing rapid growth on account of rapid digital transformation initiatives. According to the Government of India's Ministry of External Affairs, by 2028, digital transformation in India is expected to generate an economy of USD 1 trillion. Countries like China, India, and Japan are witnessing accelerated adoption of digital services, influenced by government policies promoting digital economies. For instance, India's Digital India initiative and China’s focus on smart cities are boosting businesses to adopt sophisticated identity analytics solutions. Apart from this, the region’s expanding e-commerce and fintech sectors also contribute significantly to market growth. With an increase in online transactions, companies are increasingly relying on identity analytics to prevent fraud and ensure secure customer interactions. In the fintech sector, identity analytics can help determine the legitimacy of a transaction, ensuring that high-risk transactions are reviewed before processing, reducing the chances of financial loss. Furthermore, regulatory frameworks, such as the Personal Data Protection Act (PDPA) in Singapore and China’s Cybersecurity Law, further drive demand for identity management solutions in the region. Apart from this, the widespread adoption of AI and biometrics in the region aid in enhancing the accuracy and effectiveness of identity analytics platforms.

Europe Identity Analytics Market Analysis

Europe’s identity analytics market is driven by stringent data protection regulations, particularly the General Data Protection Regulation (GDPR). Organizations across the region are under pressure to ensure data privacy and compliance, leading to increased investment in identity analytics solutions. Industries such as healthcare, banking, and government are at the forefront of adopting these technologies to safeguard sensitive data against growing cyber threats. Another key factor is the rapid rise in cybercrime, with Europol highlighting an increase in ransomware attacks and identity fraud. According to reports, 50% of UK businesses witnessed some form of cyber attack in 2023. As a result, businesses are prioritizing identity management systems to enhance cybersecurity infrastructure. Besides this, the growing adoption of cloud-based services and remote working arrangements is catalyzing the need for advanced identity analytics tools. Cloud-based environments and remote work require dynamic and flexible access control to ensure that users have the appropriate permissions while maintaining security. Identity analytics tools enable adaptive authentication, where access requirements change based on factors like the user's location, device, or behavior. Remote work often involves employees using personal devices or a mix of work and personal accounts to access corporate resources. This can lead to inconsistent security practices and difficulties in monitoring access across multiple platforms. Additionally, Europe’s focus on digital innovation, through programs like Horizon Europe, is encouraging the adoption of cutting-edge technologies, including AI-driven identity analytics solutions.

Latin America Identity Analytics Market Analysis

Increasing concerns about identity theft and fraud in sectors, such as banking and retail, is bolstering the market growth. As online transactions and digital banking gain traction in countries like Brazil and Mexico, the demand for robust identity analytics tools is rising. In addition, governing agencies in the region are undertaking several initiatives, such as Brazil's General Data Protection Law (LGPD), are encouraging organizations to invest in advanced identity management solutions to ensure compliance and data security. The market is further driven by the rapid adoption of mobile technology and e-commerce in the region. Brazil, which has the biggest economy in Latin America, is expected to have 14.3% growth in e-commerce by 2026, according to the International Trade Administration. Businesses are increasingly relying on identity analytics to detect fraudulent activities and enhance user authentication processes. Furthermore, the increasing use of AI and ML in these solutions is enabling real-time threat detection, which is crucial in mitigating risks associated with identity fraud.

Middle East and Africa Identity Analytics Market Analysis

In the Middle East and Africa, the identity analytics market is driven by the growing threat of cyberattacks and the need for enhanced cybersecurity measures. The region’s increasing adoption of cloud computing and digital services, particularly in countries like the UAE and South Africa, is creating a demand for robust identity analytics solutions. Moreover, government initiatives, such as the UAE Cybersecurity Strategy and South Africa’s Protection of Personal Information Act (POPIA), are playing a critical role in driving market growth. Organizations are adopting identity management tools to ensure compliance with these regulations and protect against identity fraud. The development of digital banking and e-commerce in the region further underscores the need for advanced analytics to secure transactions and improve customer trust. As per reports, 82% of banking customers use a digital bank at least once per week in Saudi Arabia and the United Arab Emirates.

Competitive Landscape:

The identity analytics market is highly competitive, with key players including IBM, Microsoft, Okta, Ping Identity, and SailPoint Technologies. These companies offer a range of identity governance, access management, and behavioral analytics solutions. IBM and Microsoft leverage AI and machine learning to enhance threat detection and predictive analytics, while Okta and Ping Identity focus on identity-as-a-service solutions for seamless access management. Emerging startups are also making strides with innovative cloud-based, AI-driven platforms. With increasing demand across industries like BFSI, healthcare, and retail, companies differentiate themselves through scalability, integration capabilities, and compliance-driven solutions, intensifying competition within the market.

The report has also analysed the competitive landscape of the global identity analytics market with some of the key players being:

- CyberArk Software Ltd.

- Evidian (Atos Group)

- Gurucul

- HID Global Corporation (Assa Abloy AB)

- Microsoft Corporation

- Nexis GmbH

- Okta Inc.

- One Identity LLC

- Oracle

- Ping Identity

- Radiant Logic Inc.

- SailPoint Technologies, Inc.

- Securonix

Latest News and Developments:

- January 2025: Orchid Security raised USD 36 million in an early-stage fundraising round and came out of "stealth mode" after a year of operating in secrecy. The company focuses on preserving clients' identities as AI continues to advance. Its goal is to solve the problem of managing identification systems by employing huge language models to speed up Orchid's development.

- September 2024: a leading cloud-native identity and governance platform provider Saviynt announced the general availability of Intelligent Recommendations as part of its Intelligence Suite. With the use of artificial intelligence (AI) and machine learning (ML), Saviynt Intelligence will automate identity security from a collection of simple operational procedures.

- May 2024: Omada A/S, a world leader in Identity Governance and Administration (IGA), revealed Omada Identity Cloud's new cutting-edge data analytics solution. Identity Analytics allows firms to improve their role management and identity reporting processes. Identity Analytics provides IGA teams with the resources required for strict compliance, optimum efficiency, and a more robust security posture.

- August 2022: Gurucul enhanced its Next-Gen SIEM and XDR capabilities with a new Poly-Cloud architecture, supporting advanced multi-cloud deployments across major platforms like AWS, Azure, and Google Cloud. This innovation enables organizations to maintain cloud-agnostic operations while improving threat detection and response. The system offers real-time visibility and context, reducing costs and operational complexities. Gurucul's platform integrates machine learning for predictive risk scoring, aiding in the identification of sophisticated cyber threats such as multi-RAT campaigns, thereby streamlining security operations for enterprises worldwide.

Identity Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Analytics Type Covered | Descriptive Analytics, Diagnostic Analytics, Predictive Analytics, Prescriptive Analytics |

| Component Covered | Software, Services |

| Deployment Covered | On-premises, Cloud-based |

| Organization Size Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Vertical Covered | BFSI, Telecom and IT, Government, Manufacturing, Retail, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CyberArk Software Ltd., Evidian (Atos Group), Gurucul, HID Global Corporation (Assa Abloy AB), Microsoft Corporation, Nexis GmbH, Okta Inc., One Identity LLC, Oracle, Ping Identity, Radiant Logic Inc., SailPoint Technologies, Inc., Securonix, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the identity analytics market from 2019-2033.

- The identity analytics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the identity analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The keyword market was valued at USD 1,536 Million in 2024.

The identity analytics market is projected to exhibit a CAGR of 15.2% during 2025-2033, reaching a value of USD 5,503.5 Million by 2033.

Key factors driving the identity analytics market include increasing cybersecurity threats, stringent regulatory compliance requirements, the shift to digital transformation and cloud adoption, and advancements in AI and machine learning technologies. These elements highlight the need for robust identity management solutions to safeguard sensitive data and ensure secure user access.

North America currently dominates identity analytics, accounting for a share of over 40.7% in 2024. The major factors driving the North American identity analytics market include increasing cyber threats, regulatory compliance requirements, digital transformation, advanced AI technologies, and rising adoption of identity-centric security solutions. The factors, collectively, are creating a positive identity analytics market outlook, across the region.

Some of the major players in the keyword market include CyberArk Software Ltd., Evidian (Atos Group), Gurucul, HID Global Corporation (Assa Abloy AB), Microsoft Corporation, Nexis GmbH, Okta Inc., One Identity LLC, Oracle, Ping Identity, Radiant Logic Inc., SailPoint Technologies, Inc. and Securonix.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)