Ice Cream Market Size, Share, Trends and Forecast by Flavor, Category, Product, Distribution Channel, and Region, 2026-2034

Ice Cream Market Size and Share:

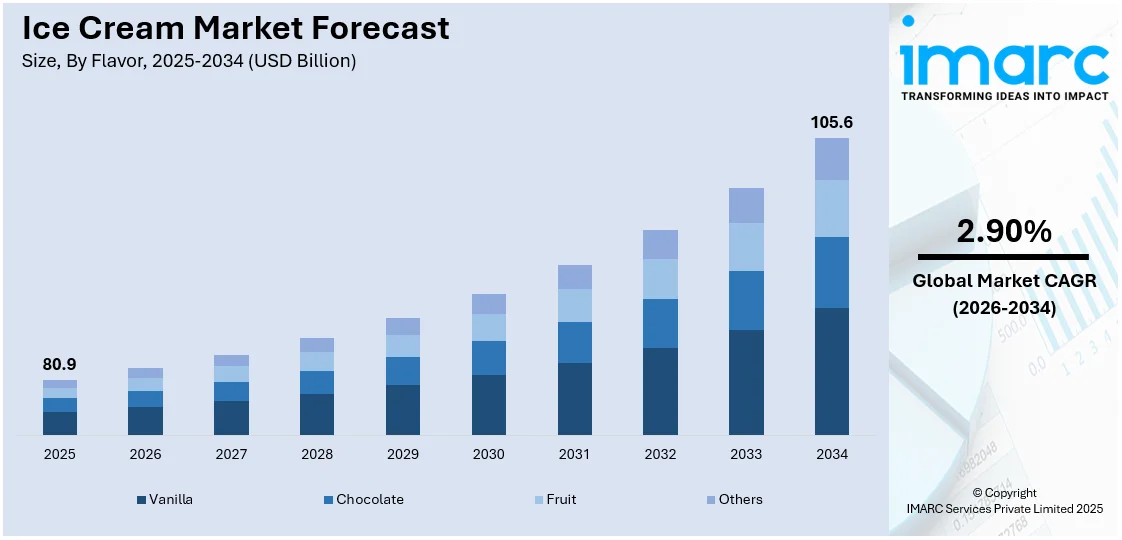

The global ice cream market size was valued at USD 80.9 Billion in 2025. The market is projected to reach USD 105.6 Billion by 2034, exhibiting a CAGR of 2.90% from 2026-2034. Europe currently dominates the market, holding a market share of over 35.1% in 2025. The market is driven by high demand for premium and artisanal products, strong retail networks, and a deep-rooted cultural affinity for dairy-based frozen desserts in key regional markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 80.9 Billion |

|

Market Forecast in 2034

|

USD 105.6 Billion |

| Market Growth Rate 2026-2034 | 2.90% |

The global ice cream market is growing strongly on the back of changing health and wellness trends. Global consumers are becoming more health-conscious and actively seeking frozen desserts that fit into healthier lifestyles. This has resulted in accelerating demand for low-fat, low-sugar, and dairy-free products, as well as functional ingredient-enriched products like protein, fiber, and probiotics. Plant-based versions produced from almond, oat, soy, and coconut milk are highly popular among various segments. Clean-label products with low levels of additives and natural sweeteners are also finding favor with health-aware consumers. Social media awareness, wellness influencers, and the worldwide move toward balanced diets are fueling this trend. Consequently, health-focused product development has emerged as a key strategy in increasing consumer base and creating brand loyalty. The market is reacting in a dynamic way, providing healthy yet tasty innovations that satisfy contemporary expectations without sacrificing the indulgent experience that comes with ice cream. For example, in April 2025, Wendy's rolled out three new Frosty Swirls—swirled chocolate or vanilla with brownie batter, caramel, or strawberry—offering added diversity as part of its spring season expansion of flavors.

To get more information on this market Request Sample

In the United States, consumer demand for premium and indulgent consumption drives the ice cream industry with the share of 94.90%. Consumers increasingly purchase high-quality frozen desserts that provide rich taste, creamy consistency, and indulgence. This is underpinned by rising disposable incomes and a larger culture of self-consumption through food. Flavor innovation is important, with consumers seeking distinctive combinations like caramel swirl, espresso fudge, and globally inspired profiles like churro or tropical fruit profiles. Artisanal manufacturing processes, small-batch packaging, and attractive appearance further contribute to the sense of luxury and premiumness. Consumers also prefer products that highlight authenticity, leveraging natural ingredients and heritage preparation methods. Seasonal products and special-edition flavors generate excitement and encourage repeated purchasing. For instance, in April 2025, Baskin-Robbins introduced Paloma Paradise, a grapefruit-chili ice cream based on the tropical cocktail, along with mocktail-version Paloma Paradise Fizz and new Flavor Flights with customizable mini scoops. Moreover, indulgence also occurs at the level of product forms, such as multi-texture cups, dipped bars, and dessert-style innovation. The trend continues to sustain vibrant growth within the premium space.

Global Ice Cream Market Trends:

Changing Consumer Preferences

Changing consumer attitudes are greatly transforming the landscape of the ice cream market. With rising health consciousness, consumers increasingly look for frozen desserts that are in sync with their dietary requirements and health objectives. This has driven the growth of low-fat, low-sugar, high-protein, and dairy-free ice creams. One of the major drivers of this trend is the rising popularity of plant-based diets. It has been estimated that the world market for non-dairy milk products, as indicated by ProVeg International, totaled USD 5.60 billion in the year 2024 and will nearly double to USD 10.96 billion by 2029 at a CAGR of 14.38%. On this basis, companies are adjusting recipes, replacing the dairy bases with substitutes such as almond milk, oat milk, and coconut milk, and utilizing natural sweeteners such as stevia or monk fruit. These technologies are broadening the reach of ice cream to a broader demographic, such as vegans, lactose intolerants, and health-conscious consumers, as well as creating new brand allegiance and market distinction through ingredient traceability and functional value.

Global Expansion of the Market

The international ice cream market is experiencing swift geographic growth due to economic growth and lifestyle shifts in developing countries. Although long-standing strongholds like North America and Europe are still at the heart of the market, others like Asia-Pacific and Latin America are observing strong growth. Urbanization, rising disposable incomes, and growing exposure to international food trends are all driving higher demand for premium and more varied ice cream products. Real household income per capita in OECD member countries increased by 0.9% in the first quarter of 2024, which means that consumer purchasing power is stronger, reports the OECD. Multinational manufacturers are thus investing in localized manufacturing, adapting flavors to local palates, and entering into strategic alliances to widen distribution. Not just increasing global sales, this growth is fueling product innovation in accordance with regional tastes. From mango and matcha to dulce de leche and red bean, diversification of flavors is at the forefront of spearheading market penetration.

Growing Sustainability and Ethical Practices

Sustainability and ethics are increasingly becoming key to consumer purchasing decisions in the ice cream market. Through greater awareness of issues related to the environment and society, most consumers are giving preference to brands that show evidence of responsible behavior across the supply chain. Green packaging, sustainably sourced ingredients, and carbon-neutral operations are fast turning into key differentiators in the market. The international market for green packaging accounted for USD 271.2 billion in 2024 and is projected to develop to USD 415.3 billion by 2033, growing at a CAGR of 4.35% from 2025–2033, as per the IMARC Group. In turn, ice cream manufacturers are turning towards biodegradable materials, fair-trade practices, and clean energy technology. Such initiatives, in addition to minimizing environmental impact, also find favor with consumers who are green-oriented and care about transparency and corporate accountability. By coupling their operations with the universal goals of sustainability, ice cream companies can project a better public image, build customer loyalty, and comply with changing regulatory requirements in global markets.

Ice Cream Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ice cream market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on flavor, category, product, and distribution channel.

Analysis by Flavor:

- Vanilla

- Chocolate

- Fruit

- Others

Chocolate is still the most popular flavor in the international ice cream industry in 2025 with 31.0% market share. This persistence is due to its wide acceptance among people of all ages and its compatibility as an addition with nuts, fruits, and sauce. Chocolate ice cream is used as both an old-time stand-alone flavor and as a platform for luxury variations, such as dark chocolate, fudge swirl, and chocolate truffle. Manufacturers keep innovating in this segment by launching artisanal variants, vegan chocolate, and low-sugar versions to keep pace with shifting dietary trends. The hedonistic appeal of chocolate, coupled with its emotional and nostalgic connotations, fuels its high consumer loyalty. Moreover, limited edition launches and local infusions like chili chocolate or hazelnut praline also serve to keep consumers engaged. The versatility of the taste to various product forms such as cones, cups, and bars guarantees its leading status across retail and food service channels around the world.

Analysis by Category:

- Impulse Ice Cream

- Take-Home Ice Cream

- Artisanal Ice Cream

Impulse ice cream dominated the market in 2025 with a commanding 59.6% share, thanks mainly to their convenience and accessibility. These products consisting of sticks, bars, cones, and sandwiches are mostly bought on-the-go and are particularly popular among young adults and children. Their popularity stems from their affordability, portion size control, and extensive availability from kiosks, street vendors, and retail chains. Impulse products are helped by strong brand prominence and spontaneous purchasing habits, frequently stimulated by quality packaging and promotion efforts. Volume is greatly helped during the warmer months and holiday seasons. Firms spend a lot of money developing impulse items with new flavors, textures, and multi-layered fillings to keep the consumer interested. In addition, new health-oriented varieties like protein bars, dairy alternatives, and low-sugar varieties are broadening the impulse category's relevance to consumers who are health-conscious. Dominance of the segment points to convenience and immediate gratification as critical factors in contemporary snacking society.

Analysis by Product:

- Cup

- Stick

- Cone

- Brick

- Tub

- Others

In 2025, cup ice creams accounted for 25.8% of the global product market share, which positions them as a prominent format based on their convenience and versatility to fit into both retail and food service channels. Cups provide managed portion sizes, reduce mess, and are simple to store, thus becoming popular among individual customers and households as well. The format accommodates a great range of textures, from soft serve to thick gelato, and both established and new flavors. Cups also lend themselves well to brand narrative through unique packaging and labeling, such as nutritional facts, sustainability messaging, and QR codes connecting to online material. And the flexibility of the format has also made it well-suited for plant-based and premium brands with niche appeal. As consumers increasingly seek hygienic, resealable, and portable products—particularly in urban centers—cup ice creams continue to make inroads, providing a convenient and premium experience across supermarkets, cafes, and online delivery channels.

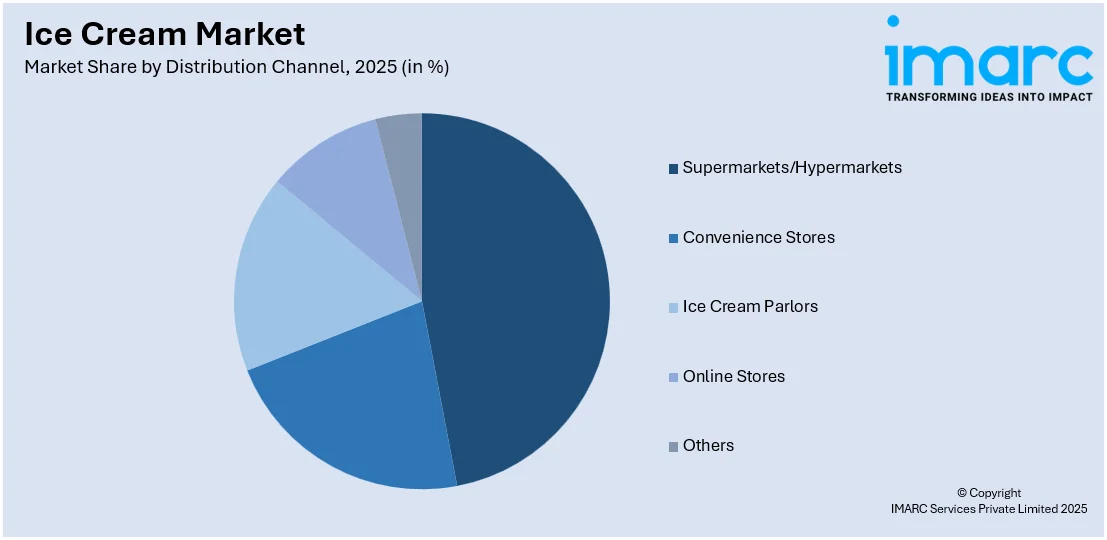

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience Stores

- Ice Cream Parlors

- Online Stores

- Others

Supermarkets and hypermarkets remained the top ice cream distribution channel worldwide, driving 46.9% of sales in 2025. These stores present consumers with an extensive range of brands, flavours, and package formats, spanning mass-market varieties to artisan and health-oriented. The organised set-up and chilled chain infrastructure at these stores support product freshness and attractiveness, with their promotion might—ranging from in-shop displays, off-shelf coupons, and free sampling activities—fuel high sales volume. Consumers tend to opt for supermarkets when making bulk purchases and family sizes, particularly in the tub and cup sizes. Furthermore, digital integration and loyalty programs through apps and e-commerce sites have contributed to increased customer interaction. Since inflation affects discretionary expenditure, the broad price spectrum offered in such stores—from economical to high-end—enables consumers to choose according to their desire and affordability. The combination of convenience, diversity, and trust that the supermarket model has enjoyed still makes it the foundation of the international ice cream distribution industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- France

- Germany

- Netherlands

- Norway

- Sweden

- Denmark

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe is accounted for the biggest regional proportion of the world's ice cream market in 2025 at 35.1% of total sales. The region's high performance is fueled by long-established consumption habits, a high standard of living, and a historical cultural preference for dairy desserts. European consumers have a high interest in quality, traceability, and traditional production processes, so brands are pushing natural ingredients, sustainability, and regional expertise to the forefront. These countries are among the global leaders in volume and innovation, with local specialties such as gelato and sorbetto gaining international momentum. Additionally, Europe's high food safety standards and clean-label demands have shaped industry practices around the globe. The region is also served by solid distribution infrastructure that includes broad retail chains and developing e-commerce presence. Seasonal fluctuations, especially hot summers, stimulate consumption, whereas increased demand for organic and functional ice creams provides sustained growth. Europe's dominance reflects a mature, yet vibrant market focused on quality and ethical manufacturing.

Key Regional Takeaways:

North America Ice Cream Market Analysis

North America ice cream market continued to show strong performance, supported by high per capita consumption, product innovation, and rich flavor variety. The region is supported by well-developed cold chain infrastructure, enabling broad accessibility through traditional retail as well as online grocery channels. North American consumer tastes support strong demand for premium, artisanal, and health-oriented options, such as low-calorie, plant-based, and high-protein ice creams. Seasonal marketing and cultural links with celebration and indulgence also underpin consistent sales levels throughout the year. Growth in customizable products and novelty formats has also driven ice cream market growth. Supermarkets and convenience stores continue to be major distribution channels, although fast expansion in e-commerce and home delivery is transforming purchasing behavior. Regional trends are driven by growing awareness of clean-label ingredients, with consumers in many cases wanting transparency and nutritional balance in frozen desserts. North America is a mature but dynamic market characterized by ongoing flavor and format innovation.

United States Ice Cream Market Analysis

The US ice cream industry is seeing consistent growth, fueled by changing consumer tastes and innovation in products. The market for premium and indulgent ice creams such as organic, dairy-free, and high-protein ones is on the rise. Buyers are becoming increasingly drawn to healthier alternatives with less sugar and natural ingredients, propelling the market for functional and plant-based options. Growth in online retail channels and direct-to-consumer sales further increases convenience and accessibility. Seasonal fluctuation of demand continues to be a critical element, with the summer season inducing peak sales. Moreover, personal income growth will also be supporting higher consumer spend on luxury and premium items such as ice creams. Amplified purchasing power enables support for better-quality and innovative products in ice creams. New innovations in packaging and environmentally friendly manufacturing processes are also becoming more prominent. The increasing popularity of experiential flavors and craft varieties drives market growth. Supermarkets, convenience stores, and specialty ice cream shops continue to be the dominant distribution channels, with digital platforms presenting new opportunities for growth.

Europe Ice Cream Market Analysis

The European ice cream industry is fueled by shifting consumer behavior and increasing demand for premium and artisanal offerings. Consumers are looking for rich experiences with novel flavors, textures, and superior ingredients, propelling the appeal of handcrafted and organic ice creams. Healthy trends are also impacting product development, resulting in the rise of dairy-free, low-calorie, and functional ice creams. This follows the growing European vegan food market, which had a value of USD 5.0 Billion in 2024 and is expected to hit USD 11.0 Billion by 2033, expanding at a CAGR of 8.65% during 2025-2033, as per the IMARC Group. The growth in demand for plant-based options is pushing producers to launch creative vegan ice cream flavors. The growth of retail distribution channels, such as supermarkets, hypermarkets, and the internet, sustains market growth. Also, sustainable packaging and environmentally friendly production processes are gaining popularity, with seasonal demand on the rise. Refrigeration technologies enhance shelf life and distribution efficiency. Growing interest in premium, clean-label, and plant-based ice creams is likely to fuel growth.

Asia Pacific Ice Cream Market Analysis

The Asia Pacific ice cream market is experiencing high growth as a result of rising disposable incomes, urbanization, and changing consumer tastes. For instance, the ice cream market in India is significantly expanding due to the boost in income levels, which is leading to increased consumer expenditure on indulgent and premium products such as ice creams. As per industry reports, salaries in India are expected to see consistent growth in 2025, driven by a projected 9.5% increase in pay. Demand for healthier and creative flavors is on the rise, resulting in the growth of low-calorie, plant-based, and high-protein ice creams. The increasing dominance of Western consumption trends and the emergence of convenience-oriented retailing also fuel market expansion. Digitalization and online platforms enhance consumer availability across a range of products, while cold chain logistics enhance distribution effectiveness. Market trends are still dictating distinctive textures and regionally inspired flavors, and speedy urbanization and shifting dietary trends forecast high growth in the next few years.

Latin America Ice Cream Market Analysis

The Latin American ice cream sector is witnessing gradual growth, which is fueled by growing disposable incomes and urbanization. This transition is leading to greater consumer access to varied foods, such as high-end and artisanal ice creams with natural ingredients and novelty flavors. There is also demand for low-calorie, dairy-free, and functional ice creams picking up pace among health-food consumers. Retail distribution is changing, with supermarkets, hypermarkets, and convenience stores being the major sales channels, and e-commerce becoming an upcoming platform. Innovations in packaging and reformulations of products also drive market growth. With increasing consumer interest in indulgent but healthier products, the market is likely to continue its growth.

Middle East and Africa Ice Cream Market Analysis

The Middle East and Africa market for ice cream is growing, buoyed by rising disposable incomes, urbanization, and shifting customer needs. The market for premium, innovative, and healthier ice cream, including low-sugar and dairy-free products, is growing. Growth in modern retail infrastructure as well as the growing power of e-commerce improves market access. This quick e-commerce expansion is also likely to promote online ice cream sales, bringing convenience and variety of products. Formulation innovation, flavoring, and packaging innovations appeal to various tastes and are sold maximally during hotter months.

Competitive Landscape:

The global ice cream market's competitive landscape is dominated by aggressive innovation, product diversification, and brand positioning across distinct consumer segments. Players compete on various parameters such as flavor innovation, packaging, efficient distribution, and health-conscious formulations. Artisan and premium segments have gained traction, targeting consumers looking for indulgence and differentiation. At the same time, there is considerable expansion of plant-based, low-calorie, and functional ice creams, which make the product more attractive to health-oriented and dietary-specific consumers. Manufacturers are taking advantage of digital marketing, influencer partnerships, and sustainability communications to drive brand loyalty and capture young consumers. Private labels and local brands are also increasing their share by providing value-for-money and localized flavors. Distribution strategies continue to change, with omnichannel models that blend brick-and-mortar retailing, direct-to-consumer channels, and rapid commerce delivery. The market is still highly fragmented and presents opportunities for differentiation by niches, innovation-driven growth, and consumer-focused brand building by regions and demographics.

The report provides a comprehensive analysis of the competitive landscape in the ice cream market with detailed profiles of all major companies, including:

- Amul (GCMMF)

- Blue Bell Creameries

- Dairy Farmers of America, Inc.

- Danone S.A.

- General Mills Inc.

- LOTTE Wellfood Co. Ltd. (LOTTE Group)

- Nestlé S.A.

- SmithFoods Inc.

- Unilever PLC

- Wells Enterprises

Latest News and Developments:

- On May 26, 2025, Food Union Latvia launched 11 new ice cream products for summer, combining global food trends with local innovation. The lineup includes kefir-based cones under Vēsma, vegan coconut milk bars and oat-cookie sandwiches from Pols, refined double-glazed sticks from Ekselence, and a new banana flavor in the Tio cocktail series. The company invested around €500,000 (USD 580,000) in developing and marketing these new offerings.

- On April 28, 2025, Lotte Wellfood launched India's first 4-layered ice cream bar, 'Lotte Krunch,' combining Korean technology with locally tailored flavors. The bar features a crushed cookie topping, sauce center, creamy ice cream, and a chocolate coating, with the Yogurt Berry variant introducing India's first yogurt-flavored ice cream bar. The product is available in three flavors, Yogurt Berry, Choco Berry, and Choco Vanilla, across major cities via various retail and quick-commerce channels.

- On March 27, 2025, Meiji Co., Ltd. announced the launch of Hokkaido Ice Vanilla, a premium ice cream bar made entirely with Hokkaido-sourced dairy, designed to meet export standards and debut in Taiwan, Hong Kong, Singapore, and Vietnam from mid-May 2025. Additionally, the company expanded its Chinese portfolio in January 2025 with the introduction of Mini Soft Cone multipacks—built on domestic manufacturing expertise to differentiate in the cone-type ice cream market.

- January 2025: Unilever unveiled its latest ice cream range, introducing new flavors across Talenti, Breyers, Popsicle, Good Humor, Magnum, and Klondike. Highlights included bakery-inspired gelato, s’mores-themed treats, character-branded novelties, and low-carb options. The lineup featured collaborations, new formats, and premium offerings, catering to diverse tastes and dietary preferences.

- November 2024: Ice Cream Works introduced a new range of artisanal ice cream flavors across Classic, Premium, and Luxury lines. The collection includes nostalgic favorites, indulgent flavors like Nutella Chocolate Brownie and Biscoff Caramel, and luxurious options such as Sea Salt Caramel Fudge.

- June 2024: See’s Candies and McConnell’s Fine Ice Creams launched four limited-time ice cream flavors, blending See’s iconic chocolates with McConnell’s artisan bases. The flavors include Vanilla with California Brittle™, Coffee with Molasses Chips™, Chocolate with Polar Bear Paws™, and Banana Cream with Toffee-ettes™.

- February 2024: Nestlé S.A. launched a new range of ice cream-inspired sharing bags featuring Aero, Milkybar, Munchies, and Rowntree’s Randoms. Inspired by nostalgic frozen flavors, the lineup includes Neapolitan Aero Melts and Raspberry Ripple Milkybar Buttons. Partnering with Jordan Banjo, Nestlé remixed classic ice cream van jingles to celebrate the launch.

Ice Cream Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD, Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Flavors Covered | Vanilla, Chocolate, Fruit, Others |

| Categories Covered | Impulse Ice Cream, Take-Home Ice Cream, Artisanal Ice Cream |

| Products Covered | Cup, Stick, cone, Brick, Tub, Others |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Ice Cream Parlors, Online Stores, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, France, Germany, Netherlands, Norway, Denmark, Brazil, Mexico, Others |

| Companies Covered | Amul (GCMMF), Blue Bell Creameries, Dairy Farmers of America, Inc., Danone S.A., General Mills Inc., LOTTE Wellfood Co. Ltd. (LOTTE Group), Nestlé S.A., SmithFoods Inc., Unilever PLC, Wells Enterprises, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ice cream market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ice cream market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ice cream industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ice cream market was valued at USD 80.9 Billion in 2025.

The ice cream market is projected to exhibit a CAGR of 2.90% during 2026-2034, reaching a value of USD 105.6 Billion by 2034.

Key drivers of the ice cream market are growing consumer demand for indulgent treats, greater availability through a range of retail channels, rising demand for premium and artisanal products, and innovation in flavor and format. Health-oriented trends have also driven demand for low-fat, plant-based, and functional ice cream.

Europe currently dominates the ice cream market, accounting for a share of 35.1%. The market is fueled by strong-established consumption patterns, high demand for premium and artisanal products, and well-developed retail structures. Sustained innovation and focus on quality further entrench the position of the region at the head of the market.

Some of the major players in the ice cream market include Amul (GCMMF), Blue Bell Creameries, Dairy Farmers of America, Inc., Danone S.A., General Mills Inc., LOTTE Wellfood Co. Ltd. (LOTTE Group), Nestlé S.A., SmithFoods Inc., Unilever PLC, Wells Enterprises, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)