Hypersonic Technology Market Size, Share, Trends and Forecast by Type, Launch Mode, Range, End User, and Region, 2025-2033

Hypersonic Technology Market Size and Share:

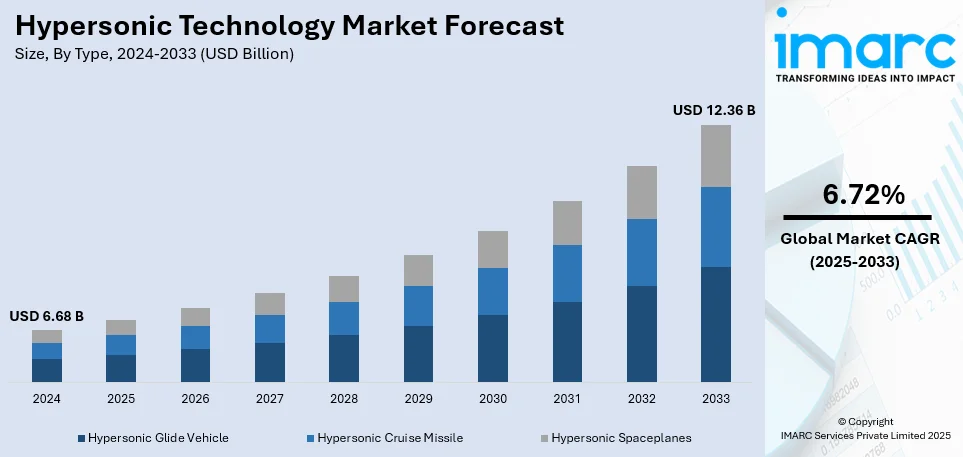

The global hypersonic technology market size was valued at USD 6.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 12.36 Billion by 2033, exhibiting a CAGR of 6.72% during 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 35.3% in 2024. The rising defense budgets, increasing private sector investments, rapid advancements in propulsion and thermal protection, heightened geopolitical tensions, and escalating commercial aerospace interest, is driving the expansion of the hypersonic technology market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.68 Billion |

|

Market Forecast in 2033

|

USD 12.36 Billion |

| Market Growth Rate (2025-2033) | 6.72% |

Countries are actively advancing defense technologies, with hypersonic systems leading military modernization efforts. Governments are making substantial investments in hypersonic weapons, which travel at speeds exceeding Mach 5, rendering them extremely difficult to detect and intercept. Conventional missile defense systems, designed for slower threats, face challenges in countering the high-speed maneuverability of hypersonic missiles. This gives military forces an unmatched strategic advantage in warfare. Countries like U.S. are pouring billions of dollars into hypersonic programs. The Pentagon’s budget for hypersonic research has been increasing year after year, with contracts awarded to major defense companies like Lockheed Martin, Raytheon, and Northrop Grumman. For instance, the Pentagon’s budget in the financial year 2025 requested $6.9 billion for hypersonic research, which was up from $4.7 billion in the request from the 2023.

The United States is leading the hypersonic technology market share in North America with 89.60%. Apart from offensive weapons, the defense agency in the United States is also working on hypersonic missile interceptors and tracking systems. The U.S. Space Development Agency is deploying satellite constellations to detect and monitor hypersonic threats. The Pentagon's Missile Defense Agency (MDA) and Space Development Agency (SDA) launched the hypersonic tracking satellites in 2024. The mission, USSF-124, will include satellites designed to track and intercept hypersonic missiles from threats like Russia and China. The joint effort faces congressional scrutiny regarding the responsibilities of MDA and SDA in missile tracking. This shows how hypersonic technology is reshaping military strategy, making it a top priority for national security.

Hypersonic Technology Market Trends:

Increased Defense Investments

The intensification of global security concerns has led to a marked increase in defense investments into hypersonic technologies. Governments, especially in the U.S., Russia, and China, are investing in hypersonic missiles and defense systems to maintain strategic superiority. Hypersonic weapons, with speeds above Mach 5, provide a unique advantage in offensive and defensive operations. They are hard to intercept, thus becoming a strong military tool. For instance, a flight from New York to Tokyo, which currently takes around 14 hours, could be reduced to just under 2 hours using hypersonic travel, as per reports. Furthermore, hypersonic systems provide strategic advantages in the conflict zones as they are faster, agile, and unpredictable, bypassing traditional defense mechanisms. Increased military interest in hypersonic capabilities drives technological innovation and creates opportunities for private sector participation. As nations are bolstering their defense infrastructure, alliances between defense contractors and governments are accelerating to speed up the rapid development of advanced and reliable hypersonic technologies, which can possibly change the course of future warfare.

Commercialization of Hypersonic Travel

As per the hypersonic technology market trends, the potential for hypersonic travel has been a great driving force in the commercial aviation sector. Hypersonic aircraft capable of traveling above Mach 5 promise to dramatically reduce flight times, which can be considered revolutionary in terms of global transportation. Companies and research organizations are now focused on technical barriers, including heat dissipation, fuel efficiency, and structural integrity, that have limited the development of these technologies for civilian use. Hypersonic travel would quite possibly revolutionize the airline industry with the provision of direct, faster routes connecting international hubs, resulting in a new age of time-efficient long-haul flights. This, in turn, may have very important implications not only for business travelers but also for the tourism industry since the concept of traveling across the globe within hours becomes a reality. As public and private investments continue to flow in, it could be within the next decades that commercial hypersonic travel enters the mainstream, opening whole new possibilities for the aviation world.

Advancements in Material Science

Based on the hypersonic technology market outlook, new materials that can endure extreme conditions such as high temperatures, friction, and pressure in hypersonic flight are essential factors in advancing hypersonic technology. Researchers are focusing on materials that can withstand temperatures that surpass 2,000°C (3,632°F), which is essential for hypersonic vehicles. According to a study by the U.S. Air Force Research Laboratory, advanced ceramic composites and metallic alloys are being inovated to maintain structural integrity under such extreme conditions. For instance, the development of new carbon-carbon composite materials could allow hypersonic vehicles to endure heat fluxes of up to 200 MW/m², compared to the 50 MW/m² capabilities of current materials. These advancements are expected to improve the performance and safety of hypersonic systems. Breakthroughs in this area will enable military and commercial hypersonic vehicles to operate more efficiently and safely. This progress in materials science not only paves the way for hypersonic technology but also leads to further breakthroughs in the aerospace, defense, and energy sectors.

Hypersonic Technology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hypersonic technology market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, launch mode, range, and end user.

Analysis by Type:

- Hypersonic Glide Vehicle

- Hypersonic Cruise Missile

- Hypersonic Spaceplanes

As per the hypersonic technology market forecast, hypersonic glide vehicle leads the market with around 43.6% of market share in 2024. This dominance is driven by increasing defense investments and the strategic need for maneuverable, high-speed weapons. Hypersonic glide vehicles (HGVs) exceed Mach 5 speeds, gliding through the atmosphere after an initial rocket boost, making them extremely difficult to intercept using conventional missile defense systems. Along with this, in increasing focus on deployment and precision strikes is favoring the expansion of the industry. With rising geopolitical tensions and a growing arms race, the HGV segment remains the primary focus of hypersonic advancements, ensuring national security dominance.

Analysis by Launch Mode:

- Air Launched

- Surface Launched

- Subsea Launched

Air launched leads the market with around 48.0% of market share in 2024. Its dominance is driven by its flexibility, rapid deployment capabilities, and military advantages. Air-launched hypersonic systems, such as the U.S. Air Force’s AGM-183A Air-Launched Rapid Response Weapon (ARRW), can be deployed from fighter jets and bombers, allowing for extended range and unpredictable flight paths that evade missile defense systems. This segment benefits from ongoing advancements in scramjet propulsion and thermal protection, making sustained hypersonic flight more feasible. The increasing investing in air-launched hypersonic weapons to enhance strategic deterrence, is fueling the market growth. As global defense agencies prioritize high-speed, maneuverable, and cost-effective solutions, air-launched hypersonic weapons continue to drive market expansion.

Analysis by Range:

- Short Range

- Medium Range

- Intermediate Range

- Intercontinental Range

Intercontinental range leads the market with around 38.6% of market share in 2024. It is fueled by increasing defense investments in next-generation long-range strike capabilities. Intercontinental hypersonic weapons are capable of exceeding 5,500 km and provide strategic deterrence by delivering precision strikes at unprecedented speeds while evading missile defense systems. The U.S. Air Force’s Long-Range Hypersonic Weapon (LRHW) and Russia’s Avangard hypersonic glide vehicle exemplify this category, with both nations accelerating development and deployment. By increasing allocation of budget toward intercontinental hypersonic programs, nations are focusing on extended-range capabilities to counter global threats. The ability to strike distant targets with minimal warning gives these weapons a tactical edge, ensuring their dominance in modern warfare and driving global hypersonic technology market growth.

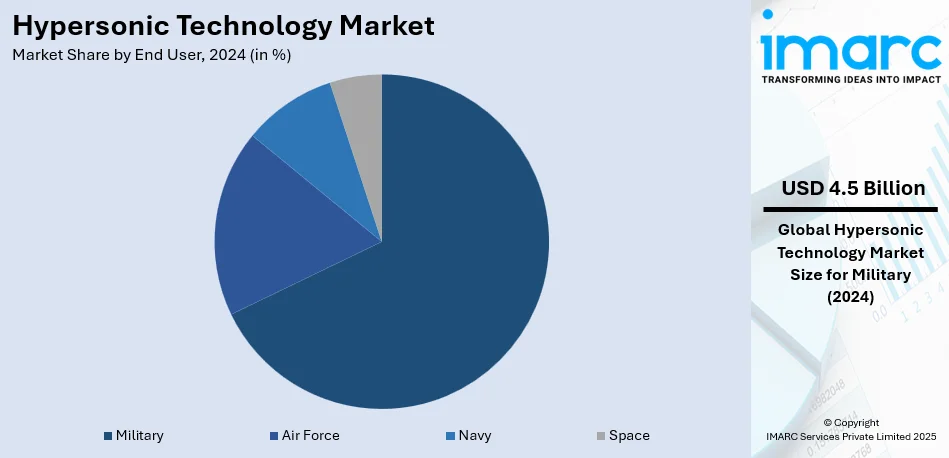

Analysis by End User:

- Military

- Air Force

- Navy

- Space

Military leads the market with around 67.5% of market share in 2024. It is driven by the increasing defense investments and the urgency to develop next-generation weapons. Nations are prioritizing hypersonic systems for strategic deterrence, rapid precision strikes, and overcoming advanced missile defense networks. Military agencies are actively funding research into hypersonic glide vehicles, cruise missiles, and boost-glide systems to enhance their offensive and defensive capabilities. Hypersonic technology is also influencing military aircraft and space-based defense initiatives, further strengthening national security strategies. As geopolitical tensions rise, defense forces are accelerating the deployment of hypersonic weapons, making military applications the dominant force shaping the hypersonic technology market demand.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 35.3%. This is driven by aggressive defense modernization programs and increasing geopolitical tensions. Countries like China, India, and Japan are heavily investing in hypersonic missile development, with China leading in operational deployments. Regional military forces are focusing on hypersonic glide vehicles and cruise missiles to enhance strategic deterrence and counter potential threats. Governments are also collaborating with defense contractors and research institutions to accelerate advancements in propulsion, thermal protection, and targeting systems. The expansion of indigenous hypersonic programs and rising defense budgets position Asia-Pacific as the fastest-growing hub for hypersonic technology, reinforcing its leadership in the global market.

Key Regional Takeaways:

North America Hypersonic Technology Market Analysis

The North America hypersonic technology market is expanding rapidly, driven by strong government funding, advanced defense infrastructure, and leading aerospace companies. The U.S. Department of Defense is prioritizing hypersonic missile development for strategic deterrence, with major programs focusing on air-launched, ground-launched, and intercontinental-range weapons. Companies like Lockheed Martin, Raytheon, and Northrop Grumman are accelerating research into propulsion systems, thermal protection, and guidance technologies to enhance hypersonic capabilities. Canada is also exploring hypersonic applications, particularly in defense collaborations with the U.S. The increasing focus on national security, coupled with technological advancements, cements North America’s role as a key player in the global hypersonic market.

United States Hypersonic Technology Market Analysis

The U.S. hypersonic technology market is constantly evolving as guided by the national strategic defense aspirations and a considerably large amount invested in the defense sector. This year, in 2023, the department of defense within the United States had budgeted about USD 916 billion of which a relatively large percentage will be invested on hypersonic warfare. The focus of the United States remains keeping its defense top-notch while repelling emerging hostile forces like the Chinese and Russia. This is mainly through hypersonic missiles, which travel at more than Mach 5. Such programs as the Hypersonic and High-Cruise Weapon Systems are key accelerators in these technologies. Lockheed Martin, Raytheon Technologies, and Northrop Grumman, among the leading U.S. defense contractors, are the primary innovators and producers of hypersonic systems. The U.S. is not only investing in missile development but also in advanced launch platforms and countermeasure technologies, thus cementing its position as a leader in the global hypersonic market.

Europe Hypersonic Technology Market Analysis

Europe's hypersonic technology market is growing as Europe increases its defense spending, not only in regard to the latest security threats. In 2023, the German defense budget was around approximately USD 66.83 billion, focusing its efforts on innovating missile defenses and hypersonic weapons, as per reports. To this end, the European Defence Agency is leading the way towards collaborative efforts for the development of these advanced technologies among the different EU nations. Companies like MBDA and Thales are at the helm of leading hypersonic weapon programs in the region. The member states of the EU have also invested in joint research and development projects in terms of developing advanced hypersonic missile systems, along with integration of defense infrastructure against threats. Further, Russia's growing advancements in hypersonic technology have been speeding up the European efforts in developing its defense capabilities. The strategic approach of the EU is placing it as a competitive player in the global hypersonic race, with ongoing efforts to integrate state-of-the-art systems into NATO's defense framework.

Asia Pacific Hypersonic Technology Market Analysis

The Asia Pacific region is one of the key regions for hypersonic technology development. Intense geopolitical tensions and increased defense budgets in the region drive this trend. According to an industrial report, China, for instance, set aside USD 230 billion in its defense budget for 2022, much of which will be channelled toward enhancing hypersonic missile capabilities. China has been advancing hypersonic weapons, such as the DF-ZF, a hypersonic glide vehicle. India, with a 2023 defense budget of USD 72.6 billion, is also looked at to be focused on developing hypersonic technology by encouraging "Make in India". The Indian Defense Research and Development Organization has aggressively put its hypersonic cruise missiles to the test. Neither is Japan lagging behind-it is putting a high focus on hypersonic firepower and advanced missile defense systems. Partnerships between local firms and international aerospace giants are fostering collaboration in hypersonic research. These nations are competing to enhance military capabilities and secure a technological edge, making the Asia Pacific region critical in the global hypersonic market.

Latin America Hypersonic Technology Market Analysis

Latin America's hypersonic technology market is still in its infancy but appears to have tremendous growth potential since countries are gradually realizing the strategic importance of hypersonic weapons. Industry reports state that Brazil, the largest economy in the region, has provided USD 21.8 billion for its defense budget in 2022 and a portion is dedicated to military technology modernization, including exploration of hypersonic systems. Brazil is also contemplating international partnerships with aerospace companies to speed up hypersonic capabilities. Other Latin American countries, like Argentina and Colombia, are developing their defense infrastructure and investing in missile technologies. However, there are financial and technological barriers for the region in developing such sophisticated capabilities. However, with increasing security threats and defense up-gradation throughout Latin America, particularly in fighting organized crime and national defense capabilities, further investment in hypersonic technologies is anticipated, which would position the region at the center of global military developments in the future.

Middle East and Africa Hypersonic Technology Market Analysis

Hypersonic technology becomes more important to the Middle East and Africa with defense modernization priorities and answers to regional security challenges. The country of Saudi Arabia, in 2022, had its defense budget allocated at USD 75.01 billion, targeting the enhancement of missile defense systems, including hypersonic capabilities, for a huge portion of their military spending, as per reports. The United Arab Emirates and South Africa are also gaining momentum in the development of missile technology, and South African companies like Denel are leading indigenous hypersonic systems. Rising threat from the neighbors and the strategic significance of missile defense are some of the factors that many nations in the Middle East have started investing in hypersonic weapon systems. Another development is that the governments of the region are strengthening their military cooperation with the rest of the world in order to acquire superior technology. Further defense budget increments and the growing dependence on next-generation technologies for the security of the region can drive the growth of hypersonic systems in the Middle East and Africa regions during the next few years.

Competitive Landscape:

Key players in the market are focusing on advanced propulsion systems, thermal protection solutions, and precision targeting technologies to enhance performance. Defense contractors are accelerating the development of hypersonic glide vehicles, cruise missiles, and air-launched weapons to strengthen military deterrence capabilities. Companies are securing government contracts for large-scale production and integrating hypersonic systems with existing defense infrastructure. Aerospace firms are investing in reusable hypersonic platforms, aiming to revolutionize both military and commercial aviation by drastically reducing travel times. Research institutions and private sector innovators are refining scramjet and combined cycle engines to improve speed, fuel efficiency, and operational range. Some organizations are expanding manufacturing facilities and testing sites to meet increasing global demand, while others are enhancing satellite-based tracking and missile defense systems to counter hypersonic threats. Collaborations between defense agencies, research centers, and private enterprises are driving rapid technological advancements, ensuring that hypersonic capabilities continue to evolve. These efforts are shaping the future of strategic defense and high-speed aerospace applications.

The report provides a comprehensive analysis of the competitive landscape in the hypersonic technology market with detailed profiles of all major companies, including:

- Dynetics (Leidos)

- Hermeus Corp.

- L3Harris Technologies

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

Latest News and Developments:

- January 2025: January 2025 Hermeus opened its HEAT facility in Cecil Airport, Jacksonville, due to a shortfall of hypersonic test infrastructure. The facility with upgraded NAS equipment has successfully tested the Pratt & Whitney F100 engine in propulsion testing to aid Hermeus in the development of hypersonic and supersonic vehicles. The HEAT offers cost-effective propulsion testing at a high capability.

- November 2024: Dynetics Inc. received a USD 670.5 million Army contract to provide a common hypersonic glide body and thermal protection system. The project is due to be completed by October 31, 2029, with USD 65.8 million for fiscal year 2024 research and development.

- September 2024: L3Harris achieved key advancements in U.S. hypersonic missile defense by successfully completing critical reviews for the Space Development Agency's (SDA) Tranche 1 and Tranche 2 Tracking Layer programs. L3Harris secured a USD 919 mln contract for Tranche 2 and launched five missile-tracking satellites in February 2024, which will further enhance the nation's missile defense capabilities.

- September 2024: The U.S. Missile Defense Agency will partner with Northrop Grumman on the Glide Phase Interceptor (GPI) program, which will target hypersonic missile threats. The program will refine GPI design, demonstrate performance in hypersonic environments, and accelerate development using digital engineering to enhance interceptor capabilities ahead of schedule.

- September 2024: Raytheon and Northrop Grumman successfully conducted a static fire test of an advanced long-range solid rocket motor. The test validated the design and performance of wired end-burning technology for hypersonic applications, improving digital modelling and simulation of this technology to accelerate further development and meet the requirements of long-range fire kill chains.

Hypersonic Technology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hypersonic Glide Vehicle, Hypersonic Cruise Missile, Hypersonic Spaceplanes |

| Launch Modes Covered | Air Launched, Surface Launched, Subsea Launched |

| Ranges Covered | Short Range, Medium Range, Intermediate Range, Intercontinental Range |

| End Users Covered | Military, Air Force, Navy, Space |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Dynetics (Leidos), Hermeus Corp., L3Harris Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hypersonic technology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hypersonic technology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hypersonic technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hypersonic technology market was valued at USD 6.68 Billion in 2024.

The hypersonic technology market is projected to exhibit a CAGR of 6.72% during 2025-2033, reaching a value of USD 12.36 Billion by 2033.

The hypersonic technology market is driven by increasing defense investments, military modernization, geopolitical tensions, advancements in propulsion and thermal protection, demand for rapid-strike weapons, and emerging commercial aerospace applications. Governments and private players are accelerating research to enhance speed, maneuverability, and precision in military and aviation sectors.

Asia Pacific currently dominates the hypersonic technology market, accounting for a share of 35.3%, driven by rising defense budgets, strategic deterrence needs, advanced missile programs, and strong investments in propulsion and aerodynamics research.

Some of the major players in the hypersonic technology market include Dynetics (Leidos), Hermeus Corp., L3Harris Technologies, Lockheed Martin Corporation, Northrop Grumman Corporation and Raytheon Technologies Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)