Hydrogen Truck Market Size, Share, and Trends by Product, Application, Range, Region, and Forecast 2025-2033

Hydrogen Truck Market Size and Share:

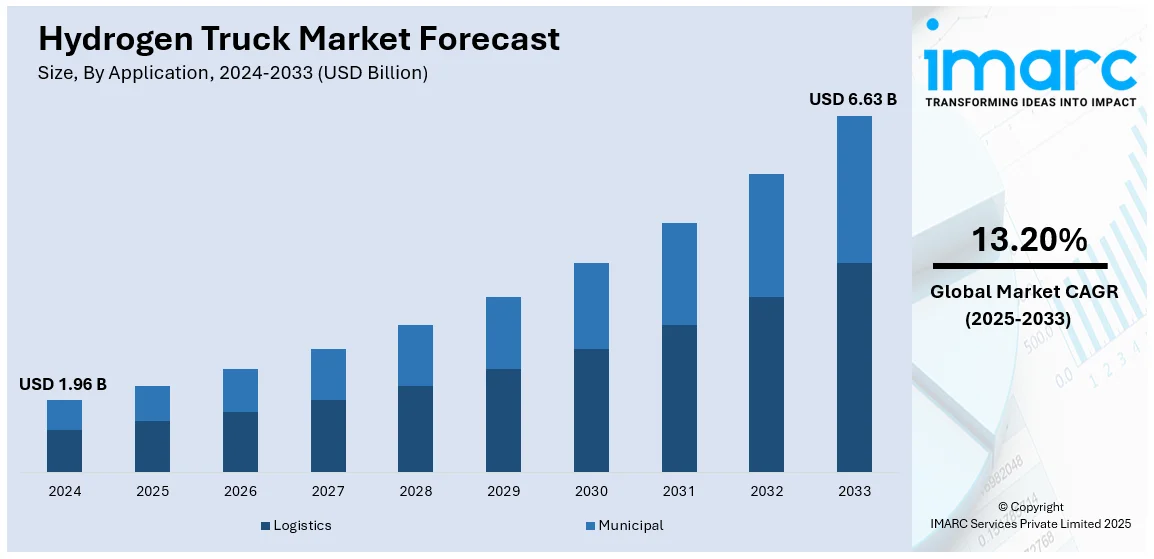

The global hydrogen truck market size was valued at USD 1.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.63 Billion by 2033, exhibiting a CAGR of 13.20% from 2025-2033. Asia Pacific currently dominates the market on account of supportive government policies, investments in hydrogen infrastructure, and the rising need for sustainable transportation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.96 Billion |

| Market Forecast in 2033 | USD 6.63 Billion |

| Market Growth Rate 2025-2033 | 13.20% |

With the global transportation industry moving towards zero-emission options, the demand for hydrogen trucks is growing. Increasing worries about global warming, strict government policies aimed at reducing greenhouse gas emissions, and improvements in fuel cell technology are major factors influencing this market. Hydrogen fuel cell trucks are becoming a feasible option to electric vehicles, providing advantages like extended ranges, quicker refueling times, and reduced environmental impact, especially for heavy-duty and long-distance uses. The market is also influenced by increased investments in hydrogen infrastructure, such as refueling stations. Governments and private organizations are dedicating more resources to developing hydrogen production and distribution networks, which are essential for the growth of hydrogen fuel cell vehicles. Furthermore, progress in fuel cell technology is enhancing the efficiency of vehicles and decreasing manufacturing expenses, improving the economic feasibility of hydrogen trucks.

The United States represents a key market for hydrogen trucks. Various economic, environmental, and technological factors influence the hydrogen truck market growth in the country. A key trend is the federal government's commitment to reducing greenhouse gas emissions via different policies. In November 2023, the Federal Highway Administration (FHWA) of the U.S. Department of Transportation revealed a completed performance measure aimed at offering State Departments of Transportation (DOTs) and Metropolitan Planning Organizations (MPOs) a nationwide framework to monitor transportation-related greenhouse gas emissions (GHG). Hydrogen trucks, characterized by zero emissions and designed for heavy-duty applications, align with the nation's sustainability objectives.

Hydrogen Truck Market Trends:

Global Push for Decarbonization and Stricter Emission Regulations

The growing initiatives to lower greenhouse gas emissions are the main factor impelling the growth of the market. Besides this, governments around the world are enforcing tougher emission rules and setting net-zero goals in order to address climate change. An example like the European Union's "Fit for 55" package and the United States' Inflation Reduction Act (IRA) promote the use of zero-emission transportation solutions such as hydrogen trucks. Hydrogen fuel cell vehicles (FCEVs) are especially appealing for use in heavy-duty settings because of their lack of tailpipe emissions and potential to help with decarbonization initiatives in the logistics and freight industries. Besides this, the Paris Agreement and green initiatives specific to each country are also motivating fleet operators and manufacturers to shift towards clean technologies.

Advancements in Hydrogen Fuel Cell Technology and Cost Reductions

Significant advancements in hydrogen fuel cell technology are enhancing the efficiency, durability, and performance of hydrogen-powered trucks. Besides this, lower costs are also attributed to the declining cost of green hydrogen production, driven by the widespread adoption of renewable energy sources. As hydrogen production becomes more affordable, fleet operators are increasingly opting for fuel cell trucks as part of their sustainability goals. Moreover, research and development (R&D) efforts are resulting in a reduction in fuel cell costs, which were historically a major barrier to market adoption.

Expansion of Hydrogen Infrastructure and Strategic Partnerships

The creation of a strong hydrogen infrastructure network is supporting the growth of the market. Hydrogen refueling stations are essential for facilitating the broad use of hydrogen-fueled trucks, especially in areas where long-distance trucking is prevalent. Governments and private firms are significantly investing in hydrogen refueling stations to facilitate widespread implementation. In 2024, Linde Engineering reached a deal with Shell Deutschland GmbH to construct a 100 megawatt (MW) renewable hydrogen facility for the REFHYNE II initiative at the Shell Energy and Chemicals Park Rheinland located in Wesseling, Germany. Linde Engineering is in charge of the design, sourcing, and construction of an innovative proton-exchange membrane (PEM) hydrogen electrolysis plant. ITM Power shall supply the electrolyzer stacks. Cooperation among car manufacturers, energy providers, and logistics companies is also driving infrastructure expansion. These infrastructure advancements guarantee the smooth functioning of hydrogen trucks, alleviating range anxiety and positioning hydrogen as a practical choice for fleet managers.

Hydrogen Truck Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydrogen truck market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, range, and region.

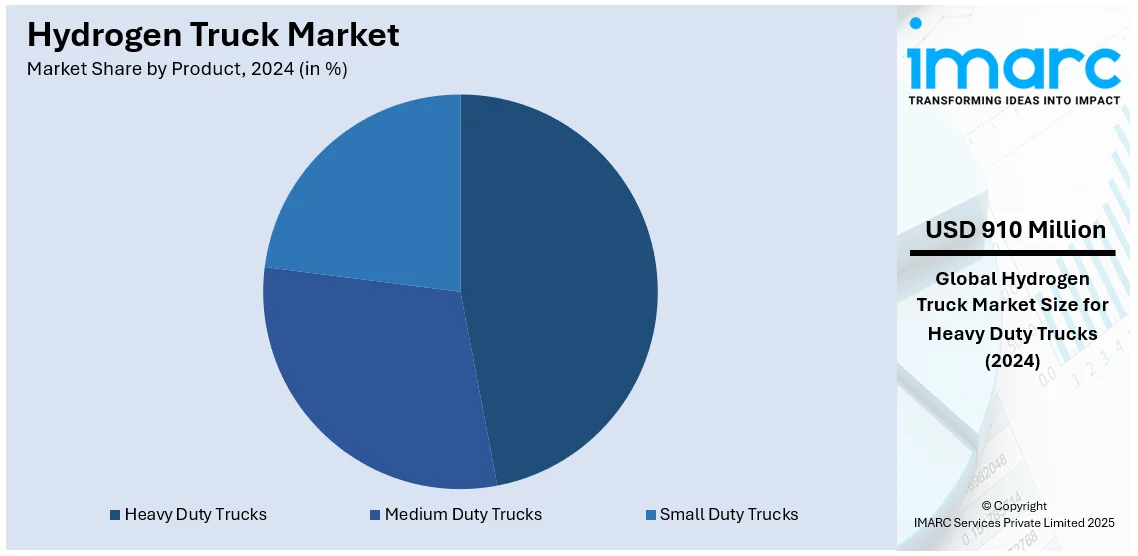

Analysis by Product:

- Heavy Duty Trucks

- Medium Duty Trucks

- Small Duty Trucks

Heavy-duty trucks dominate the hydrogen truck market due to their ability to meet the unique demands of long-haul freight and heavy-duty applications while aligning with global decarbonization goals. Traditional diesel-powered heavy-duty trucks contribute heavily to greenhouse gas emissions, prompting the transportation sector to seek cleaner alternatives. Hydrogen fuel cell technology offers a compelling solution, providing zero-emission operations without compromising on the performance metrics critical for heavy-duty vehicles, such as range, payload capacity, and fueling efficiency. Moreover, advancements in fuel cell technology and declining hydrogen production costs are enhancing the economic viability of hydrogen heavy-duty trucks. Governments and corporations are actively supporting hydrogen adoption through subsidies, partnerships, and infrastructure development. Major manufacturers are focusing their hydrogen efforts on heavy-duty vehicles, recognizing their pivotal role in achieving sustainability targets.

Analysis by Application:

- Logistics

- Municipal

Logistics represents the leading application segment. The use of hydrogen trucks in logistics is growing because the industry is placing more importance on sustainability, efficiency in operations, and adherence to regulations. Serving as the foundation of international commerce, logistics firms depend significantly on long-distance transport, which plays a key role in greenhouse gas emissions. Hydrogen trucks present an effective option for reducing carbon emissions in freight transport, delivering zero-emission operations while satisfying the high-performance demands of the logistics sector. The main benefits of hydrogen trucks in logistics are their long range, quick refueling periods, and capacity for transporting heavy loads. In contrast to battery-electric trucks, which face restrictions due to energy density and charging facilities, hydrogen-powered trucks can cover long distances on one refueling and uphold operational efficiency for long-haul and intercity journeys. This renders hydrogen technology particularly appealing for fleet managers aiming to reduce downtime and enhance productivity.

Analysis by Range:

- Above 400 Km

- Below 400 Km

Hydrogen trucks that can travel over 400 km are mainly intended for long-distance and heavy-duty uses, making them perfect for logistics and freight services. These trucks serve the requirements of industries that need long driving ranges without regular refueling. They take advantage of hydrogen's high energy density, enabling extended operation durations in comparison to battery-electric vehicles. This sector is gaining momentum as producers are creating trucks with ranges surpassing 500 km. The hydrogen truck market forecast indicates continued growth as demand for zero-emission, long-range vehicles in commercial transportation rises.

Hydrogen trucks with a range below 400 km are suited for short-haul operations, including urban delivery and regional logistics. These vehicles are favored in applications where frequent refueling stations are accessible, and payload demands are moderate. They are particularly useful in cities with stringent emission regulations, such as low-emission zones urban freight networks. Manufacturers are focusing on this segment to address last-mile delivery challenges with zero-emission solutions. The segment benefits from lower hydrogen consumption and reduced operating costs, making it an appealing option for fleet operators transitioning to sustainable transport.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific holds the biggest hydrogen truck market share, owing to government policies that sponsor it, investments in hydrogen infrastructure, and a growing demand for sustainable forms of transportation. Most governments in the Asia Pacific region have very ambitious policies implemented to reduce carbon emissions, and hydrogen fuel cell technology has emerged as one of its critical pillars. For example, the Government of Singapore has established a National Hydrogen Policy to invest in low-carbon hydrogen in its future energy mix. The government has also signed a Memorandum of Understanding (MoU) with Chile to promote low-carbon hydrogen technologies. Development of hydrogen refueling infrastructure is also an important enabler for adopting hydrogen trucks in the Asia Pacific region. Countries are putting billions of dollars into hydrogen corridors and refueling networks for long-haul trucking and freight operations.

Key Regional Takeaways:

Europe Hydrogen Truck Market Analysis

The European hydrogen truck industry is propelled by the region's bold decarbonization goals and a growing embrace of eco-friendly transport solutions. European governments are significantly funding hydrogen infrastructure, offering subsidies, and implementing strict emission regulations that promote the use of hydrogen-powered vehicles, such as trucks. Hydrogen trucks provide benefits like extended range, quicker refueling compared to battery electric trucks, and the capacity to manage heavy loads, making them suitable for long-distance transport. Major stakeholders are actively putting resources into the development and commercialization of hydrogen fuel cell trucks. Partnerships with hydrogen production firms and progress in fuel cell technology are additionally driving market expansion. Nations such as Germany, France, and the Netherlands are at the forefront of the market, backed by significant hydrogen infrastructure initiatives.

Asia Pacific Hydrogen Truck Market Analysis

The hydrogen truck market in the Asia Pacific is propelled by the worldwide shift towards eco-friendly transportation. Driven by swift industrialization, rising need for eco-friendly logistics options, and favorable government initiatives, the area is making substantial investments in hydrogen fuel cell technology for heavy-duty vehicles. Nations such as China, Japan, and South Korea lead the way, advocating hydrogen as a practical substitute for fossil fuels. China has established bold plans for introducing hydrogen trucks, supported by government incentives and extensive hydrogen refueling infrastructure projects. Hydrogen ecosystems in Japan and South Korea represent investment initiatives within their national frameworks aimed at attaining carbon neutrality in the future. Businesses are spearheading the creation and implementation of hydrogen trucks in the area.

Latin America Hydrogen Truck Market Analysis

Latin America's hydrogen truck market is gradually picking up pace, with the market being fueled by the increasing focus on carbon-emission cuts and adopting sustainability transportation solutions. Countries within the region are now starting to look into hydrogen as a possible alternative to diesel-hydro-fueled trucks, particularly for freight and logistics industries. The market has still recently started, but growing environmental awareness and government policies promoting renewable energy will be key drivers for future growth.

Middle East and Africa Hydrogen Truck Market Analysis

The hydrogen truck market in the Middle East and Africa (MEA) is propelled by increasing recognition of the importance of decreasing carbon emissions and diversifying economies to lessen reliance on fossil fuels. This shift corresponds with worldwide initiatives to reduce carbon emissions in transportation and local goals to adopt renewable energy. The area's extensive solar and wind resources render it an optimal site for generating green hydrogen, an essential element of the hydrogen truck framework. Nations such as South Africa and Morocco are also harnessing their renewable energy capabilities to establish hydrogen economies, aided by global collaborations and financial support.

Competitive Landscape:

Key market players in the market are adopting various strategies to improve their business, including research and development investment, strategic partnerships, increasing production, and infrastructure development. All these strategies are aimed at overcoming the challenges of high costs, limited infrastructure, and competition from alternative technologies, while catering to the increasing demand for zero-emission transportation. Hydrogen truck manufacturers are now leveraging strategic partnerships as a key factor in driving business growth. The partnerships between truck manufacturers, energy companies, and governments help in overcoming some of the most significant barriers like infrastructure development and hydrogen supply. In 2024, Hydrogen Truck announced it has entered into a purchase agreement for North America's first 12 hydrogen-powered refuse Fuel Cell Electric Vehicles (FCEVs) with recycling and innovation pioneer GreenWaste®. It also marked the Start of Production (SOP) of its game-changing single-stack 200kW Fuel Cell System (FCS), which will enable Hyzon to start mass production of standardized FCSs for commercial sale, quickly propelling the company toward the widespread decarbonization of heavy-duty industries.

The report provides a comprehensive analysis of the competitive landscape in the hydrogen truck market with detailed profiles of all major companies, including:

- Daimler Truck AG

- Hyundai Motor Company

- Hyzon Motors Inc

- Kenworth Truck Co. (Paccar Inc)

- Nikola Corporation

Latest News and Developments:

- February 2025: Nippon Gases and the HOYER Group introduced the inaugural hydrogen-fueled truck for dry ice transportation, representing a major advancement in sustainable logistics. The hydrogen truck, featuring advanced technology, provides a zero-emission option compared to diesel trucks. It can travel up to 450 km with a refueling time of under 15 minutes, helping reduce CO2 emissions in freight transport.

- February 2025: Pure Hydrogen delivered Australia’s first hydrogen fuel cell rear loader garbage truck to Solo Resource Recovery. The truck, which will begin operations in Adelaide with the City of West Torrens Council, marks a major milestone in clean energy adoption for waste management. The delivery received Australian Design Rules (ADR) approval, enabling future registrations of similar vehicles.

- October 2024: Ashok Leyland revealed intentions to commercially introduce its initial hydrogen-fueled truck in 18-24 months, partnering with Reliance Industries. This shipment supports Ashok Leyland's dedication to promoting sustainable commercial vehicles and minimizing India's transportation carbon emissions.

- October 2024: Tata Motors, alongside Indian Oil Corporation (IOC), initiated a pilot project showcasing hydrogen-fueled trucks utilizing internal combustion engines (H2ICE). The initiative, lasting 12 to 18 months, will evaluate vehicle efficiency and hydrogen refueling facilities, along major Indian highways. The Tata Prima H.28, a hydrogen-powered truck from Tata Motors, provides a range of 550 kilometers and represents a significant advancement in India's transition to green hydrogen.

- November 2024: The Federal Ministry for Digital and Transport (BMDV) and the federal states of Baden-Württemberg and Rhineland-Palatinate approved the funding of 226 million euros (Rs 1,986 crore) for the development, small-series production and customer deployment (operation and maintenance) of 100 fuel cell trucks. The funding is a part of the Important Project of Common European Interest (IPCEI) Hydrogen program of the European Union.

- May 2024: Hyundai Motor Company unveiled its hydrogen fuel cell truck business in the North American market with the official launch of the 'NorCAL ZERO Project' in the port of California.

Hydrogen Truck Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Heavy Duty Trucks, Medium Duty Trucks, Small Duty Trucks |

| Applications Covered | Logistics, Municipal |

| Range Covered | Above 400 Km, Below 400 Km |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Daimler Truck AG, Hyundai Motor Company, Hyzon Motors Inc, KenworthTruck Co. (Paccar Inc), Nikola Corporation, etc. |

| Report Features | Details |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydrogen truck market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydrogen truck market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydrogen truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Hydrogen truck is a zero-emission vehicle powered by hydrogen fuel cells, which convert hydrogen into electricity to drive the motor. These trucks are particularly suited for long-haul and heavy-duty applications due to their longer range, fast refueling times, and reduced environmental impact compared to traditional diesel and battery-electric alternatives.

The global hydrogen truck market was valued at USD 1.96 Billion in 2024.

IMARC estimates the global hydrogen truck market to exhibit a CAGR of 13.20% during 2025-2033.

Rising concerns over climate change, stringent emission regulations, advancements in hydrogen fuel cell technology, and growing investments in hydrogen infrastructure are key drivers. Additionally, the ability of hydrogen trucks to support long-haul and heavy-duty operations further propels demand.

In 2024, heavy-duty trucks represented the largest segment by product, driven by their ability to meet the operational needs of long-haul freight and logistics efficiently.

Logistics leads the market by application, owing to hydrogen trucks’ extended range, fast refueling, and suitability for long-haul operations, making them ideal for supply chain and freight activities.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the global market due to supportive government policies, investments in infrastructure, and demand for sustainable transport solutions.

Some of the major players in the global hydrogen truck market include Daimler Truck AG, Hyundai Motor Company, Hyzon Motors Inc, Kenworth Truck Co. (Paccar Inc), and Nikola Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)