Hydrogen Peroxide Market Report by Application (Chemical Synthesis, Bleaching, Disinfectant, Cleaning and Etching, and Others), End-Use (Pulp and Paper, Food and Beverages, Water Treatment, Textiles and Laundry, Oil and Gas, Healthcare, Electronics, and Others), and Region 2025-2033

Hydrogen Peroxide Market Overview:

The global hydrogen peroxide market size reached USD 3.5 Billion in 2024. Looking forward, the market is projected to reach USD 4.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.15% during 2025-2033. The growing occurrence of vector-borne diseases like Zika virus, dengue, and malaria, rising demand for food and beverage processing equipment, and launch of new smartphones are positively influencing the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.5 Billion |

|

Market Forecast in 2033

|

USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 3.15% |

Hydrogen Peroxide Market Analysis:

- Major Market Drivers: People are highly aware about sanitation due to the increasing prevalence of vector-borne diseases around the world.

- Key Market Trends: The growing demand for semiconductors in consumer electronics, along with the launch of new smartphones, is offering a favorable hydrogen peroxide market outlook.

- Geographical Trends: Asia Pacific enjoys the leading position because of its extensive industrial operations, coupled with the rising need for efficient and ecologically friendly chemical processes.

- Competitive Landscape: Some of the major market players in the hydrogen peroxide industry include Airedale Group, Arkema S.A., Evonik Industries AG, Gujarat Alkalies and Chemicals Limited, Kemira Oyj, Mitsubishi Gas Chemical Company Inc., National Peroxide Limited, Nouryon, OCI COMPANY Ltd, Solvay S.A., and Taekwang Industrial Co., Ltd., among many others.

- Challenges and Opportunities: While the market faces challenges like regulatory compliance and environmental concerns, it also encounters opportunities in the increasing demand for eco-friendly chemicals and expanding applications in diverse industries like healthcare, electronics, and water treatment.

To get more information on this market, Request Sample

Hydrogen Peroxide Market Trends:

Growing prevalence of vector borne diseases

According to an article published in 2024 on the website of the Earthdata, vector-borne diseases are responsible for over 17% of all the infectious diseases around the world. Viruses, bacteria, and fungi are responsible for infections and hydrogen peroxide is highly effective against these pathogens. People are highly aware about the need of effective disinfection and sanitization, especially in those areas where outbreaks of vector-borne diseases like Zika virus, dengue, and malaria transmitted by mosquitoes and ticks are common. To control the spread of these diseases, hydrogen peroxide is widely utilized in disinfecting surfaces, water containers, and medical equipment. As per hydrogen peroxide market report, the governing agencies of several countries and healthcare organizations are organizing public health campaigns to promote hygiene practices and disinfection measures. This, in turn, is catalyzing the demand for hydrogen peroxide due to its disinfectant properties, thereby propelling the hydrogen peroxide market growth factors.

Rising demand for food and beverage processing equipment

To ensure the safety and quality of their food products, food and beverage (F&B) companies have to adhere to strict regulations about sanitation. As a result, there is a rise in the demand for hydrogen peroxide to clean equipment, surfaces, and production areas, as it can effectively kill bacteria, molds, yeasts, and other pathogens without leaving any harmful residues. Clean water is a necessity for food and beverage processing applications. But sometimes there is not easy access to clean water. According to the hydrogen peroxide market research report, the product is crucial in disinfecting this water to make it suitable for various uses, which is positively influencing the hydrogen peroxide industry statistics. Packaging material used in this industry can also be sterilized by hydrogen peroxide to maintain the freshness and enhance the shelf life of the product. The IMARC Group’s report shows that the global food and beverages processing equipment market is expected to reach US$ 93.8 Billion by 2032.

Launch of new smartphones

The functioning of smartphones and other modern gadgets depend on semiconductors. In the semiconductor industry, hydrogen peroxide is utilized in cleaning and etching procedures when semiconductor components are being manufactured. In order to assure product dependability and eliminate impurities, cleaning using hydrogen peroxide-based solutions is necessary during the assembly and soldering of various electronic components used in the production of smartphones. The rising use of hydrogen peroxide in electronics manufacturing, particularly in semiconductor cleaning processes, is one of the key hydrogen peroxide market trends. Moreover, key players operating in the smartphone market are launching advance smartphones for catering to the demand of people. For instance, in 2023, Sony Electronics Inc. introduced the Xperia 1 V, its first flagship smartphone equipped with a newly developed stacked CMOS image sensor with 2-layer Transistor Pixel.

Sustainable Industrial Expansion Driving Market Growth

The market is witnessing increased demand across a wide range of industries, including pulp and paper, textiles, and electronics, where hydrogen peroxide plays a critical role in bleaching, cleaning, and etching applications. Its eco-friendly nature, characterized by decomposition into water and oxygen without harmful residues, aligns with the global push for greener chemical alternatives. Moreover, the growing focus on hygiene and sanitation, particularly after the pandemic, is accelerating the demand for effective disinfectants. Hydrogen peroxide is gaining traction due to its broad-spectrum antimicrobial efficacy, making it a preferred choice in healthcare, water treatment, and public sanitation. These factors collectively underscore hydrogen peroxide’s versatile utility, supporting its sustained adoption across sectors and contributing to a positive outlook for the hydrogen peroxide market.

Hydrogen Peroxide Market Segmentation:

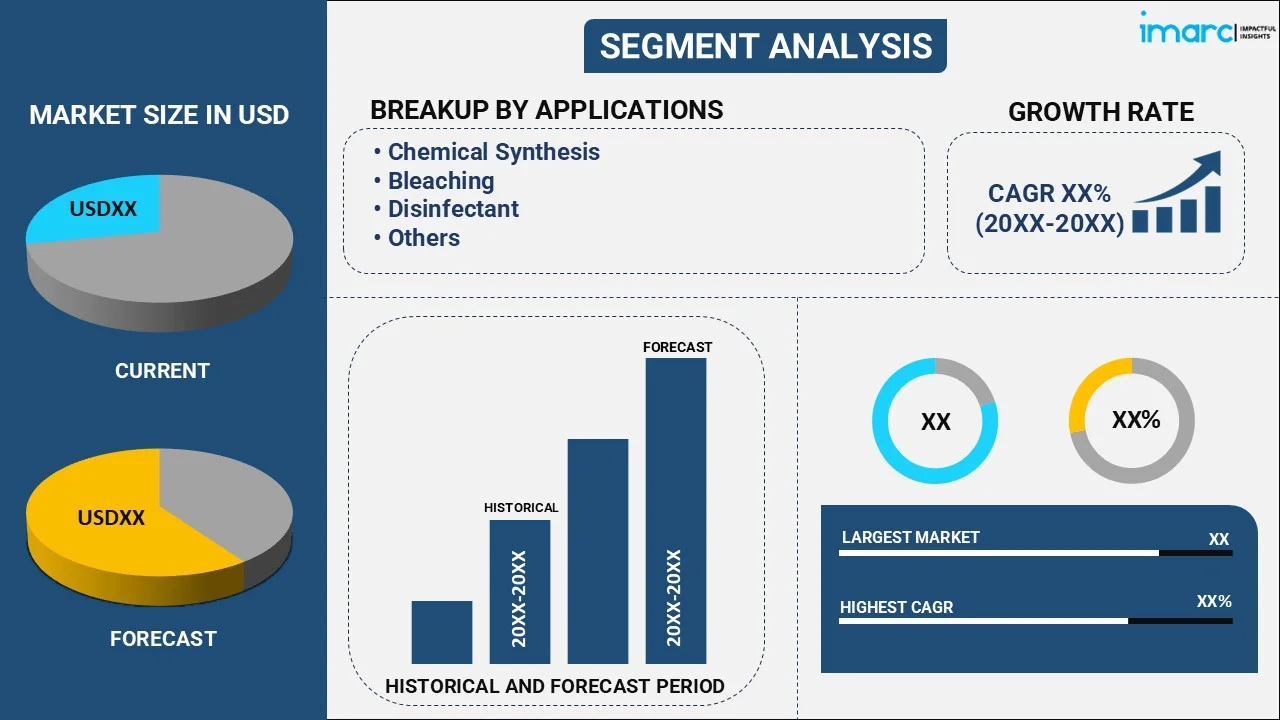

IMARC Group provides an analysis of the key trends in each segment of the market, along with hydrogen peroxide market forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on application and end-use.

Breakup by Application:

- Chemical Synthesis

- Bleaching

- Disinfectant

- Cleaning and Etching

- Others

Chemical synthesis accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes chemical synthesis, bleaching, disinfectant, cleaning and etching, and others. According to the report, chemical synthesis represents the largest segment.

Due to its essential function as a green oxidizing agent in numerous industrial processes, chemical synthesis accounts for the majority of the hydrogen peroxide market share. Hydrogen peroxide finds widespread application in the synthesis of compounds, such as propylene oxide, a necessary precursor for numerous significant materials like glycol ethers and polyurethane. Its potent oxidizing qualities allow for effective and eco-friendly reactions, which makes it a better option than conventional oxidants that frequently result in dangerous byproducts. The use of hydrogen peroxide in chemical synthesis is further encouraged by the movement towards environment friendly and sustainable production techniques.

Breakup by End-Use:

- Pulp and Paper

- Food and Beverages

- Water Treatment

- Textiles and Laundry

- Oil and Gas

- Healthcare

- Electronics

- Others

Pulp and paper hold the largest share of the industry

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes pulp and paper, food and beverages, water treatment, textiles and laundry, oil and gas, healthcare, electronics, and others. According to the report, pulp and paper account for the largest market share.

The pulp and paper industry prefers hydrogen peroxide because it can bleach wood pulp efficiently and doesn't produce any hazardous chlorinated byproducts, which reduces pollution in the environment. This industry is not relying on conventional bleaching agents based on chlorine anymore due to rising concerns about environment. As a result, there is an increase in the demand for hydrogen peroxide as an environment friendly alternative, creating a positive hydrogen peroxide market outlook. Moreover, to improve the brightness and quality of paper goods, hydrogen peroxide is highly preferable.

Breakup by Region:

- Asia Pacific

- Europe

- Middle East and Africa

- North America

- Latin America

Asia Pacific leads the market, accounting for the largest hydrogen peroxide market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, the Middle East and Africa, North America, and Latin America. According to the report, Asia Pacific represents the largest regional market for hydrogen peroxide.

There is a rise in the need for efficient and ecologically friendly chemical processes in the region due to the extensive industrial operations. In addition, countries like China, India, and Japan are major producers and users of hydrogen peroxide. Increased consumption of packaged goods and consumer goods due to rapid urbanization and population growth in the region is driving the demand for hydrogen peroxide in these industries. The focus on sustainable development and strict environmental regulations, which encourage the adoption of hydrogen peroxide as a greener alternative to existing chemicals is bolstering the hydrogen peroxide market growth. Moreover, key players operating in this region are focusing on building new hydrogen peroxide plant in the region. For instance, in 2023, Solvay, a global market leader in specialty chemicals, signed a license agreement with Guangxi Chlor-Alkali Chemical (GHCAC), which will enable the Chinese partner to build and operate a hydrogen peroxide megaplant at Qinzhou.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the hydrogen peroxide industry include Airedale Group, Arkema S.A., Evonik Industries AG, Gujarat Alkalies and Chemicals Limited, Kemira Oyj, Mitsubishi Gas Chemical Company Inc., National Peroxide Limited, Nouryon, OCI COMPANY Ltd, Solvay S.A., and Taekwang Industrial Co., Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- In an effort to improve their market positions and broaden their reach, major players in the hydrogen peroxide industry are actively participating in a number of strategic initiatives. These businesses are making significant investments in R&D to innovate, boost production efficiency, and lessen the negative environmental effects of hydrogen peroxide manufacturing, which in turn is substantially contributing to the hydrogen peroxide market worth. To fulfill the rising hydrogen peroxide demand throughout the world, especially in emerging countries, they are also concentrating on increasing their production capabilities. Acquisitions, mergers, and partnerships are typical tactics used to increase their market dominance and technological prowess. For instance, Evonik expanded its peroxides production network with full acquisition of Thai Peroxide Co., Ltd. in 2023. Furthermore, these major firms are putting more and more focus on sustainability by creating environment friendly goods and procedures, which is in line with the worldwide movement towards green chemistry and legal compliance.

Hydrogen Peroxide Market News:

- In 2025: Nouryon launched Eka® HP Puroxide™, becoming the first Nordic supplier to offer low-carbon footprint hydrogen peroxide, targeting European industries' Scope 3 emissions reduction goals. The new product, produced in Sweden using fossil-free hydrogen and renewable electricity, reduces the carbon footprint by up to 90% compared to conventional natural gas-based processes. This innovation highlights a major step in the hydrogen peroxide market toward sustainable production practices and supports the industry's shift to eco-premium chemical solutions.

- In 2025: Solvay and BASF partnered to reduce Scope 3 emissions in hydrogen peroxide production by sourcing aluminum chloride with a 50% lower carbon footprint for Solvay’s Linne Herten plant in the Netherlands. By shifting sourcing from India to Germany, the collaboration significantly cuts emissions associated with anthraquinone production, a key material in hydrogen peroxide manufacturing. This move demonstrates growing momentum in the hydrogen peroxide market towards lower-carbon supply chains, aligned with Solvay’s broader goal of reducing Scope 3 emissions by 20% by 2030.

- In 2025: Evonik and Fuhua Tongda Chemicals established a joint venture, Evonik Fuhua New Materials (Sichuan) Co., Ltd., to produce specialty hydrogen peroxide in Leshan, China, targeting high-demand sectors like solar panels, semiconductors, and food packaging. Evonik holds a 51% stake in the venture, with production volumes expected by 2026, supported by a 200 kiloton hydrogen peroxide megaplant under a prior license agreement.

- In 2025: Spanish startup Arkadia Space successfully tested its hydrogen peroxide-based DARK propulsion system in orbit aboard a D-Orbit ION satellite launched in March, announcing the achievement on June 9, 2025. The thruster, producing five newtons of thrust, performed hundreds of short pulses and burns lasting up to five seconds, with in-space performance matching ground test results. This milestone highlights the growing role of hydrogen peroxide in the aerospace sector.

- In 2023: Dow and Evonik announced the successful start-up and operation of a pioneering hydrogen peroxide to propylene glycol (HPPG) pilot plant at Evonik’s site in Hanau, Germany.

- In 2023: Shinsol Advanced Chemicals, a dynamic collaboration between Solvay and Shinkong Synthetic Fibers Corporation, inaugurated its cutting-edge electronic grade hydrogen peroxide plant in Tainan, Taiwan.

Hydrogen Peroxide Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Chemical Synthesis, Bleaching, Disinfectant, Cleaning and Etching, Others |

| End-Uses Covered | Pulp and Paper, Food and Beverages, Water Treatment, Textiles and Laundry, Oil and Gas, Healthcare, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, Middle East and Africa, North America, Latin America |

| Companies Covered | Airedale Group, Arkema S.A., Evonik Industries AG, Gujarat Alkalies and Chemicals Limited, Kemira Oyj, Mitsubishi Gas Chemical Company Inc., National Peroxide Limited, Nouryon, OCI COMPANY Ltd, Solvay S.A., Taekwang Industrial Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and business opportunities in the hydrogen peroxide market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydrogen peroxide industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global hydrogen peroxide market was valued at USD 3.5 Billion in 2024.

We expect the global hydrogen peroxide market to exhibit a CAGR of 3.15% during 2025-2033.

The rising consumer environmental concerns, along with the growing demand for eco-friendly chemicals, such as hydrogen peroxide, to reduce carbon emissions, are primarily driving the global hydrogen peroxide market.

The sudden outbreak of the COVID-19 pandemic has led to the increasing adoption of hydrogen peroxide as sterilizing agents and for sanitizing products used for the treatment of the coronavirus infection.

Based on the application, the global hydrogen peroxide market has been segmented into chemical synthesis, bleaching, disinfectant, cleaning and etching, and others. Among these, chemical synthesis currently holds the majority of the total market share.

Based on the end-use, the global hydrogen peroxide market can be divided into pulp and paper, food and beverages, water treatment, textiles and laundry, oil and gas, healthcare, electronics, and others. Currently, pulp and paper exhibits a clear dominance in the market.

On a regional level, the market has been classified into Asia Pacific, Europe, Middle East and Africa, North America, and Latin America, where Asia Pacific currently dominates the global market.

Some of the major players in the global hydrogen peroxide market include Airedale Group, Arkema S.A., Evonik Industries AG, Gujarat Alkalies and Chemicals Limited, Kemira Oyj, Mitsubishi Gas Chemical Company Inc., National Peroxide Limited, Nouryon, OCI COMPANY Ltd, Solvay S.A., Taekwang Industrial Co., Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)