Hydrochloric Acid Market Size, Share, Trends, and Forecast by Grade, Application, End User, and Region 2025-2033

Hydrochloric Acid Market 2024, Size and Outlook:

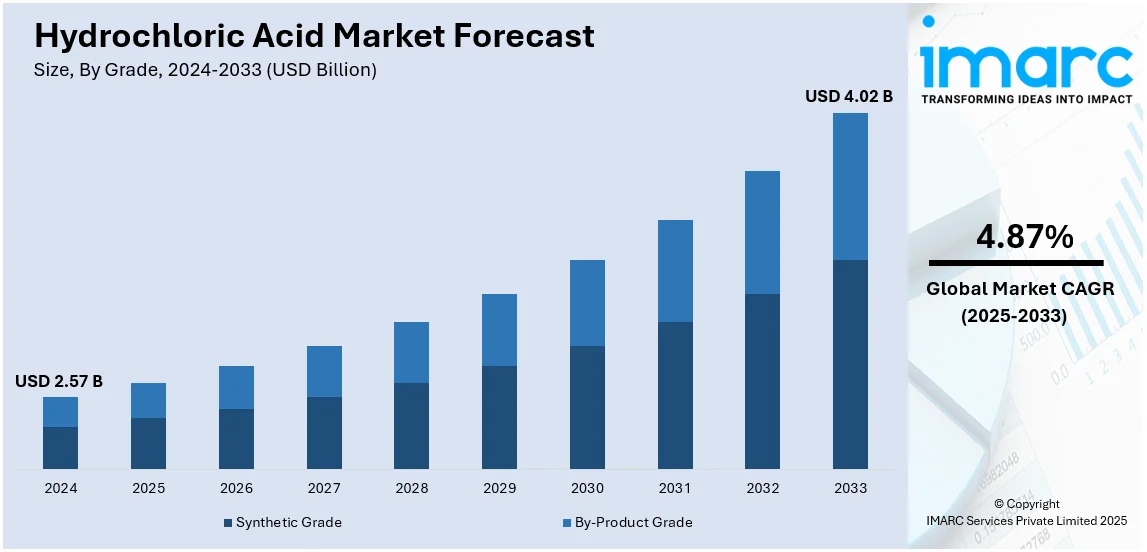

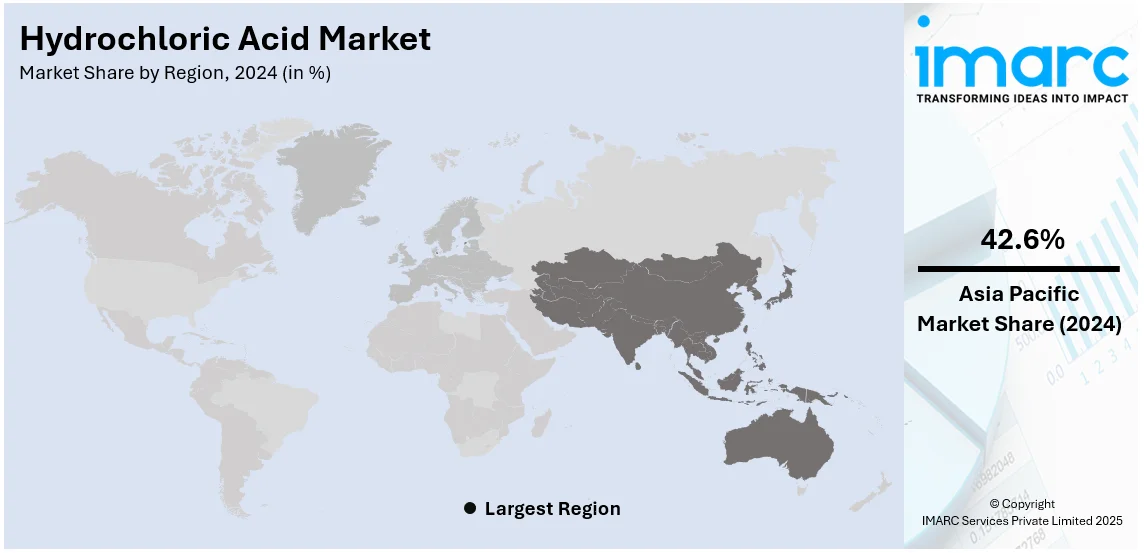

The global hydrochloric acid market size was valued at USD 2.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.02 Billion by 2033, exhibiting a CAGR of 4.87% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant hydrochloric acid market share of over 42.6% in 2024. The extensive utilization of hydrochloric acid for water treatment, augmenting product demand from the steel industry, and production of household cleaners represent some of the factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.57 Billion |

|

Market Forecast in 2033

|

USD 4.02 Billion |

| Market Growth Rate (2025-2033) | 4.87% |

The hydrochloric acid market is influenced by its versatile applications in several industries. In the steel industry, it is widely used for pickling, a process essential for removing impurities and preparing steel surfaces, especially with the growing demand for construction and automotive sectors. In the chemical industry, hydrochloric acid serves as a vital reagent in producing organic and inorganic compounds, including chlorides and fertilizers. The oil and gas sector contributes significantly, where it is employed to enhance oil recovery and well acidification. In addition, it is used for water treatment, food processing, and pharmaceuticals, thus driving its demand. Other factors such as increasing industrialization, infrastructure projects, and stringent water treatment regulations worldwide are catalyzing the hydrochloric acid market growth.

The hydrochloric acid market in the United States is driven by its extensive use across key industries. The steel industry significantly boosts demand, as hydrochloric acid is vital for pickling processes in automotive manufacturing and construction projects. In the oil and gas sector, its application in well acidizing and enhanced oil recovery supports market growth, particularly with rising shale gas exploration. The chemical industry drives demand for hydrochloric acid in producing chlorides, polymers, and other compounds. For instance, in December 2024, in Casa Grande, Arizona, Chlorum Solutions USA chose Thyssenkrupp Nucera as a partner to establish its first chlor-alkali facility in the United States. The initiative intends to modernize chemical manufacturing by the implementation of cutting-edge procedures. The US company, which specializes in chlor-alkali plants, will apply Thyssenkrupp Nucera's skid-mounted technology. Additionally, its role in water treatment aligns with stringent environmental regulations, enhancing market prospects. Growing demand in food processing and pharmaceutical applications, along with increasing industrial activities, infrastructure development, and advancements in chemical manufacturing, further fuel the hydrochloric acid market demand in the United States.

Hydrochloric Acid Market Trends:

Steel Industry Applications

The steel industry is a significant driver of the hydrochloric acid market, as it is widely used for pickling to remove rust, scale, and impurities from steel surfaces. This process is essential for preparing steel for further processing in industries such as construction, automotive, and appliances. According to industry reports, it is projected that the world's steel consumption will increase from around 1,764 million metric tons in 2023 to 1,950 million to 2,000 million metric tons in 2035. It is anticipated that demand would increase in emerging markets, shifting the centers of demand growth, as it stabilizes or declines in established, urbanized markets. With rising demand for steel in infrastructure development and industrial activities, the need for hydrochloric acid is growing. Its role in ensuring high-quality steel production and enhancing the efficiency of manufacturing processes further boosts market demand, making it a critical component in the global and regional steel industry supply chain. This represents one of the key hydrochloric acid market trends across the globe.

Chemical Manufacturing

Hydrochloric acid is a vital reagent in producing various organic and inorganic compounds, including chlorides, fertilizers, and polymers like PVC. Its widespread use in the chemical industry drives significant demand, as it plays a central role in synthesizing key products. For instance, in November 2024, Citizens M&A Advisory announced itself to be the sole financial advisor to BLEACHTECH L.L.C., a notable chlor-alkali manufacturer in the United States, in its $327 million acquisition by ANSA McAL Limited. Cleveland, Ohio-based, BLEACHTECH is a vertically integrated leader in the production of high-purity bleach, hydrochloric acid, and caustic soda. It serves industrial and municipal customers in the Midwest and Mid-Atlantic regions for the treatment of wastewater and potable water. Serving the water treatment needs of the Caribbean region for over 35 years, ANSA McAL is the top manufacturer of chlor-alkali in the Commonwealth Caribbean through its subsidiary ANSA McAL Chemicals Limited. The increasing global demand for chemicals across sectors such as agriculture, textiles, and electronics represents one of the major hydrochloric acid market trends.

Water Treatment and Environmental Applications

Hydrochloric acid plays a critical role in water treatment by adjusting pH levels, neutralizing alkaline substances, and removing impurities in municipal and industrial water systems. The increasing emphasis on water quality and strict environmental regulations fuel the demand for effective water treatment solutions. Additionally, its use in wastewater management for industries such as textiles, food processing, and chemicals enhances its relevance. With growing concerns over sustainable water use and environmental compliance, hydrochloric acid is an essential component in ensuring safe and efficient water treatment processes, further driving its hydrochloric acid market outlook. For instance, in November 2024, the Gujarat government declared the creation of a new strategy centered on wastewater recycling and reuse to alleviate the mounting strain on drinking water supplies. Under the policy, businesses and industries must use treated wastewater for uses other than drinking. Under the initiative, the government also intends to provide incentives for reusing and treating water for uses other than drinking.

Hydrochloric Acid Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydrochloric acid market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on grade, application, and end user.

Analysis by Grade:

- Synthetic Grade

- By-Product Grade

Synthetic grade stand as the largest component in 2024, holding around 74.0% of the market. Synthetic grade hydrochloric acid holds the largest share in the market due to its widespread industrial applications. The synthetic method produces this acid as an industrial byproduct during chlorine manufacturing leading to both affordable and wide availability of the product. The production requirements of chemicals alongside steel and food processing and pharmaceuticals frequently employ this hydrochloric acid grade because it handles applications from pH control to metal cleaning and PVC manufacturing. Its affordability and wide application range are vital functions in industrial chemistry that further support hydrochloric acid to maintain its dominance in the market, especially in big-scale industrial installations.

Analysis by Application:

- Steel Picking

- Oil Well Acidizing

- Ore Processing

- Food Processing

- Pool Sanitation

- Calcium Chloride

- Biodiesel

- Others

Steel pickling leads the market with around 32.2% of market share in 2024. Steel pickling holds the largest share in the hydrochloric acid market because this manufacturing process requires hydrochloric acid for steel purification through pickling. Steel pickling helps hydrochloric acid eliminate rust and scale while removing unwanted contaminants. Steel undergoes this specific process to create a smooth finished surface for subsequent applications including galvanizing and coating that precedes painting. The large-scale demand for steel in industrial sectors keeps steel pickling operations active, thus maintaining hydrochloric acid's dominant position within the market. The requirement for affordable yet productive pickling techniques and methods demonstrates market support for this approach.

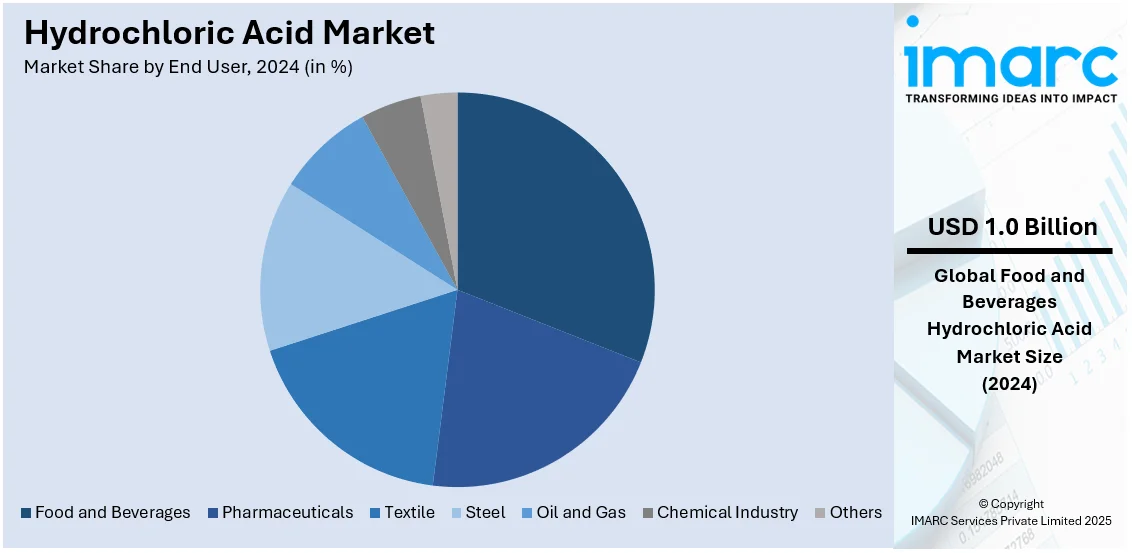

Analysis by End User:

- Food and Beverages

- Pharmaceuticals

- Textile

- Steel

- Oil and Gas

- Chemical Industry

- Others

According to the hydrochloric acid market forecast, food and beverages leads the market with around 30.9% of market share in 2024. The food and beverages sector holds the largest share in the hydrochloric acid market due to its essential role in various food processing applications. Food acidification and pH adjustments and processing assistance to create gelatin and produce sugar and high-fructose corn syrup rely on hydrochloric acid applications. Hydrochloric acid functions as an impurity removal agent as well as a food preservative for protecting prepared products. Hydrochloric acid remains important in the food and beverage sector because of escalating consumer demand for convenient foods and soft drinks combined with packaged foods making up the substantial market share.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 42.6%. The hydrochloric acid market in the Asia-Pacific (APAC) region is primarily driven by strong demand from industries such as chemicals, steel, and electronics. According to the World Bank, East Asia and the Pacific is the world’s most rapidly urbanizing region, with an average annual urbanization rate of 3%. This rapid urbanization, particularly in countries like China, India, and Japan, contributes significantly to the hydrochloric acid market share, especially in the chemical manufacturing sector. As hydrochloric acid is essential in producing chemicals like chlorine and PVC, the increasing demand for these products further boosts its consumption. The region's growing construction industry, fueled by infrastructure projects, and the expanding food processing sector are additional drivers. Moreover, the pharmaceutical industry's growth, particularly in emerging economies, also supports hydrochloric acid demand. Competitive production technologies and abundant raw material availability in the region further enhance market prospects, positioning APAC as a key driver in the global hydrochloric acid market.

Key Regional Takeaways:

North America Hydrochloric Acid Market Analysis

The hydrochloric acid market in North America is driven by several key factors, including robust industrial activity and demand across diverse sectors. The increasing demand from the steel industry, particularly for pickling processes, plays a significant role, as hydrochloric acid is essential for removing impurities from steel surfaces. In addition, the growth in the food and beverages industrial end-use where hydrochloric acid is used to regulate pH, food processing, and preservation, also positively affects market growth. Hydrochloric acid is also essential in producing products such as PVC, fertilizers, and other chemicals that make the chemical industry-dependent, which is driving the market demand. The market also experiences growth as the oil and gas industry uses hydrochloric acid for well-stimulation and production enhancement. Regulatory compliance in pharmaceuticals and water treatment industries, which use hydrochloric acid for various purification processes, also supports the market. Technological advancements and rising demand for efficient, cost-effective production methods help maintain steady growth in North America

United States Hydrochloric Acid Market Analysis

In 2024, the United States accounted for the largest market share of over 89.90% in North America. The U.S. hydrochloric acid market is primarily driven by its applications in key industries, including chemicals, food processing, and pharmaceuticals. According to the National Health Expenditure Accounts (NHEA), U.S. healthcare spending grew by 7.5% in 2023, reaching USD 4.9 Trillion, or USD 14,570 per person, accounting for 17.6% of the nation's Gross Domestic Product (GDP). This surge in healthcare spending highlights the increasing demand for pharmaceutical products, where hydrochloric acid plays a crucial role in the production of active pharmaceutical ingredients (APIs). Moreover, the expansion of shale gas exploration and refining activities boosts the demand for hydrochloric acid, especially in oil and gas well stimulation processes. The chemical manufacturing industry, which produces chlorine, PVC, and other chemicals, is another substantial factor. Additionally, the rising need for industrial cleaning, water treatment, and metal surface treatment applications further supports market growth. Innovations in hydrochloric acid production technologies, aimed at improving cost-efficiency and sustainability, contribute to the overall growth prospects. As a result, the U.S. hydrochloric acid market is expected to continue expanding, fueled by key sectors such as healthcare, chemicals, and energy.

Europe Hydrochloric Acid Market Analysis

In Europe, the hydrochloric acid market is influenced by various factors, including demand from the chemical, automotive, and pharmaceutical sectors. However, according to the European Chemical Industry Council (CEFIC), the EU27 chemical industry experienced a 10.6% decline in production, marking the third-largest drop in 2023 (January-September). Capacity utilization in the sector also fell to 74.1% in the third quarter of 2023. Despite these challenges, hydrochloric acid remains a key raw material in the production of chlorine, PVC, and other chemicals, supporting its continued demand. The automotive sector’s reliance on hydrochloric acid for metal surface treatment, along with its critical role in the pharmaceutical industry, further bolsters market growth. Additionally, the region’s heightened focus on environmental regulations has increased the need for hydrochloric acid in industrial cleaning, waste treatment, and water purification processes. Although production in the chemical industry has slowed, innovations in hydrochloric acid manufacturing technologies and the ongoing demand from key sectors are expected to drive steady growth in the market. Thus, while challenges exist, the European hydrochloric acid market continues to be supported by essential industrial applications and technological advancements.

Latin America Hydrochloric Acid Market Analysis

The hydrochloric acid market in Latin America benefits from the performance of the steel industry. According to Alacero, Latin American steel consumption reached 67.8 Mt in 2022, indicating strong demand. This robust consumption supports the demand for hydrochloric acid, particularly in steel production and metal surface treatment applications. Additionally, sectors such as chemicals, infrastructure development, and food processing continue to drive further demand for hydrochloric acid. These industries rely on hydrochloric acid for various industrial processes, helping to maintain a positive growth trajectory for the market in the region.

Middle East and Africa Hydrochloric Acid Market Analysis

In the Middle East and Africa, the hydrochloric acid market is primarily driven by the oil and gas industry, particularly in oilfield services and well stimulation. The UAE oil and gas market is projected to exhibit a growth rate of 6.30% CAGR from 2025 to 2033, which is expected to increase demand for hydrochloric acid in hydraulic fracturing and other oil extraction processes. Additionally, the chemical industry and growing water treatment needs across the region further support market expansion. As industries continue to grow, the demand for hydrochloric acid in key applications like waste treatment and chemical production will also rise.

Competitive Landscape:

The hydrochloric acid market is highly competitive, with key players focusing on diverse industrial applications and global market reach. Major companies like Olin Corporation, Westlake Chemical, BASF SE, and Dow Inc. dominate the market through extensive product portfolios and strategic distribution networks. Competition is driven by increasing demand from sectors such as steel, chemicals, water treatment, and food processing. Smaller regional players compete by offering cost-effective solutions and catering to localized industries. Innovation in production methods and sustainable practices, such as recycling and reduced environmental impact, is a growing trend. Strategic partnerships and capacity expansions are common strategies to maintain market position.

The report has also analysed the competitive landscape of the market with some of the key players being:

- AGC Chemicals

- BASF SE

- Detrex Corporation (Italmatch USA Corporation)

- Dongyue Group

- Erco Worlwide Inc. (Superior Plus LP)

- Ercross SA

- Merck KGaA

- Occidental Petroleum Corporation

- Olin Corporation

- PCC Group

- Vynova Group

- Westlake Corporation

Latest News and Developments:

- December 2024: Chlorum Solutions USA LLC is developing a small-scale chlor-alkali plant in Casa Grande, Arizona, to locally produce hydrochloric acid (HCl), sodium hypochlorite, and caustic soda. The USD 70 Million facility will use advanced membrane technology to reduce reliance on chlorine gas imports, enhance supply chain resilience, and improve safety.

- July 2024: John Cockerill and Baosteel have launched a "2*20m³/h Fluidized Bed Acid Regeneration" project to treat hydrochloric acid waste and recover metal ions and hydrogen chloride, reducing environmental impact and improving resource efficiency.

- April 2022: Aditya Birla Group launched its first chlor-alkali plant in East Godavari, Andhra Pradesh. The plant, with a capacity of 150,000 Tons per year, produces caustic soda, hydrochloric acid, and other chemicals. It strengthens the group’s chlor-alkali presence in India and supports growth in sectors like pharmaceuticals and agrochemicals.

- October 2020: Univar Solutions and PVS Chloralkali finalized an agreement transferring HCl sourcing agreements and railcars to Univar, expanding its North American distribution network. Univar served as a strategic HCl provider for PVS, improving supply chain efficiency while PVS focused on core operations.

Hydrochloric Acid Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Grades Covered | Synthetic grade, By-product grade |

| Applications Covered | Steel picking, Oil well acidizing, Ore processing, Food processing, Pool sanitation, Calcium chloride, Biodiesel, Others |

| End Users Covered | Food and beverages, Pharmaceuticals, Textile, Steel, Oil and gas, Chemical Industry, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGC Chemicals, BASF SE, Detrex Corporation (Italmatch USA Corporation), Dongyue Group, Erco Worlwide Inc. (Superior Plus LP), Ercross SA, Merck KGaA, Occidental Petroleum Corporation, Olin Corporation, PCC Group, Vynova Group, Westlake Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydrochloric acid market from 2019-2033.

- The hydrochloric acid market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydrochloric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydrochloric acid market was valued at USD 2.57 Billion in 2024.

The hydrochloric acid market is projected to exhibit a CAGR of 4.87% during 2025-2033, reaching a value of USD 4.02 Billion by 2033.

The hydrochloric acid market is driven by its widespread use in industrial applications, including steel pickling, food processing, and chemical production. Growing demand in the water treatment and oil & gas sectors further boosts market growth. Additionally, expanding construction activities and increasing pharmaceutical production contribute to the rising demand for hydrochloric acid.

Asia Pacific currently dominates the keyword market, accounting for a share of 42.6%. The hydrochloric acid market in the Asia Pacific is driven by industrial growth, steel manufacturing, chemical production, and increasing demand in food processing.

Some of the major players in the hydrochloric acid market include AGC Chemicals, BASF SE, Detrex Corporation (Italmatch USA Corporation), Dongyue Group, Erco Worlwide Inc. (Superior Plus LP), Ercross SA, Merck KGaA, Occidental Petroleum Corporation, Olin Corporation, PCC Group, Vynova Group, Westlake Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)