Hydraulic Tools Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2025-2033

Hydraulic Tools Market Size and Share:

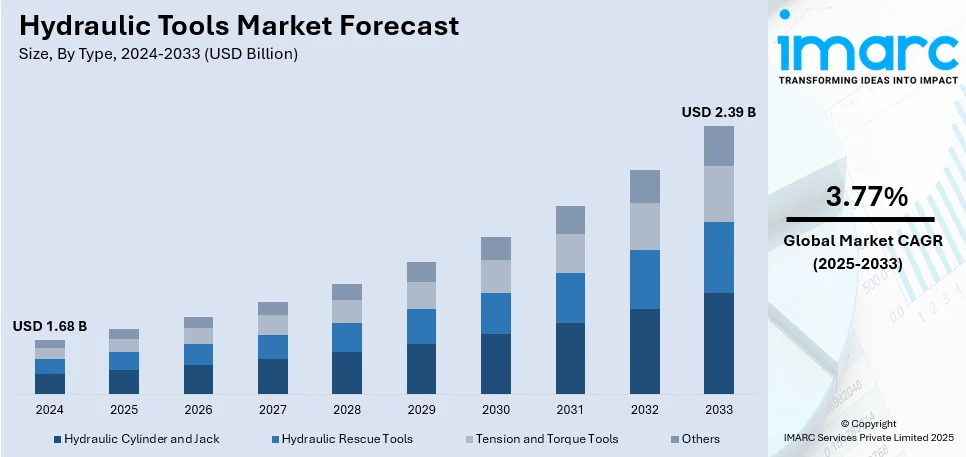

The global hydraulic tools market size was valued at USD 1.68 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.39 Billion by 2033, exhibiting a CAGR of 3.77% from 2025-2033. North America currently dominates the hydraulic tools market share by holding over 35.8% in 2024. The market in the region is driven by robust industrial activities, advanced infrastructure development, widespread adoption of automation, and strong demand from construction, automotive, and oil and gas sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.68 Billion |

|

Market Forecast in 2033

|

USD 2.39 Billion |

| Market Growth Rate (2025-2033) | 3.77% |

The global hydraulic tools market growth is driven by rapid industrialization, increasing demand for efficient construction equipment, and the rise of infrastructure development projects worldwide. In addition, the growing automotive industry requires hydraulic tools for assembly and maintenance operations, which is fueling the market demand. Moreover, the expanding renewable energy (RE) projects demand these tools for installing and maintaining heavy equipment, aiding the market growth. Besides this, ongoing technological advancements, including the integration of the Internet of Things (IoT), enhance precision and operational efficiency, driving adoption and contributing to the market expansion. For instance, Bucher Hydraulics developed an online model builder for hydraulic systems which improved industrial applications through enhanced customization and efficiency. Also, the focus on worker safety and ergonomic tool designs boosts their use in industrial and construction settings, providing an impetus to the market. Furthermore, emerging economies are investing heavily in industrial automation, thus impelling the market growth.

The United States (U.S.) hydraulic tools market demand is driven by continuous advancements in shale gas extraction and the increasing adoption of hydraulic fracturing techniques. For example, in March 2024 the U.S. House of Representatives approved H.R. 1121 which protects hydraulic fracturing through a presidential ban while reserving state authority to regulate the practice. This legislative support ensures stability and continued investment in hydraulic fracturing technologies, driving market demand. In line with this, the growth in defense and aerospace manufacturing boosts the demand for precision tools in production and maintenance, strengthening the market share. Concurrently, the rising focus on disaster management and emergency rescue operations necessitates hydraulic rescue tools, supporting the market growth. Furthermore, the expanding production of electric vehicles (EVs) requires hydraulic tools for specialized assembly tasks, which is fostering the market demand. Also, strong investments in smart city initiatives drive the use of hydraulic systems in urban infrastructure projects, contributing to the market expansion. Apart from this, stringent safety regulations in workplaces encourage the adoption of durable and efficient hydraulic equipment for industrial operations, thereby propelling the market growth.

Hydraulic Tools Market Trends:

Growing Industrial Automation

A significant growth driver influencing the hydraulic tools market trends is the adoption of automation for enhanced productivity and low labor costs. Hydraulic tools deliver unmatched efficient high-power performance as they stand as essential tools in heavy industries including manufacturing construction and mining. Moreover, the precision of these tools demands high-force operations such as lifting bolting and pressing depend heavily on hydraulic systems. A recent industry report predicts the mining market will expand to USD 3.5 Trillion by 2032 through a compound annual growth rate (CAGR) of 5.8% from its current USD 2 Trillion value in 2022. Besides this, the mining industry continues to grow at an increasing rate because hydraulic tools provide essential support for highly efficient and durable mining operations, driving the market forward.

Infrastructure Development and Urbanization

The rapid growth of infrastructure combined with urban development trends throughout emerging markets is enhancing the hydraulic tools market outlook. Urban population growth and increasing infrastructure complexity drive the continuous expansion of hydraulic tool requirements in the fields of construction demolition and civil engineering. Additionally, central to large-scale projects are hydraulic tools that enable heavy lifting and trenching operations and large equipment installation while ensuring both efficiency and precise work execution. The United Nations data reveals cities absorbed 55% of global human existence during 2018. Research also indicates urban populations will reach a predicted 68% by the year 2050. As a result, the need for advanced hydraulic tools has become essential because urbanization requires both the development of expanding cities and the construction of worldwide infrastructure, thus bolstering the market demand.

Advancements in Technology and Efficiency

Hydraulic systems have progressed through continuous advancement in technology, as they improve their mobility offering more efficient energy usage and enhanced protection capabilities. In confluence with this, the hydraulic systems market is expanding through recent developments that enable industries to reach improved operational performance while reducing expenses and maintaining regulatory compliance. In August 2024 Parker Hannifin Corporation introduced the T7G Series hydraulic pumps which combine durable casings with modern variable speed drive technology suitable for all vehicles using diesel power or hybrid or electric or hydrogen fuel. Moreover, the June 2024 Danfoss Power Solutions showcase featured advanced hydraulic remote controls including joysticks and foot pedals for excavators along with loaders and drilling equipment. Furthermore, the innovative advancements in hydraulic tools demonstrate their persistent development to satisfy multiple market sectors and impelling the market growth.

Hydraulic Tools Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydraulic tools market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Hydraulic Cylinder and Jack

- Hydraulic Rescue Tools

- Tension and Torque Tools

- Others

Hydraulic cylinders and jacks hold the largest market share at 35.8%, driven by their versatility and widespread application across industries such as construction, automotive, and heavy machinery. These tools are essential for lifting, pushing, and pulling heavy loads, making them indispensable in infrastructure projects and equipment maintenance. In addition, the growing focus on modernizing construction and industrial facilities is increasing demand for robust and high-capacity hydraulic cylinders and jacks. Moreover, innovations such as lightweight, compact designs and increased load-handling efficiency are further boosting adoption. Besides this, the market growth of these tools depends on their essential function in automotive vehicle repair and assembly operations. Concurrently, the high demand for RE projects such as wind and solar systems creates market growth because hydraulic jacks provide essential support for installing and sustaining large equipment installations. Additionally, well-built energy-efficient equipment investments drive sustained growth for this market segment.

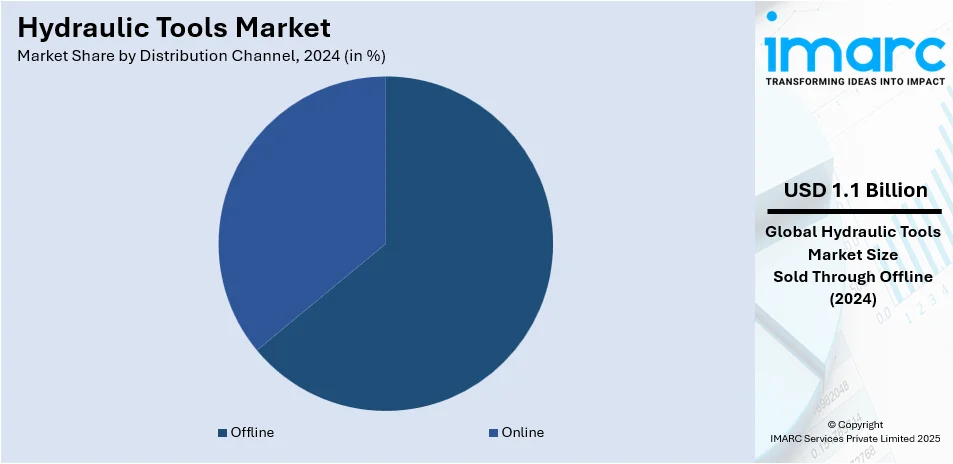

Analysis by Distribution Channel:

- Online

- Offline

Offline distribution channels account for 64.1% of the hydraulic tools market share, driven by their ability to offer hands-on product demonstrations, immediate availability, and personalized customer service. Industrial buyers often prefer offline channels, such as specialized retailers, distributors, and direct sales networks, for high-value, technical tools that require thorough inspection before purchase. The reliability of physical stores in providing after-sales support and professional consultation further strengthens this channel's dominance. Moreover, established partnerships between manufacturers and distributors enhance supply chain efficiency and ensure timely delivery to industrial and construction sites. Additionally, the rising adoption of bulk procurement strategies by large enterprises benefits from the negotiation capabilities and trust associated with offline channels. While online sales are growing, the need for physical inspection and on-site service remains a key driver for offline channels, especially in sectors like construction and heavy equipment maintenance.

Analysis by End User:

- Industrial Manufacturing

- Oil and Gas and Petrochemical

- Utility

- Railway

- Others

Industrial manufacturing dominates the hydraulic tools market with a 54.5% share, driven by its extensive use across diverse applications such as assembly lines, heavy machinery maintenance, and precision engineering. The trend toward automated manufacturing drives industries to acquire hydraulic tools that provide both higher operational precision and increased efficiency and reliability. The automotive along aerospace industries coupled with heavy equipment manufacturing drive ongoing expansion of this segment. Furthermore, advanced machinery investments and Industry 4.0 adoption practices drive the integration of real-time monitored smart hydraulic systems with predictive maintenance functionality. Hydraulic tools often represent an essential industrial requirement because they endure through time while offering impressive power efficiency for tasks that demand heavy load handling and repetitive performance. Apart from this, emerging economies, investing heavily in infrastructure and industrialization, are driving the growth within this segment through expanded production facilities and modernized plants.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The hydraulic tools market is led by North America, holding a 35.8% market share, driven by robust industrial and construction activities. The region experiences high demand because hydraulic systems have become standard in infrastructure projects as well as automotive manufacturing and oil and gas operations. In addition to this, the market adoption increases due to ongoing technological enhancements incorporating IoT-enabled systems that enhance precision together with efficiency. The market trend favors lightweight ergonomic design approaches which consider user convenience together with safety standards, especially in sectors such as construction and aerospace applications. Concurrently, hydraulic tools needed in automotive assembly and maintenance activities create the biggest segment of the market. The expansion of RE infrastructure by investors through wind and solar farms drives the market demand for hydraulic tools to support equipment installation and maintenance activities. Besides this, the strong government support along with expanding infrastructure works throughout North America, are significantly contributing to the market expansion.

Key Regional Takeaways:

United States Hydraulic Tools Market Analysis

The hydraulic tools market in the United States is growing rapidly, with the country having a strong manufacturing sector. For instance, the manufacturing sector generated USD 2.3 trillion for the U.S. GDP which represented 10.2% of the total GDP in 2023 according to available reports. This sector includes automotive, aerospace, heavy machinery, and metal fabrication, all of which heavily rely on hydraulic tools for various operations like lifting, bolting, pressing, and material handling. The growth in demand for these technologies for more advanced hydraulic systems is further accelerated in the market with the general trend of automation toward improved efficiency.

As industries increasingly adopt Industry 4.0 technologies, hydraulic tools are essential in achieving higher precision and productivity. Moreover, infrastructure development by the U.S. government, in terms of expansions and repairs of manufacturing facilities, heightens the demand for hydraulic tools. Thus, with continuous investment in advanced manufacturing processes, the U.S. hydraulic tools market is in a good position to sustain its growth in the coming years.

Europe Hydraulic Tools Market Analysis

The European hydraulic tools market is under heavy growth and the sectoral growth in manufacturing was good. For example, the manufacturing sector provided one-quarter of the EU's business economy net turnover in 2022 at Euro 8.3 Trillion (USD 8.6 Billion) representing a 16% increase compared to 2020 data reports show. This growth is driving the demand for hydraulic tools as industries such as automotive, machinery, and construction require hydraulic tools for precise, high-force operations like lifting, bolting, and pressing.

With the growth of manufacturing output in all fields, an efficient and powerful hydraulic system has to be implemented in the processes of automation and enhancement of operational productivity. Also, the emphasis on sustainable manufacturing and high-technology production supports the requirement for hydraulic tools. The investments that Europe is making in infrastructure projects, especially in the renewable energy and green manufacturing sectors, are likely to lead to an increase in the demand for hydraulic tools and sustain the expansion of the market in the region.

Asia Pacific Hydraulic Tools Market Analysis

Robust growth in the Asia Pacific hydraulic tools market is supported by the initiatives undertaken by the governments to strengthen manufacturing capabilities across the region. "Made in China 2025" initiated by China has targeted the improvement of automation levels in automotive, electronics, and heavy industries, hence adopting hydraulic tools for high-precision operations. The industry report forecasts that India's manufacturing sector will surpass USD 1 trillion by 2025-26 through its growing industrial clusters across Gujarat Maharashtra and Tamil Nadu. The automotive, electronics, and textiles sectors, as well as government initiatives such as "Make in India" and Production Linked Incentive (PLI) schemes, have led to a spurt in industrialization and foreign direct investment.

According to IBEF, these measures are upgrading the industrial infrastructure and demand for high-performance hydraulic systems, which are necessary for manufacturing automation. With rapid industrialization and infrastructural development of emerging economies, such as Indonesia, Vietnam, and Thailand, the Asia Pacific hydraulic tools market is on the verge of sustaining growth.

Latin America Hydraulic Tools Market Analysis

Latin America's hydraulic tools market is going to grow considerably under the aegis of aggressive regional infrastructure development efforts. In Chile, the administration has launched a USD 1.45 Billion integrated infrastructure initiative which includes 48 power grid projects. The company plans to start construction on its main USD 345 Million transmission line project in 2025 according to published reports. Among them, these giant-scale transmission lines need stronger hydraulic tools which could be involved with heavy-lift, bolting, and mounting equipment of installation in the engineering or construction process which would bring efficiency to it.

Regional industrial development, especially in mining and energy industries, is one of the further driving factors in hydraulic tool usage. Latin America is rich in natural resources, with an increased energy grid infrastructure and government expenditure on public infrastructure. This situation creates a thriving market for advanced hydraulic systems. Also, the surge in renewable energy projects, like wind and solar farms, pushes up the demand for precision tools. All this places Latin America as a strong growth region for hydraulic tools.

Middle East and Africa Hydraulic Tools Market Analysis

The Middle East and Africa hydraulic tools market have growth prospects underpinned by government-led industrial and manufacturing sector development initiatives. For example, Operation 300bn serves as proof of the UAE's dedication to enhancing industrial productivity since its launch in 2021. Operation 300bn targets industrial GDP growth by advancing the current level of AED 133 billion (USD 36.2 billion) in 2021 to reach AED 300 billion (USD 81.68 billion) by 2031. The initiative emphasizes automation, advanced manufacturing technologies, and industrial infrastructure development, which also increases demand for hydraulic tools.

The region is also experiencing large-scale construction, energy, and infrastructure projects that are driving the demand for the market. The increasing use of hydraulic systems for heavy lifting, material handling, and equipment maintenance ensures efficiency in the oil and gas, construction, and manufacturing industries. In addition, economic diversification efforts across the Gulf Cooperation Council (GCC) and Africa's growing industrial base provide a basis for market growth.

Competitive Landscape:

Market players in hydraulic tools are focusing on expanding their product portfolios through technological advancements and strategic partnerships. Companies are integrating the IoT and smart features for enhanced performance and remote monitoring. Investments in lightweight and ergonomic designs are growing to improve user convenience. Key players are emphasizing acquisitions and collaborations to strengthen global distribution networks. Additionally, the rising demand for hydraulic tools in the construction, automotive, and manufacturing sectors is driving innovation. Moreover, sustainability trends are pushing manufacturers to develop energy-efficient and durable tools. Furthermore, digital platforms are increasingly used for customer engagement, training, and after-sales services, highlighting a shift towards enhancing user experience. Apart from this, regional expansions are prominent to cater to emerging markets and reduce supply chain disruptions.

The report provides a comprehensive analysis of the competitive landscape in the hydraulic tools market with detailed profiles of all major companies, including:

- Atlas Copco North America LLC

- BVA Hydraulics

- Cembre S.p.A. (Lysne S.P.A.)

- Emerson Electric Co.

- Enerpac Tool Group Corp.

- Hangzhou WREN Hydraulic Equipment Manufacture Co. Ltd.

- Hi-Force Limited

- HTL Group Ltd.

- Kudos Mechanical Co. Ltd.

- LUKAS Hydraulik GmbH (IDEX Corporation)

- SPX Flow Inc.

- Super Unique Enterprise Co. Ltd.

- Tai Cheng Hydraulic Industry Co. Ltd.

Latest News and Developments:

- August 2024: Parker Hannifin Corporation's Pump & Motor Division in Europe launched the T7G Series of truck hydraulic pumps. The single and double hydraulic vane pumps have strong new housings and are equipped with Parker's advanced variable speed drive technology. The T7G series is designed to meet the ISO 7653 mounting standard and is intended for diesel trucks as well as hybrid, electric, and hydrogen vehicles. It is an upgrade from the previous T6G Series.

- June 2024: Danfoss Power Solutions demonstrated its newest hydraulic remote controls—the DHRCD sectional valve, DHRCP foot pedal, and DHRCJ joystick—at an international show. Excavators, skid steer loaders, backhoe loaders, wheel loaders, forklifts, truck cranes, aerial work platforms, telehandlers, and drilling equipment are among the devices for which these new controls have been created.

- October 2023: Danfoss strengthened its "Make in India for India and the World" initiative by locally manufacturing hydraulic hoses (Winner EC110 and EC210). This further strengthens the company's fluid conveyance solutions as part of its expansion in manufacturing across multiple locations, including Chennai, Pune, Baroda, Navi Mumbai, and Bengaluru.

Hydraulic Tools Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydraulic Cylinder and Jack, Hydraulic Rescue Tools, Tension and Torque Tools, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Industrial Manufacturing, Oil and Gas and Petrochemical, Utility, Railway, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco North America LLC, BVA Hydraulics, Cembre S.p.A. (Lysne S.P.A.), Emerson Electric Co., Enerpac Tool Group Corp., Hangzhou WREN Hydraulic Equipment Manufacture Co. Ltd., Hi-Force Limited, HTL Group Ltd., Kudos Mechanical Co. Ltd., LUKAS Hydraulik GmbH (IDEX Corporation), SPX Flow Inc., Super Unique Enterprise Co. Ltd., Tai Cheng Hydraulic Industry Co. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydraulic tools market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydraulic tools market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydraulic tools industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydraulic tools market was valued at USD 1.68 Billion in 2024.

IMARC estimates the hydraulic tools market to exhibit a CAGR of 3.77% during 2025-2033, expecting to reach USD 2.39 Billion by 2033.

Key factors driving the hydraulic tools market include rapid industrialization, rising construction activities, increasing adoption of automation, advancements in hydraulic technology, demand for ergonomic and efficient tools, and the growing need for hydraulic equipment in the automotive, aerospace, renewable energy, and infrastructure development sectors globally.

North America currently dominates the market, accounting for a share exceeding 35.8% in 2024. This dominance is fueled by the rising demand for advanced hydraulic tools in construction, automotive manufacturing, oil and gas operations, renewable energy projects, and the growing focus on industrial automation.

Some of the major players in the hydraulic tools market include Atlas Copco North America LLC, BVA Hydraulics, Cembre S.p.A. (Lysne S.P.A.), Emerson Electric Co., Enerpac Tool Group Corp., Hangzhou WREN Hydraulic Equipment Manufacture Co. Ltd., Hi-Force Limited, HTL Group Ltd., Kudos Mechanical Co. Ltd., LUKAS Hydraulik GmbH (IDEX Corporation), SPX Flow Inc., Super Unique Enterprise Co. Ltd. and Tai Cheng Hydraulic Industry Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)