Hydraulic Pump Market Size, Share, Trends and Forecast by Product Type, Pressure Range, Application, End User, and Region, 2025-2033

Hydraulic Pump Market Size and Share:

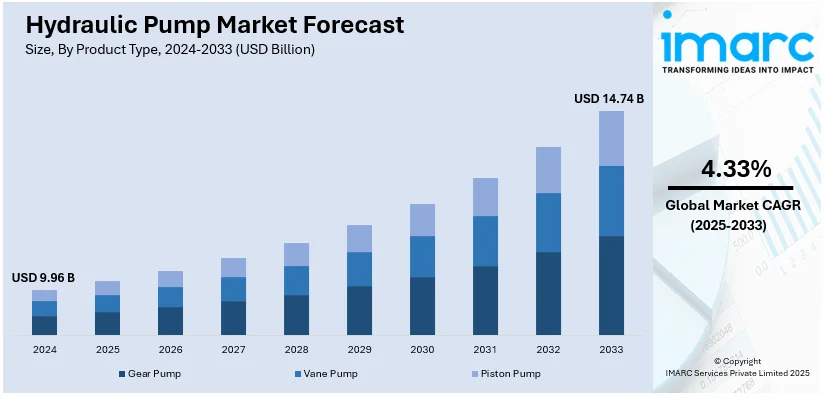

The global hydraulic pump market size was valued at USD 9.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 14.74 Billion by 2033, exhibiting a CAGR of 4.33% from 2025-2033. Asia Pacific currently dominates the market. The market is witnessing stable expansion, primarily fueled by growing demand from automotive, construction, and manufacturing industries, alongside continual advancements in industrial automation, hydraulic technology innovations, and an increasing focus on energy-efficient solutions that collectively contribute to sustained growth and adoption across diverse sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 9.96 Billion |

|

Market Forecast in 2033

|

USD 14.74 Billion |

| Market Growth Rate 2025-2033 | 4.33% |

The global market is majorly driven by the growing demand for hydraulic pumps in construction and infrastructure development, as they are used for heavy machinery and equipment. The fast pace of industrialization in developing economies also established a strong requirement for advanced hydraulic systems to support manufacturing processes. Also, increased agricultural activities where hydraulic pumps play a vital role in irrigation and machinery are facilitating the growth of the market. Apart from these, advancements in technology and continual product innovations are improving performance, reliability, and operational efficiency, further enhancing the market appeal. For example, on December 23, 2024, RCHC Hydraulics introduced its innovative hydraulic pump shock release system developed for enhancing the safety and effectiveness of operations. This system effectively manages pressure increase and potential equipment damage by providing controlled release of hydraulic shock, thereby extending machinery lifespan. Also, the new hydraulic pump shock release system aligns with sustainability goals by reducing energy waste and minimizing wear on hydraulic systems.

To get more information on this market, Request Sample

The United States is a key regional market and is primarily propelled by the ongoing implementation of renewable energy initiatives. The initiatives are primarily related to hydroelectric and wind power sectors, thereby significantly increasing demand for applications of hydraulic systems in energy generation and maintenance. Also, growth in the aerospace and defense sectors further increased investment and innovation in hydraulic technology to control motion and safety systems for high-precision applications. On November 21, 2024, Fortress Investment Group acquired TH Holdings, including its subsidiaries Texas Hydraulics, Hydromotion, and Oilgear, leading manufacturers of custom hydraulic components. The partnership aims to drive growth through innovation, expanded market reach, and investment in operations. TH Holdings serves diverse heavy-duty applications across mobile, industrial, and energy sectors, leveraging its engineering expertise and strong industry reputation. Moreover, the growing adoption of cordless battery-powered hydraulic pumps due to their portability, safety, and efficiency broadens the market scope. The increasing interest in urban development and smart city projects, from waste management to modern public transport systems, raised the requirement for advanced hydraulic equipment.

Hydraulic Pump Market Trends:

Rising Demand in Construction and Infrastructure Development

As per the hydraulic pump market research, the global market is witnessing significant growth driven by heightening construction and infrastructure development projects. Hydraulic pumps are integral components in heavy machinery such as excavators, loaders, and cranes, which are requisite for large-scale infrastructure ventures. Moreover, the rise in urbanization, especially in developing economies, is leading to amplified requirement for construction equipment powered by hydraulic systems. According to industry reports, it is projected that by the year 2030, 93.2% Asian population and 87.9% of the total global population will be dwelling in urban areas. Governments are also increasingly investing in smart city ventures and enhancing transport networks, which further fosters market expansion. In addition, the magnifying preference for hydraulic pumps in construction due to their efficacy, robustness, and capability to handle high-pressure tasks is expanding the market size. Hydraulic pump market analysis further indicates that this trend is expected to persist, with infrastructure demands in emerging regions playing a key role in driving global market growth.

Advancements in Energy-Efficient Hydraulic Pump Technology

Technological advancements in energy-efficient hydraulic pumps are significantly steering the market share as major sectors seek to minimize their energy consumption and reduce operational costs. Manufacturers are currently developing pumps with better energy efficiency, reduced emissions, and enhanced performance to address the amplifying demand for sustainable solutions. In addition, variable displacement pumps, which adjust their output based on the load, are rapidly gaining momentum due to their capability to conserve energy without compromising power. Moreover, advancements in digital control systems are facilitating more accurate operation, improving pump efficacy, and notably accelerating the hydraulic pump market growth. Such advancements are increasingly deployed in key sectors such as construction, manufacturing, and agriculture, where energy consumption is a crucial consideration. Furthermore, the inclination toward energy-efficient hydraulic solutions is projected to drive market expansion as companies emphasize sustainability and regulatory adherence. For instance, in January 2024, Grundfos launched an SP 6-inch hydraulic pump featuring upgraded energy efficacy, a reliable magnet motor to improve overall efficacy and a resilient stainless-steel rotor design.

Increasing Adoption in the Agricultural Sector

The agricultural sector is establishing itself as a significant driver for the global hydraulic pump market, with the increasing adoption of hydraulic systems in farming equipment. These pumps are extensively used in irrigation systems, tractors, and harvesters, providing improved power and accuracy for numerous agricultural applications, ultimately scaling up the hydraulic pump market growth. Moreover, the increasing requirement for food production, mainly augmented by amplifying populations and transforming consumption patterns, is raising the need for more effective farming methods. According to the Food and Agriculture Organization, demand for cereal, animal feed as well as food purposes is anticipated to reach approximately 3 Billion Tons by the year 2050. Furthermore, hydraulic pumps assist modern agricultural machinery to function with greater productivity and efficiency, lowering labor costs and elevating crop yields. In addition, technological improvements in precision agriculture and the incorporation of hydraulic systems with smart farming technologies are further increasing market expansion. As global food demand continues to propel, the agricultural industry’s adoption of hydraulic pumps is expected to rise, contributing to the overall expansion of the market.

Hydraulic Pump Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydraulic pump market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, pressure range, application, and end user.

Analysis by Product Type:

- Gear Pump

- Vane Pump

- Piston Pump

Gear pump leads the market in 2024, due to their reliability, simplicity, and cost-effectiveness. These are used in all types of industrial applications like construction, agriculture, and manufacturing as they can sustain high-pressure fluids and maintain steady fluid flows. The compact, durable, and easy-to-maintain design of these pumps makes them a prime choice for systems that need constant performance in extreme conditions. Gear pumps are specifically known for their ability to transport oil and other viscous materials with minimal pulsation-a vital aspect that increases efficiency in the system and longer periods of service. The versatility and adaptability of gear pumps to the requirements of the system make them an integral part of the market.

Analysis by Pressure Range:

- Up to 600 psi

- 601 psi–1000 psi

- More than 1000 psi

Hydraulic pumps that work with pressure up to 600 psi are widely used when applications require moderate pressure, including light-duty machinery and material handling, as well as for specific industrial processes. Due to their cost-effectiveness, these pumps are typically selected for systems that are not required to have high performance. They are popular in equipment such as agricultural sprayers and low-pressure hydraulic systems with guaranteed operation and energy use. Their simpler design and ease of maintenance render them very attractive to industries that focus on budget-friendly and efficient solutions. As the demand for lighter and more compact machinery grows, pumps in this range continue to find relevance in specific niche applications within the hydraulic pump market.

Pumps in the 601 psi–1000 psi pressure range are used for medium-pressure applications that need balanced performance and durability. They find applications in construction equipment, mid-range industrial machines, and some mobile hydraulic systems. This pressure range is very versatile, supporting a number of tasks while keeping energy usage at a reasonable level. These pumps are widely used where consistent performance and moderate pressure are necessary for productivity. With advances in material and pump technology, these systems are now delivering improved efficiency and durability and meeting industry needs for sustainable and reliable equipment. Their ability to operate on diverse applications makes this pressure range a major player in the hydraulic pump market.

Hydraulic pumps with a pressure range exceeding 1000 psi are essential for heavy-duty applications in industries like construction, mining, and aerospace. These high-pressure pump power systems require maximum performance, such as heavy machinery, hydraulic presses, and industrial tooling. They are engineered to handle demanding tasks with precision and reliability, despite the most severe conditions. The increased focus on infrastructure development and advanced manufacturing has been driving the need for this category of pumps, with the pressure for innovation in terms of efficiency and design. High-pressure hydraulic pumps can provide greater force and energy transfer and thus remain an integral component of applications where power and durability are of prime importance, hence a critical part of the hydraulic pump market.

Analysis by Application:

- Mobile Application

- Industrial Application

Mobile applications in the hydraulic pump market play a very crucial segment by catering to machines like excavators, cranes, tractors, and loaders deployed in industries. Hydraulic pumps deliver a smooth transmission of power and precise control with excellent, reliable performance even at variations. As urbanization projects increase, mobile equipment using complex hydraulic systems gains much prominence. These applications often operate in challenging environments, so durability and energy efficiency are essential features for hydraulic pumps. Technological advancements, including lightweight and compact pump designs, enhance the mobility and versatility of equipment, meeting the specific needs of mobile operations. As sectors prioritize productivity and sustainability, mobile hydraulic applications remain a vital driver of innovation and demand in the market.

Industrial application is an important segment in the market as it powers equipment in manufacturing, material handling, and energy production. These pumps are integral in processes requiring high pressure, precision, and durability for metal forming, molding, and assembly operations. Industries heavily rely on hydraulic systems to improve efficiency, maintain consistent performance, and reduce downtime. Hydraulic pumps continue to be integrated into smarter, more efficient systems as industries advance in automation and technologies. Growth in renewable energy and a focus on sustainable manufacturing fuels the requirement for innovative energy-efficient hydraulic solutions. Industry applications play an indispensable role by enabling critical operations in all kinds of industrial settings.

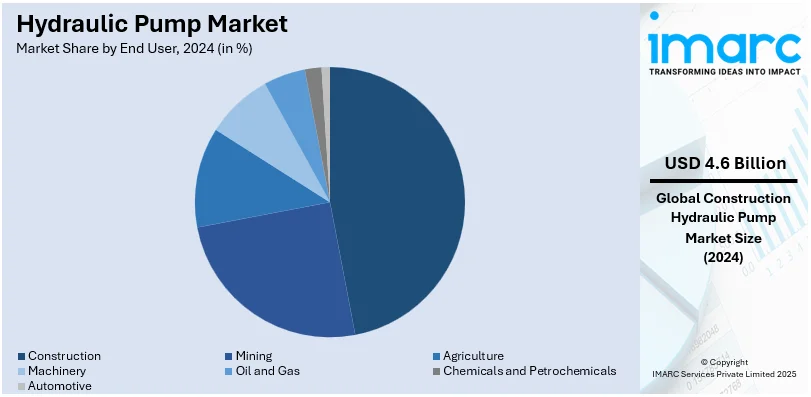

Analysis by End User:

- Construction

- Mining

- Agriculture

- Machinery

- Oil and Gas

- Chemicals and Petrochemicals

- Automotive

Construction leads the market in 2024, , as it highly depends on machinery such as excavators, loaders, and cranes. Hydraulic pumps are essential for machinery equipment, and they provide the necessary power and accuracy to execute under heavy-duty conditions. With the high rise in urbanization and increased projects in construction going on in the metropolis, the hydraulic system advances constantly. Furthermore, improvements in hydraulic technology, including energy-saving designs and improved durability, align with increasing focus in the construction industry towards sustainability and long-term value. The industry focuses on efficiency and longevity; therefore, the industry demands the most reliable hydraulic solutions in the market. The inventions of more energy-efficient, longer-lasting pumps are addressing the construction sector requirements. As construction projects continue to rise, the importance of hydraulic pumps in ensuring seamless machinery performance.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share, driven by the rapid growth of industries in the region, coupled with urbanization and expansion in key sectors such as construction, agriculture, and manufacturing. The countries at the forefront include China and India, with massive infrastructure projects and investments in industrial development, which have fueled the demand for hydraulic pumps. The high machinery used to power construction and farming activities heavily relies on hydraulic systems for their operation. The emerging automotive and mining industries raise their implementation of hydraulic technology. Competitively cheap manufacturing and a strong supply chain place Asia-Pacific at the center stage in hydraulic pump manufacturing globally. Innovation in hydraulic systems is fulfilling local needs while also creating trends on a global scale. Being a region with high growth potential and strategic importance, Asia-Pacific continues to be a vital region in shaping the global hydraulic pump market trends.

Key Regional Takeaways:

United States Hydraulic Pump Market Analysis

Extensive investments in large-scale infrastructure and construction projects in the United States primarily fuel the adoption of hydraulic pumps. For instance, the U.S. construction sector, with over 919,000 establishments as of Q1 2023, continues to drive economic growth. This expansion fuels the need for hydraulic pumps, essential for efficient machinery operation. Increasing infrastructure projects in the region highlight the sector's reliance on advanced hydraulic systems for productivity and sustainability. Urban expansion has driven demand for advanced construction machinery, particularly in the development of residential, commercial, and transportation hubs. This growth has led to a rise in the usage of hydraulic pumps in heavy-duty equipment such as excavators, loaders, and cranes, known for their efficiency in handling large-scale operations. The capability of hydraulic pumps to maintain consistent power under demanding conditions makes them indispensable in these sectors. Enhanced government spending on modernizing aging infrastructure, including bridges and highways, further amplifies their use. This expansion accelerated innovations in hydraulic pump technology, such as energy-efficient designs and smart integration for performance optimization. Additionally, the introduction of modular and compact hydraulic pumps supports the growth of the market in the region.

Asia Pacific Hydraulic Pump Market Analysis

The growing reliance on mechanized agricultural practices in the Asia Pacific has significantly driven the adoption of hydraulic pumps across diverse farming applications. According to India Brand Equity Foundation, private investment in agriculture surged to 9.3% in 2020-21, increasing the sector's growth and modernization. This expansion drives demand for hydraulic pumps, vital for efficient irrigation and mechanized farming. The trend highlights the growing dependence on advanced machinery to enhance productivity. These systems are crucial for powering equipment like tractors, harvesters, and irrigation systems, enabling precision and efficiency in large-scale farming operations. The increasing need for enhanced productivity to meet food demands accelerated the deployment of hydraulic pumps in advanced agricultural machinery. Innovations in pump technology, such as lightweight designs and low-maintenance components, have further fueled their integration into agricultural tools. The adoption of hydraulic pumps also expanded into emerging segments like greenhouse farming and controlled-environment agriculture, where reliable water and nutrient delivery systems are essential. Their ability to perform under variable conditions while maintaining consistent output positioned Asia Pacific as an integral region in the hydraulic pump market.

Europe Hydraulic Pump Market Analysis

The growing industrial sector in Europe requires hydraulic pumps, as these pumps have become essential components in industrial manufacturing and machinery operations due to their unparalleled efficiency. According to reports, industrial production in the euro area rose by 1.8% in August 2024 compared to July, with EU-wide growth at 1.3%. This growth is driven by expanding machinery and manufacturing industries, increasing need for hydraulic pumps. Enhanced industrial activity in the region highlights their critical role in optimizing operational efficiency and productivity. Their role in heavy manufacturing processes such as forging, molding, and machining elevated their importance in optimizing production lines. Advances in robotics and automation within industrial settings have further expanded the adoption of hydraulic pumps, with applications ranging from material handling to complex assembly lines. Europe’s focus on energy-efficient systems led to the development of pumps with variable-speed drive technology, reducing energy consumption while maintaining output reliability. Hydraulic pumps also support the growing demand for specialized machinery in precision engineering and equipment maintenance. Customizable features and integration with automated control systems ensure their adaptability across a broad range of industrial applications, which ensures the growth of the market in the region.

Latin America Hydraulic Pump Market Analysis

Latin America is a prominent mining region where the adoption of hydraulic pumps increased, driven by their ability to enhance operational efficiency in demanding environments. According to the International Energy Agency, Latin America, producing 40% of the world's copper, driven by Chile (27%), Peru (10%), and Mexico (3%), fuels the growing need for hydraulic pumps. The region's booming mining sector highlights the critical role of efficient hydraulic systems in resource extraction. These systems power critical equipment like excavators, drilling rigs, and haul trucks, ensuring uninterrupted performance under extreme conditions. With increased mineral extraction activities in the region, the need for robust and durable hydraulic solutions has risen, supported by innovations in pump designs that withstand heavy loads and abrasive materials. Hydraulic pumps also enable advanced excavation techniques, improving precision and safety. Their use in transporting extracted materials through hydraulic conveying systems further highlights their versatility.

Middle East and Africa Hydraulic Pump Market Analysis

In the Middle East, which is a hub for the oil and gas industry, hydraulic pumps have become indispensable due to their reliability and precision, supporting critical exploration, drilling, and refining operations in the region's vast energy reserves. According to the International Trade Administration, Saudi Arabia, holding 17% of the world's proven oil reserves, bolsters hydraulic pump demand as its expansive oil sector, led by Saudi Aramco, drives upstream and downstream operations. The kingdom's petroleum dominance supports advanced hydraulic technologies and energy efficiency. These systems power equipment like hydraulic fracturing machines and offshore rigs, which require consistent pressure for optimal performance. The rising focus on efficiency in upstream and downstream processes raised the requirement for advanced hydraulic pump solutions, including those designed for high-pressure and subsea applications. Innovations in corrosion-resistant materials and compact designs have enhanced their suitability for challenging environments.

Competitive Landscape:

The global hydraulic pump market is extremely competitive and dynamic, primarily due to technological advancements and different industrial applications. Manufacturers are attempting to innovate to improve the energy efficiency, durability, and performance of hydraulic pumps. Regional preferences, changing regulatory standards and shifting towards automation and internet of things (IoT) enabled hydraulic systems are factors influencing the market. Competitive strategies include expansion into new product lines, entry into emerging markets, and use of advanced materials and designs. Price sensitivity coupled with the need for credible after-sales service and more customized solutions intensifies competition. Emerging players challenge leading players by introducing cost-efficient alternatives and niche offerings in the market.

The report provides a comprehensive analysis of the competitive landscape in the global hydraulic pump market with detailed profiles of all major companies, including:

- Bailey International LLC

- Bosch Rexroth (India) Private Limited

- Bucher Hydraulics

- Danfoss

- Dynamatic Technologies Limited

- HAWE Hydraulik SE

- HYDAC International GmbH

- KYB Americas Corporation

- Parker Hannifin Corporation

- Shimadzu Corporation

Latest News and Developments:

- December 2024: Moog Inc. unveiled its Electro-Hydrostatic Unit (EPU)-G, featuring a four-quadrant, internal-gear hydraulic pump with variable speed and power-on-demand capabilities. Designed for applications requiring 20-85 liter/min flow rates and pressures up to 345 bar, EPU-G enables direct control via pump speed. Available in smaller sizes (5, 8, 13, 20 cm³), it complements Moog's existing EPU range (19-250 cm³).

- November 2024: Ruichen Hydraulic showcased its advanced hydraulic pump technology at the exhibition, highlighting its new PGP315 hydraulic pump launch. Renowned for high efficiency and low energy consumption, the PGP315 emerged as the star product, attracting significant interest. Customers engaged in in-depth consultations and technical discussions on its innovative design. The launch highlights Ruichen's commitment to energy-saving solutions and technical excellence.

- September 2024: Precision Hydraulics Engineers introduced Recon Pumps in India, targeting high-demand sectors like construction, power plants, and railways. These pumps boast advanced reliability and efficiency, ensuring optimal performance in critical applications. The launch reflects the company's focus on catering to industrial needs with cutting-edge hydraulic solutions. This innovation is expected to enhance operational productivity across diverse industries.

- January 2024: Enerpac unveiled its SC-Series, a lightweight and cordless hydraulic pump designed for versatile industrial use. This battery-operated pump delivers enhanced precision, catering to tasks requiring compact and portable solutions. Its innovative design aligns with modern industry demands for efficiency and mobility. The SC-Series underlines Enerpac's commitment to pioneering advanced tools for diverse sectors.

- January 2024: Schweiss Doors unveiled a cordless drill-operated hydraulic pump, enabling easy operation of hydraulic doors up to 24x12 feet using any cordless drill or manual effort. The compact system delivers the strength, security, and space efficiency of Schweiss hydraulic doors, eliminating the need for power, according to company officials.

Hydraulic Pump Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gear Pump, Vane Pump, Piston Pump |

| Pressure Ranges Covered | Up to 600 psi, 601 psi-1000 psi, More than 1000 psi |

| Applications Covered | Mobile Application, Industrial Application |

| End Users Covered | Construction, Mining, Agriculture, Machinery, Oil and Gas, Chemicals and Petrochemicals, Automotive |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bailey International LLC, Bosch Rexroth (India) Private Limited, Bucher Hydraulics, Danfoss, Dynamatic Technologies Limited, HAWE Hydraulik SE, HYDAC International GmbH, KYB Americas Corporation, Parker Hannifin Corporation, Shimadzu Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydraulic pump market from 2019-2033.

- The Hydraulic pump market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydraulic pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A hydraulic pump is a mechanical device that converts mechanical power into hydraulic energy by generating fluid flow. It is widely used in construction, manufacturing, automotive, and aerospace industries for tasks such as lifting, pressing, and moving heavy loads. Hydraulic pumps are vital for systems requiring efficient power transfer.

The global hydraulic pump market was valued at USD 9.96 Billion in 2024.

IMARC estimates the global Hydraulic Pump market to exhibit a CAGR of 4.33% during 2025-2033.

The key factors driving the global hydraulic pump market are rising demand for energy-efficient hydraulic systems, increasing construction and infrastructure development, growing industrial automation, and advancements in hydraulic technology. Expansion in the mining and agriculture sectors further increases the adoption of hydraulic pumps.

According to the report, gear pumps represented the largest segment by product type, driven by their affordability, simplicity in design, and reliability in handling high-pressure applications.

According to the report, construction represented the largest segment by the end user, driven by rapid urbanization, government investments in infrastructure projects, and the rising need for high-performance machinery to manage heavy-duty tasks in construction and civil engineering projects.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global hydraulic pump market include Bailey International LLC, Bosch Rexroth (India) Private Limited, Bucher Hydraulics, Danfoss, Dynamatic Technologies Limited, HAWE Hydraulik SE, HYDAC International GmbH, KYB Americas Corporation, Parker Hannifin Corporation, and Shimadzu Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)