Hydraulic Motors Market Report by Type, Speed, Application, and Region 2025-2033

Hydraulic Motors Market Size and Share:

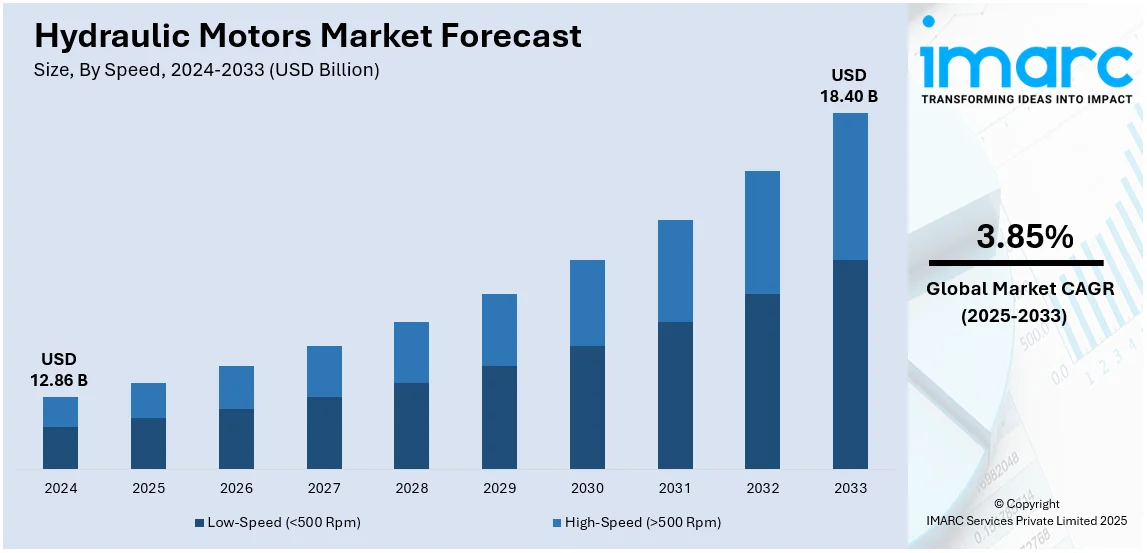

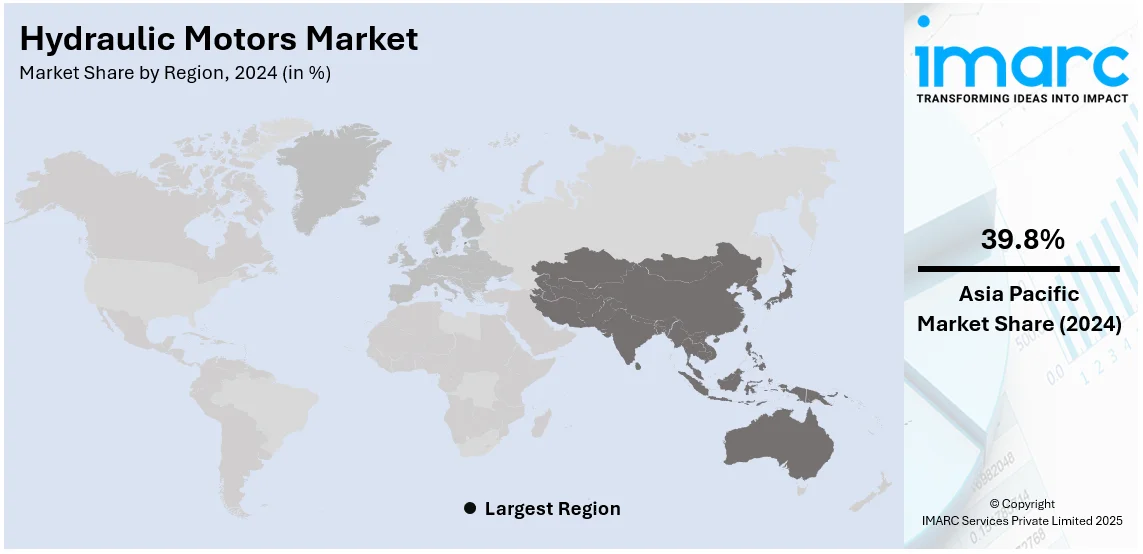

The global hydraulic motors market size was valued at USD 12.86 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.40 Billion by 2033, exhibiting a CAGR of 3.85% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 39.8% in 2024. The hydraulic motors market share is primarily driven due to rapid industrialization, increased construction activities, mechanization of agriculture, and investments in emerging economies for infrastructure development.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.86 Billion |

| Market Forecast in 2033 | USD 18.40 Billion |

| Market Growth Rate (2025-2033) | 3.85% |

Driven by escalated demand in construction, agricultural, and industrial sectors, the global hydraulic motors market is expected to rise. Urbanization and numerous other infrastructure development projects accelerate the acceptance of hydraulic motors in the construction sector for use in construction machinery, whereas a growing demand for automation increases their utilization in industrial applications. Mechanization and efficiency requirements increase the deployment of hydraulic motors among tractors and harvesters along with other agricultural machinery. High-torque, long-lasting motors in heavy-duty equipment are required due to the rapidly expanding mining sector. There is a substantial investment in technology development for hydraulic systems, particularly in compact designs, energy efficiency, and the ability to function under extreme conditions. Environmental regulations that focus on energy efficiency and emissions reduction stimulate innovation in this sector. For instance, in September 2024, Bezares unveiled advanced pump technologies and electric vehicle solutions at IAA 2024. The company introduced high-efficiency pumps and components designed to support the shift to sustainable electric mobility. Moreover, material handling, marine, and renewable energy applications further increase the hydraulic motors' global market share. Emerging economies in Asia Pacific and Latin America hold enormous growth potential because of increased industrialization and investments in infrastructure.

The US hydraulic motors market growth is driven primarily by construction, manufacturing, and material handling sectors with robust demand. For example, in September 2024, Parker Hannifin expanded its GVM motor series, unveiling larger sizes with up to 351 kW power, offering high efficiency, power density, and adaptability for on- and off-road electric vehicles. Moreover, federal infrastructure projects involving huge investments in highways, bridges, and renewable energy projects are also building considerable scopes for hydraulic equipment adoption. With increased smart manufacturing and Industry 4.0 practices, advanced hydraulic motors are finding usage in high-end automatic machinery. Amplified mechanization, due to the use of more modern equipment for which the government gives some subsidies, accelerates the demand for hydraulic systems in tractors and harvesters. A boost in the U.S. shale oil and gas industry has also escalated the need for hydraulic motors in drilling and exploration equipment. The innovations in electric and hybrid hydraulic systems for sustainability purposes continue to attract investment. There is also a robust presence of established manufacturers in the U.S. market, taking advantage of the latest technologies to meet changing customer needs and regulatory standards.

Hydraulic Motors Market Trends:

Widespread Adoption Across Industrial Verticals

The widespread adoption of hydraulic motors across various industrial verticals, such as petrochemicals, aerospace, chemical, marine, and oil and gas on account of the increasing demand for efficient wheel loaders and hydraulic motors for optimizing manufacturing processes is acting as one of the major factors driving the market toward growth. In line with this, significant technological advancements, along with the widespread adoption of innovative approaches by manufacturers for maximizing outputs, while lowering overheads is acting as another growth-inducing factor. This is further supported by the favorable initiatives undertaken by the governments of various countries for strengthening industrial infrastructure. This, in turn, aids in minimizing the operational costs and capital expenditure, which is contributing to the market growth. Additionally, the extensive utilization of hydraulic motors in on-shore and off-shore oil exploration activities, along with its deployment in the agriculture sector in hydrostatically powered wheel motors, are propelling the market growth. IEA estimates that increasing offshore gas output to 700 Billion cubic metres (bcm) by 2040, balanced between shallow water and deep-water developments, puts the share of offshore production above 30 percent of total gas output by 2040.Apart from this, the escalating construction activities and high infrastructural development across the globe are creating a positive outlook for the market. According to TST Europe, private sector construction spending in the U.S. was around USD 1.38 Trillion during 2023, and that of the public sector was USD 368 Billion.

Expansion in Offshore Exploration and Energy Applications

Hydraulic motors are observing boosting demand across offshore exploration and energy sectors, because they are efficient, long-lasting, and withstand extreme conditions. Motors are essential in subsea equipment, drilling rigs, and marine operations with a high torque output and reliability in extreme conditions. The increasing demand to explore deeper reservoirs and produce highly advanced offshore sources of energy supports the application of hydraulic systems to handle high complexity and high pressure. Further, hydraulic motors are becoming prominent in renewable projects, like an offshore wind farm, for sustainable energy production in a system of high performance. Hydraulic motors are versatile and can accommodate various marine and energy applications, which makes them relevant in the industries that seek innovative and efficient solutions. They are indispensable in the offshore energy and exploration sectors due to their ability to meet performance demands in extreme environments.

Growing Adoption in Precision Agriculture

Hydraulic motors are becoming highly common in agriculture because of their efficiency, adaptability, and performance in modern farming applications. Such motors facilitate accurate operations within agricultural machinery, such as tractors, harvesters, and sprayers, by giving them better control and power. These are energy-efficient motors with less mechanical complexity, just like the requirements for high-performance agriculture. Hydraulic systems are also very commonly used in irrigation equipment supports mechanized water management and increases productivity in water-scarce regions. With the rising trend towards precision farming, which employs the maximum utilization of crops, gains maximum yields, uses the minimum number of resources, also increases the need for hydraulic motors. Increased farm automation or farm smartness calls for reliability and flexibility of hydraulic systems. These motors reduce labor dependence and improve operational efficiency, making them essential for addressing the evolving challenges of modern agriculture while boosting overall productivity.

Hydraulic Motors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydraulic motors market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, speed, and application.

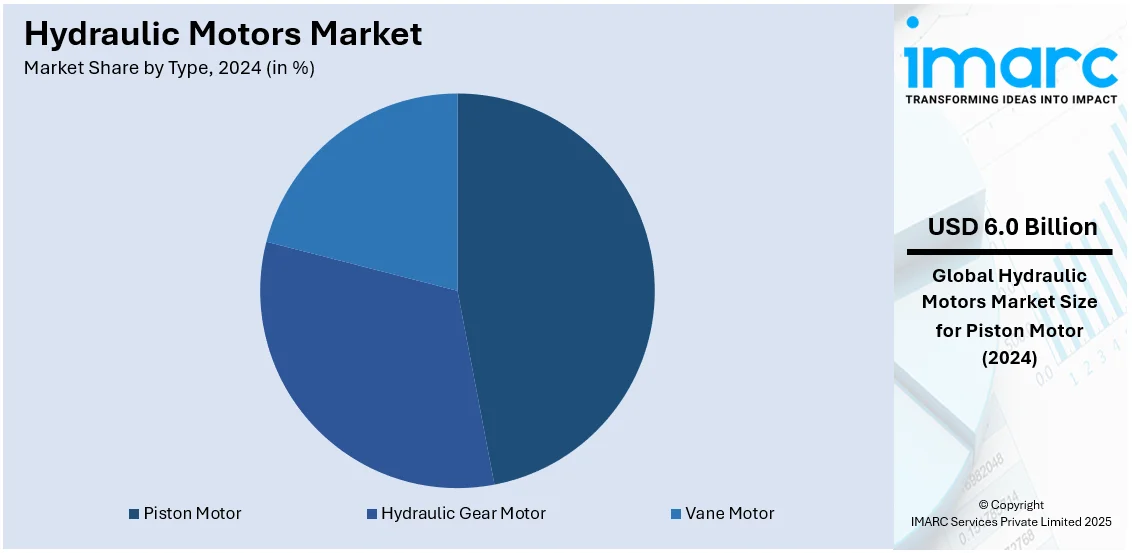

Analysis by Type:

- Hydraulic Gear Motor

- Gear Motor

- Epicyclic Gear Motor

- Vane Motor

- Piston Motor

- Radial Piston Motor

- Axial Piston Motor

Piston motors are the largest hydraulic motors market with a market share of 46.6% because of their efficiency superiority, high torque, and capacity to operate in high-pressure environment. They are used for heavy-duty applications such as construction equipment, industrial machinery, and mining machines, where the ability to achieve accurate results and withstand a stress environment is of great importance. They have the highest power density and efficiency for other motor types; hence, these are excellent applications for rigorous cases. Piston motors are also applied in applications which require variable displacement capabilities. Moreover, the use of these motors increases control and flexibility. Increasing concerns about energy efficiency and high performance in machinery have increased the usage of piston motors. As hydraulic technology has progressed, piston motors have gained more ground among organizations seeking reliability, performance, and life. Their ability to work under extreme conditions puts them in a strategic position in the hydraulic motors market.

Analysis by Speed:

- Low-Speed (<500 Rpm)

- High-Speed (>500 Rpm)

The high-end hydraulic motors, which run at speeds higher than 500 rpm, are an important part of the hydraulic motors market due to their flexibility and efficiency in high-demand applications. Commonly used in manufacturing, material handling, and automation systems requiring rapid and precise movement, these motors provide quick turning speed with minimal variation in torque for dynamic operations. They are also highly used in agricultural machinery, construction machines, and other off-road equipment, as fast, timely jobs require swift execution. Improvement of motor designs aimed at decreasing the energy usage of motors while raising the accuracy in their functioning have pushed these motors even more. Industrial automation and robotics with the requirement of high-speed functions have expanded its market share. All these motors are the preferred for usage in applications requiring speed, precision, and also absolute reliability.

Analysis by Application:

- Off-Road

- Construction Machinery

- Agricultural Machinery

- Mining Machinery

- Industrial

- Manufacturing

- Marine

Off-road segment is a major contributor to the hydraulic motors market due to their vast application in construction, agriculture, and mining machinery. Hydraulic motors are crucial in the operation of off-road equipment like wheel loaders, excavators, tractors, and harvesters, which demand reliability and high performance. Such motors help heavy machinery function effectively in uneven and rugged terrains, with the ability to function smoothly in harsh conditions. Demand for this segment has increased with increasing demand in infrastructure development, agricultural mechanization, and resource extraction. The off-road hydraulic motors have been designed to offer a high torque output and transmit the pressure accurately, which enables them to tolerate any amount of pressure without failure. With their heavy-duty applications, the technologies used here enhance compact designs and energy efficiency. With continued industrialization and a demand for robust, high-performance equipment, the off-road segment is driving considerable demand for hydraulic motors.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific accounted for the highest market share, holding 39.8% due to its high rate of industrialization and rapid infrastructure growth in the region as well as growth in agricultural mechanization. Strong demand for hydraulic motors is also from expanding construction activities backed by government spending in roads, railways, and other urban infrastructures. Further expansion in mining and the resultant necessity for the adoption of effective extraction equipment boosted market demand in this region. In agriculture, the accelerated number of modern tools like tractors and reapers has shifted towards hydraulic equipment for better results. The major drivers in the Asian region are also the countries focusing on industrial progress and technological change, such as China, India, and Japan. The presence of top manufacturers, accompanied by escalating demands for energy efficient and high performing machinery, strengthen Asia-Pacific to be the current leader in global hydraulic motors markets.

Key Regional Takeaways:

North America Hydraulic Motors Market Analysis

Hydraulic motors industry in North America is growing steadily, and it is increasingly driven by these three main industries including construction, agricultural, and the mining industry. Infrastructure development and modernization works propel the utilization of hydraulic motors in constructing machinery and material handling equipment. Such machinery as tractors and harvesters benefits the agricultural industry by having hydraulic motors. Efficiency improvements due to technological advancements, such as energy and compact designs in hydraulic motors, further make them attractive in industrial applications. The mining industry is constantly expanding, demanding high-torque hydraulic motors in harsh environments. The United States is the country with the biggest market share. It has witnessed significant investments from construction and manufacturing sectors. It is also augmented in Canada due to increasing adoption by the mining and agriculture sectors. The key players innovate, form alliances, and widen their distribution channels to further the market share. The emphasis of regulatory standards on energy efficiency and reduced emissions influences product development and makes North America a significant region in the hydraulic motors market worldwide.

United States Hydraulic Motors Market Analysis

The United States hydraulic motors market is driven by several key factors, including the thriving construction and manufacturing sectors, the growing demand for automation, and the rapid advancements in industrial technologies. The U.S. construction industry is experiencing significant growth, fueled by large-scale infrastructure projects and government investments in roads, bridges, and urban development. According to reports, in 2023, construction accounted for approximately 4.3% of the GDP, highlighting its economic significance. Hydraulic motors are integral to construction processes, powering essential machinery such as cranes, excavators, and drilling equipment. Also, the manufacturing sector of the U.S. is gradually incorporating automation technologies for more efficient production processes. Hydraulic motors are integral to powering automated systems, robots, and material handling equipment, driving demand in industrial settings. The recent development is a prominent driver in this hydraulic motor marketplace. It includes growth in the oil and gas industry. Hydraulic motors are needed in drilling rigs, pipeline construction, and offshore platforms. As the U.S. increases its energy production and explores new drilling locations, the demand for hydraulic motors in these sectors continues to grow. Moreover, technological advancements, such as the integration of IoT and predictive maintenance solutions into hydraulic systems, are boosting the efficiency and reliability of hydraulic motors, making them a preferred choice for high-performance applications. The push toward sustainable energy and green initiatives also encourages the adoption of energy-efficient hydraulic systems, supporting market growth.

Asia Pacific Hydraulic Motors Market Analysis

The Asia Pacific hydraulic motors market is experiencing robust growth on account of increasing industrial activities, urbanization, and a strong emphasis on infrastructure development. China and India are leading the list of countries in terms of infrastructure projects such as roads, bridges, and urban transportation systems, which call for heavy machinery with hydraulic motors. According to CRISIL's Infrastructure yearbook 2023, India will spend nearly USD 1,727.05 Billion on infrastructure in seven fiscals through 2030. As the construction and mining industries are booming in this region, the requirement for high-performance hydraulic motors in excavators, cranes, and other construction machinery is on the rise. Additionally, the region’s manufacturing sector is increasingly adopting automation, creating significant demand for hydraulic motors in industrial robots, conveyors, and automated material handling systems. The rise of smart factories in countries like Japan and South Korea also boosts the demand for hydraulic motor applications. Furthermore, the automotive sector in Asia Pacific is experiencing a shift towards electric and hybrid vehicles, which require precision hydraulic systems for various functions, such as braking, steering, and suspension. This shift to advanced technologies further drives market demand. The third important driver is the increasing demand for hydraulic systems in agriculture particularly in countries with immense agricultural sectors, such as China and India. Hydraulic motors are used in tractors, harvesters, and other machines, aiding in the modernization of the region's agriculture.

Europe Hydraulic Motors Market Analysis

The region's strong automotive and manufacturing industries, as well as the growing emphasis on renewable energy projects and environmental sustainability. The International Council on Clean Transportation estimated that in 2023, approximately 10.6 Million new cars were registered in the 27 Member States of the EU. Furthermore, the commitment to sustainability and the reduction of carbon emissions by the European Union is stimulating the demand for energy-efficient and environmentally friendly technologies, including hydraulic systems. Hydraulic motors are also a necessity in those applications that require high efficiency and low energy consumption, including wind turbines, renewable energy plants, and electric vehicles. With a focus on reducing industrial carbon footprints, hydraulic motors are being incorporated into green technologies, promoting further market expansion. Besides this, the ongoing demand for construction equipment and mining machinery in Europe, particularly in countries like Germany, France, and the UK, continues to drive growth. Hydraulic motors are critical in equipment used for excavation, tunneling, and material handling. The region’s commitment to urban development and infrastructure upgrades ensures that the demand for construction machinery powered by hydraulic motors remains high. The European manufacturing sector is also increasingly adopting automation and robotics, which rely on hydraulic motors for operation. Furthermore, with technological advancements in hydraulic systems, including improvements in power density and precision control, European manufacturers are opting for hydraulic motors for specialized applications, fostering the market’s growth.

Latin America Hydraulic Motors Market Analysis

The growth of the market is further supplemented by the increased infrastructure projects, especially in Brazil and Mexico. New roads, bridges, and residential complexes are intensifying demand for hydraulic-powered machinery, including excavators, bulldozers, and cranes. Moreover, the mining and agriculture sectors of the region, particularly Chile and Argentina, heavily rely on hydraulic motors to power the equipment used in extraction, processing, and mechanized farming. The market is also witnessing growth with growing investments in renewable energy projects in the region. According to reports, in 2023, Brazil announced a new "growth acceleration" plan with a commitment of USD 12.5 Billion for new renewable energy projects. With the industry on the growth curve, demand for hydraulic motors increases.

Middle East and Africa Hydraulic Motors Market Analysis

In the Middle East and Africa, demand in the oil and gas sector particularly in the countries of Saudi Arabia, UAE, and Nigeria-will continue to drive demand in hydraulic motors for offshore drilling rigs, pipeline construction, and machinery in refineries. Heavy investment in infrastructure development coupled with the rising adoption of hydraulic-powered machinery in construction and agriculture is also an important factor driving the market. The MENA region's construction sector has taken tremendous knocks but continues to award projects worth a phenomenal USD 101 Billion in the first half of the year, according to reports. The need for automation in most industrial sectors directly increases the requirement for high-performance hydraulic motors in most applications in line with this.

Competitive Landscape:

The hydraulic motors market is highly competitive with various players concentrating on innovation and technological developments for a competitive edge. There has been a high investment in research and development (R&D) in introducing energy-efficient, high-performance, and compact designs catering to diversified industrial needs. Key trends strategies collaborations, partnerships, and acquisitions are one of the most significant trends that allow players to expand their portfolios and enhance market presence. Hydraulics motors customized to satisfy certain application requirements in construction, agriculture, and mining increase the rivalry. Another trend shaping the market is the presence of eco-friendly and sustainable hydraulic solutions that are observing growth due to heightening regulatory pressure to reduce emissions and energy consumption. Other trends seen to impact the market include accelerated adoption of advanced manufacturing techniques, automation, and robotics. The above has seen manufacturers "talk" their products into being smart products. The strategies collectively outline the competitive dynamics of the hydraulic motors market.

The report provides a comprehensive analysis of the competitive landscape in the hydraulic motors market with detailed profiles of all major companies, including:

- Bezares SA

- Bosch Rexforth AG (Robert Bosch GmbH)

- Bucher Hydraulics GmbH (Bucher Industries AG)

- Danfoss A/S

- Eaton Corporation PLC

- Hydro Leduc

- Kawasaki Heavy Industries Ltd.

- M + S Hydraulic PLC

- Maha Hydraulics Private Limited

- Mitsubishi Heavy Industries Ltd.

- Parker-Hannifin Corporation

- Permco Inc.

- Rotary Power

- VELJAN Hydrair Private Ltd.

Latest News and Developments:

- May 2024: Poclain added an MI330 that offers 30% more displacement and hydraulic power density with high power density capabilities, allowing this motor to attain 600 kW with a higher lifetime.

- May 2024: Black Bruin introduced the newly designed X-Series of radial piston hydraulic motors. A patent-pending design, X-series was built into the core aim of performance boost for both fresh and older machine equipment especially related to strength, workability, and cost effectiveness.

- November 2023: Danfoss Power Solutions, the global leader in the supply of mobile and industrial hydraulics as well as electric powertrain systems, has launched its new H1F fixed displacement bent axis hydraulic motor. The design of the H1F motor is aimed at providing open- and closed-circuit applications with best-in-class efficiency, proven reliability, and compactness.

- July 2023: Bosch Rexroth unveiled Hägglunds Quantum motor range, eliminating former torque and speed limitations but putting them together with high efficiency for applications ranging from heavy-duty to mobile ones. The new unit reaches more than 150 rpm but it achieves sustainable maximum torque over 350 kilonewton-meter.

Hydraulic Motors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Speeds Covered | Low-Speed (<500 Rpm), High-Speed (>500 Rpm) |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bezares SA, Bosch Rexforth AG (Robert Bosch GmbH), Bucher Hydraulics GmbH (Bucher Industries AG), Danfoss A/S, Eaton Corporation PLC, Hydro Leduc, Kawasaki Heavy Industries Ltd., M + S Hydraulic PLC, Maha Hydraulics Private Limited, Mitsubishi Heavy Industries Ltd., Parker-Hannifin Corporation, Permco Inc., Rotary Power and VELJAN Hydrair Private Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydraulic motors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydraulic motors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydraulic motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydraulic motors market was valued at USD 12.86 Billion in 2024.

IMARC Group estimates the market to reach USD 18.40 Billion by 2033, exhibiting a CAGR of 3.85% from 2025-2033.

The hydraulic motors market is further driven by rising construction and infrastructure projects, growth in adoption within agriculture and industrial automation, and demand for energy-efficient systems and hydraulic technology improvements. Other contributors to growth are the increasing activities of mining operations, growing applications in material handling equipment, and the development of compact, high-torque motor designs to address various industrial applications.

Asia Pacific currently dominates the market driven by the region's rapid industrialization, significant infrastructure development, and increasing adoption of agricultural mechanization, the demand for hydraulic motors remains strong. This growth is further fueled by expanding construction activities, supported by government investments in roads, railways, and other urban infrastructure projects.

Some of the major players in the hydraulic motors market include Bezares SA, Bosch Rexforth AG (Robert Bosch GmbH), Bucher Hydraulics GmbH (Bucher Industries AG), Danfoss A/S, Eaton Corporation PLC, Hydro Leduc, Kawasaki Heavy Industries Ltd., M + S Hydraulic PLC, Maha Hydraulics Private Limited, Mitsubishi Heavy Industries Ltd., Parker-Hannifin Corporation, Permco Inc., Rotary Power and VELJAN Hydrair Private Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)