Hydraulic Fluids Market Size, Share, Trends and Forecast by Base Oil, Point of Sale, End User, and Region, 2025-2033

Hydraulic Fluids Market Size and Share:

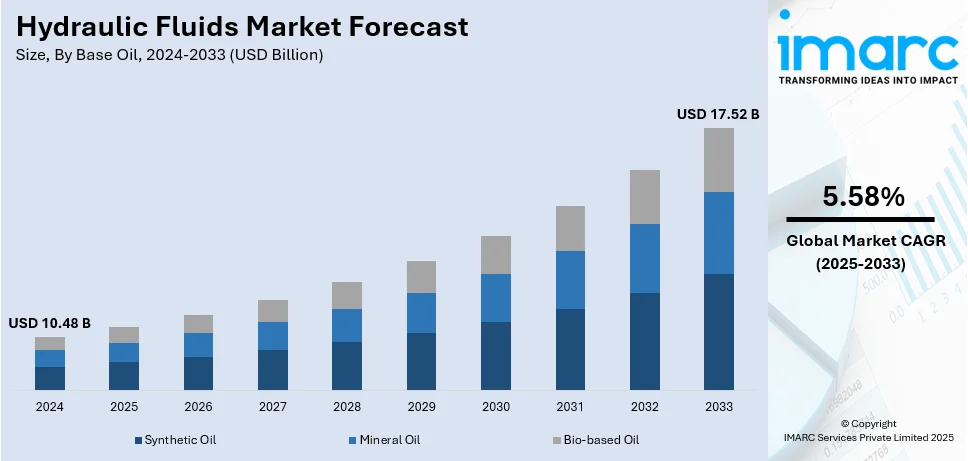

The global hydraulic fluids market size was valued at USD 10.48 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.52 Billion by 2033, exhibiting a CAGR of 5.58% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 36.5% in 2024. The increasing hydraulic fluids market share in the Asia Pacific region is because of expanding construction and mining sectors and strong manufacturing growth in China and India. Rising infrastructure investments, increased automation, and demand for high-performance lubricants are further bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 10.48 Billion |

|

Market Forecast in 2033

|

USD 17.52 Billion |

| Market Growth Rate (2025-2033) | 5.58% |

The growing adoption of automation and artificial intelligence (AI)-integrated hydraulic systems in industries like automotive manufacturing, agriculture, and material handling are catalyzing the demand for specialized hydraulic fluids. These smart systems require fluids that can maintain efficiency under varying conditions and reduce friction. Moreover, ongoing innovation in hydraulic fluid formulations is leading to improved properties such as higher thermal stability, superior oxidation resistance, and enhanced anti-wear characteristics. These advancements contribute to better equipment performance, extended service life, and reduced downtime. Besides this, authorities and regulatory agencies are enforcing more stringent environmental regulations to decrease pollution and improve sustainability. This is resulting in the development and adoption of biodegradable and fire-resistant hydraulic fluids that offer high performance while minimizing environmental impact.

The United States plays a vital role in the market, propelled by the growing number of large infrastructure initiatives, such as roads, bridges, and energy plants, which necessitate hydraulic machinery like excavators, loaders, and cranes. Moreover, progress in construction equipment technology is boosting the need for high-performance hydraulic fluids, as producers unveil machines with longer service intervals, better hydraulic efficiency, and greater durability, lowering maintenance expenses and enhancing operational productivity. For example, in 2024, Volvo Construction Equipment introduced new excavators in North America, featuring the ECR145 short swing and EC500 models. These excavators showcased enhanced performance, safety, and operator comfort, with a 50% extension in hydraulic oil lifespan. Hydraulic oil service intervals are now 3,000 hours for standard oil and 6,000 hours for extended-life hydraulic oil, improving productivity and lowering maintenance expenses.

Hydraulic Fluids Market Trends:

Growing Environmental Concerns and Stringent Regulations

The increasing environmental issues and strict regulations are currently positively impacting the expansion of the hydraulic fluids market. In addition to this, manufacturers are progressively creating and advertising biodegradable and less harmful hydraulic fluid formulas. This change is a reaction to increased environmental consciousness and the necessity of adhering to more stringent regulations designed to lessen the ecological footprint of industrial activities. Furthermore, the expansion of the automotive industry is also fueling the demand for hydraulic fluids. In 2022, worldwide motor vehicle production totaled 85,016,728 units, reflecting a 5.9% rise from the previous year, according to the International Organization of Motor Vehicle Manufacturers (OICA). The year-on-year growth for 2021-2022 was 6%, indicating a consistent expansion in the sector. As vehicle production rises, the need for high-performance hydraulic fluids in automotive manufacturing, assembly processes, and hydraulic braking systems grows. In addition, the enforcement of strict regulations and standards by regulatory authorities and environmental organizations is promoting the use of hydraulic fluids that comply with defined criteria for environmental safety and sustainability. Businesses are actively searching for hydraulic fluid options that both operate efficiently and comply with these standards. Consequently, manufacturers are allocating resources to research efforts aimed at developing hydraulic fluids that reduce the emission of toxic materials into the environment.

Rising Construction of Residential and Commercial Infrastructure

The global construction industry is predicted to increase by USD 4.5 Trillion from 2020 to 2030 to USD 15.2 Trillion in 2030, with USD 8.9 Trillion in emerging economies, as per Oxford Economics. At present, the rising construction of residential and commercial infrastructure is propelling the utilization of hydraulic fluids. Besides this, construction projects in the residential and commercial sectors are creating a sustained demand for hydraulic systems and equipment. These systems play a critical role in various construction applications, including heavy machinery, cranes, and elevators, among others. In addition, the need for hydraulic fluids that can deliver high performance and operational reliability is currently driving innovation within the industry. Furthermore, as construction projects become more sophisticated and demanding, there is a growing emphasis on hydraulic fluids that can withstand higher pressures, temperatures, and operational stress.

Increasing Trend of Industrial Automation

According to the COMTRADE database (by the United Nations) for international trade, Canada's exports of prepared liquids for hydraulic transmission and hydraulic brake fluids stood at USD 32.33 million in 2021. The increasing trend of industrial automation is contributing to the hydraulic fluids market growth. Besides this, the rising adoption of industrial automation technologies in manufacturing and industrial processes is necessitating the use of hydraulic systems. These systems are vital for the precise control and efficient operation of various automated machinery and equipment. As the trend toward automation continues, there is a constant and growing demand for hydraulic fluids to lubricate, cool, and transmit power within these systems. Moreover, the complexity and precision required in automated processes are pushing hydraulic fluid manufacturers to develop advanced formulations. Furthermore, the drive towards energy efficiency in automated systems is promoting the use of hydraulic fluids that can minimize energy losses.

Hydraulic Fluids Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hydraulic fluids market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on base oil, point of sale, and end user.

Analysis by Base Oil:

- Synthetic Oil

- Mineral Oil

- Bio-based Oil

Mineral oil leads the market with a 49.6% share in 2024. This dominance is driven by its cost-effectiveness, wide availability, and excellent lubricating properties. As a petroleum-based liquid, it serves as a reliable medium for transmitting power in hydraulic systems, offering high stability and viscosity suitable for diverse applications. Industrial equipment, construction machinery, and agricultural machinery widely use mineral oil-based hydraulic fluid to enhance operational efficiency and ensure smooth performance. This fluid plays a crucial role in powering hydraulic cylinders, motors, and valves, enabling precise control in heavy-duty applications. In the automotive sector, it is essential for power steering systems and shock absorbers, ensuring responsive handling and superior ride comfort. Its ability to reduce wear, prevent corrosion, and enhance equipment longevity further strengthens its market position. With continuous advancements in additive technology, modern mineral oil-based hydraulic fluid offers improved thermal stability and oxidation resistance, meeting the demands of high-performance hydraulic systems.

Analysis by Point of Sale:

- Original Equipment Manufacturer (OEM)

- Aftermarket

An original equipment manufacturer (OEM) of hydraulic fluids produces specialized fluids and hydraulic systems tailored for various machinery and equipment, ensuring compatibility, efficiency, and long-term performance. These fluids are engineered to withstand extreme pressure, temperature variations, and environmental conditions, preventing wear, oxidation, and contamination. By maintaining viscosity stability and resisting degradation, OEM hydraulic fluids contribute to enhanced equipment reliability, reduced maintenance requirements, and lower operational costs. OEMs often collaborate with machinery manufacturers to develop advanced formulations that meet industry-specific standards and performance benchmarks.

The aftermarket sector is vital for enhancing the durability and performance of hydraulic systems following their initial acquisition. It encompasses providing replacement fluids, filters, seals, hoses, and other essential parts required for continuous maintenance, repairs, and system enhancements. The increased emphasis on preventive maintenance, cost efficiency, and environmental regulations is boosting the demand for top-tier aftermarket hydraulic fluids, facilitating seamless operations across various sectors.

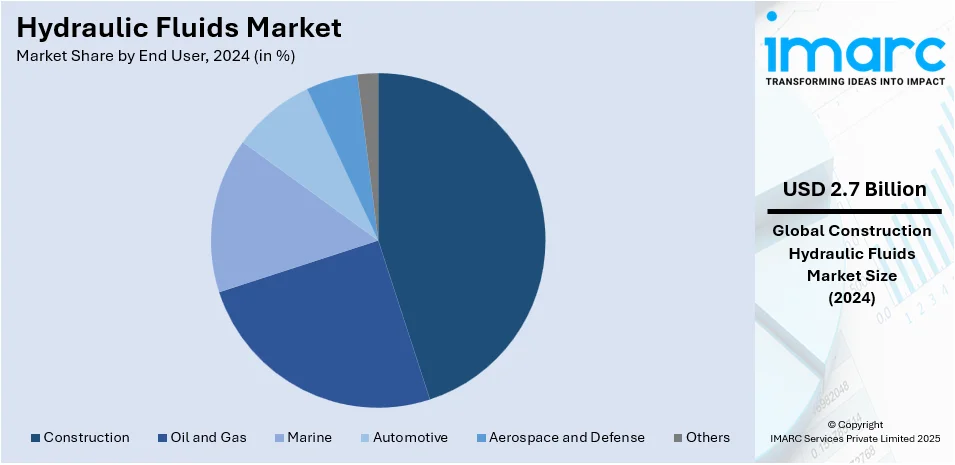

Analysis by End User:

- Oil and Gas

- Marine

- Automotive

- Aerospace and Defense

- Construction

- Others

Construction represents the largest segment, accounting 25.5% of the market share in 2024. This dominance is driven by increasing infrastructure projects, rapid urbanization, and rising investments in smart construction technologies. Hydraulic fluids play a crucial role in powering heavy machinery like excavators, bulldozers, cranes, and loaders, ensuring efficient performance, reduced friction, and extended equipment lifespan. Their ability to enhance energy efficiency, minimize wear, and withstand high-pressure conditions makes them indispensable for modern construction operations. Additionally, with advancements in hydraulic fluid formulations, the industry is benefiting from improved thermal stability, oxidation resistance, and anti-wear properties, leading to reduced maintenance costs and operational efficiency. The growing adoption of environment-friendly, biodegradable hydraulic fluids aligns with sustainability goals while maintaining high performance. As governments and private investors continue to prioritize infrastructure development worldwide, the demand for high-quality hydraulic fluids in construction applications is set to remain strong, driving further market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of 36.5%. The region held the biggest market share due to rising investments in the construction of residential and commercial infrastructure. Besides this, the increasing adoption of hydraulic equipment in various manufacturing processes, including metalworking, plastic molding, and material handling, is contributing to the growth of the market. Moreover, the rising mechanization of agricultural practices is contributing to the market growth. Additionally, strategic collaborations between key industry players are driving product innovation and market expansion, enabling the development of high-performance hydraulic fluids with advanced additives to enhance efficiency, durability, and after-sales support across various applications. For example, in 2024, Energizer Holding, Inc. and Assurance Intl Limited announced a new line of STP® automotive lubricants, hydraulic oils, filters, and batteries. The products, designed for various vehicle and household needs, featured advanced additives for improved performance and engine life. This collaboration aimed to enhance product offerings in India with superior protection and after-sales support.

Key Regional Takeaways:

United States Hydraulic Fluids Market Analysis

In North America, the market portion held by the United States was 87.50% of the overall total. The US hydraulic fluids market is set to experience tremendous growth with the country's continuous infrastructure development. Upon signing of the Bipartisan Infrastructure Law (BIL) by President Biden, a considerable USD 1.2 Trillion of federal funds will be invested in transportation, energy, and climate infrastructure projects. These investments are expected to drive hydraulic system demand, which is core to the performance of heavy machines, construction tools, and industrial processes. BIL's thrust towards upgrading the nation's infrastructure, such as roads, bridges, and public utilities, likewise speeds up demand for hydraulic fluid to support seamless operation of main machinery. Furthermore, increased focus on clean energy and sustainability is promoting the application of environmentally friendly hydraulic fluids across industries such as renewable energy and electric vehicle production. Consequently, demand for high-performance and eco-friendly hydraulic fluids is on the rise, with industries looking for dependable solutions to address both operational and regulatory needs.

Europe Hydraulic Fluids Market Analysis

The European hydraulic fluids market is increasing due to various major factors such as the rising demand for high-performance and eco-friendly options. The increasing emphasis of the European Union on sustainability, along with stricter environmental laws, is incentivizing producers to use hydraulic fluids less reliant on petroleum oil. According to an industry report, the EU also imported hydraulic fluids for transmission and brakes worth USD 88,641.30 Thousand in 2020, which indicates the transition to lower petroleum content fluids. This is driven by the reduction of carbon emissions and energy efficiency in the industrial sector of the region. The European market's high industrial base, especially in automotive, manufacturing, and renewable energy industries, is also fueling the demand for effective hydraulic systems. Ongoing advances in green technology, like non-toxic and biodegradable hydraulic fluid, also promote growth in the market. While Europe's manufacturing sector continues its drive towards high-performance equipment and sustainability, it will increasingly rely on sophisticated hydraulic fluid solutions.

Asia Pacific Hydraulic Fluids Market Analysis

The Asia Pacific hydraulic fluids market is witnessing strong growth with the increasing industrialization, rising infrastructure activities, and expanding demand for high-performance lubricants. In March 2022, BASF SE revealed an investment to expand the production capacity of its synthetic ester base stock at its Jinshan, China plant, in response to the increasing demand for advanced lubricants in the region. Also, in March 2021, TotalEnergies introduced the fire-resistant HYDRANSAFE HFC_E hydraulic fluid in Australia, which is aimed at increasing machine reliability and preventing fire risks in underground mines. This technology responds to the growing demand for more efficient and safe hydraulic fluids for the mining and industrial industries. Also, the growth of urbanization, along with the development of manufacturing, automotive, and construction industries, is fueling the use of hydraulic systems and fluids. As a result of more stringent environmental laws, Asia Pacific industries are adopting bio-based and environmentally friendly hydraulic fluid formulations, abetting sustainable growth for the Asia Pacific hydraulic fluids market.

Latin America Hydraulic Fluids Market Analysis

The Latin America hydraulic fluids market is expected to see considerable growth fuelled by large investments in industrial operations and infrastructure development. Brazil's National Development Bank (BNDES) is still backing the federal government's privatization program, with local analysts anticipating a total of USD 145 Billion in network extension investments by 2033. This comprises USD 96 Billion in building sanitation infrastructure and USD 49 Billion in refurbishing and enhancing existing ones, ITA reports. Such infrastructure projects are propelling demand for hydraulic fluids, especially in construction, mining, and heavy machinery applications. As industrialization and urbanization increase throughout Latin America, there is an increased demand for sustainable and high-performing hydraulic systems. Moreover, the emphasis in the region towards sustainability and complying with environmental legislation is driving eco-friendly hydraulic fluid solutions. Based on these investments and industrial innovations, the market for hydraulic fluids in Latin America is anticipated to experience consistent growth in the forthcoming years.

Middle East and Africa Hydraulic Fluids Market Analysis

The Middle East and Africa (MEA) hydraulic fluids market is growing at a strong rate, stimulated by regional industrialization and infrastructure development. The main driver is the UAE's vision for GreenTech and CleanTech, where it has pledged to become a net-zero carbon economy by 2050. The nation aims to invest USD 163 Billion in clean energy and renewable technologies, including improving industrial efficiency and increasing infrastructure projects. These developments are driving high-performance hydraulic fluid demand in construction equipment, mining, and oil and gas activities. Furthermore, the increasing urbanization in MEA, with countries such as Saudi Arabia pumping money into infrastructure as part of their Vision 2030, is compelling hydraulic fluid demand in mega construction projects. As environmental regulations tighten, there is also growing use of biodegradable and less toxic hydraulic fluid products, further fueling market growth in the region. The intersection of industrial growth, green investment, and environmental concern puts the MEA hydraulic fluids market outlook on a path to strong growth.

Competitive Landscape:

Major market players are channeling funds into research initiatives to develop groundbreaking products that provide enhanced performance, extended durability, and greater environmental sustainability by formulating bio-based and synthetic hydraulic fluids with advanced characteristics. Leading firms are investigating new geographic areas and broadening their international presence to access emerging economies and regions with developing industrial sectors. They are also providing tailored solutions to meet the unique requirements of various industries and applications. Furthermore, top companies are concentrating on creating hydraulic fluids that are more eco-friendly and adhere to environmental standards. For example, in 2024, Chevron launched Clarity Bio EliteSyn AW, a biodegradable hydraulic fluid tailored for the marine and construction sectors. It showcased outstanding performance, surpassing regulatory criteria for biodegradation and toxicity, and was eco-friendly. The renewable base stock formulation of the product guaranteed compatibility, durability, and safety for wildlife

The report provides a comprehensive analysis of the competitive landscape in the hydraulic fluids market with detailed profiles of all major companies, including:

- BASF SE

- bp p.l.c.

- Chevron Corporation

- China National Petroleum Corporation

- China Petroleum & Chemical Corporation

- Croda International Plc

- Dow Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co. Ltd.

- Lukoil

- Phillips 66 Company

- Royal Dutch Shell plc

- TotalEnergies SE

Latest News and Developments:

- May 2024: Exxon Mobil Corporation completed the acquisition of Pioneer Natural Resources Company to establish a distinct entity. This acquisition strengthened Exxon Mobil's standing in the Permian Basin via its unconventional business operations.

- April 2024: TotalEnergies SE and its subsidiary TotalEnergies Marketing USA formed a strategic partnership with OK Petroleum, a distributor based in Long Island. The aim of this strategic partnership was to enhance TotalEnergies' market presence in the region.

- In 2023: Exxon Mobil Corporation revealed the growth of its chemical production by launching two new chemical manufacturing units in Baytown, Texas.

Hydraulic Fluids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Base Oils Covered | Synthetic Oil, Mineral Oil, Bio-based Oil |

| Point of Sales Covered | Original Equipment Manufacturer (OEM), Aftermarket |

| End Users Covered | Oil and Gas, Marine, Automotive, Aerospace and Defense, Construction, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, bp p.l.c., Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Croda International Plc, Dow Inc., Eastman Chemical Company, Exxon Mobil Corporation, Fuchs Petrolub SE, Idemitsu Kosan Co. Ltd., Lukoil, Phillips 66 Company, Royal Dutch Shell plc, TotalEnergies SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hydraulic fluids market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hydraulic fluids market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hydraulic fluids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hydraulic fluids market was valued at USD 10.48 Billion in 2024.

The hydraulic fluids market is projected to exhibit a CAGR of 5.58% during 2025-2033, reaching a value of USD 17.52 Billion by 2033.

The hydraulic fluids market is driven by rising industrial automation, expanding construction and mining activities, and increasing demand for energy-efficient hydraulic systems. Stricter environmental regulations are fueling the shift toward biodegradable fluids, while advancements in synthetic formulations enhance performance, extending equipment lifespan and reducing maintenance costs.

Asia Pacific currently dominates the hydraulic fluids market, accounting for a share of 36.5%. The dominance of the region is because of expanding construction and mining sectors and strong manufacturing growth in China and India. Rising infrastructure investments, increased automation, and demand for high-performance lubricants further support the market growth in the region.

Some of the major players in the hydraulic fluids market include BASF SE, bp p.l.c., Chevron Corporation, China National Petroleum Corporation, China Petroleum & Chemical Corporation, Croda International Plc, Dow Inc., Eastman Chemical Company, Exxon Mobil Corporation, Fuchs Petrolub SE, Idemitsu Kosan Co. Ltd., Lukoil, Phillips 66 Company, Royal Dutch Shell plc, TotalEnergies SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)