Hybrid Memory Cube Market Size, Share, Trends and Forecast by Product, Application, End Use Industry, and Region, 2025-2033

Hybrid Memory Cube Market Size and Share:

The global hybrid memory cube market size was valued at USD 1,963.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 11,629.8 Million by 2033, exhibiting a CAGR of 21.86% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.7% in 2024. The hybrid memory cube market share is driven by growing AI, HPC, and big data applications that demand high bandwidth. Energy-efficient designs reduce power consumption, while cloud services and 3D stacking enhance scalability, processing speed, and efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,963.0 Million |

|

Market Forecast in 2033

|

USD 11,629.8 Million |

| Market Growth Rate (2025-2033) | 21.86% |

Energy efficiency is driving the market by reducing power consumption in high-performance computing. Traditional DRAM uses more power per bit, making HMC a preferred alternative for energy-conscious industries. HMC’s 3D stacking architecture and Through-Silicon Via (TSV) technology improve data transfer speed while minimizing energy loss. This efficiency is crucial for data centers, AI accelerators, and cloud computing platforms handling massive workloads. Enterprises prioritize low-power, high-speed memory solutions to reduce operational costs and environmental impact. HMC operates at lower voltage levels, utilizing less power compared to conventional memory modules. Artificial intelligence (AI) and machine learning (ML) applications demand high-bandwidth memory without excessive power consumption, accelerating HMC adoption. The growing demand for big data, real-time analytics, and supercomputing is increasing the need for power-efficient memory to support continuous processing.

.webp)

The increasing requirement for high-bandwidth memory in supercomputing is driving the United States hybrid memory cube market demand. For example, in February 2025, Lawrence Livermore National Laboratory (LLNL) in California introduced El Capitan, the world's fastest supercomputer, with a $600 million investment. Operational since November 2024 and unveiled on January 9, 2025, it delivers 1,742 exaflops on the High-Performance Linpack benchmark, peaking at 2,746 exaflops. Designed for classified tasks, it supports US nuclear stockpile safety, material discovery, high-density physics, and nuclear data analysis. Supercomputers require high-speed, energy-efficient memory solutions for applications like scientific simulations, AI, and climate modeling. Hybrid Memory Cube technology enhances data transfer rates and processing efficiency, making it ideal for high-performance computing workloads. The US government and research institutions are investing in advanced computing infrastructures for national security, healthcare, and aerospace. Cloud service providers deploy HMC-based supercomputers to support big data analytics, ML, and cybersecurity solutions. The demand for low-latency, high-speed memory in quantum computing and AI fuels market growth. Leading semiconductor companies in the US integrate hybrid memory cube into AI accelerators and high-performance processors.

Hybrid Memory Cube Market Trends:

High performance needs

The demand for high-bandwidth, energy-efficient, and scalable memory solutions is increasing across various industries. Growing requirements for faster data processing and efficient storage technologies are key drivers propelling the market growth. Hybrid memory cube offers lower energy consumption per bit compared to conventional DRAM-based systems, enhancing performance and efficiency. The growing adoption of big data applications in business analytics, scientific computing, financial transactions, and social networking is driving increased usage and integration across industries. The global big data software market reached USD 208.7 billion in 2024 and is expected to grow significantly. According to IMARC Group, the market is projected to reach USD 456.0 billion by 2033, with a CAGR of 8.13% from 2025 to 2033. Hybrid memory cube provides higher bandwidth, lower latency, and better power efficiency, making it ideal for high-speed computing applications. Industries such as finance, healthcare, and scientific research require real-time data processing and rapid analytics, accelerating hybrid memory cube adoption.

Growing adoption of cloud-based services

The rising demand for mobility and cloud services is driving the need for enhanced networking capabilities and performance. The expansion of telecommunication technologies and advancements in data transmission, processing, analysis, and retrieval are creating profitable growth opportunities. Leading market players are investing in research and development (R&D) efforts to develop advanced product variants. Additionally, companies are focusing on strategic partnerships, mergers, and acquisitions (M&A) to strengthen their market presence. These initiatives are expected to influence sales and overall profitability in the industry. Data-intensive industries including finance, healthcare, and e-commerce, rely on cloud-based AI, analytics, and machine learning solutions. Cloud data centers require scalable, high-performance memory to handle real-time analytics, virtualization, and big data applications. The demand for high-bandwidth memory in multi-cloud and hybrid cloud environments accelerates market expansion.

Advancements in 3D stacking technology

Technological advancements in 3D stacking technology are propelling the market growth by improving memory efficiency and performance. Hybrid memory cube uses Through-Silicon Via (TSV) interconnects to stack several layers of DRAM, providing increased bandwidth and lower latency. This design greatly enhances data transfer rates, which makes it suitable for AI, supercomputing, and high-performance computing applications. The increasing demand for low-power memory in data centers and AI accelerators drives hybrid memory cube adoption. 3D stacking technology enables miniaturized memory designs, easing form factor limitation in future computing devices. Semiconductor companies are investing in 3D-stacked architectures to enhance scalability, power efficiency, and thermal management. Hybrid memory cube's stacked memory structure facilitates quicker communication among processing units and memory controllers. Applications that need real-time analytics and AI-based workloads take advantage of hybrid memory cube's enhanced data rate and computational performance. With improving 3D stacking technology, hybrid memory cube becomes more affordable and prevalent in high-performance computing. High-bandwidth memory demand in GPUs, cloud infrastructure, and telecommunications is fueling market growth.

Hybrid Memory Cube Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hybrid memory cube market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use industry.

Analysis by Product:

- 2GB

- 4GB

- 8GB

The 2GB hybrid memory cube segment caters to low-power, high-speed computing applications where energy efficiency and cost-effectiveness are priorities. It is widely used in embedded systems, networking devices, and low-end GPUs requiring faster memory performance. Its compact size and lower power consumption make it suitable for edge computing and IoT devices. Enterprises deploying smart sensors, industrial automation, and AI-driven analytics use 2GB hybrid memory cube for optimized processing.

The 4GB hybrid memory cube segment balances performance and power efficiency, making it ideal for high-performance computing and AI workloads. It is widely adopted in data centers, cloud computing, and enterprise-level GPUs. Mid-range AI accelerators and gaming GPUs benefit from higher bandwidth and low-latency memory access. The increasing adoption of AI, deep learning, and 5G infrastructure drives demand for 4GB hybrid memory cube modules.

The 8GB hybrid memory cube segment is designed for high-end AI, high-performance computing applications and deep learning. It supports ultra-fast data processing for machine learning, scientific simulations, and defense computing. Advanced GPUs used in autonomous vehicles, cryptocurrency mining, and high-frequency trading require 8GB hybrid memory cube for seamless data flow. The rise of cloud-based AI platforms and HPC clusters further drives demand for 8GB hybrid memory cube solutions.

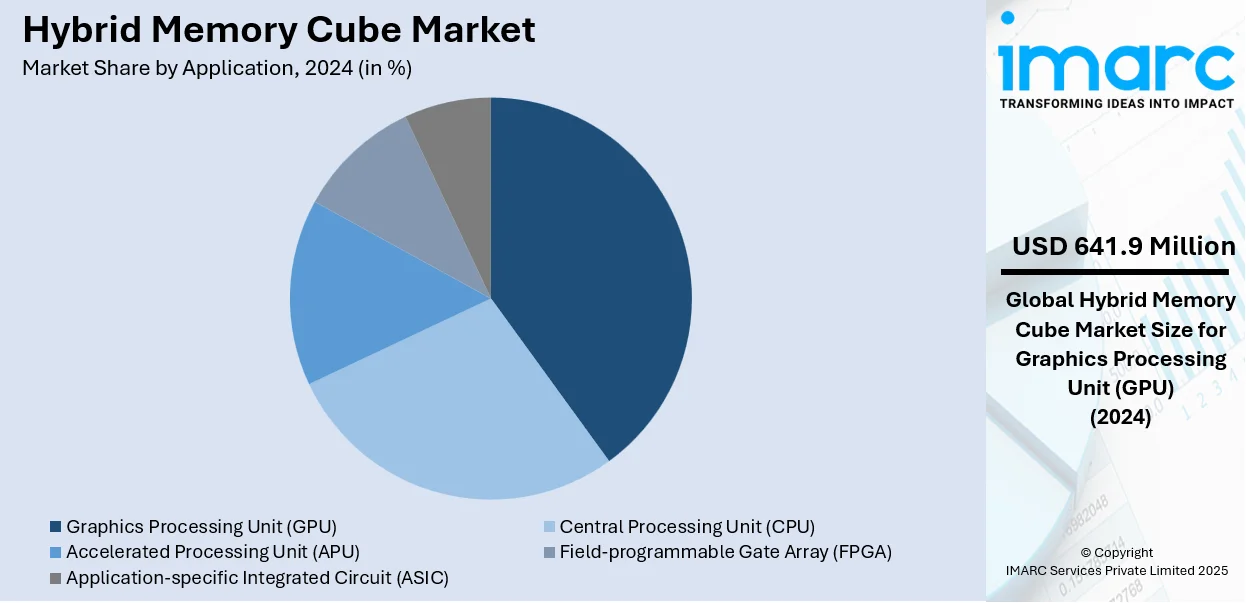

Analysis by Application:

- Graphics Processing Unit (GPU)

- Central Processing Unit (CPU)

- Accelerated Processing Unit (APU)

- Field-programmable Gate Array (FPGA)

- Application-specific Integrated Circuit (ASIC)

Graphics processing units leads the market with 32.7% of market share in 2024. They require high-bandwidth memory to handle complex computations, AI processing, and real-time graphics rendering. Hybrid memory cube technology provides considerably larger data transfer rates compared to conventional DRAM-based solutions. GPUs used in gaming, AI, and high-performance computing rely on low-latency, power-efficient memory architectures. The demand for deep learning and neural network training has increased the adoption of HMC in AI accelerators. High-resolution gaming, VR, and professional rendering applications require faster memory access and improved parallel processing capabilities. GPUs are essential in scientific computing, machine learning, and cryptocurrency mining, driving the need for high-speed memory solutions. Hybrid memory cube through-silicon via (TSV) architecture enhances memory bandwidth, optimizing GPU performance across multiple workloads. Leading GPU manufacturers integrate hybrid memory cube to overcome traditional memory bottlenecks and improve computational efficiency. Cloud service providers use GPUs with hybrid memory cube -based memory modules for data-intensive AI workloads.

Analysis by End Use Industry:

- Enterprise Storage

- Telecommunications and Networking

- Others

Enterprise storage solutions require high-speed, low-latency memory for data centers, cloud computing, and AI-driven analytics. Hybrid memory cube technology enhances data processing efficiency and power management, optimizing server performance. Large-scale enterprises use hybrid memory cube for high-performance storage architectures supporting big data, virtualization, and database management. The demand for faster access to cloud-based applications and real-time data processing drives hybrid memory cube adoption in enterprise storage. With AI-driven workloads increasing, enterprises integrate hybrid memory cube for accelerated computing and high-speed caching solutions.

The telecommunications sector relies on high-speed memory solutions for 5G infrastructure, edge computing, and real-time data transmission. Hybrid memory cube technology supports low-latency processing, enhancing network efficiency for cloud services, IoT, and mobile connectivity. High-speed routers, switches, and network processors benefit from hybrid memory cube’s higher bandwidth and faster data transfer rates. The deployment of AI-driven network analytics, cybersecurity solutions, and smart city infrastructure catalyzes hybrid memory cube’s adoption. With 5G and edge networks expanding, telecom companies use hybrid memory cube to support faster data flow and efficient processing.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.7%. The presence of leading GPU manufacturers, AI firms, and cloud service providers drives hybrid memory cube adoption. The region has high demand for high-performance memory in AI, deep learning, and data center applications. Government investments in defense and aerospace computing systems accelerate the need for high-speed memory solutions. Silicon Valley hosts semiconductor giants and AI startups, fostering hybrid memory cube research and technological advancements. Cloud service providers in North America deploy Hybrid memory cube -enabled AI accelerators and high-performance GPUs in data centers. The region leads in autonomous vehicle development, requiring low-latency memory for real-time processing and AI inference. Growing investments in high-performance computing and quantum computing further strengthens market growth. North America’s defense sector utilizes hybrid memory cube-based memory for advanced radar, avionics, and battlefield analytics. The expansion of smart cities, IoT, and 5G infrastructure drives demand for high-speed memory solutions.

Key Regional Takeaways:

United States Hybrid Memory Cube Market Analysis

The United States hold 87.50% of the market share in North America. The US market is expanding due to rising demand for HPC, AI, and data center infrastructure. AI-driven applications require high-bandwidth, low-latency memory, accelerating hybrid memory cube adoption across multiple industries. According to IMARC Group, the US AI market, valued at USD 31,807.6 million in 2023, is projected to reach USD 97,084.2 million by 2032, growing at a 12.8% CAGR, further increasing demand for advanced memory solutions. Hyperscale data centers operated in the region rely on high-performance memory architectures, amplifying HMC deployment. The expansion of 5G networks and edge computing requires low-power, high-speed memory solutions for real-time data processing. Gaming, VR, and autonomous vehicles drive further demand for efficient memory technologies. The CHIPS Act of US supports semiconductor manufacturing and innovation, strengthening domestic memory production. Growing IoT adoption and energy-efficient computing initiatives are also increasing hybrid memory cube integration. These factors collectively position hybrid memory cube as a key solution for next-generation computing applications.

Asia Pacific Hybrid Memory Cube Market Analysis

The Asia-Pacific market is expanding due to advancements in AI, IoT, and HPC applications. Countries like Japan, China, and South Korea are heavily investing in semiconductor innovation, accelerating hybrid memory cube adoption. Leading memory manufacturers are propelling regional market growth. Expanding 5G infrastructure and increasing smartphone penetration drives demand for high-performance memory. According to GSMA, China has over 700 million 5G connections, representing 41% of all mobile connections, while South Korea has 31.3 million 5G connections, covering 48% of its mobile network. Government-backed semiconductor initiatives in China and India further support hybrid memory cube adoption. The rise of autonomous vehicles and smart city projects increases demand for power-efficient memory solutions. Additionally, AI-driven cloud computing expansion and the fast-growing gaming industry in Japan and South Korea strengthen regional hybrid memory cube market growth.

Europe Hybrid Memory Cube Market Analysis

The European market is expanding due to the region’s strong focus on AI, HPC, and IoT advancements. The automotive sector’s investment in autonomous driving technologies is driving demand for high-performance memory solutions. Increasing data center investments enhance processing speed and energy efficiency, catalyzing hybrid memory cube adoption across cloud infrastructure. Semiconductor research and development (R&D) initiatives, supported by European Union policies, promote local chip manufacturing, strengthening the regional market growth. The rise of Industry 4.0 and smart factory automation in Germany, France, and the UK accelerates demand for high-speed memory architectures. Reports indicate that in 2021, 29% of EU enterprises deployed IoT devices for security applications, highlighting growing reliance on advanced computing solutions. The European Space Agency’s focus on satellite and space exploration technologies further necessitates efficient memory solutions. Expanding edge computing, smart city initiatives, and 5G rollouts support hybrid memory cube market growth. Additionally, strict EU energy efficiency regulations encourage power-efficient memory adoption, ensuring hybrid memory cube integration in next-generation computing.

Latin America Hybrid Memory Cube Market Analysis

The Latin American market is expanding due to digital transformation, cloud adoption, and AI-driven applications. Increasing data center investments in Brazil and Mexico are driving demand for high-performance memory solutions. Reports indicate that Latin America is among the fastest-growing mobile markets, with mobile internet users projected to rise from 326 million in 2018 to 422 million by 2025, creating opportunities for hybrid memory cube adoption. The deployment of 5G networks and edge computing is further catalyzing demand for efficient memory architectures. AI-driven fintech and e-commerce applications are accelerating hybrid memory cube integration in cloud-based computing. Additionally, the automotive sector’s shift toward advanced driver-assistance systems (ADAS) is increasing the need for high-speed memory solutions across the region.

Middle East and Africa Hybrid Memory Cube Market Analysis

The Middle East and Africa market is expanding due to smart city initiatives, AI adoption, and data center investments. Cloud computing services in the UAE and Saudi Arabia are driving demand for high-speed memory solutions. Reports indicate that Saudi Arabia leads the region in 5G adoption, with over 11.2 million subscriptions by the end of 2022, accounting for more than a quarter of the total mobile sector, driving demand for advanced computing solutions. Increasing AI-driven analytics adoption in finance and healthcare is accelerating hybrid memory cube integration. Additionally, growing semiconductor research and expanding 5G infrastructure support high-performance memory market growth across the region.

Competitive Landscape:

Leaders are targeting high-bandwidth, low-power memory solutions for AI, data center, and high-performance computing applications. Companies are investing in research and development (R&D) to improve through-silicon via (TSV) technology and 3D stacking methods. For example, Micron Technology Inc. created several HBM generations in April 2024, boosting bandwidth and efficiency with through-silicon vias (TSVs) and stacked DRAM design. The firm has also pushed the development of hybrid memory cube technology, which combines logic and memory in a single package to drive performance and power efficiency. Moreover, strategic alliances with cloud providers and semiconductor manufacturers speed hybrid memory cube adoption within enterprise and cloud infrastructure. Large players are adding manufacturing capacity to address increasing demand for high-speed, low-latency memory products. They are emphasizing power efficiency and cost optimization to render hybrid memory cube feasible for mainstream computer markets. Leaders in the industry work together with automotive, aerospace, and defense industries to facilitate next-generation computer architecture. Main actors promote standardization to achieve compatibility and interoperability across various computing platforms.

The report provides a comprehensive analysis of the competitive landscape in the hybrid memory cube market with detailed profiles of all major companies, including:

- Achronix Semiconductor Corporation

- Arira Design Inc.

- Arm Limited

- Fujitsu Limited

- Intel Corporation

- International Business Machines Corporation

- Micron Technology Inc.

- NVIDIA Corporation

- Open-Silicon Inc. (SiFive Inc.)

- Samsung Electronics Co. Ltd.

- Semtech Corporation

- Xilinx Inc

Latest News and Developments:

- April 2024: Samsung introduced the industry’s first LPDDR5X DRAM chip, optimized for AI applications, delivering enhanced performance and efficiency. This advanced memory solution meets the growing demands of AI processing, reinforcing Samsung’s commitment to innovation. The launch underscores its focus on advancing memory technologies for next-generation computing and high-performance applications.

- September 2023: Winbond Electronics unveiled CUBE, an ultra-bandwidth memory solution optimized for hybrid edge/cloud AI applications. Designed for 2.5D/3D integration, CUBE enhances chip-on-wafer (CoW), wafer-on-wafer (WoW), and Si-interposer architectures. Supporting 256Mb to 8Gb per die, it enables 3D stacking for increased bandwidth and lower power consumption.

Hybrid Memory Cube Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | 2GB, 4GB, 8GB |

| Applications Covered | Graphics Processing Unit (GPU), Central Processing Unit (CPU), Accelerated Processing Unit (APU), Field-programmable Gate Array (FPGA), Application-specific Integrated Circuit (ASIC) |

| End Use Industries Covered | Enterprise Storage, Telecommunications and Networking, Others |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Achronix Semiconductor Corporation, Arira Design Inc., Arm Limited, Fujitsu Limited, Intel Corporation, International Business Machines Corporation, Micron Technology Inc., NVIDIA Corporation, Open-Silicon Inc. (SiFive Inc.), Samsung Electronics Co. Ltd., Semtech Corporation and Xilinx Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, hybrid memory cube market outlook, and dynamics of the market from 2019-2033.

- The hybrid memory cube market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hybrid memory cube industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hybrid memory cube market was valued at USD 1,963.0 Million in 2024.

The hybrid memory cube market is projected to exhibit a CAGR of 21.86% during 2025-2033, reaching a value of USD 11,629.8 Million by 2033.

The hybrid memory cube market growth is driven by rising demand for high-performance computing (HPC), AI, and big data applications. Energy-efficient memory solutions are essential for data centers, cloud computing, and AI accelerators. Advancements in 3D stacking technology and through-silicon vias (TSVs) improve bandwidth and processing efficiency. Growing 5G networks, edge computing, and autonomous vehicles require low-latency, high-speed memory. Increasing IoT adoption and Industry 4.0 applications further increases hybrid memory cube integration.

North America currently dominates the hybrid memory cube market, accounting for a share of 36.7% in 2024. The presence of leading technology firms drives memory innovation. Expanding hyperscale cloud infrastructure from AWS, Microsoft Azure, and Google Cloud accelerates hybrid memory cube adoption. Government support through the CHIPS Act enhances domestic semiconductor manufacturing. Increasing 5G deployment, edge computing, and AI-driven analytics further strengthens market growth in the region.

Some of the major players in the hybrid memory cube market include Achronix Semiconductor Corporation, Arira Design Inc., Arm Limited, Fujitsu Limited, Intel Corporation, International Business Machines Corporation, Micron Technology Inc., NVIDIA Corporation, Open-Silicon Inc. (SiFive Inc.), Samsung Electronics Co. Ltd., Semtech Corporation and Xilinx Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)