Hybrid Fabrics Market Size, Share, Trends and Forecast by Fiber Type, Form, End Use Industry, and Region, 2025-2033

Hybrid Fabrics Market Size and Share:

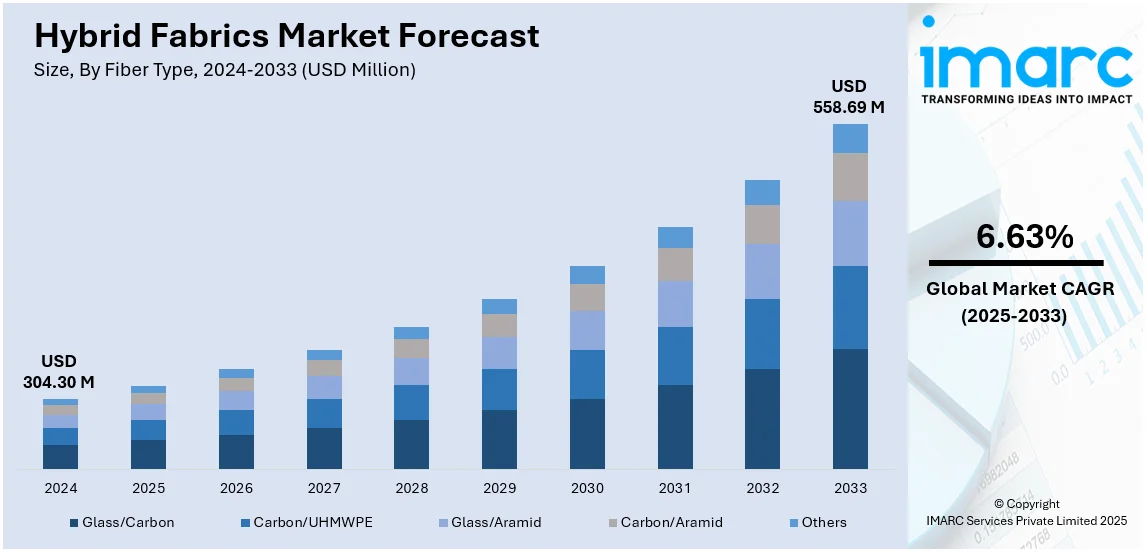

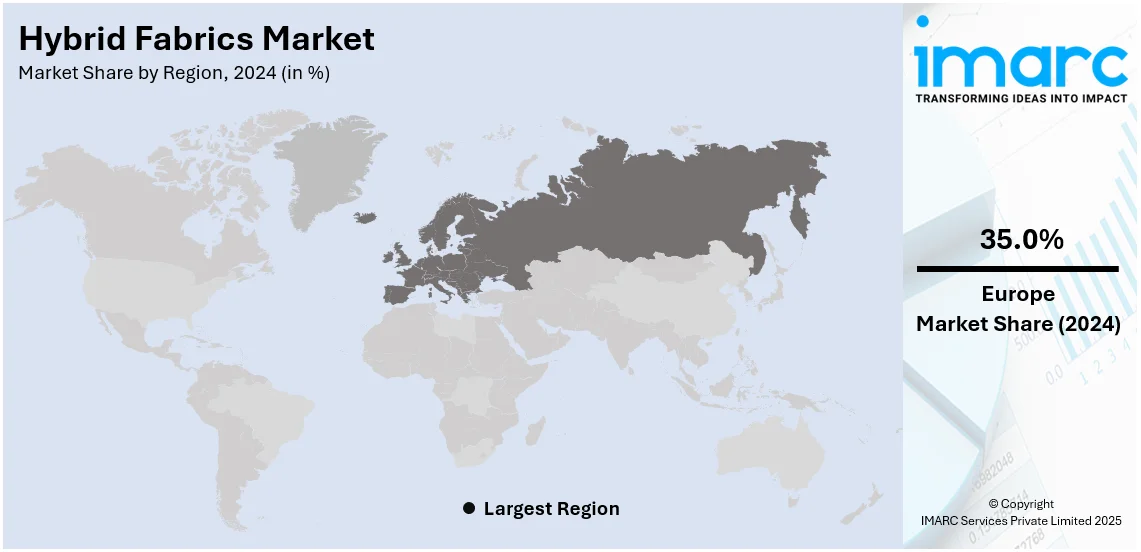

The global hybrid fabrics market size was valued at USD 304.30 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 558.69 Million by 2033, exhibiting a CAGR of 6.63% from 2025-2033. Europe currently dominates the market, holding a reusable packaging market share of over 35.0% in 2024. Innovations in material technology, increased demand for performance fabrics, growth in automotive industry, and rising outdoor sports activities are primarily driving the market's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 304.30 Million |

|

Market Forecast in 2033

|

USD 558.69 Million |

| Market Growth Rate (2025-2033) | 6.63% |

A key driver of the hybrid fabrics market is the growing demand from the aerospace and automotive sectors for lightweight, high-performance materials. Hybrid textiles, which are made from a mix of diverse fiber content such as carbon, glass, and aramid, offer improved strength-to-weight ratios, impact resistance, and endurance. In aerospace applications, the textiles offer fuel efficiency and resistance to structural damage, while in automotive applications, they enhance vehicle performance and reduce emissions. The need for sustainable mobility and aggressive regulation standards on fuel efficiency are also fuelling adoption. Ongoing improvement in fabric making and processing technologies are also broadening the applications of hybrid fabrics in these sectors.

The U.S. hybrid fabrics market is dominated by high demand from aerospace, automotive, and defense industries with 80.80% market share. The nation's established aerospace industry depends on hybrid fabrics for light, high-strength parts that enhance fuel efficiency and structural strength. In the automotive industry, increasing use of electric vehicles (EVs) is driving demand for high-performance materials that increase performance while minimizing weight. Besides, defense uses advantage from the endurance and shock resistance of hybrid materials. Advances in technology, government policies favoring eco-friendly material use, and research and development (R&D) investments also stimulate the market growth. The availability of major producers and innovation centers stabilizes the nation's market presence.

Hybrid Fabrics Market Trends:

Growing Automotive Industry

The expansion of the automotive motors industry, especially with the rise of electric vehicles (EVs) and advanced motor technologies, is significantly driving the hybrid fabrics market. According to IMARC, the global automotive motors market reached $39.8 billion in 2023 and is projected to grow to $59.7 billion by 2032, at a CAGR of 4.5% from 2024 to 2032. This growth fuels the demand for high-performance materials capable of meeting the evolving requirements of modern vehicles. Hybrid fabrics play a crucial role in EV battery packs, interior insulation, and heat shields, offering durability, lightweight properties, and thermal resistance. As the automotive sector prioritizes energy efficiency and safety, the integration of hybrid fabrics continues to expand, supporting the reusable packaging market growth.

Surging Participation in Sports Activities

The growing participation in sports and fitness activities is driving demand for high-performance sportswear, boosting the hybrid fabrics market. According to the Bureau of Labor Statistics, 19.3% of the U.S. population engaged in daily sports and exercise in 2019, while in Wales, around 32% participated in sports at least three times per week. This rising engagement fuels the need for specialized apparel that offers durability, flexibility, moisture management, and breathability. Hybrid fabrics, combining materials like polyester, spandex, and natural fibers, provide these essential properties, making them ideal for athletic wear. As both professional athletes and fitness enthusiasts seek advanced, comfortable, and sustainable sportswear, the increasing adoption of hybrid fabrics further strengthens the reusable packaging market demand.

Rising Carbon Emissions from the Construction Sector

The construction sector is a significant source of carbon emissions, driving a strong shift toward sustainable building practices. Based on the UN Environment Programme, the sector accounts for 37% of global greenhouse gas (GHG) emissions, making it a key focus for environmental reforms. In response, hybrid fabrics are gaining traction as eco-friendly alternatives, as they can be produced from recycled materials and contribute to more efficient construction processes. Their lightweight, durable, and high-performance properties support energy-efficient infrastructure while reducing material waste. With increasing regulatory pressure and industry-wide sustainability initiatives, the adoption of hybrid fabrics in construction is expanding, enhancing their market growth and reinforcing their role in reducing the sector’s environmental footprint.

Hybrid Fabrics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hybrid fabrics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fiber type, form, and end use industry.

Analysis by Fiber Type:

- Glass/Carbon

- Carbon/UHMWPE

- Glass/Aramid

- Carbon/Aramid

- Others

Glass/carbon hybrid fabrics account for the majority of the reusable packaging market share of 35.8% due to their balanced combination of strength, flexibility, and cost-effectiveness. Carbon fibers provide exceptional tensile strength, stiffness, and lightweight properties, making them ideal for aerospace and high-performance automotive applications. Glass fibers, on the other hand, offer good impact resistance, affordability, and durability. When combined, these fibers create hybrid fabrics that enhance structural integrity while maintaining cost efficiency. The increasing use of lightweight materials in electric vehicles (EVs), aircraft, and defense applications further boosts demand. Additionally, advancements in fiber processing and resin compatibility improve performance, expanding their adoption in industries requiring high mechanical properties, thermal stability, and long-term durability at a competitive cost.

Analysis by Form:

- Composite

- Non-composite

According to the reusable packaging market forecast, the composite form of hybrid fabrics holds a 65.7% market share due to its superior mechanical properties, lightweight nature, and high durability. Industries such as aerospace, automotive, and defense increasingly adopt composite hybrid fabrics to enhance structural strength while reducing weight, leading to improved fuel efficiency and performance. The growing demand for electric vehicles (EVs) and energy-efficient aircraft further drives the use of composites in critical components. Additionally, advancements in fiber blending techniques and resin matrix development enhance the versatility and application range of composite hybrid fabrics. Strict environmental regulations promoting sustainable and recyclable materials also contribute to their widespread adoption, making composites the preferred choice for high-performance applications across various industries.

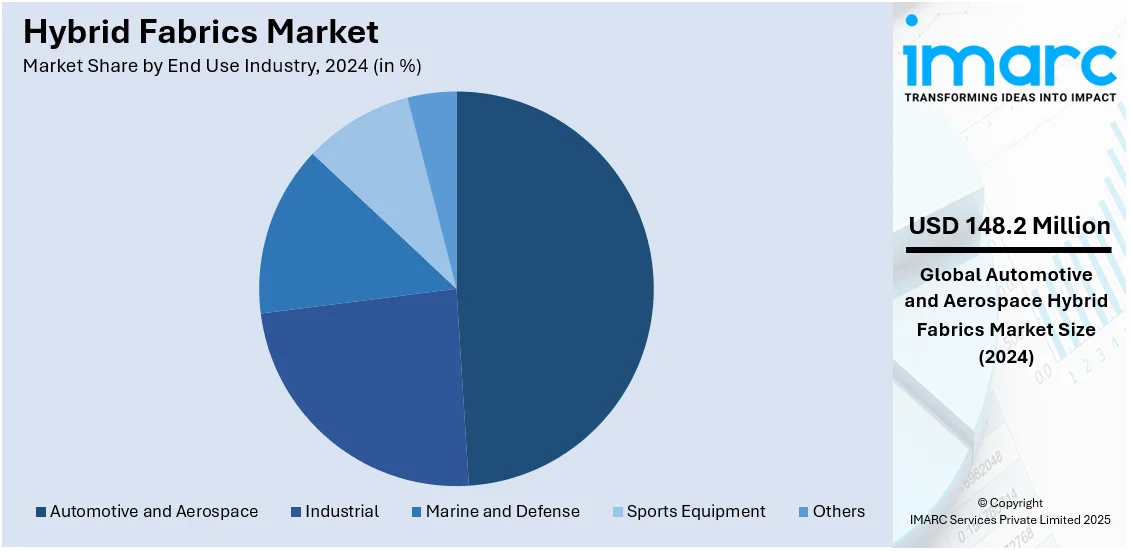

Analysis by End Use Industry:

- Automotive and Aerospace

- Industrial

- Marine and Defense

- Sports Equipment

- Others

The automotive and aerospace sectors dominate the hybrid fabrics market with a 48.7% share, driven by the need for lightweight, high-performance materials. In aerospace, hybrid fabrics enhance fuel efficiency, structural strength, and impact resistance, aligning with the industry's push for more efficient and durable aircraft. The automotive sector, particularly the rise of electric vehicles (EVs), fuels demand for lightweight materials to improve energy efficiency and range. Stringent emission regulations and sustainability goals further accelerate the adoption of hybrid fabrics in both industries. Advancements in fiber blending technologies and automated manufacturing processes contribute to improved performance and cost efficiency, solidifying the dominance of these sectors in driving market growth and innovation.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe holds a significant position in the hybrid fabrics market, accounting for approximately 35.0% of the market share due to its strong industrial base and technological advancements. The region's well-established aerospace and automotive industries are key drivers, with leading manufacturers increasingly adopting lightweight, high-performance materials to enhance fuel efficiency and sustainability. Stricter environmental regulations and emission reduction targets further accelerate demand for hybrid fabrics in electric vehicles (EVs) and energy-efficient aircraft. Additionally, Europe’s focus on research and development, along with government incentives promoting sustainable materials, fosters innovation in hybrid fabric production. The presence of major industry players, collaborations with research institutions, and advancements in fiber blending technologies strengthen the region’s dominance in the reusable packaging market outlook.

Key Regional Takeaways:

North America Hybrid Fabrics Market Analysis

The North America hybrid fabrics market is expanding due to strong demand from aerospace, automotive, and defense industries. The region's well-established aerospace sector, particularly in the United States, relies on hybrid fabrics for lightweight, high-strength components that improve fuel efficiency and structural durability. In the automotive industry, the rising adoption of electric vehicles (EVs) is accelerating the use of hybrid fabrics for lightweight construction and enhanced energy efficiency. Additionally, defense applications benefit from hybrid fabrics’ impact resistance and durability, supporting advancements in protective gear and high-performance equipment. Stringent environmental regulations promoting sustainable materials and fuel efficiency further drive market growth. Technological advancements in fiber processing and composite materials enhance the performance and versatility of hybrid fabrics, increasing their adoption across multiple industries. Moreover, significant research and development investments and the presence of key manufacturers in the region strengthen North America’s market position. These factors collectively contribute to the continuous expansion of the hybrid fabrics market in the region.

United States Hybrid Fabrics Market Analysis

The hybrid fabrics market in the United States is expanding as demand grows in aerospace, automotive, sports, and defense sectors. The 2024 edition of "Facts & Figures", released by the Aerospace Industries Association (AIA), highlights the U.S. aerospace and defense (A&D) industry’s significant economic impact in 2023, generating USD 955 Billion in sales, contributing USD 425 Billion to GDP. The A&D workforce grew by 4.8%, surpassing the national average, reflecting increasing demand for high-performance materials like hybrid fabrics. These fabrics, made from carbon, aramid, and glass fibers, offer superior durability and strength while reducing weight, making them vital for aerospace and electric vehicle (EV) applications. The automotive industry is a key consumer, integrating hybrid fabrics into lightweight panels and interiors to enhance fuel efficiency. The aerospace sector also increasingly adopts hybrid materials for structural components to improve performance and reduce emissions. Government policies favoring sustainability and fuel efficiency further encourage market adoption. However, high production costs and complex manufacturing processes may hinder growth. Advances in recycling technology and fabric weaving techniques are enhancing the cost efficiency, supporting long-term expansion.

Europe Hybrid Fabrics Market Analysis

The market in Europe is growing rapidly, driven by strict environmental regulations and demand from automotive, aerospace, and renewable energy sectors. Countries such as Germany, France, and the UK lead the market with technological advancements in composite materials and a focus on sustainable manufacturing. For example, on January 7, 2025, Siemens partnered with Spinnova to scale sustainable fiber production using Siemens Xcelerator at the Woodspin factory in Finland. SPINNOVA fiber emits 74% less CO₂, uses 98% less water than conventional cotton, and requires zero harmful chemicals. Siemens' digital twin, automation, and cybersecurity technologies accelerated production, improving efficiency and sustainability, supporting eco-friendly textile manufacturing at an industrial scale. The European Union’s strict emission regulations are encouraging automakers to use lightweight hybrid fabrics to enhance fuel efficiency and reduce emissions. The renewable energy sector, particularly wind turbine manufacturing, is also increasing its use of hybrid fabrics for turbine blades, benefiting from their high strength-to-weight ratio. Additionally, the sports and leisure industry are incorporating hybrid fabrics into high-performance cycling and athletic gear. Despite high production costs, ongoing research into bio-based hybrid fabrics and circular economy initiatives is stimulating sustainability and cost efficiency, fostering long-term market growth across Europe.

Asia Pacific Hybrid Fabrics Market Analysis

The Asia Pacific hybrid fabrics market is bolstering, propelled by industrialization, infrastructure expansion, and rising consumer demand in automotive, aerospace, and sports sectors. China, Japan, South Korea, and India lead in production and innovation, with China emerging as a major manufacturing hub. As per industry reports, China has planned 4 Trillion Yuan (USD 551 Billion) in investment over five years in urban infrastructure, along with 6 trillion yuan in 2024 government investments, supports this growth. Infrastructure investment grew 4.3%, while manufacturing investment rose 9.3% in the first 10 months of 2024. The automotive sector, especially EVs, is a key consumer, using hybrid fabrics in lightweight structural components. The wind energy sector is also increasing demand, utilizing hybrid fabrics in durable turbine blades. Despite challenges like high raw material costs and complex manufacturing, government incentives for renewable energy and advanced materials research are improving production efficiency, driving long-term market expansion in Asia Pacific.

Latin America Hybrid Fabrics Market Analysis

The market in Latin America is expanding, driven by automotive, aerospace, and renewable energy sectors. Brazil and Mexico lead the market due to their growing automotive industry and government policies on fuel efficiency. According to Mexican Automotive Industry Association (AMIA), Mexico's automotive sector contributed 4.7% of the national GDP and 21.7% of the manufacturing GDP, generating one million jobs. Mexico ranked seventh in global vehicle production with 3.8 million units, exporting 3.3 million, and was the 12th largest light vehicle seller. Hybrid fabrics are increasingly used in automotive interiors, lightweight panels, and wind energy. The aerospace industry in Mexico is integrating hybrid fabrics into aircraft components. While high production costs and dependence on imports present challenges, foreign investments and technological advancements in material science are propelling market growth.

Middle East and Africa Hybrid Fabrics Market Analysis

The hybrid fabrics market in the Middle East and Africa (MEA) is witnessing growth, attributed to aerospace, defense, and renewable energy sectors. The UAE and Saudi Arabia are leading with investments in advanced materials. On December 9, 2024, Graphene Innovations Manchester (GIM) announced a graphene-enriched carbon fiber factory in Saudi Arabia, backed by the UK Prime Minister, with a EUR 250 Million investment and 1,000+ jobs. South Africa’s wind energy sector is creating demand for lightweight turbine blades, while MEA’s defense industry integrates hybrid fabrics into protective gear and armor. Challenges include limited local manufacturing and high import reliance, but government investments in industrialization and sustainability are expected to drive local hybrid fabric production and improve cost-effectiveness.

Competitive Landscape:

The hybrid fabrics market is characterized by intense competition, driven by technological advancements and increasing demand across aerospace, automotive, defense, and sports industries. Market participants focus on innovation, developing high-performance fabrics with superior strength, lightweight properties, and enhanced durability. Research and development efforts are key to improving product efficiency and expanding applications. Companies compete on product differentiation, cost-effectiveness, and sustainability, with a growing emphasis on eco-friendly production processes. Strategic collaborations, mergers, and acquisitions are common to strengthen market presence and expand geographic reach. Additionally, advancements in fiber blending techniques and automated manufacturing processes are enhancing production efficiency, allowing firms to cater to evolving consumer and industry demands while maintaining a competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the hybrid fabrics market with detailed profiles of all major companies, including:

- BGF Industries Inc.

- FTS S.p.A.

- HALARIT Composites GmbH

- Haufler Composites GmbH and Co. KG

- Isomatex SA

- Koninklijke DSM N.V.

- Kordcarbon a.s.

- Kordsa Teknik Tekstil A.S.

- Porcher Industries SA

- SGL Carbon SE

Latest News and Developments:

- February 2025: Owens Corning agreed to sell its glass fiber reinforcements business to India’s Praana Group for USD 755 Million. The business, generating USD 1.1 Billion in 2024 revenue, manufactures glass fiber reinforcements for wind energy, infrastructure, and transportation. It employs 4,000 people across 12 countries, strengthening Praana’s composites sector.

- October 2024: Envalior launched new Tepex® high-performance composites with polyetherimide, PPS, PA4.6, PA4.10, and TPC-E matrices. These high-temperature, wear-resistant materials support aircraft, automotive, and sports applications. Sustainable PA4.10 composites, derived 70% from castor oil, reduce carbon footprint by 50%. Carbon-fiber-reinforced variants offer superior tensile strength and flexural properties.

- August 2024: Carnegie, a supplier of sustainable textiles and acoustic control solutions for the commercial industry, launched Embellish Print and Botanic Print to their silicone hybrid coated upholstery line.

- July 2024: Corsair introduced their MM500 v2 gaming mouse pad. The MM500 v2 is constructed of high-density hybrid fabric and comes in two sizes: large and extra-large.

- November 2023: Manjushree Spntek introduced Hightex Hybrid Spunmelt non-woven fabrics. These multi-layer composite nonwovens, created using Reifenhäuser Reicofil's world-first Reicofil smart composite line and A.Celli's superior resin-treatment technology (SFT), provide surgeons and nurses with the protection and utmost comfort they require.

Hybrid Fabrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Fiber Types Covered | Glass/Carbon, Carbon/UHMWPE, Glass/Aramid, Carbon/Aramid, Others |

| Forms Covered | Composite, Non-composite |

| End Use Industries Covered | Automotive and Aerospace, Industrial, Marine and Defense, Sports Equipment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BGF Industries Inc., FTS S.p.A., HALARIT Composites GmbH, Haufler Composites GmbH and Co. KG, Isomatex SA, Koninklijke DSM N.V., Kordcarbon a.s., Kordsa Teknik Tekstil A.S., Porcher Industries SA, SGL Carbon SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Hybrid Fabrics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global Hybrid Fabrics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Hybrid Fabrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hybrid fabrics market was valued at USD 304.30 Million in 2024.

The Hybrid Fabrics market was valued at USD 558.69 Million in 2033 exhibiting a CAGR of 6.63% during 2025-2033.

The hybrid fabrics market is driven by rising demand from aerospace and automotive industries for lightweight, high-performance materials, increasing adoption in sportswear and protective gear, advancements in fabric manufacturing, and growing sustainability initiatives. Additionally, expanding applications in construction and defense further boost market growth, enhancing durability, efficiency, and environmental benefits.

Europe leads the hybrid fabrics market with a 35.0% share due to strong demand from the aerospace, automotive, and defense sectors. Stringent environmental regulations, advanced manufacturing capabilities, and increasing adoption of lightweight, high-performance materials drive growth. Additionally, government support for sustainability and innovation further strengthens the region’s market position.

Some of the major players in the Hybrid Fabrics market include BGF Industries Inc., FTS S.p.A., HALARIT Composites GmbH, Haufler Composites GmbH and Co. KG, Isomatex SA, Koninklijke DSM N.V., Kordcarbon a.s., Kordsa Teknik Tekstil A.S., Porcher Industries SA, SGL Carbon SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)