Hybrid Electric Vehicle Market Size, Share, Trends and Forecast by Propulsion Type, Configuration Type, Vehicle Type, Power Source, and Region, 2025-2033

Hybrid Electric Vehicle Market Size and Share:

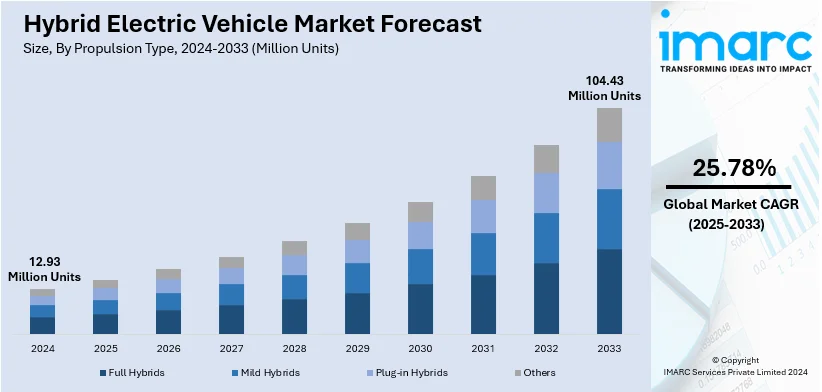

The global hybrid electric vehicle market size was valued at 12.93 Million Units in 2024. Looking forward, IMARC Group estimates the market to reach 104.43 Million Units by 2033, exhibiting a CAGR of 25.78% from 2025-2033. North America currently dominates the market, holding a market share of over 40.9% in 2024. The growing consumer consciousness regarding the environmental advantages of hybrid electric vehicles (HEVs), a growing social responsibility urging consumers to make greener choices, and the emergence of cutting-edge technologies are some of the major drivers consolidating the growth of hybrid electric vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

12.93 Million Units |

|

Market Forecast in 2033

|

104.43 Million Units |

| Market Growth Rate (2025-2033) | 25.78% |

One of the key drivers in the HEV market is the growing demand for fuel efficiency and environmental sustainability. As fuel prices continue to increase and anxieties about climate change grow consumers and governments alike are increasingly seeking vehicles that lower emissions and offer better fuel economy. HEVs, which combine a traditional internal combustion engine with an electric motor, offer a solution by reducing fuel consumption and lowering carbon dioxide (CO2) emissions. Additionally, governments worldwide are implementing stricter emission regulations and offering incentives for eco-friendly vehicles, further boosting the demand for HEVs as a sustainable transportation alternative.

The United States is emerging as a major disruptor, holding 77.80% of the total market share. The market is driven by both environmental goals and government incentives. The U.S. Department of Energy's initiatives, such as tax credits for electric vehicle and funding for charging infrastructure, have encouraged adoption. These vehicles are becoming increasingly popular due to their lower emissions and fuel efficiency compared to traditional vehicles. However, in 3Q24, the share of electric and hybrid vehicle sales in the U.S. reached a record 21.2%, up from 19.1% in 2Q24. Additionally, U.S. regulations pushing for reduced greenhouse gas (GHG) emissions from transportation contribute to the growing demand for HEVs. The presence of incentives like rebates and federal tax credits further supports the market's expansion.

Hybrid Electric Vehicle Market Trends:

Increasing environmental concerns

One of the primary market drivers for the HEV industry is the growing concern over environmental degradation, specifically climate change and air pollution. Global garbage is predicted to reach 3.4 billion tonnes by 2050, according to World Bank figures. The leading environmental cause of illness and early mortality is pollution. Over 9 million premature deaths are caused by pollution, with air pollution accounting for the majority of these deaths. Traditional internal combustion engine vehicles are significant contributors to GHG emissions and air pollutants, including carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter. As a result, governments and organizations worldwide are pushing for cleaner, more sustainable modes of transport. HEVs, which combine internal combustion engines with electric propulsion systems, offer a viable solution. They produce fewer emissions and are more fuel-efficient compared to their gasoline-only counterparts. Some models even meet the stringent emission standards set by regulatory bodies. As public awareness around environmental sustainability grows, consumers are increasingly leaning towards eco-friendly choices, providing a robust market for HEVs.

Government incentives and policies

Another major driver in the HEV market is the range of government incentives and policies aimed at encouraging cleaner transportation options. Various countries offer tax incentives, grants, and subsidies for purchasing HEVs, making them more financially appealing to consumers. For instance, the Netherlands is a pioneer in e-mobility promotion owing to its generous EV subsidies. The Dutch government offers grants of up to Euro 2,000 (USD 2116.66) for used EVs and Euro 2,950 (USD 3122.07) for new EV purchases. Road tax exemptions and lower company car tax rates are further advantages for EV owners. Several countries have set ambitious targets for reducing emissions from the transportation sector and are actively promoting the use of HEVs through financial and non-financial incentives. Thus, this is significantly supporting the market. These policy measures make hybrid electric vehicles more accessible to the average consumer and act as a catalyst for manufacturers to invest in HEV technologies, thereby driving market growth.

Advancements in battery technology

The past decade, which is a crucial driver for the hybrid electric vehicle industry. Along with this, advancements in lithium-ion batteries have led to higher energy density, quicker charging times, and longer lifespan, making them more suitable for automotive use. These technological leaps have enhanced the performance and reliability of hybrid electric vehicles, addressing some of the primary concerns potential buyers may have had earlier, such as range anxiety. According to IEA data, the battery demand for lithium stood at around 140 kt in the year 2023. As battery technology continues to improve, it is likely that HEVs will become even more efficient and cost-effective, further driving consumer adoption and market expansion.

Hybrid Electric Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hybrid electric vehicle market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on propulsion type, configuration type, vehicle type, and power source.

Analysis by Propulsion Type:

- Full Hybrids

- Mild Hybrids

- Plug-in Hybrids

- Others

Plug-in hybrids stand as the largest component in 2024, holding around 29.7% of the market. PHEVs combine an internal combustion engine with a larger battery that can be recharged via an outside source, providing more longer electric-only driving ranges compared to traditional HEVs. This extended range makes PHEVs more appealing to consumers seeking the flexibility of electric power for daily commutes and gasoline for longer trips. With growing environmental concerns and government incentives promoting low-emission vehicles, the market for PHEVs is expanding rapidly. Furthermore, advancements in battery technology and charging infrastructure are further driving their adoption, positioning PHEVs as a dominant choice for eco-conscious consumers.

Analysis by Configuration Type:

- Series HEV

- Parallel HEV

- Combination HEV

Parallel HEV led the market in 2024 due to its simple, efficient design. In parallel HEVs, it is the combination of the operation of the internal combustion engine and that of the electric motor that contributes to driving the vehicle. These configurations optimize fuel efficiency by allowing assistance from the electric motor mainly in city driving, where they make frequent stops and starts. Parallel systems also provide greater power output and a smoother driving experience compared to other HEV types. In addition, this configuration usually requires less complex infrastructure and has lower manufacturing costs, which makes it more attractive to consumers and car makers. Parallel HEVs are still the preferred choice in the global market with the increasing focus on reduction of emissions and improvement of fuel economy.

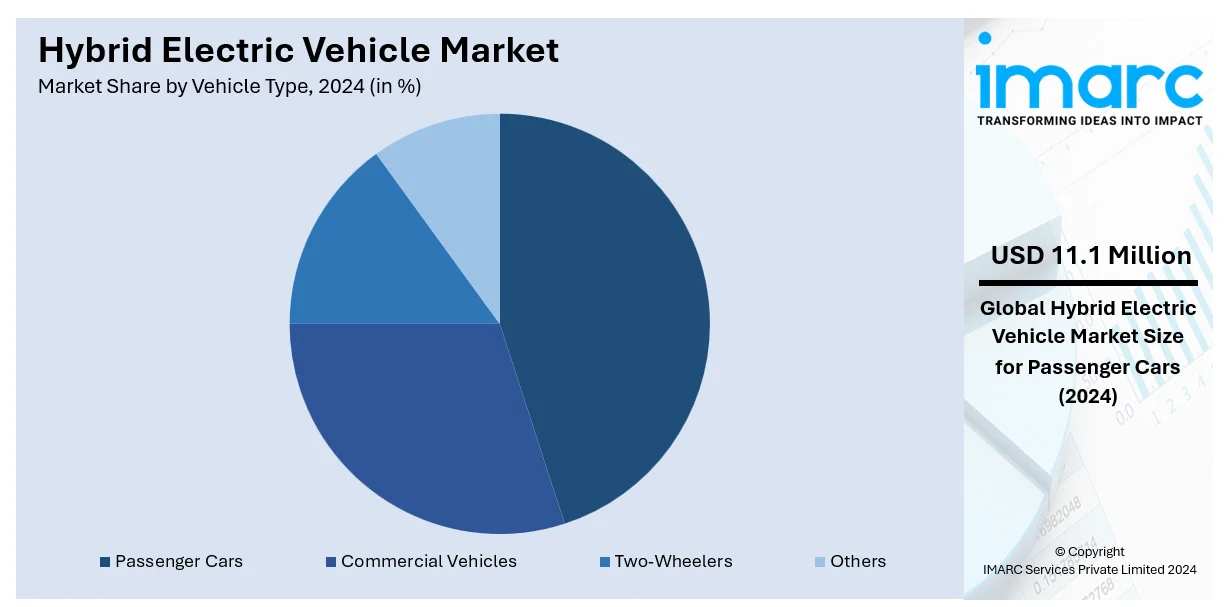

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

In 2024, passenger cars account for the majority of the market at around 85.7% due to their widespread use and increasing consumer demand for fuel-efficient, environmentally-friendly options. These vehicles are popular in urban and suburban settings where fuel efficiency is critical. The growing awareness of environmental issues, coupled with government incentives for clean energy vehicles, has driven the adoption of HEVs in the passenger car segment. Additionally, advancements in battery technology have improved driving range and performance, making HEVs more appealing. The U.S. Department of Energy and other governmental bodies report that passenger cars, including sedans and compact vehicles, represent the largest share of the HEV market.

Analysis by Power Source:

- Stored Electricity

- On Board Electric Generator

Stored electricity represented the leading market segment, holding 70.0% of the total share due to its essential role in improving fuel efficiency and reducing emissions. The electric motor in HEVs uses the stored energy from the battery, which is replenished through regenerative braking or the internal combustion engine. It is this ability to store and use electricity efficiently that enables HEVs to seamlessly switch between electric power and gasoline, optimizing fuel use. The advancements in battery technology have also improved storage capacity, thereby increasing the electric-only driving range and overall performance. As governments seek stricter controls over emissions and customers increasingly look toward eco-friendly vehicles, the demand for HEVs and efficient energy storage systems continues to rise.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest hybrid electric vehicle market share of over 40.9% driven by strong consumer demand, government incentives, and robust charging infrastructure. The U.S. is a leader, as there are federal tax credits and rebates on hybrid and electric vehicles that drive adoption. Further, automakers in North America have stepped up PHEV and HEV production in order to keep up with environmental standards that are rising. Regulation standards like the CAFE standard set in the United States nudge manufacturers toward producing fuel-efficient, low-emission automobiles. A shift among consumers towards more environmentally friendly modes of transport further supports the market.

Key Regional Takeaways:

United States Hybrid Electric Vehicle Market Analysis

Hybrid electric vehicles are so far quite popular in the U.S. market due to climbing prices of petrol, because of government incentives, and as well as due to pollution controls. Corporate Average Fuel economy regulations encourage hybridizing automobile manufacturers by an average fuel economy of 49 mpg by 2026. Federal tax incentives with up to USD 7,500 also promote the usage of hybrid and plug-in hybrid electric vehicles. Hybrid sales were 8.6% of light-duty sales in the first quarter of this year, while 9.6% were recorded in the second quarter, according to the US Energy Information Administration. In terms of vehicle sales of light-duty plug-in hybrids, there was a little uptick during this period, and it rose from 1.7% to 2.0% of the total light-duty sales.

The demand by consumers for fuel-efficient vehicles due to fluctuating petrol prices can be considered as one major influence. As of 2023, more than one million hybrid and electric vehicles were sold in the US. Hybrid sales rose 65%, according to Edmunds, which serves as a source of information for car shoppers, while EV sales leaped 46%. Improvements in battery efficiency and regenerative braking systems are enhancing vehicle performance and making HEVs more appealing. Cities like California have banned the sale of cars that are petrol-only from 2035. Corporate fleet changes to hybrids, and growing concern for carbon emissions are also generating market momentum.

Europe Hybrid Electric Vehicle Market Analysis

The HEV market is gaining momentum in Europe due to strong government support and tough rules on carbon emissions. Automakers are moving towards hybrid technology as a result of the European Union's "Fit for 55" project, which seeks to reduce GHG emissions by 55% by 2030. Tax incentives and subsidies have been provided by nations like as Germany, France, and the UK. In 2023, France was offering up to Euro 6,000 (USD 6,345) for hybrid purchases of the price below Euro 45,000 (USD 47,593)

International Energy Agency says that the data for 2023 shows that 25% of the new sales of automobiles in the region were electric cars. Therefore, this suggests that a majority of the customers preferred less harmful options. Giant automobile companies like Volvo and BMW have increased the production rate of hybrid cars to be able to take up this trend. Low-emission urban cities like London and Paris encourage more use of hybrids by charging higher tolls on conventional combustion vehicles. Fuel-efficient HEVs are more attractive with the rising cost of petrol and Europe's emphasis on energy independence. The market is expanding because of advancements in mild hybrids and plug-in hybrids.

Asia Pacific Hybrid Electric Vehicle Market Analysis

Asia-Pacific leads the world in HEV production and sales, with China, South Korea, and Japan leading the way. Japan is still a leader in the world market for HEVs, and most of its manufacturers are Toyota and Honda. Initiatives such as the New Energy Vehicle mandate provide incentives for hybrid vehicles as part of China's transition to green mobility. For the first time in March 2024, NEVs took a 40% share of national automobile sales, according to China Passenger Automobile Association data. It will become clear in 2023 that sales of plug-in hybrid electric vehicles are growing at a more rapid rate than pure battery electric vehicle sales. Despite starting from a lower base, plug-in hybrid electric car sales in China rose by more than 75% in the first quarter of 2023 compared with the same period last year, while battery electric car sales rose by 15% only. This is because regional automakers such as BYD have entered the HEV market, and the Asian Pacific market is developing sophisticated battery technology that will rise highly.

Latin America Hybrid Electric Vehicle Market Analysis

Latin America's HEV sector is growing because of fuel price escalation and environmental concerns. In ending 2023, Brazil commenced the Green Mobility and Innovation Program. The program offers relief in taxes to companies that create and manufacture low-emission road transport technology. These incentives total more than BRA 19 billion, that is, USD 3.8 Billion, in the period of 2024-2028. This is why many huge car manufacturers in Brazil have already started manufacturing hybrid vehicles using ethanol and electricity. Electrification of public transport in cities like Bogotá in Colombia also boosts demand. Increasing awareness of the sustainability of cities and air quality is also fueling hybrid adoption. Infrastructure challenges and income inequality notwithstanding, the sector is growing due to regional partnerships with multinationals and the steady drop in HEV prices.

Middle East and Africa Hybrid Electric Vehicle Market Analysis

Increasing awareness of sustainability and volatile oil prices are making the deployment of HEVs spread across the Middle East and Africa (MEA). This is led by the United Arab Emirates, with encouragement from government laws with respect to green transportation and hybrid purchase incentives. Demand is also stimulated by Saudi Arabia's Vision 2030, which places an emphasis on sustainability. Hybrid electric buses are becoming more and more widely used in African cities to decrease air pollution. Although it is a constraint, the bond between the government and automobile companies is helping this growth. The HEV Market in the MEA is expected to rise gradually with affordability.

Competitive Landscape:

Key players are investing in research for developing advanced battery technologies, including lithium-ion and solid-state batteries, which will help in increasing the energy storage capacity and lifespan of HEV batteries. Along with this, the automakers are expanding their HEV offerings across different vehicle segments, such as sedans, SUVs, and even trucks, to cater to a wider range of consumer preferences. Further efforts are continuously being devoted to enhancing the electric-only range of HEVs and promoting general fuel efficiency. Apart from that, HEV manufactures integrate advanced connectivity features, such connectivity will better integrate to smartphone services, update over airways, and enable remote command control for mobile apps. To achieve that, companies associate themselves with technology firms to progress toward autonomous driving features, as such, the process shall be further enhanced generally in driving experience.

The report provides a comprehensive analysis of the competitive landscape in the hybrid electric vehicle market with detailed profiles of all major companies, including:

- Toyota Motor Corporation

- Honda Motor Co. Ltd.

- Ford Motor Company

- Volkswagen Aktiengesellschaft

- General Motors Company

- Hyundai Motor Company

- Nissan Motor Corporation Ltd.

Latest News and Developments:

- May 2025: Mitsubishi Motors and Foxtron (a Foxconn subsidiary) signed an MOU to supply Mitsubishi with an OEM electric vehicle developed by Foxtron and manufactured by Yulon Motor in Taiwan. The EV will launch in Oceania (Australia and New Zealand) in late 2026 as part of Mitsubishi’s product plan through 2030, featuring strong EV performance and advanced infotainment. Mitsubishi is advancing electrification by upgrading the Outlander PHEV, adding hybrids in ASEAN, and leveraging Alliance partnerships with Renault and Nissan globally to expand its electrified lineup and achieve carbon neutrality by 2035.

- May 2025: Renault introduced a new 1.8L full hybrid E-Tech 160 hp powertrain with a 1.4 kWh battery, available on Captur and Symbioz, delivering more power, better acceleration, and lower fuel consumption (4.3 L/100 km) with CO₂ emissions as low as 98-99 g/km. The advanced system features a series-parallel hybrid architecture, direct fuel injection, a clutchless dog box for smooth gear changes, and enhanced regenerative braking. It supports up to 80% electric driving in cities and increases towing capacity to 1,000 kg.

- April 2025: Hyundai Motor Group unveiled its next-generation hybrid system featuring a new transmission with dual integrated motors (P1 and P2) that enhances power, fuel efficiency, and refinement across various vehicle classes. The turbocharged 2.5L petrol engine uses advanced thermodynamics and fuel injection for a 2.9% efficiency gain. The system delivers 45% better fuel economy and 19% more power than comparable ICE powertrains, debuting in the Hyundai Palisade hybrid. It includes advanced electrification tech like e-AWD, Smart Regenerative Braking, Stay Mode, and V2L, improving drivability, comfort, and convenience. The hybrid lineup will expand to cover compact through luxury models, with further innovations planned.

- April 2025: Nissan unveiled two key models at Auto Shanghai 2025: the all-new Frontier Pro plug-in hybrid pickup and the Dongfeng Nissan N7 electric sedan. The Frontier Pro, Nissan’s first electrified pickup, features a 1.5L turbo hybrid powertrain delivering 800Nm torque and up to 135km EV range, designed for urban and adventure use with rugged tech styling, advanced AWD, and a spacious, tech-rich interior. The N7 sedan offers up to 635km range, fast charging, advanced driver-assist tech, and a luxurious, AI-enhanced cabin. Both models will launch in China in 2025 and be exported globally.

- April 2025: Harbinger unveiled a pioneering plug-in series hybrid vehicle for medium-duty fleets, combining an electric drivetrain with a 1.4-liter gas-powered range extender, enabling up to 500 miles of range. Designed for diverse commercial applications like delivery vans, box trucks, and RVs, it offers rapid DC fast charging and robust performance (440 hp, 1,140 lb-ft torque). Manufactured in California using Panasonic lithium-ion batteries, the chassis supports customization by third parties. Deliveries begin in 2026, with pre-orders open, backed by an IRA Risk-Free Guarantee.

Hybrid Electric Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Full Hybrids, Mild Hybrids, Plug-in Hybrids, Others |

| Configuration Types Covered | Series HEV, Parallel HEV, Combination HEV |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Others |

| Power Sources Covered | Stored Electricity, On Board Electric Generator |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Toyota Motor Corporation, Honda Motor Co. Ltd., Ford Motor Company, Volkswagen Aktiengesellschaft, General Motors Company, Hyundai Motor Company, Nissan Motor Corporation Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hybrid electric vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the hybrid electric vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hybrid electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A HEV combines an internal combustion engine with an electric motor, using both to optimize fuel efficiency and reduce emissions. It automatically switches between the engine and motor depending on driving conditions. HEVs offer better fuel economy than traditional vehicles, reducing dependence on fossil fuels.

The hybrid electric vehicle market was valued at 12.93 Million Units in 2024.

IMARC estimates the global hybrid electric vehicle market to exhibit a CAGR of 25.78% during 2025-2033.

Key factors driving the HEV market include the growing demand for fuel efficiency, stricter environmental regulations, government incentives, and advancements in battery technologies. These elements reduce GHG emissions and fuel consumption, making HEVs an attractive option for consumers and governments aiming for sustainable transportation.

In 2024, plug-in hybrids represented the largest segment by propulsion type, driven by their ability to operate on electric power for longer ranges, offering flexibility and greater fuel efficiency.

Parallel HEV leads the market by configuration type owing to their efficient use of both the internal combustion engine and electric motor, optimizing fuel economy.

The passenger cars are the leading segment by vehicle type, driven by increasing consumer demand for fuel-efficient, environmentally friendly, and cost-effective transportation options.

Stored electricity represents the leading segment due to its essential role in improving fuel efficiency and reducing emissions. It allows hybrid vehicles to rely on battery power for part of their operation, reducing dependence on internal combustion engines and fossil fuels.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global hybrid electric vehicle market include Toyota Motor Corporation, Honda Motor Co. Ltd., Ford Motor Company, Volkswagen Aktiengesellschaft, General Motors Company, Hyundai Motor Company, Nissan Motor Corporation Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)