HVDC Transmission Systems Market Size, Share, Trends and Forecast by Component, Transmission Type, Technology, Project Type, Application, and Region, 2025-2033

HVDC Transmission Systems Market Size and Share:

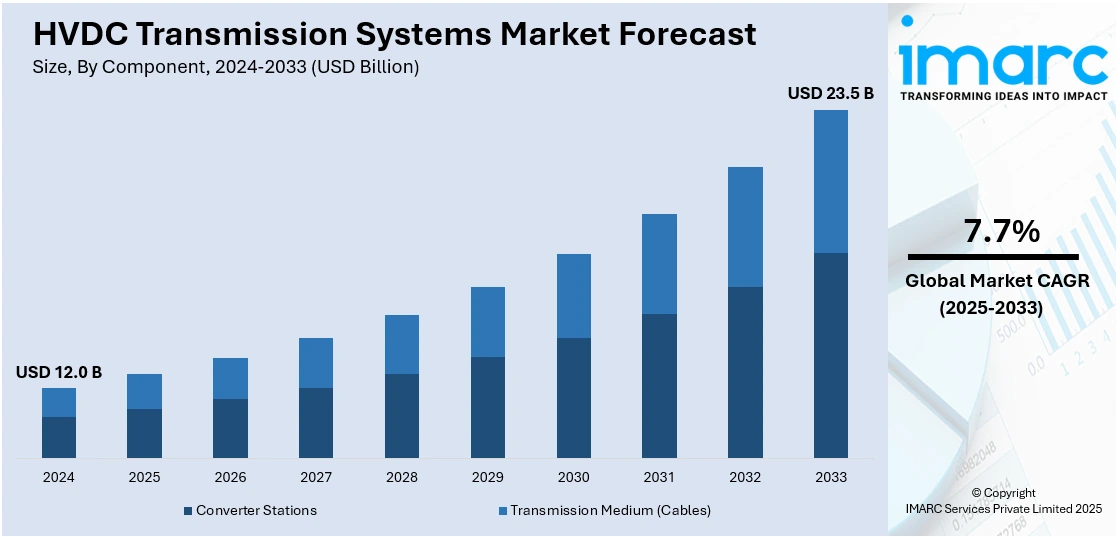

The global HVDC transmission systems market size reached USD 12.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.5 Billion by 2033, exhibiting a growth rate (CAGR) of 7.7% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 39.8% in 2024. The market growth is driven by the increasing focus of key players on grid modernization and the widespread adoption of renewable energy sources, such as wind and solar power.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.0 Billion |

| Market Forecast in 2033 | USD 23.5 Billion |

| Market Growth Rate (2025-2033) | 7.7% |

The rising demand for efficient long-distance power transmission, especially for integrating renewable energy sources such as wind and solar into national grids, is driving the global HVDC (High Voltage Direct Current) transmission systems market. Increasing focus on reducing energy losses and enhancing grid stability has further fueled adoption. Technological advancements in power electronics and a surge in cross-border electricity trade are also significant contributors. In addition, government policies and investment in energy infrastructure modernization along with stringent environmental regulations to encourage clean energy are creating strong growth opportunities. Besides, the increasing energy demand in developing economies and the need for reliable high-capacity transmission systems make HVDC technology vital for sustainable and efficient energy distribution. The International Energy Agency projects a significant increase in global electricity demand, anticipating a 4% rise in 2024, the largest since 2007, propelled by strong economic activity and powerful heat waves.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by the nation's transition towards renewable energy and the need to integrate geographically dispersed energy resources. After declining in 2023 amid mild weather, electricity demand in the United States is forecast to rebound this year by 3% amid steady economic growth, rising demand for cooling and an expanding data center sector. The escalating inclination for decarbonization under federal and state-level policies is accelerating investments in advanced grid technologies, including HVDC systems. Rising energy demands in urban centers and the need to connect them with renewable energy production hubs located in remote areas highlight the importance of long-distance, high-efficiency transmission solutions. Concurrently, the growing prevalence of offshore wind energy projects and the need to interconnect regional grids for improved resilience against power outages further bolster the market growth. Investments in modernizing aging infrastructure and adopting smart grid solutions also act as key market drivers.

HVDC Transmission Systems Market Trends:

Growing Demand for Electricity

The growing population is inflating the electricity requirements, which is one of the key factors driving the HVDC transmission systems market demand. For instance, according to the United Nations, the population across the globe is anticipated to increase by nearly 2 Billion in the coming 30 years and could reach 9.7 Billion in 2050. Moreover, according to IEA, the demand for electricity across the world is anticipated to increase at a faster rate over the coming three years, growing at 3.4% annually through 2026. HVDC transmission systems are more efficient than traditional high voltage alternating current (HVAC) systems for transmitting electricity over long distances. This makes them ideal for transmitting power from remote power plants, such as hydroelectric or wind farms, to urban centers. As electricity demand grows, there is a need to expand and interconnect regional and national grids. HVDC transmission systems can help to facilitate grid expansion and interconnection by enabling the transmission of large amounts of electricity over long distances without significant losses. In many areas, data centers are a major factor contributing to the rise in electricity demand. For instance, according to IEA, Data centers may use more than one thousand terawatt-hours (TWh) of power in 2026. These factors are further adding to the HVDC transmission systems market revenue.

Emergence of Submarine HVDC Transmission System

According to the HVDC transmission systems market overview, submarine HVDC transmission systems is one of the most significant developments in electrical power transmission. Submarine HVDC transmission systems refer to the transmission of significant amounts of electrical power through water, usually over long distances, with high efficiency and reliability. The increasing focus on power trading between nations is driving the demand for submarine electricity transmission. Besides, offshore wind platforms employ the use of HVDC undersea power transmission system in exporting power to the coastline. For instance, according to the Global Wind Energy Council, 64 GW of offshore wind was generated globally in 2022, which grew at a pace of 14% annually over the previous year. Such innovations are projected to propel the HVDC transmission systems market price in the coming years.

Rising Demand for Renewable sources

As countries and regions strive to reduce their carbon footprints and focus on transitioning towards more sustainable energy sources, there has been a significant increase in the development of offshore renewable energy projects, such as offshore wind farms. Submarine HVDC transmission systems play a crucial role in these projects by enabling the efficient transmission of electricity generated offshore to onshore locations where it is needed. Also, there has been a shift towards using clean, emission-free energy sources, such as HVDC systems for electricity transmission. Additionally, new projects are being approved worldwide for the transmission of renewable energy by using HVDC power supplies. Power consumption has increased significantly in the commercial, industrial, and residential domains. Besides this, the widespread adoption of high-voltage DC transmissions in grid stability and renewable energy systems, owing to their exceptional controllability and compatibility, is also augmenting the global market. For instance, TenneT granted McDermott International the largest-ever renewable energy contract in February 2022 for the 980 MW high-voltage direct current BorWin6 project. The project involved creating, producing, setting up, and commissioning an HVDC offshore converter platform on the North Sea Cluster 7 platform in Germany.

HVDC Transmission Systems Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global HVDC transmission systems market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, transmission type, technology, project type, and application.

Analysis by Component:

- Converter Stations

- Transmission Medium (Cables)

Converter stations lead the market with around 55.2% of market share in 2024. Converter stations are important in HVDC transmission systems as they allow the efficient conversion of AC to DC and vice versa for long-distance electricity transmission. These are important parts of HVDC infrastructures and are crucial to the functioning of an HVDC transmission system. Technological advancement, government policy on energy, energy demand, and investment in infrastructure cause fluctuation in this market segment.

Analysis by Transmission Type:

- Submarine HVDC Transmission System

- HVDC Overhead Transmission System

- HVDC Underground Transmission System

Submarine HVDC transmission system leads the market with around 58.9% of market share in 2024. Submarine HVDC transmission systems utilize submarine cables for the connection of renewable sources of energy located offshore, for instance, offshore wind farms to onshore power grids, or interconnection of water bodies' power grids. The transmission lines have better voltage stability in the long distance and therefore useful for interconnection between far-off power grids or from onshore to offshore installation of renewable energy. For example, the Global Wind Energy Council reports that 64 GW of offshore wind was produced globally in 2022, growing at an annual rate of 14% from the HVDC transmission systems market in 2021.

Analysis by Technology:

- Capacitor Commutated Converter (CCC)

- Voltage Source Converter (VSC)

- Line Commutated Converter (LCC)

Line Commutated Converter (LCC) lead the market with around 43.2% of market share in 2024. Line Commutated Converter (LCC) technology leads the HVDC transmission systems market due to its proven reliability, cost efficiency, and ability to handle high power levels over long distances. This technology, which uses thyristors for current conversion, is particularly well-suited for bulk power transmission and interconnecting grids with different frequency standards. LCC systems are widely adopted for their operational maturity and lower installation costs compared to newer technologies. Their ability to efficiently transmit power across vast geographical spans, especially in developing regions, makes them a preferred choice. Moreover, the rising demand for stable and reliable power transmission systems in energy-intensive industries further solidifies LCC’s position as the largest segment within the HVDC technology market.

Analysis by Project Type:

- Point-to-Point

- Back-to-Back

- Multi-terminal

Point-to-point HVDC systems are the most widely adopted due to their efficiency in transmitting electricity over long distances. They are particularly valuable for connecting remote renewable energy sources, such as offshore wind farms, to urban load centers, minimizing energy loss and enhancing grid reliability.

Back-to-back HVDC systems are crucial for interconnecting asynchronous power grids, enabling seamless power exchange between regions with different electrical frequencies. These systems play a key role in maintaining grid stability and supporting cross-border electricity trade in areas with mismatched grid standards.

Multi-terminal HVDC systems are an emerging segment designed to integrate multiple renewable energy sources into a single network. Their ability to support complex grid architectures makes them ideal for advanced grid modernization efforts, particularly in regions with diverse energy inputs and a focus on flexible power distribution.

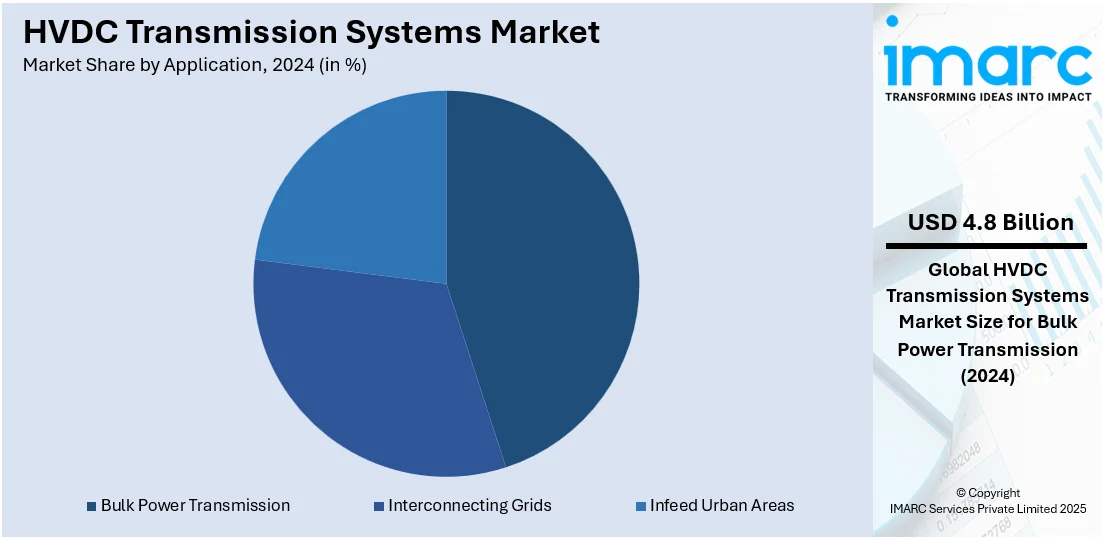

Analysis by Application:

- Bulk Power Transmission

- Interconnecting Grids

- Infeed Urban Areas

Bulk power transmission leads the market with around 40.2% of market share in 2024. Bulk power transmission is the largest application segment in the HVDC transmission systems market, driven by the growing need to transport electricity over long distances with minimal energy loss. This application is particularly crucial for connecting large-scale renewable energy projects, such as offshore wind farms and solar parks, to urban centers and industrial hubs. HVDC technology’s ability to transmit vast amounts of electricity efficiently makes it indispensable for meeting the energy demands of populous regions. Additionally, bulk power transmission facilitates interregional power exchange and enhances grid reliability by supporting the integration of diverse energy sources. Its cost-effectiveness for high-capacity transmission further solidifies its position as the leading application segment in the HVDC market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 39.8%. The growing penetration towards the adoption of renewable energy is fueling the demand for HVDC transmission system in Europe. Besides this, various countries in Europe, including Germany, Spain, and France, are significantly moving towards the low carbon economy, owing to rising environmental concerns. The increasing adoption of various policies, such as EU's renewable energy directive and national renewable action plants, is expected to proliferate the overall market growth. For instance, TenneT began construction on the offshore IJmuiden Ver wind area by the end of 2022. It also initiated the tender for the platform and HVDC system for the offshore Dutch IJmuiden Ver projects. Furthermore, the project is anticipated to be put into service by 2028.

Key Regional Takeaways:

United States HVDC Transmission Systems Market Analysis

In 2024, the United States accounted for around 75.00% of the total North America HVDC transmission systems market. The necessity to update the ageing power infrastructure and the growing need for renewable energy integration are driving the market for HVDC (High Voltage Direct Current) transmission systems in the United States. HVDC systems are now necessary for effective long-distance power transmission and lowering energy losses, as nearly 18% of national retail electricity sales in 2023 came from wind, solar and geothermal, up from 6 percent in 2014. In terms of total renewable energy generation, the top five states were Texas, California, Iowa, Oklahoma, and Kansas. HVDC project investments are being further stimulated by the U.S. Department of Energy's (DOE) ambitious goals to have a 100% sustainable electricity system by 2035.

North America HVDC Transmission Systems Market Analysis

The increasing number of offshore wind projects, especially along the East Coast, is encouraging the deployment of HVDC technology. For example, the Atlantic Wind Connection project intends to increase grid capacity and stability by employing HVDC technology to carry power from offshore wind farms. In order to effectively transport power across long distances, HVDC networks have also had to be implemented due to cross-state and cross-region interconnection requirements. Billions of dollars are being allocated by the government and public-private partnerships, such those under the Bipartisan Infrastructure Law (with a total funding of USD 1.5 Trillion), to update transmission networks, including HVDC systems. Furthermore, HVDC systems are now more scalable and flexible due to developments in voltage-source converter (VSC) technology, which is increasing their demand in utilities and grid operators across the region.

Europe HVDC Transmission Systems Market Analysis

Europe's aggressive decarbonisation targets and growing reliance on renewable energy sources have made it a global leader in the market for HVDC transmission networks. Significant investments in HVDC infrastructure are required to integrate wind, solar, and hydroelectric electricity into the grid in order to meet the European Union's Fit for 55 plan, which aims to reduce greenhouse gas emissions by 55% by 2030. Leading HVDC initiatives to link offshore wind farms to mainland grids are being carried out by nations including Norway, the UK, and Germany.

With large projects like the Viking Link between Denmark and the UK and the North Sea Wind Power Hub demonstrating the region's dedication to cross-border energy interconnectivity, Europe accounted for a sizeable portion of the worldwide HVDC market in 2023. European grid operators have deployed about 50 gigawatts of VSC-based HVDC technology by the end of 2023. For these projects, HVDC technology is crucial because it improves grid stability and permits effective power transfer between nations. The growing electrification of the transport and industrial sectors, which necessitates strong grid infrastructure, is another factor propelling the European market. Growth is also being stimulated by technological developments in greater capacity solutions and multi-terminal HVDC systems. Continued investment in HVDC technology is ensured by supportive policies, including as financial support from the European Green Deal and regulatory frameworks under the ENTSO-E (European Network of Transmission System Operators).

Asia Pacific HVDC Transmission Systems Market Analysis

HVDC transmission networks are expanding at the quickest rate in Asia-Pacific due to the region's rapid industrialisation, urbanisation, and adoption of renewable energy. With state-owned utilities like the State Grid Corporation of China (SGCC) making significant investments in ultra-high voltage (UHV) DC projects to carry power across the enormous topography of the nation, China dominates the industry. In 2022, China accounted for almost 50% of all new renewable power capacity globally, according to the data by International Energy Agency. In 2024, China is delivery almost 70% of all new offshore wind projects globally, as well as over 60% of onshore wind and 50% of solar PV projects.

India is another significant player with the government's Green Energy Corridor project, which integrates renewable energy into the national grid. HVDC technology is also being used by nations like South Korea and Japan in order to assist their renewable energy goals and improve energy security. The expansion of demand is being driven by large-scale solar projects in Southeast Asia and offshore wind farms in Japan. Furthermore, regional interconnectivity projects, such as the proposed ASEAN Power Grid, further boost the adoption of HVDC technology for cross-border energy transmission.

Latin America HVDC Transmission Systems Market Analysis

The necessity to transmit electricity from distant renewable energy sites to metropolitan centres is the main factor driving the market in Latin America. According to the data by World Economic Forum, Brazil and Chile emerged amongst the top 20 performers in the 2024 index of Fostering Effective Energy Transmission and Costa Rica and Colombia also well positioned. The significance of the technology in the area is demonstrated by projects like the Belo Monte Transmission System, one of the biggest HVDC projects in the world. Nations like Mexico and Chile are also investing in HVDC infrastructure to include renewable energy into their networks. For instance, the need for effective gearbox technology is fuelled by Mexico's wind energy potential in Oaxaca and Chile's emphasis on solar energy in the Atacama Desert. Furthermore, HVDC is essential to regional interconnectivity programs like the Central American Electrical Interconnection System (SIEPAC), which seek to establish a single electric grid.

Middle East and Africa HVDC Transmission Systems Market Analysis

The need to improve energy availability and integrate renewable energy sources is driving the HVDC industry in the Middle East and Africa (MEA) region. Under programs like Saudi Vision 2030 and the UAE's Energy Strategy 2050, nations in the Middle East, including Saudi Arabia and the United Arab Emirates, are making significant investments in renewable energy projects. For effective solar and wind energy transmission over large desert expanses, HVDC systems are necessary. Improving energy access and facilitating cross-border energy trade are priorities in Africa. The region's emphasis on utilising HVDC to fortify regional power systems is demonstrated by initiatives such as the Ethiopia-Kenya HVDC Interconnector. Furthermore, the need for HVDC technology to combine and distribute power is being created by South Africa's investments in renewable energy projects under its Integrated Resource Plan (IRP).

Competitive Landscape:

The HVDC transmission systems market is highly competitive, with key players focusing on technological advancements and strategic collaborations to maintain their market positions. Companies are investing in R&D to develop more efficient, cost-effective systems, including advancements in modular converters and compact HVDC substations. Strategic partnerships with utilities and governments are enabling the execution of large-scale projects, including cross-border and renewable energy integration projects. Industry leaders are also expanding their portfolios through acquisitions and joint ventures, aiming to enhance their capabilities in grid modernization and energy transition initiatives. Additionally, emphasis on sustainable solutions and compliance with stringent environmental regulations is driving innovation in HVDC systems, ensuring they meet evolving energy demands effectively.

The report provides a comprehensive analysis of the competitive landscape in the HVDC transmission systems market with detailed profiles of all major companies, including:

- GE Grid Solutions, LLC

- Hitachi Energy Ltd

- Mitsubishi Electric Corporation

- NKT A/S

- Prysmian

- Siemens Energy

- TenneT

- Toshiba India Private Limited

- XJ Global

Recent Developments:

- November 2024: The U.S. Department of Energy (DOE) has announced an USD 11 Million initiative to support four high-voltage direct current (HVDC) transmission projects. This funding aims to enhance grid reliability, integrate renewable energy sources, and support the transition to a cleaner energy infrastructure. By focusing on HVDC technology, the program seeks to reduce energy losses during transmission over long distances and improve power system resilience.

- November 2024: Power Grid Corporation of Limited (PGCIL) has been granted the Special Purpose Vehicle (SPV) for the Khavda V-A Power Transmission Project by REC Power Development and Consultancy Limited (RECPDCL), a division of REC Limited under the Ministry of Power. This is the first project granted under the Tariff-Based Competitive Bidding (TBCB) process for High Voltage Direct Current (HVDC) transmission.

- February 2024: Hitachi Energy gave the contract to modernize the control and protection systems of the EstLink 1 high-voltage direct current (HVDC) transmission system for Fingrid and Elering, the transmission system operators in Finland and Estonia.

- January 2024: DNV initiated a Join Industry Project with ten offshore wind and transmission developers to determine the necessary standardized and electrical standardizing adjustments to allow high voltage direct current (HVDC) transmission to be connected to the US grid. The members of JIP include Atlantic Shores Offshore Wind, DNV, EDF Renewables, Equinor, Invenergy, National Grid Ventures, Ocean Winds, PPL Translink WindGrid, Rwe, Shell, and TotalEnergies.

- December 2023: National Grid Electricity Transmission and SP Transmission, a division of SP Energy Networks (SPEN), was given the contract of a £1 Billion to GE Vernova's Grid Solutions business and MYTILINEOS Energy & Metals for the construction of the first high-capacity east coast subsea link in the United Kingdom.

HVDC Transmission Systems Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Converter Stations, Transmission Medium (Cables) |

| Transmission Types Covered | Submarine HVDC Transmission System, HVDC Overhead Transmission System, HVDC Underground Transmission System |

| Technologies Covered | Capacitor Commutated Converter (CCC), Voltage Source Converter (VSC), Line Commutated Converter (LCC) |

| Project Types Covered | Point-to-Point, Back-to-Back, Multi-terminal |

| Applications Covered | Bulk Power Transmission, Interconnecting Grids, Infeed Urban Areas |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | GE Grid Solutions, LLC, Hitachi Energy Ltd, Mitsubishi Electric Corporation, NKT A/S, Prysmian, Siemens Energy, TenneT, Toshiba India Private Limited, XJ Global, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, HVDC transmission systems market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global HVDC transmission systems market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the HVDC transmission systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

HVDC (High Voltage Direct Current) transmission systems are advanced electrical transmission technologies designed to transport large amounts of electricity over long distances with high efficiency and minimal energy loss. They are particularly suited for integrating renewable energy sources and interconnecting grids.

The global HVDC transmission systems market was valued at USD 12.0 Billion in 2024.

IMARC estimates the global HVDC transmission systems market to exhibit a CAGR of 7.7% during 2025-2033.

The market is driven by the rising demand for efficient long-distance power transmission, increasing adoption of renewable energy sources, advancements in power electronics, and government initiatives for grid modernization and clean energy integration.

Converter stations represented the largest segment by component, driven by their crucial role in efficiently converting AC to DC for long-distance transmission and vice versa.

The submarine HVDC transmission system leads the market by transmission type due to its efficiency in connecting offshore renewable energy sources to onshore grids and interconnecting grids across water bodies.

The line commutated converter (LCC) is the leading segment by technology, driven by its reliability, cost efficiency, and ability to handle high power levels over long distances.

Bulk power transmission is the leading segment by application, driven by its capacity to transport electricity over long distances efficiently and connect large-scale renewable projects to urban and industrial centers.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the global HVDC transmission systems market include GE Grid Solutions, LLC, Hitachi Energy Ltd, Mitsubishi Electric Corporation, NKT A/S, Prysmian, Siemens Energy, TenneT, Toshiba India Private Limited and XJ Global, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)