HVDC Converter Station Market Report by Component (Converter, DC Equipment, Converter Transformer, and Others), Technology (Voltage Source Converter (VSC), Line Commutated Converter (LCC)), Type (Bi-Polar, Monopolar, Back-to-back, Multi Terminal), Application (Power Industry, Oil and Gas, Powering Island and Remote Loads, Interconnecting Networks, and Others), and Region 2025-2033

Market Overview:

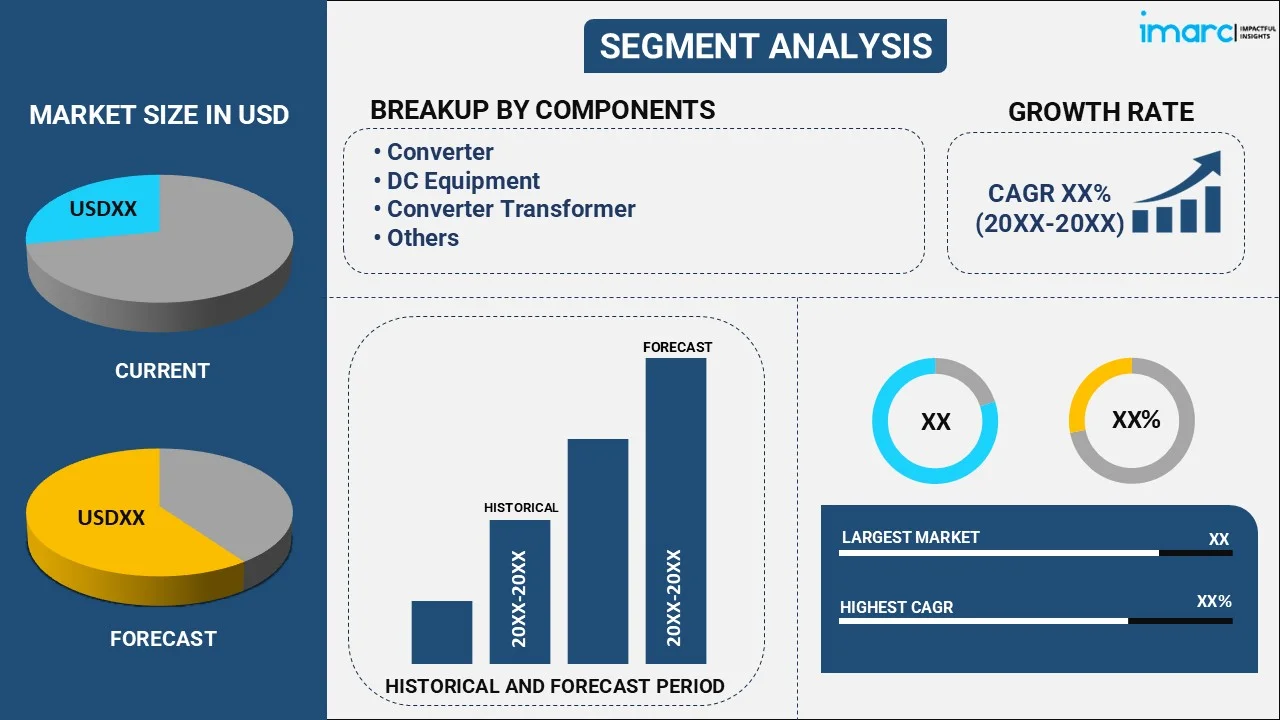

The global HVDC converter station market size reached USD 12.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The widespread adoption of renewable energy and HVDC converter stations for interconnecting power grids across different regions or countries, and the numerous government initiatives promoting renewable energy deployment represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.9 Billion |

|

Market Forecast in 2033

|

USD 22.5 Billion |

| Market Growth Rate 2025-2033 | 6.08% |

An HVDC converter station, short for a high-voltage direct current converter station, is crucial in high-voltage direct current (HVDC) transmission systems. It functions as a bridge between various power systems, enabling the stable and effective transfer of electricity across great distances. Its primary duty is to change electricity from alternating current (AC) to direct current (DC) or vice versa, depending on the direction the power is flowing. The converter station consists of various key elements that work in harmony to facilitate the conversion process. One of the main components is the converter transformer, which is responsible for stepping up or down the AC power's voltage level. These transformers are typically designed to handle extremely high voltages, ranging from a few hundred kilovolts to several hundreds of kilovolts, depending on the specific HVDC transmission system. Additionally, it also incorporates smoothing reactors, which are used to smooth out any fluctuations in the DC power, reducing ripple effects and improving overall power quality. Moreover, the station includes filters and harmonic traps to mitigate harmonics and other electrical disturbances that may arise during the conversion process.

HVDC Converter Station Market Trends:

The growing trend of renewable energy majorly drives the global market. Coupled with the augmenting need for efficient transmission of power from remote renewable energy generation sites to population centers, this is significantly supporting the market. Along with this, the widespread adoption of HVDC converter stations for interconnecting power grids across different regions or countries is propelling the market as they enable the transfer of electricity between asynchronous AC grids, facilitating the exchange of power, improving grid stability, and enhancing overall energy security. In addition, the increasing inclination toward HVDC systems over AC transmission as they offer lower transmission losses, reduced voltage drops, and increased power transfer capacity over longer distances is positively influencing the market. As the demand for long-distance power transmission increases, the demand for HVDC converter stations grows, thereby creating a positive market outlook. Apart from this, government initiatives promoting renewable energy deployment, grid interconnections, and energy market liberalization are contributing to the market. Furthermore, the development of advanced power electronic devices, improved converter station designs, and enhanced control and protection systems are creating a positive market outlook. Some of the other factors driving the market include rapid industrialization and the increasing number of offshore wind farms.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global HVDC converter station market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on component, technology, type, and application.

Component Insights:

- Converter

- DC Equipment

- Converter Transformer

- Others

The report has provided a detailed breakup and analysis of the HVDC converter station market based on the component. This includes converter, DC equipment, converter transformer, and others. According to the report, the DC equipment represented the largest segment.

Technology Insights:

- Voltage Source Converter (VSC)

- Line Commutated Converter (LCC)

A detailed breakup and analysis of the HVDC converter station market based on the technology has also been provided in the report. This includes voltage source converter (VSC) and line commutated converter (LCC). According to the report, line commutated converter (LCC) accounted for the largest market share.

Type Insights:

- Bi-Polar

- Monopolar

- Back-to-back

- Multi Terminal

The report has provided a detailed breakup and analysis of the HVDC converter station market based on the type. This includes bi-polar, monopolar, back-to-back, and multi terminal. According to the report, the bi-polar represented the largest segment.

Application Insights:

- Power Industry

- Oil and Gas

- Powering Island and Remote Loads

- Interconnecting Networks

- Others

A detailed breakup and analysis of the HVDC converter station market based on the application has also been provided in the report. This includes power industry, oil and gas, powering island and remote loads, interconnecting networks, and others. According to the report, powering island and remote loads accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe was the largest market for HVDC converter station. Some of the factors driving the Europe HVDC converter station market included the emerging trend of renewable energy, continual technological advancements, rapid industrialization, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global HVDC converter station market. Also, detailed profiles of all major companies have been provided. Some of the companies covered include GE Grid Solutions LLC (General Electric Company), Hitachi Energy Ltd. (Hitachi Ltd.), Hyosung Heavy Industries, Mitsubishi Electric Corporation, NR Electric Co. Ltd. (NARI Technology Co. Ltd.), Siemens Energy AG, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Converter, DC Equipment, Converter Transformer, Others |

| Technologies Covered | Voltage Source Converter (VSC), Line Commutated Converter (LCC) |

| Types Covered | Bi-Polar, Monopolar, Back-to-back, Multi Terminal |

| Applications Covered | Power Industry, Oil and Gas, Powering Island and Remote Loads, Interconnecting Networks, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | GE Grid Solutions LLC (General Electric Company), Hitachi Energy Ltd. (Hitachi Ltd.), Hyosung Heavy Industries, Mitsubishi Electric Corporation, NR Electric Co. Ltd. (NARI Technology Co. Ltd.), Siemens Energy AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global HVDC converter station market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global HVDC converter station market?

- What is the impact of each driver, restraint, and opportunity on the global HVDC converter station market?

- What are the key regional markets?

- Which countries represent the most attractive HVDC converter station market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the HVDC converter station market?

- What is the breakup of the market based on the technology?

- Which is the most attractive technology in the HVDC converter station market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the HVDC converter station market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the HVDC converter station market?

- What is the competitive structure of the global HVDC converter station market?

- Who are the key players/companies in the global HVDC converter station market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the HVDC converter station market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global HVDC converter station market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the HVDC converter station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)