Huber Needles Market Size, Share, Trends and Forecast by Product, Application, End User, and Region, 2025-2033

Huber Needles Market Size and Share:

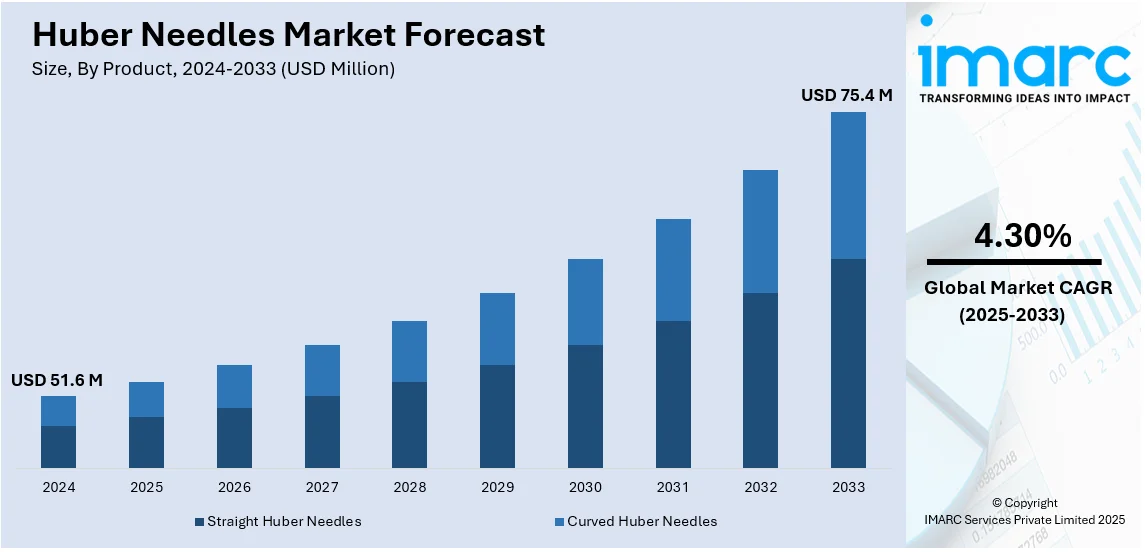

The global huber needles market size was valued at USD 51.6 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 75.4 Million by 2033, exhibiting a CAGR of 4.30% during 2025-2033. North America currently dominates the market, holding a significant market share of over 42.7% in 2024. The rising prevalence of cancer, increasing incidences of chronic illnesses, and the introduction of innovative products represent some of the key factors fueling the huber needles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.6 Million |

| Market Forecast in 2033 | USD 75.4 Million |

| Market Growth Rate (2025-2033) | 4.30% |

The huber needles market is driven by the increasing prevalence of cancer, chronic diseases, and blood disorders that require frequent vascular access. The rising adoption of implantable ports for chemotherapy, dialysis, and long-term drug administration boosts demand. Advanced healthcare infrastructure, particularly in developed regions, supports market growth alongside favorable reimbursement policies and stringent infection control regulations. Additionally, technological advancements in needle design, such as safety-engineered huber needles, enhance patient comfort and reduce complications. Growing hospital admissions, the expanding geriatric population, and increasing awareness about infection prevention contribute further. The presence of key industry players and continuous innovations in medical devices also play a significant role in driving market expansion globally, particularly in North America and Europe.

The huber needles market in the United States is driven by the high prevalence of cancer, chronic diseases, and blood disorders requiring frequent vascular access. According to industry reports, Prostate, lung, and colorectal cancers represented about 48% of all cancers identified in men in 2024. Among women, the three most prevalent cancers are breast, lung, and colorectal, and these represented around 51% of all new cancer cases in women in 2024. The increasing use of implantable ports for chemotherapy, dialysis, and long-term medication administration boosts demand. Enhanced healthcare infrastructure, substantial healthcare expenditure, and advantageous reimbursement policies additionally facilitate market expansion. Strict safety regulations and infection control standards drive the adoption of safety-engineered huber needles. Additionally, the rising geriatric population, increasing hospital admissions, and growing awareness of minimally invasive procedures contribute to market expansion. The presence of key market players and continuous advancements in needle technology also strengthen the industry.

Huber Needles Market Trends:

Rising Prevalence of Cancer and Chronic Diseases

The growing incidence of cancer, chronic illnesses, and blood disorders is a key driver of the Huber needles market. According to IARC's 2022 report, there were 20 Million new cancer cases and 9.7 Million deaths globally reported in 2022. Cancer patients undergoing chemotherapy often require frequent vascular access through implantable ports, making huber needles essential for safe drug administration. Similarly, patients with conditions like sickle cell anemia and end-stage renal disease need regular blood transfusions or dialysis, boosting demand. The growing global burden of chronic diseases, coupled with the rising elderly population who require long-term medical treatments, further fuels the market. As healthcare providers seek efficient and safe vascular access solutions, the demand for huber needles continues to rise.

Expanding Healthcare Infrastructure and Favorable Reimbursement Policies

The expansion of healthcare facilities, particularly in developed countries, has significantly contributed to the growth of the market. Hospitals, cancer treatment centers, and dialysis clinics are increasing their use of Huber needles to meet the rising patient demand. Favorable reimbursement policies in regions like North America and Europe further support market growth by reducing out-of-pocket expenses for patients requiring frequent vascular access. Government and private insurance coverage for cancer treatment, blood transfusions, and dialysis procedures encourage hospitals to invest in high-quality Huber needles, boosting overall huber needles demand.

Stringent Safety Regulations and Infection Control Measures

Strict regulations and infection control protocols set by health organizations, such as the FDA, CDC, and WHO, play a crucial role in driving the Huber needles market. According to the FDA, at present, it is estimated that approximately 50% of single-use medical devices undergo terminal sterilization using ethylene oxide (EtO). Moreover, modifications in sterilization methods now necessitate extensive revalidation testing, which encompasses biocompatibility, chemical characterization, and performance testing of materials/devices. Healthcare providers are required to follow strict safety standards to prevent bloodstream infections and complications associated with implanted ports. As a result, hospitals and clinics increasingly adopt high-quality, safety-engineered huber needles to comply with these regulations. The emphasis on reducing hospital-acquired infections (HAIs) and ensuring patient safety further drives the demand for advanced Huber needle designs, creating a positive Huber needles market outlook.

Huber Needles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global huber needles market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Straight Huber Needles

- Curved Huber Needles

Curved huber needles stand as the largest product in 2024, holding around 56.4% of the market due to their superior functionality, safety, and widespread use in oncology and long-term vascular access. These needles are designed to reduce coring and minimize tissue damage when accessing implanted ports, making them ideal for chemotherapy, parenteral nutrition, and pain management. Their ergonomic design ensures ease of insertion and removal, reducing patient discomfort and complications. Additionally, healthcare providers prefer curved Huber needles for their flexibility and ability to maintain secure access in various clinical settings. The growing prevalence of chronic diseases and increasing chemotherapy procedures further drive the demand for these needles.

Analysis by Application:

- Transfusion of Blood

- Application for Cancer

- Parental Nutrition

- Others

The transfusion of blood holds the largest share in the market due to the high demand for safe and efficient vascular access in critical care, oncology, and chronic disease management. Huber needles are essential for accessing implanted ports in patients requiring frequent blood transfusions, such as those with leukemia, sickle cell anemia, and other hematological disorders. Their non-coring design minimizes tissue damage and infection risks, ensuring safe and repeated use. The increasing prevalence of blood-related disorders, the rising number of cancer patients undergoing chemotherapy, and advancements in port-based transfusion techniques further drive the dominance of this segment.

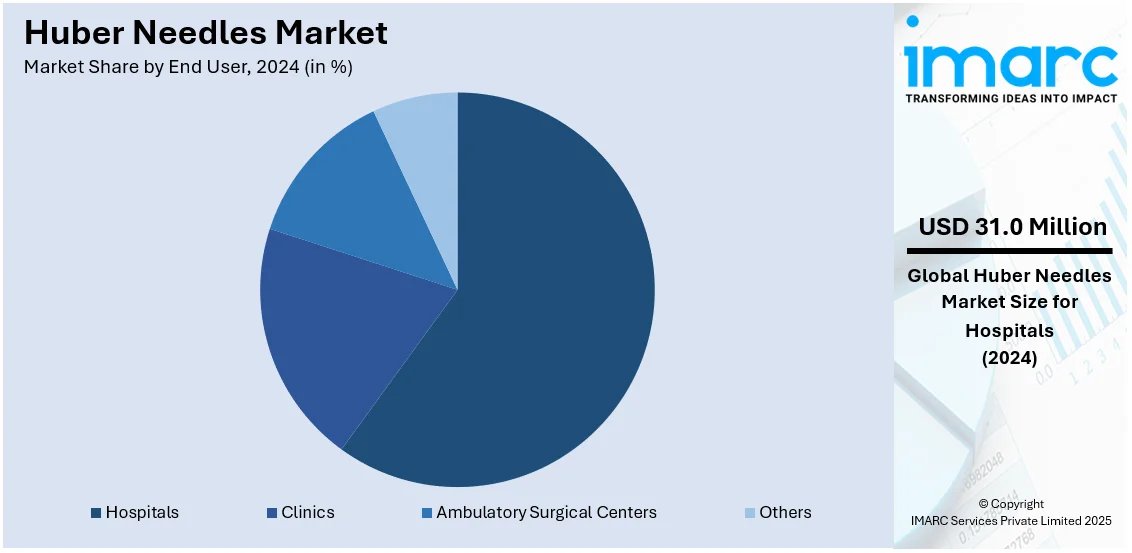

Analysis by End User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

Hospitals leads the market with around 60.0% of the market share in 2024 due to the high volume of procedures requiring safe vascular access, such as chemotherapy, blood transfusions, dialysis, and parenteral nutrition. As primary healthcare providers, hospitals handle a significant number of patients with chronic diseases and critical conditions that necessitate frequent use of Huber needles. Their well-equipped infrastructure, availability of skilled healthcare professionals, and adherence to strict safety protocols further drive adoption. Additionally, the rising prevalence of cancer, increasing hospital admissions, and advancements in port-based drug delivery systems contribute to hospitals' dominant market position in Huber needle utilization.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.7%. The huber needles market in North America is driven by the rising prevalence of cancer, chronic diseases, and blood disorders that require frequent vascular access. The increasing adoption of implantable ports for chemotherapy, dialysis, and long-term drug administration boosts demand. Advanced healthcare infrastructure, favorable reimbursement policies, and high healthcare spending further support market growth. Additionally, growing awareness about infection control, stringent safety regulations, and technological advancements in needle design enhance adoption. The presence of key market players, increasing hospital admissions, and a growing elderly population also contribute to North America’s dominance in the Huber needles market.

Key Regional Takeaways:

United States Huber Needles Market Analysis

In 2024, the United States accounted for the largest market share of over 87.70% of the huber needles market in North America. The growing huber needles adoption in the United States is driven by the rising prevalence of obesity, human immunodeficiency virus (HIV), and hepatitis cases. According to Centers for Disease Control and Prevention (CDC), at least 35% of adults in 2022 US states are now living with obesity. The increasing number of individuals diagnosed with obesity-related conditions has resulted in a higher demand for safe and effective vascular access solutions. The expanding patient base requiring long-term intravenous therapies due to HIV and hepatitis further accelerates the need for huber needles. Additionally, advancements in needle technology to minimize discomfort and infection risks support their adoption. The medical sector is actively integrating improved catheterization techniques, leading to a rise in huber needle usage. Healthcare providers emphasize patient safety, reinforcing the preference for huber needles in infusion therapies. Growing awareness of bloodborne infections and stringent sterilization protocols further contribute to the market expansion. The increasing focus on advanced drug delivery mechanisms enhances their significance in clinical treatments. The emphasis on reducing complications in chronic disease management continues to influence huber needles demand, positioning them as critical components in modern healthcare settings.

Asia Pacific Huber Needles Market Analysis

The growing huber needles adoption in Asia-Pacific is fueled by rising investment in healthcare infrastructure and services. According to India Brand Equity Foundation, The total FDI equity inflow in the Drugs and Pharmaceuticals sector amounts to USD 22.52 Billion from April 2000 to March 2024, representing nearly 3.4% of the overall inflow received by various sectors. Expanding medical facilities and increased government funding for healthcare improvements contribute to a higher demand for efficient vascular access devices. The focus on strengthening hospital networks and integrating modern medical equipment promotes the widespread adoption of huber needles. Increasing private sector investments in specialty clinics and infusion centers enhance accessibility to advanced infusion technologies. The growing emphasis on healthcare modernization has led to the implementation of updated treatment protocols, reinforcing the use of huber needles in various medical procedures. The rise in patient admissions for chronic conditions and long-term therapies further drives the market. Technological advancements in medical devices and training programs for healthcare professionals improve procedural efficiency, ensuring increased huber needles utilization. The focus on reducing complications associated with traditional vascular access methods strengthens the demand for safer alternatives.

Europe Huber Needles Market Analysis

The growing huber needles adoption in Europe is propelled by the increasing incidences of chronic illnesses, necessitating effective long-term vascular access solutions. According to reports, in 2023, over one-third (35.0%) of individuals in the EU indicated that they had a long-term (chronic) health issue. The rising number of patients requiring chemotherapy, dialysis, and parenteral nutrition has intensified the demand for specialized medical devices. The emphasis on minimizing catheter-associated complications has led to widespread implementation of huber needles in healthcare institutions. Technological advancements and innovative needle designs enhance safety, reducing infection risks and improving patient comfort. The growing need for precise drug administration in chronic disease management promotes their integration into medical protocols. Expanding research and development initiatives in medical devices support the refinement of needle-based treatment approaches. Healthcare providers prioritize the adoption of advanced vascular access solutions, influencing huber needles market expansion. The increasing burden of age-related illnesses and the need for long-term therapeutic interventions further drive demand.

Latin America Huber Needles Market Analysis

The growing huber needles adoption in Latin America is influenced by the rising prevalence of cancer, necessitating improved infusion therapies. For instance, in Latin America, there were around 1·5 Million new cases of cancer and 750,000 deaths from cancer in 2022. The increasing cancer patient population drives the demand for effective vascular access devices to ensure safe and precise drug administration. The growing emphasis on supportive cancer care has led to the integration of huber needles in treatment regimens. Advancements in oncology therapies and targeted drug delivery mechanisms reinforce their adoption in clinical settings. The expanding healthcare sector prioritizes the enhancement of medical procedures, encouraging the use of specialized needle systems. The increasing focus on minimizing catheter-related complications strengthens their role in infusion protocols. Healthcare professionals emphasize patient safety and treatment efficiency, leading to broader utilization. The rising adoption of advanced infusion techniques supports the market growth. Expanding awareness of infection prevention and stringent safety standards further contribute to huber needles market expansion across medical institutions.

Middle East and Africa Huber Needles Market Analysis

The growing huber needles adoption in the Middle East and Africa is attributed to the increasing healthcare facilities, expanding medical infrastructure, and rising investments in hospital services. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. The establishment of new hospitals and specialty clinics has amplified the demand for efficient vascular access devices. The emphasis on strengthening healthcare capabilities supports the integration of huber needles in medical treatments. The increasing focus on improving patient care quality promotes their utilization in infusion therapies. Advancements in healthcare technologies facilitate the adoption of specialized needle systems. The expanding healthcare workforce and professional training initiatives enhance procedural efficiency, reinforcing market demand. The need for infection prevention and enhanced patient safety measures drives huber needles usage in clinical applications. The rising burden of chronic diseases further strengthens the necessity for reliable infusion solutions, positioning them as essential components in modern medical practices.

Competitive Landscape:

The huber needles market is highly competitive, with key players focusing on product innovation, safety enhancements, and strategic partnerships. Leading companies such as Becton, Dickinson and Company (BD), Baxter International, Smiths Medical, Nipro Corporation, and AngioDynamics dominate the market through extensive product portfolios and global distribution networks. These companies invest in R&D to develop advanced non-coring needles with enhanced patient safety features. Mergers, acquisitions, and collaborations with healthcare institutions further strengthen their market presence. Additionally, rising regulatory compliance and stringent safety standards drive manufacturers to improve product quality. Emerging players are also entering the market, intensifying competition with cost-effective and innovative solutions, particularly in North America and Europe, where demand for Huber needles is high.

The report provides a comprehensive analysis of the competitive landscape in the huber needles market with detailed profiles of all major companies, including:

- B. Braun Medical Inc.

- Becton

- Dickinson and Company

- Exelint International Co.

- Medline Industries

- Medsurg

- Smiths Medical Inc. (ICU Medical Inc)

- Vygon S.A.

Latest News and Developments:

- January 2025: BD (Becton, Dickinson and Company) is expanding its U.S. manufacturing network with over USD 10 Million in investments to increase production of critical medical devices, including huber needles, syringes, and IV catheters. New production lines have been installed in BD’s Connecticut and Nebraska plants, with one already operational and more launching soon. This expansion aims to meet the growing demand for essential health care supplies in the U.S.

- October 2024: MedSafety Solutions has introduced the TwoFer™ Needle, a dual-purpose Huber-tipped needle enabling both vented and non-vented vial transfers. Available in two color-coded lengths, it streamlines liquid drug movement without frequent needle changes, enhancing efficiency and safety in pharmaceutical applications.

- October 2024: The FDA approved zolbetuximab-clzb (Vyloy) with chemotherapy for first-line treatment of CLDN18.2-positive, HER2-negative gastric or gastroesophageal junction adenocarcinoma. The approval includes the VENTANA CLDN18 (43-14A) RxDx Assay for patient identification. Administration involves intravenous infusion using a huber needle to ensure safe and effective drug delivery.

- February 2024: The FDA has approved AstraZeneca's Tagrisso (osimertinib) in combination with chemotherapy for advanced lung cancer with an EGFR mutation based on the findings of the FLAURA2 trial. By lowering the risk of disease progression or death by 38%, the combination increased median progression-free survival by 8.8 months. A huber needle may be necessary for patients undergoing treatment in order to safely administer chemotherapy drugs into implanted ports.

- January 2024: Nipro has launched Huber needle sets, ensuring precision and safety from needle stick injuries. Designed for accurate punctures, these needles address common medical concerns. The collection enhances protection while maintaining reliability in use.

- January 2022: ICU Medical Inc. expanded its infusion therapy portfolio by completing the acquisition of Smiths Medical from Smiths Group plc. Its status as a more serious international competitor is strengthened by the deal, which covers syringe and ambulatory infusion devices, needles, vascular access, and critical care supplies. It is projected that the combined company will generate pro forma income of about $2.5 billion.

- December 2021: Vygon India launches POLYPERF Safe, a safety Huber needle for chemo port vascular access. Designed to enhance treatment effectiveness while reducing risks for patients and clinicians. Reinforcing expertise in vascular access, Vygon ensures safer medical solutions.

Huber Needles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Straight Huber Needles, Curved Huber Needles |

| Applications Covered | Transfusion of Blood, Application for Cancer, Parental Nutrition, Others |

| End Users Covered | Hospitals, Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Medical Inc., Becton, Dickinson and Company, Exelint International Co., Medline Industries, Medsurg, Smiths Medical Inc. (ICU Medical Inc), Vygon S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the huber needles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global huber needles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the huber needles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The huber needles market was valued at USD 51.6 Million in 2024.

The huber needles market is projected to exhibit a CAGR of 4.30% during 2025-2033, reaching a value of USD 75.4 Million by 2033.

The market is driven by the rising prevalence of cancer and chronic diseases, increasing demand for implantable ports, and advancements in needle design. Growing hospital admissions, stringent safety regulations, improved healthcare infrastructure, and favorable reimbursement policies further boost market growth. Additionally, increasing awareness of infection control enhances adoption rates.

North America currently dominates the huber needles market, accounting for a share of 42.7%. Rising cancer cases, advanced healthcare infrastructure, favorable reimbursement, infection control awareness, and increasing implantable port usage drive market growth.

Some of the major players in the huber needles market include B. Braun Medical Inc., Becton, Dickinson and Company, Exelint International Co., Medline Industries, Medsurg, Smiths Medical Inc. (ICU Medical Inc), Vygon S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)