Household Insecticides Market Size, Share, Trends and Forecast by Product Type, Composition, Packaging, Application, Distribution Channel, and Region, 2025-2033

Household Insecticides Market Size and Share:

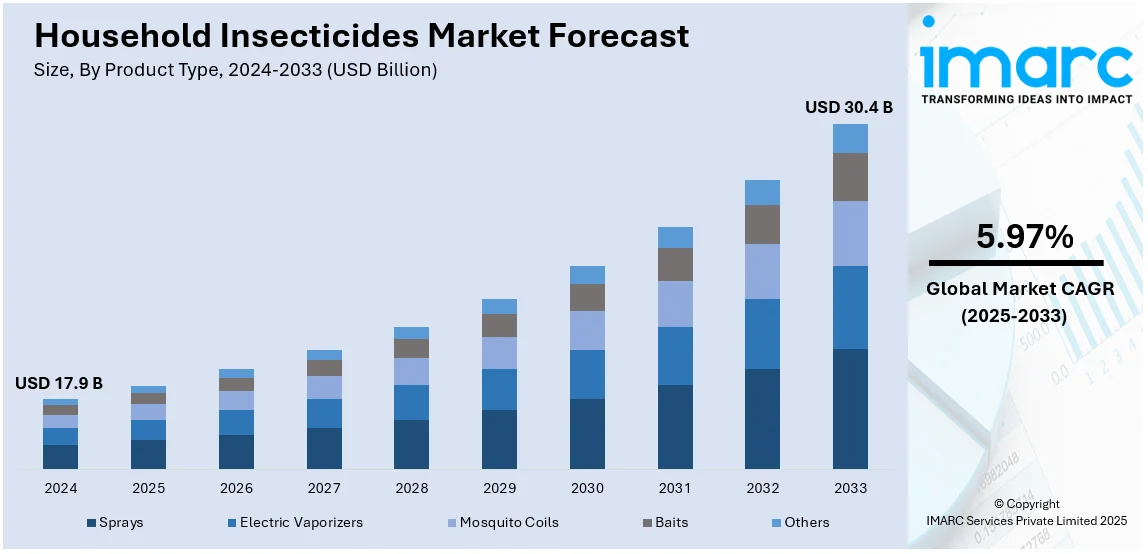

The global household insecticides market size was valued at USD 17.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 30.4 Billion by 2033, exhibiting a CAGR of 5.97% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 43.6% in 2024. The market is experiencing steady growth driven by the escalating demand for pest control solutions due to global urbanization, the rising shift towards eco-friendly and natural products is influencing market trends and continuous technological advancements in product formulations and application methods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.9 Billion |

|

Market Forecast in 2033

|

USD 30.4 Billion |

| Market Growth Rate 2025-2033 | 5.97% |

The household insecticides market share is witnessing significant growth, driven by heightened awareness of hygiene and the health risks posed by pests. Urbanization and improving living standards have increased the demand for effective pest control, especially in densely populated areas. Private organisations and government-backed public health initiatives, such as the World Health Organization's Global Strategic Preparedness, Readiness, and Response Plan (SPRP), launched on October 3, 2024, aim to reduce disease and mortality from dengue, Zika, and chikungunya, further stimulating market growth. The ongoing shift toward eco-friendly and natural formulations appeals to environmentally conscious consumers, while e-commerce expansion enhances accessibility. Seasonal growth in vector-borne diseases also amplify the need for efficient household insecticide solutions.

The United States is a major regional market is primarily growing due to increasing awareness of pest-borne diseases and their public health impact. Urban gardening and outdoor living trends have heightened the demand for pest control solutions in residential spaces. Continual advancements in non-toxic, residue-free formulations address safety concerns, especially for families with children and pets. Notably, the U.S. EPA announced, on October 22, 2024, the final cancellation of pesticide DCPA, citing its risks to fetal thyroid development, including irreversible harm to brain and motor skills. AMVAC voluntarily ceased DCPA production, initiated returns, and EPA will oversee proper disposal. Rising disposable incomes and the demand for ready-to-use products further stimulate the household insecticides market growth insights. The growing adoption of smart insect-repellent technologies appeals to tech-savvy consumers, while seasonal pest outbreaks and climate variations continue to drive the need for effective insecticides.

Household Insecticides Market Trends:

Rapidly Increasing Urbanization

The global market is significantly driven by rising urbanization across various regions. According to the data by the World Bank, some 56% of the world’s population – 4.4 billion inhabitants live in cities today. This trend is anticipated to persist, with the number of urban residents more than growing twice as large, encompassing close to seven out of ten people will reside in cities. As urban areas expand, the density of human populations increases, leading to more waste generation and stagnant water bodies, which become ideal breeding grounds for pests. These conditions necessitate the adoption of insecticides to maintain hygiene and health standards, preventing insect-borne diseases. Urban lifestyles also promote the demand for convenient, ready-to-use insecticide formulations, propelling market growth. Moreover, the urban demographic tends to have higher awareness and affordability for such products, further augmenting market expansion. This trend is particularly noticeable in emerging economies, where rapid urbanization is accompanied by growing middle-class populations seeking improved living conditions.

Growing Health Awareness and Disease Prevention

As per the household insecticides market forecast report, improved awareness about health, hygiene, and the need for a clean-living environment is emerging as a critical driver of demand. The increasing prevalence of insect-borne diseases like malaria, dengue, and Zika virus is also driving preventive efforts. More than 3.9 billion people in over 132 countries are exposed to a risk of getting infected by dengue, while the approximate 96 million symptomatic cases are estimated every year along with the estimated deaths of about 40,000 each year. Increasingly aware of the health risks that these insects’ infestations may bring, consumers are opting for such insecticides to secure their living places. This preventive approach is supported through health organizations promoting the use of insecticides as an imperative step in combating vector-borne diseases. Consequently, the market for such products is increasing demand for these products that are effective, safe, and environmentally friendly, which is driving the innovation in formulation and delivery systems in the sector.

Innovation and Eco-friendly Solutions

The market is experiencing a transformative shift driven by consumer preference for innovative and eco-friendly solutions. There is a growing demand for products that are effective against pests, with minimal harmful impact on the environment, and also safe for humans. This is leading to significant advancements in product formulations, with manufacturers increasingly focusing on natural ingredients and sustainable practices. Bio-insecticides and products formulated with plant extracts are gaining traction, appealing to health-conscious consumers and those concerned with environmental sustainability. Many consumer brands such as Global Consumer Products, Team One Biotech etc. have already launched their eco-friendly mosquito repellents. These innovations are supported by stringent regulatory frameworks that mandate reduced chemical usage and lower toxicity levels, encouraging the development of safer, more eco-conscious insecticide options, thereby propelling market growth.

Household Insecticides Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global household insecticides market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, composition, packaging, application, and distribution channel.

Analysis by Product Type:

- Sprays

- Electric Vaporizers

- Mosquito Coils

- Baits

- Others

Sprays leads the market with around 35.6% of market share in 2024. The spray segment holds a significant share in the market, favored for their convenience, instant action, and ease of application. Furthermore, these products are popular among consumers seeking quick and effective solutions for eliminating insects, with offerings ranging from chemical-based formulations to natural and organic alternatives. The versatility of sprays, suitable for various indoor and outdoor applications, along with continuous innovations in formulation to improve safety and efficacy, keeps this segment in high demand.

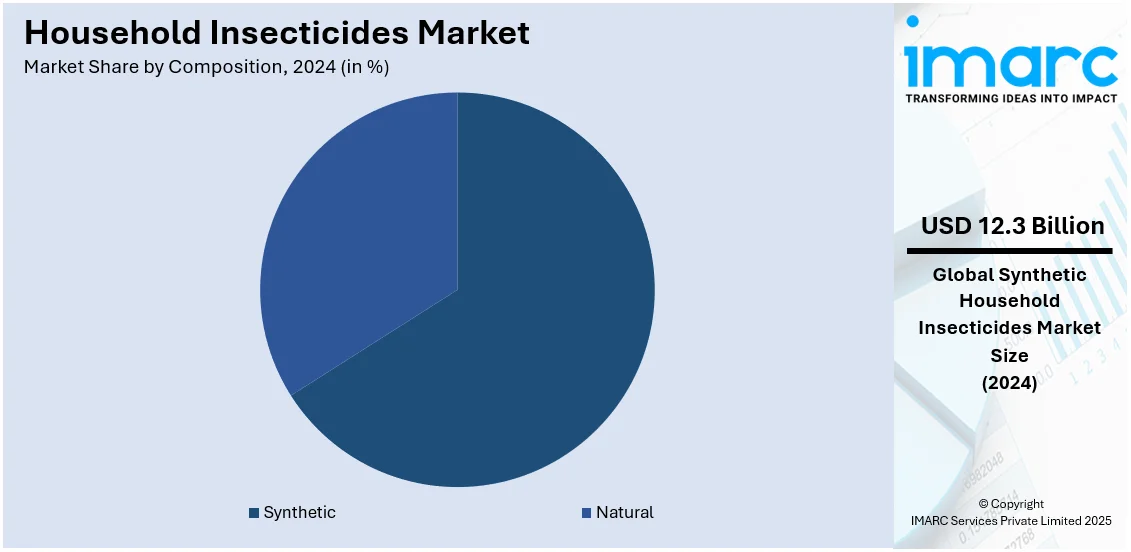

Analysis by Composition:

- Natural

- Citronella Oil

- Geraniol

- Others

- Synthetic

- N,N-Diethyl-Meta-Toluamide (DEET)

- Hydroxyethyl Isobutyl Piperidine Carboxylate (Picaridine)

- Others

Synthetic leads the market with around 68.5% of market share in 2024. The synthetic segment holds a dominant position in the market, driven by its longstanding use, affordability, and proven effectiveness. These insecticides commonly feature active ingredients like pyrethroids, organophosphates, or carbamates, which are highly effective against a wide range of household pests. Their fast-acting properties and availability in diverse formulations, including sprays, baits, and aerosols, render them a preferred choice among consumers. This versatility ensures they address various pest control needs efficiently while remaining accessible to a broad audience.

Analysis by Packaging:

- Small

- Medium

- Large

Small lead the market with around 38.5% of market share in 2024. The small packaging segment in the market caters to consumers seeking convenience, portability, and trial options before committing to larger quantities. These packages are ideal for individuals living in smaller living spaces, such as apartments or urban dwellings, where storage space is limited, and the volume of insecticide needed is lower. Small packages are also favored for their affordability, allowing consumers to test the effectiveness of a product or explore new formulations without a significant financial outlay. The demand for small packaging is further bolstered by the growing trend of eco-conscious consumers who prefer purchasing smaller quantities to avoid excess and minimize environmental impact.

Analysis by Application:

- Cockroaches

- Ants

- Files & Moths

- Mosquitoes

- Rats & Rodents

- Bedbugs & Beetles

- Others

Mosquitoes leads the market with around 33.6% of market share in 2024. The mosquito segment is critically important in the market, especially in areas prone to mosquito-borne diseases such as dengue, Zika virus, and malaria. This segment offers a range of products, including coils, electric vaporizers, sprays, and lotions, formulated to repel or kill mosquitoes. Consumer demand in this segment is high due to the health risks associated with mosquitoes, driving continuous innovation in safer and more effective mosquito control solutions.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- General Stores

- Online Stores

- Others

Supermarkets and hypermarkets lead the market with around 42.5% of market share in 2024. Supermarkets and hypermarkets segment represents a major distribution channel for household insecticides, offering consumers the convenience of purchasing along with their routine grocery and household shopping. Supermarkets and hypermarkets provide a wide array of insecticide brands and formulations, catering to diverse consumer preferences and needs. These retail giants benefit from high foot traffic, which ensures high visibility and accessibility for various insecticide products, enabling customers to compare options and make informed decisions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 43.6%. The Asia Pacific region represents a rapidly expanding market, fueled by significant urbanization, rising living standards, and growing awareness of the health risks associated with pest infestations. In addition to this, the climate diversity across the region contributes to a wide range of pest-related challenges, thereby demanding varied insecticide solutions. The market is also witnessing an ongoing shift towards natural and safer products, although affordability remains a decisive factor for a large segment of the consumer base.

Key Regional Takeaways:

United States Household Insecticides Market Analysis

In 2024, the United States accounted for 80.20% of the North America household insecticides market. Growing awareness of vector-borne illnesses like Lyme disease and West Nile virus is driving the market for household pesticides in the United States. The need for efficient pest management methods is growing as more than 50,000 cases of tick-borne illnesses are documented each year, according to the data by Centre for Disease Control and Prevention. Since 2004, the number of VBD cases dramatically increased; in the United States, almost 1 Million cases were documented between 2001 and 20231. During this time, the number of VBD cases recorded annually more than doubled. For instance, the number of treated Lyme disease cases may be ten times greater than the number reported to the CDC, and it is predicted that only one out of ten West Nile virus infections are reported. The real number of cases may be significantly greater, which would increase the demand for protection and support market expansion. The need for pest management is also growing given urbanisation and population expansion, especially in urban regions where pests are more prevalent.

The trend towards sustainability is reflected in the development of non-toxic and ecologically friendly insecticides that appeal to individuals concerned about the environment. Additionally, the market is expanding due to consumers' growing preference for smart home pest control devices that incorporate IoT technology.

With online sales of pesticides increasing at double-digit rates every year, e-commerce sites like Amazon and Walmart are essential to product accessibility. Consumer confidence and market stability are guaranteed by regulatory support from organisations like the EPA, which keeps an eye on the safety and effectiveness of pesticides. The U.S. market is anticipated to continue growing steadily due to improvements in pesticide formulations and growing health consciousness.

Europe Household Insecticides Market Analysis

The temperate climate of Europe, which promotes the breeding of flies, mosquitoes, and other insects during warmer months, influences the household insecticide market. The European Centre for Disease Prevention and Control has reported a high number of dengue and chikungunya cases, which raises public awareness of insect-borne diseases and fuels demand for preventive measures. Since the start of the year 2024, more than 8,000 cases of dengue have been confirmed in French Guyana as of August 2024. In total, La Reunion has recorded 1,265 dengue cases since the start of the year and as of August 2024.

Due to strict EU laws on the use of chemicals and consumer desire for sustainable products, eco-friendly and organic pesticides are becoming more popular in the region. Leading markets include Germany, France, and Italy, and growing urban populations are making residential pest problems worse. Products that are odourless and residue-free are examples of technological innovations that have enhanced consumer experiences and increased adoption. Product availability is improved by expanding e-commerce channels and retail chains like Tesco and Carrefour. The market for home insecticides in Europe is expected to increase steadily due to rising health consciousness and support for eco-friendly products.

Asia Pacific Household Insecticides Market Analysis

The market for home insecticides is expanding at the quickest rate in Asia-Pacific attributed to the region's tropical environment, dense urbanisation, and rising rates of vector-borne illnesses including dengue and malaria. Key markets include China and India, where governments are launching extensive initiatives to raise awareness about mosquito control. For instance, In India, a national government initiative called the National Vector Borne Disease Control Programme (NVBDCP) works to prevent and manage vector-borne illnesses such as dengue, chikungunya, malaria, kala-azar, Japanese encephalitis (JE), and lymphatic filariasis. Another initiative that aids in preventing malaria and other illnesses spread by mosquitoes is the Urban Malaria Scheme (UMS). To help protect residents in 131 communities in 19 states and one union territory, the UMS gives state governments 100% grants.

Urbanisation and rising disposable incomes fuel demand for contemporary pesticide remedies, such as aerosols and electric repellents. Innovation helps the market, as seen in products like organic and herbal insecticides that appeal to consumers who are health conscious. Both urban and rural market penetration are further supported by the growth of organised retail and e-commerce. With more than 70% of dengue cases worldwide occurring in the region each year, public health campaigns and shifting consumer habits are predicted to strengthen demand for household pesticides.

Latin America Household Insecticides Market Analysis

The tropical environment of Latin America, which encourages large pest population, is the primary driver of the household pesticides business in the region. Due to the prevalence of diseases like dengue, chikungunya, and Zika, efficient pest control measures are required. In 2023, Brazil more than 35,000 cases of Zika virus disease, making it the Latin American country with the highest prevalence of infections caused by Zika virus among selected nations. The government of Brazil, one of the biggest markets, is supporting projects to eradicate mosquitoes. The use of high-end pesticides, such as electric repellents and sprays, is growing due to rising urbanisation and an expanding middle class. The growing desire for environmentally friendly solutions is reflected in the growing popularity of plant-based product innovations. In rural areas, e-commerce platforms are making insecticides more accessible, which is bolstering market expansion. Latin America is a major growth market for home insecticides due to a combination of health concerns, urbanisation, and new product offers.

Middle East and Africa Household Insecticides Market Analysis

High rates of malaria and other vector-borne illnesses are driving the demand for home pesticides across the Middle East and Africa. More than 90% of malaria deaths worldwide occur in Sub-Saharan Africa, which is raising the need for efficient pesticides. In nations like South Africa, Kenya, and the United Arab Emirates, the use of contemporary pest management technologies increased due to urbanisation and rising disposable incomes. Given the health and environmental concerns, non-toxic and herbal pesticides are becoming increasingly popular. Improved product availability and favorable government initiatives to control mosquitoes fuel market expansion. For producers of insecticides, this area continues to be a crucial growth frontier.

Competitive Landscape:

Key players in the market are actively engaging in research and development (R&D) to introduce innovative, safe, and eco-friendly products, responding to the growing consumer demand for sustainability and health safety. They are focusing on expanding their product portfolio through technological advancements, such as improved formulations and delivery systems, to enhance efficacy and user convenience. Along with this, strategic mergers, acquisitions, and partnerships are prevalent as companies aim to broaden their market reach and strengthen their market positions. Additionally, these players are investing in marketing and branding efforts to build customer loyalty and increase awareness of their product offerings, adapting to the changing consumer preferences and regulatory landscapes.

The report provides a comprehensive analysis of the competitive landscape in the household insecticides market with detailed profiles of all major companies, including:

- Amplecta AB

- BASF SE

- Bayer AG

- Dabur India Limited

- Earth Corporation

- Godrej Consumer Products Limited

- HPM Chemicals & Fertilizers Ltd.

- Jyothy Laboratories Ltd.

- NEOGEN Corporation

- Reckitt Benckiser Group plc

- S. C. Johnson & Son, Inc.

- Spectrum Brands Holdings, Inc.

- Sumitomo Chemical Co., Ltd.

- Zapi S.p.A.

- Zhongshan Lanju Daily Chemical Industry Co Ltd.

Latest News and Developments:

- August 2024: Flora-scent Organics introduced innovative mosquito-repellent incense sticks that are citronella-free and claimed to be five times more effective than traditional options. A special combination of plant oils, such as peppermint, rosemary, cedarwood, and geraniol from geranium oil, are used to make these environmentally friendly sticks.

- July 2024: Godrej Consumer Products (GCPL) said that it has created a proprietary chemical called "Renofluthrin" that repels mosquitoes and incorporated it into its household insecticide products.

- May 2024: The pyrethrum herb's essential oil is used to make BASF's SUWEIDA natural pyrethrin insecticide aerosol. This solution effectively repels a variety of pests, such as flies and mosquitoes, while being less harmful to people and pets. The aerosol's precision application and fixed-dosage spray design minimise waste and its negative effects on the environment.

- Feb 2023: Godrej Consumer Products Ltd (GCPL) has launched two homegrown innovations; low-cost liquid mosquito repellent device and a no-gas instant mosquito–kill spray. Experts from Fortis Hospital Noida, Malaria No More India, and the National Centre for Vector-Born Disease Control were present when the goods were introduced.

Household Insecticides Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Electric Vaporizers, Mosquito Coils, Baits, Others |

| Compositions Covered |

|

| Packagings Covered | Small, Medium, Large |

| Applications Covered | Cockroaches, Ants, Files & Moths, Mosquitoes, Rats & Rodents, Bedbugs & Beetles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, General Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amplecta AB, BASF SE, Bayer AG, Dabur India Limited, Earth Corporation, Godrej Consumer Products Limited, HPM Chemicals & Fertilizers Ltd., Jyothy Laboratories Ltd., NEOGEN Corporation, Reckitt Benckiser Group plc, S. C. Johnson & Son, Inc., Spectrum Brands Holdings, Inc., Sumitomo Chemical Co., Ltd., Zapi S.p.A., Zhongshan Lanju Daily Chemical Industry Co Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the household insecticides market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global household insecticides market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the household insecticides industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The household insecticides market was valued at USD 17.9 Billion in 2024.

The household insecticides market is projected to exhibit a CAGR of 5.97% during 2025-2033, reaching a value of USD 30.4 Billion by 2033.

The market is primarily driven by rising urbanization, increased awareness of pest-borne diseases, and a growing demand for eco-friendly products, ongoing technological advancements in formulations and delivery methods ensure improved safety, efficacy, and convenience.

Asia Pacific currently dominates the market, accounting to a share of over 43.6%, driven by increasing population density, rising awareness of vector-borne diseases, expanding middle-class income, heightened hygiene concerns, strong retail networks, and innovative product.

Some of the major players in the household insecticides market include Amplecta AB, BASF SE, Bayer AG, Dabur India Limited, Earth Corporation, Godrej Consumer Products Limited, HPM Chemicals & Fertilizers Ltd., Jyothy Laboratories Ltd., NEOGEN Corporation, Reckitt Benckiser Group plc, S. C. Johnson & Son, Inc., Spectrum Brands Holdings, Inc., Sumitomo Chemical Co., Ltd., Zapi S.p.A., and Zhongshan Lanju Daily Chemical Industry Co Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)