Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, End-Use, Packaging, Distribution Channel, and Region, 2026-2034

Hot Sauce Market Size and Share:

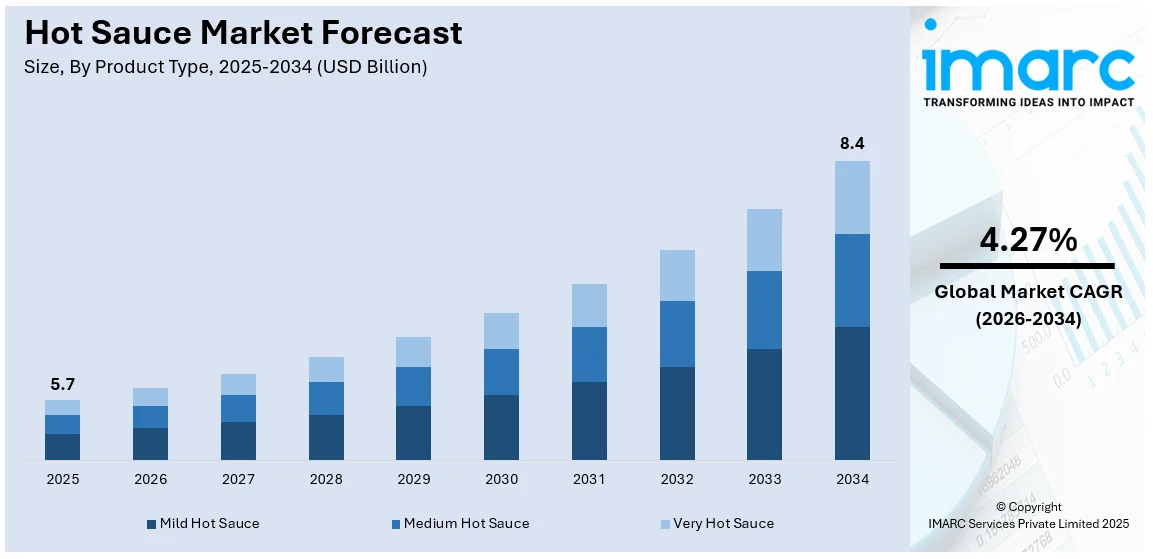

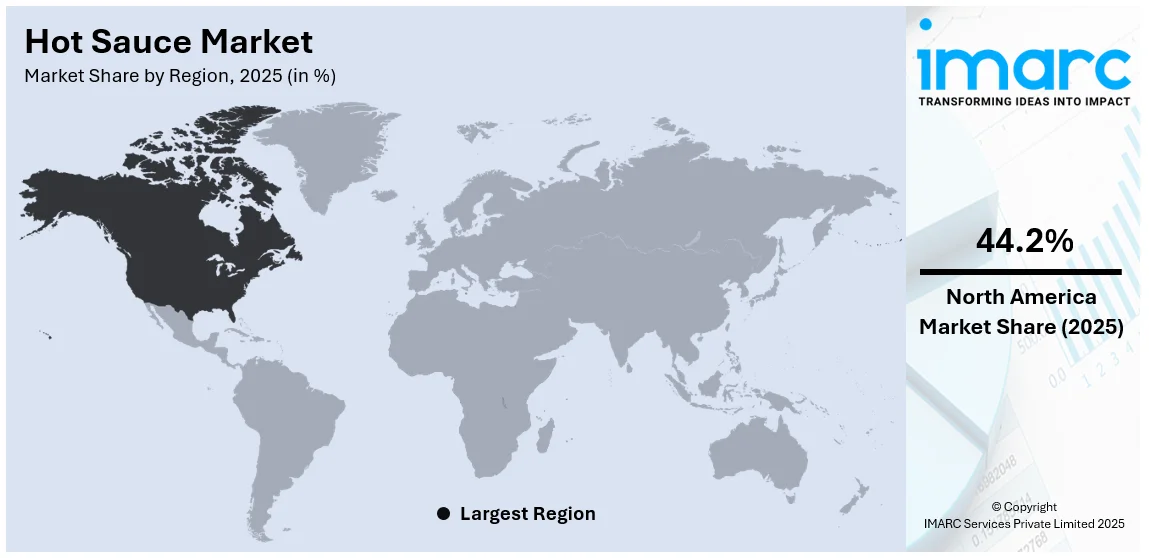

The global hot sauce market size was valued at USD 5.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 8.4 Billion by 2034, exhibiting a CAGR of 4.27% from 2026-2034. North America currently dominates the market, holding a market share of over 44.2% in 2025. The hot sauce market share in North America is growing because of increasing consumer preferences for spicy foods, rising interest in international cuisines, and higher demand for innovative hot sauces.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.7 Billion |

|

Market Forecast in 2034

|

USD 8.4 Billion |

| Market Growth Rate 2026-2034 | 4.27% |

With a growing focus on healthier eating habits, many consumers are turning to hot sauces as a flavorful, low-calorie alternative to other condiments. Hot sauces often contain natural ingredients like chili peppers, vinegar, and spices, making them an appealing choice for health-conscious individuals. Moreover, certain hot sauces are promoted as gluten-free, sugar-free, and vegan, expanding their attractiveness to individuals with particular dietary preferences. In addition, the increasing availability of hot sauces through supermarkets, hypermarkets, and online shopping platforms is broadening their distribution. Individuals can readily discover a diverse selection of hot sauces at local outlets or online, simplifying the process for both new and returning shoppers to buy them. The ease of purchasing both in-person and online is contributing to the extensive distribution of hot sauce items throughout international markets.

To get more information on this market Request Sample

The United States represents an important part of the market, fueled by an increase in premium, artisanal, and gourmet hot sauces that attract consumers seeking quality ingredients, distinctive flavor profiles, and small-batch manufacturing. The rise of craft and specialty hot sauces is forming a new market segment, appealing to culinary enthusiasts and individuals in search of unique flavor experiences. Moreover, buyers are placing greater emphasis on sustainability and ecological effects in their buying choices. Companies are reacting by endorsing eco-friendly sourcing and manufacturing practices to attract environmentally-aware consumers seeking to lessen their ecological impact. In 2023, Barnacle Foods based in Juneau, Alaska, introduced a kelp-infused habanero hot sauce crafted with fresh kelp from Alaska, habanero, and sweet mango. The firm, recognized for its kelp products such as salsas and jams, sought to promote sustainable kelp farming in conjunction with conventional seafood industries. This item embodied their goal to support ocean-friendly food options.

Hot Sauce Market Trends:

Increasing Cultural Diversity

The hot sauce industry overview is significantly influenced by an increasing cultural diversity and culinary exploration among consumers. People are more exposed than ever to different cultures and cuisines, leading to heightened curiosity and willingness to experiment with new flavors. Hot sauce, with its myriads of flavors and origins, such as Mexican salsas and fiery Thai sauces, represents a symbol of this culinary exploration. It is not only utilized in restaurants but also in home cooking, wherein individuals are increasingly trying their hands on recreating global dishes. For example, the US has the largest Mexican population, which is followed by India and China. This shift is further reflected in demographic trends, according to the Census Bureau, as of July 1, 2023, the Hispanic population accounted for 19.5% of the total US population, making it the nation’s largest racial or ethnic minority. The evolving dietary patterns of individuals are catalyzing the demand for ethnic and regional cuisine.

Rising Popularity of Ethnic Cuisines

The rising popularity of ethnic cuisines, particularly across Latin America, the Caribbean, and parts of Asia, which are known for their spicy flavors, is propelling the hot sauce market business opportunity. These cuisines often feature hot sauce as a staple condiment, integral to the authenticity of their flavors. Furthermore, the increasing number of ethnic restaurants and food trucks in major cities across the world is acting as another growth-inducing factor. According to IMARC Group, the global ethnic foods market size reached USD 58.4 Billion in 2024, and is projected to grow to USD 113.8 billion by 2033, at a CAGR of 7.7% from 2025 to 2033. Furthermore, people are becoming more adventurous with their food choices, which is catalyzing the demand for ethnic cuisines and hot sauces. For instance, consumers across the globe are widely inclining towards gourmet cuisines. According to hot sauce industry statistics, new major players are expected to gain significant opportunities by creating a wide array of product varieties. For example, in January 2024, TRUFF, a global hot sauce and condiments company, introduced the TRUFF Jalapeno Lime Hot Sauce.

Emerging Health and Wellness Trends

Modern consumers are becoming conscious about their dietary choices and seeking products that offer health benefits without compromising on flavor. In line with this, hot sauces made with natural ingredients like chili peppers, garlic, and vinegar align well with this health-oriented approach. They are known for their health benefits, including pain relief, weight loss support, and anti-inflammatory properties. According to the Global Wellness Institute, the wellness economy is projected to reach nearly USD 9.0 Trillion by 2028, highlighting the increasing consumer focus on functional foods and clean-label products. Additionally, many hot sauces are low in calories and free from artificial additives, aligning with the growing demand for clean-label products. The shift towards home cooking, where individuals have more control over the ingredients they use, are boosting the market growth.

Innovations in Flavors and Varieties

Hot sauce industry top brands are constantly experimenting and introducing new flavors to meet the evolving tastes and preferences of consumers. For instance, in February 2022, McCormick & Co. collaborated with Campbell Soup Co.'s Goldfish brand, to re-launch Goldfish Frank's Red-Hot crackers. The integration of fruits, such as mango, pineapple, and raspberry in hot sauces, catering to a segment of consumers looking for a blend of sweet and spicy flavors, is boosting the market growth. Additionally, the use of various types of peppers, herbs, and spices, leading to a proliferation of distinct and regional hot sauce flavors, is positively influencing the market growth. The growing trend of gourmet and artisanal hot sauces that emphasize quality, locality, and traditional production methods, is positively influencing the market. Besides this, continuous experiments with aging processes, fermentation, and unusual ingredient combinations, adding depth and complexity to the flavors, are positively influencing the hot sauce market outlook.

Growing Fast Food and Food Service Industries

Fast food chains and restaurants across the globe are incorporating spicy items into their menus, responding to consumer demand for more flavorful and diverse food options. Hot sauce is an integral component in many spicy offerings, used either as an ingredient in food preparation or as a condiment offered alongside meals. Furthermore, the emerging trend of customizable meals in fast food and casual dining restaurants, allowing consumers to tailor the spice level of their food, often through a selection of hot sauces, is supporting the market growth. According to the National Restaurant Association, the foodservice industry is forecast to reach USD 1.5 Trillion in sales by 2025, highlighting the increasing opportunities for hot sauce brands to expand their presence in this sector.

Hot Sauce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hot sauce market, along with forecast at the global and regional levels from 2026-2034. The market has been categorized based on product type, application, end-use, packaging, and distribution channel.

Analysis by Product Type:

- Mild Hot Sauce

- Medium Hot Sauce

- Very Hot Sauce

The mild hot sauce category is leading the market, holding a share of 42.7%, as it appeals to a wide audience, encompassing individuals who enjoy gentle heat and newcomers to hot sauces. The mild hot sauce provides a subtle heat that enhances rather than overshadows the flavors of the food, making it appealing to a broader audience. It possesses a deep flavor, blending spices and components such as garlic, onion, and different herbs, which elevates the overall taste without overpowering it. This adaptability enables its use in numerous culinary contexts, including marinades and dressings, as well as dipping sauces and toppings for different dishes. Additionally, mild hot sauces attract families and individuals who like to enhance their dishes with a hint of warmth without experiencing intense heat. With the increasing demand for flavorful, balanced condiments, the mild hot sauce category continues to be a mainstay in numerous homes.

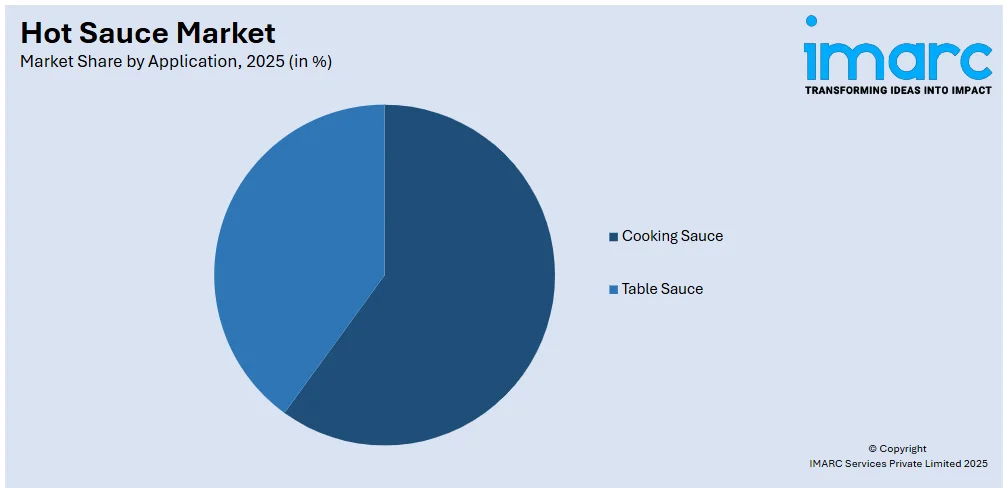

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Cooking Sauce

- Table Sauce

Cooking sauce leads the market with 60.6% of market share in 2025. It represents the largest segment because of its versatility and essential contribution to improving the flavor profiles of different dishes. This hot sauce is intended to be incorporated as a component in the cooking process, providing both heat and richness to various types of cuisines. Cooking sauce provides a convenient method to add intense, flavorful heat to recipes, whether incorporated in marinades, stir-fries, stews, soups, or grilled meals. Its versatility in professional kitchens and home cooking makes it essential for both chefs and everyday users. Moreover, cooking sauce is frequently made with harmonious flavors that enhance, instead of overshadowing, the other components in a dish, guaranteeing it elevates the overall flavor. The rising appeal of international and ethnic cooking, along with the heightened curiosity of individuals to try various flavors, is catalyzing the demand for cooking sauce, establishing it as a leading category in the hot sauce market.

Analysis by End-Use:

- Commercial

- Household

In 2025, commercial accounted for the largest market share of 55.9%. It leads the market due to the escalating demand from restaurants, foodservice chains, and food manufacturers. Commercial establishments depend on hot sauces as key components to devise uniform, tasty dishes that attract a wide variety of clients. The production of commercial hot sauce emphasizes large-scale operations to satisfy the demands of high-volume kitchens, guaranteeing that the product is easily accessible in bulk while preserving quality and flavor. Many fast-food chains and casual dining restaurants also incorporate hot sauces to set their offerings apart, enriching their menus with distinctive spicy flavors that draw in individuals. The rising trend of spicy foods, along with consumer preferences for bold and adventurous flavors, is establishing hot sauces as an essential element in the food industry. With the growing consumer appetite for varied and distinctive dining experiences, the commercial utilization of hot sauces is anticipated to stay a leading presence in the market.

Analysis by Packaging:

- Jars

- Bottles

- Others

Jars hold the biggest market share because of their practicality, sturdiness, and capacity to maintain the quality of hot sauces. Glass jars are especially favored because they offer an airtight seal, which aids in preserving the taste and freshness of the sauce for longer periods. They provide a high-end appearance that attracts buyers looking for quality and genuineness in their items. Additionally, jars are simple to organize and showcase, which makes them a favored option for both sellers and buyers. The broad-opening design of jars facilitates easy pouring and regulated dispensing, improving the user experience, especially for home chefs who incorporate hot sauce into numerous cooking methods. Additionally, jars tend to be recyclable and environment-friendly, reflecting the increasing consumer demand for sustainable packaging. The blend of usability, conservation advantages, and sustainability is establishing jars as a top packaging option in the hot sauce industry.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

Supermarkets and hypermarkets stand as the largest component in 2025, holding 44.8% of the market. They dominate the market because of their broad accessibility, convenience, and capacity to meet diverse consumer preferences. These retail stores provide a wide range of hot sauces, enabling shoppers to pick from different brands, flavors, and heat intensities all in a single location. The extensive reach of supermarkets and hypermarkets allows them to offer both popular and niche hot sauce brands, drawing in a diverse crowd, ranging from everyday buyers to food lovers. Moreover, these shops enjoy significant foot traffic, making hot sauces readily available to many consumers. The ease of shopping in-store enables consumers to evaluate products, examine labels, and make knowledgeable choices regarding their buys. Due to regular promotions, discounts, and the availability of various brands, supermarkets and hypermarkets remain the primary distribution channels, proving crucial for accessing mass-market consumers in the hot sauce sector.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America leads the market, holding a share of 44.2%, owing to a mix of cultural tastes, strong consumer appetite for spicy cuisine, and a varied culinary scene. The area has a deep-rooted history of including hot sauces in diverse cuisines, ranging from Mexican and Southern American to Tex-Mex and BBQ, establishing a robust market base. The growing trend of bold tastes and adventurous dining among consumers, particularly millennials and Gen Z, is greatly fueling the surge in hot sauce usage. Additionally, North America hosts several of the biggest hot sauce manufacturers, driving creativity in taste profiles and product varieties, including gourmet, organic, and specialty hot sauces. The robust retail infrastructure of the region, comprising supermarkets, hypermarkets, and online shopping platforms, guarantees broad availability and convenient access for shoppers. Moreover, the increasing popularity of ethnic and international cuisines is catalyzing the demand for hot sauces, reinforcing North America's leading position in the market.

Key Regional Takeaways:

United States Hot Sauce Market Analysis

The United States hot sauce market has witnessed notable growth, accounting for a share of 83.70%, driven by a rising consumer demand for bold and spicy flavors. This trend is fueled by an increasing interest in ethnic cuisines, particularly Mexican, Asian, and Caribbean foods. With more consumers opting for versatile and convenient products, hot sauces are being integrated into everyday meals, ranging from snacks to gourmet dishes. Additionally, the health-conscious movement is boosting the popularity of natural and organic hot sauces, which are made with fewer preservatives and additives. Retail channels, such as supermarkets, specialty stores, and e-commerce platforms, are making hot sauces more accessible, leading to a further increase in sales. The market also benefits from the growing popularity of gourmet and artisanal hot sauces, with a focus on unique flavors and premium ingredients. Moreover, the US retail and food services sector is showing substantial growth. According to the U.S. Census Bureau, retail and food services sales for February 2025 reached USD 722.7 Billion, marking a 0.2% increase from the previous month, adjusted for seasonal and holiday variations. This broader economic trend contributes to the continued expansion of the hot sauce market, as consumers are spending more on food-related products and exploring new culinary experiences.

Europe Hot Sauce Market Analysis

Europe's hot sauce market is experiencing growth owing to a heightened interest in diverse culinary experiences. As more consumers experiment with spicy foods, the demand for hot sauces across various cuisines is increasing. The rising trend of health-conscious eating is also playing a key role, with consumers opting for sauces with fewer artificial ingredients and preservatives. According to Viva, in 2024, there were approximately 2.5 million vegans in the UK, representing 4.7% of the adult populace. This growing vegan demographic is further influencing the hot sauce market, as vegan-friendly, plant-based options become more popular. Hot sauces are being used not only as a condiment but also in cooking, expanding their appeal beyond traditional dishes. This versatility, combined with growing consumer interest in authentic flavors and healthier alternatives, is driving the demand for both mass-produced and artisanal hot sauce varieties. Additionally, the market is benefiting from an expanding number of specialty retailers and e-commerce channels that provide a broad array of options, making hot sauces more accessible and diverse.

Asia Pacific Hot Sauce Market Analysis

The Asia Pacific hot sauce market is expanding rapidly, because of an increasing preference for spicy flavors in regional cuisines. As consumer palates evolve, the demand for both local and international hot sauce varieties is rising. This growth is further fueled by a shift in consumer behavior, with more individuals becoming experimental in their food choices, seeking bold and unique flavors to enhance their meals. The rise in food delivery services and dining out is driving the demand for convenient and versatile hot sauces that complement a wide range of dishes. Additionally, an expanding middle class across the region is fostering a larger consumer base with more disposable income to explore different culinary options. The growing exposure to global food trends is playing a pivotal role, as consumers increasingly incorporate international flavors into their diets. According to ICRA, the Indian quick service restaurant (QSR) industry’s revenue growth is expected to moderate to around 15-18% in the current fiscal year, but it is projected to improve to 18-21% in FY2025-26, indicating a positive long-term outlook for the market. This reflects the region's continued appetite for new, flavorful, and diverse hot sauce products, particularly across fast food retail chains and QSRs.

Latin America Hot Sauce Market Analysis

Latin America's hot sauce market remains strong, owing to the region's rich culinary heritage and love for bold, spicy flavors. Hot sauces are a staple in everyday meals, with demand rising for diverse and premium offerings. The market is witnessing the emergence of innovative, artisanal brands catering to evolving consumer preferences. Additionally, the growing interest in international cuisine is contributing to the market’s expansion. The region’s food industry growth further supports this trend, with Brazil’s food sector revenue increasing by almost 10% in 2024, reaching BRL 1.277 trillion representing 10.8% of the country’s GDP, according to industry reports. This economic growth fosters greater purchasing power and demand for high-quality, flavorful condiments, boosting the hot sauce market's potential.

Middle East and Africa Hot Sauce Market Analysis

The Middle East and Africa hot sauce market is evolving, with a growing preference for spicy and flavorful food options. Traditional dishes, often enhanced with hot sauces, are becoming more popular as consumers embrace bolder flavors. The market’s growth is supported by an increasing urban population and higher exposure to international food trends. Additionally, rising consumer awareness about health and wellness is catalyzing the demand for natural and additive-free hot sauces. The region’s food retail sector is also expanding, creating more opportunities for hot sauce sales. According to the USDA, Saudi Arabia’s food retail market, currently valued at USD 30 Billion, is projected to grow by another USD 15 Billion by 2030, reflecting increasing consumer spending on diverse food products, including condiments like hot sauces.

Competitive Landscape:

Major participants in the market are concentrating on product development, widening their ranges with novel flavors, heat intensities, and unique options to meet changing consumer tastes. They are putting money into research and development (R&D) to produce distinctive blends, including organic, vegan, and health-focused selections that attract a wider audience. For example, in 2025, McIlhenny Company launched TABASCO® Salsa Picante for the foodservice industry, offering a rich, thick texture and vibrant spice blend. This Mexican-style hot sauce is available in various sizes, including a bulk-friendly half-gallon and PC Packet. It’s non-GMO, vegan, gluten-free, and was rated superior in a US taste test. Moreover, numerous brands are improving their marketing approaches by utilizing social media and partnership with influencers to increase brand visibility and connect with a younger, more daring audience. These businesses are also investigating sustainable packaging options to match increasing environmental issues, choosing recyclable or eco-conscious materials. Additionally, major players are enhancing their distribution channels, boosting their visibility in both physical shops and online sites, to guarantee broader access and reach.

The report provides a comprehensive analysis of the competitive landscape in the hot sauce market with detailed profiles of all major companies, including:

- McIlhenny Company

- McCormick & Company Inc.

- Huy Fong Food

- Baumer Foods

- Garner Foods

- B&G Foods

- The Kraft Heinz Company

- SALSA TAMAZULA SA DE CV

- Bruce Foods

- Schwartz

Latest News and Developments:

- October 2024: Brooklyn Beckham entered the hot sauce market with Cloud 23, a luxury sauce featuring Hot Habanero and Sweet Jalapeño, following celebrity brands like Ed Sheeran’s Tingly Ted’s and Alice Cooper’s Poison Reaper.

- September 2024: Taco Bell introduced a limited-time sauce packet, Disha Hot™, inspired by Omar Apollo’s family recipe. The smoky, flavorful sauce celebrated his Mexican American heritage. Rewards members had early access, and Taco Bell also offered a special vinyl of Apollo’s album “God Said No” through the app.

- August 2024: McIlhenny Company launched TABASCO® Salsa Picante, its first-ever Mexican-style hot sauce, designed for Tex-Mex dishes. Made with red jalapeño peppers, the sauce is thick, preservative-free, and vegan-friendly.

- January 2024: TRUFF launched its Jalapeño Lime Hot Sauce offering a new flavor profile combining green jalapeño peppers, lime, and black winter truffle. Inspired by Latin cuisine, the sauce was available on TRUFF’s website and at Whole Foods, continuing the brand's mission to create unique, luxurious hot sauces.

- March 2024: Frank's Red Hot launched two new product lines: Dip'n Sauce and Squeeze Sauce. The Dip'n Sauces, available in buffalo ranch, roasted garlic, and golden flavors, were designed for dipping and spreading. The Squeeze Sauces, including sriracha, hot honey, and creamy buffalo, offered easy drizzling for added flavor and heat.

Hot Sauce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mild Hot Sauce, Medium Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| End-Uses Covered | Commercial, Household |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | McIlhenny Company, McCormick & Company Inc., Huy Fong Foods Inc., Baumer Foods Inc., Garner Foods, B&G Foods Inc., The Kraft Heinz Company, SALSA TAMAZULA SA DE CV., Bruce Foods, Schwartz |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hot sauce market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hot sauce market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hot sauce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hot sauce market was valued at USD 5.7 Billion in 2025.

The hot sauce market is projected to exhibit a CAGR of 4.27% during 2026-2034, reaching a value of USD 8.4 Billion by 2034.

The hot sauce market is driven by the increasing consumer demand for bold flavors, growing interest in spicy foods, and the rising popularity of international cuisines. Additionally, health-conscious consumers seek sauces with natural ingredients, while millennials and Gen Z's adventurous taste preferences fuel innovation and premium offerings in the market.

North America currently dominates the hot sauce market, accounting for a share of 44.2%. The dominance of the region is attributed to strong consumer demand and the widespread popularity of diverse culinary experiences. The well-established foodservice industry, coupled with increasing interest in ethnic flavors and premium products, further supports the market growth.

Some of the major players in the hot sauce market include McIlhenny Company, McCormick & Company, Inc., Huy Fong Foods, Inc., Baumer Foods Inc., Garner Foods, B&G Foods, Inc., The Kraft Heinz Company, SALSA TAMAZULA SA DE CV., Bruce Foods, Schwartz, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)