Hot Runner Market Report by Gate Type (Valve Gate Hot Runner, Open Gate Hot Runner), Product Type (Insulated Runner, Heated Runner), End Use Industry (Automotive, Electronic, Medical, Packaging, and Others), and Region 2026-2034

Hot Runner Market Size:

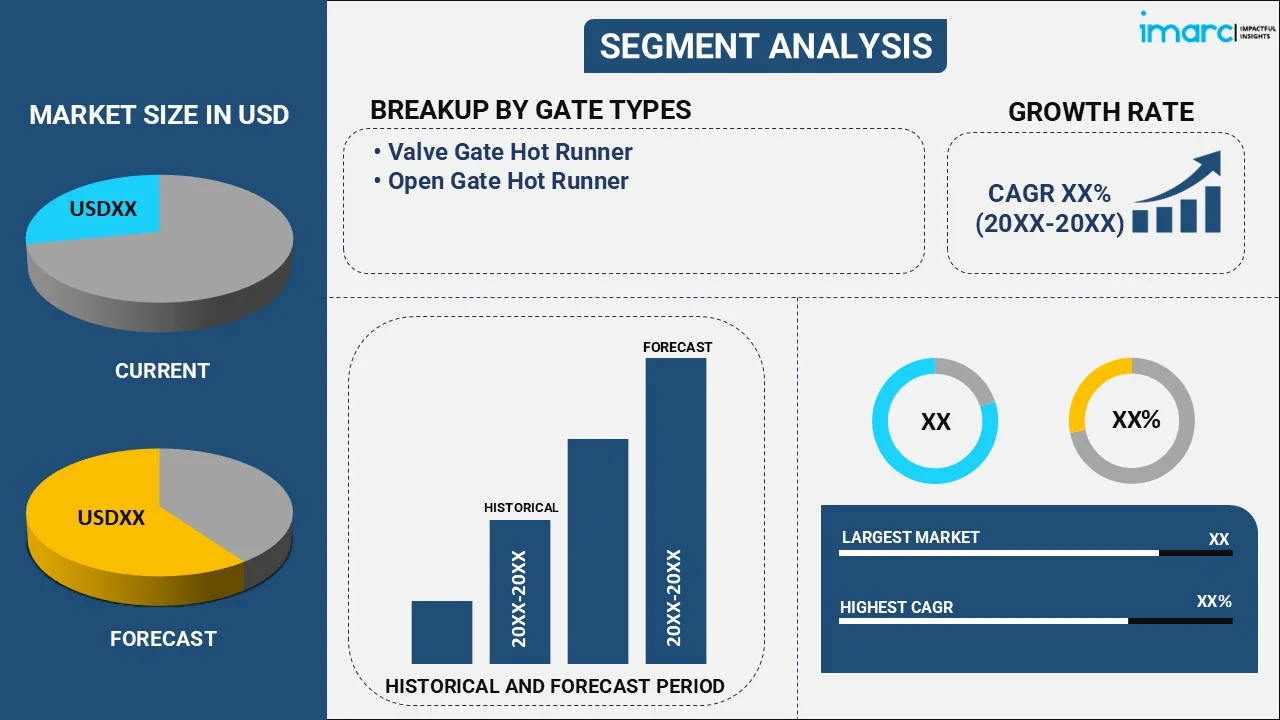

The global hot runner market size reached USD 4.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.48% during 2026-2034. The increasing demand for plastic products and components across various industries, continuous advancements in injection molding technologies, reduced production costs and enhanced product quality, and considerable growth in the packaging industry are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.4 Billion |

|

Market Forecast in 2034

|

USD 7.1 Billion |

| Market Growth Rate 2026-2034 | 5.48% |

Hot Runner Market Analysis:

- Market Growth and Size: The global market is experiencing robust growth, driven by the increasing demand for plastic products, particularly in automotive, electronics, medical, and packaging industries. The market size reflects the integral role hot runner systems play in precision plastic injection molding processes across diverse applications.

- Major Market Drivers: Key drivers include the growing demand for plastic components, advancements in injection molding technologies, and the compelling benefits of reduced production costs and enhanced product quality. Industries such as automotive and packaging prioritize hot runner systems for achieving efficiency, precision, and cost-effectiveness in the production of high-quality plastic components.

- Technological Advancements: Ongoing technological advancements in hot runner systems focus on design innovations, material enhancements, and control system improvements. Smart and connected hot runner solutions with features like insulation for energy efficiency and advanced temperature control contribute to the overall efficiency and reliability of injection molding processes.

- Industry Applications: These systems find extensive applications across industries, including automotive, electronics, medical, and packaging. These systems enable the production of intricate and high-precision plastic components, meeting the specific requirements of each industry. The versatility of hot runner technology addresses the diverse needs of manufacturers in different sectors, contributing to its widespread adoption.

- Key Market Trends: Emerging trends include a focus on energy-efficient solutions, the integration of Industry 4.0 technologies, and the application of hot runner systems in sustainable manufacturing practices. Manufacturers increasingly seek solutions that reduce material waste and energy consumption, aligning with global initiatives for environmentally responsible production processes.

- Geographical Trends: Asia Pacific leads the hot runner market, driven by dynamic industrialization, extensive manufacturing activities, and rapid economic growth. North America and Europe showcase mature markets with a focus on technological innovation, while Latin America and the Middle East, and Africa represent emerging markets with growing adoption.

- Competitive Landscape: The competitive landscape features major players actively investing in research and development, collaborations, and global expansions to maintain market leadership. The competitive environment emphasizes innovation, partnerships, and a focus on sustainability.

- Challenges and Opportunities: Challenges include data security concerns, resistance to behavioral changes, and the need for widespread adoption. Opportunities lie in sustainability-focused solutions, meeting evolving consumer demands, and navigating global supply chain complexities.

- Future Outlook: The future outlook for the global market is promising, driven by sustained technological advancements, increasing adoption across industries, and the growing recognition of hot runners as a strategic enabler for efficient and environmentally responsible plastic injection molding processes.

To get more information on this market Request Sample

Hot Runner Market Trends:

Growing demand for plastic products and components

The hot runner market is driven by the increasing global demand for plastic products and components across various industries. As plastic becomes a preferred material for manufacturing due to its versatility, cost-effectiveness, and lightweight properties, the demand for hot runner systems rises. Industries such as automotive, packaging, consumer goods, and electronics rely on hot runners to achieve precision in molding intricate plastic parts, contributing to the market's growth.

Rapid advancements in injection molding technologies

Continuous advancements in injection molding technologies propel the hot runner market forward. Innovations in design, materials, and control systems enhance the efficiency and reliability of hot runner systems. Advanced hot runner solutions offer precise temperature control, faster cycle times, and reduced material wastage, aligning with the industry's pursuit of more sustainable and cost-effective manufacturing processes.

Benefits of reduced production costs and enhanced product quality

The adoption of hot runner systems is accelerated by the compelling advantages they offer in terms of reduced production costs and improved product quality. Hot runners minimize material waste by eliminating the need for runners (the channels through which molten plastic flows), leading to cost savings. Additionally, precise control over temperature distribution ensures uniform part quality, reduced defects, and enhanced overall productivity, driving manufacturers to embrace hot runner technology for injection molding processes.

Hot Runner Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2026-2034 Our report has categorized the market based on gate type, product type, and end use industry.

Breakup by Gate Type:

To get detailed segment analysis of this market Request Sample

- Valve Gate Hot Runner

- Open Gate Hot Runner

Valve gate hot runner accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the gate type. This includes valve gate hot runner and open gate hot runner. According to the report, valve gate hot runner represented the largest segment.

The market segmentation based on gate type includes the prominent category of valve gate hot runner systems. Valve gate hot runners offer precise control over the molten plastic flow through individual valve pins, ensuring accurate filling of the mold cavities. This gate type excels in applications requiring tight tolerances and high-quality surface finishes. Valve gate hot runners provide optimal gate sealing, minimizing material waste and enabling the production of intricate and complex plastic parts with enhanced aesthetics, making them ideal for industries demanding precision and superior part quality.

On the contrary, open gate hot runner systems represent a significant category. Open gate hot runners facilitate the continuous flow of molten plastic through the gates, eliminating the need for individual valve pins. This gate type is well-suited for applications where fast cycle times and cost-effectiveness are paramount. Open gate hot runners are particularly advantageous for molding simpler parts and larger components, making them a preferred choice in industries that prioritize efficiency and economies of scale in their plastic injection molding processes.

Breakup by Product Type:

- Insulated Runner

- Heated Runner

Heated runner holds the largest share of the industry

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes an insulated runner and heated runner. According to the report, heated runners accounted for the largest market share.

The market segmentation by product type includes the significant category of Heated Runner systems. Heated runners maintain consistent and controlled temperatures throughout the runner channels to ensure the proper flow of molten plastic. These systems are particularly advantageous in applications where the molten plastic needs to remain in a fluid state during the molding process. Heated runners offer versatility and flexibility, making them suitable for a wide range of plastic injection molding applications across various industries, providing efficient and reliable solutions for manufacturers seeking consistent material flow and part quality.

On the other hand, insulated runner systems are designed with insulation materials to minimize heat loss and enhance thermal efficiency during the injection molding process. These systems contribute to energy savings and improved temperature control, crucial factors in achieving consistent part quality. Insulated runners are favored in applications where maintaining precise temperature distribution is essential for producing high-quality plastic components, making them integral to industries that prioritize efficiency and precision in their manufacturing processes.

Breakup by End Use Industry:

- Automotive

- Electronic

- Medical

- Packaging

- Others

Automotive represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electronic, medical, packaging, and others. According to the report, automotive represented the largest segment.

In the market segmentation based on end-use industries, the automotive sector stands out as a key category driving the hot runner market. The automotive industry extensively utilizes hot runner systems for the precise injection molding of plastic components, ranging from intricate interior parts to durable exterior components. Hot runners contribute to the manufacturing of lightweight and complex automotive parts, meeting the industry's demands for efficiency, precision, and cost-effectiveness in the production of high-quality plastic components.

On the other hand, the electronic industry represents a significant segment in the hot runner market. Hot runner systems play a crucial role in molding precise and intricate plastic parts used in electronic devices, including housings, connectors, and other components. The demand for miniaturized and high-precision electronic products necessitates the use of hot runners to achieve tight tolerances and consistent quality. Hot runner technology enables the electronic industry to produce complex plastic parts with enhanced accuracy, contributing to the efficiency and reliability of electronic devices.

Furthermore, the medical sector is a critical and growing segment in the hot runner market. Hot runner systems are widely employed in the production of medical devices and components, including syringes, vials, and other intricate parts. The healthcare industry demands precision, cleanliness, and repeatability in the manufacturing of medical equipment, making hot runners essential for achieving stringent quality standards. Hot runner technology ensures the production of sterile and high-quality plastic components, addressing the specific requirements of the medical industry and contributing to advancements in healthcare.

Moreover, the packaging industry is a notable segment driving the hot runner market. Hot runners are extensively used in the injection molding of plastic packaging components, such as caps, containers, and closures. The packaging sector demands high production efficiency, cost-effectiveness, and the ability to mold intricate designs. Hot runner systems provide precise control over the molding process, enabling the production of customized and aesthetically appealing packaging solutions. The technology enhances the competitiveness of the packaging industry by ensuring fast cycle times and minimizing material waste in the manufacturing of plastic packaging products.

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest hot runner market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific emerges as the largest and fastest-growing segment in the hot runner market, reflecting the region's dynamic manufacturing landscape, extensive industrialization, and the proliferation of end-use industries. Countries such as China, India, and Japan are witnessing robust demand for hot runner systems across the automotive, electronics, medical, and packaging sectors. The region's emphasis on cost-effective and efficient production processes, coupled with rapid economic growth, positions Asia Pacific as a key driver of the global hot runner market. Continuous industrial expansion and the adoption of advanced manufacturing technologies contribute to the pervasive use of hot runners in injection molding processes throughout the Asia Pacific region.

North America constitutes a significant segment in the hot runner market, driven by the region's mature manufacturing sector and technological advancements. Industries in North America, particularly in the United States, leverage hot runner systems for precision molding of plastic components across various applications. The demand for high-quality and efficient injection molding solutions in automotive, electronics, and packaging industries contributes to the prominence of the hot runner market in North America. The region's focus on innovation and adherence to stringent quality standards further propel the adoption of advanced hot runner technologies.

Europe represents a prominent segment in the hot runner market, characterized by the region's focus on technological innovation, precision engineering, and adherence to stringent quality standards. European industries, including automotive and medical, rely on hot runner systems for molding intricate plastic components with high precision and efficiency. The emphasis on sustainability and energy efficiency also drives the adoption of advanced hot runner technologies in the European manufacturing landscape.

Latin America is an emerging and promising segment in the hot runner market, experiencing increasing adoption as industries in the region recognize the benefits of efficient injection molding processes. The region's expanding manufacturing activities, coupled with the pursuit of cost-effective and sustainable production, drive the adoption of hot runner technologies.

The Middle East and Africa represent a developing segment in the hot runner market, with growing adoption in industries seeking advanced injection molding solutions. The region's focus on infrastructure development and economic diversification contributes to the adoption of modern manufacturing technologies, including hot runners.

Leading Key Players in the Hot Runner Industry:

The key players in the market are actively engaged in strategic initiatives to maintain their market leadership and address the evolving needs of the plastic injection molding industry. These industry leaders focus on continuous innovation, investing in research and development to introduce advanced features and capabilities in their hot runner systems. Collaborations and partnerships with mold makers and end-use industries are common strategies to understand specific application requirements and enhance product offerings. Furthermore, the key players are expanding their global footprint through acquisitions and mergers to strengthen their presence in key regional markets. With an increasing emphasis on sustainable and energy-efficient solutions, hot runner manufacturers are integrating technologies that reduce material waste and energy consumption, aligning with the industry's commitment to environmentally responsible practices.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Barnes Group Inc.

- CACO PACIFIC Corporation

- EWIKON Heißkanalsysteme GmbH

- Fast Heat UK Limited

- FISA Corporation

- GÜNTHER Heisskanaltechnik GmbH

- Husky Injection Molding Systems Ltd.

- INCOE Corporation

- Inglass S.p.A (OC Oerlikon Management AG)

- Milacron Holdings Corp. (Hillenbrand Inc.)

- Seiki Corporation

- Yudo Co. Ltd.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- September 22, 2023: Barnes Aerospace is pleased to announce significant milestones in partnering with Safran Aircraft Engines. The two businesses extended a long-term agreement for the repair and overhaul of components for the highly regarded LEAP and CFM engine programs. This agreement solidifies Barnes Aerospace's position as a key supplier in the aerospace industry and highlights its expertise in machining and assembly of complex engine components.

- May 1, 2021: EWIKON Heißkanalsysteme GmbH introduced the EWIKON L2X-Mikro high-performance hot runner system for small injection moulding machines, now available as a compact 4-drop version with valve gate technology for shot weights around 0.01 gram per nozzle.

- May 12, 2023: Husky Injection Molding Systems Ltd. commemorated the next phase of expansion to the company’s India facilities with ceremonies at their new offices and existing Chennai campus. The events were hosted by local leaders in the region, as well as senior executive, Robert Domodossola, President of Husky’s Rigid Packaging business.

Hot Runner Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gate Types Covered | Valve Gate Hot Runner, Open Gate Hot Runner |

| Product Types Covered | Insulated Runner, Heated Runner |

| End Use Industries Covered | Automotive, Electronic, Medical, Packaging, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Barnes Group Inc., CACO PACIFIC Corporation, EWIKON Heißkanalsysteme GmbH, Fast Heat UK Limited, FISA Corporation, GÜNTHER Heisskanaltechnik GmbH, Husky Injection Molding Systems Ltd., INCOE Corporation, Inglass S.p.A (OC Oerlikon Management AG), Milacron Holdings Corp. (Hillenbrand Inc.), Seiki Corporation, Yudo Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hot runner market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global hot runner market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hot runner industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global hot runner market was valued at USD 4.4 Billion in 2025.

We expect the global hot runner market to exhibit a CAGR of 5.48% during 2026-2034.

The rising demand for hot runners across numerous industries, including automotive, construction, consumer electronics, etc., as they aid in preventing the material from solidifying and minimizing the trimming required to smoothen the final product, is primarily driving the global hot runner market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of various end-use industries for hot runners.

Based on the gate type, the global hot runner market can be segmented into valve gate hot runner and open gate hot runner. Currently, valve gate hot runner holds the majority of the total market share.

Based on the product type, the global hot runner market has been divided into insulated runner and heated runner, where heated runner currently exhibits a clear dominance in the market.

Based on the end use industry, the global hot runner market can be categorized into automotive, electronic, medical, packaging, and others. Among these, the automotive industry accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global hot runner market include Barnes Group Inc., CACO PACIFIC Corporation, EWIKON Heißkanalsysteme GmbH, Fast Heat UK Limited, FISA Corporation, GÜNTHER Heisskanaltechnik GmbH, Husky Injection Molding Systems Ltd., INCOE Corporation, Inglass S.p.A (OC Oerlikon Management AG), Milacron Holdings Corp. (Hillenbrand Inc.), Seiki Corporation, and Yudo Co. Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)