Hospital Information System Market Size, Share, Trends and Forecast by Component, Deployment Type, System Type, End-User, and Region, 2025-2033

Hospital Information System Market Size and Share:

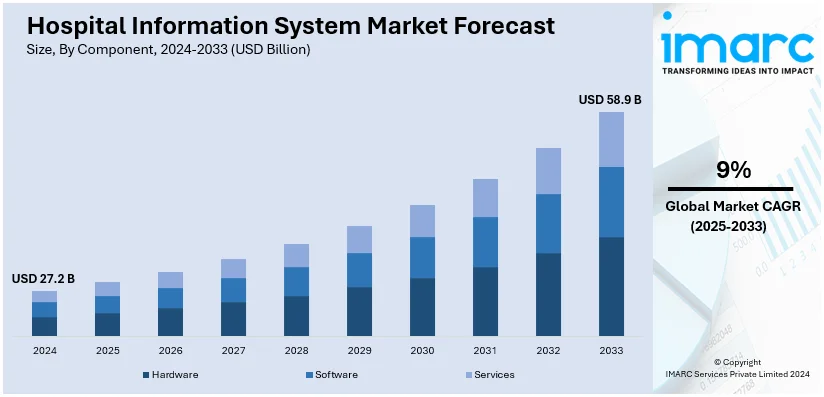

The global hospital information system market size reached USD 27.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 58.9 Billion by 2033, exhibiting a growth rate CAGR of 9% during 2025-2033. North America currently dominates the market, holding a market share of over 45.8% in 2024. This is due to the growing popularity of electronic health records, favorable government initiatives, ongoing technological advancement, and the increasing need for telemedicine and remote monitoring.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 27.2 Billion |

|

Market Forecast in 2033

|

USD 58.9 Billion |

| Market Growth Rate (2025-2033) | 9% |

The hospital information system (HIS) market is growing at a rapid rate, influenced by the rising adoption of digital healthcare solutions to increase operational efficiency and patient outcomes. The high demand for electronic health records and streamlined data management within healthcare facilities are significant growth factors. Advancements in telemedicine and remote patient monitoring also encourage HIS integration, since such systems support real-time data exchange and access to medical information remotely. The need for regulatory compliance, along with patient safety issues, is driving the demand for HIS solutions among governments and healthcare organizations and cloud based HIS seems to be the key emerging trend in this area by offering scalability, data security, and cost-effectiveness. Moreover, the increasing adoption of artificial intelligence and analytics is helping make more effective decisions and personalized care for patients. The incidence of chronic diseases is rising and requires efficient data management for long-term care and planning.

The United States has emerged as the key regional market for hospital information system. The market is witnessing rapid growth due to the increasing adoption of digital health technologies and strict healthcare regulations promoting EHRs. Demand for efficient data management, driven by the need to enhance patient care and streamline hospital operations, is fueling market expansion. Government initiatives like the HITECH Act and investments in healthcare IT infrastructure are further accelerating HIS adoption. Scalable and cost-effective, cloud-based solutions are gaining more attention, while AI and data analytics enhance decision-making. With increased telemedicine and interoperability emphasis, the U.S. market continues to lead in innovation and adoption of sophisticated hospital information systems.

Hospital Information System Market Trends:

Rising prevalence of chronic diseases

The growing prevalence of chronic diseases is driving the expansion of the hospital information system market. Chronic diseases like diabetes, cardiovascular diseases, and arthritis require continuous monitoring and continuous management, hence there is a need for advanced healthcare solutions. The National Council on Aging reported that 95 percent of people aged 60 and older have at least one chronic condition, and nearly 80 percent live with two or more. This reflects the rising trend in healthcare burdens for offering effective care and handling intricate patient data. HIS platforms enable centralization to store, analyze, and access patient information. It has continuous monitoring, personalized care plans for patients, and the following treatment protocol that contribute positively to the outcome for a patient. Moreover, growing old age and concomitant increase in chronic disease compel investment in robust healthcare infrastructures. HIS will support the sharing of information as well as health care data across the organization and provide maximum resource utilization with improved care. These factors, together with the growing demand for patient-centered care, are expected to drive the adoption of HIS across hospitals and clinics in the coming years.

Adoption of digital health technologies

Hospitals see HIS as the solution to implementing digital health technologies due to these healthcare facilities' growing demand to bring about efficiency and care service enhancements. Digital health solutions remove complex administrative tasks, minimize potential errors, and optimize workflows - necessary needs for modern healthcare. The digital health market was valued at USD 421.7 Billion in 2023 and is expected to reach USD 1,794.7 Billion by 2032, growing at a compound annual growth rate (CAGR) of 16.9% during 2024–2032, according to IMARC Group. Such growth shows a trend of the entire health sector undergoing digital transformation. HIS plays a key role in this change through the integration of electronic health records, telemedicine, and remote patient monitoring systems. Such systems enhance interoperability, thereby making it possible for healthcare providers to deliver coordinated and timely care. Additionally, improvements in mobile health applications and wearable devices create real-time patient data that can be easily incorporated into HIS for better clinical decision-making. The efficiency and accuracy provided by digital healthcare technologies are driving healthcare institutions to invest in HIS, further boosting hospital information system market growth. As the global healthcare ecosystem embraces digital innovations, HIS adoption is poised to rise, making it a cornerstone of modern medical infrastructure.

Technological Advancements

Technological innovations in enhancing the functionality and adoption of the HIS market are reshaping this area. Emerging technologies include advanced data analytics, AI, and cloud computing, which have the power to enable better patient care while improving operational efficiencies. Recently, in August 2023, HCA Healthcare Inc. collaborated with Google Cloud to integrate generative AI technology into clinical documentation processes. This partnership will make complex tasks easier to manage and help doctors and nurses concentrate more on patient care. Scalability, data security, and cost-effectiveness have been making cloud based HIS solutions more popular in healthcare institutions. The ability of AI tools to analyze a huge amount of patient data, track trends, predict outcomes, and help in creating individualized treatment plans also makes it a favorite for healthcare institutions. These innovations enable smooth data management, better patient monitoring, and improved decision-making. As healthcare systems become more data-driven, the adoption of cutting-edge technologies within HIS is expected to gain pace. The increasing adoption of these solutions points to the role of HIS in transforming healthcare delivery, ensuring improved patient outcomes and streamlined operations.

Hospital Information System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hospital information system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment type, system type, and end user.

Analysis by Component:

- Hardware

- Software

- Services

In 2024, software represents the largest segment with a share of 47.8%. Its growth is highly dependent on digitization happening in healthcare and the number of EHRs telemedicine platforms and other clinical decision support systems rising in numbers. Software applications are helpful in the management of patient data, efficient workflow improvement, and enhanced communication with different departments. The growing emphasis on interoperability and compliance with healthcare regulations, such as the Health Information Technology for Economic and Clinical Health (HITECH) Act in the U.S., is further boosting the demand for robust software solutions. Technological advancements, including artificial intelligence (AI) and machine learning, are enhancing software capabilities, enabling predictive analytics and real-time clinical decision-making. Besides, software systems in their flexibility and scalability fit every healthcare setting from small clinics to large hospitals. Investment into healthcare IT infrastructure and more awareness about the advantages of digitized operations boost HIS software adoption globally. As healthcare facilities continue the process of decreasing administrative workload and improving the quality of services offered to patients, innovative software solutions are in greater demand. This makes it the biggest and most profitable share in the HIS market.

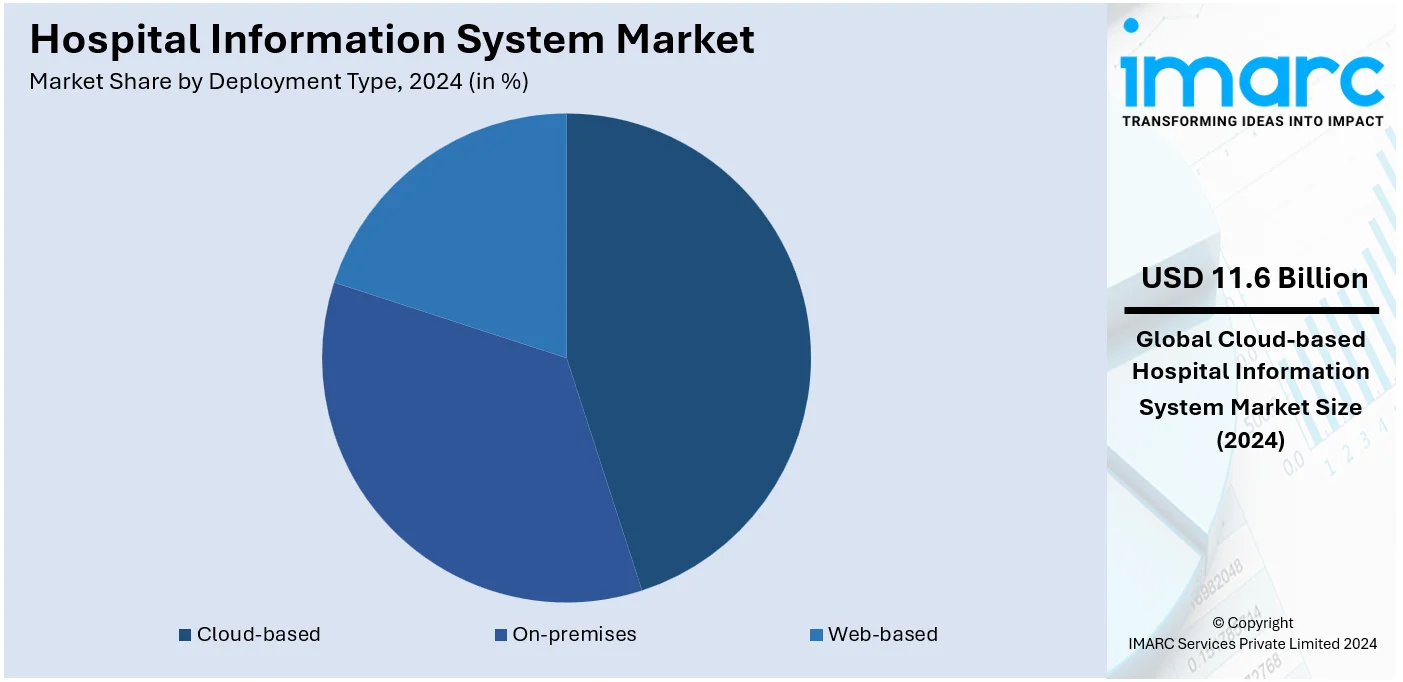

Analysis by Deployment Type:

- On-premises

- Web-based

- Cloud-based

Cloud-based systems lead the HIS market with the highest share of 42.5% in 2024 as they ensure scalability, cost-effectiveness, and access to the latest data. Cloud-based HIS solutions allow healthcare providers to access critical patient information remotely, supporting real-time decision-making and enhancing operational efficiency, unlike traditional on-premises systems. Systems that support seamless data integration across multiple locations are also suitable for large healthcare networks and multi-specialty hospitals. Enhanced data security measures, including encryption and updates, address concerns around breaches and compliance, further fueling adoption. Significant up-front infrastructure costs are avoided in cloud deployment, thus saving many healthcare facilities with minimal budget. The increasing popularity of telemedicine and patient remote monitoring has increased the adoption of cloud-based systems for interoperability between health applications. Moreover, the Covid-19 pandemic speeded up the adoption of cloud solutions as healthcare organizations were looking for flexible scalable solutions to handle the spate of patient data that is generated. Continuously upgraded the cloud technology, combined with the rapid pace of the adoption of healthcare digitization processes, cloud-based HIS continues to enjoy a high run rate, with being well-positioned as the lead deployment type.

Analysis by System Type:

- Clinical Information System

- Administrative Information System

- Electronic Medical Record

- Laboratory Information System

- Radiology Information System

- Pharmacy Information System

- Others

The laboratory information system holds the largest hospital information system market share due to the diagnostic data that is used in laboratories which enhances the lab's operational efficiency. These systems streamline workflows by automating processes such as tracking samples, generating results, and reporting data, hence diagnostics that are faster and more accurate. The LIS market is driven by the rise in chronic diseases and diagnostic tests, which in turn creates a need for better data management solutions. The integration of LIS with other hospital systems, such as electronic medical records (EMR) and radiology information systems (RIS), further supports cohesive healthcare delivery. With advancements in technology, such as AI and cloud-based LIS solutions, real-time data sharing and predictive analytics improve the decision-making capabilities of clinicians. Furthermore, LIS helps laboratories meet regulatory standards by maintaining accurate records and ensuring quality control. As healthcare facilities focus on standardized and automated diagnostic systems to ensure better patient results, the implementation of the LIS continues to increase. Increased health infrastructure and expenditure on diagnostic technology are boosting the market for the dominance of the HIS market under the LIS segment.

Analysis by End User:

- Hospitals

- Insurance Companies

- Others

Hospitals hold significant share in the market due to their extensive requirement to manage high volumes of patients' data optimally and achieve streamlined process management. HIS solutions in hospitals integrate a variety of functions, which include clinical documentation, administrative processes, and financial management for efficiency and effective patient care. The rising volume of hospital admissions, especially of chronic diseases and critical care, requires powerful data management systems to share information amongst healthcare providers on time and accurately. Rising investments in hospital infrastructure and IT systems are further pushing HIS adoption in this segment. This means that the integration of HIS with advanced technologies such as AI, telemedicine, and remote monitoring allows hospitals to offer personalized care and maximize resource utilization. Moreover, the need for compliance with healthcare regulations and the pressure for interoperability across departments is accelerating the implementation of HIS. Improved patient engagement through HIS features such as patient portals and real-time updates also benefits hospitals. With the modernization and scaling of operations in healthcare facilities, HIS adoption in hospitals will continue to grow steadily and remain the largest end-user segment in the market.

Insurance companies rely heavily on accurate, real-time data for processing claims, reducing fraud, and managing costs. HIS solutions offer seamless integration of patient data, medical records, and billing information, helping insurers streamline these processes. By promoting the adoption of HIS, insurance companies gain a structured framework to evaluate medical services and ensure cost-effective care delivery. Also, HIS solutions provide insurers with valuable insights into patient health trends, treatment outcomes, and population health metrics. This data aids in accurate risk assessment and policy pricing, making insurance products more tailored and competitive.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America region held the largest market share of over 45.8%. Hospital information system market statistics reveal that the need for advanced technological solutions to improve patient care and operational efficiency is increasing in the North America region. The main driver behind this push for digitalization in healthcare to improve patient outcomes and operational efficiency is a significant force. For example, the United States digital health market size is expected to grow at a CAGR of 17.30% during 2024-2032, said IMARC. HIS forms the core of this change. It enables data management seamlessly and integrates care. Secondly, there is a critical need to manage increasing healthcare expenses while preserving quality care delivery, and hospitals are using HIS to make operations smooth, minimize administrative overheads, and use resources effectively.

The growth in Asia Pacific HIS is attributed to increasing healthcare investment, adopting digital health technology, and enhancement of government efforts to build modern healthcare infrastructures. India and China are observing growth at considerable rates attributed to the escalating prevalence of chronic conditions and the mounting demand for EHR. HIS adoption is further fueled by the region's large population and the improvement in healthcare accessibility coupled with advancements in telemedicine. Emerging technologies such as AI and cloud computing are also driving market expansion.

The HIS market in Europe is driven by stringent healthcare regulations, widespread adoption of electronic health records, and strong government support for digital healthcare transformation. Countries like Germany, the UK, and France are taking the lead since they possess a well-developed infrastructure for healthcare, along with a high level of investments in advanced technology. Growth in chronic disease and increased age population leads to efficient hospital management system demand. Additionally, initiatives by the EU toward interoperability and data exchange concerning cross-border health care facilitate HIS adoption throughout the region.

The Latin American HIS market is increasing due to growing investments in the healthcare IT infrastructure and surging demand for efficient management solutions in hospitals. Brazil and Mexico's governments are encouraging digitization in healthcare so that the care provided can be improved and the administration can be made efficient. The increasing adoption of telemedicine and electronic health records is also driving the market. Besides, HIS implementation is gaining momentum as the region focuses on modernizing public healthcare systems and solving problems like resource optimization and chronic disease management.

The Middle East and Africa HIS market is growing due to increasing government initiatives to modernize healthcare systems and growing investments in healthcare IT. Countries like Saudi Arabia and the UAE are leading with ambitious digital health transformation programs. The increasing prevalence of chronic diseases and the need for better accessibility in healthcare are driving demand for HIS. In addition, the adoption of cloud-based systems and telemedicine is gaining momentum, supported by efforts from the region to improve interoperability and deliver effective healthcare services.

Key Regional Takeaways:

United States Hospital Information System Market Analysis

In 2024, the United States held a share of 91.60% for the hospital information systems market in North America. The market is driven by a mix of technological developments, regulatory requirements, and an emphasis on economically providing healthcare. Adoption of EHRs greatly escalated in recent times once the HITECH Act began, from data sourced from the National Coordination for Health Information Technology in the United States, in the year 2023, 96% of American hospitals adopted EHR. AI and advanced analytics which are embedded into the HIS have significantly enhanced efficiency operations and decision-making processes among the clinical personnel. For example, in HIS, AI-based modules optimize the scheduling of patients and predict the risks of readmission; such can translate to annual operating cost savings of up to 15% for hospitals. Other drivers of HIS adoption are due to the increasing incidence of chronic diseases, which affected over 40% of the US population in 2022, requiring effective patient data management. These scalable and augmented security cloud-based systems are also in vogue today. Owing to an increase in telehealth, interoperability between HIS and telehealth platforms has emerged as an imperative. Information from the Centres for Disease Control reported in 2021 that 37.0 percent of adults used telemedicine in the past 12 months. With age, telemedicine use has increased, and there is a likelihood that women use it more (42.0%) than men (31.7%). This has hastened adoption even further.

Europe Hospital Information System Market Analysis

A major stimulus in Europe for the digital transformation of health care is the robust governmental initiatives in HIS. Interoperable HIS and EHR usage across member states are supported by the European Commission through its Digital Health and Care Strategy. UK and Germany are the leaders; through the Hospital Future Act, Germany invested Euro 4.3 Billion (USD 4.53 Billion) in the infrastructure for digital health care as an industrial report said. The demand for effective hospital systems to handle complex patient care is increased by the aging population, with 20.8% of the EU's population expected to be 65 or older in 2022, according to an industrial report. The increased use of cloud-based HIS solutions and the shift to value-based care are additional factors. An example of using integrated HIS platforms is seen when the National Health Service of the United Kingdom recently adopted them in a move to hasten the interchanging of patient data. 40 countries within the WHO European Region either have a national telehealth strategy or include telehealth as part of a bigger strategy on digital health. The most popular telehealth services in the region are teleradiology, telemedicine, and telepsychiatry, which further support the growth of the market.

Asia Pacific Hospital Information System Market Analysis

The HIS market in Asia-Pacific is growing fast due to the increasing healthcare costs and government-led digital health initiatives. Adoption is fast paced in countries like China, India, and Japan. HIS integration has been driven by the investment of China in IT investment in its hospital systems which was made possible through USD 9.5 Billion in investment in 2022, as per industrial report. Ayushman Bharat Digital Mission is driving the demand for HIS a it intends to develop a unified health information infrastructure in India. The rising prevalence of chronic diseases necessitates the effective administration of hospital data. According to the World Health Organization, the death toll from such diseases in the region comes to 9 million people, which makes up for 62% of overall deaths. The proportion of premature death from NCDs from causes occurring at ages <70 years is of particular concern. Other reasons that play to operational effectiveness are a new type of cloud and AI technology.

Latin America Hospital Information System Market Analysis

Increasing healthcare IT investment along with the demand for hospital management systems effectively drives the market of HIS in Latin America. The two biggest markets include Brazil and Mexico, according to data from the International Trade Administration, Brazil expended USD 161 Billion in 2023 on its healthcare, or 9.5% of its GDP. Accelerated telemedicine breakthroughs owing to the COVID-19 pandemic also increase the demand for interoperable hospital information system platforms. The reason for adopting such solutions is that chronic diseases cause 70% of deaths in the region. The cloud-based solutions are popular due to their affordability and are gaining very high adoption rates. It is due to the government initiatives like Mexico's Digital Health Strategy, among others, driving the growth of the business.

Middle East and Africa Hospital Information System Market Analysis

As an after-effect of investments in digital transformation and health infrastructures, the HIS market is growing in the entire Middle East and Africa. Saudi Arabia and the UAE account for most of the market. Along similar lines, to upgrade the effectiveness, accessibility, and transparency of healthcare, the World Economic Forum data states that USD 50 Billion will be invested in projects such as digital health services. The very high prevalence of chronic diseases, including diabetes, projected to affect nearly 20% of the population in the GCC, underscores the need for an effective hospital information system. Flexibility and lower initial costs are some factors that make cloud based HIS more popular. Government initiatives such as Saudi Arabia's Vision 2030 to update hospitals also form a significant growth factor for the market.

Competitive Landscape:

Market players in the hospital information system market are heavily focusing on innovation, partnerships, and expansions to fortify their positions in the market. Companies use advanced technologies such as artificial intelligence, cloud computing, and machine learning to make their HIS solutions more functional and efficient. For example, collaborations between healthcare providers and tech companies aim to streamline clinical workflows and improve patient care. Thus, the key players are focusing research and development on providing the market with customizable and interoperable solutions to suit the various needs of the healthcare sector. Acquisitions and strategic alliances are common as these would expand their portfolios of products as well as their geographic reach. Emerging markets in Asia-Pacific and Latin America are targeted for increasing health digitization adoption within those markets. The importance of being compliant with regulations and also patient-centric care is emphasizing the focus on innovations regarding data security, scalability, and seamless integration across healthcare ecosystems.

The report provides a comprehensive analysis of the competitive landscape in the hospital information system market with detailed profiles of all major companies, including:

- Agfa-Gevaert Group. (Dedalus Holding S.p.A.)

- Allscripts Healthcare Solutions Inc.

- Carestream Health Inc. (Koninklijke Philips N.V.)

- Cerner Corporation

- Comarch SA.

- Computer Programs and Systems Inc.

- Epic Systems Corporation (Compass Group plc)

- GE Healthcare Inc. (Danaher Corporation)

- McKesson Corporation

- Medical Information Technology Inc.

- Nextgen Healthcare Inc.

- Wipro Limited

Latest News and Developments:

- July 2024: Makueni County has launched a digital health management information system to replace antiquated manual and inefficient practices. It will connect all healthcare facilities in the county, thus ensuring a continuous flow of information to improve patient care, streamline operations, and increase overall efficiency.

- April 2024: Munich Re Life US and Clareto have launched Automated EHR Summarizer, a new digital solution that provides an intelligent and intuitive synopsis of electronic health record (EHR) data in two formats, an easy-to-use human-readable HTML report and structured digital data for use in rules, models, and analytics.

- March 2024: The Department of Veterans Affairs and the Defense Department rolled out a new, interoperable Electronic Health Record, at the Capt. James A. Lovell Federal Health Care Center in North Chicago.

Hospital Information System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Deployment Types Covered | On-premises, Web-based, Cloud-based |

| System Types Covered | Clinical Information System, Administrative Information System, Electronic Medical Record, Laboratory Information System, Radiology Information System, Pharmacy Information System, Others |

| End-Users Covered | Hospitals, Insurance Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agfa-Gevaert Group. (Dedalus Holding S.p.A.), Allscripts Healthcare Solutions Inc., Carestream Health Inc. (Koninklijke Philips N.V.), Cerner Corporation, Comarch SA., Computer Programs and Systems Inc., Epic Systems Corporation (Compass Group plc), GE Healthcare Inc. (Danaher Corporation), McKesson Corporation, Medical Information Technology Inc., Nextgen Healthcare Inc., Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hospital information system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hospital information system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hospital information system industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A hospital information system is a comprehensive network that performs medical, administrative, and financial operations within healthcare centers. It has streamlined patient record management, appointment scheduling, billing, and resource allocation, ensuring an efficient workflow and improved data accuracy that enhances patient care through a centralized digital solution.

The hospital information system market was valued at USD 27.2 Billion in 2024.

IMARC estimates the global hospital information system market to exhibit a CAGR of 9% during 2025-2033.

The market is driven by the growing popularity of electronic health records, favorable government initiatives, ongoing technological advancement, and the increasing need for telemedicine and remote monitoring.

In 2024, software represented the largest segment driven by digitization happening in healthcare and the number of EHRs telemedicine platforms and other clinical decision support systems rising in numbers.

Cloud-based systems lead the market owing to their scalability, cost-effectiveness, and access to the latest data.

The laboratory information system is the leading segment due to the diagnostic data that is used in laboratories which enhances the lab's operational efficiency.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global hospital information system market include Agfa-Gevaert Group. (Dedalus Holding S.p.A.), Allscripts Healthcare Solutions Inc., Carestream Health Inc. (Koninklijke Philips N.V.), Cerner Corporation, Comarch SA., Computer Programs and Systems Inc., Epic Systems Corporation (Compass Group plc), GE Healthcare Inc. (Danaher Corporation), McKesson Corporation, Medical Information Technology Inc., Nextgen Healthcare Inc., Wipro Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)