Hospital Beds Market Size, Share, Trends and Forecast by Technology, Bed Type, Usage, End User, and Region, 2025-2033

Hospital Beds Market Size and Share:

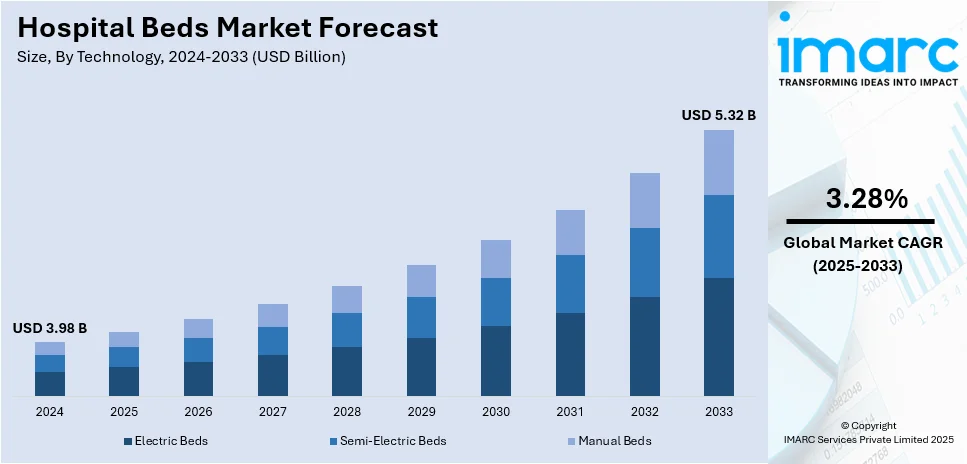

The global hospital beds market size was valued at USD 3.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.32 Billion by 2033, exhibiting a CAGR of 3.28% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.8% in 2024. The market growth is driven by factors, such as the increasing geriatric population, rapid technological advancements in bed features, rising prevalence of chronic diseases, the implementation of government initiatives in healthcare infrastructure and the expanding healthcare reforms and insurance coverage. North America holds the largest hospital beds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.98 Billion |

| Market Forecast in 2033 | USD 5.32 Billion |

| Market Growth Rate (2025-2033) | 3.28% |

The primary driver for the hospital beds market is the increasing demand for advanced healthcare infrastructure due to an aging population and the rising prevalence of chronic diseases. According to data published by the World Health Organization (WHO) it is anticipated that by 2030 1 in 6 people will be aged 60 or older increasing from 1 billion in 2020 to 1.4 billion. This number is projected to double by 2050 to 2.1 billion, of which 426 million will be 80 years old and above. Pandemics and other medical emergencies have resulted in an increased hospital admission that has further escalated the demand for quality hospital beds. These factors are creating a positive hospital beds market outlook, driving growth and innovation across the world.

The primary drivers of the US hospital beds market are an aging population base and an increasing number of chronically ill patients, which leads to a high rate of hospitalization. According to data published by the CDC, in the US approximately 129 million people suffer from at least one major chronic disease. About 42% have two or more conditions and 12% have five or more. Chronic diseases account for 90% of the $4.1 trillion annual health care expenditure. Higher healthcare spending and technological advancements in the hospital bed, like smart and adjustable beds, have enhanced the comfort and care of patients. Government-oriented initiatives and private investments in healthcare facilities are promoting the market and continue to innovate and have availability of hospital beds. One of the reasons why increasing demands have been a challenge in hospitals beds market has been due to the escalating population on the global level and more percentage of elderlies.

Hospital Beds Market Trends:

Increasing Geriatric Population Across the Globe

According to the United Nations report, "the share of those aged 65 and above is projected to rise from 10% in 2022 to 16% in 2050. Therefore, the market growth has been driven by the rising need for healthcare services from the elderly population who have a high tendency to get hospitalized". The other major factor is the increasing chronic diseases, for instance, diabetes, heart disease, and respiratory illnesses, which are more prevalent. Other than this, rising complexity in the healthcare needs, especially among elderly populations, drives the demand for specialized hospital beds with features like adjustable height, electronic monitoring capabilities, and comfort, thereby growing the market. The increasing demand for beds meeting the needs of several medical conditions, such as basic care and ICUs, is driving the growth.

Rapid Technological Advancements in Hospital Beds

The rapid technological advancements in hospital beds that evolve into sophisticated pieces of medical equipment to enhance patient care and treatment are favoring the market growth. According to this, the hospital beds market is expected to grow with the introduction of various features like electronic positioning, adjustable side rails, and integrated pressure relief systems to improve patient comfort and safety and aid in the prevention of complications, such as bedsores and respiratory issues. For instance, Hill-Rom's Smart Care beds use sensors to track patient information, helping in better communication between healthcare professionals and reducing the burden of documentation. Hill-Rom's NaviCare Patient Safety Solution also increases safety as it triggers alert for falls. Stryker's ProCuity® beds, in particular, pay attention to safety with a low bed height and ergonomic touch screen adjustments for patients and staff alike. Apart from that, integration of technology, like remote monitoring and electronic record-keeping, into hospital beds to strengthen the efficiency and effectiveness of patient care is growing in favor of market growth. They allow for real-time monitoring of patient's vital signs and quick adjustments to their care plan. This leads to good patient outcome and efficient use of the resources available in the hospitals.

Rising Incidence of Chronic Diseases

The burgeoning prevalence of chronic diseases across the globe is driving the hospital beds market growth. In line with this, the heightened incidences of chronic diseases, including diabetes, stroke, heart disease, and cancer, that require hospitalization are acting as a growth-inducing factor. The World Health Organization warns that chronic diseases, including cancer, cardiovascular diseases, diabetes, and respiratory diseases, continue to take a toll on health systems, economies, communities, and societies. By around 2050, an estimate by the WHO puts the said diseases to account for 86% of the 90 million deaths each year. Additionally, the increasing utilization of beds during the treatment of chronic diseases, which often necessitates longer hospital stays compared to acute illnesses, is strengthening the market growth. Besides this, the ongoing development of specialized hospital beds catering to chronic disease patients, such as those with enhanced monitoring capabilities and customizable support systems, is stimulating the market growth. As a result, the growing adoption of personalized care among healthcare systems across the globe, leading to the heightened demand for hospital beds tailored to the patient's needs is fostering the market growth.

Implementation of Government Initiatives and Expansion of Healthcare Infrastructure

The implementation of various government policies and initiatives aimed at improving healthcare infrastructure is providing an impetus to the market growth. In line with this, the increasing investment in healthcare, owing to the rising recognition of the importance of accessible and quality medical facilities for the well-being of the citizens, is creating a positive hospital beds market outlook. According to the World Health Organization (WHO), global healthcare infrastructure investment has been increasing, with a projected USD 2.4 trillion required annually for global healthcare infrastructure by 2030. Additionally, the construction of new hospitals and the expansion of existing ones, leading to a higher demand for hospital beds, is anticipated to drive the market growth. Furthermore, the introduction of various government initiatives to improve healthcare services in rural and underserved areas through funding for new medical facilities and the modernization of existing ones is stimulating the market growth.

Rising Healthcare Reforms and Insurance Coverage

The introduction of healthcare reforms aimed at providing universal health coverage and increasing the accessibility of healthcare services is creating a positive outlook for the market growth. According to the Centers for Medicare & Medicaid Services (CMS), the Affordable Care Act (ACA) has resulted in over 20 million Americans gaining health insurance coverage since its enactment, driving hospital beds demand and other healthcare services. In line with this, the implementation of reforms that make healthcare affordable for a larger segment of the population is favoring the market growth. Additionally, the growing adoption of reforms that lead to an increase in preventive care and early intervention, thereby prompting the demand for beds suitable for shorter stays and outpatient care, is enhancing the market growth. Moreover, the development of more patient-centric healthcare models, emphasizing the importance of patient comfort and safety, is fostering the market growth. In line with this, the widespread inclusion of beds with enhanced ergonomics, improved mobility, and advanced safety features for delivering quality patient care, is facilitating the market growth.

Hospital Beds Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, bed type, usage, and end user.

Analysis by Technology:

- Electric Beds

- Semi-Electric Beds

- Manual Beds

Manual beds the market with around 43.9% of market share in 2024. Manual beds represent the largest segment due to their affordability and simplicity. They offer mechanical simplicity, which makes them highly durable and easy to maintain. Moreover, manual beds are a cost-effective solution for healthcare settings that offer basic functionality and reliability. Besides this, their widespread utilization, owing to their practicality that ensures longevity and minimal repairs, is supporting the market growth. Furthermore, the versatility and ease of use of manual beds, making them a practical choice for home care settings, is providing a considerable boost to the market growth.

Analysis by Bed Type:

- Regular Beds

- Pediatrics Bed

- Respiratory Beds

- ICU Beds

- Bariatric Beds

- Birthing Beds

- Pressure Relief Beds

- Others

Regular hospital beds are designed to cater to the general needs of hospital patients. They feature basic adjustability for comfort and are used in various hospital departments. Moreover, regular hospital beds are versatile, catering to patients with a range of medical conditions. Along with this, the simplicity and functionality of regular beds make them a staple in healthcare facilities.

Pediatric beds are specially designed for children and are equipped with safety features like side rails. They are sized appropriately for children and may include playful designs to create a more comforting environment for young patients. Moreover, pediatric beds address the unique needs of children in healthcare settings, ensuring safety, comfort, and suitability for various pediatric treatments.

Respiratory beds are designed for patients with respiratory ailments. They include features that aid in respiratory therapy, such as elevated head sections and integration with respiratory equipment. Moreover, respiratory beds are essential in units caring for patients with chronic respiratory conditions or acute respiratory emergencies, providing critical support for breathing treatments.

Intensive care unit (ICU) beds are equipped with advanced features for critically ill patients. They have capabilities for electronic monitoring and adjustable positions and are designed for easy access by healthcare professionals. Moreover, ICU beds are essential in providing optimal care for patients in critical condition, with features that support complex medical interventions and continuous monitoring.

Bariatric beds are designed for obese patients and are reinforced for higher-weight capacities. They are wider than standard beds, ensuring comfort and safety for patients. Moreover, bariatric beds feature robust frames and special mattresses to prevent pressure sores and accommodate the unique needs of the patients.

Birthing beds are designed for use in maternity wards and are adjustable to various positions to aid in the childbirth process and provide comfort to expectant mothers. In addition to this, they are equipped with various features to facilitate labor, delivery, and postnatal care.

Pressure relief beds are designed to prevent ulcers in patients who spend extended periods in bed. They are widely utilized for long-term care and patients with mobility issues. Moreover, pressure relief beds employ special mattresses and technologies to distribute pressure evenly.

Analysis by Usage:

- Critical Care

- Acute Care

- Long-Term Care

Acute care leads the market with around 33.7% of market share in 2024. Acute care beds represent the largest segment of the market as they are used for patients who need active and short-term treatment, including severe injury, episodes of illness, urgent medical conditions, or recovery from surgery. They are designed to provide a wide range of medical needs and are commonly found in almost all hospital departments, such as emergency rooms and post-surgical recovery units. Moreover, acute care beds balance functionality and comfort, providing essential features like adjustability and ease of access for healthcare providers. As a result, the increasing demand for acute care beds due to the broad spectrum of patient care requirements and the high turnover and diverse patient population, is favoring the market growth.

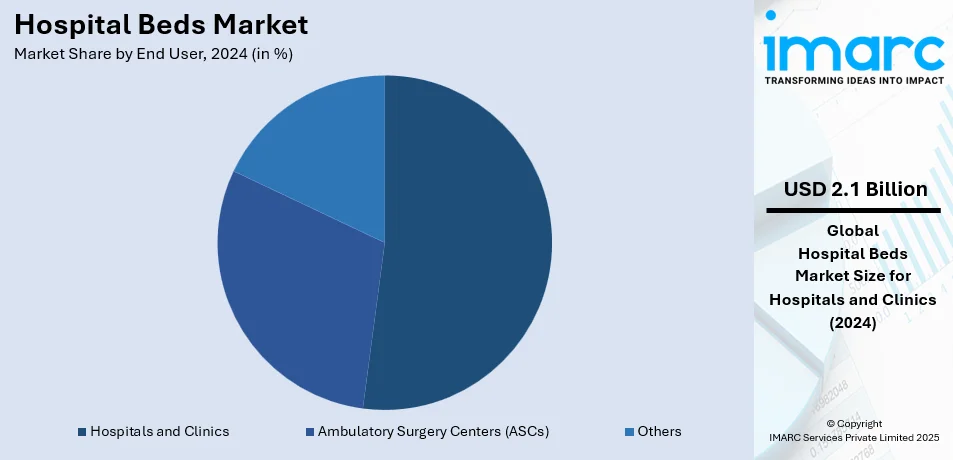

Analysis by End User:

- Hospitals and Clinics

- Ambulatory Surgery Centers (ASCs)

- Others

Hospitals and clinics leads the market with around 52.2% of market share in 2024. Hospitals and clinics represent the largest share of the market as they encompass a wide range of healthcare facilities, such as large-scale hospitals, smaller clinics, and community health centers. Moreover, the increasing need for various types of hospital beds in institutions to cater to different patient needs, including acute care, intensive care, and long-term care, is providing a thrust to the market growth. Along with this, the high patient turnover and the wide range of medical conditions treated in hospitals and clinics, necessitating the need for hospital beds, are driving the market growth. Besides this, the continued expansion and modernization of healthcare facilities across the globe, driven by increasing demand and advancements in medical care, is contributing to the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.8%. North America represents the largest segment in the market, attributed to various factors, including advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading hospital bed manufacturers. In addition to this, the region is known for its rapid adoption of technologically advanced medical equipment, including smart hospital beds equipped with features like patient monitoring systems. Apart from this, the prevalence of chronic diseases and the burgeoning geriatric population in North America, contributing to a sustained demand for hospital beds, is fostering the market growth. Moreover, the introduction of favorable government policies and initiatives aimed at improving healthcare facilities and expanding access to care is supporting the market growth.

Key Regional Takeaways:

United States Hospital Beds Market Analysis

In 2024, the United States captured 89.20% of revenue in the North American market. The U.S. hospital beds market is increasing because of investments in healthcare and adoption of new technologies. According to the American Hospital Association, total staffed beds in the United States totaled about 916,752 in 2023. Occupancy averages around 65-67%. The CARES Act allocated USD 100 billion for hospital and health care provider infrastructure improvement and response to the pandemic. Key competitors in the marketplace, such as Hill-Rom Holdings and Stryker Corporation, are focusing on the roll-out of superior hospital beds enabled with IoT facilities and thus efficient handling of patients. Public-private associations and government funding are further enabling innovation, allowing for a healthy supply chain. Its less dependence on importing products has now made the United States market among the leaders where advanced healthcare infrastructures are deployed.

Europe Hospital Beds Market Analysis

The European hospital beds market is expanding with modernization of healthcare and increased spending. Eurostat reported that the EU had an average of 5.16 hospital beds per 1,000 inhabitants in 2022, with Germany leading at 7.66 beds per 1,000 inhabitants. The German Hospital Future Act (Krankenhauszukunftsgesetz) provided federal funding of €3 billion (USD 3.11 billion) supplemented by €1.3 billion (USD 1.34 billion) from states for modernizing and digitalizing the healthcare system. Also, in December 2023, the Digital Act, DigiG, which also promotes electronic patient records and e-prescriptions, encourages efforts at raising patient safety and efficiency of care. Some firms, for instance, like Invacare and Arjo, are producing cutting-edge smart, sustainable designs in advanced hospital beds to suit demand in the market. R&D funding by EU drives these improvements into the best European solutions on modern hospital infrastructure to be installed in the facility.

Asia Pacific Hospital Beds Market Analysis

The Asia Pacific hospital beds market is growing at a significant rate due to huge investments in healthcare infrastructure and modernization. Industrial reports show that China's hospital bed density increased to 7.23 beds per 1,000 inhabitants in 2023, with an annual growth of 4.4% from 2022, indicating the country's commitment to expanding healthcare capacity. The health care sector in India is also seeing a transformation where the government in its 2024-2025 budget allocated INR 90,958 crore, or USD 10.8 billion, towards the development of health care infrastructure. One major focus of the budget is the Ayushman Bharat program, an initiative that ensures affordable health care services to many people, promoting the use of medical technologies like advanced hospital beds. The demand for smart hospital beds has increased with technology advancement, automation, and monitoring systems. Both local manufacturers like Apex Medical and international players ensure the region's significant place in the global healthcare market. Growth is further supplemented by government initiatives in the provision of affordable and efficient healthcare solutions.

Latin America Hospital Beds Market Analysis

The Latin America hospital beds market is growing, driven by expansion in healthcare access and modernization of healthcare infrastructure. The Brazilian government has adopted the CEIS Development Strategy and allocated BRL 42 billion (USD 7.98 billion) between 2023 and 2026 to develop healthcare services and infrastructure. It includes purchasing more advanced medical equipment and upgrading hospitals. In addition, the FNS has planned to invest BRL 101.1 billion (USD 19.21 billion) in 2022 in order to modernize healthcare. The demand for modern hospital beds and other high-tech equipment is expected to rise from these efforts. Moreover, the supply of modern hospital beds in the region is being boosted through local manufacturing and international partnership, positioning Latin America as an emerging market for healthcare innovations.

Middle East and Africa Hospital Beds Market Analysis

The demand for hospital beds is growing in the Middle East and Africa, mainly because of increasing investments in healthcare and modernization efforts. According to International Trade Administration, in 2023, Saudi Arabia committed around USD 50.4 billion (SAR 189 billion) to its healthcare sector, which would support the opening of three hospitals with a total capacity of 900 beds and elderly and home healthcare services. In addition, the Ministry of Health has sought to improve primary care through a "doctor-for-every-family" approach, which has targeted over 20 million beneficiaries with the aim of improving access to healthcare. These significant investments in infrastructure are also likely to push demand for beds in hospitals, especially in new facilities. Moreover, partnerships with global companies and local manufacturers are encouraging the acceptance of advanced hospital bed technologies and are positioning the region as a key player in the healthcare market.

Competitive Landscape:

The major players are engaged in various strategic initiatives to strengthen their market positions and respond to evolving healthcare needs. They are investing in research and development (R&D) to enhance the functionality, safety, and comfort of hospital beds. Besides this, they are incorporating features like electronic adjustments, improved ergonomics, and integrated monitoring systems. Additionally, key players are involved in mergers and acquisitions, partnerships, and collaborations with other companies and healthcare institutions to expand their reach and capitalize on emerging market opportunities. Furthermore, they are working on improving their supply chains and distribution networks to meet the increasing global demand efficiently.

The report provides a comprehensive analysis of the competitive landscape in the hospital beds market with detailed profiles of all major companies, including:

- GF Health Products Inc.

- Getinge AB

- Hill-Rom Holdings Inc.

- Invacare Corporation

- Malvestio S.P.A.

- Stryker Corporation

- Paramount Bed Holdings Co. Ltd.

- Savion Industries

- Span-America Medical Systems Inc. (Savaria Corporation)

- Stiegelmeyer GmbH & Co. KG.

Recent Developments:

- April 2024: Graham-Field bought Transfer Master Products (TMP), a maker of adjustable beds, to further the company's offerings in bed and sleep support systems. TMP Supernal Sleep Systems will benefit from the acquisition as well as improve manufacturing capabilities at Graham-Field's Wisconsin facility. The purchase is in line with Graham-Field's strategy for global growth.

- February 2024: Malvestio announced that it has collaborated with BioCote to bring its antimicrobial technology into a line of innovative beds specifically targeting the Italian marketplace. It focuses on hygiene and safety of hospital beds and may help reduce the risks of infections in patients.

- March 2023: GF Health Products Inc. announced the launch of its new American 7200 bed, to add to its “made in USA” initiative.

- March 2023: Stryker Corporation launched India’s first ICU bed upgrade platform called SmartMedic.

- September 2021: Baxter International Inc. announced its plan to purchase Hill-Rom Holdings Inc. for expanding its portfolio by adding smart hospital beds.

Hospital Beds Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electric Beds, Semi-Electric Beds, Manual Beds |

| Bed Types Covered | Regular Beds, Pediatrics Bed, Respiratory Beds, ICU Beds, Bariatric Beds, Birthing Beds, Pressure Relief Beds, Others |

| Usages Covered | Critical Care, Acute Care, Long-Term Care |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgery Centers (ASCs), Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | GF Health Products Inc., Getinge AB, Hill-Rom Holdings Inc., Invacare Corporation, Malvestio S.P.A., Stryker Corporation, Paramount Bed Holdings Co. Ltd., Savion Industries, Span-America Medical Systems Inc. (Savaria Corporation), Stiegelmeyer GmbH & Co. KG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hospital beds market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global hospital beds market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the hospital beds industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hospital beds market was valued at USD 3.98 Billion in 2024.

The hospital beds market is projected to exhibit a CAGR of 3.28% during 2025-2033, reaching a value of USD 5.32 Billion by 2033.

The hospital beds market is driven by the aging population, the rising prevalence of chronic diseases, advancements in bed technology, increasing healthcare investments, and expanded access to quality medical facilities worldwide.

North America currently dominates the hospital beds market, accounting for a share of 43.8%. The market is primarily driven by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of leading hospital bed manufacturers. Other factors, such as the widespread adoption of technologically advanced medical equipment, such as smart hospital beds and the steadily expanding geriatric population base, along with favorable government initiatives are creating a positive hospital beds market outlook across the region.

Some of the major players in the hospital beds market include GF Health Products Inc., Getinge AB, Hill-Rom Holdings Inc., Invacare Corporation, Malvestio S.P.A., Stryker Corporation, Paramount Bed Holdings Co. Ltd., Savion Industries, Span-America Medical Systems Inc. (Savaria Corporation), Stiegelmeyer GmbH & Co. KG., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)