Horizontal Directional Drilling Market Size, Share, Trends and Forecast by Technique, Parts Application, End User, and Region, 2026-2034

Horizontal Directional Drilling Market Size and Share:

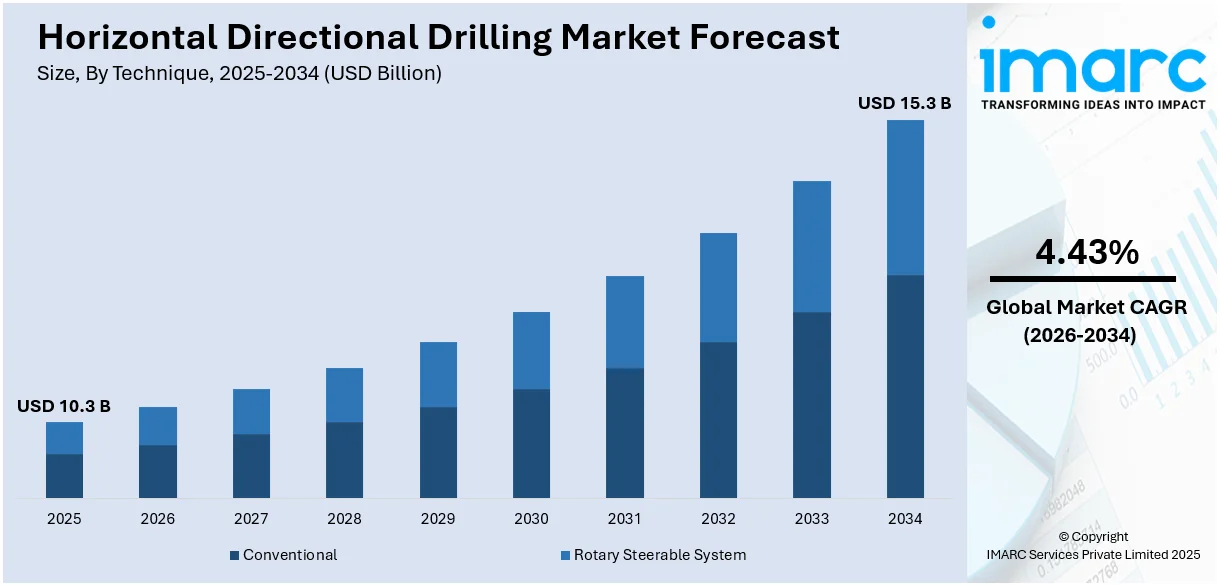

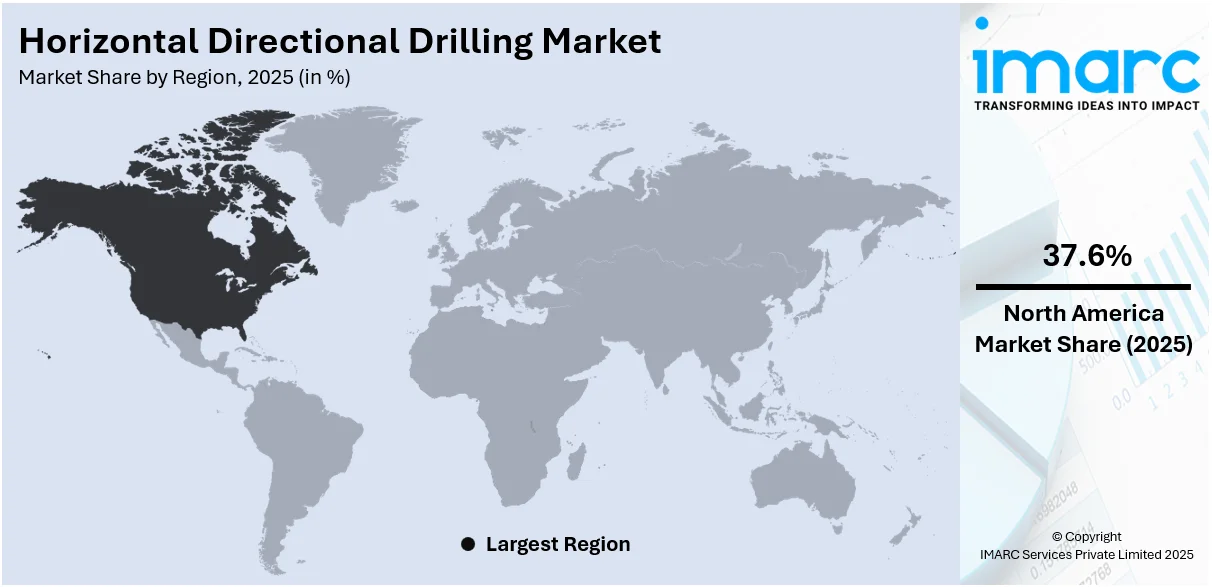

The global horizontal directional drilling market size was valued at USD 10.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 15.3 Billion by 2034, exhibiting a CAGR of 4.43% from 2026-2034. North America currently dominates the market, holding a market share of over 37.6% in 2025. The growing demand for underground infrastructure, advancements in drilling technology, the need for environmentally sustainable solutions, urbanization, and infrastructure expansion, the increased renewable energy projects and government investments in utilities, telecommunications, and pipeline installations are bolstering the market growth in the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10.3 Billion |

|

Market Forecast in 2034

|

USD 15.3 Billion |

| Market Growth Rate 2026-2034 | 4.43% |

One major driver in the global horizontal directional drilling (HDD) market is the increasing demand for underground infrastructure. As urbanization grows and the need for efficient utility installations rises, HDD provides a non-disruptive, cost-effective method for laying pipelines, cables, and other utilities beneath the surface. This technology reduces the need for extensive surface excavation, minimizing environmental impact and disruptions to daily activities. In addition, HDD has been the preferred choice of projects involving challenging terrains, hence its adoption by sectors like telecommunications, energy, and water management because traditional drilling methods are often too expensive or impractical.

To get more information on this market Request Sample

The U.S. accounted for a substantial share of 92% the HDD market and continued to benefit from large industry demand in the energy sector, telecommunications, and utility companies. Large infrastructure-development programs, such as broadband, oil and gas pipelines, and utility projects were all drivers for HDD applications in the country. Additionally, the U.S. benefits from advanced HDD technology and skilled workforce, making it a leader in complex directional drilling projects. Strict environmental regulations also encourage non-invasive methods like HDD, which reduces surface disruption. These factors, along with substantial investments in infrastructure, position the U.S. as a key player in the global HDD market.

Horizontal Directional Drilling Market Trends:

Technological advancements in HDD equipment:

Technological innovations are significantly shaping the global HDD market. Advanced equipment, such as automated drill rigs, real-time monitoring systems, and precision guidance technology, is improving drilling efficiency and accuracy. These innovations allow for better management of complex, long-distance, and deep borehole projects, reducing risks and costs. Enhanced drilling tools, including high-performance drill bits and mud motors, enable HDD contractors to operate in more challenging environments, such as urban areas or harsh terrains. As demand for more sustainable and efficient drilling techniques grows, these technological advancements are expected to drive the market, making HDD the preferred method for laying pipelines, cables, and utilities with minimal surface disruption.

Increasing demand for renewable energy projects:

The global shift toward renewable energy sources is another key trend driving the HDD market. As countries invest in wind, solar, and geothermal energy infrastructure, the need for efficient and environmentally friendly installation methods has grown. HDD plays a crucial role in these projects by facilitating the underground installation of energy cables and pipelines, avoiding environmental damage and reducing land disturbance. For instance, offshore wind farms often require cable systems installed through HDD to connect to the grid. As renewable energy projects expand globally, especially in offshore and remote areas, the demand for HDD services is expected to rise, aligning with global sustainability goals and energy transitions.

Urbanization and infrastructure expansion:

Urbanization and fast expansion of infrastructure in both developed and emerging markets is a key driving force behind the global HDD market. As cities grow, demand for underground utilities such as water pipelines, communication cables, and energy systems increases. HDD offers an installation technique that minimizes surface disturbance and traffic disruption. This approach is especially beneficial in densely populated regions where conventional excavation would lead to considerable disruptions. In addition to this, smart city initiatives and modernization of the infrastructure across governments worldwide are rising, thereby demanding HDD, and this pace of demand is further augmented by the rise in the urbanization quotient, leading to improved or replacement aging infrastructure both residentially as well as commercially.

Horizontal Directional Drilling Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global horizontal directional drilling market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on technique, parts application and end user.

Analysis by Technique:

- Conventional

- Rotary Steerable System

Rotary steerable system stands as the largest component in 2025, holding around 65.8% of the market due to its ability to provide precise control over the drilling direction and enhance operational efficiency. It will continuously rotate the drill string with a steerable bit for enhanced hole quality, accuracy, and speed. The downtime of RSS technology is lesser in relation to tripping the drill string, therefore minimizing its downtime and improving productivity. As projects demand more complicated wells, it makes them demand deeper, longer, and accurate ones; that's why more and more use RSS technology in HDD applications. Its role in optimizing drilling performance, reducing costs, and enhancing safety is driving its dominance in the market.

Analysis by Parts:

- Rigs

- Pipes

- Bits

- Reamers

Rigs stands as the largest component in 2025, holding around 32.8%. They are essential for the HDD process, providing the mechanical power to drive the drill string and perform the drilling operations. The demand for advanced rigs with higher horsepower and automation features is increasing, driving improvements in efficiency, accuracy, and the ability to handle complex projects.

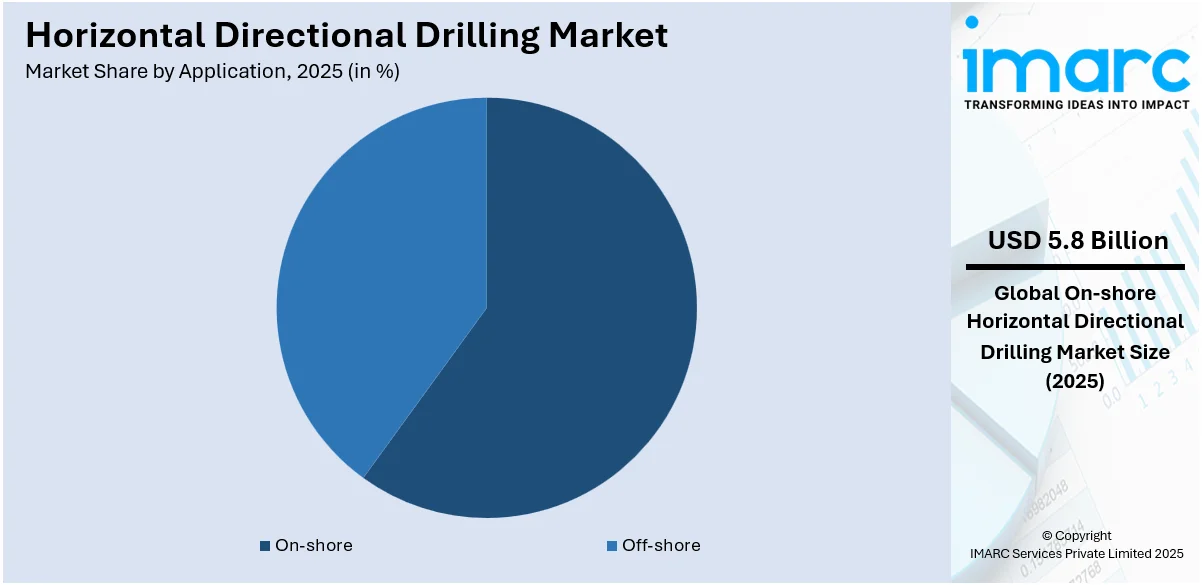

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- On-shore

- Off-shore

In 2025, on shore accounts for the majority of the market at around 58.9% due to its widespread application in various industries, including oil and gas, utilities, and telecommunications. Onshore HDD projects are of less complexity and more economical compared to offshore projects; therefore, it is preferred for developing infrastructure. The demand for underground utilities such as pipelines, water systems, and communication cables in urban and rural is driving the adoption of HDD onshore. Apart from this, the advancements that have taken place in the drilling technology and equipment have improved the productivity and feasibility of onshore operations, which is further favoring the growth of markets.

Analysis by End User:

- Oil and Gas Excavation

- Utility

- Telecommunication

Oil and gas excavation represented the leading market segment, holding 36.3% of the total share due to the industry's need for efficient, cost-effective, and environmentally friendly methods of installing pipelines and conducting drilling operations. HDD enables the pipeline, conduit, and cable installation to be done as minimally invasive as possible to the surface, which in many areas is sensitive, or heavily populated. For this reason, the adoption of HDD is driven more by new oil and gas infrastructure and pipeline network extensions, given that HDD could provide the precision and invasiveness advantages over traditional trenching methods. In addition, growing concerns in the oil and gas industry with regard to environmental impact and cost-cutting have propelled HDD as the preferred method of excavation and pipeline installation.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 37.6% due to the region's extensive infrastructure development and high demand for energy, telecommunications, and utilities. The U.S., in particular, remains a key driver, with ongoing projects in oil and gas, renewable energy, and urban utilities that require advanced drilling technologies. The region’s mature oil and gas industry, coupled with an increasing push for cleaner and more sustainable energy solutions, boosts HDD adoption. Moreover, stringent environmental regulations in North America favor non-invasive drilling methods like HDD, which minimize surface disruption. The demand for pipeline installations, especially for natural gas and oil, alongside urban expansion, continues to fuel the region’s dominance in the global HDD market.

Key Regional Takeaways:

United States Horizontal Directional Drilling Market Analysis

The U.S. Horizontal Directional Drilling (HDD) market is experiencing significant growth, driven by the increasing demand for advanced infrastructure in sectors like energy, telecommunications, and utilities. In 2024, the U.S. oil and gas market was valued at USD 252.6 Billion, fueling the need for efficient and cost-effective drilling technologies. The rise in shale oil and gas production, particularly in regions like Texas, has contributed to the growing adoption of HDD, which offers minimal environmental disruption and the ability to navigate complex terrains. Moreover, HDD is gaining popularity in pipeline construction for natural gas, water, and wastewater systems due to its ability to minimize surface disturbance. The growing emphasis on upgrading aging infrastructure further supports market demand, as HDD provides a way to install underground utilities without interrupting surface activities. Environmental regulations and sustainability concerns are pushing the adoption of HDD to reduce ecological impact. Advancements in HDD technology, including improved drilling rigs, precision tracking systems, and specialized drill bits, have increased operational efficiency and reduced costs. Furthermore, the push for renewable energy infrastructure, such as wind and solar projects, is expanding the need for HDD services, creating new growth opportunities within the U.S. market.

Europe Horizontal Directional Drilling Market Analysis

Europe’s Horizontal Directional Drilling (HDD) market is experiencing growth driven by the need for infrastructure modernization and environmental sustainability. The demand for natural gas and renewable energy sources, including wind and solar energy, is increasing the application of HDD for pipeline installations, utility lines, and underground cabling. According to the European Environment Agency (EEA), renewable energy sources represented an estimated 24.1% of the European Union’s final energy use in 2023, highlighting the region's transition toward cleaner energy. This shift is prompting investments in energy infrastructure, where HDD plays a key role, especially in offshore wind farms and challenging geological areas. Many European countries are upgrading aging infrastructure, and governments are encouraging the use of HDD to avoid surface disruption and minimize ecological impact. HDD’s ability to work in difficult terrains makes it a preferred method in regions like the North Sea for wind installations and in urban areas where traditional trenching methods would cause greater disruption. Furthermore, the strict environmental regulations in Europe are making utilities and energy companies take more sustainable construction methods. HDD fits well into that agenda. Improvements in HDD technology reduce costs and enhance operational efficiency, leading to further expansion in the region.

Asia Pacific Horizontal Directional Drilling Market Analysis

The Horizontal Directional Drilling (HDD) market in the Asia-Pacific (APAC) region is experiencing robust growth, driven by rapid urbanization, infrastructure expansion, and increasing energy demand. According to the UNFPA, Asia and the Pacific account for 60% of the world’s population, approximately 4.3 Billion people, and include the world’s most populous countries, China and India. This large and growing population drives substantial investments in energy and utility infrastructure, with HDD offering an efficient solution for pipeline installations in densely populated and environmentally sensitive areas. The demand for renewable energy projects, such as offshore wind farms and solar power infrastructure, further contributes to market expansion. Additionally, the region’s industrialization and large-scale construction projects, particularly in ASEAN countries, fuel the need for advanced drilling technologies. Environmental regulations and the need to minimize surface disruption in urban areas are key drivers for HDD adoption. Furthermore, advancements in drilling technologies and the availability of skilled labor are strengthening market prospects across the region.

Latin America Horizontal Directional Drilling Market Analysis

The HDD market in Latin America is growing due to increasing energy demand and infrastructure development. According to BBVA Research, urbanization in Latin American countries has now reached around 80%, driving the need for advanced infrastructure solutions. HDD provides an effective method for pipeline installations in densely populated and environmentally sensitive areas. The region’s expanding oil and gas, water, and utility sectors further boost market demand. Along with this, the support for minimal surface disruption within environmental regulations contributes to the adoption of HDD as it forms a preferred choice to build infrastructure in urban areas as efficiently as possible and sustainably.

Middle East and Africa Horizontal Directional Drilling Market Analysis

The Middle East HDD market is driven by the increasing demand for energy, urbanization, and infrastructure development. The International Energy Agency (IEA) reported that nearly 95% of the electricity generated in the region comes from natural gas and oil, the highest share globally, though the Middle East also has few of the best solar resources in the world. HDD is a significant input in the development of pipelines for oil and gas as well as renewable energy projects, which include solar infrastructure. Not only does it efficiently navigate areas with challenging terrains and urban scenarios, but the growing preference for sustainability also contributes towards market growth.

Competitive Landscape:

The competitive landscape in the global HDD market is highly fragmented, with numerous regional and international players offering a wide range of services and technologies. The market is characterized by companies specializing in advanced HDD equipment, such as high-performance drill rigs, precision guidance systems, and real-time monitoring tools. These players differentiate themselves through technological innovations, service quality, and project expertise in diverse sectors, including energy, utilities, and telecommunications. To gain a competitive edge, firms focus on expanding their geographic reach, forming strategic alliances, and investing in research and development (R&D) for improved drilling techniques. Additionally, players are increasingly adopting environmentally sustainable practices to meet stringent regulations and growing demand for eco-friendly infrastructure solutions. Competitive pressures are also driven by pricing strategies and the ability to handle large, complex projects.

The report provides a comprehensive analysis of the competitive landscape in the horizontal directional drilling market with detailed profiles of all major companies, including:

- Baker Hughes Company

- Barbco Inc

- Ellingson Companies

- Halliburton Company

- Herrenknecht AG

- Inrock Drilling Systems, Inc.

- Laney Drilling

- NOV Inc.

- SLB

- The Charles Machine Works, Inc.

- Vermeer Corporation

- XCMG Group

Latest News and Developments:

- In October 2024, OCU Group acquired Peter McCormack & Sons, a Northern Ireland-based firm specializing in horizontal directional drilling (HDD), for an undisclosed sum. The acquisition, announced on 24 October, strengthened OCU’s HDD capabilities. The company continued to operate under its current name and staff.

- In February 2024, Numaligarh Refinery Limited (NRL) successfully carried out one of the longest Horizontal Directional Drilling (HDD) operations beneath the Subansiri River, linking Lakhimpur and Majuli in Assam as part of its crude oil pipeline project. This milestone is a key component of NRL's broader Numaligarh Refinery Expansion Project (NREP), which includes the development of a 1,635 km pipeline stretching from Paradip Port in Odisha to Numaligarh in Assam. Additionally, the project aims to increase the refinery's capacity from 3.0 MMTPA to 9.0 MMTPA.

- In January 2024, SLB and Nabors Industries partnered to advance automated drilling solutions. Their collaboration enables seamless integration of SLB’s PRECISE™ and Nabors’ SmartROS® systems, improving well construction efficiency. The partnership aims to overcome integration challenges, offering enhanced drilling capabilities, including Neuro™ autonomous directional drilling, and expanding access to automation technologies across the industry.

- In July 2023, Ditch Witch has collaborated with Heavy Equipment Colleges of America (HEC) to provide accredited training for HDD operators. The program covers machine operation, safety, mud mixing, drilling, and HDD tracking. It is designed to help address the shortage of qualified operators and can be completed in two weeks. This training is available for both new and experienced operators, supporting workforce development and internal promotions for HDD contractors.

Horizontal Directional Drilling Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Techniques Covered | Conventional, Rotary Steerable System |

| Parts Covered | Rigs, Pipes, Bits, Reamers |

| Applications Covered | On-shore, Off-shore |

| End Users Covered | Oil and Gas Excavation, Utility, Telecommunication |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baker Hughes Company, Barbco Inc, Ellingson Companies, Halliburton Company, Herrenknecht AG, Inrock Drilling Systems, Inc., Laney Drilling, NOV Inc., SLB, The Charles Machine Works, Inc., Vermeer Corporation, XCMG Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the horizontal directional drilling market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global horizontal directional drilling market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the horizontal directional drilling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Horizontal directional drilling (HDD) is a trenchless technology used to install underground utilities like pipelines, cables, and conduits with minimal surface disruption. It involves drilling a pilot hole, followed by reaming to the desired size, allowing for the placement of pipes without extensive excavation, making it ideal for urban or sensitive areas.

The horizontal directional drilling market was valued at USD 10.3 Billion in 2025.

IMARC estimates the global horizontal directional drilling market to exhibit a CAGR of 4.43% during 2026-2034.

Key factors driving the global horizontal directional drilling market include increasing demand for underground infrastructure, technological advancements in drilling equipment, growing urbanization, and the need for non-invasive, cost-effective drilling methods.

In 2025, rotary steerable system represented the largest segment by techniques, driven by offering precise directional control, improved drilling efficiency, and reducing operational costs in HDD.

Rigs are the largest segment by type, these are critical to the HDD process as they provide mechanical power for driving the drill string and performing the operations of drilling.

On shore leads the market by application owing to its cost-effectiveness, ease of operation, and widespread use in infrastructure development projects.

The oil and gas excavation is the leading segment by end user, driven by the demand for pipeline installations and infrastructure expansion.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global horizontal directional drilling market include Baker Hughes Company, Barbco Inc, Ellingson Companies, Halliburton Company, Herrenknecht AG, Inrock Drilling Systems, Inc., Laney Drilling, NOV Inc., SLB, The Charles Machine Works, Inc., Vermeer Corporation, XCMG Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)