Home Office Furniture Market Size, Share, and Trends by Product Type, Material Type, Price Range, Distribution Channel, Region, and Forecast 2026-2034

Home Office Furniture Market Size & Share:

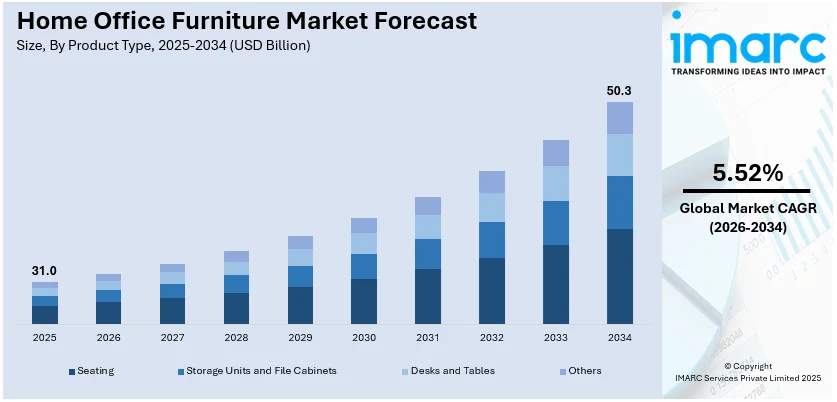

The global home office furniture market size was valued at USD 31.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 50.3 Billion by 2034, exhibiting a CAGR of 5.52% from 2026-2034. In 2025, the home office furniture market in the United States accounts for over 75.5% of the North American market share. The market is driven by the increase in remote job opportunities and the advancement in the gig economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 31.0 Billion |

| Market Forecast in 2034 | USD 50.3 Billion |

| Market Growth Rate (2026-2034) | 5.52% |

The widespread adoption of remote and hybrid work models is driving the demand for ergonomic, functional, and aesthetically pleasing furniture tailored for home office setups. The increasing importance of health and wellness is leading to a rise in the demand for adjustable desks, ergonomic chairs, and furniture designed to enhance comfort and productivity. E-commerce is emerging as a major trend, offering people access to a diverse range of products with convenient purchasing options and customization features. Additionally, sustainability is becoming a critical focus with individuals showing a preference for eco-friendly materials and furniture designed for durability and recyclability. Compact and multifunctional designs are also gaining traction, especially in urban areas where space optimization is essential.

To get more information on this market Request Sample

The United States has emerged as a major regional market for home office furniture. The market is driven by several key factors, reflecting shifts in work culture, lifestyle changes, and consumer preferences. One of the most prominent drivers is the widespread adoption of remote and hybrid work models, spurred by technological advancements Products, such as height-adjustable desks, supportive chairs, and multifunctional workstations are becoming essential for creating efficient home office spaces. The rising awareness about the importance of health and wellness in work-from-home (WFH) environments is driving the demand for furniture that promotes proper posture and reduces strain. Additionally, smaller living spaces are encouraging the adoption of compact and space-saving furniture designs. Moreover, as per the predictions of the IMARC Group, the United States home office furniture market is expected to reach US$ 9.5 Billion in 2032.

Home Office Furniture Market Trends:

Growing Number of Digital Jobs

Remote work arrangements are rising because of digital jobs' tendency to provide flexibility to work from any location. The need for home office furniture is driven by the growing number of professionals who do WFH and the resulting requirement for dedicated and practical home office spaces. The gig economy, in which people work as independent contractors or freelancers, includes internet employment. To complete their jobs, freelancers and gig workers frequently set up home offices. Purchasing high-quality home office furniture, such as desks that are roomy, comfortable seats, and sufficient lighting, can assist establish a productive workspace. As more people work from home, the need of designing cozy and healthful workspaces is growing. As per the whitepaper published in 2024 on the website of the World Economic Forum, digital jobs are estimated to grow around 25% by 2030.

Focus of Key Players on Expansion

By improving online retail platforms, businesses are taking advantages of the expanding e-commerce sector and reaching a wider audience. Businesses are also coming up with new ideas and growing their product lines to include customized options, smart furniture, and ergonomic designs. To gain the attention of various clients, major firms are offering a broad range of furniture for catering to various demands and preferences. By entering new geographic locations, key players are addressing the growing home office furniture market demand around the world while increasing accessibility to home office furniture. For instance, in 2024, Harbin Yueyang Furnishing celebrated the Grand Opening and Ribbon Cutting of its new Ashley Furniture HomeStore showroom located in Harbin, China. Key players are collaborating with tech firms to include advanced elements into furniture items or working with designers to create exclusive lines. By acquiring smaller or specialist businesses, they are increasing their product offerings and market share.

Thriving e-commerce Industry

Internet retailers are open 24/7, making it convenient for buyers to shop whenever they want. This is especially useful for working professionals. People can choose from a wide range of home office furniture styles, brands, and price points that may not be offered in their area by using e-commerce platforms. Product descriptions, specifications, and visuals provided by e-commerce platforms make them highly preferable among people. E-commerce platforms offer a wide range of home office furniture with detailed descriptions, visuals, and price comparisons, enabling users to make informed decisions. For instance, Wayfair has been churning out deals on desks, bathmats, couches, throws, glassware, and more this year without any big hit to its profit margins, a tricky feat for a retailer.

Home Office Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global home office furniture market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, material type, price range, distribution channel, and region.

Analysis by Product Type:

- Seating

- Storage Units and File Cabinets

- Desks and Tables

- Others

Seating leads the market with around 35.3% of market share in 2025. Ergonomic seating is gaining traction as remote work is becoming more prevalent. Sitting comfortably and supportively allows people to work longer hours without experiencing discomfort, which can increase overall productivity. Maintaining proper posture and lowering the risk of back discomfort, neck strain, and other musculoskeletal problems linked to extended sitting are made possible with the help of ergonomic chairs. Chairs are a necessary component of any home office arrangement because they are utilized constantly during the workday.

Analysis by Material Type:

- Wood

- Metal

- Plastic

- Glass

- Others

Wood leads the market with around 54.6% of market share in 2025. Wood has a timeless, classic appearance that goes well with both traditional and modern home decor trends. A variety of wood species and coatings like oak, maple, walnut, and cherry offer a range of visual possibilities that cater to different preferences. Wood is a dependable material for furniture that lasts a long time because of its strength and durability. Wooden furniture of superior quality may endure heavy use and abuse without losing its structural integrity or aesthetic appeal. A variety of home office furniture pieces, such as desks, seats, bookcases, shelves, and cupboards, are made of wood. Size, style, and finish can all be readily altered in wooden furniture to suit individual requirements and tastes.

Analysis by Price Range:

- Low

- Medium

- High

Medium price range leads the market with around 39.5% of market share in 2025. Because it strikes a balance between price and quality, the medium price range appeals to a wide spectrum of customers, both those on a tight budget and those who are prepared to shell out a little extra for superior features. Furniture that is priced in the middle range is seen by buyers as having good value for the money, durability, and functionality without the premium price tag of higher-end items. Most expectations of people for quality are typically met by furniture in the medium price category, which offers sufficient longevity and durability for frequent usage. Reliable materials and construction methods are frequently used in the production of medium-priced furniture, guaranteeing a respectable lifespan and performance.

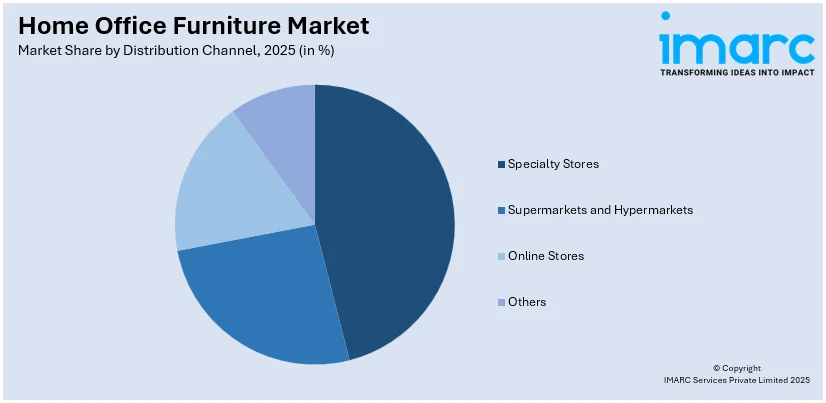

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

Specialty stores lead the market with around 45.3% of market share in 2025. Specialty stores only sell furniture, which enables them to provide in-depth product knowledge and professional advice that normal retailers might not be able to. Specialty store employees are frequently more knowledgeable about the subtleties of home office furniture, such as ergonomics, materials, and design trends. Specialty retailers usually carry a wider range of home office furniture, including high-end and specialist items that may not be found in mainstream retail stores. They frequently provide customization options, enabling clients to fit furniture to their unique requirements, tastes, and home office setups, which is positively influencing the home office furniture market insights.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

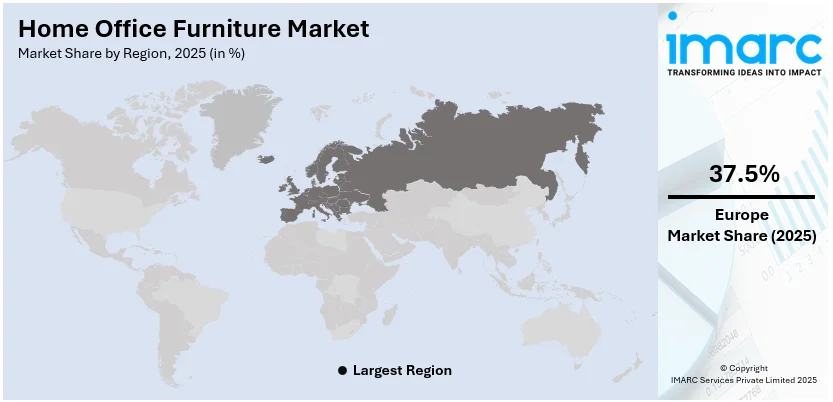

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 37.5%. European countries are adopting flexible work rules, including remote employment, more freely. As more people are setting up home offices, it is increasing the need for furnishings for those spaces. In Europe, the emphasis on work-life balance promotes the design of cozy and effective home offices. Due to their strong economies and large levels of disposable cash, several European nations encourage their citizens to purchase high-quality home office furniture. The market is also driven by several government initiatives and incentives for home offices and remote work. European people have a predisposition for robust and aesthetically beautiful home office products because they value well-designed, high-quality furniture. Moreover, key players are opening new showrooms to cater to the demand of people. For instance, in 2024, Bisley opened its second showroom in Dublin to consolidate their position within Dublin’s architect and design community.

Key Regional Takeaways:

United States Home Office Furniture Market Analysis

In 2025, the home office furniture market in the United States accounts for over 75.5% of the North American market share. It is driven by the increase in remote job opportunities and the advancement in the gig economy. Professionals now tend to struggle within the confines of non-ergonomic stationery and even furniture for the purpose of being productive and working comfortably from home and would prefer furniture that is not only comfortable but also easy to manipulate and adjust to specific needs/purpose by the user. With the rise of hybrid work models, the prospects of the furniture industry are bound to increase since consumers will continue looking for more stylish and durable alternatives for their multi-purpose workspaces. E-commerce sites such as Amazon and Wayfair have aided people with their online sales offers and low prices. The rush of consumers looking for greener materials is evident; sustainability is being embraced more. Local manufacturers employing modern technologies are creating new items that consumers want. Since the market is already established there are always new products to meet the need. Further, the government support for small businesses allowing them to work from home increases the demand for furniture as well. Colorado was America’s remote working capital of 2023, with the highest percentage of people regularly working from home, around 37%. Further, the U.S. is a major hub for home office furniture expansion and innovation considering that they have higher disposable income and have strong information and communication technology.

Europe Home Office Furniture Market Analysis

The home office furniture market in Europe is seeing a sizeable increase owing to the newly emerging hybrid workplace arrangements being made, as well as a shift towards more environmentally friendly ways of living. Germany, France and the UK consumer markets are leading this growth, with purchasing power allowing customers to spend more on high-end ergonomic furniture. A higher rate of demand for multi-use modular designs and green materials is in line with the development of the EU housing policy. Primary players are developing new toys using recyclable products and furniture designs designed for optimum functionality in constricted spaces. E-commerce is making it easier for people to buy their type of furniture, with the availability of local designs. Western Europe remains the leader in B2C e-commerce turnover in Europe. In addition to these factors, government policies encouraging telework have offered opportunities for many manufacturers to satisfy the increasing requirements of telecommuters. The market growth is backed by the strong manufacturing base of Europe as well as the increasing penetration of technology into the sector. With the implementation of additional hybrid working models across the continent, Europe is still considered to be a major area for further home office furniture development and expansion.

Asia Pacific Home Office Furniture Market Analysis

The home office furniture market in the Asia-Pacific region has started to rapidly grow due to the expansion of the digital job market, urbanization, and the culture of working remotely. The region is led by countries such as China, India, and Japan where a massive part of their working population is slowly making the shift to either hybrid or remote work. The popularity of home office furniture also stems from cheaper and various local and foreign manufacturers that are available. Online retailers assist this process by offering a wide selection of products at reasonable prices. Growth of disposable income in developing countries has increased demand for the market with the growing trend in consumers looking for ergonomic and long-lasting furniture. Due to China’s position as a manufacturing powerhouse, the region’s exports are also positioned to get lower-priced and higher-quality products. Other areas of improvement include the integration of advanced technologies and the increased popularity of home office ergonomics, which suggests further growth of Asia-Pacific region in the home office furniture market.

Latin America Home Office Furniture Market Analysis

The expansion of the home office furniture, particularly driven by the increase in the remote working trend and improvement in the internet penetration, is relatively speaking, a steady one in the specific region of Latin America. According to an industrial research report, as of the first month of 2024, more than nine out of 10 people living in the Bahamas, Costa Rica, Antigua & Barbuda, and Chile were online, putting the countries in the top position regarding internet access in Latin America. Brazil and Mexico are leading the region, capturing the expanding working-age population as well as the growing e-business sector. Ergonomic and cheaper furniture solutions are attractive to home office consumers as their drive is to be productive and comfortable while operating from home. The local players supply the cheaper substitutes whereas international players follow the expensive oriented business targeting specific market segments. Increased investment in infrastructure and technology in the region which was stimulated by the pandemic recovery has also indirectly promoted the market growth. In addition, the availability of different payment schemes makes online purchases more appealing.

Middle East and Africa Home Office Furniture Market Analysis

The Middle East and Africa home office furniture market is experiencing gradual growth, fueled by increasing digitalization and the expansion of remote work culture. The UAE and South Africa are the primary markets, benefiting from higher disposable incomes and a growing interest in modern interior designs. Consumers prioritize furniture that blends aesthetics with functionality, leading to increased demand for ergonomic and space-saving options. E-commerce platforms are expanding their presence in the region, offering a wide range of products at varying price points. Manufacturers focus on delivering durable and customizable furniture to meet diverse consumer preferences. Government initiatives supporting technological development indirectly drive market growth, as businesses adapt to hybrid work models. Challenges such as economic disparities and limited market awareness exist, but rising internet penetration and a growing middle class position the region as a promising market for home office furniture expansion.

Competitive Landscape:

There are several major companies in the market that are well-known for their wide range of products, inventiveness, and market presence. Large corporations offer various ergonomic workstations, chairs, storage options, and accessories designed to accommodate the changing requirements of home offices and remote workers. These businesses, which cater to buyer demands for long-lasting, environment friendly furniture, place a strong emphasis on sustainability, ergonomic design, and high craftsmanship. To further improve product performance and customer experience, they make use of cutting-edge technologies and design trends. These major players are crucial in determining the direction of the home office furniture market across the globe because of their extensive global distribution networks and commitment to providing quality customer service. They are also focusing on expansion to expand their customer base and strengthen their position in the market. For instance, in 2024, Haworth announced about the opening of its new facility in Sriperumbudur, India, to expand their business in the Indian market.

The report provides a comprehensive analysis of the competitive landscape in the home office furniture market with detailed profiles of all major companies, including:

- Ashley Furniture Industries Inc.

- Haworth Inc.

- Herman Miller Inc.

- HNI Corporation

- Inter IKEA Systems B.V.

- Kimball International Inc.

- Knoll Inc

- KOKUYO Co. Ltd.

- Okamura Corporation

- Steelcase Inc.

- Teknion Corporation

Latest News and Developments:

- August 2024: Steelcase, a global design and thought leader in the world of work, and the Frank Lloyd Wright Foundation launched the Frank Lloyd Wright Rockford and Galesburg Collections by Steelcase. The collections, an expansion of the organizations’ collaboration, reintroduce Frank Lloyd Wright’s iconic pieces and reinterpret his midcentury, Usonian style designs into fine modern furniture for the home and workplace.

- April 2024: Herman Miller Inc. and Studio 7.5 introduce Zeph Side Chair in April to enliven and add comfort to shared workspaces.

- March 2024: Inter IKEA Systems B.V. launched MITTZON, its largest office system, to help create spaces that enable various work activities and provide an optimized office experience.

- March 2024: Ashley Home, Inc. and Resident Home Inc. announced the signing of an agreement, under which Ashley Home, Inc., an affiliate of Ashley Global Retail, LLC, will acquire Resident Home Inc. Through Ashley’s affiliate company, Ashley Furniture Industries, LLC, Resident will experience improved sourcing and efficiencies to foster additional growth in both its direct-to-consumer and wholesale businesses.

Home Office Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seating, Storage Units and File Cabinets, Desks and Tables, Others |

| Material Types Covered | Wood, Metal, Plastic, Glass, Others |

| Price Ranges Covered | Low, Medium, High |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ashley Furniture Industries Inc., Haworth Inc., Herman Miller Inc., HNI Corporation, Inter IKEA Systems B.V., Kimball International Inc., Knoll Inc, KOKUYO Co. Ltd., Okamura Corporation, Steelcase Inc., Teknion Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the home office furniture market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global home office furniture market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the home office furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home office furniture market was valued at USD 31.0 Billion in 2025.

The home office furniture market is projected to exhibit a CAGR of 5.52% during 2026-2034, reaching a value of USD 50.3 Billion by 2034.

The market is majorly driven by the rise of remote and hybrid work models, growing awareness of ergonomic and health-focused furniture, increasing e-commerce penetration, and consumer preferences for compact, multifunctional, and eco-friendly furniture designs.

Europe currently dominates the home office market, accounting for a share of over 37.5%, driven by its rising remote work trends, high demand for ergonomic and stylish furniture, and a growing focus on workspace optimization for productivity and comfort.

Some of the major players in the home office furniture market include Ashley Furniture Industries Inc., Haworth Inc., Herman Miller Inc., HNI Corporation, Inter IKEA Systems B.V., Kimball International Inc., Knoll Inc, KOKUYO Co. Ltd., Okamura Corporation, and Steelcase Inc., Teknion Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)