Home Healthcare Market Size, Share, Trends and Forecast by Product, Service, Indication, and Region, 2025-2033

Home Healthcare Market Size and Share:

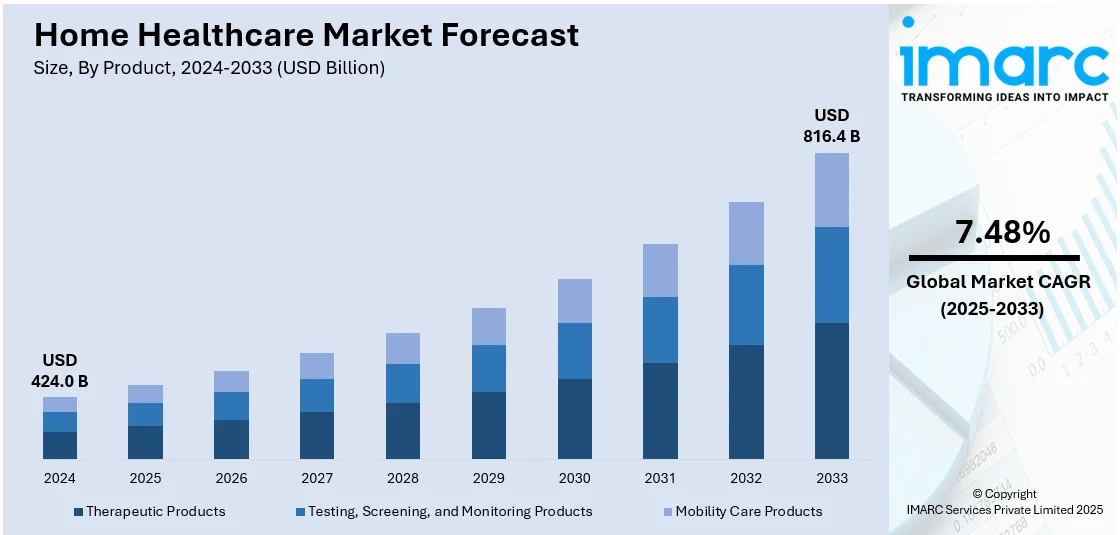

The global home healthcare market size was valued at USD 424.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 816.4 Billion by 2033, exhibiting a CAGR of 7.48% during 2025-2033. North America currently dominates the market in 2024 with over 42.5% of the market share. Several advancements in medical technology, and the escalating demand for personalized and cost-effective healthcare services are propelling the market growth. Additionally, the growing government initiatives to enhance healthcare services are among the major factors augmenting the home healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 424.0 Billion |

|

Market Forecast in 2033

|

USD 816.4 Billion |

|

Market Growth Rate 2025-2033

|

7.48% |

The increasing geriatric population worldwide, which requires ongoing medical care and assistance, particularly for chronic conditions, is driving the global home healthcare market. According to the Population Reference Bureau (PRB), 10% of the total global population is aged 65 years and older in 2024. In addition, the rising healthcare costs encourage patients to opt for more affordable, in-home care options. Technological advancements, including telemedicine and remote patient monitoring, make home-based healthcare more efficient and accessible. Additionally, growing awareness about the benefits of personalized care, such as increased comfort and independence, boosts demand. Supportive government policies, healthcare reforms, and the increasing availability of insurance coverage for home healthcare services further expand the market, making it a more attractive option for patients worldwide.

To get more information on this market, Request Sample

The United States has emerged as a key regional market for home healthcare. The industry in this region is driven by factors such as the increasing geriatric population, which requires more personalized care for chronic diseases and mobility issues. As per the Population Reference Bureau (PRB), the number of American citizens aged 65 and older will reach 82 million by 2025, constituting 23% of the total population of the United States. Moreover, rising healthcare costs and the preference for affordable alternatives are propelling patients toward home care solutions. Technological advancements, including telehealth, remote monitoring, and health-tracking devices, have enhanced the efficiency and accessibility of home healthcare. Besides this, increasing awareness about the benefits of in-home care, such as comfort and independence, is propelling market growth. Government policies, including Medicaid and Medicare coverage for home healthcare services, further contribute to industry expansion and affordability.

Home Healthcare Market Trends:

Prevalence of chronic diseases

The rising prevalence of diabetes, heart disease, chronic respiratory conditions, and neurological disorders is propelling the home healthcare market. According to the Centers for Disease Control and Prevention, in 2024, one person dies every 33 seconds from cardiovascular disease. Also, according to the New York State Department of Health, CVD (cardiovascular disease) accounted for 27% of all deaths statewide in 2021. These conditions often require long-term management, frequent monitoring, and personalized care, thereby stimulating the market. According to the home healthcare market report, the introduction of remote monitoring can reduce the burden on hospitals and healthcare facilities, as patients with chronic diseases often require frequent follow-up visits, readmissions in hospitals, and ongoing support, thus augmenting the market growth. For example, in March 2024, UTMHealthcare, one of the mobile health technology firms, partnered with virtual care platform Somml Health to launch NuLink Health, which collaborates with physicians to improve the treatment of at-risk patients in between office visits, resulting in operational and economic savings for medical practices. It uses UTMHealthcare's remote patient monitoring (RPM) technology and Somml Health's virtual care platform to deliver optimal care to patients with complicated chronic diseases, with the goal of reducing hospital readmissions. Also, by providing care at home, healthcare resources can be better allocated to patients with acute and critical conditions, which is propelling the home healthcare market outlook.

Favorable government policies

Governments initiatives are transforming the potential benefits of home-based care and launching supportive policies to promote its adoption, particularly for older people. For instance, in March 2024, the health minister of Columbia extended programs to help more seniors remain in their homes by providing approximately USD 354 Million in cash over three years. Under this program, home health services provided by regional health authorities and community-based senior services offered by nonprofit organizations would be improved to help seniors and relieve the burden on health institutes and long-term care facilities. Additionally, many governments promote the use of telehealth technologies and remote monitoring devices to facilitate virtual consultations, monitor patients remotely, and manage chronic conditions without the need for frequent hospital visits. For example, in October 2023, the government in Uttar Pradesh developed the 'Digital Doctor Initiative' aimed at increasing access to healthcare in the state. It also seeks to integrate telemedicine and on-the-spot basic diagnostic skills. Apart from this, investments in research and development (R&D) activities aimed at improving home healthcare delivery, such as wearable devices, remote monitoring systems, and electronic health records, are further contributing to the home healthcare market share. The market is undergoing substantial development, influenced by increasing demand for aging-in-place solutions and the rising adoption of telehealth technology. Favorable government policies and accelerating investments in research and development drive the emergence of innovative healthcare delivery models, including remote monitoring and wearable devices. The increasing incidences of chronic diseases and the need for lower-cost alternatives are continually driving market growth, with a growing focus on home health models that promote sustainable, high-quality care at a reasonable cost. Therefore, it is anticipated that these trends will continue to support growth in the market.

Increasing adoption of advanced technologies

Technological advancements play a vital role in driving the growth of the home healthcare market. Advanced medical devices and sensors allow healthcare providers to remotely monitor patients' vital signs, health metrics, and adherence to treatment plans. For instance, in April 2024, Royal Philips, a leading health technology company, partnered to combine smartQare's cutting-edge solution, viQtor, with the industry's best clinical patient monitoring platforms. Through this partnership, patients across Europe can benefit from the next generation of continuous monitoring, both inside and outside of hospitals. According to the home healthcare market report, innovations in telemedicine, remote patient monitoring devices, wearable health technologies, and electronic health records (EHRs) are transforming home healthcare. For example, in January 2024, Pylo Health, a supplier of remote patient monitoring equipment, launched two cutting-edge patient devices namely the Pylo 200-LTE weight scale and the Pylo 900-LTE blood pressure monitor for patients participating in remote patient monitoring (RPM) programs for hypertension and related chronic illnesses. The blood pressure monitor connects patients in even the remote and challenging-to-reach rural locations with its roaming 4G/5G connectivity and 2G fallback. These technologies improve communication between patients and healthcare providers, enable real-time monitoring of vital signs, and facilitate timely interventions, thereby enhancing patient outcomes and reducing healthcare costs.

Home Healthcare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global home healthcare market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, service, and indication.

Analysis by Product:

- Therapeutic Products

- Testing, Screening, and Monitoring Products

- Mobility Care Products

Therapeutic products stand as the largest component in 2024, holding around 42.5% of the market. According to the report, therapeutic products represented the largest market segmentation. Therapeutic products encompass several medical devices, equipment, and supplies designed to aid in the treatment and management of various health conditions at home. These products include mobility aids, such as wheelchairs and walking aids, respiratory devices, and wound care products, including dressings and wound healing agents, thus influencing the market growth. Additionally, therapeutic monitoring devices, such as blood glucose meters and blood pressure monitors, are essential in managing chronic conditions and promoting proactive health management, which is augmenting the home healthcare market revenue. For instance, in June 2024, Prevounce Health, a remote care management software, devices, and services provider, launched its first remote blood glucose monitoring device, Pylo GL1-LTE.

Analysis by Service:

- Skilled Nursing

- Rehabilitation Therapy

- Hospice & Palliative Care

- Unskilled Care

- Respiratory Therapy

- Infusion Therapy

- Pregnancy Care

Skilled nursing services leads the home healthcare market with around 87.5% of market share in 2024. According to the home healthcare market research report, skilled nursing represented the largest market segmentation. Skilled nursing is emerging as the dominant service in the market. This specialized form of care is provided by trained and licensed nurses who offer comprehensive medical support to patients in the comfort of their homes. It encompasses several healthcare tasks, including wound care, medication management, intravenous therapy, and post-surgical care, thus influencing market growth. Additionally, the growing geriatric population and the rising prevalence of chronic illnesses are escalating the demand for skilled nursing services as patients with complex medical conditions seek personalized and continuous care. Also, skilled nursing at home allows patients to avoid hospital stays and reduce the risk of infections while also providing convenience and comfort during their recovery process.

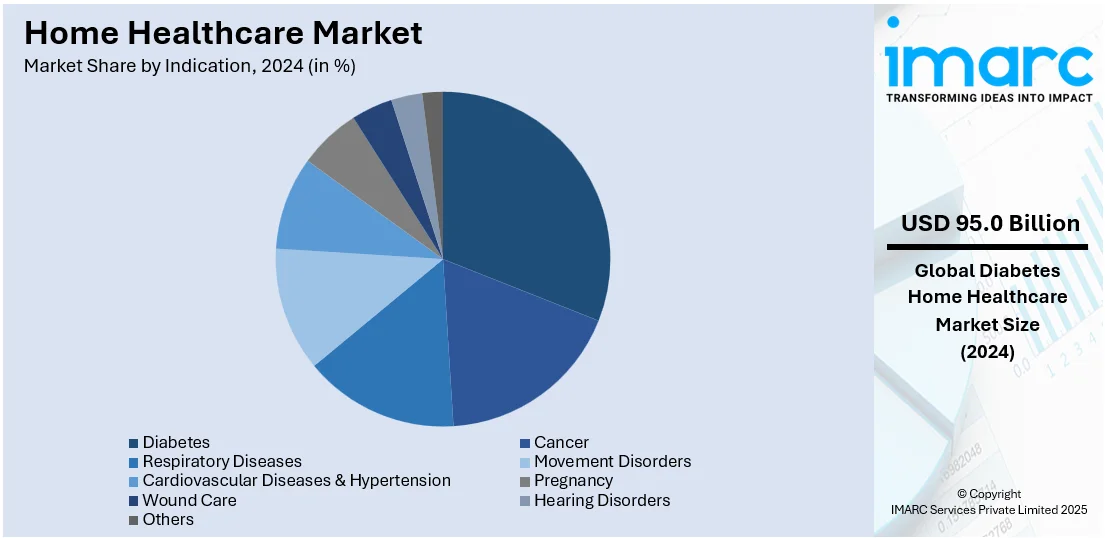

Analysis by Indication:

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases & Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Others

Diabetes leads the home healthcare market with around 22.4% of market share in 2024. According to the report, diabetes represented the largest market segmentation. The increasing incidences of diabetes are escalating the demand for home-based care for diabetic patients, thus influencing the home healthcare market statistics. Managing diabetes requires continuous monitoring of blood glucose levels, medication adherence, lifestyle modifications, and regular follow-up with healthcare professionals. Home healthcare offers a convenient and personalized approach to address these needs. For instance, in March 2024, Dexcom, one of the real-time continuous glucose monitoring (CGM) device manufacturers for people with diabetes, introduced its latest CGM system, the Dexcom ONE+, in Ireland.

Regional Analysis:

- North America

- United States

- Canda

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.5%. According to the report, North America accounted for the largest market share. The growing geriatric population, the rising prevalence of chronic diseases, and advanced healthcare infrastructures represent some of the factors driving the home healthcare market demand in North America. Additionally, technological advancements in medical devices and telehealth solutions are further propelling the adoption of home healthcare in North America. For instance, in April 2024, the United States Food and Drug Administration (FDA) launched an initiative to help create home healthcare models and home-based solutions that promote health equity.

Key Regional Takeaways:

United States Home Healthcare Market Analysis

In 2024, the United States accounts for over 84.10% of home healthcare market in North America. The home healthcare market of the United States is growing rapidly due to several key factors. Firms are focusing on providing remote patient monitoring, which is gaining demand since more and more people want to manage their chronic ailments from home. Healthcare professionals are responding to the mounting needs of people for their care, such that each person can get tailored treatment, all at the comfort of his or her home. The integration of technology is changing the face of care delivery as smart devices and telemedicine platforms are able to monitor the patient constantly and allow direct access to healthcare professionals in case of emergencies. More patients are choosing home healthcare services over visits to hospitals, while the health system is taking a shift toward preventive care and encouraging insurers to make investments in home healthcare services by reducing hospital readmission. Regulatory policies are also changing in favor of home care. Government initiatives are now making reimbursement possible for home healthcare services. The aging population is also increasingly seeking home-based care, considering it as more cost-effective and comfortable. The older population of the United States was 55.8 million or 16.8% of the population, according to the Census Bureau, in 2020. With these factors of technological innovation, patient preferences, and policy support, the home healthcare market is moving forward, with companies constantly creating new solutions to meet the rising demand for high-quality, in-home care.

Asia Pacific Home Healthcare Market Analysis

The Asia Pacific home healthcare market is growing at a rapid pace as technology has developed to make more personal care solutions. Due to the ever-rising cost of healthcare, patients and families are seeking more affordable alternatives to hospital visits. Overcrowding and long waiting hours for treatment are also prevalent problems for healthcare systems in the region. As a result, patients are preferring home-based care for convenience and efficiency. The aging population is significantly driving the demand for home healthcare services as they prefer to spend their old age in the comforts of their homes while getting medical attention. According to the United Nations Population Fund, in 2023, the elderly population across India reached 153 Million. In addition, innovations in telemedicine and remote monitoring equipment make continuous care accessible while remotely tracking patients' condition. With a high rate of chronic conditions, in combination with the need to switch toward preventive care, patients have begun to pursue long-term solutions in their home to help manage conditions consistently. Healthcare policies of many countries are also adapting to support home healthcare. Governments and insurers are reimbursing home care services more and more. This is propelling the demand for home healthcare in Asia Pacific, while promoting better care outcomes and increasing patient satisfaction.

Europe Home Healthcare Market Analysis

The home healthcare market in Europe is currently expanding as healthcare systems are increasingly adopting home-based care solutions to reduce hospital admissions and alleviate strain on medical facilities. There is a rising demand for chronic disease management, as more individuals are living with conditions such as diabetes, cardiovascular diseases, and respiratory disorders, which are requiring continuous monitoring and care at home. According to the European Union, over 33 million people in the EU suffer from diabetes. Technological advancements in telemedicine, remote patient monitoring, and wearable health devices are driving this shift by providing real-time data to healthcare providers and enhancing patient outcomes. Governments and healthcare insurers are offering more incentives and reimbursements for home healthcare services, making them financially viable for patients. The growing preference for personalized care, coupled with an aging population, is also contributing to the market's growth. Families are becoming more involved in caregiving, and as a result, home healthcare services are becoming more comprehensive, addressing a variety of needs including rehabilitation, post-operative care, and mental health support. Additionally, there is an increasing focus on improving quality of life for elderly individuals, who are preferring to age at home rather than in institutions, further boosting demand for home healthcare solutions across the region.

Latin America Home Healthcare Market Analysis

The home healthcare market in Latin America is experiencing significant growth as more people are opting for in-home care services, driven by the increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions. According to the Brazilian National Health Survey, in 2019, there were 12 946 932 individuals with CVD in Brazil. Governments are investing in healthcare infrastructure and promoting policies to alleviate pressure on hospitals and medical facilities. There is a rising demand for personalized healthcare solutions, with families seeking alternatives to institutionalized care for elderly relatives, particularly in countries with aging populations such as Brazil and Mexico. Telemedicine and remote patient monitoring are becoming more integrated into home healthcare services, as patients and providers are leveraging digital health technologies to ensure continuous care. Insurance providers are expanding coverage for home-based care, making these services more accessible and affordable. Additionally, healthcare providers are adopting innovative business models and partnerships to cater to underserved rural regions where access to traditional healthcare facilities is limited. Rising awareness about the benefits of home healthcare, such as better patient outcomes and reduced hospital readmissions, is further fuelling the demand. The integration of advanced medical devices and healthcare technologies is enhancing the delivery of in-home care services, making it an increasingly attractive option for patients and families alike across the region.

Middle East and Africa Home Healthcare Market Analysis

The home healthcare market in the Middle East and Africa is currently experiencing significant growth as consumers are increasingly seeking alternatives to traditional healthcare settings. Rising healthcare costs are propelling individuals to adopt home-based care options, allowing them to manage chronic conditions more cost-effectively. At the same time, advancements in telemedicine and remote monitoring technologies are enabling healthcare providers to offer more personalized care in the home, making it a viable option for patients who previously relied on hospital visits. Governments are also investing heavily in digital healthcare infrastructure, driving the integration of home healthcare services into national healthcare systems. In addition, the growing preference for patient-centred care, combined with an aging population and a higher prevalence of chronic diseases, is fuelling the demand for in-home healthcare services. According to the government of UAE, the geriatric population in the year 2022 was 44,289. The increasing availability of home healthcare products such as medical equipment, mobility aids, and monitoring devices is also contributing to market expansion. Healthcare professionals are adapting to the shift by offering home-based rehabilitation and monitoring services, while patients are becoming more comfortable with receiving care at home, supported by family members and caregivers. These factors are collectively driving the market, transforming home healthcare into a key pillar of the healthcare landscape in the region.

Competitive Landscape:

Leaders in the global home healthcare market have promoted the expansion of the sector by developing innovative technologies, such as remote patient monitoring systems and wearable health devices where healthcare providers are able to deliver patient care in real-time, which contribute to better patient outcomes and reduced hospital visits along with expanded home-based services (like physical therapy, skilled nursing, and chronic disease management) and are working with in-home providers and patients to establish partnerships with insurance companies to increase access to home healthcare services and reduce costs. Best practices for accessing services are also being developed through partnerships between providers and insurance companies. Companies are developing training, education, and certification programs that will contribute to the effectiveness of care and the quality of patient outcomes. Government policies are also supporting home healthcare by creating greater awareness of the benefits of in-home care, increasing access to home services, and expanding the home healthcare market to enhance accessibility and convenience.

The report provides a comprehensive analysis of the competitive landscape in the home healthcare market with detailed profiles of all major companies, including:

- A&D Company, Limited

- Addus HomeCare

- Amedisys

- B. Braun SE

- Baxter International Inc.

- Becton, Dickinson and Company

- Fresenius Medical Care AG

- Invacare Corporation

- Koninklijke Philips N.V.

- McKesson Medical-Surgical Inc.

- Medline Industries LP

- OMRON Healthcare, Inc.

- Resmed Inc.

Latest News and Developments:

- May 22, 2025: Apollo Home Healthcare has launched India's first 90-minute doctor-on-call assurance in Bangalore, setting a new standard for home healthcare services. Utilizing a technology-based logistics platform, the service promises rapid response rates by positioning physicians in strategic locations, offering quick access to life-saving medical services, most notably for geriatric patients and working-class families. Apollo plans to roll out the service to Delhi and Hyderabad during the fiscal year 2025-26, thus solidifying its leadership in India's home healthcare space.

- May 2024: LG Electronics introduced "Primefocus Health," a new venture intended to utilize innovative technology and novel healthcare therapies to enable clinicians to give a comprehensive care experience and empower consumers to take charge of their health at home.

- June 2024: Prevounce Health, a leading provider of remote care management software, devices, and services, announced the launch of its first remote blood glucose monitoring device: Pylo GL1-LTE. The blood glucose meter is clinically validated and connects to multiple cellular networks to better ensure reliable data transmission throughout the United States.

- June 2024: Auscura tailored its SmartContactTM platform with features that redefine home healthcare. Through the use of mobile technology and a simple interface, SmartContact enabled patients and authorized family members to communicate with their care teams.

- July 2024: Standalone health insurance company Star Health and Allied Insurance Company with an aim to providing healthcare service at doorstep has launched Home Health Care service in 50 cities. This company would further expand the service to other cities of India.

Home Healthcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Therapeutic Products, Testing, Screening, and Monitoring Products, Mobility Care Products |

| Services Covered | Skilled Nursing, Rehabilitation Therapy, Hospice & Palliative Care, Unskilled Care, Respiratory Therapy, Infusion Therapy, Pregnancy Care |

| Indications Covered | Cancer, Respiratory Diseases, Movement Disorders, Cardiovascular Diseases & Hypertension, Pregnancy, Wound Care, Diabetes, Hearing Disorders, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A&D Company, Limited, Addus HomeCare, Amedisys, B. Braun SE, Baxter International Inc., Becton, Dickinson and Company, Fresenius Medical Care AG, Invacare Corporation, Koninklijke Philips N.V., McKesson Medical-Surgical Inc., Medline Industries LP, OMRON Healthcare, Inc., Resmed Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the home healthcare market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global home healthcare market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the home healthcare industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Home Healthcare refers to medical and non-medical services provided to individuals in their homes, aimed at promoting recovery, managing chronic conditions, or assisting with daily activities. It includes services such as nursing care, physical therapy, medication management, and personal care, ensuring comfort, independence, and improved quality of life for patients.

The global home healthcare market was valued at USD 424.0 Billion in 2024.

IMARC estimates the global home healthcare market to exhibit a CAGR of 7.48% during 2025-2033.

The increasing geriatric population and rising prevalence of chronic diseases, growing healthcare costs and preference for cost-effective care solutions, advancements in telemedicine and healthcare technology, increased demand for personalized and patient-centric care, and government initiatives and policies supporting home healthcare services are the primary factors driving the global home healthcare market.

According to the report, therapeutic products represented the largest segment by product due to their essential role in managing chronic conditions, providing pain relief, and aiding in recovery.

Skilled nursing services leads the market by service due to its essential role in providing specialized medical care, including wound care, medication administration, and post-surgical support.

Diabetes represents the leading segment by indication due to the growing prevalence of the condition and the need for continuous monitoring and management.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global home healthcare market includes A&D Company, Limited, Addus HomeCare, Amedisys, B. Braun SE, Baxter International Inc., Becton, Dickinson and Company, Fresenius Medical Care AG, Invacare Corporation, Koninklijke Philips N.V., McKesson Medical-Surgical Inc., Medline Industries LP, OMRON Healthcare, Inc., Resmed Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)