Home Automation System Market Size, Share, Trends and Forecast by Application, Type, and Region, 2025-2033

Home Automation System Market Size and Share:

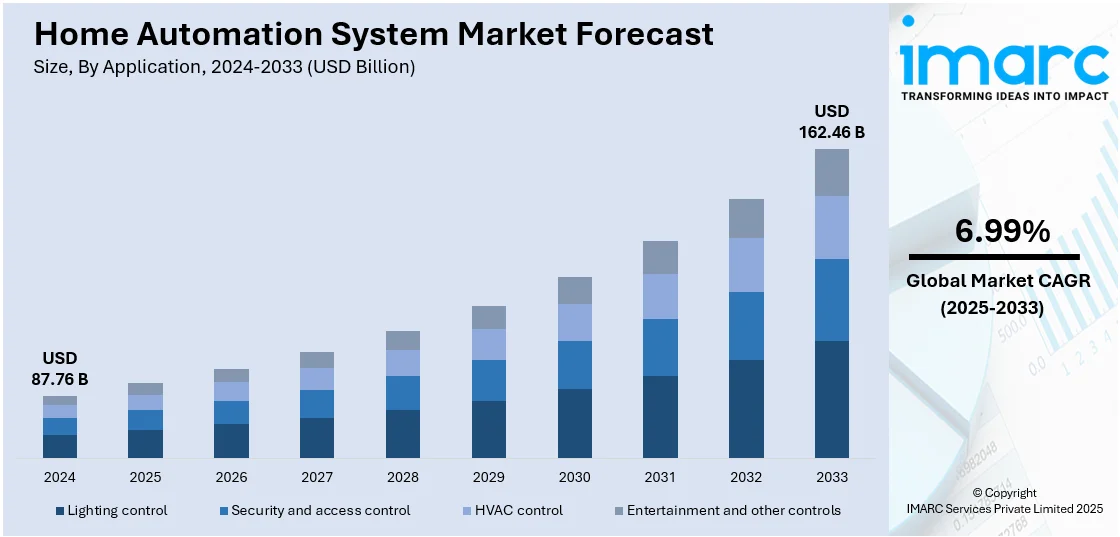

The global home automation system market size was valued at USD 87.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 162.46 Billion by 2033, exhibiting a CAGR of 6.99% during 2025-2033. Asia currently dominates the market, holding a significant market share of over 30.9% in 2024. The increasing adoption of IoT, rising consumer demand for energy-efficient solutions and convenience, integration of AI and voice assistants, government-backed initiatives promoting sustainability, and growing awareness about security and smart infrastructure in residential settings are some of the factors that are positively influencing the home automation system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 87.76 Billion |

| Market Forecast in 2033 | USD 162.46 Billion |

| Market Growth Rate 2025-2033 |

6.99%

|

The global market is primarily driven by the ongoing advances in IoT technology that allow for easy connectivity between devices. Moreover, the rising consumer demand for convenience, energy efficiency, and smart security systems is propelling the market. Additionally, the increasing disposable incomes and urbanization, particularly in developed and emerging economies, thereby fostering the market further. Apart from this, integration with AI and voice-controlled assistants improves user experience, which in turn is providing an impetus to the market. Notably, On November 14, 2024, PYMNTS reported that Apple plans to launch an AI-powered smart home display as early as March, featuring a 6-inch screen, built-in camera, and speakers. This device aims to serve as a central command center for smart home management and eCommerce transactions, potentially enhancing user convenience through voice commands and touchscreen interfaces. The PYMNTS "How We Will Pay" report reveals that 85% of consumers are highly connected, with more than half using devices during breakfast, two-thirds while commuting, and many while caregiving. Also, government favorable initiatives promoting energy conservation drive interest, is contributing to the home automation system market growth further. Apart from this, the smart devices and platform compatibility are further supporting the market.

The market in the United States is primarily driven by the growing consumer demand for convenience, energy efficiency, and security. Additionally, improving penetration of smartphones and development in IoT technology have also ensured easy remote control of smart devices, thereby raising the adoption rate. For instance, as of January 11, 2024, YouGov reports that 65% of Americans own at least one smart home device, a significant increase from 51% in 2020. Ownership of smart home security technologies has risen by 64% during the same period, with 18% of Americans now possessing such devices, up from 11% in 2020. Additionally, 37% of Americans are considering purchasing smart home technology in 2024, marking a 68% increase from 2020. Moreover, increasing user comfort due to integration of voice assistants, such as Amazon Alexa and Google Assistant, with smart home systems, and rising emphasis on sustainability that encourages use of automated lighting and energy management systems, are creating a positive home automation system market outlook. Apart from this, government initiatives for smart infrastructure, in addition to the increased interest for connected homes, is facilitating market growth.

Home Automation System Market Trends:

Rising Demand for Voice-Controlled Assistants

The escalating popularity of voice-controlled assistants such as Google Assistant, Amazon's Alexa, and Apple's Siri, which are growing to be pivotal to home automation, thereby supporting the market. They allow one to control anything in the home through simple voice commands, thereby bringing more accessibility and convenience. Besides this, another major growth-inducing factor is the growing integration of voice assistants with smart home devices to perform various activities in hands-free modes like controlling thermostats, lights, security systems, and entertainment units. For instance, in March 2024, open hardware specialist PINE64 introduced a smart speaker voice assistant platform called PineVox to help build a good community option for voice interactions.

Increasing Deployment of Energy Management Systems

Energy management systems in home automation assist in optimizing energy consumption, cutting down costs, and promoting sustainability. The U.S. Department of Energy estimates that residential energy consumption accounts for around 22% of total use in the U.S., with heating and cooling being the largest contributor. The use of such energy-efficient solutions as smart thermostats and intelligent power strips will cut down on energy use and cost for the homeowners. Energy-efficient lighting, smart thermostats, and intelligent power strips, which monitor and control energy usage, are also part of them. They also integrate with renewable energy sources such as solar panels, thus improving energy efficiency. The rising focus on environmental sustainability and the increasing cost of energy are driving the adoption of these systems in smart homes, thereby impelling the home automation system market demand. This, in turn, is propelling the home automation system industry outlook. For instance, in July 2024, Schneider Electric unveiled cutting-edge home energy management solutions, along with Miluz Lara, a new range of functional switches and sockets.

Growing Need for Security

As home automation continues to gain momentum, concerns over safety and surveillance make home security systems an integral part of the setup. According to the U.S. Bureau of Justice Statistics, 15.9 Million U.S. households faced property crime in 2020, indicating a requirement for improved home security solutions. The trend towards surveillance systems, such as video doorbells, smart locks, security cameras, and motion detectors, integrated into a network, is propelling the market. They also enable users to receive notifications about suspicious behavior, monitor the house in real-time, and control who enters the property from a remote location. For instance, in January 2024, Samsung Electronics introduced the home automation system Ballie to improve users' daily lives through its multifunctional capabilities. Besides this, prominent players are incorporating advanced features, including AI-driven threat detection, which is expected to fuel the market in the coming years.

Home Automation System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the home automation system market forecast at the global and regional levels for 2025-2033. Our report has categorized the market based on application and type.

Analysis by Application:

- Lighting control

- Security and access control

- HVAC control

- Entertainment and other controls

Entertainment and other controls lead the market in 2024 due to the high consumer demand for convenience, customization, and better living experiences. With smart homes becoming increasingly common, homeowners want an integrated control of entertainment systems, lighting, climate, and security for a seamless, personalized environment. Innovations such as voice-activated assistants, smart TVs, and multi-room audio systems drive this segment, offering advanced features that improve user convenience and enjoyment. For instance, as of May 2024, LG introduced its range of AI-based smart TVs in home entertainment markets. Additionally, the ability to control various aspects of the home from a single interface or remotely via mobile devices significantly contributes to the popularity, which is increasing the home automation system market revenue in this segmentation.

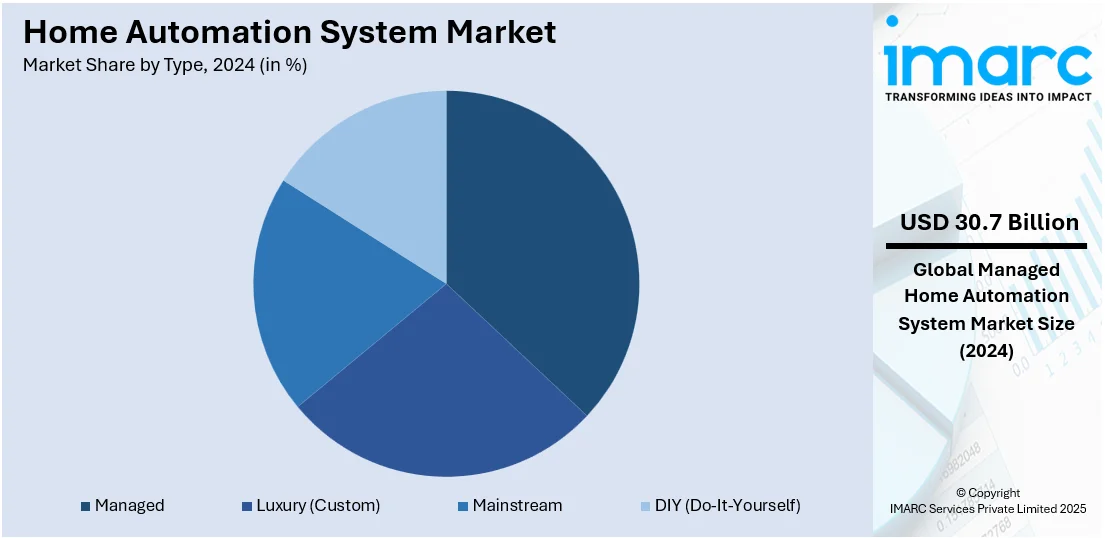

Analysis by Type:

- Luxury (Custom)

- Mainstream

- DIY (Do-It-Yourself)

- Managed

The managed segment leads the market with around 35.0% of market share in 2024. The growing consumer preference for professionally installed and maintained smart home solutions is providing reliability, security, and ease of use, thereby driving the segment. Managed services offer comprehensive support, including installation, configuration, monitoring, and troubleshooting, appealing to homeowners who want hassle-free experiences. For instance, in March 2024, Accedo introduced a dedicated OTT video-managed services offering designed to minimize complexity and risk for video service providers. They provide peace of mind with continuous monitoring and timely maintenance, proactively addressing potential issues. The increasing complexity of home automation technologies and the desire for seamless integration of various systems further drive the demand for managed services, making them a dominant segment in the home automation system market dynamics.

Regional Analysis:

- North America

- Europe

- Asia

- Rest of the World

In 2024, Asia accounted for the largest market share of over 30.9%. Rapid urbanization is driving the growth of the home automation system market in Asia. Countries such as China, Japan, and South Korea are leaders in this aspect, with considerable investments in smart home infrastructure and a high penetration of internet-connected devices. For instance, in China, companies such as Xiaomi and Huawei offer complete smart home ecosystems that include smart lighting, security systems, and voice-activated assistants. In Japan, Panasonic and Sony offer sophisticated automation solutions for smart homes, allowing integration with AI and IoT-based systems to realize energy efficiency benefits and greater comfort for the inhabitants. Furthermore, the rise in smart cities trend in countries including Singapore is also advancing the demand in home automation systems as residents seek highly integrated and integrated control over a home environment and these advancements denote the region commitment towards the promotion of better-quality living through innovated technology.

Key Regional Takeaways:

United States Home Automation Market System Analysis

The U.S. accounted for 78.80% of the total North America home automation systems market, witnessing rapid growth as consumers increasingly seek smart technologies that offer convenience, security, and energy efficiency. For instance, according to industrial reports, more than 40 Million homes in the U.S. had smart devices in 2023, indicating the strong adoption of home automation solutions. Demand for smart thermostats, lighting systems, and voice-controlled assistants has increased due to the ability it offers to facilitate more efficient home management and energy saving. Developers such as Google, Amazon, and Control4 are continuously innovating integrated solutions in response to growing consumer needs and improving availability for controlling various home functions. Government-backed initiatives in the form of Energy Star programs and smart grid technologies are also fuelling the market through energy-efficient standards. It is expected that this push for energy efficiency in homes as well as on smart grid technologies is going to boost the market over the next years.

Europe Home Automation Market System Analysis

Home automation systems market in Europe has a high prospect of growth due to its new smart home technologies and great support from regulatory forces for energy efficiency. According to the European Commission, smart home device adoption is growing in the EU with many countries making regulations on energy-efficient buildings. This shift toward sustainability is forcing a demand in the market for these systems, especially ones that optimize energy consumption and integrate renewable sources such as solar power. As an industrial report, at the end of 2023, 65.5 Million homes were smart in Europe, which means 28% of all homes in the region. Leading smart home adopters in the developed markets are Germany, the UK, and France, both on account of consumer demand and policies implemented by their respective governments. All European governments focus on minimizing carbon footprint, as such, the development of automated solutions for energy consumption reduction with energy saving, for instance, through smart energy management, smart climate control, or IoT, shall remain integral in Europe's development. Its growth is expected in the market as the European nations prefer smart city and energy-efficient home projects.

Asia Pacific Home Automation System Market Analysis

The Asia Pacific market for home automation systems is expanding rapidly. This is driven by high disposable incomes, urbanization, and increased government spending on smart city initiatives. In Japan, for instance, there are about 360 Million smart home households, having a penetration rate of 11 percent for smart home appliances in household numbers, revealing an increase in interest for automation in homes, an industrial report stated. According to the Chinese government, investments in smart city infrastructure have been high, therefore, adoption of smart home technologies has gained momentum. Other countries such as India also witness the rising demand for home automation systems, led by an increasing middle class and increasing awareness about energy-efficient solutions. The Indian government has been actively encouraging IoT and AI, thus driving innovative home automation products. The increasing demand for smart and energy-efficient homes makes the Asia Pacific region the leader in the global home automation market, with its growth likely to continue in the future.

Latin America Home Automation System Market Analysis

Home automation systems market in Latin America is gaining pace. Urbanization, improvements in connectivity, and rising consumer demand for smart living solutions drive market growth. The adoption of smart technologies, especially energy-efficient solutions, and home security systems, is expanding rapidly in Brazil, as reported by Brazil's Ministry of Science, Technology, and Innovation. According to the latest industrial report, approximately 77.7 Million households existed in Brazil in 2023, while there were merely 74.15 Million households reported in 2022. Increased demand for smart home technologies is linked to household connectivity. Brazil still dominates the regional market due to consumer interest in the region, seeking affordable, environmentally friendly, and connected devices. Additionally, as per the reports, the percentage of smart home penetration reached 16% in 2023 worldwide, showing an increasing adoption of automation systems. As the government focuses on renewable energy and green building standards, home automation systems promoting energy efficiency are in high demand. Mexico also is experiencing an increase in the adoption of smart technology, as there is a strong push for energy-efficient buildings and renewable energy solutions. Home automation systems are bound to see greater penetration as the middle class continues to grow and people embrace urban lifestyles, especially in countries with more developed technological infrastructure and government-backed green initiatives.

Middle East and Africa Home Automation System Market Analysis

The Middle East and Africa (MEA) home automation systems market is witnessing high growth rates due to increased demand for luxury homes, energy-efficient solutions, and security system enhancement. Smart Dubai initiative from the UAE government revealed that 16% penetration rate was registered in smart home technology in 2023, where the consumers of the UAE region have started developing an interest in connecting their homes to various technologies. According to industrial reports, there were nearly 130 Million smart home actions initiated in the UAE that year, which indicated higher engagement with automation systems. The customer base for smart homes in the UAE increased by 50% year-on-year in 2023, demonstrating the robust expansion of the market. The number of connected devices also increased sharply, by 90% in 2023, thereby affirming the nation's shift toward a more automated and connected habitat. The Vision 2030 program launched by Saudi Arabia is fast-tracking the development of smart homes, which emphasizes the building of technological advanced infrastructures. This trend is likely to continue pushing the market forward throughout the rest of the region.

Competitive Landscape:

Key players in the market are implementing strategic initiatives to reinforce their positions and stay ahead in the competitive landscape. These actions encompass a range of measures aimed at innovation, customer engagement, partnerships, and market expansion. They are continuously investing in research and development (R&D) to introduce innovative features and functionalities, including advancements in artificial intelligence, voice recognition, and integration with emerging technologies such as 5G and edge computing. Moreover, as per the home automation system market insights, companies are recognizing the diversity of consumer preferences across regions and focusing on providing customizable solutions. Besides this, key players are investing in educational initiatives to increase awareness and understanding of these systems by providing informative content, tutorials, and demonstrations, which is influencing the home automation system market trends. For instance, on August 29, 2024, Honeywell International and Cisco announced a collaboration to develop an AI-driven solution that autonomously adjusts building systems based on real-time occupancy data, aiming to reduce energy consumption and enhance occupant comfort. This integration combines Honeywell Forge Sustainability+ for Buildings with Cisco Spaces to monitor and optimize HVAC operations without requiring additional hardware. During a pilot at Hamdan Bin Mohammed Smart University in Dubai, the solution demonstrated an initial 10% energy savings.

The report provides a comprehensive analysis of the competitive landscape in the home automation system market with detailed profiles of all major companies, including:

- Siemens AG

- Honeywell International, Inc.

- Johnson Controls, Inc.

- Schneider Electric SE

- Legrand SA

- Ingersoll-Rand PLC

- ABB Ltd.

- Acuity Brands, Inc.

- Samsung Electronics Co., Ltd.

Recent Developments:

- January 2025: Samsung is widening its AI Home ecosystem by adding new 9" and 7" screens for the Bespoke series of refrigerators, Wall Ovens, and Washer & Dryer sets; its "Screens Everywhere" vision becomes a reality. Screens present increased usability and smart connectivity plus entertainment features that really innovate, so much so, at CES 2025.

- September 2024: ABB India said launch of ABB-free@home in India marks the advent of a full wireless home automation system. It is 'comfort, security, and energy efficiency in a single appliance.' The products can integrate and control appliances and EV chargers by connecting to any Matter-enabled Bridge in the home, thanks to its Matter Bridge Add-on for easy device connectivity.

- July 2024: Acuity Brands, through its Edison Report, launched the Cell Connect™ solution, developed in collaboration with Ubicquia Inc., for outdoor lighting on July 18, 2024. The D4i certified cellular photocontrols and LED drivers are integrated in this solution, allowing it to communicate with the UbiVu® cloud-based asset management system of Ubicquia, further enhancing smart city and utility lighting control.

- February 2024: Keus Smart Home Automation secured INR 100 Crore in its first external funding round led by OAKS Consumer Fund, a mid-market private equity fund to launch experience centers in Pune, Delhi-NCR, Bengaluru, and Mumbai, India.

- January 2024: OliverIQ launched a smart home as a service (SHaaS) platform that offers a subscription model with unlimited support and a user-friendly app for control and automation at the Consumer Electronics Show (CES) 2024.

Home Automation System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Applications Covered | Lighting Control, Security and Access Control, HVAC Control, Entertainment and Other Controls |

| Types Covered | Luxury (Custom), Mainstream, DIY (Do-It-Yourself), Managed |

| Regions Covered | North America, Europe, Asia, Rest of the World |

| Companies Covered | Siemens AG, Honeywell International, Inc., Johnson Controls, Inc., Schneider Electric SE, Legrand SA, Ingersoll-Rand PLC, ABB Ltd., Acuity Brands, Inc., Samsung Electronics Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the home automation system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global home automation system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the home automation system industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global home automation system market was valued at USD 87.76 Billion in 2024.

IMARC estimates the global home automation system market to exhibit a CAGR of 6.99% during 2025-2033, reaching a value of USD 162.46 Billion in 2033.

The key factors market includes the adoption of IoT for seamless connectivity, rising disposable incomes, growing demand for convenience, energy efficiency, and smart security, integration with AI and voice assistants, and favorable government initiatives promoting energy conservation and smart infrastructure.

Asia currently dominates the home automation system market, accounting for a share of 30.9% in 2024. The dominance is fueled by rapid urbanization, technological adoption, and increasing demand for energy-efficient solutions.

Some of the major players in the global home automation system market include Siemens AG, Honeywell International, Inc., Johnson Controls, Inc., Schneider Electric SE, Legrand SA, Ingersoll-Rand PLC, ABB Ltd., Acuity Brands, Inc., and Samsung Electronics Co., Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)