HIV Drugs Market Size, Share, Trends and Forecast by Drug Class, Distribution Channel, and Region, 2025-2033

HIV Drugs Market Size and Share:

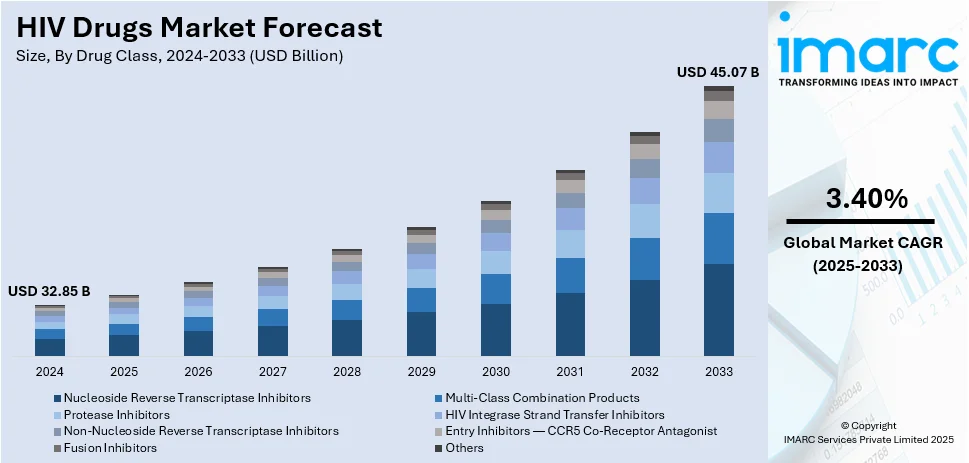

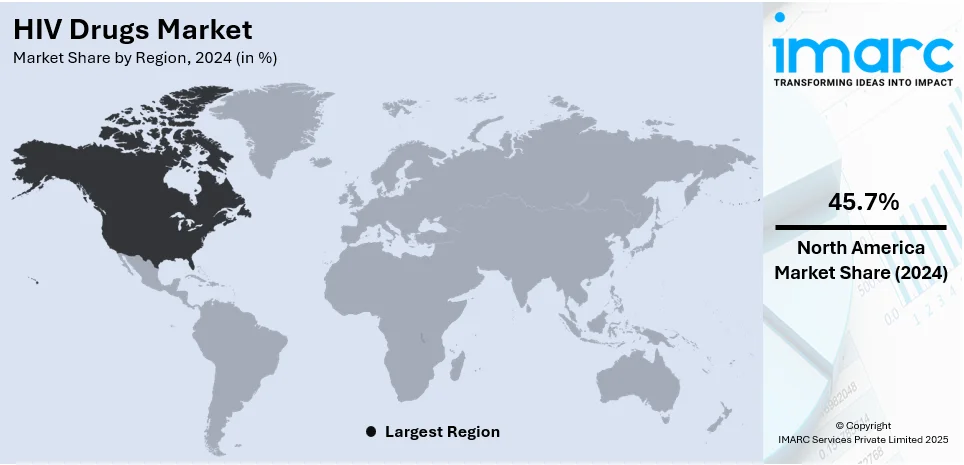

The global HIV drugs market size was valued at USD 32.85 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 45.07 Billion by 2033, exhibiting a CAGR of 3.40% during 2025-2033. North America currently dominates the market, holding a significant market share of over 45.7% in 2024. The HIV drugs market share is experiencing steady growth due to the increasing awareness and prevention efforts, growing prevalence of HIV/AIDS across the globe, and ongoing various research and development initiatives focused on more effective and accessible antiretroviral therapies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 32.85 Billion |

|

Market Forecast in 2033

|

USD 45.07 Billion |

| Market Growth Rate (2025-2033) | 3.40% |

Various organizations are identifying the significance of leveraging vast volumes of structured and unstructured data to make decisions, enhance customer experience, and enhance operations. Growing use of big data, innovations in AI and machine learning technologies, and broadening use areas of cloud computing have further increased this trend. Additionally, increased demand for data-driven decision-making across various industries is driving the HIV drugs demand. Besides, the growth in digital transformation projects and the demand for real-time analytics to respond to competitive pressures and changing market needs are the major drivers of the growth of the market.

The United States stands out as a key market disruptor, driven by widespread digital transformation initiatives across diverse sectors where analytics is pivotal for operational optimization and strategic planning. The increasing initiatives for implementing advanced technologies in the defense sector are opening new growth avenues for the HIV drugs market growth. For instance, in July 2024, The United States Department of Defense signed a Statement of Intent (SOI) for data, analytics, and artificial intelligence cooperation with the Singapore Ministry of Defense. The SOI deploys a holistic method for technological collaboration, allowing both defense establishments to examine approaches and discuss the best practices for leveraging data, analytics, and AI capabilities at speed and scale.

HIV Drugs Market Trends:

Growing Prevalence of HIV/AIDS

The global HIV/AIDS epidemic remains a critical public health issue, with approximately 38 million people living with HIV worldwide as of 2021, according to an industry report. This increased prevalence directly drives the demand for HIV drugs. As new cases continue to emerge, especially in regions with limited access to preventive measures, the need for effective treatment options intensifies. The high transmission rate of HIV, particularly in sub-Saharan Africa and certain parts of Asia and Eastern Europe, necessitates sustained and increased availability of antiretroviral therapy (ART), which remains the cornerstone of HIV treatment.

Advancements in Treatments

Recent years have witnessed significant advancements in HIV treatment regimens, contributing to the growth of the HIV drugs market. The development of highly active antiretroviral therapy (HAART), which combines multiple antiretroviral drugs, has revolutionized HIV treatment. These advancements have not only improved the effectiveness of HIV drugs but also reduced side effects, leading to better patient adherence and outcomes. The introduction of newer drug classes like integrase inhibitors and the development of long-acting injectables have further expanded treatment options, catering to diverse patient needs and preferences. For example, in 2024, Gilead shared complete Phase 3 PURPOSE 2 trial results on twice-yearly lenacapavir for HIV prevention at HIV Glasgow. The research demonstrated lenacapavir lowered HIV infections by 96%, beating Truvada. These developments increase treatment effectiveness and also enhance patient compliance, underpinning ongoing HIV drugs market growth.

Increasing Awareness Among Patients

Rising awareness and diagnostic rates among patients represent the primary factor driving the HIV drugs market. In India, for instance, the National AIDS Control Programme (NACP) conducted approximately 48 million HIV tests in the 2020-21 period, including 24.8 million tests among pregnant women. In the first six months of 2022-23, around 31 million HIV tests were undertaken, with projections indicating that more than 60 million tests would be conducted during the entire 2022-23 period—the highest since the program's inception. This increase in testing has led to a rise in the number of individuals diagnosed and subsequently seeking treatment. As of September 2022, approximately 1.624 million people living with HIV (PLHIV) in India were on antiretroviral (ARV) treatment, an increase of 110,000 from the previous year. Public health campaigns and educational initiatives have increased the understanding of HIV/AIDS, reducing stigma and encouraging more people to get tested. Early and improved diagnostic techniques have also contributed to higher detection rates of HIV, subsequently increasing the number of individuals seeking treatment. This rise in diagnosis, coupled with ongoing efforts to improve HIV testing, particularly in regions with high prevalence rates, continues to fuel the demand for effective HIV medications.

Rising Focus on Combination Therapies

Combination therapies have become a standard in HIV treatment, involving the use of multiple antiretroviral drugs to enhance efficacy and prevent drug resistance. The development and approval of fixed-dose combinations (FDCs) have simplified treatment regimens, improving adherence and patient outcomes. Pharmaceutical companies are increasingly focusing on developing these combination therapies, which offer several advantages over monotherapy, including reduced pill burden and improved patient compliance. Gilead Sciences, a leading pharmaceutical company, reported robust sales of its combination therapy, Biktarvy. In the fourth quarter of 2024, Biktarvy achieved sales of USD 3.8 billion, marking a 21% increase from the previous year. This growth contributed to Gilead's total HIV drug revenue of USD 7.6 billion for the quarter. The growing preference for combination therapies among healthcare providers and patients is a key factor providing a positive HIV drugs market outlook.

HIV Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the HIV drugs market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on drug class and distribution channel.

Analysis by Drug Class:

- Nucleoside Reverse Transcriptase Inhibitors

- Multi-Class Combination Products

- Protease Inhibitors

- HIV Integrase Strand Transfer Inhibitors

- Non-Nucleoside Reverse Transcriptase Inhibitors

- Entry Inhibitors — CCR5 Co-Receptor Antagonist

- Fusion Inhibitors and Others

Nucleoside reverse transcriptase inhibitors lead the market with around 43.2% of market share in 2024. NRTIs, also known as nucleoside analogs, are a crucial class of HIV drugs. They inhibit the action of reverse transcriptase, an enzyme the virus uses to replicate its genetic material. NRTIs are often included as a backbone in HIV treatment regimens due to their effectiveness and safety. They are widely used as a first-line therapy, either alone or in combination with other drug classes, making them the largest segment in the HIV drugs market.

Multi-class combination products refer to antiretroviral therapies that combine drugs from different classes. These combinations are designed to target HIV from multiple angles, reducing the risk of resistance development and increasing treatment efficacy. They offer convenience by simplifying the regimen for patients and are often prescribed when NRTIs alone are insufficient.

Protease inhibitors (PIs) interfere with the protease enzyme, necessary for HIV maturation and replication. PIs are a vital part of combination therapies and have been instrumental in reducing HIV-related deaths. They are used in conjunction with other drug classes to suppress viral replication effectively.

Integrase strand transfer inhibitors (INSTIs) block the integration of viral genetic material into the host cell's DNA, preventing viral replication. INSTIs have gained prominence due to their potent antiviral activity and favorable side-effect profiles. They are commonly used in first-line regimens and in treatment-experienced patients.

NNRTIs are another class of HIV drugs that target reverse transcriptase but do so differently from NRTIs. They bind to the enzyme and inhibit its activity. NNRTIs are often part of combination therapies and are especially useful in cases where resistance to other drug classes has developed.

CCR5 co-receptor antagonists block the CCR5 receptor on the surface of immune cells, preventing HIV from entering and infecting these cells. They are typically used in patients who are CCR5-tropic, meaning their virus uses the CCR5 co-receptor for entry.

Fusion inhibitors work by preventing the virus from fusing with the host cell membrane, thus inhibiting viral entry. This class of drugs is less commonly used than others due to their complex administration (usually by injection).

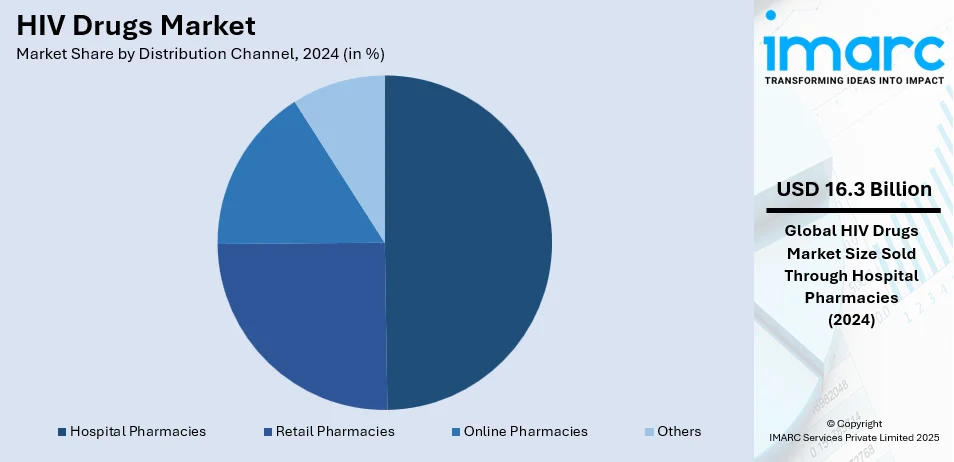

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Hospital pharmacies lead the market with around 49.5% of market share in 2024. Hospital pharmacies constitute the largest segment in the HIV drugs market, primarily due to their role as essential providers of antiretroviral therapies to inpatients and outpatients living with HIV/AIDS. These pharmacies operate within healthcare institutions, including public and private hospitals, clinics, and specialty HIV treatment centers. They offer a wide range of HIV medications, ensuring access to the latest antiretroviral therapies for patients. Hospital pharmacies play a crucial role in medication management, counseling, and monitoring, contributing significantly to patient adherence and treatment outcomes. With a direct link to healthcare providers, hospital pharmacies are pivotal in the comprehensive care and management of HIV/AIDS patients.

Retail pharmacies, including independent drugstores and chain pharmacies, form another vital segment in the HIV drugs market. They serve as accessible points of care for individuals seeking prescription medications, including antiretroviral drugs. Retail pharmacies provide convenience and privacy for patients picking up their HIV medications. They play a critical role in supporting medication adherence through counseling and refill reminders. The retail segment is especially important for patients in urban and suburban areas who may not access hospital-based care regularly.

Online pharmacies have gained prominence as a convenient and discrete source of HIV medications. This segment caters to individuals who prefer the convenience of ordering their antiretroviral drugs online and having them delivered to their doorstep. Online pharmacies offer a wide selection of HIV medications, often at competitive prices. They may also provide telemedicine services, enabling patients to consult with healthcare professionals remotely. The online pharmacy segment has seen significant growth, particularly in regions with robust e-commerce infrastructure, and it serves as an option for individuals who face barriers to traditional pharmacy access.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 45.7%. North America dominates the global HIV drugs market due to its well-developed healthcare infrastructure, high awareness about HIV/AIDS, and access to advanced antiretroviral therapies. The region is characterized by extensive research and development activities, a large patient population, and significant government funding for HIV/AIDS programs. Furthermore, the presence of major pharmaceutical companies in North America contributes to the market's growth. The focus here is on innovative treatments, combination therapies, and efforts to reduce new infections through comprehensive prevention strategies.

Europe is a substantial market for HIV drugs, characterized by a well-regulated healthcare system and access to state-of-the-art treatments. The region has made progress in reducing HIV transmission rates, but it continues to face challenges related to stigma and late diagnosis. The market in Europe is driven by increasing awareness, comprehensive healthcare coverage, and collaborations between healthcare providers and pharmaceutical companies to improve patient outcomes. Additionally, research into long-acting therapies and preventive measures like PrEP contributes to the market's development.

The Asia Pacific region is witnessing rapid growth in the HIV drugs market due to its large and diverse population, including many individuals living with HIV. This segment faces unique challenges, such as varying healthcare infrastructure, economic disparities, and culturally diverse populations. Increased efforts to expand access to treatment, raise awareness, and reduce new infections are driving market growth. Generic medications and government initiatives to combat HIV/AIDS play a significant role in the Asia Pacific market. Moreover, collaborations with international organizations and NGOs are enhancing the region's response to the HIV epidemic.

Latin America has a growing HIV drugs market, driven by the expanding healthcare infrastructure and increased access to treatment and prevention programs. The region faces challenges related to inequality and limited access to healthcare services in some areas. However, initiatives to improve healthcare coverage, raise awareness, and expand access to antiretroviral therapies are driving market growth. Collaboration between governments, pharmaceutical companies, and non-profit organizations is critical to addressing the HIV/AIDS epidemic in Latin America.

The Middle East and Africa represent a diverse and challenging market for HIV drugs. While access to treatment has improved in some countries, significant disparities persist due to economic and healthcare infrastructure differences. The region faces cultural and social stigma related to HIV/AIDS, which can hinder diagnosis and treatment. Nonetheless, efforts to expand access to medications, increase awareness, and promote preventive measures are ongoing. Partnerships with international organizations and global health initiatives are crucial in addressing the unique challenges in the Middle East and Africa.

Key Regional Takeaways:

United States HIV Drugs Market Analysis

In 2024, the United States accounted for over 93.60% of the HIV drugs market in North America. The U.S. HIV medicines market is supported by high prevalence levels, strong government action, and ongoing innovation in available treatments. The CDC states that nearly 1.2 million Americans have HIV, and it reported about 32,100 new cases in 2021. The Ryan White HIV/AIDS Program cared for more than 560,000 individuals in 2023, providing extensive treatment access. Gilead Sciences and ViiV Healthcare dominate the market, investing in emerging therapies like long-acting injectables and two-drug regimens. Patent cliff is bringing more competition, allowing the introduction of cheap generics. The "Ending the HIV Epidemic" plan would curb new infections by 90% by 2030, spurring market growth. PrEP use is also on the rise with the support of insurance coverage and public health programs. The American market is also seeing developments in HIV cure science, with companies venturing into gene therapy and immunologically based therapies to transform patient treatment.

Europe HIV Drugs Market Analysis

Government-sponsored healthcare programs, rising awareness, and advances in treatments drive the European HIV medications market. It is estimated by the European Centre for Disease Prevention and Control (ECDC) and the World Health Organization (WHO) Regional Office for Europe that over 2.3 million individuals within the WHO European Region live with HIV. In 2022, an estimated 107,000 individuals were diagnosed with HIV in the region, with approximately 17,000 diagnosed in the EU/EEA. Germany, France, and the UK are among the leaders in ART adoption, with a robust healthcare infrastructure and reimbursement environment. PrEP demand is rising, with wider access programs among leading European countries. Gilead Sciences and ViiV Healthcare hold sway in the market, with approvals for long-acting injectables influencing treatment directions. Furthermore, programs such as the Fast-Track Cities initiative seek to enhance diagnosis levels and treatment compliance, promoting long-term market development in the region.

Asia Pacific HIV Drugs Market Analysis

The Asia Pacific market for HIV drugs is growing owing to rising prevalence of the disease, government efforts, and access to better healthcare. UNAIDS estimates that there are nearly 6.7 million HIV-positive individuals in the Asia-Pacific region, and India and China have the maximum number of cases. India's National AIDS Control Programme (NACP) has been offering free antiretroviral treatment (ART) to more than 1.8 million patients, which contributes to market growth. China's landscape of HIV care is changing through growing ART use and government-sponsored prevention initiatives. The region has seen growing long-acting injectable and fixed-dose combination demand, mostly in Japan and Australia, with innovative treatments that are increasingly sought after. Major players Gilead Sciences and ViiV Healthcare, alongside local players such as Cipla and Hetero, control the market. Further, international associations and public health programs are pushing early diagnosis and access to treatment, making Asia Pacific a major contributor to global HIV treatment innovator.

Latin America HIV Drugs Market Analysis

The Latin American HIV medications market is increasing because of widening government programs and increased treatment access. UNAIDS estimates that nearly 2.2 million people in the region are HIV positive. The leading market is in Brazil with its universal ART program, where over 715,000 individuals are receiving free treatment. Other nations, such as Mexico and Argentina, are also increasing ART access through public health programs. Global partnerships, including with the Global Fund, facilitate early treatment and treatment expansion. Increasing awareness and more effective screening programs underpin growth in the market, with domestic production of generic ART in Brazil and Argentina making it affordable. Gilead Sciences and ViiV Healthcare continue to lead, but local production is raising competition. The market is also experiencing a gradual transition towards long-acting injectables and streamlined regimens, as with global treatment gains. Latin America's ongoing commitment to HIV care places it as one of the more important emerging markets for ART availability and innovation.

Middle East and Africa HIV Drugs Market Analysis

The Middle East and African HIV drugs market is dominated by the high incidence of HIV in sub-Saharan Africa and increasing government programs to enhance access to treatment. Sub-Saharan Africa has about 67% of all HIV cases in the world, and an estimated 25.6 million individuals live with HIV. South Africa continues to be the biggest market, with more than 5.4 million people on antiretroviral therapy (ART) under its public health system. South Africa's ART coverage was also cited at 75% in 2022, by the World Bank. Other countries, such as Kenya and Nigeria, are consolidating ART distribution through international partnerships and national healthcare funding. The growing access to generic ART medicines is decreasing the cost of treatment, improving affordability. In addition, efforts by international health agencies are enhancing early diagnosis and increasing access to long-acting ART choices, setting the region up for ongoing success in HIV care.

Competitive Landscape:

Key players in the global HIV drugs market are actively engaged in several strategic initiatives. They are focusing on research and development to innovate and improve existing antiretroviral therapies, aiming for more convenient dosing regimens, fewer side effects, and enhanced treatment outcomes. These companies are also expanding their product portfolios by developing new drugs and combination therapies. Additionally, they are collaborating with governments, NGOs, and healthcare providers to increase access to HIV medications in resource-limited regions and to implement preventive measures. Furthermore, these pharmaceutical giants are investing in awareness campaigns and education to reduce HIV stigma and promote early diagnosis and treatment.

The report provides a comprehensive analysis of the competitive landscape in the HIV drugs market with detailed profiles of all major companies, including:

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- ViiV Healthcare

- AbbVie

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

- Bristol-Myers Squibb

- Gilead Sciences, Inc.

- Johnson & Johnson

- Cipla Limited

- Daiichi Sankyo

- Emcure Pharmaceuticals

- Hetero Drugs

- Mylan N.V

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- February 2025: ViiV Healthcare finalized negotiations with the pan-Canadian Pharmaceutical Alliance for APRETUDE (cabotegravir) for HIV-1 pre-exposure prophylaxis (PrEP). APRETUDE, a long-acting injectable, demonstrated superior efficacy over daily FTC/TDF tablets. ViiV aims to expedite public reimbursement, ensuring broad access through provincial and territorial drug plans.

- November 2024: Gilead presented full Phase 3 PURPOSE 2 trial data on twice-yearly lenacapavir for HIV prevention at HIV Glasgow. The study showed lenacapavir reduced HIV infections by 96%, outperforming Truvada. The FDA granted Breakthrough Therapy Designation, with regulatory filings expected by late 2024.

- October 2024: Gilead and Merck announced that a Phase 2 study of their once-weekly oral HIV treatment, islatravir + lenacapavir, maintained viral suppression (94.2%) at Week 48. No participants had a viral load ≥50 copies/mL. The regimen will advance to Phase 3 trials.

- March 2024: AbbVie has initiated a Phase I trial for ABBV-1882, a novel HIV treatment combining ABBV-181 and ABBV-382. The study evaluates its safety, tolerability, and pharmacokinetics. Dr. Samantha Reynolds highlighted its potential to enhance HIV therapy by targeting immune pathways.

- June 2022: Cipla Ltd. and its partner Drugs for Neglected Diseases Initiative (DNDi) reported the availability of a 4-in-1 antiretroviral medication for younger children. This innovative treatment has been approved by the South African Health Products Regulatory Authority (SAHPRA) and is specifically designed for infants and young children living with HIV.

HIV Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Class Covered | Multi-Class Combination Products, Nucleoside Reverse Transcriptase Inhibitors, Non-Nucleoside Reverse Transcriptase Inhibitors, Protease Inhibitors, Fusion Inhibitors, Entry Inhibitors - CCR5 Co-Receptor Antagonist, HIV Integrase Strand Transfer Inhibitors |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Boehringer Ingelheim International GmbH, Merck & Co., Inc., ViiV Healthcare, AbbVie, F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb, Gilead Sciences, Inc., Johnson & Johnson, Cipla Limited, Daiichi Sankyo, Emcure Pharmaceuticals, Hetero Drugs, Mylan N.V, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the HIV drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global HIV drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the HIV drugs industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The HIV drugs market was valued at USD 32.85 Billion in 2024.

The HIV drugs market is projected to exhibit a CAGR of 3.40% during 2025-2033.

The HIV drugs market is driven by increasing global awareness, improved diagnostic tools, and rising prevalence of HIV. Advances in antiretroviral therapies (ART), government initiatives for expanded access, and research into long-acting treatments contribute to market growth. Additionally, the demand for personalized treatment regimens fuels innovation in the sector.

North America currently dominates the market driven by high healthcare spending, robust research and development, and advanced healthcare infrastructure.

Some of the major players in the HIV drugs market include Boehringer Ingelheim International GmbH, Merck & Co., Inc., ViiV Healthcare, AbbVie, F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Bristol-Myers Squibb, Gilead Sciences, Inc., Johnson & Johnson, Cipla Limited, Daiichi Sankyo, Emcure Pharmaceuticals, Hetero Drugs, Mylan N.V, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)