Histology and Cytology Market Report by Product (Instruments and Analysis Software System, Consumable and Reagents), Type of Examination (Histology, Cytology), Test Type (Microscopy Tests, Molecular Genetics Tests, Flow Cytometry), Application (Drug Discovery and Designing, Clinical Diagnostics, Research), and Region 2025-2033

Global Histology and Cytology Market:

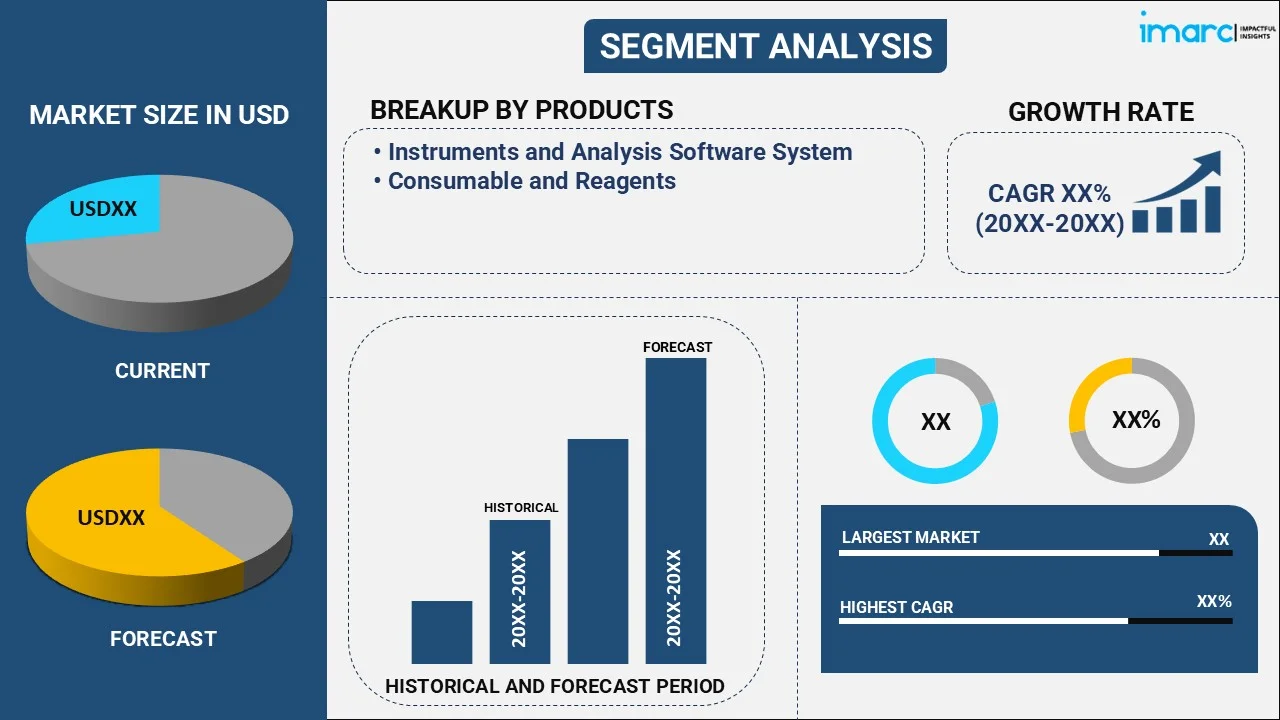

The global histology and cytology market size reached USD 18.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.6 Billion by 2033, exhibiting a growth rate (CAGR) of 9.43% during 2025-2033. The increasing demand for early disease detection, along with the rising awareness about advanced therapeutics, is propelling the market.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.2 Billion |

| Market Forecast in 2033 | USD 42.6 Billion |

| Market Growth Rate 2025-2033 | 9.43% |

Histology and Cytology Market Analysis:

- Major Market Drivers: The growing advancements in diagnostic technology are making these tests more efficient, thereby propelling the market.

- Key Market Trends: The rising awareness about cancer screening is leading to higher utilization of these tests, which is acting as a significant growth-inducing factor.

- Competitive Landscape: Some of the major market companies include Abbott Laboratories, Becton Dickinson and Company, Carl Zeiss AG, Danaher Corporation, F. Hoffmann-La Roche AG, Hologic Inc., Koninklijke Philips N.V., Merck KGaA, Olympus Corporation, PerkinElmer Inc., Sysmex Corporation, Thermo Fisher Scientific Inc., and Trivitron Healthcare, among many others.

- Geographical Trends: North America exhibits a clear dominance in the market due to advanced healthcare infrastructure and rising cancer cases, along with the increasing demand for diagnostic services in pathology labs.

- Challenges and Opportunities: The limited accessibility and high costs are hindering the market. However, technological advancements and expanded training programs to improve efficiency and affordability will continue to strengthen the market over the forecast period.

Histology and Cytology Market Trends:

Technological Advancements in AI Integration

AI integration is transforming histology and cytology by enabling more precise analysis of pathology slides. Moreover, advanced imaging techniques paired with AI-driven tools improve the detection of abnormal cells, thereby reducing manual errors. Furthermore, these innovations streamline processes, thereby making diagnoses quicker and more reliable. Thus, benefiting laboratories and healthcare providers and driving histology and cytology market growth. For instance, in August 2024, Modella AI launched multimodal foundation models and generative AI copilots, including PathChat 2, to enhance diagnostic accuracy in pathology. These innovations revolutionize the market by automating tasks, improving efficiency, and integrating pathology images with clinical data for comprehensive analysis.

Improved Diagnostic Accuracy and Efficiency

Enhanced imaging technologies and automated workflows are increasing the accuracy of diagnoses in histology and cytology. In addition, faster detection of abnormalities ensures early intervention while reducing false negatives. Also, this results in better patient outcomes, as medical professionals can make more informed decisions with greater confidence and in less time. For instance, in February 2024, Hologic launched the FDA-cleared genius digital diagnostics system, the first digital cytology platform combining AI with advanced imaging for cervical cancer screening. It reduces false negatives by approximately 28%, improves workflow, and enables remote collaboration for enhanced diagnostic accuracy in histology and cytology.

Growing Demand for Digital Pathology Solutions

The need for scalable, remote, and secure solutions drives the shift towards digital pathology. In contrast, laboratories and healthcare institutions are adopting digital platforms for easy access to data, centralized workflows, and enhanced collaboration among professionals, which improves research and clinical efficiency while ensuring the secure handling of pathology information. For instance, in October 2024, HistoWiz launched its advanced FFPE block management solution as part of the PathologyMap 2.0 platform. This solution offers 24/7 digital access to tissue samples, secure storage, rapid histology services, and integrated workflows, enhancing efficiency and security in histology and cytology research.

Global Histology and Cytology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the market forecast at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, type of examination, test type, and application.

Breakup by Product:

- Instruments and Analysis Software System

- Consumable and Reagents

Consumable and reagents currently dominate the market

The report has provided a detailed breakup and analysis of the market based on the product. This includes instruments and analysis software system and consumable and reagents. According to the report, consumable and reagents represented the largest market segmentation.

Consumables and reagents exhibit a clear dominance in the market, with significant growth driven by the regular need for replenishing consumables during diagnostic procedures. For example, Hologic's ThinPrep Pap Test reagents have become widely adopted in cytology for detecting cervical abnormalities.

Breakup by Type of Examination:

- Histology

- Cytology

Cytology currently dominates the market

The report has provided a detailed breakup and analysis of the market based on the type of examination. This includes histology and cytology. According to the report, cytology represented the largest market segmentation.

Cytology, lead the market, which is driven by focusing on the study of individual cell structures, often surpasses histology in faster diagnostics. For example, fine needle aspiration cytology is widely used in cancer screening due to its minimally invasive nature and quick results.

Breakup by Test Type:

- Microscopy Tests

- Molecular Genetics Tests

- Flow Cytometry

Microscopy tests currently dominates the market

The report has provided a detailed breakup and analysis of the market based on the test type. This includes microscopy tests, molecular genetics tests, and flow cytometry. According to the report, microscopy tests represented the largest market segmentation.

Microscopy tests dominate the market, offering precise cellular analysis. For example, Roche's Digital Pathology portfolio enhances efficiency by integrating AI in microscope testing, thereby helping pathologists detect abnormalities in tissue samples more accurately and quickly than traditional methods.

Breakup by Application:

- Drug Discovery and Designing

- Clinical Diagnostics

- Point-of-Care (PoC)

- Non-Point-of-Care

- Research

Drug discovery and designing currently hold the largest histology and cytology market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes drug discovery and designing, clinical diagnostics (point-of-care (PoC) and non-point-of-care), and research. According to the report, drug discovery and designing represented the largest market segmentation.

Drug discovery and designing leads the market, as they play a significant role in histology and cytology by enabling the identification of cellular changes in response to new compounds. For instance, PerkinElmer's launch of advanced imaging systems accelerates these processes by providing detailed cellular analysis for drug development.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America currently dominates the market

The market outlook report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest histology and cytology market share.

North America dominates the market, which is driven by advanced healthcare infrastructure and high adoption of diagnostic technologies. In addition, the presence of key industry players, like Hologic and Becton Dickinson, fuels innovation and product launches. For example, Hologic's Panther Fusion system, offering advanced molecular diagnostics, highlights the region's focus on expanding diagnostic capabilities. Also, favorable government initiatives and a rising number of cancer cases support the market's growth, making North America a leader in histology and cytology advancements.

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all market companies have also been provided. Some of the key players in the market include:

- Abbott Laboratories

- Becton Dickinson and Company

- Carl Zeiss AG

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Hologic Inc.

- Koninklijke Philips N.V.

- Merck KGaA

- Olympus Corporation

- PerkinElmer Inc.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Trivitron Healthcare

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Histology and Cytology Market Recent Developments:

- October 2024: HistoWiz launched its advanced FFPE block management solution as part of the PathologyMap 2.0 platform. This solution offers 24/7 digital access to tissue samples, secure storage, rapid histology services, and integrated workflows.

- September 2024: Vieworks introduced the Luceon 510 digital pathology scanner, featuring a three-camera structure and trifocal layer merge mode for histopathology and cytology slides.

- February 2024: Hologic unveiled the FDA-cleared genius digital diagnostics system, the first digital cytology platform combining AI with advanced imaging for cervical cancer screening. It reduces false negatives by approximately 28%, improves workflow, and enables remote collaboration.

Histology and Cytology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Instruments and Analysis Software System, Consumable and Reagents |

| Type of Examinations Covered | Histology, Cytology |

| Test Types Covered | Microscopy Tests, Molecular Genetics Tests, Flow Cytometry |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Becton Dickinson and Company, Carl Zeiss AG, Danaher Corporation, F. Hoffmann-La Roche AG, Hologic Inc., Koninklijke Philips N.V., Merck KGaA, Olympus Corporation, PerkinElmer Inc., Sysmex Corporation, Thermo Fisher Scientific Inc., Trivitron Healthcare, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC's industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the histology and cytology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global histology and cytology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the histology and cytology industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global histology and cytology market size was valued at USD 18.2 Billion in 2024.

We expect the global histology and cytology market to exhibit a CAGR of 9.43% during 2025-2033.

The rising usage of histology and cytology in diagnosing numerous diseases, such as cancer, cervical disease, tuberculosis, etc., as well as in enhancing the sensitivity, specificity, and accuracy of diagnostic methods, is primarily driving the global histology and cytology market.

The sudden outbreak of the COVID-19 pandemic has led to the rising adoption of histology and cytology methods to understand the nature of the coronavirus infection and develop novel vaccines to combat the risk of disease spread.

Based on the product, the global histology and cytology market can be segmented into instruments and analysis software system and consumable and reagents. Currently, consumable and reagents hold the majority of the total market share.

Based on the type of examination, the global histology and cytology market has been divided into histology and cytology, where cytology exhibits a clear dominance in the market.

Based on the test type, the global histology and cytology market can be categorized into microscopy tests, molecular genetics tests, and flow cytometry. Among these, microscopy tests account for the majority of the global market share.

Based on the application, the market has been segregated into drug discovery and designing, clinical diagnostics, and research. Currently drug discovery and designing holds the largest histology and cytology market share.

On a regional level, the market can be classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global histology and cytology market include Abbott Laboratories, Becton Dickinson and Company, Carl Zeiss AG, Danaher Corporation, F. Hoffmann-La Roche AG, Hologic Inc., Koninklijke Philips N.V., Merck KGaA, Olympus Corporation, PerkinElmer Inc., Sysmex Corporation, Thermo Fisher Scientific Inc., and Trivitron Healthcare.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)