Hip Replacement Market Report by Procedure (Total Hip Replacement, Partial Hip Replacement, Revision Hip Replacement, Hip Resurfacing), Material (Metal on Metal, Metal on Polyethylene, Ceramic on Polyethylene, Ceramic on Metal, Ceramic on Ceramic), End User (Hospitals, Orthopedic Clinics, Ambulatory Surgery Centers), and Region 2025-2033

Market Overview:

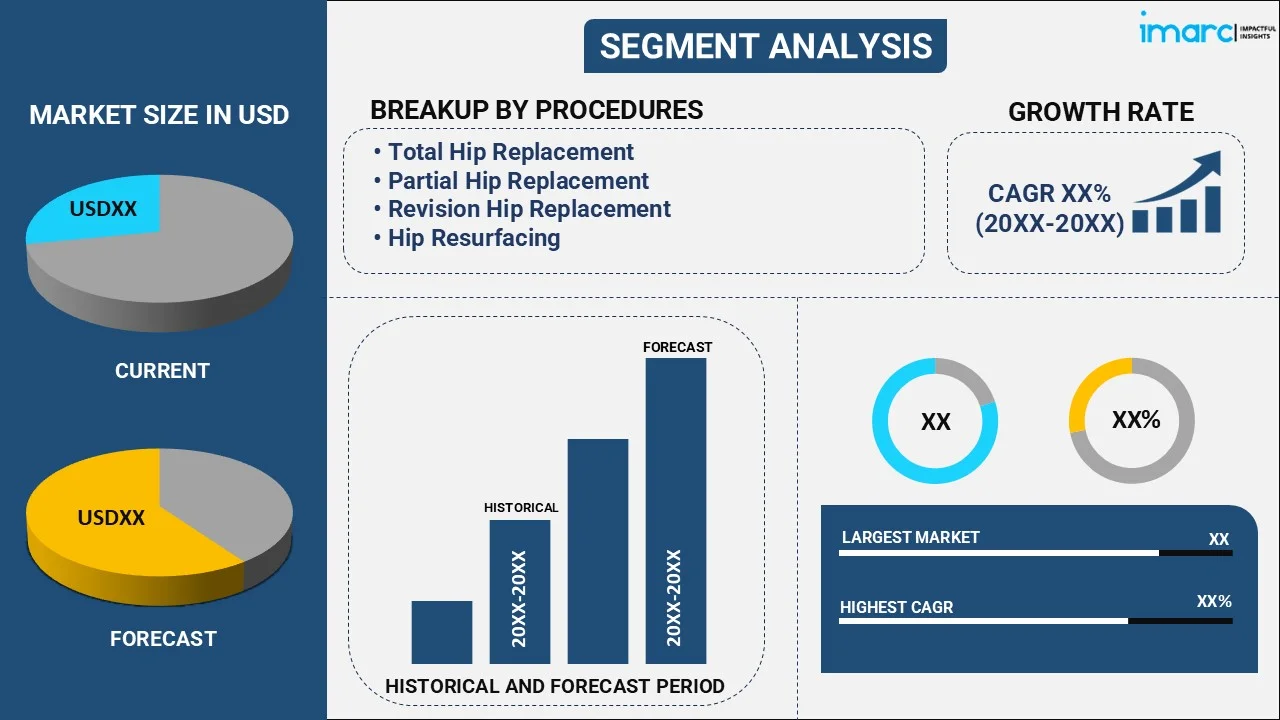

The global hip replacement market size reached USD 8.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 11.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.34% during 2025-2033. The rising prevalence of various types of arthritis, the increasing popularity of minimally invasive hip replacement procedures, the aging population, and the advent of innovative non-metal materials are some of the major factors propelling the hip replacement market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.1 Billion |

| Market Forecast in 2033 | USD 11.9 Billion |

| Market Growth Rate (2025-2033) | 4.34% |

Hip replacement, also known as hip arthroplasty, is a surgical procedure in which a damaged or diseased hip joint is replaced with an artificial joint, known as a prosthesis. The procedure is usually performed to relieve pain and improve mobility in individuals with severe hip joint conditions such as osteoarthritis, rheumatoid arthritis, avascular necrosis, hip fractures, or other hip-related injuries or conditions. Hip replacement surgery is usually performed under general anesthesia, and the surgeon either uses traditional open surgery or minimally invasive techniques.

Hip replacement aids in restoring function and mobility, resuming daily activities, and improving patients' overall quality of life. As a result, the rising awareness about these procedures and their related benefits will fuel the growth of the hip replacement market during the forecast period. A surge in the incidence of orthopedic problems and obesity due to sedentary lifestyles, poor dietary habits, and a lack of physical activity is contributing to the high prevalence of hip joint and bone damage. Since hip replacement implants are useful in patients suffering from total or partial hip damage and injuries, the increase in the prevalence of such conditions across the globe represents the primary factor driving the market growth. Moreover, the escalating need for surgical procedures and the growing burden of fatal road accidents and sports-related injuries are other factors that are contributing to the market expansion.

Hip Replacement Market Trends/Drivers

Rise in the cases of lower extremity conditions

Lower extremity conditions, such as osteoarthritis (OA), osteoporosis, and hip ailments, significantly affect the mobility, life quality, and ability of patients to participate in regular activities. According to a report by Osteoarthritis Research Society International, about 130 million people globally will suffer from osteoarthritis by 2050. Over the years, there has been a rise in the prevalence of various types of arthritis, including rheumatoid arthritis, OA, traumatic arthritis, and osteonecrosis. Therefore, hip replacement is becoming more and more popular and is predicted to expand at a significant CAGR during the forecast period. Moreover, the surging incidences of orthopedic conditions and degenerative disorders are contributing to market growth.

Increase in research and development (R&D) activities

At present, the increasing utilization of modern technology, such as 3D printing, is providing a lucrative growth opportunity to the hip replacement industry. The 3D printing technology has enabled manufacturers to develop novel hip replacement prostheses that provide higher precision, improved surgical efficiency, shortened operation times, and reduced exposure to radiation, thereby enhancing treatment outcomes. In addition to this, the increasing research and development (R&D) activities by key players to introduce new hip replacement implants made from advanced alloys and the growing patient preferences for minimally invasive and effective alternatives to traditional surgeries are contributing to the strong uptake of advanced hip replacement procedures worldwide.

Rapid growth in the geriatric population

The growing geriatric population across the globe is fueling the growth of the hip replacement market. This can be attributed to weak bone density, increased wear and tear of joints with age, and reduced ability of older adults to regenerate bones, making them more susceptible to developing bone fractures and joint damage. There is also a high incidence of various orthopedic conditions, such as hip ailments and arthritis, among elderly people, which is augmenting the demand for hip replacement surgeries and implants. Furthermore, significant improvements in medical infrastructure and surgical facilities coupled with rising healthcare expenditure of the masses and favorable reimbursement policies are catalyzing market growth.

Hip Replacement Industry Segmentation

IMARC Group provides an analysis of the key trends in each segment of the global hip replacement market report, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on procedure, material, and end user.

Breakup by Procedure:

- Total Hip Replacement

- Partial Hip Replacement

- Revision Hip Replacement

- Hip Resurfacing

Total hip replacement dominates the hip replacement market

The report has provided a detailed breakup and analysis of the hip replacement market based on the procedure. This includes total hip replacement, partial hip replacement, revision hip replacement, and hip resurfacing. According to the report, total hip replacement dominates the market.

The total hip replacement procedure involves removing and replacing the damaged hip with an artificial implant or prosthesis. As a result, the high prevalence of osteoarthritis and hip fractures owing to the aging population and other related factors, such as obesity, road accidents, and sports injuries, is propelling the expansion of this segment. Moreover, there has been a surge in the adoption of advanced robotics and navigation systems embedded with smart sensor technology to assist surgeons in total hip replacement procedures. In line with this, continual technological advancements and the launch of novel minimally invasive (MI) implants that offer enhanced patient comfort, reduced pain, faster recovery time, and better treatment outcomes are stimulating the growth of the total hip replacement segment.

Breakup by Material:

- Metal on Metal

- Metal on Polyethylene

- Ceramic on Polyethylene

- Ceramic on Metal

- Ceramic on Ceramic

Metal on polyethylene holds the largest share in the hip replacement market

A detailed breakup and analysis of the hip replacement market based on the material has also been provided in the report. This includes metal on metal, metal on polyethylene, ceramic on polyethylene, ceramic on metal, and ceramic on ceramic. According to the report, metal on polyethylene accounted for the largest market share.

Metal on polyethylene is widely preferred for hip replacement by patients and surgeons as it is the most cost-effective implant compared to other alternative materials. Also, this material provides added benefits such as fewer complications and lesser wear particles, which in turn contribute to improved patient outcomes and reduced need for revision hip replacement procedures. This represents one of the key factors supporting the expansion of the metal on polyethylene segment. Besides this, the escalating demand for affordable and efficient treatment options among patients, coupled with the widespread availability of metal on polyethylene hip replacement products, is further driving the growth of this segment.

However, ceramic on polyethylene segment is also anticipated to witness significant growth during the forecast period due to the rising awareness about the superior advantages of ceramic and plastic materials over metal, including the lowest wear rate, fewer post-surgery complications, and reduced risk of inflammatory reactions.

Breakup by End User:

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgery Centers

Hospitals represent the leading segment in the hip replacement market

A detailed breakup and analysis of the hip replacement market based on the end user has also been provided in the report. This includes hospitals, orthopedic clinics, and ambulatory surgery centers. According to the report, hospitals represent the largest segment in the market.

Hip replacement procedures are majorly performed in hospitals as they have a wide range of healthcare professionals, including orthopedic surgeons, anesthesiologists, nurses, and physical therapists who are experienced in managing hip replacement surgeries. They work together as a multidisciplinary team to provide comprehensive care before, during, and after the procedure. Besides this, there has been elevating number of hip replacement surgeries within hospitals since these medical facilities are equipped with the latest technologies and skilled healthcare professionals, which further propels the growth of this segment. Additionally, the ongoing collaborations between hospitals and key players in the hip replacement market to develop advanced surgical procedures and novel hip prostheses are further aiding the expansion of this segment. Also, the rising government funding and support to upgrade healthcare infrastructure in both developed and developing nations, with the aim to improve the affordability and accessibility of treatments, is fueling the growth of the hospital segment.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest hip replacement market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

North America holds the largest share of the hip replacement market due to the presence of a well-established medical infrastructure and surgical facilities and high healthcare expenditure. Moreover, the region comprises developed nations such as the United States. The United States is also propelling segment growth owing to the expanding population, the rising number of orthopedic clinics, ongoing technological advancements, and the wide availability of better insurance plan coverages.

Another contributing aspect is the increasing penetration of cutting-edge healthcare technologies, which has helped eliminate issues associated with conventional hip replacement procedures. A rise in investments and research-related efforts by industry players for new product launches, faster product approvals from regulatory bodies in the region, and supportive government initiatives represent other major factors augmenting the market growth in North America.

Competitive Landscape

The global hip replacement market is experiencing continuous growth due to the launch of innovative implants, improved surgical facilities, and rising awareness about the available treatment options for hip ailments. The market is also witnessing a steady increase in research and development (R&D) initiatives as well as investments by key players resulting in better technology and supply chain, coupled with the widespread use of advanced non-metal materials for manufacturing high-quality hip replacement implants at reduced costs. We expect the market to witness new entrants, consolidation of product portfolios, and increased strategic collaborations and partnerships to drive healthy competition within the hip replacement industry.

The report has provided a comprehensive analysis of the competitive landscape in the global hip replacement market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- B. Braun SE

- Conformis Inc.

- Corentec Co. Ltd.

- Corin Group

- DJO LLC (Enovis)

- Exactech Inc.

- Globus Medical Inc.

- Integra LifeSciences

- Johnson & Johnson

- Kyocera Corporation

- Medacta International SA

- MicroPort Scientific Corporation

- Smith & Nephew PLC

- Stryker Corporation

- Zimmer Biomet

Recent Developments

- In June 2021, MicroPort Scientific Corporation, a worldwide leader in orthopedic prosthetics, received Green Path, which is a special approval procedure for innovative medical devices, for its MicroPort Orthopedics zirconium-niobium alloy femoral head from the National Medical Products Administration (NMPA) of China.

- In August 2021, Zimmer Biomet Holdings Inc., a global medical technology leader, received U.S. Food and Drug Administration (FDA) 510(k) clearance of its ROSA Hip System for robotically assisted direct anterior total hip arthroplasty.

- In August 2018, Conformis Inc., a leading manufacturer of medical devices, collaborated with JFK Medical Center in Florida to perform the first-ever 3D total hip replacement surgery.

Hip Replacement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Procedures Covered | Total Hip Replacement, Partial Hip Replacement, Revision Hip Replacement, Hip Resurfacing |

| Materials Covered | Metal on Metal, Metal on Polyethylene, Ceramic on Polyethylene, Ceramic on Metal, Ceramic on Ceramic |

| End Users Covered | Hospitals, Orthopedic Clinics, Ambulatory Surgery Centers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun SE, Conformis Inc., Corentec Co. Ltd., Corin Group, DJO LLC (Enovis), Exactech Inc., Globus Medical Inc., Integra LifeSciences, Johnson & Johnson, Kyocera Corporation, Medacta International SA, MicroPort Scientific Corporation, Smith & Nephew PLC, Stryker Corporation, Zimmer Biomet,etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global hip replacement market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global hip replacement market?

- What is the impact of each driver, restraint, and opportunity on the global hip replacement market?

- What are the key regional markets?

- Which countries represent the most attractive hip replacement market?

- What is the breakup of the market based on the procedure?

- Which is the most attractive procedure in the hip replacement market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the hip replacement market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the hip replacement market?

- What is the competitive structure of the global hip replacement market?

- Who are the key players/companies in the global hip replacement market?

Key Benefits for Stakeholders

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hip replacement market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hip replacement market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hip replacement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)