High Voltage Cable Market, Size, Share, Trends and Forecast by Installation, Voltage Type, End User, and Region, 2025-2033

High Voltage Cable Market Size and Share:

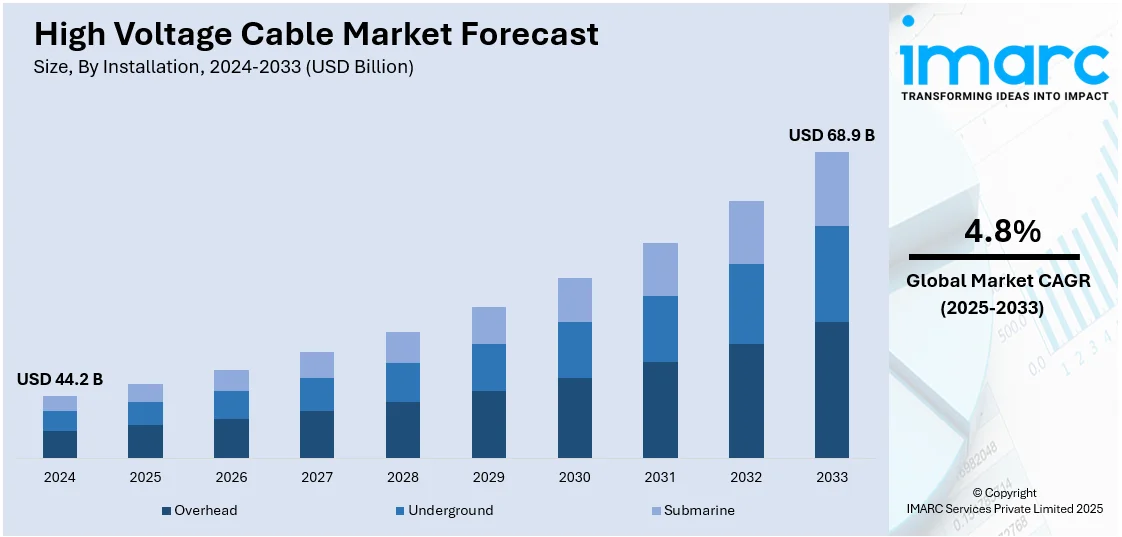

The global high voltage cable market size was valued at USD 44.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 68.9 Billion by 2033, exhibiting a CAGR of 4.8% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 42.1% in 2024, driven by rapid industrialization, expanding renewable energy projects, and significant investments in power transmission infrastructure across the region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 44.2 Billion |

|

Market Forecast in 2033

|

USD 68.9 Billion |

| Market Growth Rate 2025-2033 | 4.8% |

The growth in electricity transmission and distribution infrastructure serves as a key driver to the high-voltage cable market. Due to continuing urbanization and industrialization across the globe, there would be an increase in efficiency and reliability of power systems. For instance, in January 2024, the U.S. The Department of Energy allocated $34 million to 12 projects in 11 states with the aim of developing underground cable solutions meant to improve the resilience of the electric system. Moreover, the high-voltage cables allow electricity to travel over long distances without a significant loss, and for this reason, they have a very key role in connecting renewable sources of energy such as wind and solar farms to the grid. Government initiatives to replace old-age electrical infrastructure as well as in the increase of smart grid technologies, further fuels this market. This further makes high-voltage cables relevant for sustainable solutions in the realm of energy.

United States is a major player that features extensively in the high voltage cables market because of investment in major infrastructure development as well as modernization of the country. Regarding investment in replacement and the strengthening of its aging electrical grid, the U.S government and private sector investors prefer replacing its current transmission of power systems with modern efficiency and reliability of its newly developed high voltage power supply transmission. This has also been further driven by increased renewable energy initiatives, like wind and solar, wherein high-voltage cables become important for connecting these energy sources to the grid. For example, in December 2024, LS Cable & System won a $190 million deal to supply 275kV high-voltage export cables for the Atlantic Shores offshore wind project with a target capacity of 6.8 GW in the U.S. Due to these reasons, the U.S. market is witnessing healthy growth in high-voltage cable production and installation activities.

High Voltage Cable Market Trends:

Replacement of Aged Grid Infrastructure and the Increasing Number of Smart Grids

The increased demand for energy due to population growth and rapid urbanization will drive the global high voltage cables market. According to the UN, it is projected that 68% of the global population will reside in urban areas by 2050. Aged grid infrastructure that has met power distribution and transmission needs to date is being replaced by new advanced smart grids. The proposed grids necessitate the establishment of a new transmission network. High voltage cables with a high current carrying capacity over long distances are recommended for these networks over alternative options. This will fuel high voltage cable market share expansion throughout the forecast period.

Rapid Industrialization and Urbanization

Increasing electricity demand is largely based on the global trends towards industrialization and urbanization. Rising power demand, hence, would require higher capacity for generating and transmitting electrical power. This automatically gives rise to the necessity to use high-voltage cables. Over the past ten years, growing pressures for electrification in developing nations of China, Japan, and India have led to setting up of different kinds of renewable energy projects. According to the International Renewable Energy Agency (IRENA), data indicates that in 2023, the global renewable energy capacity reached a record high of 3,865 GW. This is an increase of 473 GW from 2022, which is the largest annual growth ever recorded. The need for high-voltage cables in power distribution centers and industries including power utilities, oil and gas, and mining is fast expanding and is thus creating a positive outlook for the high voltage cable market.

Rising Penetration of Renewables in Power Generation

Growing concerns about greenhouse gas emissions, combined with increased energy consumption, have prompted countries to seek alternative power generation sources. According to Our World in Data, the global emissions of greenhouse gases amount to approximately 50 Billion Tons annually, measured in carbon dioxide equivalents (CO2eq). Renewable energy sources, particularly wind and solar, are the preferred source of energy generation. This increased use of renewables leads to the construction of additional transmission lines, which drives the global market. In the future years, Europe and North America intend to significantly reduce carbon emissions, which will undoubtedly enhance the market for renewables and, by extension, high voltage cable market demand.

High Voltage Cable Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global high voltage cable market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on installation, voltage type, and end user.

Analysis by Installation:

- Overhead

- Underground

- Submarine

Overhead stand as the largest installation segment in 2024, holding around 55.9% of the market. According to the high voltage cable market industry report, the overhead segment has remained the most popular technique. It is the most comfortable and cost-effective method of installation, requiring only average installation skills. The ease of installation and reduced gearbox losses over long distances are important factors driving the expansion of overhead installations. Another reason for the widespread use of overhead cables is the cost-benefit they bring by eliminating the need for complicated technologies.

Analysis by Voltage Type:

- 50kV-110kV

- 115kV-330kV

- More than 330kV

115kV-330kV leads the market with around 45.1% of the market share in 2024. This dominance is attributed to its widespread application in regional power grids, industrial facilities and renewable energy projects. Because of the balance between such a capacity and cost-effectiveness, these cables are an ideal choice for medium as well as long-distance transmission. Their extensive use to expand urban infrastructures coupled with renewable energy initiatives related to solar and wind powers further strengthens their market position. Industries such as manufacturing and mining also contribute to the demand, requiring reliable power for operations. With ongoing advancements in technology and increasing government investments in power infrastructure, the 115kV-330kV segment is set to maintain its leadership in the market.

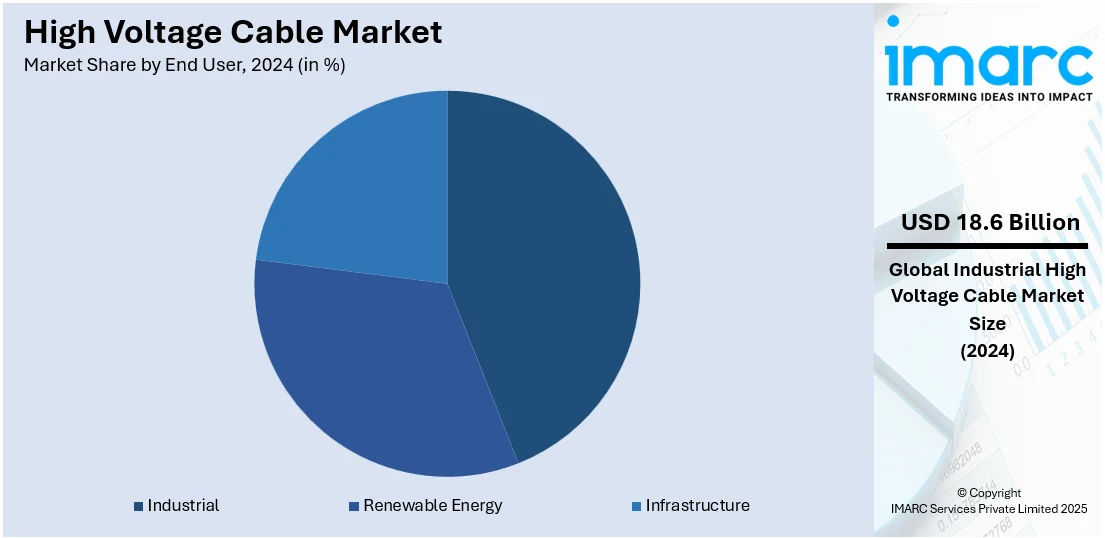

Analysis by End User:

- Industrial

- Power Utilities

- Oil and Gas

- Mining

- Chemical and Petrochemical

- Others

- Renewable Energy

- Wind

- Hydropower

- Others

- Infrastructure

- Commercial

- Residential

Industrial leads the market with around 43.5% of the market share in 2024. The industrial segment contributes significantly to the high voltage cable market expansion. The massive machines that are operated in factories require a lot of power and current. As a result, high-voltage cables are utilized to transmit and distribute electricity from the main grids to industrial substations. Underground and overhead cables are commonly used to carry power in industries such as mining and metals, power utilities, manufacturing, and others (paper and pulp, wastewater treatment, and cement production). Submarine cables are used to transport power in the oil and gas industries, which operate within ocean or river basins.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 42.1%. Asia-Pacific was the market that generated the highest revenue, and is also expected to grow at a faster pace in the coming years. It is one of the largest electricity producers in the world. The rise in the production of electricity in this region has increased the use of high-voltage cables in the region. Many government policies, such as investment and renewable energy project policies, are positively influencing the growth of the high-voltage cable market. In addition, most major players have entered into the global market to amplify the outreach in the market. Moreover, growth in the activities of oil and gas exploration, metals, mining, and constructional would also increase the demand for high-voltage cables. Major developments in this region in the renewable sector act as growth drivers. This region will expand during the forecast period due to the growing solar sector, which would propel the high-voltage cable market growth in this region.

Key Regional Takeaways:

United States High Voltage Cable Market Analysis

US accounts for 87.31% share of the market in North America. Driven by increasing investments in renewable energy and the modernization of aging power grids, the U.S. high voltage cable market is experiencing strong growth. Federal and state-level incentives, such as tax credits and grants, are driving the development of large-scale wind and solar farms, necessitating efficient long-distance power transmission. Additionally, the rapid adoption of electric vehicles (EVs) is playing a key role in transforming the market. According to the International Energy Agency (IEA), new electric car registrations in the U.S. reached 1.4 Million in 2023, marking a more than 40% increase from 2022. The rapid rise in EV adoption highlights the critical need for grid upgrades and the expansion of EV charging infrastructure, both of which heavily depend on high voltage cables. Another trend is that urbanization and population growth in prime geographies are driving the transmission projects to cater to this rapidly rising electricity demand. Improved technologies in cables, including the use of high-temperature superconductors and their integration with smart grids, are also opening further prospects for increasing grid reliability and efficiency. All these aspects make the U.S. a substantial market for high voltage cable solutions.

North America High Voltage Cable Market Analysis

The North America high voltage cable market is growing steadily, driven by increasing investments in power infrastructure and renewable energy projects. Expansion of the offshore wind farms and an increase in urbanization further intensified the demand for an efficient power transmission solution. For example, in December 2024, the Interior Department sanctioned the 2.4-gigawatt SouthCoast Wind farm off Massachusetts, with 141 turbines and offshore substations, likely the last major offshore project sanctioned since 2021. In addition, overhead cables are the dominant choice in the installation sector as they are cheaper and easier to use for long-distance transmission, while underground cables are increasingly being used in cities for aesthetic and safety reasons. The 115kV-330kV segment is led by application and caters to regional power grids and industrial facilities. Moreover, industrial end-users drive significant demand, particularly in manufacturing and energy-intensive sectors. Technological advancements and government initiatives to modernize power networks further strengthen the market, positioning it for sustained growth in the region.

Asia Pacific High Voltage Cable Market Analysis

The high voltage cable market in Asia-Pacific is driven by rapid urbanization, industrialization, and significant investments in renewable energy. According to UN-Habitat, Asia is home to 54% of the global urban population, with over 2.2 Billion people living in urban areas. This figure is projected to grow by 50% by 2050, adding 1.2 Billion more people, intensifying the demand for robust power infrastructure. Countries like China, India, and Japan are actively expanding their transmission networks to meet rising electricity needs and integrate renewable energy sources such as wind and solar. Initiatives like China’s Belt and Road Initiative and India’s Green Energy Corridor further drive cross-border energy connectivity and infrastructure development. The growth of offshore wind farms in Vietnam and South Korea also boosts demand for submarine high voltage cables. Additionally, the electrification of transportation and industrial activities amplifies the need for reliable and efficient power transmission solutions.

Europe High Voltage Cable Market Analysis

The high voltage cable market in Europe is experiencing significant growth, driven by the region's focus on renewable energy expansion and decarbonization efforts. According to the European Environment Agency (EEA), renewable energy sources accounted for an estimated 24.1% of the European Union’s final energy consumption in 2023. This shift underscores the region’s commitment to transitioning to clean energy, supported by policies like the European Green Deal, which aims to achieve carbon neutrality by 2050. Large-scale investments in offshore wind farms across the North Sea, Baltic Sea, and Mediterranean are driving demand for submarine high voltage cables to enable cross-border power transmission and grid interconnectivity. Additionally, the replacement and modernization of aging energy infrastructure in countries such as Germany, France, and the UK contribute to the growing need for advanced cable solutions. The adoption of decentralized energy systems and smart grid technologies is further fueling demand for high-performance cables that enhance grid efficiency and reliability. Moreover, the increasing uptake of electric vehicles and corresponding development of EV charging infrastructure add to the expansion of transmission networks. With these factors at play, Europe remains a leading region in the adoption and deployment of high voltage cable technologies.

Latin America High Voltage Cable Market Analysis

Latin America’s high voltage cable market is bolstered by its strong focus on renewable energy. According to the International Energy Agency (IEA), fossil fuels constitute around two-thirds of the region’s energy mix, significantly lower than the global average of 80%, due to renewables contributing 60% of electricity generation. Hydropower alone accounts for 45% of the region’s electricity supply, highlighting its dominance in the energy sector. Countries like Brazil, Chile, and Mexico are investing heavily in wind and solar projects, requiring robust transmission infrastructure. Additionally, efforts to modernize power grids, expand regional connectivity, and improve energy access further drive demand for high voltage cables.

Middle East and Africa High Voltage Cable Market Analysis

The Middle East’s high voltage cable market is expanding due to the growing shift towards renewable energy. According to the International Energy Agency (IEA), in 2022, hydro and solar photovoltaic (PV) systems were the largest sources of non-combustible renewable electricity in the region, accounting for 45% and 43% of total renewable generation, respectively. This transition is driving significant investments in transmission infrastructure to integrate renewable energy into existing grids. Solar energy, in particular, is rapidly expanding, with large-scale projects underway in countries like the UAE and Saudi Arabia. Combined with ongoing electrification efforts and cross-border grid initiatives, the demand for high voltage cables is rising.

Competitive Landscape:

The competitive landscape of the high-voltage cable market is characterized by a diverse array of key players, ranging from established manufacturers to emerging companies. Major industry participants are focusing on technological advancements and product innovation to enhance cable performance and reliability. Strategic partnerships and collaborations are also prevalent, as companies seek to leverage complementary strengths and expand their market reach. Moreover, the growing interest in sustainability and renewable energy is compelling firms to create environment-friendly cable solutions. For instance, in March 2024, South Korean cable manufacturer Taihan Cable & Solution landed its largest U.S. project, an $82 million contract to replace aging power grids across the country with ultra-high voltage power grid. As a result, the market is witnessing heightened competition, with companies striving to differentiate themselves through quality, service, and technological capabilities.

The report has also analysed the competitive landscape of the market with some of the key players being:

- Brugg Kabel AG

- Ducab

- LS Cable & System Ltd

- NEXANS

- NKT A/S

- Prysmian Group

- Siemens AG

- Southwire Company LLC

- Sumitomo Electric Industries Ltd.

- TBEA Co. Ltd.

- TELE-FONIKA Kable S.A.

Latest News and Developments:

- June 2024: Nexans, a key player in the global shift toward sustainable energy, has finalized its acquisition of La Triveneta Cavi, a prominent European manufacturer of medium- and low-voltage cables. This strategic move marks a major step in Nexans’ ongoing transformation into a dedicated electrification-focused company.

- June 2024: LS recently announced it is expanding its manufacturing capabilities with the construction of a new manufacturing plant in Queretaro, Mexico. This state-of-the-art facility will specialize in producing large capacity busway systems for both the US and international markets.

- April 2024: LS Eco Energy, a subsidiary of LS Cable & System, has secured a USD 30.51 million contract with Denmark’s Energinet to supply high-voltage cables for three years. This follows an earlier deal to provide cables for the Thor Offshore Wind Farm. Since 2017, LS Eco Energy has become a key player in Denmark's high-voltage cable market. CEO Lee Sang-ho highlighted growing global demand for cables driven by offshore wind farms, power grid upgrades, and data center construction.

- June 2023: Nexans has launched new high-voltage cables for electric, hybrid-electric, and E-VTOL aircraft, designed to support higher power without increasing weight. The cables, unveiled at the Paris Air Show, are 20 times more efficient than standard aircraft cables and operate across a wide voltage range (600V to 6,000V). They aim to help the aerospace industry meet carbon neutrality goals by 2050 and reduce its environmental impact.

- March 2023: Ducab Group, a leading cable manufacturer in the UAE, has unified its metals operations under a newly formed subsidiary, Ducab Metals Business (DMB). This strategic consolidation establishes a focused division within the organization, dedicated to delivering copper and aluminium solutions tailored for the electrical supply chain.

High Voltage Cable Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Overhead, Underground, Submarine |

| Voltage Types Covered | 50kV-110kV, 115kV-330kV, More than 330kV |

| End Users Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Brugg Kabel AG, Ducab, LS Cable & System Ltd, NEXANS, NKT A/S, Prysmian Group, Siemens AG, Southwire Company LLC, Sumitomo Electric Industries Ltd., TBEA Co. Ltd., TELE-FONIKA Kable S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the high voltage cable market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global high voltage cable market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high voltage cable industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

High voltage cables (HVCs) are specialized electrical cables designed to transmit electricity at high voltages, typically above 35 kV. Used in power transmission and distribution, they feature robust insulation and shielding to prevent energy loss and ensure safety. HVCs are essential for efficiently delivering electricity over long distances.

The global high voltage cable market was valued at USD 44.2 Billion in 2024.

IMARC estimates the global high voltage cable market to exhibit a CAGR of 4.8% during 2025-2033.

The global high voltage cable market is driven by rising energy demand, expansion of renewable energy projects, and increased investments in power infrastructure. Urbanization, industrialization, and grid modernization further contribute to market growth. Technological advancements and the need for efficient long-distance electricity transmission also play a significant role in boosting demand.

According to the report, overhead represented the largest segment by installation, driven by its cost-effectiveness, ease of deployment, and suitability for long-distance power transmission, particularly in rural and large-scale infrastructure projects.

115kV-330kV leads the market by voltage type as it is widely used in power transmission and distribution networks, balancing the need for high-capacity energy transfer with cost-efficiency, making it ideal for urban and regional infrastructure projects.

Industrial leads the market by end user as extensive use in power generation, heavy machinery, and large-scale manufacturing facilities requiring reliable energy transmission.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global high voltage cable market include Brugg Kabel AG, Ducab, LS Cable & System Ltd, NEXANS, NKT A/S, Prysmian Group, Siemens AG, Southwire Company LLC, Sumitomo Electric Industries Ltd., TBEA Co. Ltd., TELE-FONIKA Kable S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)