High-Speed Camera Market Size, Share, Trends and Forecast by Component, Spectrum, Frame Rate, Application, and Region, 2025-2033

High-Speed Camera Market Size and Share:

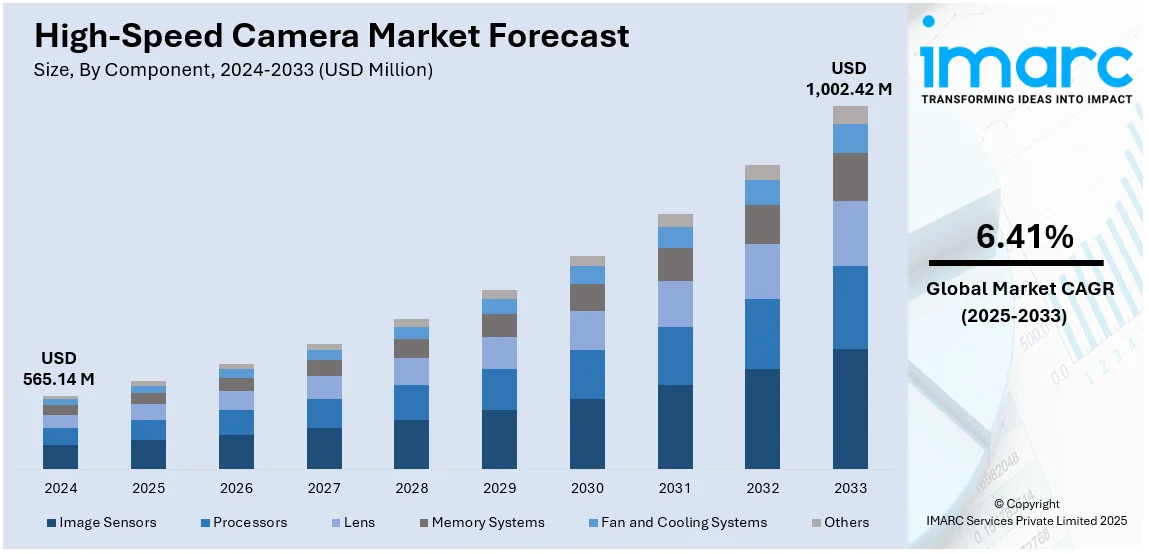

The global high-speed camera market size was valued at USD 565.14 Million in 2024. The market is expected to reach USD 1,002.42 Million by 2033, exhibiting a CAGR of 6.41% from 2025-2033. The market growth is driven by advancements in imaging technology, increasing industrial automation, rising demand for slow-motion analysis in sectors such as sports, automotive, and engineering, and the growing use of AI for motion tracking and analysis.

Market Insights:

- North America leads the market, holding 35.8% of the share in 2024, driven by technological infrastructure and industrial demand.

- By component, image sensors play a critical role in capturing high-speed data, with processors, lenses, and memory systems crucial for the device's performance.

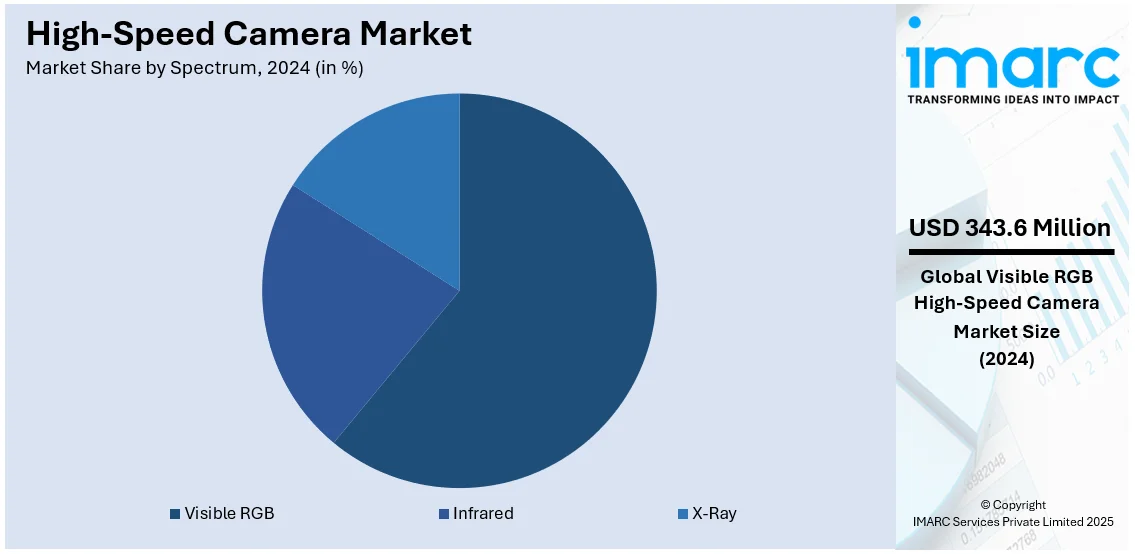

- By spectrum, visible RGB cameras dominate, accounting for 60.8% of the market in 2024 due to their versatility and precision.

- By application, the automotive and transportation sector holds the largest share, primarily for vehicle safety testing and performance analysis.

Market Size & Forecast:

- 2024 Market Size: USD 565.14 Million

- 2033 Projected Market Size: USD 1,002.42 Million

- CAGR (2025-2033): 6.41%

- North America: Largest market in 2024

High-Speed Camera Market Overview:

The high-speed camera market is experiencing notable expansion due to advancements in image processing technology that have improved precision, frame rates, and data quality, making these devices indispensable across diverse industries. Enhanced real-time processing algorithms allow users to extract actionable insights with greater accuracy, supporting applications in automotive crash tests, aerospace research, biomechanics, and scientific experiments. However, the market faces challenges such as high initial investment costs, storage requirements for large data volumes, and integration complexities with existing industrial systems. The COVID-19 pandemic initially disrupted supply chains and delayed industrial projects but also accelerated digitalization and automation in several sectors. Looking ahead, innovations in AI-driven analytics and ultra-high frame rate capabilities will drive growth across industrial, research, and defense applications.

To get more information on this market, Request Sample

The United States represents a leading market for high-speed cameras, driven by robust demand across automotive, defense, aerospace, and healthcare sectors. Applications such as vehicle crash testing, ballistics analysis, and advanced R&D in smart factories have made these cameras crucial for improving operational efficiency and regulatory compliance. The automotive sector’s focus on safer vehicles aligns with stringent safety norms, while the defense industry relies on high-speed imaging for precision analysis. Challenges include the high acquisition and maintenance costs, but technological innovations and increased government funding for research offset these barriers. COVID-19 accelerated automation trends, fueling the adoption of smart manufacturing practices. With numerous innovations, the U.S. is set to retain its leadership in high-speed camera market share.

High-Speed Camera Market Trends:

Increasing applications of the product

High-speed cameras are applied in various applications, including scientific research, sports analysis, industrial inspection, and entertainment. These cameras are widely used to capture fast-moving processes and events, making them useful for capturing detailed information in a variety of industries, such as automotive, aerospace, and pharmaceuticals. According to high-speed camera market research report, electric car sales are set to grow by nearly 25% in 2024, reflecting a significant surge in the automotive industry, driven by increasing consumer demand and sustainability initiatives. High-speed cameras are used in a variety of industries, including automotive and aerospace, electronics, and manufacturing, to analyze complicated phenomena such as material deformation, impact dynamics, and fluid behavior. This, in turn, is contributing to the accelerating high-speed camera demand worldwide.

Enhanced analysis and growing VR/AR demand

During the projected period, the market size of high-speed cameras is expected to increase due to increased usage of thorough analysis and process visualization, as well as increased demand for virtual and augmented reality. For instance, meta holds a dominant 70.8% share of the VR/AR market as emerging players drive innovation in mixed reality and AI-enhanced wearable technologies, meeting rising demand. High-speed cameras can take hundreds or even thousands of photos per second. The sequences they record can be analyzed in great detail, with the precision needed to detect a malfunction or a technical issue. Companies in the worldwide high-speed camera sector are focusing on addressing end-user demands for efficient goods. To expand their high-speed camera market share, they are introducing high-frame rate cameras and products with excellent triggering systems, which is creating a positive high-speed camera market outlook.

Rising intelligent transportation systems initiatives

The Intelligent Transport System (ITS) attempts to improve traffic efficiency by reducing traffic difficulties while increasing safety and comfort. It provides customers with prior knowledge about traffic, local convenience, real-time running information, seat availability, and so on, reducing commuter travel time while also improving safety and comfort. According to reports, by 2028, smart traffic management spending is expected to rise 75% from USD 10.6 Billion in 2023, driven by growing government investments in smart cities and transportation-focused urban transformation projects. Cameras, particularly high-performance machine vision cameras, are increasingly vital in intelligent traffic systems. As per the high-speed camera market forecast, increasing government investment in traffic management systems is projected to drive up demand for high-speed cameras in the coming years. For example, in April 2022, the Ministry of Electronics and Information Technology (MeitY) launched a number of apps under the Intelligent Transportation System (ITS) as part of the InTranSE- II program to enhance traffic in India. According to the administration, the onboard driver assistance and warning system (ODAWS) aims to improve highway infrastructure as the number of cars and speeds on highways increase, exacerbating safety concerns.

High-Speed Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global high-speed camera market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, spectrum, frame rate, and application.

Analysis by Component:

- Image Sensors

- Processors

- Lens

- Memory Systems

- Fan and Cooling Systems

- Others

In high-speed camera systems, every single component makes the device very significant in functionalities and performance. Thus, image sensors have been really a critical need to capture an image at fast frame rates that have motivated researchers to seek advanced picture qualities as well as the low light capability. Further, processors tackle tremendous data for which the actual processing and transmission could be conducted while recording. Lenses provide precise imaging due to high optical clarity and versatility across various applications, including industrial and scientific research. Memory systems ensure that large volumes of data generated by high-speed cameras are always stored well, and innovation in storage capacity and speed only enhances performance. Fan and cooling systems maintain the optimal device temperature while performing at high intensity for longevity and reliability. The others category includes parts such as, the display and enclosures that enhance usability and durability. All these parts come together to form robust, versatile high-speed cameras that meet the diverse needs of industries.

Analysis by Spectrum:

- Visible RGB

- Infrared

- X-Ray

Visible RGB high-speed cameras account for a significant share of 60.8% in 2024, primarily because of their versatility and applicability across industries. These cameras capture images within the visible color spectrum, which closely replicating the human eye's perception. These cameras are best suited for tasks that require accurate color reproduction and detailed visual inspection, such as product quality control, scientific research, and medical imaging. Their wide-ranging applicability is in industrial automation, entertainment, and sports analysis, where precision and efficiency are improved in each field. Real-time guidance during cooking, automotive testing, and visual media production further fuels their adoption. Visible RGB cameras remain the market leader with advancements in image processing and the introduction of cutting-edge models. Their ability to provide high-quality images with precise color accuracy ensures their continued growth and popularity across diverse applications.

Analysis by Frame Rate:

- 250–1,000 FPS

- 1,001–10,000 FPS

- 10,001–30,000 FPS

- 30,001–50,000 FPS

- Above 50,000 FPS

High-speed cameras are divided which are based on frame rate into the different application fields according to various speed and precision requirements. Cameras with a frame rate in the range of 250-1,000 FPS are often used in applications requiring medium-speed motion analysis such as quality control and educational research. The segment 1,001-10,000 FPS serves industrial automation, sports analysis, and scientific research where the capture of detailed motion is essential. Camcorders with 10,001–30,000 FPS are used in the advanced industrial and automotive testing field. These help in accurately judging high-speed processes like crash tests and fluid dynamics. The niche applications, such as explosive testing and high-speed manufacturing require ultra-detailed imaging that falls in the 30,001–50,000 FPS segment. Above 50,000 FPS is highly specialized and includes ballistics, aerospace testing, and microscopic imaging, which requires minute ultra-rapid phenomena capture. This broad range of frame rates provides for a lot of the versatility of the market of high-speed cameras to industry requirements.

Analysis by Application:

- Automotive and Transportation

- Consumer Electronics

- Aerospace and Defense

- Healthcare

- Media and Entertainment

- Others

The automotive and transportation sector is at the lead, in the high-speed camera market in 2024, led by its role in vehicle safety testing and performance analysis. High-speed cameras are critical in crash simulations, recording fast events to measure vehicle strength and occupant safety under impact conditions. They are also indispensable for airbag deployment studies, where engineers can optimize timing and effectiveness. Beyond safety, these cameras are used in performance testing for brakes, engines, and fuel systems under real-world conditions, providing detailed insights that aid in design refinement and problem-solving. Boosting focus on electric and autonomous vehicles further accelerates demand, as high-speed cameras enable precise testing of advanced components. With manufacturers prioritizing safety and innovation, the automotive industry continues to rely heavily on high-speed imaging technologies, solidifying its leadership in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America is significantly dominating the high-speed camera market in 2024, accounting for a market share of 35.8%. The market is driven by strong demand across industries, such as automotive, consumer electronics, and healthcare. The region is leading in adopting high-speed imaging solutions due to the advanced technological infrastructure and focus on innovation. High-speed cameras are used in the automotive testing area by North American companies for crash simulations and component evaluations, improving vehicle safety and performance. These applications serve major purposes in the medical imaging and research industries in the healthcare sector, where accuracy is a must. The entertainment industry also contributes to the market development, as the high-speed camera is used for visual effects in movies and sports broadcasting. Government policies, high investments in R&D, and the presence of the key market players strengthen North America's leadership position. This established ecosystem allows the region to remain a global center for high-speed imaging innovation that caters to diverse and ever-changing industry requirements.

Key Regional Takeaways:

United States High-Speed Camera Market Analysis

In 2024, the United States accounted for a market share of 85% in North America. The adoption of high-speed cameras has significantly increased due to the rapid expansion of the immersive technology sector. Virtual and augmented reality technologies are becoming integral across entertainment, education, and other industries, requiring precise capture and analysis of rapid movements for enhanced user experiences. As VR/AR applications continue to grow, especially for real-time simulations, the demand for high-speed cameras to accurately record, process, and analyze motion has surged. For instance, nearly USD 1.9 Billion in venture capital has been invested in startups within the virtual and augmented reality software and hardware space, signaling rapid growth in the industry. These technologies necessitate cameras capable of recording at higher frame rates and resolutions to ensure a seamless and immersive experience. This demand has driven advancements in camera technology, leading to an increase in their adoption across various sectors. Furthermore, the rising importance of motion capture for training, design, and content creation has contributed to the expansion of high-speed camera utilization, making them indispensable tools in the development and optimization of virtual and augmented reality environments.

Asia Pacific High-Speed Camera Market Analysis

In the automotive and transportation industries, the demand for high-speed cameras has surged due to the growing implementation of intelligent transportation systems. These systems require precise monitoring of vehicle and pedestrian movement to improve safety, traffic management, and vehicle performance. For instance, since May 2024, the BTP has booked over 42,000 speed limit violations, averaging 200 cases daily, following the installation of eight high-speed cameras on the expressway to address rampant speeding. As technologies like autonomous vehicles and advanced driver assistance systems (ADAS) become more widespread, high-speed cameras are essential for capturing and processing fast-moving objects in real-time. The integration of these cameras into transportation infrastructure, such as traffic cameras and automated toll systems, has become a necessity. High-speed cameras enable accurate detection, analysis, and response to real-time conditions, contributing to enhanced transportation efficiency, vehicle safety, and reduced congestion. With the growing adoption of these systems, high-speed camera technologies are evolving to meet the increasing demands of this rapidly developing sector.

Europe High-Speed Camera Market Analysis

In the industrial sector, high-speed cameras are increasingly adopted for their role in industrial inspection and quality control. According to reports, the EU's industrial production grew by 8.5% in 2021 and continued to rise by 0.4% in 2022 compared to the previous year. With the rise in automation and precision manufacturing, the need for efficient monitoring of fast-moving processes has become more crucial. High-speed cameras are used to capture high-resolution images of fast-moving components, enabling detailed inspection that is essential for maintaining high standards in production lines. These cameras help identify defects, irregularities, and potential failures during the manufacturing process, ensuring that products meet quality standards. The ability to perform high-speed visual analysis without interrupting production processes has made these cameras a vital tool in improving operational efficiency, reducing errors, and ensuring the long-term reliability of industrial operations. As industries push for higher precision in manufacturing and inspection, the demand for high-speed cameras continues to rise, propelling their adoption in various industrial sectors.

Latin America High-Speed Camera Market Analysis

The aerospace and defense sectors are seeing a surge in high-speed camera adoption as demand for precise monitoring and testing increases. According to the FAA's 20-year aviation forecast, the Latin American region is projected to grow by 4.5% annually through 2034. High-speed cameras are essential for analyzing rapid events, such as the performance of aircraft components under stress, missile launches, and explosive tests. In these sectors, the ability to capture fast-moving objects with clarity is crucial for evaluating the performance, safety, and reliability of equipment. As the aerospace and defense industries invest in more sophisticated technologies and testing procedures, the need for high-speed imaging tools that can provide real-time analysis has grown. These cameras play a key role in ensuring that complex systems function as intended under extreme conditions, leading to safer and more efficient operations in the industry. With the expansion of these sectors, the demand for advanced high-speed cameras is expected to increase.

Middle East and Africa High-Speed Camera Market Analysis

The healthcare sector in the Middle East and Africa is witnessing a rise in the adoption of high-speed cameras due to the growing focus on medical imaging and diagnostics. According to Dubai Healthcare City Authority report, by 2022, Dubai's healthcare sector saw 4,482 private medical facilities. High-speed cameras are being used to capture and analyze rapid bodily movements and intricate processes, such as heartbeats or muscle contractions, in a highly detailed manner. This technology allows for more precise diagnostic tools, such as monitoring real-time movements in patients undergoing physical therapy or assessing the functionality of surgical tools during procedures. With the healthcare industry's growing emphasis on advanced diagnostics and personalized care, the demand for high-speed cameras continues to rise, contributing to improved medical outcomes and patient care.

Competitive Landscape:

The high-speed camera market's competitive landscape is defined by innovation, technological development, and strategic collaboration. Major players are heavily investing in R&D to develop advanced imaging technologies with higher frame rates, higher resolutions, and compact designs for diversified applications across industries. Cutting-edge features like real-time data processing, AI integration, and IoT connectivity are the factors that differentiate the products. Now manufacturers are also promoting sustainability by utilizing 'ecofriendly' products and energy-conscious designs. The companies are expanding portfolios in the market while entering new geographic regions through strategies like strategic collaborations, mergers, and acquisition. Increasing cross-sector demand on the lines of automotive testing and healthcare and for consumer electronics triggers a competition frenzy among the company.

The report provides a comprehensive analysis of the competitive landscape in the high-speed camera market with detailed profiles of all major companies, including:

- AOS Technologies AG

- Baumer Holding AG

- DEL Imaging

- Excelitas Technologies Corp.

- Fastec Imaging (RDI Technologies, Inc.)

- iX Cameras Inc.

- Motion Capture Technologies

- NAC Image Technology

- Optronis GmbH

- Photron (Imagica Group Inc)

- SVS-Vistek GmbH

- Vision Research Inc

- Weisscam GmbH

Latest News and Developments:

- On January 22, 2025, Panasonic announced four new 4K60p 10-bit professional camcorders featuring a wide-angle 25mm lens and 24x optical zoom, designed to meet high-speed video production demands. The lineup—AG-CX20, HC-X2100, HC-X1600, and HC-X1200—introduces improvements such as OLED viewfinders, USB-C ports, FHD live streaming, and advanced low-speed zoom functionality. These innovations bolster Panasonic’s leadership in the high-speed camera market, catering to professional creators seeking superior mobility and image quality.

- On April 8, 2025, FLIR, a Teledyne Technologies company, launched FLIR MIX™, an advanced multispectral imaging solution capable of synchronizing high-speed thermal and visible imagery at up to 1,004 frames per second. The FLIR MIX Starter Kits, designed for applications from defense to electronics testing, integrate thermal precision with real-time visible-light data using FLIR Research Studio software. This innovation is poised to significantly advance the high-speed camera market by enhancing research accuracy and efficiency across industries.

- On June 12, 2025, Shenzhen SinceVision Technology unveiled its SHS Series high-speed camera, capturing the ice-breaking process at 2,250 frames per second (FPS) with real-time 1920×1080 resolution transmission via CoaXPress 2.0. Successfully tested at -20°C, the camera provided high-quality, frame-loss-free footage of crack propagation, supporting advanced mechanical analysis. This launch enhances the high-speed camera market with precise imaging solutions for scientific research and industrial applications.

- December 2024: Excelitas Technologies will showcase its X-Cite® fluorescence illumination and PCO® high-speed camera solutions at Cell Bio 2024. The company, a leader in advanced technologies for life sciences, aerospace, and other industries, will highlight these innovations at booth #339. X-Cite is renowned for its fluorescence microscopy applications, while PCO cameras feature cutting-edge sCMOS and high-speed imaging capabilities. These solutions are designed to enhance scientific research across various fields.

- December 2024: Lumotive and NAMUGA Co., Ltd. have launched the Stella series of next-generation 3D sensing solutions, powered by Lumotive's Light Control Metasurface (LCM™) technology. The collaboration marks a significant advancement in high-speed camera technology. The Stella series is designed to enhance the performance of optical semiconductor devices. This innovation aims to push the boundaries of 3D sensing applications in various industries.

- December 2024: SinceVision’s Ultra High-Speed Series (SH6 Series) sets a new standard in high-speed motion capture with the highest megapixel performance. Engineered for extreme conditions in scientific research, aerospace, manufacturing, and motion analysis, these cameras offer unparalleled frame rates and exceptional image quality. Designed for precision, they provide advanced technical features to meet the demands of cutting-edge industries. The SH6 Series is revolutionizing high-speed video capture with industry-leading performance.

- December 2024: Emergent Vision Technologies unveils Eros, the world’s smallest and most energy-efficient 10GigE high-speed camera lineup. Initially introduced as a 5GigE series, Eros was showcased at VISION 2024 in Stuttgart, Germany, offering multiple interface options and power configurations. The cameras, measuring just 29 x 29 mm, support zero-copy imaging and GPUDirect, with auto-negotiation for lower speeds. Designed for cost-effective performance, Eros provides full features of Emergent’s HR 10GigE cameras at reduced power consumption.

- June 2024: AOS Technologies announced the launch of the PROMON 2000 high-speed streaming camera system in a new bundle package, revolutionizing high-speed recording. The PROMON 2000 features an advanced light-sensitive sensor capable of streaming Full-HD 1920 x 1080 pixel video at 1000 frames per second (fps) in 8-bit mode, or at 300 fps in high dynamic range 12-bit mode.

High-Speed Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Image Sensors, Processors, Lens, Memory Systems, Fan and Cooling Systems, Others |

| Spectrums Covered | Visible RGB, Infrared, X-Ray |

| Frame Rates Covered | 250-1,000 FPS, 1,001-10,000 FPS, 10,001-30,000 FPS, 30,001-50,000 FPS, Above 50,000 FPS |

| Applications Covered | Automotive and Transportation, Consumer Electronics, Aerospace and Defense, Healthcare, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AOS Technologies AG, Baumer Holding AG, DEL Imaging, Excelitas Technologies Corp., Fastec Imaging (RDI Technologies, Inc.), iX Cameras Inc., Motion Capture Technologies, NAC Image Technology, Optronis GmbH, Photron (Imagica Group Inc), SVS-Vistek GmbH, Vision Research Inc, Weisscam GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the high-speed camera market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global high-speed camera market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high-speed camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global high-speed camera market was valued at USD 565.14 Million in 2024.

The global high-speed camera market is estimated to reach USD 1,002.42 Million by 2033, exhibiting a CAGR of 6.41% from 2025-2033.

Factors driving growth in the global market for high-speed cameras include advances in imaging technology, increasing demand from the automotive and aerospace industries to test crashes and motion, as well as adoption in scientific research and healthcare. Industrial automation growth, the surge in high-resolution camera usage, and innovation in AI and IoT integration drive further expansion in the market.

North America currently dominates the market, holding a significant market share of 35.8% in 2024. Continual advancements in imaging technology, rising trend of industrial automation, and the escalating demand for slow-motion analysis in numerous industries, such as sports, automotive, and engineering, represent some of the key factors driving the market in the region.

Some of the major players in the global high-speed camera market include AOS Technologies AG, Baumer Holding AG, DEL Imaging, Excelitas Technologies Corp., Fastec Imaging (RDI Technologies, Inc.), iX Cameras Inc., Motion Capture Technologies, NAC Image Technology, Optronis GmbH, Photron (Imagica Group Inc), SVS-Vistek GmbH, Vision Research Inc, Weisscam GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)