High-Integrity Pressure Protection System (HIPPS) Market Size, Share, Trends and Forecast by Type, Offering, End Use Industry, and Region, 2025-2033

High-Integrity Pressure Protection System (HIPPS) Market Size and Share:

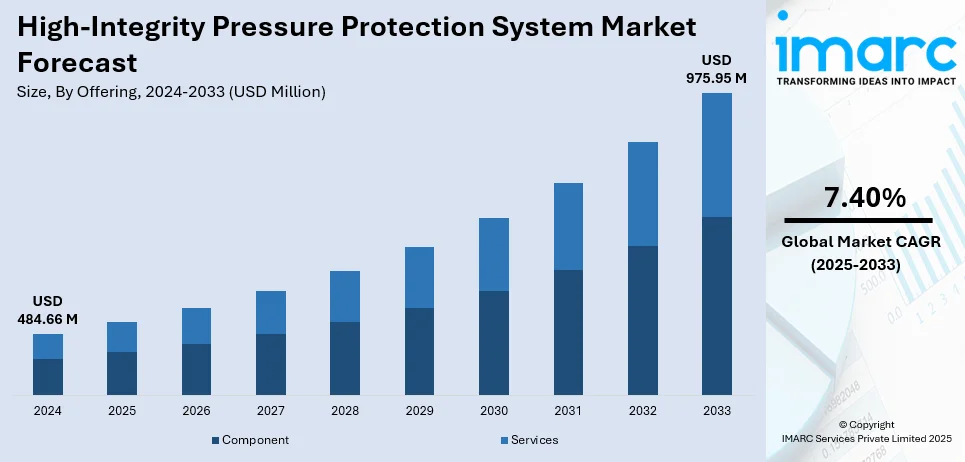

The global high-integrity pressure protection system (HIPPS) market size was valued at USD 484.66 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 975.95 Million by 2033, exhibiting a CAGR of 7.40% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 37.6% in 2024. This leadership is propelled by increasing industrial augmentation, magnifying investments in oil & gas infrastructure, and stringent safety policies to prevent over-pressurization cases.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 484.66 Million |

| Market Forecast in 2033 | USD 975.95 Million |

| Market Growth Rate (2025-2033) | 7.40% |

The industry for high-integrity pressure protection system (HIPPS) is growing globally due to increasing emphasis on industrial safety, stringent regulatory requirements, and rising adoption in oil and gas, petrochemical, and power industries. Expanding offshore exploration and production activities, coupled with growing pipeline infrastructure, are driving demand for advanced pressure protection solutions. Technological advancements, including digital monitoring and automation integration, enhance system reliability and efficiency. Additionally, rising environmental concerns and the need to minimize operational risks are pushing industries toward HIPPS adoption. For instance, as per industry reports, pipeline-associated accidents are significantly prevalent across the U.S., with nation witnessing around 1,187 critical incidents pertaining to pipeline oil spillage during 2004-2023. Moreover, in June 2024, crude oil spilling from a pipeline resulted in leakage of above 100,000 gallons to neighboring areas. Apart from this, investments in smart safety systems and compliance-driven modernization further support market expansion.

The United States holds a crucial share in the high-integrity pressure protection system (HIPPS) landscape due to stringent industrial safety regulations and increasing adoption in oil and gas, petrochemical, and power sectors. The presence of major energy producers and ongoing shale gas exploration drive demand for advanced pressure protection solutions. For instance, as per the U.S. Energy Information Administration, during January-September 2024, shale gas production across the Permian Region in the U.S. elevated by 10%. Besides this, rising investments in pipeline infrastructure, coupled with regulatory compliance requirements from agencies such as OSHA and API, further accelerate market growth. In addition to this, technological advancements in digital safety systems and automation integration enhance HIPPS efficiency, making them essential for preventing overpressure incidents and ensuring operational safety.

High-integrity pressure protection system (HIPPS) Market Trends:

Increasing Adoption of Smart and Digitalized HIPPS

The integration of smart technologies in high-integrity pressure protection systems (HIPPS) is transforming the market, impacted by advancements in automation, real-time monitoring, and predictive maintenance. Industries are increasingly adopting digitalized HIPPS with IoT-enabled sensors, cloud-based analytics, and AI-driven diagnostics to enhance safety and operational efficiency. These innovations provide real-time pressure monitoring, early failure detection, and remote system control, reducing downtime and maintenance costs. For instance, as per industry reports, AI-powered predictive maintenance significantly lowers the downtime by around 30% and energy usage by some extend. In line with this, Schneider Electric's IoT platform EcoStruxure can minimize usage of energy by 25%. Additionally, the growing implementation of Industry 4.0 principles across oil and gas, petrochemical, and power sectors is accelerating demand for intelligent HIPPS solutions, ensuring regulatory compliance and improved process safety management.

Growing Demand in the Oil and Gas Sector

The oil and gas segment remains the most prominent end-user of HIPPS due to its need for advanced safety solutions in high-pressure environments. Rising offshore exploration, deepwater drilling activities, and expanding liquefied natural gas (LNG) infrastructure are driving demand for robust pressure protection systems. Stringent environmental and safety regulations, aimed at reducing methane emissions and preventing catastrophic equipment failures, are further accelerating HIPPS adoption. Additionally, investments in pipeline expansions and upgrades, particularly in North America, the Middle East, and Asia-Pacific, are increasing the need for HIPPS to mitigate overpressure risks and enhance operational reliability in complex energy projects. For instance, as per industry reports, since the expanded Trans Mountain pipeline initiated complete operations in June 2024, Canadian oil producers have exported around 28 million additional crude barrels to Asia via the Pacific.

Regulatory Compliance and Safety-Driven Market Expansion

Stringent global safety regulations are shaping the HIPPS market as industries focus on reducing operational risks and preventing hazardous incidents. Regulatory organizations, mainly encompassing OSHA, API, IEC, and ISO mandate the implementation of high-integrity safety systems to protect personnel and infrastructure. Compliance-driven modernization in the chemical, power generation, and oil and gas sectors is prompting the widespread adoption of HIPPS as an essential safety solution. Additionally, growing concerns over industrial accidents, coupled with increased corporate responsibility toward workplace safety, are pushing companies to invest in advanced HIPPS with SIL (Safety Integrity Level) certification, ensuring high reliability and performance under extreme conditions. For instance, as per industry reports, in 2024, around 240 industrial accidents were observed across energy, mining, and manufacturing segments of India, causing above 850 critical injuries and more than 400 deaths.

High-integrity pressure protection system (HIPPS) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global high-integrity pressure protection system (HIPPS) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, offering, and end use industry.

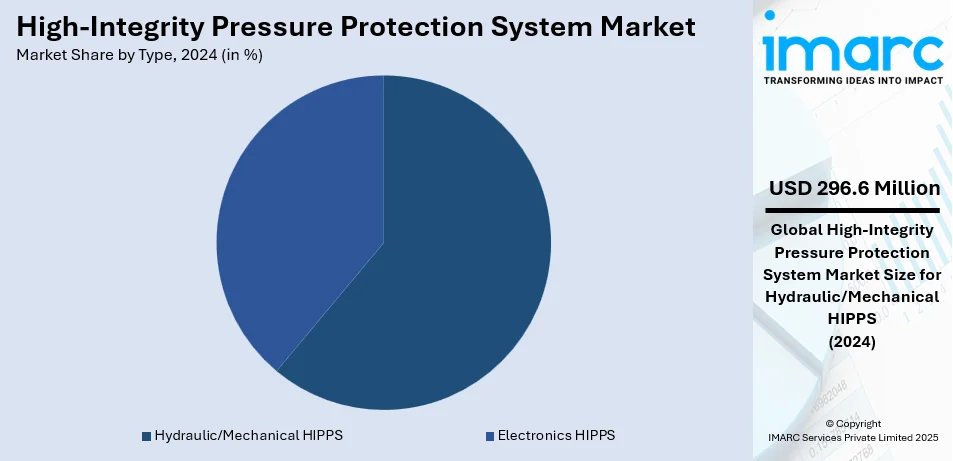

Analysis by Type:

- Electronics HIPPS

- Hydraulic/Mechanical HIPPS

Hydraulic/mechanical HIPPS leads the market with around 61.2% of market share in 2024. Hydraulic and mechanical high-integrity pressure protection systems (HIPPS) are widely used for safeguarding high-pressure installations in critical industries. These systems operate independently of electronic controls, relying on hydraulic actuators, mechanical pilots, and spring-loaded mechanisms to achieve rapid pressure isolation. Their ability to function without external power enhances reliability, particularly in offshore oil and gas facilities where failure can lead to catastrophic consequences. Furthermore, the demand for hydraulic and mechanical HIPPS is driven by stringent safety regulations, increased deepwater exploration, and growing concerns about overpressure incidents in high-risk environments. Advancements in component durability and real-time diagnostics further contribute to their adoption. In addition to this, compared to electronic HIPPS, hydraulic and mechanical systems offer enhanced resilience in extreme conditions, reinforcing their strong market presence. The dominance of these solutions is expected to continue as operators prioritize fail-safe pressure containment mechanisms in high-pressure processing units.

Analysis by Offering:

- Component

- Services

Component leads the market with around 76.2% of market share in 2024. Components form the backbone of the global HIPPS market, comprising pressure sensors, logic solvers, final elements, actuators, and valves. These critical parts work together to detect overpressure conditions, process signals, and execute shut-off procedures within milliseconds. The rising emphasis on system reliability and lifecycle management has spurred innovations in component design, particularly in high-performance valves and SIL-rated logic solvers. Moreover, advances in digital pressure sensing and redundant architectures are improving failure detection, reducing downtime, and enhancing operational safety. In addition, component manufacturers are investing in material enhancements to withstand corrosive and high-temperature environments, ensuring compliance with evolving industry standards. The growing adoption of integrated HIPPS solutions, featuring predictive maintenance capabilities and real-time performance monitoring, is reshaping component selection criteria. Furthermore, market growth is further supported by increased demand for custom-engineered solutions tailored to complex process conditions, particularly in upstream and midstream oil and gas operations.

Analysis by End Use Industry:

- Oil & Gas

- Power Generation

- Chemical

- Waste and Wastewater

- Food and Beverages

- Pharmaceutical

- Metal and Mining

- Paper & Pulp

- Others

Oil and gas leads the market with around 27.5% of market share in 2024, due to its high-pressure processes, stringent safety requirements, and growing investments in offshore and unconventional resource development. Upstream applications, including wellhead protection and subsea installations, drive significant demand for HIPPS, ensuring compliance with regulatory mandates while mitigating overpressure risks. Midstream operations benefit from HIPPS deployment in gas transmission and storage infrastructure, preventing pipeline ruptures and uncontrolled releases. Moreover, the refining sector increasingly integrates HIPPS into high-temperature processing units to safeguard personnel and assets. Expansion of LNG terminals and deepwater projects further accelerates adoption, particularly in regions with heightened safety enforcement. In addition to this, rising investments in automation and digitalized safety systems enhance HIPPS performance, with oil and gas companies prioritizing reliability, cost optimization, and adherence to international safety standards. The industry's reliance on HIPPS remains strong, reinforcing its position as the dominant end-use segment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, Asia Pacific accounted for the largest market share of over 37.6%. The Asia Pacific high-integrity pressure protection system (HIPPS) industry is expanding due to rapid industrialization, increasing energy demand, and stricter policies pertaining to safety. Nations including India, China, Australia are investing heavily in pipeline infrastructure, petrochemical processing, and oil and gas exploration, bolstering the requirement for innovative pressure protection solutions. For instance, in July 2024, Oil and Gas Exploration and Production Sector in India announced investment prospects of USD 100 Billion by the end 2024. Moreover, the nation is actively targeting to elevate exploration territory up to 1 Million square Km by 2030. In addition to this, rising adoption of automation, digital monitoring, and SIL-certified systems enhances regulatory compliance and operational efficiency. Government initiatives promoting industrial safety and environmental risk mitigation further accelerate market growth. Furthermore, growing offshore drilling activities and modernization efforts in refining and power generation industries contribute to increased HIPPS deployment.

Key Regional Takeaways:

United States High-integrity pressure protection system (HIPPS) Market Analysis

In 2024, United States accounted for 84.70% of the market share in North America. The United States high-integrity pressure protection system (HIPPS) industry is bolstering because of stringent industrial safety regulations, rising investments in energy infrastructure, and increasing adoption of automation technologies. For instance, as per the International Energy Agency, in 2024, clean energy investment magnified to approximately USD 300 Billion of more across the United States. Regulatory agencies mandate the use of advanced pressure protection systems to ensure workplace safety and prevent catastrophic equipment failures. The presence of major oil and gas producers, along with ongoing shale gas exploration and pipeline expansions, is driving demand for HIPPS solutions across upstream, midstream, and downstream sectors.In addition to this, growing investments in LNG export terminals, petrochemical processing plants, and power generation facilities are further accelerating market growth. The shift toward digitalized safety systems, including IoT-enabled monitoring and predictive maintenance, is enhancing HIPPS efficiency and reliability. Moreover, the modernization of aging industrial infrastructure and increasing focus on reducing environmental risks are prompting industries to integrate advanced HIPPS technologies. Strategic collaborations between manufacturers and energy companies, coupled with strong domestic production capabilities, position the U.S. as a key market for HIPPS adoption and innovation.

Europe High-integrity pressure protection system (HIPPS) Market Analysis

The Europe high-integrity pressure protection system (HIPPS) market is expanding due to stringent safety regulations, rising energy transition efforts, and increasing investments in industrial automation. Countries such as Germany, the UK, and France are driving need for HIPPS in oil and gas, petrochemical, and power sectors to enhance operational safety and regulatory compliance. In addition to this, the region’s focus on reducing carbon emissions and improving environmental sustainability is accelerating the adoption of advanced pressure protection solutions. For instance, as per the European Environment Agency, European Union is responsible for 6% of emissions worldwide. In line with this, the region is actively implementing new targets that encompass 55% reduction or above by the year 2030. Besides this, growing investments in offshore wind projects and hydrogen production further contribute to HIPPS deployment, ensuring safe pressure management in evolving energy sectors. The adoption of smart monitoring systems, IoT-enabled sensors, and AI-driven diagnostics enhances HIPPS efficiency and reliability. Additionally, modernization of aging infrastructure and increased integration of automation technologies in industrial plants are fostering market growth. Strategic collaborations between manufacturers and energy companies further strengthen Europe’s position as a key HIPPS market.

North America High-integrity pressure protection system (HIPPS) Market Analysis

The North America high-integrity pressure protection system (HIPPS) market is expanding due to stringent regulatory requirements, increasing production of oil and gas, and rising investments in industrial automation. The U.S. and Canada are driving demand for HIPPS solutions across upstream, midstream, and downstream sectors, ensuring compliance with safety and environmental standards. Ongoing shale gas exploration, LNG infrastructure development, and petrochemical plant expansions further support market growth. For instance, as per industry reports, in July 2024, Wolf Midstream announced a substantial investment of USD 1 Billion for Natural Gas Liquids system expansion in Canada to cater to the heightening requirement for petrochemicals. Advancements in digital monitoring, IoT-enabled diagnostics, and predictive maintenance enhance HIPPS efficiency and reliability. Additionally, modernization of aging energy infrastructure and strategic partnerships between manufacturers and industry stakeholders are strengthening market competitiveness.

Latin America High-integrity pressure protection system (HIPPS) Market Analysis

The Latin America high-integrity pressure protection system (HIPPS) market is growing due to increasing pipeline infrastructure investments, stricter industrial safety regulations, and expanding oil and gas production. For instance, as per the U.S. Energy Information Administration, it is anticipated that in the Gulf of Mexico, new twelve oil fields will begin production during time period 2024-2025, highlighting escalating oil production. Countries such as Brazil and Mexico are driving demand for advanced pressure protection solutions in offshore and onshore projects. Besides, rising adoption of automation and digital safety technologies enhances system reliability and regulatory compliance. In addition to this, modernization efforts in the petrochemical and power sectors are accelerating HIPPS deployment to improve operational efficiency and risk management.

Middle East and Africa High-integrity pressure protection system (HIPPS) Market Analysis

The Middle East and Africa high-integrity pressure protection system (HIPPS) market is expanding due to increasing oil and gas exploration, rising investment in pipeline infrastructure, and stringent safety regulations. Major energy-producing nations, including Saudi Arabia and the UAE, are driving demand for advanced pressure protection solutions. For instance, according to the International Energy Agency, leading oil producers globally are from Middle East, encompassing Kuwait, United Arab Emirates, Saudi Arabia, Iran, and Iraq. This presence of dominating fuel providers significantly impacts market dynamics optimistically. This is also results in elevated offshore drilling activities, meanwhile compliance with international safety standards further support market growth. Additionally, technological advancements in automation and digital monitoring are enhancing HIPPS adoption across petrochemical and power industries, ensuring operational reliability and risk mitigation.

Competitive Landscape:

The market exhibits intense competition, with leading players actively emphasizing on technological innovations, regulatory compliance, and tactical collaborations. Leading manufacturers dominate the market by offering advanced safety solutions with digital integration and automation capabilities. Furthermore, numerous firms are heavily allotting funds for research and development initiatives to enhance system reliability, predictive maintenance, and remote monitoring. Strategic mergers, acquisitions, and collaborations with oil and gas operators and EPC contractors strengthen market positioning. Increasing demand for certified SIL-rated systems and compliance with international safety standards further drive competition, compelling players to differentiate through innovation, cost efficiency, and robust after-sales support. For instance, Emerson Electric Co., a leading HIPPS provider, provides SIL certification aid for its HIPPS, fostering the adherence to new regulatory policies. Moreover, this prominent company earned a revenue of USD 17.5 Billion in 2024, a 15% elevation from fiscal year 2023.

The report provides a comprehensive analysis of the competitive landscape in the high-integrity pressure protection system (HIPPS) market with detailed profiles of all major companies, including:

- Emerson Electric Co.

- Yokogawa Electric Corp.

- HIMA

- Schneider Electric

- Rockwell Automation Inc.

- ABB

- Schlumberger

- Siemens

- Honeywell International

- L&T Valves

- Samson AG

Latest News and Developments:

- In May 2024, IMI launched HIPPS to safeguard from overpressure diffusion during post-production of hydrogen. HIPPS will facilitate manufacturers to amplify availability as well as safety while providing a crucial layer of safety for downstream components and pipelines.

- In May 2024, L&T Valves Limited, a major HIPPS provider, announced the development of news production facility in Saudi Arabia. This move aims to address the magnifying requirement from Middle East Market.

High-integrity pressure protection system (HIPPS) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electronics HIPPS, Hydraulic/Mechanical HIPPS |

| Offerings Covered | Component, Services |

| End Use Industries Covered | Oil & Gas, Power Generation, Chemical, Waste and Wastewater, Food and Beverages, Pharmaceutical, Metal and Mining, Paper & Pulp, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Emerson Electric Co., Yokogawa Electric Corp., HIMA Schneider Electric, Rockwell, Automation Inc., ABB, Schlumberger, Siemens, Honeywell International, L&T Valves, Samson AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the high-integrity pressure protection system (HIPPS) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global high-integrity pressure protection system (HIPPS) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the high-integrity pressure protection system (HIPPS) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The high-integrity pressure protection system (HIPPS) market was valued at USD 484.66 Million in 2024.

IMARC estimates the high-integrity pressure protection system (HIPPS) market to reach USD 975.95 Million by 2033, exhibiting a CAGR of 7.40% from 2025-2033.

Stringent safety regulations, rising demand for pressure protection in oil and gas, petrochemical, and power industries, and increasing offshore exploration are driving HIPPS market growth. Technological advancements in automation, digital monitoring, and predictive maintenance enhance adoption. Growing investments in pipeline infrastructure and environmental risk mitigation further support market expansion.

Asia Pacific currently dominates the high-integrity pressure protection system (HIPPS) market, accounting for a share exceeding 37.6%. This dominance is fueled by magnified industrialization, escalating oil & gas exploration, and stricter safety policies in the region.

Some of the major players in the high-integrity pressure protection system (HIPPS) market include Emerson Electric Co., Yokogawa Electric Corp., HIMA Schneider Electric, Rockwell, Automation Inc., ABB, Schlumberger, Siemens, Honeywell International, L&T Valves, Samson AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)