Heparin Market Size, Share, Trends and Forecast by Product, Source, Mode of Administration, Application, End-User, Distribution Channel, and Region 2025-2033

Heparin Market Size, Global Share Analysis & Industry Forecast:

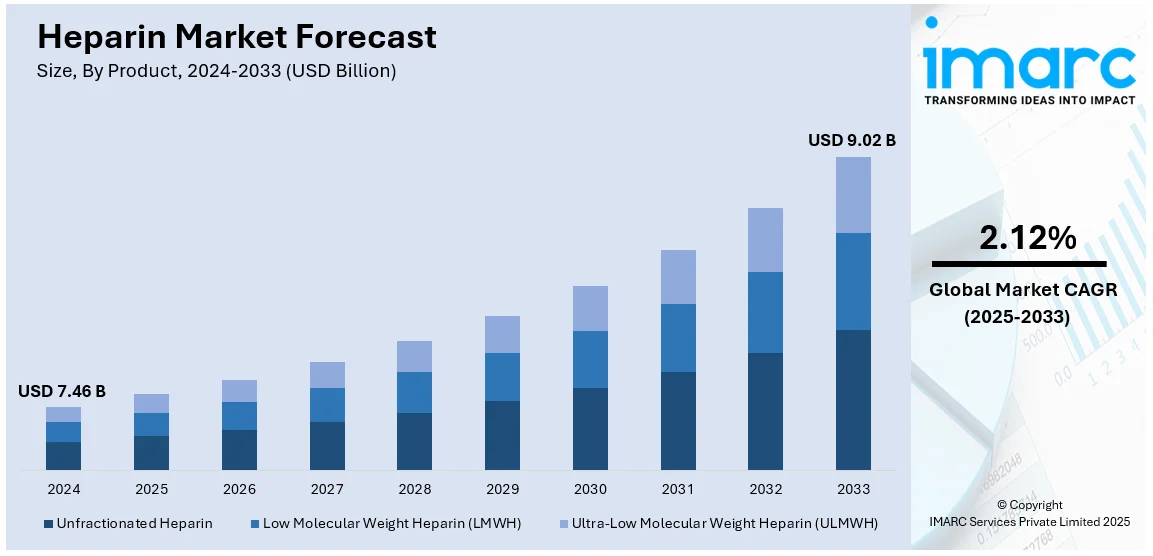

The global heparin market size was valued at USD 7.46 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.02 Billion by 2033, exhibiting a CAGR of 2.12% during 2025-2033. North America currently dominates the market, holding a significant market share of 36% in 2024. The rising need for effective treatment options for cardiovascular diseases, substantial investments in R&D activities by the key players, the growing prevalence of numerous surgical procedures, and the considerable rise in the number of geriatric population that is susceptible to chronic diseases are the key factors bolstering the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.46 Billion |

|

Market Forecast in 2033

|

USD 9.02 Billion |

| Market Growth Rate (2025-2033) | 2.12% |

The global market is primarily driven by the rising prevalence of cardiovascular diseases, venous thromboembolism, and other coagulation disorders requiring anticoagulant therapy. The increasing geriatric population, prone to such conditions, significantly enhances market growth. Furthermore, continual advancements in heparin production, such as low-molecular-weight heparin formulations, enhance therapeutic efficiency and safety, fueling market demand. On 29th January 2024, Avenacy, a pharmaceutical company specializing in injectable medications, launched its FDA-approved generic version of Angiomax (bivalirudin) in the U.S. Bivalirudin for Injection is an anticoagulant outlined for patients encountering percutaneous coronary intervention (PCI), as well as those with heparin-induced thrombocytopenia and associated conditions. Along with this, expanding awareness about thrombotic disorders and improvements in healthcare infrastructure, especially in developing economies, also contribute to market expansion. Additionally, the growing adoption of heparin in surgical procedures and dialysis, coupled with supportive government initiatives to combat coagulation-related diseases, bolsters the market. Moreover, the escalating demand for effective anticoagulant therapies is positively influencing the market.

The United States stands out as a key regional market, primarily driven by the high incidence of surgical procedures and the widespread prevalence of chronic diseases such as diabetes, cancer, and obesity, which increase the risk of thrombosis. According to a 2024 research report by the National Center for Chronic Disease Prevention and Health Promotion, about 129 million Americans have one or more major chronic conditions, of whom 42% have two or more, and 12% have five or more. Five of the top 10 leading causes of death are strongly related to preventable and treatable chronic conditions. Chronic diseases account for 90% of the annual USD 4.1 Trillion U.S. healthcare costs, and their prevalence has been increasing steadily for the past two decades. Besides this, the increasing focus on reducing hospital readmissions related to thromboembolic events further fuels the demand in the country. Concurrently, extensive research and development (R&D) activities by pharmaceutical companies to improve heparin formulations and minimize side effects enhance market potential. Furthermore, the emerging trend of outpatient procedures and home-based anticoagulant therapies also supports the heparin market share in the US. Moreover, the growing awareness of thrombosis prevention is also creating a positive market outlook.

Heparin Market Trends

Continuous Technological Innovations

The rising investments in heparin production for enhancing efficiency and safety are bolstering the market. For instance, in the United States alone, there are over 900,000 annual cardiac surgeries, and the CABG is a major component of the numbers, as per an industry report. This alone fuels demand for heparin as an essential anticoagulant during surgery. Moreover, advancements, such as recombinant DNA technology and improved extraction methods, are being extensively used to produce heparin with higher purity and consistency, which is propelling the market. For example, Momenta Pharmaceuticals has been at the forefront of developing synthetic heparin using recombinant technology, thereby aiming to ensure a reliable and contamination-free supply. Furthermore, in April 2024, a team of researchers created three quality improvement measures incorporated into electronic health records (EHRs) to improve treatment delivery in patients with heparin-induced thrombocytopenia..

Improving Healthcare Infrastructures

The expanding healthcare infrastructures and the increasing awareness of anticoagulant therapies drive the widespread applications of heparin in emerging situations. As per a report from the World Economic Forum, global health expenditure in 2021 hit an astonishing USD 9.8 Trillion, representing 10.3% of the world's GDP. Moreover, countries in Latin America and Asia-Pacific are witnessing growing adoption of heparin for numerous medical conditions, supported by local production and distribution initiatives. For example, India's Bharat Serums and Vaccines Ltd. has been active in supplying and producing heparin to meet domestic and regional demand. The broader availability and affordability of heparin in these regions are crucial for managing surgical procedures and cardiovascular diseases, thereby elevating the heparin industry's size.

Growing Popularity of Heparin Alternatives

The demand for synthetic heparin alternatives is escalating as these products address supply chain and safety concerns associated with animal-derived heparin. According to an industrial report, cardiovascular diseases were responsible for 928,741 deaths in the United States in 2020, and there is a growing need for safe and effective anticoagulant therapies since the incidence of such conditions as coronary heart disease and stroke continues to rise. Furthermore, synthetic alternatives including Fondaparinux (Arixtra), developed by GlaxoSmithKline, provide consistent quality and reduce the risk of contamination. These products are particularly valuable in managing patients with specific sensitivities or allergies to animal proteins. The approval and development of synthetic heparins offer reliable anticoagulant options, thereby driving heparin market growth in regions prioritizing advanced healthcare solutions.

Heparin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global heparin market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on the product, source, mode of administration, application, end-user, and distribution channel.

Analysis by Product:

- Unfractionated Heparin

- Low Molecular Weight Heparin (LMWH)

- Ultra-Low Molecular Weight Heparin (ULMWH)

Low molecular weight heparin (LMWH) led the market in 2024 with 63.3% market share. Low Molecular Weight Heparin (LMWH) is a refined form of heparin used widely for its anticoagulant properties, offering advantages such as a more predictable response, longer half-life, and lower risk of osteoporosis and heparin-induced thrombocytopenia compared to unfractionated heparin. A notable product launch in this segment is Sanofi's Clexane (enoxaparin), which has become a standard in clinical practice for preventing and treating thromboembolic disorders. Another significant launch is Pfizer's Fragmin (dalteparin), known for its efficacy in treating venous thromboembolism and its use in cancer patients to reduce the risk of recurrent blood clots.

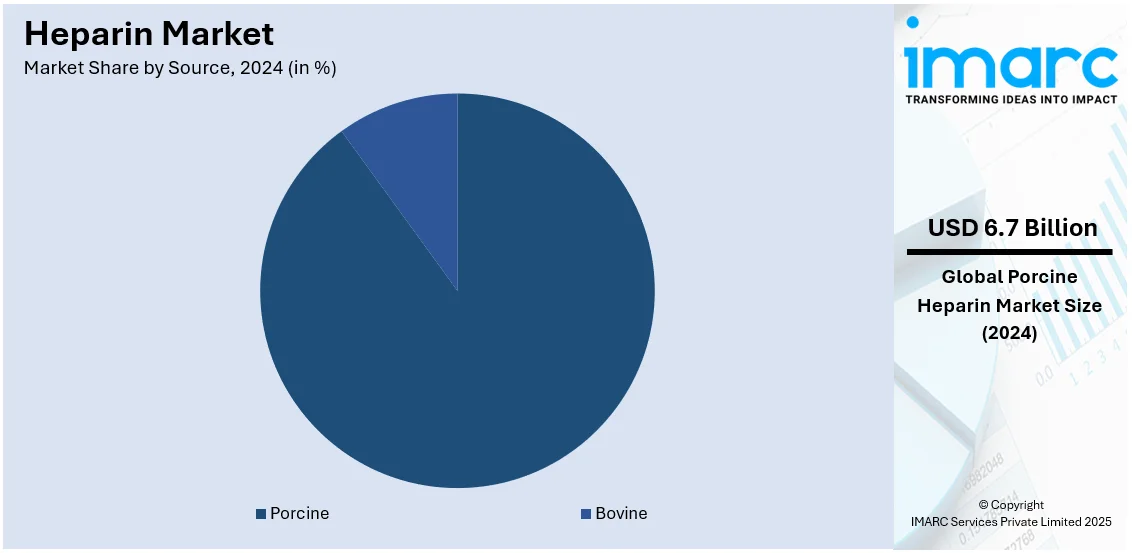

Analysis by Source:

- Bovine

- Porcine

Porcine led the market in 2024 with 90% market share. Porcine-derived heparin, extracted from pig intestines, remains a crucial anticoagulant in medical practice due to its effectiveness in preventing and treating blood clots. Despite concerns about supply chain vulnerabilities and contamination risks, porcine heparin continues to be widely used. A notable product launch in this segment is Pfizer's Heparin Sodium Injection, which is utilized extensively in hospitals for various indications, including surgery and dialysis.

Analysis by Mode of Administration:

- Oral

- Parenteral

Oral led the market in 2024. Oral administration of heparin is bringing promising developments in this area. A notable product launch is Rivaroxaban, marketed as Xarelto by Bayer and Janssen Pharmaceuticals, which represents a significant breakthrough in anticoagulant therapy. Research and development (R&D) continue to focus on creating true oral heparin formulations, aiming to combine the efficacy of heparin with the convenience of oral administration, which could revolutionize anticoagulant therapy in the future.

Analysis by Application:

- Atrial Fibrillation & Heart Attack

- Stroke

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Others

Atrial fibrillation & heart attack led the market in 2024 due to the high prevalence and significant clinical need for effective anticoagulation therapy in these conditions. Atrial fibrillation, a common cardiac arrhythmia, significantly increases the risk of stroke, necessitating the use of anticoagulants such as heparin to prevent thromboembolic events. Similarly, during heart attacks, immediate anticoagulation is critical to prevent further clot formation and to stabilize patients. The widespread incidence of these cardiovascular conditions drives substantial demand for heparin, highlighted by its effectiveness in acute management and prevention of complications. As a result, the heparin market is heavily focused on providing solutions for these high-risk, high-need patient populations, ensuring their central role in market segmentation.

Analysis by End-User:

- Hospitals

- Clinics

- Homecare Settings

- Ambulatory Surgical Centers

- Others

Hospitals led the market in 2024 due to their critical role in administering acute and intensive care, where heparin is extensively used. In hospital settings, heparin is a cornerstone for preventing and treating various thromboembolic disorders, managing patients undergoing surgeries, and supporting those in intensive care units (ICUs). For instance, Pfizer’s Heparin Sodium Injection is commonly utilized in hospitals for a range of applications, from ensuring anticoagulation during cardiac surgeries to preventing deep vein thrombosis in bedridden patients.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Drug Stores

- Online Stores

- Others

Hospital pharmacies led the market in 2024 due to their pivotal role in providing immediate and efficient access to critical medications such as heparin. These pharmacies cater to the high demand for anticoagulants in inpatient settings, particularly for surgical procedures, intensive care, and emergency treatments. Their direct integration with healthcare providers ensures timely delivery and administration of heparin, enhancing patient outcomes. Additionally, hospital pharmacies are trusted for their stringent quality control and compliance with regulatory standards, which is critical for sensitive drugs. The centralized nature of these facilities further strengthens their position as a key distribution channel in the market.

Regional Analysis

- Europe

- North America

- Asia Pacific

- Middle East and Africa

- Latin America

North America accounted for the largest market share of 36% in 2024. The market in North America is characterized by robust demand driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and significant investment in medical research. The United States, in particular, sees extensive use of heparin in hospitals and clinics for preventing and treating thromboembolic disorders. For instance, Pfizer's Heparin Sodium Injection is a staple in American healthcare facilities, widely used during surgeries and for managing conditions including deep vein thrombosis and pulmonary embolism. In Canada, Leo Pharma's Innohep (tinzaparin) is commonly used for similar indications, highlighting the region's reliance on effective anticoagulant therapies. Besides this, ongoing research and development (R&D) efforts, such as those aimed at improving heparin formulations and delivery methods, continue to bolster the market.

Heparin Market Regional Takeaways:

United States Heparin Market Analysis

In 2024, the United States accounted for a market share of 86.5% in North America. As highlighted by a research article, cardiovascular disease remains the biggest cause of death in the United States, resulting in 928,741 deaths in 2020. With such a huge burden imposed by CVD, treatment needs such as heparin continue to increase. In the years 2018-2019, the total CVD cost was USD 407.3 Billion, with a direct healthcare cost of USD 251.4 Billion and a lost productivity and mortality cost of USD 155.9 Billion. Coronary heart disease accounted for most of the deaths due to CVD. It caused about 41.2 percent of deaths, followed by stroke at 17.3%, heart failure at 9.2%, and other causes of death due to CVD. All these high incidences feed the CVD demand for anticoagulant treatment, specifically heparin, an essential treatment that patients undergoing cardiac surgery procedures, including CABG procedures, require. In the U.S., heparin demand will increase along with the growth in CVD incidence since the number of anticoagulants required will increase due to the population aging. Becton Dickinson and Pfizer currently lead in the market but continue to dominate by providing vital heparin products across the healthcare continuum, making greater access a reality for more patients while improving their outcomes.

Europe Heparin Market Analysis

The European heparin market is positively impacted by increased access to healthcare, a growing elderly population, and an increasing incidence of cardiovascular diseases. According to the European Heart Network, there are approximately 49 million people in Europe who suffer from cardiovascular diseases, thereby highly driving the demand for heparin. As cardiovascular diseases increase in prevalence, the emphasis in European health care systems is being increasingly placed on anticoagulation therapies, thus positioning heparin at the forefront of the management of diseases such as DVT and atrial fibrillation. Countries including Germany and France have taken the lead with growing prescriptions for standard heparin and LMWH. Strict regulatory bodies such as the European Medicines Agency (EMA) ensure that heparin products are of an acceptable safety standard, the reason why clinicians prefer their use. Companies such as Leo Pharma and Sanofi are contributing positively to the market by investing substantially in R&D to build therapeutic efficacy and safety further while expanding market share across the continent.

Asia Pacific Heparin Market Analysis

The rapid growth of the Asia Pacific heparin market is attributed to the escalating healthcare expenditures and cardiovascular disease prevalence. The "Report on Cardiovascular Health and Diseases in China 2022" reports that between 2005 and 2020, CVD deaths increased from 3.09 million to 4.58 million in China, which considerably drives demand for heparin as a key anticoagulant treatment. With an upward trend in cardiovascular diseases, such countries as China and India experience more uptake of heparin therapy, especially in hospitals and healthcare centers. Also, the health care budget of India for 2023-2024 is about USD 11.5 Billion; it is channeled toward the development of infrastructures, hence the growing heparin market. Other than cardiovascular diseases, there are increased cases of pulmonary embolism and deep vein thrombosis in this region, all of which demand heparin. Increased investments in research and development are also seen in the Asia Pacific region as local manufacturers collaborate with global pharmaceutical companies to enhance the availability and accessibility of heparin products in the entire region, hence establishing itself in the global market.

Latin America Heparin Market Analysis

Latin America heparin market is expanding due to increasing healthcare demands, as more people suffer from cardiovascular conditions and age. Cardiovascular diseases account for nearly 30% of all deaths in Latin America, which directly enhances the demand for heparin products, as reported by the OECD. Of major significance is Brazil, as the largest economy in its region, which has an emphasis on healthcare infrastructure that gives considerable investment to it with strong efforts to modernize the medical sector. According to the Brazilian healthcare system's emphasis on anticoagulant treatments, hospital and clinic use of heparin has become better in availability and usage. Semiautonomous trends, along with liberalization of access to gun ownership laws as well as an increased awareness of healthcare in Mexico and Colombia, are propelling a demand for heparin, especially to treat surgery and traumatic injury complications. Companies including Laboratorios Heber and Instituto Bioclon have become prime movers in developing and promoting heparin products all over Latin America, positively leading at an amplified level across the region.

Middle East and Africa Heparin Market Analysis

The Middle East and Africa-based heparin market have been found to be going steadily forward on account of increasingly growing diseases related to the heart and widening healthcare infrastructures. In fact, according to research articles, this region is reported to contribute to more deaths than other causes, attributed to cardiovascular disease, which brings about approximately 2 million deaths yearly. This continually rising condition is highly creating a demand for effective drugs such as heparin used in hospitals around the area. Saudi Arabia and the UAE, with a large-scale investment in the modernization of healthcare, face increased demand for heparin, not only in surgical use but also in critical care units. South Africa, with a more developed pharmaceutical sector, is experiencing growth in the use of heparin, both for local consumption and exports. Improvement in healthcare infrastructure in the region, along with government support for healthcare programs, will fuel the market further. An increase in healthcare spending combined with increased awareness of cardiovascular diseases places the Middle East and Africa as a growing segment in the global heparin market.

Leading Heparin Companies:

The leading market players are investing significantly in R&D to develop improved formulations and delivery methods, enhancing the effectiveness and safety of heparin products. These efforts aim to address medical needs more efficiently and reduce potential side effects. To tap into new markets and diversify revenue streams, major manufacturers are expanding their geographic presence by establishing distribution networks, manufacturing facilities, and sales operations in emerging markets. Additionally, they are investing in advanced quality control measures, adherence to Good Manufacturing Practices (GMP), and transparency in their supply chains to maintain customer trust and regulatory approval. According to the heparin industry analysis, key players are also forming strategic partnerships with research institutions, healthcare providers, and pharmaceutical companies to advance heparin-based treatments collectively.

The report provides a comprehensive analysis of the leading companies in the heparin market with detailed profiles of all major companies, including:

- GlaxoSmithKline Plc

- Shenzhen Hepalink Pharmaceutical Co., Ltd

- Pfizer Inc.

- LEO Pharma A/S

- Sanofi S.A.

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Aspen Holdings

- Baxter International Inc.

- Hebei Changshan Biochemical Pharmaceutical Co. Ltd.

- Sandoz International GmbH

- Opocrin S.p.A.

- Sichuan Deebio Pharmaceutical Co., Ltd.

- Dongying Tiandong Pharmaceutical Co. Ltd.

Latest News and Developments:

- December 2024: Dongying Tiandong Pharmaceutical announced that they filed a patent application related to method for determining dopes content of bovine lung- obtained heparin in porcine intestine mucosa- derived heparin.

- November 2024: Bristol Myers Squibb reports that it featured data from its cardiovascular pipeline at the American Heart Association Annual Scientific Sessions.

- February 2024: B. Braun Inc., a prominent company in smart infusion therapy, launched 2000 units of heparin in 0.9% sodium chloride injections.

- February 2024: Roche has introduced three coagulation tests specifically designed for the oral Factor Xa inhibitors: apixaban, edoxaban, and rivaroxaban, in European nations that recognize the CE mark.

Heparin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Unfractionated Heparin, Low Molecular Weight Heparin (LMWH), Ultra-Low Molecular Weight Heparin (ULMWH) |

| Sources Covered | Bovine, Porcine |

| Mode of Administrations Covered | Oral, Parenteral |

| Applications Covered | Atrial Fibrillation & Heart Attack, Stroke, Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Others |

| End-users Covered | Hospitals, Clinics, Homecare Settings, Ambulatory Surgical Centers, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | GlaxoSmithKline Plc, Shenzhen Hepalink Pharmaceutical Co., Ltd, Pfizer Inc., LEO Pharma A/S, Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Aspen Holdings, Baxter International Inc., Hebei Changshan Biochemical Pharmaceutical Co. Ltd., Sandoz International GmbH, Opocrin S.p.A., Sichuan Deebio Pharmaceutical Co., Ltd., Dongying Tiandong Pharmaceutical Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the heparin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global heparin market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the heparin industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global heparin market was valued at USD 7.46 Billion in 2024.

The global heparin market is estimated to reach USD 9.02 Billion by 2033, exhibiting a CAGR of 2.12% during 2025-2033.

The global market is majorly driven by the rising prevalence of cardiovascular diseases, increasing geriatric populations, advancements in heparin formulations including low-molecular-weight heparins, and the expanding adoption of anticoagulant therapies in surgical procedures and dialysis.

North America currently dominates the heparin market, which held a market share of 36% in 2024. The dominance is driven by advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and significant investment in pharmaceutical research and development.

Some of the major players in the global heparin market include GlaxoSmithKline Plc, Shenzhen Hepalink Pharmaceutical Co., Ltd, Pfizer Inc., LEO Pharma A/S, Sanofi S.A., Dr. Reddy’s Laboratories Ltd., Teva Pharmaceutical Industries Ltd., Aspen Holdings, Baxter International Inc., Hebei Changshan Biochemical Pharmaceutical Co. Ltd., Sandoz International GmbH, Opocrin S.p.A., Sichuan Deebio Pharmaceutical Co., Ltd., and Dongying Tiandong Pharmaceutical Co. Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)