Heavy-Duty Automotive Aftermarket Market Size, Share, Trends and Forecast by Replacement Parts, Vehicle Type, Service Channel, and Region, 2026-2034

Heavy-Duty Automotive Aftermarket Market Size and Share:

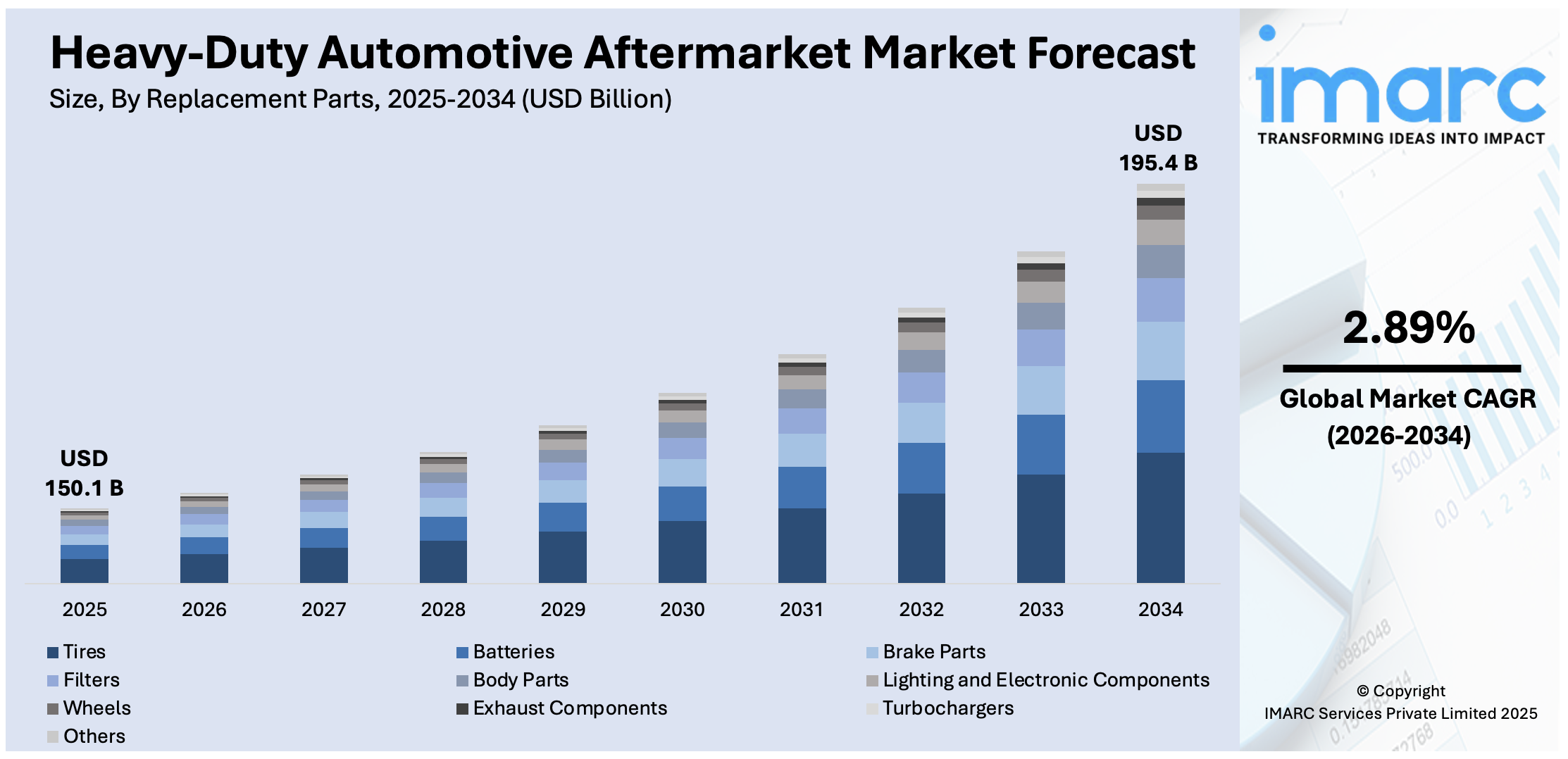

The global heavy-duty automotive aftermarket market size was valued at USD 150.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 195.4 Billion by 2034, exhibiting a CAGR of 2.89% from 2026-2034. North America currently dominates the market, holding a market share of 40.5% in 2025. The market share is expanding, driven by the growing adoption of digital tools that aid in streamlining the repair process, along with the expansion of e-commerce portals, leading to the enhanced accessibility of a wide range of parts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 150.1 Billion |

| Market Forecast in 2034 | USD 195.4 Billion |

| Market Growth Rate 2026-2034 | 2.89% |

As commercial vehicles stay on the road longer and need regular maintenance and part replacements, the demand for heavy-duty automotive aftermarket services is high. Fleet operators rely on affordable and reliable aftermarket parts to keep their trucks and trailers running efficiently. As freight and logistics activities are increasing, vehicles are experiencing more wear and tear, driving higher demand for servicing and component upgrades. New technologies like diagnostic tools and telematics help to detect issues early, which encourages the use of aftermarket solutions. Emission regulations also play a role, as older heavy-duty vehicles often require upgrades to stay compliant.

To get more information on this market Request Sample

The United States has emerged as a major region in the heavy-duty automotive aftermarket market owing to many factors. The country has a large and aging fleet of commercial vehicles that need constant servicing and part replacements. Many logistics and freight companies prefer to maintain existing vehicles instead of buying new ones, catalyzing the demand for aftermarket solutions. Harsh weather conditions and long-haul routes also lead to more frequent wear and tear, creating the need for durable and efficient parts. There is also rising utilization of advanced diagnostic tools that aid in the early detection of issues, boosting aftermarket services. Strong distribution networks and digital platforms are making it easier for buyers to access a wide range of products quickly. Apart from this, with commercial telematics, fleet operators can track the condition of their vehicles in real-time, monitor fuel efficiency, and identify maintenance needs before they lead to breakdowns. According to the IMARC Group, the United States commercial telematics market is set to attain USD 61.0 Billion by 2033, showing a growth rate (CAGR) of 12.3% during 2025-2033.

Heavy-Duty Automotive Aftermarket Market Trends:

Growing environmental concerns

Rising environmental concerns are impelling the market growth. Government agencies are implementing stringent environmental regulations, encouraging the adoption of greener technologies and components. As a result, there is a higher demand for environment friendly aftermarket parts, such as low-emission exhaust systems, energy-efficient tires, and fuel-efficient engines. Additionally, fleet operators are focusing on maintaining their vehicles in ways that minimize environmental impact, leading to the expansion of services like eco-friendly vehicle maintenance and the use of sustainable products. This trend is also influencing the development of alternative fuel solutions, such as electric and hybrid systems, which are gaining popularity in the heavy-duty sector. As environmental awareness among people is growing and they are shifting towards clean energy, companies in the market are offering products and services that help to reduce environmental footprints and comply with regulatory standards. In 2024, the United Nation's second Peoples' Climate Vote, which involved over 73,000 individuals from 77 nations, found that 85% of participants advocated for a rapid shift away from fossil fuels to green energy.

Rising digital transformation

The ongoing digital transformation is fueling the heavy-duty automotive aftermarket market growth. Technologies like predictive analytics and telematics help to monitor vehicle performance in real-time, enabling early detection of issues before they become major problems. Digital platforms are also making it easier for fleet operators to track service histories, order parts, and schedule maintenance, enhancing overall management. Additionally, digital tools streamline the repair process by providing technicians with up-to-date repair manuals, diagnostic data, and technical support, reducing errors and improving turnaround times. The rising expenditure on digital transformation is assisting in enhancing operational efficiency, lowering costs, and enhancing customer satisfaction. According to the latest forecast by industry reports, worldwide spending on digital transformation is set to approach USD 4 Trillion by 2027.

Expansion of e-commerce portals

The expansion of e-commerce sites is offering a favorable heavy-duty automotive aftermarket market outlook. Online platforms provide convenience, allowing fleet operators and individual buyers to browse, compare, and purchase heavy-duty parts at competitive prices. This digital shift also enables faster delivery and more flexible options for purchasing hard-to-find or specialized parts. E-commerce platforms allow businesses to reach a larger audience, including international markets, and offer detailed product information, customer reviews, and support services. Additionally, advanced tools help businesses track inventory, forecast demand, and manage supply chains more efficiently. With more people turning to online shopping, e-commerce sites are becoming key drivers of the broadening, making parts and services more accessible to a broader customer base. Industry analysis projects that the online automotive parts and accessories market is set to grow at a 15.3% CAGR from 2024 to 2032. People aged between 25 and 40 accounted for 57% of US online car part sales in 2024, indicating continued growth driven by digitally native buyers.

Heavy-Duty Automotive Aftermarket Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global heavy-duty automotive aftermarket market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on replacement parts, vehicle type, and service channel.

Analysis by Replacement Parts:

- Tires

- Batteries

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Exhaust Components

- Turbochargers

- Others

Tires hold a significant portion of the market, as they wear out faster than many other components due to constant road contact and heavy loads and require maintenance. Tires face tough conditions like rough terrains, long distances, and varying weather, which makes regular replacement necessary. Fleet operators and truck owners prioritize tire maintenance to ensure safety, fuel efficiency, and smooth operations. As commercial vehicles are used for extended hours, the demand for durable and high-performance tires is high. Tires also directly impact vehicle performance, traction, and braking, which are critical for heavy-duty applications. According to the heavy-duty automotive aftermarket market report, the growing logistics and transportation activities across regions are increasing the frequency of tire replacements. Additionally, innovations in tire technology and the availability of various options tailored to specific vehicle needs lead to more replacements. As tire quality plays a major role in reducing downtime and improving operational efficiency, businesses are investing in timely maintenance, making tires a leading segment in the market.

Analysis by Vehicle Type:

- Class 4 to Class 6

- Class 7 and Class 8

Class 7 and class 8 account for 65.3% of the market share. They are widely used for long-haul freight, industrial transport, and commercial logistics. These vehicles operate under intense conditions, covering long distances while carrying heavy loads, which leads to more frequent wear and tear. Due to their demanding use, parts like brakes, engines, tires, and suspension systems require regular maintenance and replacement. Class 7 and class 8 trucks also form the backbone of the supply chain, especially in sectors, such as manufacturing, agriculture, and retail, which keeps them on the road constantly. Their high usage rate creates the need for aftermarket services. Fleet owners rely on aftermarket parts to reduce downtime and manage operational costs effectively. The sheer size and complexity of these vehicles also mean they require specialized and high-value parts, adding more weight to this segment in the market.

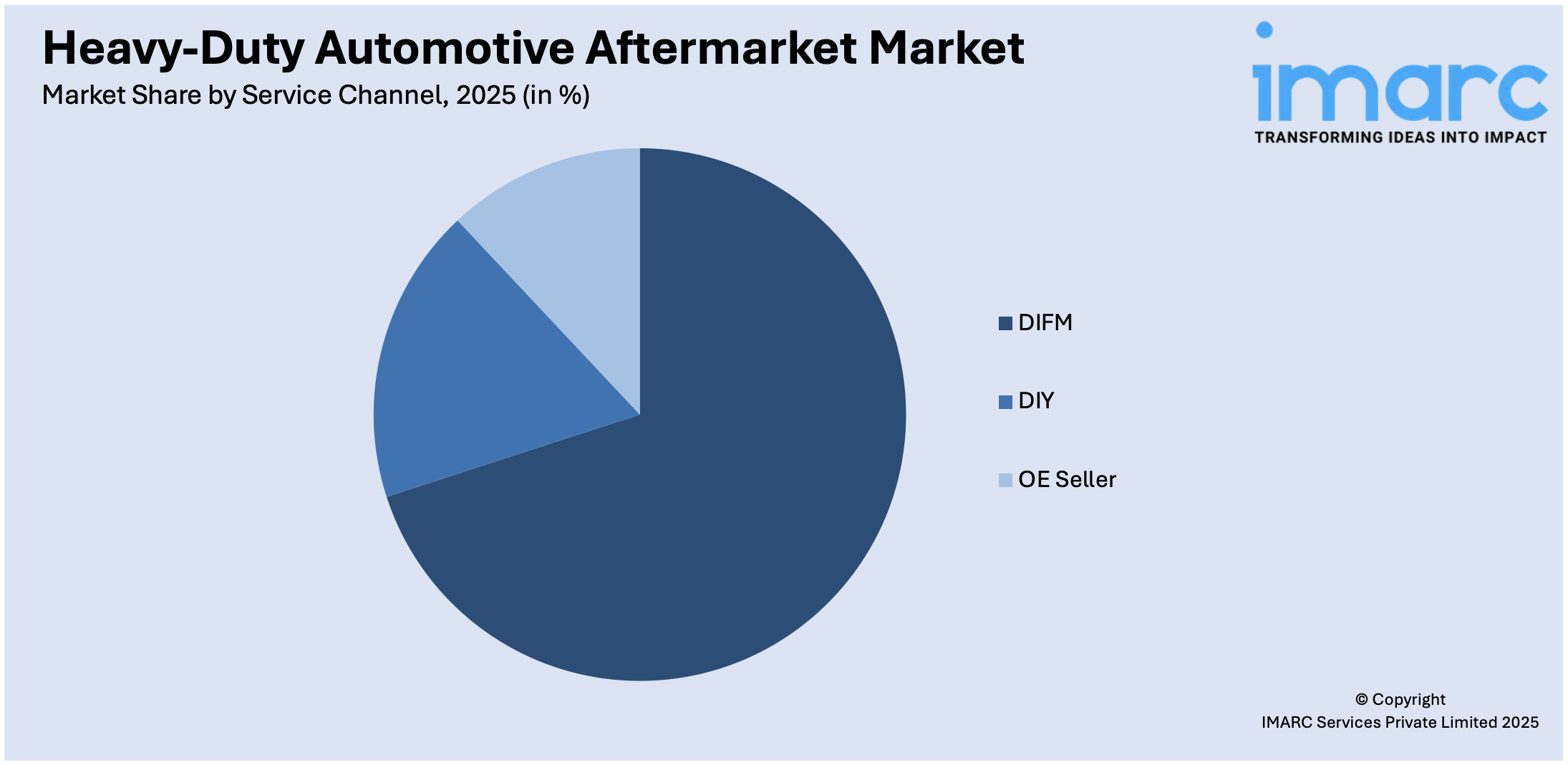

Analysis by Service Channel:

Access the comprehensive market breakdown Request Sample

- DIY

- OE Seller

- DIFM

DIFM holds 69.1% of the market share. DIFM solutions are gaining traction, as most fleet operators and heavy vehicle owners prefer professional maintenance and repair services over doing it themselves. These vehicles are complex, require specialized tools, and need skilled technicians for accurate diagnostics and repairs. Downtime can be costly in the commercial transport sector, so quick and reliable service is a priority, which makes DIFM a more convenient and efficient choice. Many companies choose to outsource maintenance to ensure compliance with safety and emissions regulations. Professional service centers also offer warranties and access to genuine parts, adding trust and reliability to the process. With an increase in the number of commercial vehicles, the need for effective service networks and regular maintenance is rising, encouraging more users to employ DIFM solutions. Fleet management companies rely on DIFM to keep their operations smooth without spending on in-house service facilities.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 40.5%, enjoys the leading position in the market. The region, including the United States and Canada, is noted for its large base of commercial vehicles and a well-established transportation sector. As per the data released by the New Motor Vehicle Survey, Canada saw sales of 172,104 new motor vehicles in March 2024, marking the highest sales figure as 176,036 were sold in March 2021. This count featured 148,740 trucks, the highest sold since 149,661 were sold in May 2019. The area has a strong logistics and freight movement network that depends heavily on commercial vehicles, driving the demand for maintenance and replacement parts. The presence of major aftermarket suppliers and service providers in the US and Canada adds to the market’s strength. Advanced repair facilities, skilled labor, and widespread access to spare parts help to ensure that vehicles are kept in working condition for longer periods. Stringent safety and emission regulations are also encouraging fleet operators to maintain their trucks to higher standards, boosting aftermarket spending.

Key Regional Takeaways:

United States Heavy-Duty Automotive Aftermarket Market Analysis

The United States market, holding a share of 80.90%, is experiencing growth owing to rising aging fleet vehicles, driving the demand for replacement components and maintenance services. The ongoing implementation of stricter emission regulations, which are encouraging the retrofitting of older vehicles with compliant technologies, is fueling the market growth. The rising telematics and predictive maintenance systems, enabling fleet operators to schedule timely repairs and reduce unplanned failures, is strengthening the market growth. A survey by Automotive Fleet and Work Truck found that 51% of 73 US fleet managers ranked cameras and video telematics as their leading technology focus for 2025. Similarly, the broadening of vocational and off-highway vehicle segments is catalyzing the demand for specialized parts and services. The continual technological advancements in parts manufacturing, including remanufacturing and 3D printing, are improving cost-efficiency and product availability in the market. Additionally, the rise of private-label and value-line item offerings is enhancing competitiveness among distributors, thereby expanding market scope.

Europe Heavy-Duty Automotive Aftermarket Market Analysis

The Europe market is being shaped by extended vehicle lifecycles across commercial fleets. The region’s stringent environmental and safety regulations are encouraging the adoption of advanced emission control and braking systems. In line with this, the growth in cross-border freight activities, driven by EU trade integration, is increasing the utilization of heavy-duty trucks and related aftermarket services. Furthermore, the ongoing digitalization of fleet operations is leading to the enhancement of parts traceability and inventory management. An expanding network of independent repair shops is also promoting greater accessibility and competition in aftermarket services. Additionally, the growing electrification of commercial vehicles is catalyzing the demand for specialized components and technician training. The industry report shows battery electric vehicles (EVs) accounted for 40% of bus sales and 10% of light and medium commercial vehicle sales in 2023. Moreover, rising investments in intelligent transport systems are promoting the adoption of connected aftermarket solutions, including diagnostics, remote monitoring, and digital service platforms.

Asia-Pacific Heavy-Duty Automotive Aftermarket Market Analysis

The Asia-Pacific market is witnessing growth due to rapid industrialization activities and urban infrastructure development. In addition to this, the expanding road freight networks across developing regions is contributing to higher vehicle wear and maintenance requirements. According to the Economic Survey, in 2024, India’s road network totaled 63.4 Lakh KM, with National Highways accounting for 146,195 KM. Despite forming only 2% of the network, National Highways carried around 40% of road freight, highlighting their critical role in transport infrastructure. Furthermore, favorable government initiatives focused on road safety and emissions compliance are encouraging timely repairs and part replacements. The broadening of independent repair networks and authorized service centers are improving the access to maintenance solutions in rural and semi-urban areas. Moreover, rising fleet digitization and telematics adoption are enhancing predictive maintenance, streamlining parts procurement, and minimizing downtime.

Latin America Heavy-Duty Automotive Aftermarket Market Analysis

In Latin America, the market is expanding, which is attributed to a rise in the number of aging commercial vehicle fleets across the region. Similarly, the increasing economic reliance on road freight for domestic and cross-border trade is intensifying vehicle utilization, creating aftermarket needs. Furthermore, the growth in the mining, agriculture, and construction sectors is driving the demand for specialized heavy-duty components. A report by the International Energy Agency (IEA) highlighted that in 2021, mining held 13% to 19% of Latin America’s foreign direct investment (FDI). The region contributed around 40% of worldwide copper output and 35% of lithium supply, led by Chile, Peru, Argentina, and Mexico. Moreover, stricter regional vehicle standards and safety efforts are attracting more fleet investments in compliant and durable aftermarket solutions.

Middle East and Africa Heavy-Duty Automotive Aftermarket Market Analysis

The market in the Middle East and Africa is experiencing growth owing to increasing infrastructure development and logistics activities. Furthermore, the high prevalence of harsh operating conditions, including extreme temperatures and rugged terrains, is accelerating wear and tear, necessitating frequent maintenance. Additionally, a rise in cross-border trade and regional freight corridors is contributing to higher vehicle utilization, thereby enhancing market competitiveness. Apart from this, the growing investments in industrial zones and free trade areas are attracting fleet operations and related service providers to key transport hubs. For example, Elite Group Holding signed an AED 100 Million agreement to develop a 1 Million sq.ft. integrated automotive hub at Dubai Industrial City. Set to open in 2026, the facility will support the expansion of the automotive and e-commerce industry.

Competitive Landscape:

Key players are working to develop innovative solutions to meet the high heavy-duty automotive aftermarket market demand. They are offering a wide range of reliable parts and services that cater to the growing needs of commercial vehicle owners. They are wagering on research and development (R&D) activities to refine the quality and durability of components like brakes, suspension systems, and filters. These companies also focus on expanding their distribution networks to ensure quick delivery and easy availability of products across different regions. They are teaming up with service centers and garages to offer professional support, which boosts customer trust. Many key players also use digital platforms to provide easy online access to catalogs, ordering systems, and diagnostic tools. Their strong branding, warranty support, and customer service help build long-term relationships. For instance, in September 2024, VARTA Automotive was set to present an updated battery lineup at Automechanika 2024, supported by Clarios. The lineup included color-coded labels, the new EFB H9 and AGM H3 designed for hybrids and EVs, improved ProMotive options for heavy-duty vehicles, and sophisticated Li-Ion batteries for the leisure market, boosting aftermarket support worldwide.

The report provides a comprehensive analysis of the competitive landscape in the heavy-duty automotive aftermarket market with detailed profiles of all major companies, including:

- 3M Company

- Atc Drivetrain, LLC

- Continental Aktiengesellschaft

- DENSO CORPORATION

- Detroit Diesel Corporation

- Dorian Drake International Inc.

- Dorman Products, Inc.

- Federal-Mogul Products US LLC

- Instrument Sales and Service, Inc.

- UCI International, LLC

Latest News and Developments:

- April 2025: VIPAR Heavy Duty improved its PARTSPHERE PIM and introduced PARTSPHERE DAM to provide better access to 1.2 Million aftermarket components and 1.4 Million visual resources. These enhancements were intended to optimize e-commerce functions, enhance data precision, and assist distributors and suppliers within the heavy-duty aftermarket parts industry.

- April 2025: Assurance Intl Limited re-introduced General Motors’ ACDelco aftermarket brand in India via a licensing collaboration. The partnership brought forth premium lubricants and batteries, utilizing Assurance’s robust distribution network to address changing customer needs. The initiative sought to enhance product quality and reinforce ACDelco’s presence in the Indian automotive aftermarket.

- February 2025: Continental’s ContiTech revealed an aftermarket hydraulics initiative for heavy-duty trucks in the United States and Canada. The program provided premium hoses and fittings, improving durability and functionality. It strengthened Continental’s aftermarket offerings with dependable and effective solutions designed for the changing demands of the commercial trucking sector.

- November 2024: Standard Motor Products (SMP) finalized its USD 390 Million purchase of Nissens Automotive, a prominent European provider of aftermarket engine cooling and A/C components. The agreement enhanced SMP’s position throughout North America and Europe, facilitating cross-selling, operational efficiencies, and increased market access in important item categories.

Heavy-Duty Automotive Aftermarket Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacement Parts Covered | Tires, Batteries, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Exhaust Components, Turbochargers, Others |

| Vehicle Types Covered | Class 4 to Class 6, Class 7 and Class 8 |

| Service Channels Covered | DIY, OE Seller, DIFM |

| Regions Covered | North America, Asia-Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | 3M Company, Atc Drivetrain, LLC, Continental Aktiengesellschaft, DENSO CORPORATION, Detroit Diesel Corporation, Dorian Drake International Inc., Dorman Products, Inc., Federal-Mogul Products US LLC, Instrument Sales and Service, Inc., UCI International, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the heavy-duty automotive aftermarket market forecast, and dynamics of the market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global heavy-duty automotive aftermarket market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the heavy-duty automotive aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The heavy-duty automotive aftermarket market was valued at USD 150.1 Billion in 2025.

The heavy-duty automotive aftermarket market is projected to exhibit a CAGR of 2.89% during 2026-2034, reaching a value of USD 195.4 Billion by 2034.

The rise in freight and logistics activities is driving the demand for quicker servicing and reliable parts. Besides this, technological developments like diagnostics and telematics systems are making it easier to monitor vehicle performance and identify issues early. Emission regulations are another factor, as older vehicles often need to be upgraded to meet newer standards.

North America currently dominates the heavy-duty automotive aftermarket market, accounting for a share of 40.5% in 2025, driven by the presence of a large commercial vehicle fleet, high vehicle usage, thriving logistics sector, and advanced service infrastructure. Moreover, the expansion of e-commerce sites is enhancing the accessibility of aftermarket components.

Some of the major players in the heavy-duty automotive aftermarket market include 3M Company, Atc Drivetrain, LLC, Continental Aktiengesellschaft, DENSO CORPORATION, Detroit Diesel Corporation, Dorian Drake International Inc., Dorman Products, Inc., Federal-Mogul Products US LLC, Instrument Sales and Service, Inc., UCI International, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)