Heat Transfer Fluids Market Report by Type (Mineral Oils, Synthetic Fluids, Glycols, and Others), End User (Chemical, Oil and Gas, Food and Beverages, Pharmaceutical, Renewable Energy, Automotive, HVAC and Refrigeration, and Others), and Region 2025-2033

Heat Transfer Fluids Market Size:

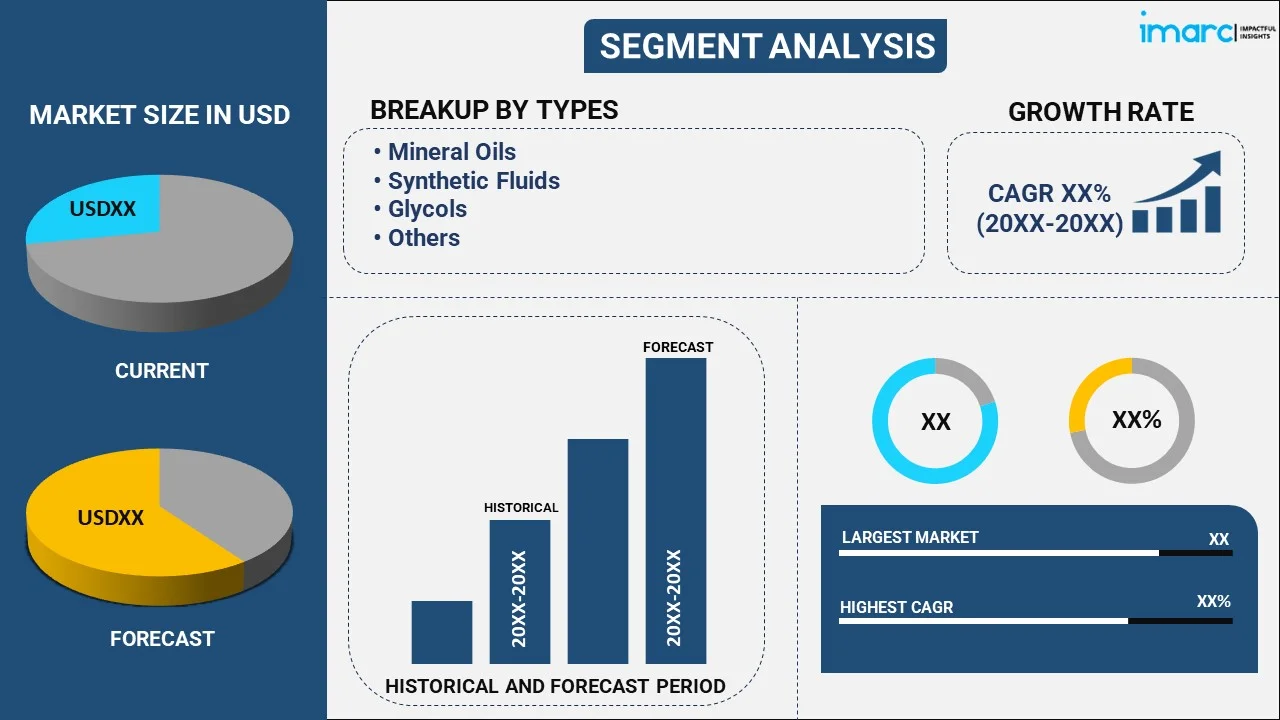

The global heat transfer fluids market size reached USD 11.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.31% during 2025-2033. The market growth is primarily driven by the growing need for sophisticated heat transfer fluids in electric vehicles and electronics for optimal thermal management, the increasing demand for energy efficiency in various industrial processes, and the rapid utilization of environmentally friendly heat-transfer fluids.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.6 Billion |

|

Market Forecast in 2033

|

USD 17.3 Billion |

| Market Growth Rate 2025-2033 | 4.31% |

Heat Transfer Fluids Market Analysis:

- Major Market Drivers: The growing focus on energy efficiency in industrial processes, especially in manufacturing and chemical sectors, is a key driver. Additionally, the rise of electric vehicles and electronics requiring sophisticated thermal management is fueling demand for advanced heat transfer fluids.

- Key Market Trends: The market is seeing a shift toward environmentally sustainable solutions, with the adoption of bio-based fluids and the increasing use of concentrated solar power. Moreover, the demand for advanced fluids in the electric vehicle sector is expanding rapidly.

- Geographical Trends: Asia-Pacific holds the largest share of the global heat transfer fluids market, driven by significant growth in pharmaceutical and chemical industries. The region's increasing adoption of renewable energy technologies, such as solar power, also contributes to market expansion.

- Competitive Landscape: Some of the major market players in the global industry include Arkema S.A., BASF SE, Chevron Corporation, Clariant AG, Dalian Richfortune Chemicals Co. Ltd., Dow Inc., Dynalene Inc., Eastman Chemical Company, Exxon Mobil Corporation, Hindustan Petroleum Corporation Ltd. (Oil and Natural Gas Corporation), Indian Oil Corporation Ltd., Phillips 66 Company, Radco Industries Inc., Shell plc, and TotalEnergies SE, among many others.

- Challenges and Opportunities: Environmental regulations and the transition to bio-based fluids pose challenges for traditional heat transfer fluid manufacturers. However, the shift towards renewable energy and electric vehicles offers significant growth opportunities for advanced heat transfer fluid solutions.

Heat Transfer Fluids Market Trends:

Increasing Demand for Energy Efficiency

The market is witnessing a significant trend with the increasing demand for energy efficiency in industrial processes. Businesses in sectors such as manufacturing, energy and gas, or chemical processing are highly motivated to maximize their operational effectiveness while reducing their energy usage. To achieve this, heat transfer fluids are required as they ensure strong thermal management in situations where extremely high temperatures may develop. The growing usage of concentrated solar power (CSP) is also propelling the demand for heat transfer fluids that can effectively manage higher temperatures. Advanced fluids are being adopted to improve efficiency, reduce heat loss, and lower maintenance costs, helping businesses operate more sustainably and cost-effectively in the renewable energy sector.

Constant Transition to Bio-Based and Environmentally Friendly Fluids

As concerns over the impact of synthetic fluids on the environment and stringent environmental directives grow, industries are increasingly searching for more environmentally acceptable alternatives. Bio-based fluids, derived from renewable resources such as plant oils, are preferable in applications where environmental considerations are paramount, as they are more biodegradable and less toxic compared to traditional heat transfer fluids. The utilization of bio-based heat transfer fluids is growing in industries where sustainability and safety are critical, such as food processing and pharmaceuticals. This tendency in the heat transfer fluids industry is indicative of a larger movement in the direction of environmental rules and a smaller carbon footprint.

Growing Need for Advanced Fluids

The market is also being shaped by the growing requirement for sophisticated fluids in the electronics and electric vehicle (EV) industries. Effective thermal management becomes essential to sustaining performance and avoiding overheating as EVs and electronic gadgets develop. Nowadays, heat transfer fluids are frequently used in high-heat applications such power electronics, battery cooling systems, and other applications to ensure stable and secure operation. According to the IDTechEx study “Thermal Management for Electric Vehicles 2025-2035: Materials, Markets, and Technologies”, electric vehicles would need more than 880 million liters of coolant fluids by 2035, comprising oils, refrigerants, immersion fluids, and water-glycol. The EV market's explosive growth and continuing electronic technical developments, which lead to better heat dissipation and temperature control, are driving innovation in heat transfer fluids. This trend is anticipated to speed up as these high-tech industries' need for effective thermal management systems grows.

Heat Transfer Fluids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global heat transfer fluids market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Mineral Oils

- Synthetic Fluids

- Glycols

- Others

The report has provided a detailed breakup and analysis of the heat transfer fluids market share based on the type. This includes mineral oils, synthetic fluids, glycols, and others. According to the report, mineral oils represented the largest segment.

End User Insights:

- Chemical

- Oil and Gas

- Food and Beverages

- Pharmaceutical

- Renewable Energy

- Automotive

- HVAC and Refrigeration

- Others

A detailed breakup and analysis of the heat transfer fluids market based on the end user has also been provided in the report. This includes chemical, oil and gas, food and beverages, pharmaceutical, renewable energy, automotive, HVAC and refrigeration, and others. According to the report, oil and gas accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for heat transfer fluids. Some of the factors driving the market in Asia Pacific include significant growth in the pharmaceuticals and chemical processing industries, the increasing adoption of concentrated solar power, and the easy availability of base stock.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global x. Detailed profiles of all major companies have also been provided. Some of the companies covered include:

- Arkema S.A.

- BASF SE

- Chevron Corporation

- Clariant AG

- Dalian Richfortune Chemicals Co. Ltd.

- Dow Inc.

- Dynalene Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Hindustan Petroleum Corporation Ltd. (Oil and Natural Gas Corporation)

- Indian Oil Corporation Ltd.

- Phillips 66 Company

- Radco Industries Inc.

- Shell plc

- TotalEnergies SE

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Heat Transfer Fluids Market News:

- January 2025: Global Heat Transfer launched Globaltherm® Q, a high-performance synthetic organic heat transfer fluid. It offers excellent thermal stability, a wide operating range of -35°C to 330°C, and low-pressure operation, making it ideal for various industries like pharmaceuticals, oil and gas, and plastics processing. The fluid extends system lifespan and reduces maintenance costs, ensuring efficient thermal management in demanding environments.

- December 2024: Castrol launched the ON Direct Liquid Cooling PG 25, a new propylene glycol-based fluid designed for high-performance data centers. This cooling fluid targets the thermal demands of AI and computing systems by providing direct-to-chip cooling, enhancing heat transfer efficiency. Castrol aims to revolutionize data center cooling with this advanced solution.

- October 2024: Prestone launched three thermal management fluids for electric vehicles (EVs) to meet industry standards. These include a silicate organic inhibitor fluid, a phosphate organic acid fluid, and an ultra-low conductivity fuel cell coolant. The fluids aim to enhance safety, prevent corrosion, and comply with the GB29743.2 standard, which vehicle OEMs must adhere to by mid-2026.

- October 2024: HF Sinclair launched the INNOVATE series of immersion cooling fluids, designed with proprietary Highly Refined Alkanes (HRA) technology. These fluids offer exceptional heat transfer capabilities, ensuring compatibility with immersed computing applications and superior oxidative stability.

Heat Transfer Fluids Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Types Covered | Mineral Oils, Synthetic Fluids, Glycols, and Others |

| End Users Covered | Chemical, Oil and Gas, Food and Beverages, Pharmaceutical, Renewable Energy, Automotive, HVAC and Refrigeration, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arkema S.A., BASF SE, Chevron Corporation, Clariant AG, Dalian Richfortune Chemicals Co. Ltd., Dow Inc., Dynalene Inc., Eastman Chemical Company, Exxon Mobil Corporation, Hindustan Petroleum Corporation Ltd. (Oil and Natural Gas Corporation), Indian Oil Corporation Ltd., Phillips 66 Company, Radco Industries Inc., Shell plc, TotalEnergies SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global heat transfer fluids market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global heat transfer fluids market?

- What is the impact of each driver, restraint, and opportunity on the global heat transfer fluids market?

- What are the key regional markets?

- Which countries represent the most attractive heat transfer fluids market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the heat transfer fluids market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the heat transfer fluids market?

- What is the competitive structure of the global heat transfer fluids market?

- Who are the key players/companies in the global heat transfer fluids market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the heat transfer fluids market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global heat transfer fluids market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the heat transfer fluids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)