Heat Pumps Market Report by Rated Capacity (Up To 10 Kw, 10–20 Kw, 20–30 Kw, Above 30 Kw), Product Type (Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, and Others), End Use Sector (Residential, Commercial, Hospitality, Retail, Education, Food & Beverage, Paper & Pulp, Chemicals & Petrochemicals, and Others), and Region 2025-2033

Heat Pumps Market Overview:

The global heat pumps market size reached USD 64.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 129.0 Billion by 2033, exhibiting a growth rate (CAGR) of 8.1% during 2025-2033. The rapid pace of urbanization and infrastructure development, increasing awareness about environment and preference for sustainable living, and development of eco-friendly technologies to meet the rising demand for energy-efficient heating and cooling solutions in residential, commercial, and industrial sectors are some of the factors impelling the market growth. Furthermore, Asia Pacific leads the heat pump market, fuelled by enhanced urbanisation, favorable government initiatives, surging demand for energy-efficient technologies, and ongoing technological advancement in residential, commercial, and industrial applications, promoting regional uptake and expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 64.2 Billion |

|

Market Forecast in 2033

|

USD 129.0 Billion |

| Market Growth Rate 2025-2033 | 8.1% |

Heat Pumps Market Analysis:

- Major Market Drivers: The market is experiencing strong growth owing to the increasing energy prices and rising environmental worries that are encouraging the use of heat pumps as an effective substitute for conventional heating systems. In addition, government support and regulations that encourage the use of renewable energy and energy-efficient appliances are strengthening the market growth.

- Key Market Trends: There is a shift towards electric heat pumps because of their lesser carbon footprint compared to fossil fuel systems. Furthermore, the employment of smart technologies like the internet of things (IoT) and artificial intelligence (AI) in heat pumps to enhance energy management and operational efficiency is positively influencing the market.

- Geographical Trends: Asia Pacific dominates the market, driven by supportive government policies, substantial investments in infrastructure, and a high demand for sustainable energy solutions.

- Competitive Landscape: Some of the major market players in the industry include Daikin Industries, Ltd., Mitsubishi Electric Corporation, MIDEA GROUP, NIBE Industrier AB, Corp., Ingersoll Rand, Danfoss, Panasonic Corporation, GDC Group Limited, Viessmann Manufacturing Company Inc., Robert Bosch GmbH, and United Technologies Corporation.

- Challenges and Opportunities: Expensive setup fees and complicated technology, especially in less developed areas, are influencing the heat pumps market revenue. However, opportunities in the development of cost-effective solutions and the growing demand for sustainable heating technologies are expected to overcome these complications.

Heat Pumps Market Trends:

Rising Urbanization and Infrastructure Development

The rate of urbanization increased by more than three times since 1982, reaching 66.2% in 2023, according to the” China in Numbers (2023)” report by the United Nations Development Programme (UNDP). The fast rate of urbanization and development of infrastructure, particularly in developing countries, is catalyzing the heat pumps demand. The rising construction of cities and the development of new residential and commercial structures are driving the need for contemporary, energy-saving heating and cooling options. Heat pumps are gaining traction in construction because of their effectiveness, eco-friendliness, and flexibility. The growing construction of smart cities and green buildings is encouraging the adoption of heat pumps, which are essential in achieving energy efficiency and reducing the environmental impacts of urban infrastructure.

Technological Advancements and Innovation

Modern heat pumps are more efficient and adaptable compared to older models, showcasing enhanced capabilities in different weather conditions, even in extremely cold environments. Advancements like variable speed compressors, improved refrigerants, and integration with smart homes are increasing the reliability, ease of use, and versatility of heat pumps. Combining Internet of Things (IoT) and artificial intelligence (AI) results in improved energy management and predictive maintenance, ultimately enhancing user experience and operational efficiency. These advancements in technology not only improve the appeal of heat pumps for users but also broaden their potential in residential, commercial, and industrial settings. In line with the heat pumps market recent developments, in May 2024, Midea introduced the EVOX G3 heat pump system, which includes advanced technologies such as improved vapor injection and low GWP refrigerant R454B, intended for effective heating in colder regions.

Growing Awareness and Preference for Sustainable Living

People are becoming more concerned about how their energy use affects the environment and are choosing to use eco-friendly and energy-efficient options. Heat pumps are widely preferred due to their ability to greatly decrease energy usage and carbon emissions, aligning with the shift towards sustainable lifestyles. The widespread dissemination of information regarding the long-term economic and environmental benefits of heat pumps, such as lower utility bills and reduced carbon footprints, further motivates both homeowners and businesses to transition to this technology. The increase in need is encouraging manufacturers to create new and improved heat pump models that are more advanced, efficient, and visually appealing. In March 2023, Mitsubishi Electric Trane HVAC US introduced the intelli-HEAT™ Dual Fuel System, which merges heat pump and gas furnace technology to reduce dependence on fossil fuels while providing consistent, reliable heating in extremely cold weather.

Heat Pumps Market Segmentation:

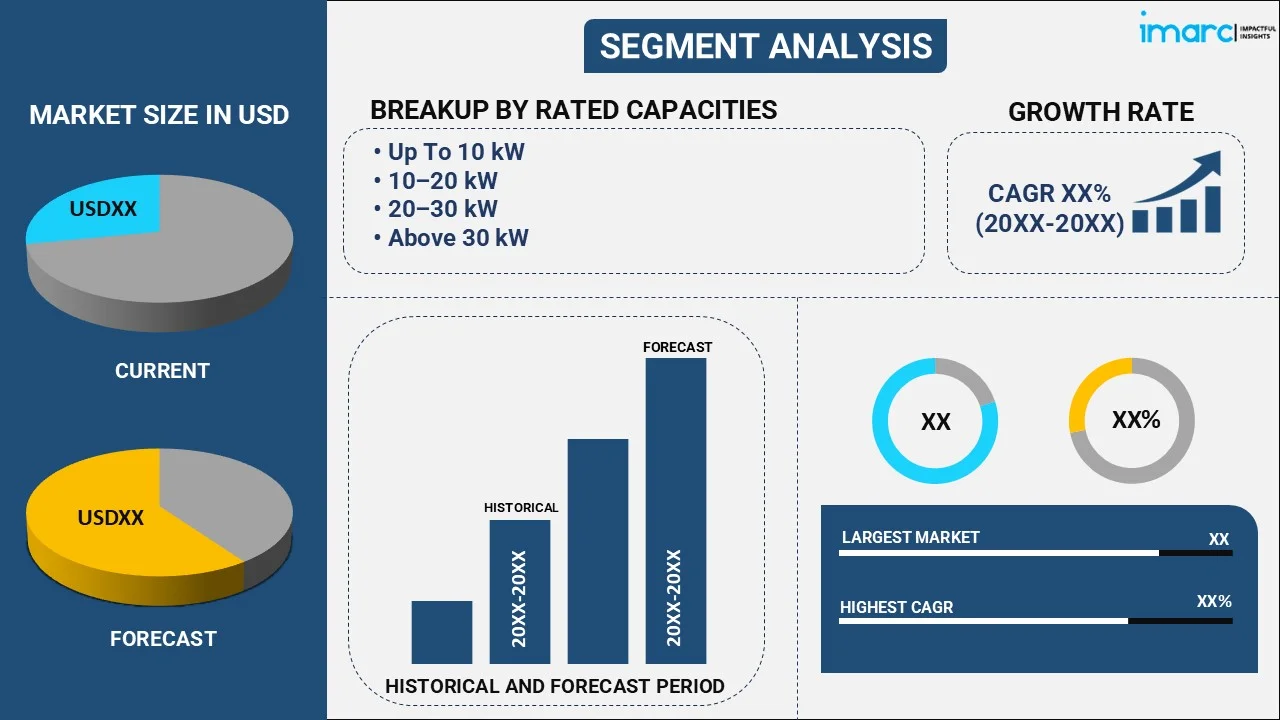

IMARC Group provides an analysis of the key heat pumps market trends in each segment, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on rated capacity, product type, and end use sector.

Breakup by Rated Capacity:

- Up to 10 kW

- 10–20 kW

- 20–30 kW

- Above 30 kW

Up to 10 kW accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the rated capacity. This includes up to 10 kW, 10–20 kW, 20–30 kW, and above 30 kW. According to the report, up to 10 kW represented the largest segment.

Up to 10 kW accounts for the majority of the market share because it is widely used in homes. It is preferred for its effectiveness in offering heating and cooling solutions for individual homes and small apartments. The affordability and relatively simple installation process make it an attractive option for homeowners looking to reduce energy costs and minimize their carbon footprint. Furthermore, the growing recognition and use of renewable energy sources, along with government rewards for energy-efficient appliances, also play a vital role in the prevalence of this segment.

Breakup by Product Type:

- Air Source Heat Pump

- Ground Source Heat Pump

- Water Source Heat Pump

- Exhaust Air Heat Pump

- Others

Air source heat pump holds the largest share of the industry

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes air source heart pump, ground source heat pump, water source heat pump, exhaust air heat pump, and others. According to the report, air source heat pump accounted for the largest market share.

Air source heat pump (ASHP) represents the largest segment according to the heat pumps market forecast, driven by its wide range of applications and cost efficiency. ASHP is preferred as it can draw heat from the outdoor air, even in cold temperatures, and effectively move it indoors for heating. It is relatively easier and less expensive to set up than ground or water source heat pumps, making it a viable choice for residential and commercial purposes. Advancements in technology are increasing the efficiency and performance of ASHP, contributing to its popularity across different climate conditions. Furthermore, the growing emphasis on lowering carbon emissions and the presence of government incentives for renewable energy options are key factors in the widespread acceptance of ASHP. In 2023, Daikin UK confirmed the purchase of Robert Heath Heating Ltd to improve its ability to provide services for ASHP, aiding the UK in its shift to low-carbon heating. The goal of the acquisition was to enhance Daikin's ability to service its heat pump systems throughout the UK.

Breakup by End Use Sector:

- Residential

- Commercial

- Hospitality

- Retail

- Education

- Food & Beverage

- Paper & Pulp

- Chemicals & Petrochemicals

- Others

Residential represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use sector. This includes residential, commercial, hospitality, retail, education, food & beverage, paper & pulp, chemicals and petrochemicals, and others. According to the report, residential represented the largest segment.

Residential dominates the market, as per the heat pumps market outlook, owing to the growing need for energy-efficient and eco-friendly heating and cooling options in households. Homeowners are prioritizing sustainability and cost savings, leading to a rise in the adoption of heat pumps for residential use. Government incentives and subsidies also help to promote energy-efficient appliances and encourage the shift from traditional heating systems to heat pumps. The increasing popularity of smart home technologies aligns with this trend, as advanced heat pumps can be connected to home automation systems to improve convenience and energy efficiency. Furthermore, the growing awareness about the long-term economic benefits, such as lower utility bills and increased property values, is driving the demand for heat pumps in the residential sector. In 2024, Daikin Europe revealed that its Altherma 4 HS-S+ series, the company's first R290 residential heat pump. It comes in four different sizes and can function dependably in temperatures as low as −28°C while also delivering water flow temperatures of up to 75°C.

Breakup by Region:

- Europe

- North America

- Asia Pacific

- Latin America

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest heat pumps market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Europe, North America, Asia Pacific, the Middle East and Africa, and Latin America. According to the report, Asia Pacific represents the largest regional market for heat pumps.

Asia Pacific holds the biggest market share due to rapid urbanization, economic growth, and rising disposable incomes. The increasing need in the construction sector and the growing emphasis on energy efficiency and sustainability are driving the need for heat pumps in residential and commercial settings. Government policies and efforts to support renewable energy and environmental preservation are also enhancing the uptake of heat pumps in the region. Furthermore, the widespread acceptance and use of heat pump systems are also attributed to technological advancements and their growing affordability. The focus on decreasing carbon emissions and improving energy security is bolstering the heat pumps market growth. In March 2023, Daikin Industries revealed intentions to transform India into its primary manufacturing center for air conditioners and heat pumps to increase exports by three times by the year 2025. The company planned to take advantage of the rising demand in India by expanding production capabilities in the country.

Key Regional Takeaways:

Europe Heat Pumps Market Analysis

Europe is a global leader in the uptake of heat pump technology, with stringent energy efficiency directives, decarbonization targets, and government-sponsored incentives to displace fossil-fuel-based heating contributing to it. Western and Northern European countries are seeing widespread installations in new constructions and retrofits, especially in residential and light commercial applications. Policy tools like subsidies, carbon pricing, and building regulations requiring low-carbon heating are accelerating heat pump adoption. Additionally, heating electrification fits into the overall net-zero objectives in the region through the European Green Deal. Air-to-water heat pumps are also most preferred for compatibility with current radiator systems and hydronic heating infrastructure. Increasingly high natural gas prices and geopolitical energy issues further spurred the transition toward electric heat solutions. Consequently, the Europe heat pumps market is growing steadily in volume and value, particularly in urban residential and public infrastructure upgrade activities.

North America Heat Pumps Market Analysis

North America's heat pump market is experiencing gradual change, driven primarily by sustainability targets, regulatory schemes, and energy savings awareness among consumers. In the United States and Canada, the shift towards electrification of heating systems in residential and commercial segments is picking pace, especially in states and provinces that have decarbonization requirements. Federal and state incentives, such as rebates and tax credits under bills such as the Inflation Reduction Act, are making heat pumps more affordable. The technology for cold-climate heat pumps is rapidly evolving, making adoption possible even in northern climates previously served by gas or oil furnaces. Furthermore, the replacement cycle of conventional HVAC systems is increasingly tending towards heat pumps because of enhanced efficiency and long-term cost savings. Developers are incorporating these systems in green housing and sustainable buildings. The North America heat pumps market, therefore, is expanding steadily with an immense thrust from policy initiatives, green building codes, and technological advancements.

Asia Pacific Heat Pumps Market Analysis

Asia Pacific is a vibrant and fast-expanding market for heat pumps driven by rising energy needs, urbanization, and economic growth. China, Japan, South Korea, and Australia are among the primary adopters, driven by government initiatives and carbon-neutrality commitments and energy conservation policies. The residential segment, especially, is seeing an uptrend in demand for energy-efficient heating and cooling systems. In densely populated countries such as China and India, market penetration is growing due to the emphasis on green buildings and sustainable infrastructure. Technological innovations in inverter-based technology and variable refrigerant flow systems are enhancing system flexibility in diverse climates. Furthermore, rising investments in renewable generation of electricity make heat pumps an economical option to abate building sector emissions. Commercial applications are on the rise as well, especially in hospitality, educational, and healthcare buildings. With policy backing and regional manufacturing bases, the Asia Pacific heat pumps market is set for strong growth, driven by domestic demand as well as export-led expansion.

Latin America Heat Pumps Market Analysis

The Latin American heat pumps market is slowly growing, aided by increased interest in green energy solutions and climate-sensitive building design. Although market maturity is lower than in advanced regions, growth through adoption in Brazil, Chile, and Mexico, especially in commercial and hotel segments, is increasing. Urbanization, combined with improved access to electricity and consumer knowledge of energy-efficient equipment, is driving the market growth. Heat pump water heaters are gaining popularity as a cost-effective and environmentally friendly option for warmer climates. Regional governments are now starting to implement energy-efficiency labeling and incentive programs to drive market growth. Affordability and awareness continue to pose challenges for mass residential adoption. As global manufacturers expand their presence and domestic manufacturing capacity improves, the Latin America heat pumps market is likely to expand moderately, particularly in mid-to-high income urban markets and industries with high hot water usage such as tourism and healthcare.

Middle East and Africa Heat Pumps Market Analysis

MEA heat pumps market is still in the nascent phase but is expected to have significant long-term growth prospects on account of rising urbanization, expanding access to electricity, and changing consumer preferences towards energy-efficient climate control solutions. In the Middle East, where cooling represents a major necessity, heat pumps are mainly being used for their dual advantage—supplying heating in winter months while handling cooling loads efficiently. Gulf countries are seeking sustainable options to support Vision 2030 and corresponding green development plans. In South Africa and East African regions, hybrid heat pump and solar-assisted water heating technologies are being researched for domestic and institutional applications. Commercial uses in hospitals, schools, and hotels are slowly picking up steam. International development finance and infrastructure investments may finance future growth. In total, the Middle East and Africa heat pump market demonstrates potential, but scale-up is subject to affordability, consciousness, and grid stability.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the industry include Daikin Industries, Ltd., Mitsubishi Electric Corporation, MIDEA GROUP, NIBE Industrier AB, Corp., Ingersoll Rand, Danfoss, Panasonic Corporation, GDC Group Limited, Viessmann Manufacturing Company Inc., Robert Bosch GmbH, United Technologies Corporation, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Major heat pump companies are focusing on improving the efficiency and performance of their products through innovation and technological advancements. They are making investments in research operations to launch advanced heat pumps with intelligent capabilities, enhanced energy efficiency, and reduced environmental footprint. Strategic alliances and cooperative efforts are being established to broaden their market presence and enhance their distribution channels. Businesses are also involved in mergers and acquisitions (M&A) to strengthen their market presence and broaden their range of products. Moreover, they are taking advantage of government incentives and policies that support renewable energy to increase their sales and market share. In May 2024, Daikin declared five commitments to boost heat pump supply in California, backing the state's aim to have six million heat pumps in use by 2030. This involved intentions to manufacture one million heat pumps and increase local staff and partnerships.

Heat Pumps Market News:

- February 2024: Ingersoll Rand acquired Friulair for $146 million in order to broaden its air treatment expertise, strengthen its presence in the food and beverage (F&B), and pharmaceutical industries, and introduce new chiller and heat pump technologies. The purchase was anticipated to raise Ingersoll Rand's Adjusted EBITDA margins to more than 30% in three years.

- May 2023: Daikin Applied Americas introduced the Trailblazer HP, an air-to-water heat pump made for commercial use, offering both heating and cooling functions with a heating capacity of 91.2 kW and a cooling capacity of 23.58 tons.

- November 2023: Mitsubishi Electric US was granted $50 million by the US Department of Energy to set up a heat pump compressor factory in Kentucky, as a portion of a $169 million fund to enhance US heat pump production at 15 locations.

Heat Pumps Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Rated Capacities Covered | Up To 10 Kw, 10–20 Kw, 20–30 Kw, Above 30 Kw |

| Product Types Covered | Air Source Heat Pump, Ground Source Heat Pump, Water Source Heat Pump, Exhaust Air Heat Pump, Others |

| End Use Sectors Covered | Residential, Commercial, Hospitality, Retail, Education, Food & Beverage, Paper & Pulp, Chemicals & Petrochemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Daikin Industries, Ltd., Mitsubishi Electric Corporation, MIDEA GROUP, NIBE Industrier AB, Corp., Ingersoll Rand, Danfoss, Panasonic Corporation, GDC Group Limited, Viessmann Manufacturing Company Inc., Robert Bosch GmbH, United Technologies Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and heat pumps market recent opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global heat pumps market was valued at USD 64.2 Billion in 2024.

The global heat pump market is expected to reach USD 129.0 Billion by 2033.

We expect the global heat pumps market to exhibit a CAGR of 8.1% during 2025-2033.

The emerging trend of modernization across the residential and commercial sectors, along with the rising adoption of green buildings to enhance the deployment of sustainable technologies in minimizing carbon emissions, is primarily driving the global heat pumps market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for heat pumps.

Based on the rated capacity, the global heat pumps market can be segmented into up to 10 kW, 10–20 kW, 20–30 kW, and above 30 kW. Currently, up to 10 kW holds the majority of the total market share.

Based on the product type, the global heat pumps market has been divided into air source heat pump, ground source heat pump, water source heat pump, exhaust air heat pump, and others. Among these, air source heat pump currently exhibits a clear dominance in the market.

Based on the end use sector, the global heat pumps market can be categorized into residential, commercial, hospitality, retail, education, food & beverage, paper & pulp, chemicals & petrochemicals, and others. Currently, residential accounts for the largest market share.

On a regional level, the market has been classified into Europe, North America, Asia Pacific, Latin America, and Middle East and Africa, where Asia Pacific currently dominates the global market.

Some of the major players in the global heat pumps market include Daikin Industries, Ltd., Mitsubishi Electric Corporation, MIDEA GROUP, NIBE Industrier AB, Corp., Ingersoll Rand, Danfoss, Panasonic Corporation, GDC Group Limited, Viessmann Manufacturing Company Inc., Robert Bosch GmbH, and United Technologies Corporation.temporary closure of numerous end-use industries for heat pumps.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)