Healthcare Furniture Market Size, Share, Trends and Forecast by Furniture Type, Sector, Application, Material, Distribution Channel, and Region, 2025-2033

Healthcare Furniture Market Size and Share:

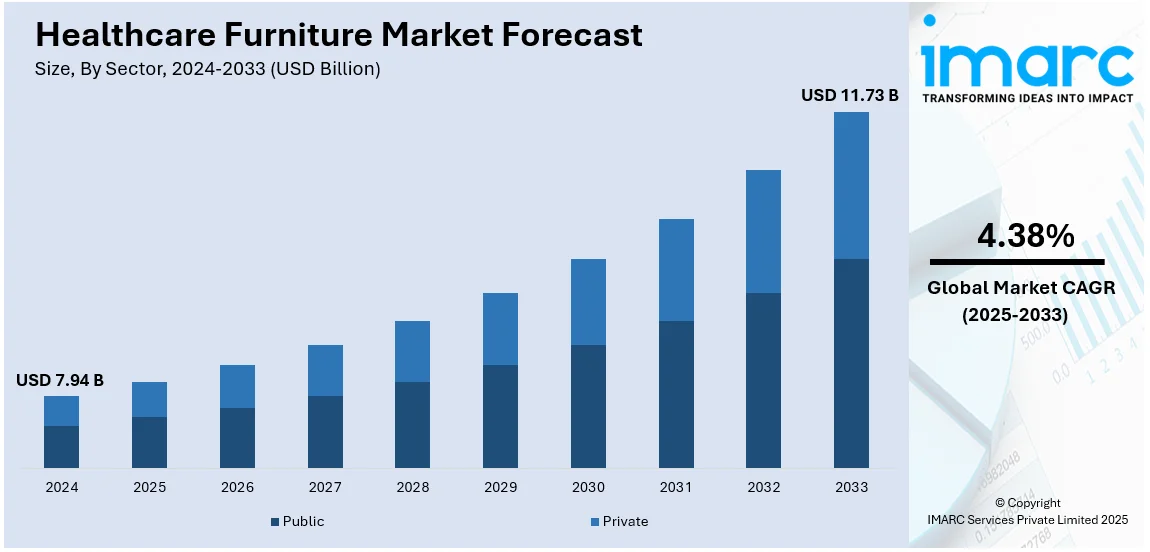

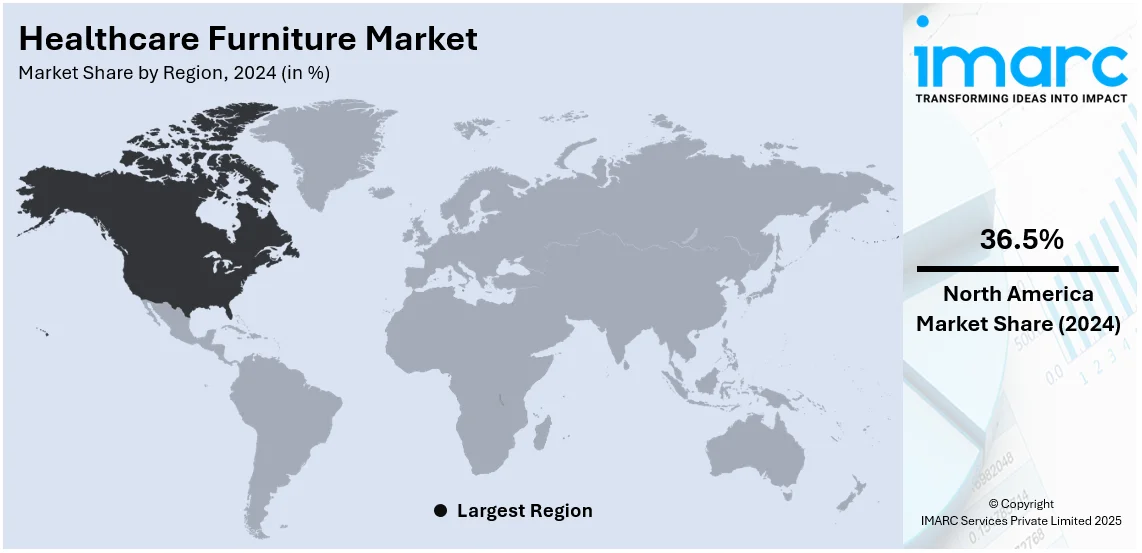

The global healthcare furniture market size was valued at USD 7.94 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.73 Billion by 2033, exhibiting a CAGR of 4.38% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.5% in 2024. The increasing use of sustainable furniture choices in healthcare settings, the development of innovative technologies in healthcare furniture and the substantial growth of healthcare establishments such as hospitals, clinics and nursing homes are key factors driving the market. North America holds the largest market share driven by significant investments in healthcare facilities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.94 Billion |

|

Market Forecast in 2033

|

USD 11.73 Billion |

| Market Growth Rate (2025-2033) | 4.38% |

The market is growing rapidly mainly due to an increase in investments in healthcare infrastructure and growing demand for patient centric environments. The growing geriatric population and the prevalence of chronic diseases worldwide are propelling the demand for specialized furniture which enhances comfort and functionality in clinics, hospitals, and elderly care facilities. According to the report published by WHO, by year 2030 1 in 6 individuals across the world will be aged 60 or above increasing from 1 billion in the year 2020 to 1.4 billion. By the year 2050 this age group will reach around 2.1 billion while the population aged 80 and above is expected to triple to 426,000,000 during the same period. Technological advancements in ergonomic designs and materials which promote hygiene and durability are also contributing significantly to the market growth further across the world.

The United States healthcare furniture market is driven by the modernization of healthcare facilities and a growing emphasis on patient-centered care. Increasing investments in hospitals, clinics, and long-term care centers are fueling the demand for ergonomic, durable, and adaptable furniture. For instance, in December 2024, Advocate Health Care announced a $1 billion investment for health improvements on Chicago's South Side including a new $300 million hospital with 52 beds and a 16-bay ER. The plan also includes 10 outpatient facilities creating over 1,000 jobs and adding 85,000 annual healthcare appointments. The aging population and rising prevalence of chronic diseases are also key factors requiring furniture that supports mobility and comfort. Innovations in antimicrobial and sustainable materials cater to stringent hygiene standards and eco-conscious practices. Government policies promoting healthcare infrastructure upgrades and the expansion of outpatient services contribute to the market growth aligning with the evolving needs of patients and healthcare providers.

Healthcare Furniture Market Trends:

The significant expansion of healthcare facilities

The expanding population along with longer life expectancies resulted in a heightened need for healthcare services. According to the United Nations Population Fund, the global population reached the eight Billion mark by November 2022. This, in turn, has prompted the construction of new healthcare facilities such as hospitals, clinics and long-term care centers and the expansion of existing ones. In addition, the establishment of these facilities raises a critical requirement for furniture that is purpose-built to meet the unique demands of healthcare environments. Furthermore, the expansion of healthcare facilities depends on the evolving nature of healthcare delivery. The shift toward more patient-centered care models which prioritize comfort and well-being is escalating the demand for ergonomic and patient-friendly furniture. In addition to this, healthcare providers are becoming aware of the significance of developing healing environments that improve the patient experience and are investing in contemporary patient-focused furniture solutions which is driving market expansion. Moreover, the growth of outpatient care centers and ambulatory surgery facilities is generating a new segment in the market that demands functional furniture that is versatile and space-efficient leading to an optimistic market perspective. As healthcare providers seek to optimize their operations and accommodate more patients in outpatient settings the demand for versatile furniture that can be easily reconfigured.

Emerging technological advancements in healthcare furniture

Continuous technological developments in healthcare furnishings are driving the market as they are changing the overall patient care model, improving the work of healthcare workers, and elevating the overall healthcare experience. Furthermore, the incorporation of intelligent and interconnected features into healthcare furniture such as hospital beds that utilize sensors and Internet of Things (IoT) technology is driving market growth. These smart beds can track vital signs and patient movements sending alerts to healthcare personnel when action is necessary. This not only enhances patient safety but also enables more proactive and efficient care delivery. Furthermore, electronic medical records (EMRs) are becoming prevalent in healthcare settings. Additionally, medical equipment is changing to make room for these electronic devices. The market is expanding because furniture components like nursing stations and bedside tables now have built-in charging outlets, touchscreen interfaces, and cable management systems to make using EMRs and other digital tools easier. This integration streamlines data access and documentation reducing the administrative burden on healthcare professionals.

The widespread adoption of eco-friendly furniture options

Healthcare facilities are recognizing the importance of reducing their carbon footprint and minimizing the impact of their operations on the environment resulting in the growing demand for ecofriendly healthcare furniture produced from sustainable materials like bamboo, reclaimed wood, or recycled plastics. According to reports, furniture industry contributes 2% to global CO2-equivalent emissions. These materials produce less toxic chemicals, which lessens their influence on the environment and promotes a healthier interior atmosphere. Moreover, ecofriendly furniture aligns with the principles of patient centered care thus representing another major growth inducing factor. Along with this, healthcare providers understand that patient well-being goes beyond medical treatment alone thus propelling the market growth. Also, ecofriendly furniture are often designed with ergonomic principles in mind, which enhances patient comfort while also conveying a commitment to sustainable and responsible healthcare practices thus augmenting the market growth. Furthermore, healthcare organizations are recognizing the long-term cost savings associated with ecofriendly furniture which is more durable and requires less maintenance over time thus propelling market growth.

Healthcare Furniture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare furniture market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on furniture type, sector, application, material, and distribution channel.

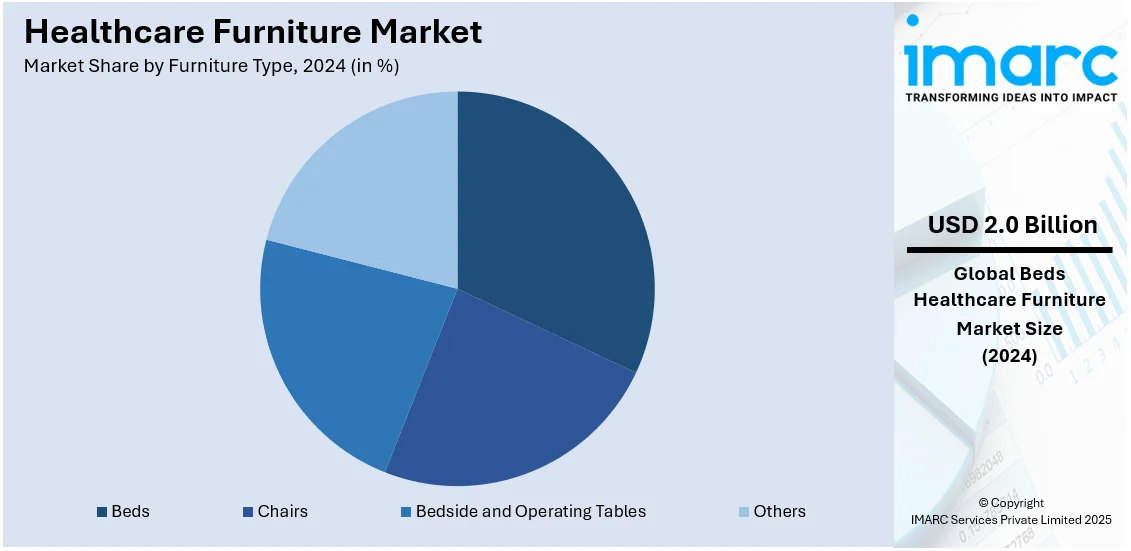

Analysis by Furniture Type:

- Beds

- Chairs

- Bedside and Operating Tables

- Others

Beds stand as the largest furniture type in 2024, holding around 25.7% of the market. Beds are fundamental to patient care in healthcare settings. Hospital beds serve as the primary point of care for patients during their stay. These beds are equipped with various features including adjustable heights, reclining capabilities and electronic controls making them versatile and adaptable to the numerous requirements of patients. They are designed to enhance patient comfort and convenience of healthcare professionals facilitating tasks such as patient examinations and administering treatments.

Moreover, the increasing demand for specialized medical beds for the rising need for customized beds for specific medical conditions represents another major growth-inducing factor. For instance, critical care beds, labor and delivery beds and bariatric beds are designed to address the unique requirements of patients in critical care units, maternity wards, and those with obesity-related healthcare needs.

Additionally, the growing geriatric population requires healthcare services thus escalating the demand for long-term care facilities and nursing homes which heavily rely on beds that promote patient comfort, mobility and safety contributing to the market growth.

Analysis by Sector:

- Public

- Private

Private leads the market with around 53.7% of market share in 2024. Private healthcare facilities including hospitals, clinics and specialty centers are witnessing substantial growth in recent years. The increasing flexibility and adaptability that private institutions possess are influencing market growth. Also, private providers can quickly respond to changing patient needs and market dynamics allowing them to invest more easily in modern and patient-focused furniture solutions thus augmenting the market growth.

Besides this, private healthcare providers prioritize patient satisfaction and comfort to attract and retain clients thus representing another major growth-inducing factor. This emphasis on quality patient experiences drives the demand for ergonomic and aesthetically pleasing furniture in private healthcare settings. Along with this, hospital rooms furnished with comfortable beds, recliners and patient friendly designs contribute to enhanced patient comfort which is a significant selling point for private healthcare providers thus augmenting the market growth.

Furthermore, private healthcare institutions often have more financial resources at their disposal enabling them to invest in advanced technology and equipment thus propelling market growth.

Analysis by Application:

- Hospitals and Clinics

- Diagnostic Centres

- ASCs (Ambulatory Surgical Centres)

- Homecare Settings

- Others

Hospitals and clinics leads the market with around 52.5% of healthcare furniture market share in 2024.Hospitals as primary healthcare providers require numerous furniture including hospital beds, patient chairs and examination tables to accommodate the various needs of patients thus influencing the market growth. It is designed for patient comfort and for ease of use by healthcare professionals. In addition, ergonomically designed furniture is essential for ensuring patients and medical staff can navigate the healthcare environment efficiently thus contributing to market growth. The need for specialized furniture such as adjustable hospital beds and treatment carts is essential in providing high-quality patient care.

Moreover, clinics including outpatient and specialized medical facilities are escalating the demand for clinic furniture representing another major growth-inducing factor. These facilities require furniture that caters to numerous medical specialties from dental chairs in dental clinics to examination tables in general outpatient settings. Clinic furniture must be versatile and adaptable to accommodate the specific needs of various medical practices and ensure patient comfort during consultations and treatments.

Analysis by Material:

- Wood

- Metal

- Plastic

- Others

Metal leads the market with around 43.2% of market share in 2024. Metal dominates the healthcare furniture market due to its durability, strength, and ability to meet strict hygiene standards. Metal furniture resists wear and tear making it ideal for high-traffic healthcare environments like hospitals and clinics. Its non-porous surface prevents bacterial growth ensuring easy cleaning and infection control. The material's versatility allows for a range of applications including hospital beds, surgical tables, and seating. Additionally, metal's ability to support heavy loads and withstand repeated use makes it a preferred choice. With advancements in corrosion-resistant coatings and lightweight alloys metal continues to lead the market providing long-lasting and reliable solutions for healthcare settings.

Analysis by Distribution Channel:

- Direct Sales

- Distributors and Dealers

- Others

Distributors and Dealers leads the market with around 40.0% of market share in 2024. In the healthcare furniture market distributors and dealers are pivotal as primary distribution channels. These intermediaries facilitate the widespread availability of healthcare furniture by connecting manufacturers with healthcare facilities, such as hospitals, clinics, and nursing homes. Distributors usually handle extensive inventories and provide a broad selection of products, such as hospital beds, chairs, and examination tables. Dealers on the other hand often provide personalized sales support, product customization and post-sale services like installation and maintenance. Their established networks, regional presence and expertise in healthcare sector requirements help ensure that the right furniture reaches the right end-users driving market growth and accessibility.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2024, North America accounted for the largest market share of over 36.5%. The North American healthcare system is characterized by its improved infrastructure and significant investment in healthcare facilities. In addition, the extensive network of hospitals, clinics, long-term care facilities and outpatient centers require a substantial supply of healthcare furniture thus contributing to the market growth. This vast healthcare infrastructure is escalating the demand for specialized furniture to equip these facilities from hospital beds and examination tables to waiting room seating and administrative furniture.

Moreover, the growing geriatric population in North America is propelling the market. As the population ages there is a growing need for healthcare services and long-term care facilities. Consequently, the demand for healthcare furniture that enhances patient comfort and mobility addresses accessibility issues and ensures the well-being of geriatric patients by providing quality care thereby propelling the market growth.

Furthermore, technological advancements in the healthcare sector are contributing to North America market. In addition, the adoption of innovative medical equipment and digital healthcare solutions requires furniture that can integrate with advanced technologies such as electronically controlled hospital beds and ergonomic furniture developed for telemedicine applications thus creating a positive market outlook.

Key Regional Takeaways:

United States Healthcare Furniture Market Analysis

In 2024, the United States captured 78.50% of the North American market. The healthcare furniture industry in the United States is expanding at a rapid pace for several reasons. Investment in healthcare infrastructure is increasing, which leads to the expansion and modernization of hospitals, clinics, and long-term care facilities, which results in the need for high-end and ergonomic furniture solutions. The American Hospital Association reported 5,129 community hospitals in the United States in 2024. Increasing awareness of patient comfort and well-being among healthcare providers is driving use of specialized furniture designed for recovery and improving user comfort. The growing population of geriatric patients is increasing demand for furniture especially designed for elderly care: adjustable beds and recliner chairs. Advancements in technology are making multi-functional and intelligent healthcare furniture of great interest to institutions as a way to improve productivity. Moreover, the sector is more concentrated on issues of infection control and hygiene, thereby enhancing the market for antimicrobial and easier-to-clean healthcare furniture. Sustainability concerns will also encourage using eco-friendly material and design and thus lead to change in market patterns.

Asia Pacific Healthcare Furniture Market Analysis

The healthcare furniture market in the Asia-Pacific region is witnessing significant growth driven by multiple factors such as increasing healthcare infrastructure investments are boosting the demand for advanced furniture solutions. Growth in health consciousness and an aging population are leading to establishment of more hospitals and elderly care facilities, thus raising the requirement for ergonomic and functional furniture. The governments are introducing friendly policies to enhance the medical infrastructure, which is also contributing significantly to the market growth. The growing trend of medical tourism is compelling the healthcare facilities to update their interiors with modern furniture to make the patients feel more comfortable. Moreover, the rapid urbanization and the growing disposable incomes in the developing economies are also contributing to the growing demand for premium healthcare furniture. According to CIA, by 2023, 36.4% of India's total population will be urbanized.

Europe Healthcare Furniture Market Analysis

The healthcare furniture market in Europe is experiencing growth due to several driving factors. With the aging of population, there is an increasing demand for specific healthcare furniture that includes adjustable beds, ergonomic chairs, and mobility aids. Apart from this, demand for elderly care is also increasing. The Office for National Statistics reported an increase in population of persons aged 65 and above by a very considerable margin: from 9.2 million in 2011 to over 11 million by 2021. Hospitals and healthcare facilities continually improve the infrastructure with emphasis on comfort for patients and infection control, thus increasing demand for modern and durable furniture solutions. In addition, technological advancement is also helping the market as manufacturers are bringing various smart features into furniture; like sensors and automation that help improve functionality. Governments along with private agencies on both sides are consistently investing in healthcare infrastructure. Therefore, demand for quality furniture is growing. The production of green furniture is also advancing because the demand for sustainable and eco-friendly materials is on the rise.

Latin America Healthcare Furniture Market Analysis

The healthcare furniture market is increasing in Latin America due to increased investment in the healthcare infrastructure, patient-centric care and rising demand for ergonomic and modular furniture. Facilities in hospitals and clinics are improving patient comfort along with staff efficiency through constant improvement. Growth in chronic diseases is requiring advanced medical furniture solutions; government initiatives are increasing public health service. According to International Diabetes Federation, there were 83,741,600 people with diabetes in 2021 in Mexico.

Middle East and Africa Healthcare Furniture Market Analysis

Middle East and Africa healthcare furniture market is experiencing growth due to increase in investment in healthcare infrastructure combined with growing demand for advanced healthcare facilities are taking place. The region has witnessed a surging demand for medical tourism that is facilitating the adoption of ergonomic and multifunctional furniture, as both governments and private organizations are giving importance to the modernization of healthcare. By projections of the IMARC Group, there exists substantial growth in the Middle Eastern medical tourism market at around a compound annual growth rate (CAGR) of 8.70% within the period from 2024 to 2032. The increasing incidence rate for chronic diseases also necessitates specific care settings, fuelling demand.

Competitive Landscape:

The healthcare furniture market is marked by intense competition, with participants focusing on innovation, quality, and functionality to differentiate their offerings. Companies are leveraging advanced materials and ergonomic designs to cater to the growing demand for comfort and hygiene in healthcare environments. For instance, in February 2024, Stance Healthcare launched the award-winning Lotus Casegoods collection designed for behavioral health environments. Recognized with a Nightingale Gold Award the collection emphasizes safety, sustainability and aesthetic appeal featuring ligature-resistant elements and an open design. This innovative furniture aims to enhance healing spaces in hospitals and health facilities. Modular and customizable furniture solutions are gaining traction addressing the specific needs of diverse healthcare settings. Market players are also emphasizing sustainable practices incorporating ecofriendly materials to appeal to environmentally conscious buyers. With increasing investments in healthcare infrastructure participants are adopting strategic partnerships expanding their distribution networks and enhancing their after-sales services.

Latest News and Developments:

- January 2024: Joerns Healthcare, a trusted leader in medical equipment and services tailored to the long-term care continuum has announced the launch of its 2024 models of the acclaimed EasyCare® and UltraCare® beds. These new models feature advanced clinical enhancements for personalized resident care, improved caregiver-friendly functionalities for ease of use and innovative accessories that enhance overall value. This launch reinforces Joerns Healthcare's established leadership in the healthcare beds market.

- February 2023: Godrej & Boyce, the flagship company of the Godrej Group announced that its business division Godrej Interio a leading brand in India’s furniture solutions market across home and institutional segments has introduced an innovative healthcare birthing bed named ‘Solace’.

- June 2023: Baxter International Inc. launched the Progressa+ ICU bed in the U.S., designed to ease the workload of critical care teams. This bed features technologies for pulmonary support, skin protection, and early mobility, addressing common ICU challenges.

- August 2022: Dozee, India’s pioneering contactless Remote Patient Monitoring (RPM) company has partnered with Midmark India South Asia’s leading manufacturer of hospital beds and allied furniture with an extensive domestic presence to launch India’s first connected bed platform. This innovative solution aims to automate and integrate patient monitoring seamlessly into hospital beds specifically targeting non-ICU environments.

Healthcare Furniture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Furniture Types Covered | Beds, Chairs, Bedside and Operating Tables, Others |

| Sectors Covered | Public, Private |

| Applications Covered | Hospitals and Clinics, Diagnostic Centres, Ambulatory Surgical Centres (ASCs), Homecare Settings, Others |

| Materials Covered | Wood, Metal, Plastic, Others |

| Distribution Channels Covered | Direct Sales, Distributors and Dealers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global healthcare furniture market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare furniture market was valued at USD 7.94 Billion in 2024.

The healthcare furniture market is projected to exhibit a CAGR of 4.38% during 2025-2033, reaching a value of USD 11.73 Billion by 2033.

The market is driven by the growing demand for healthcare services, an aging population, advancements in medical technology, increased focus on patient comfort and safety, and the need for efficient, hygienic environments. Additionally, rising healthcare infrastructure investments and innovations in design and materials contribute to market growth.

North America currently dominates the healthcare furniture market, accounting for a share of 36.5% in 2024. The dominance is fueled by advanced healthcare infrastructure, rising investments in healthcare facilities, increasing aging population, and growing focus on patient-centric care.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)