Healthcare Cognitive Computing Market Size, Share, Trends and Forecast by Technology, Deployment Mode, End Use, and Region, 2025-2033

Healthcare Cognitive Computing Market Size and Share:

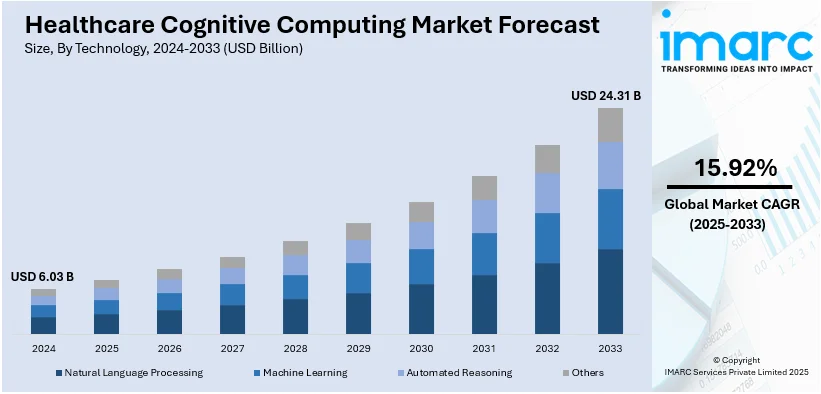

The global healthcare cognitive computing market size was valued at USD 6.03 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.31 Billion by 2033, exhibiting a CAGR of 15.92% from 2025-2033. North America currently dominates the market, holding a market share of over 38.6% in 2024. The heightened adoption of AI and big data for diagnostics and personalized treatments, the rising demand for precision medicine and advanced diagnostics, and the growing need for automation to address workforce challenges and improve operational efficiency are some of the factors impacting the market positively.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.03 Billion |

|

Market Forecast in 2033

|

USD 24.31 Billion |

| Market Growth Rate (2025-2033) | 15.92% |

The global market is largely driven by the growing need for real-time insights to enhance patient outcomes and optimize clinical workflows. In line with this, increased digitization in healthcare, coupled with the adoption of the Internet of Medical Things (IoMT), creating vast data pools requiring advanced cognitive systems for effective analysis, is impelling the market. Furthermore, expanding applications in drug development are fueling growth in the market by reducing costs and accelerating time-to-market. For example, on September 6, 2024, ArisGlobal and Sitero expanded their strategic partnership to integrate Sitero's eClinical platform with ArisGlobal's LifeSphere technology suite. This collaboration leverages LifeSphere’s cognitive computing engine to automate clinical trial processes, ensure data harmonization, enhance compliance, and streamline research and development (R&D) workflows, addressing global challenges like aging populations and chronic diseases.

The United States stands out as a key regional market and is majorly propelled by the rapid adoption of advanced technologies, bolstered by significant government investments in healthcare IT infrastructure and research. Similarly, the country’s strong focus on personalized medicine drives demand for cognitive systems capable of analyzing genomic and clinical data to deliver tailored treatments. Notably, on October 21, 2024, GE HealthCare launched its AI Innovation Lab, highlighting cognitive computing advancements. Key projects include the Health Companion, leveraging agentic AI for personalized care, predictive tools for triple-negative breast cancer recurrence, and AI-driven solutions for maternal and neonatal care, emphasizing precision diagnostics and enhanced clinical decision-making through multi-modal data. Moreover, rising chronic disease prevalence and aging population management needs further fuel market growth across the region.

Healthcare Cognitive Computing Market Trends:

Rising Adoption of AI and Big Data in Healthcare

One of the main factors propelling the cognitive computing market is the growing use of big data analytics and artificial intelligence (AI) in healthcare. Large volumes of medical data can be processed by AI-powered cognitive systems to increase diagnostic precision and provide individualised treatment regimens. For example, cognitive computing systems are essential for efficiently analysing the more than 2,300 exabytes of data that healthcare facilities produce each year, as per reports. Through the analysis of clinical studies, genetic data, and patient history, technologies such as IBM Watson Health help suggest possible therapy alternatives. The need to improve operational effectiveness and lower medical mistakes is driving this adoption.

Growing Need for Advanced Diagnostics and Precision Medicine

The market for healthcare cognitive computing is mostly driven by the increased focus on precision medicine and sophisticated diagnostic tools. In order to provide individualised treatments, doctors can use cognitive algorithms to evaluate large, complicated datasets, including genomic data. For example, the cost of genome sequencing has decreased from USD 1 Million in 2007 to less than USD 500 in 2023 as per the data by National Human Genome Research Institute, allowing more patients to access data-rich precision medicine. Platforms for cognitive computing, such as DeepMind and NVIDIA's Clara Discovery, are essential for finding biomarkers and forecasting the course of diseases, especially in oncology, where accurate therapy is essential. The need for cognitive computing solutions to increase survival rates and treatment efficacy is growing quickly, since over 20 million instances of cancer are diagnosed globally each year. Adoption of early-stage diagnostics is also being fuelled by the global movement towards preventative healthcare.

Increasing Healthcare Workforce Challenges and Demand for Automation

The growth of cognitive computing solutions is also being fueled by the global lack of healthcare personnel. The WHO estimates that by 2030, the healthcare industry will lack about 10 million experts, mostly in low- and middle-income nations. This problem is solved by cognitive computing systems, which automate repetitive processes including patient triage, claims processing, and administrative procedures. Cognitive systems have been used to handle electronic health records (EHRs) in a significant number of hospitals globally, increasing data accuracy. These systems also support telehealth services, which enabled remote consultations and patient monitoring during the COVID-19 pandemic. The ageing population's increased burden highlights the need for automated cognitive solutions. One in six individuals worldwide will be 60 years of age or older by 2030, according to the World Health Organisation. At this point, there will be 1.4 billion people over the age of 60, up from 1 billion in 2020. The number of individuals in the world who are 60 years of age or older is expected to increase to 2.1 billion by 2050.

Healthcare Cognitive Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global healthcare cognitive computing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, deployment mode and end use.

Analysis by Technology:

- Natural Language Processing

- Machine Learning

- Automated Reasoning

- Others

Natural language processing the market with around 42.8% of market share in 2024. This is due to ability of NLP to process and interpret unstructured medical data, such as clinical notes, research articles, and patient records, with exceptional accuracy. NLP facilitates seamless interaction between humans and machines, enabling efficient patient data extraction, sentiment analysis, and real-time transcription in electronic leads health records (EHRs). It supports advanced applications like virtual health assistants, which improve patient engagement, and predictive analytics for treatment planning. As healthcare increasingly emphasizes data-driven decision-making and personalized care, NLP's transformative role in simplifying complex data and enhancing diagnostics positions it as a cornerstone technology in cognitive computing.

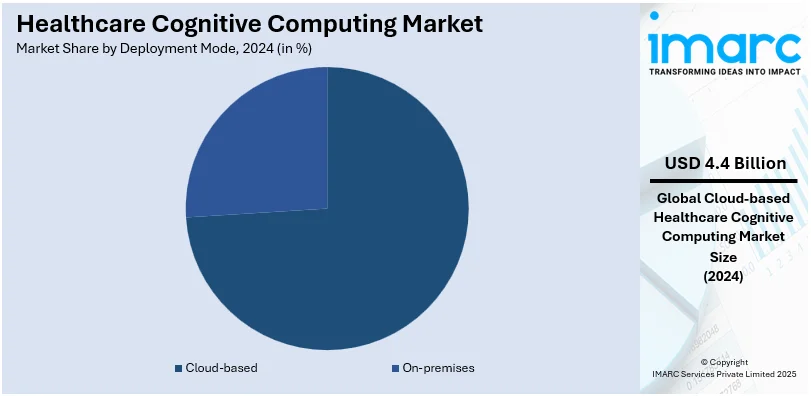

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based leads the market with around 73.7% of market share in 2024, attributed to their scalability, cost-effectiveness, and ability to handle vast amounts of data in real-time. These platforms enable seamless integration of electronic health records (EHRs), telemedicine services, and advanced analytics, improving accessibility and interoperability across healthcare systems. Cloud infrastructure supports AI-driven applications for diagnostics, personalized treatment plans, and remote patient monitoring, ensuring secure and efficient data storage. Additionally, cloud-based systems facilitate collaboration between global healthcare providers, researchers, and institutions, accelerating innovation. Their flexibility in adapting to changing healthcare needs and reducing operational complexities makes them indispensable in cognitive computing applications.

Analysis by End Use:

- Hospitals

- Pharmaceuticals

- Medical Devices

- Insurance

- Others

Hospitals lead the market share in 2024, driven by their extensive need for data-driven technologies to improve patient outcomes and operational efficiency. With high volumes of patient data, hospitals leverage cognitive computing for advanced diagnostics, personalized treatment plans, and real-time decision support. These systems enhance electronic health records (EHR) management, reduce medical errors, and streamline administrative processes like billing and scheduling. Hospitals also adopt AI-driven solutions for predictive analytics, resource allocation, and patient monitoring, ensuring better care delivery. Their central role in the healthcare ecosystem positions hospitals as key adopters of cognitive computing to meet changing medical and operational demands.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 38.6%. This is propelled by its robust healthcare infrastructure, focused investments in technological innovation, and a significant investment portfolio towards research and development (R&D). The region houses critical technology providers and early users of advanced solutions, supported by favorable government initiatives in terms of enhancing healthcare IT systems. North America's developed regulatory environment provides utmost compliance and data security, thereby building trust for cognitive computing technologies. In addition, addition, an increasing prevalence of chronic diseases along with the growing geriatric population more susceptible to these ailments are driving the demand for advanced, AI-powered solutions, which positions North America as a leader in integrating cognitive computing across healthcare systems.

Key Regional Takeaways:

United States Healthcare Cognitive Computing Market Analysis

In 2024, the United States accounted for 86.70% of the North America healthcare cognitive computing market. This is due to its advanced healthcare system, huge investment in AI, and growing demand for precision medicine. Healthcare costs the country more than USD 4 Trillion a year according to data by Centres for Medicare and Medicaid Services, making room for creative alternatives like cognitive computing. More than 90% of all hospitals use certified electronic health records, according to the National Coordinator for Health Information Technology. This widespread adoption has significantly enhanced data analysis, patient management, and decision-making processes through cognitive computing technologies. With the increasing prevalence of chronic diseases that affect 60% of adults, proper care through cognitive computing-powered predictive analytics is necessary.

Healthcare technologies, especially diagnosis and personalized care, are highly invested in by firms such as Google Health and IBM Watson Health through AI. In addition, government initiatives such as the 21st Century Cures Act emphasize the integration of AI and data interoperability. The use of cognitive computing in clinical trials, which account for a significant portion of all trials conducted worldwide each year, and its ability to expedite and shorten the time required for drug discovery are other factors driving demand for the technology.

Europe Healthcare Cognitive Computing Market Analysis

An aging population, a need to increase healthcare efficiency, and strong government support for the digital transformation of healthcare are the major drivers for the healthcare cognitive computing market in Europe. Healthcare spends over Euro 1.6 Trillion (USD 1.63 Trillion) annually in the region, as per European Commission, with a considerable chunk going into AI and cognitive solutions. As the European Commission's Horizon Europe initiative invests billions of dollars in AI and healthcare technology, the application of cognitive computing is promoted. Front-runners in the utilization of AI-powered solutions for the diagnosis and care management of patients in the region are Germany, the United Kingdom, and France. According to an industry report, given that over 20% of Europeans are at the age of 65 and above, it is becoming ever more necessary to treat age-related conditions including Alzheimer's and heart disease through cognitive computing. In addition, the fact that a lot of clinical trials happening worldwide are held in Europe adds emphasis to the need of cognitive computing in accelerating drug development. Other reasons for fueling innovation and uptake include growing partnerships between tech companies and healthcare providers.

Asia Pacific Healthcare Cognitive Computing Market Analysis

Healthcare cognitive computing adoption is expanding fast in Asia-Pacific, driven by a large population in the region, increasing healthcare costs, and chronic illnesses. As per an industry report, with more than 50% of the world's population in countries such as China, Japan, and India, there is a great need for scalable healthcare solutions. According to reports, China spends over USD 1.2 Trillion annually on healthcare, and this figure continues to grow year after year. Millions of people across the region suffer from chronic diseases like diabetes and cancer, which are increasing in numbers. Cognitive computing is being used to alleviate this burden. Considering that 30% of its population is 65 years of age or older (as per reports), Japan is a leader in using AI for elder care. With 1.4 billion people, India is implementing cognitive computing to enhance diagnosis and address barriers to healthcare accessible. Additionally, the usage of cognitive computing for data analysis and patient recruitment is driven by the region's growing clinical trial market, which is bolstered by cost advantages.

Latin America Healthcare Cognitive Computing Market Analysis

Considerable growth in investments for digital healthcare and an increasing focus on improving the accessibility of healthcare is driving the healthcare cognitive computing industry in Latin America. Mexico and Brazil spend the most on health care of all the countries in the region, with Brazil even surpassing 9% of its GDP being spent on health care, according to International Trade Administration. With more than 20% of adults suffering from diabetes and hypertension, handling the pressure of chronic diseases requires advanced management strategies of diseases. Cognitive computing is also being implemented in health care systems with scarce funding to maximize the utilization of available resources. The expanding pharmaceutical sector in the region, especially in clinical trials, shows how cognitive computing can fast-track the production of new drugs. To encourage adoption, the government has been working with technology companies to introduce AI-based healthcare solutions into both rural and urban regions.

Middle East and Africa Healthcare Cognitive Computing Market Analysis

Growing government expenditure on healthcare modernization and an increasingly growing burden of chronic diseases are fueling the growth of the Middle East and Africa's healthcare cognitive computing industry. As part of their Vision 2030 aspirations, the GCC countries, spearheaded by Saudi Arabia and the United Arab Emirates, are significantly investing in artificial intelligence (AI) and digital health technology. Healthcare in Saudi Arabia accounts for over USD 50 Billion of the budget and increasingly focuses on AI-based solutions, according to The World Economic Forum. More than 25% of the adult population has diabetes, according to reports which points out the need for cognitive computing as the largest category in managing that condition. Cognitive computing is also being applied to problems such as manpower shortages and restricted access to healthcare in countries like South Africa and Kenya in Africa. Telemedicine and diagnostic tools empowered by AI are being implemented with the help of collaborations between governments, international organisations, and tech companies in remote locations.

Competitive Landscape:

The healthcare cognitive computing market is highly competitive, marked by major technology providers, innovative startups, and strategic partnerships. Dominant players are leading with advanced AI-driven platforms and cloud-based solutions. Startups contribute by addressing niche areas such as predictive analytics, drug discovery, and precision medicine. Strategic collaborations between technology companies and health care organizations fuel innovation even more. For instance, on May 28, 2024, Wipro Limited collaborated with the Centre for Brain Research (CBR) at IISc to design AI-based healthcare cognitive computing solutions, focusing on a personal care engine for the management of cardiovascular and neurodegenerative disorders. Companies continue to invest in research and development, data security, interoperability, and regulatory compliance to stay competitive in a rapidly changing, tech-driven market.

The report provides a comprehensive analysis of the competitive landscape in the healthcare cognitive computing market with detailed profiles of all major companies, including:

- Apixio (Centene Corporation)

- Apple Inc.

- CognitiveScale

- Enterra Solutions LLC

- Google LLC (Alphabet Inc.)

- Healthcare X.0 GmbH

- Intel Corporation

- International Business Machines Corporation

- MedWhat

- Microsoft Corporation

Latest News and Developments:

- July 2024: Amazon Web Services (AWS) and GE Healthcare established a strategic partnership to use generative AI to change healthcare. By leveraging AWS's AI and cloud technologies and GE Healthcare's medical imaging experience, the collaboration will concentrate on improving patient care and operational efficiency through the development of cutting-edge tools and solutions. Workflows will be streamlined, diagnostic accuracy will increase, and personalized medicine will advance more quickly thanks to this initiative.

- April 2024: The AI technology business Avant Technologies purchased the healthcare technology and data integration services provider Wired-4-Health. By advancing AI interoperability in healthcare data, this strategic merger will enable organizations to integrate data and systems more effectively.

- March 2024: NVIDIA and Johnson & Johnson MedTech announced a collaboration to use AI to improve surgical procedures. The partnership focusses on real-time data processing and clinical insights to enhance surgical outcomes and operating room efficiency through the integration of NVIDIA's IGX and Holoscan technologies.

Healthcare Cognitive Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Natural Language Processing, Machine Learning, Automated Reasoning, Others |

| Deployment Modes Covered | On-premises, Cloud-based |

| End Uses Covered | Hospitals, Pharmaceuticals, Medical Devices, Insurance, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apixio (Centene Corporation), Apple Inc., CognitiveScale, Enterra Solutions LLC, Google LLC (Alphabet Inc.), Healthcare X.0 GmbH, Intel Corporation, International Business Machines Corporation, MedWhat, Microsoft Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the healthcare cognitive computing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global healthcare cognitive computing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the healthcare cognitive computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthcare cognitive computing market was valued at USD 6.03 Billion in 2024.

The healthcare cognitive computing market is projected to exhibit a CAGR of 15.92% during 2025-2033,reaching a value of USD 24.31 Billion by 2033.

The market is majorly driven by rising adoption of AI and big data, increasing demand for precision medicine and advanced diagnostics, expanding applications in drug development, and the escalating need for automation to address workforce shortages and improve operational efficiency in healthcare systems globally.

North America dominates the healthcare cognitive computing market in 2024, accounting for a share exceeding 38.6%. This dominance is fueled by advanced healthcare infrastructure, substantial research, and development (R&D) investments, and strong adoption of cutting-edge AI and data-driven healthcare solutions.

Some of the major players in the healthcare cognitive computing market include Apixio (Centene Corporation), Apple Inc., CognitiveScale, Enterra Solutions LLC, Google LLC (Alphabet Inc.), Healthcare X.0 GmbH, Intel Corporation, International Business Machines Corporation, MedWhat, and Microsoft Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)