Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2025-2033

Health and Wellness Market Size and Share:

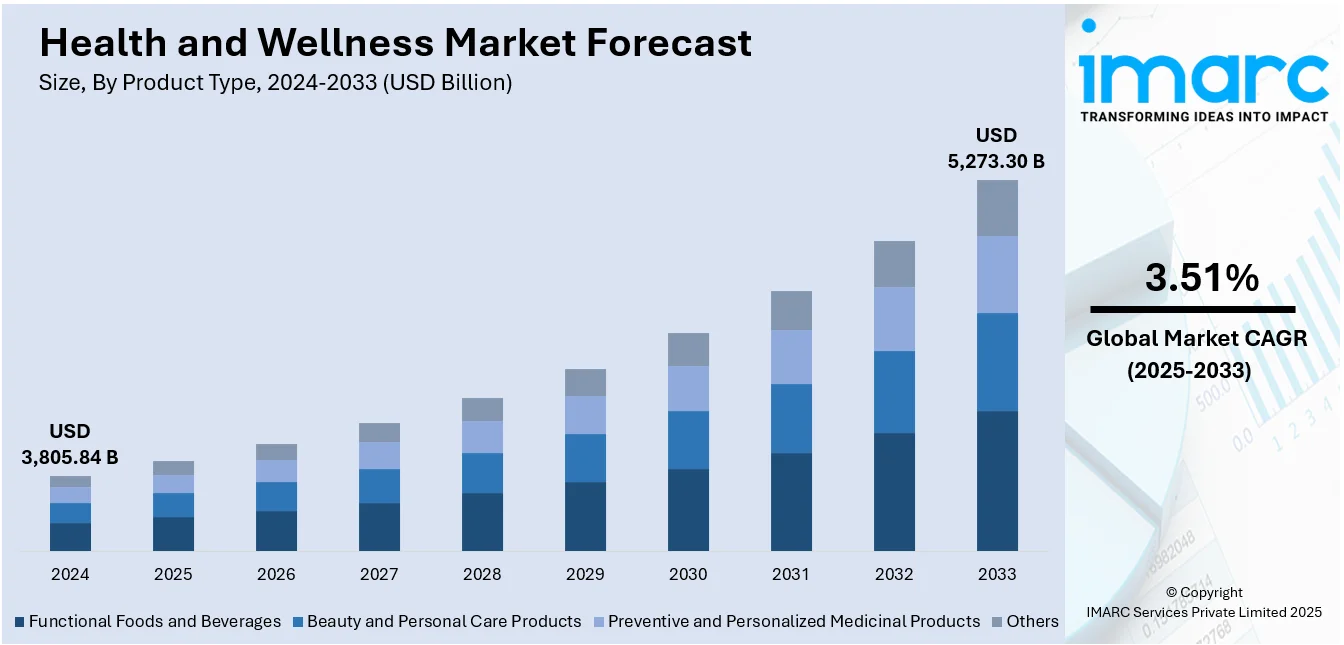

The global health and wellness market size was valued at USD 3,805.84 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,273.30 Billion by 2033, exhibiting a CAGR of 3.51% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.6% in 2024. Several technological advancements, including the development of mobile apps, health monitoring devices, wearable instruments, and the rising consumer awareness about the importance of leading a healthy lifestyle, are primarily fueling the health and wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,805.84 Billion |

|

Market Forecast in 2033

|

USD 5,273.30 Billion |

| Market Growth Rate 2025-2033 | 3.51% |

The market for health and wellness is influenced by growing awareness of preventive healthcare, rising incidences of chronic diseases, and a growing global focus on holistic well-being. Consumers are prioritizing healthier lifestyles, which includes improved diets, regular exercise, stress management, and mental health care. Technological advancements, such as wearable fitness devices and mobile health apps, enable better self-monitoring and personalized wellness experiences. The surge in demand for natural, organic, and clean-label products is also influencing purchasing behavior. Aging populations, especially in developed regions, are boosting the demand for supplements and functional foods. Additionally, the influence of social media, wellness influencers, and a growing preference for sustainable and ethical products are reshaping the industry, encouraging innovation and expansion across multiple segments.

To get more information on this market, Request Sample

The market in the United States is influenced by the growing incidence of chronic conditions like obesity and diabetes, which has heightened awareness and demand for preventive healthcare solutions. Americans are increasingly prioritizing health, leading to greater demand for fitness, nutrition, and mental well-being products and services. For instance, in March 2024, Modern Health, a top worldwide platform for workplace mental health, unveiled its newest Pathways Collection, which is centered on physical well-being. Modern Health is paving the way for its future as the exclusive platform to promote physical and mental health across all care modalities in a ground-breaking step for the organization. With the debut of its Physical Well-Being Pathways Collection, the company is kicking off a comprehensive product roadmap aimed at tackling the critical nexus between mental and physical health. Innovations such as wearable fitness trackers and telemedicine platforms have made health management more accessible and personalized. Millennials and Gen Z are leading wellness spending, emphasizing fitness and nutrition, and driving market growth. Consumers are shifting towards organic and natural products, reflecting a preference for clean-label and sustainable options.

Health and Wellness Market Trends:

The Increasing Need for Providing Awareness Towards Health at Workplaces

The growing requirement among corporate companies to provide and promote health and wellness programs at work is acting as a growth-inducing factor. This is due to the increasing prevalence of chronic diseases, including high blood pressure, diabetes, obesity, etc., and other mental health-related issues. For example, according to a survey conducted, with the sudden outbreak of the COVID-19 pandemic, 74% of employees' productivity has been negatively affected, owing to poor mental health, thereby elevating the need for efficient workplace health and wellness programs. The urgency for such initiatives is further underscored by the economic impact of work-related injuries and illnesses, which cost the U.S. economy an estimated USD 250 Billion annually, according to the CDC. Consequently, these companies across the globe are continuously collaborating with nutritionists, fitness centers, mental health professionals, and other health and wellness providers to offer their insights and expertise to their employees. For instance, GYMGUYZ, the largest onsite, in-home, and virtual personal training company, announced the expansion of its corporate wellness services. In recent times, the company has offered its corporate wellness services both in-home and onsite at corporate locations and facilities to workers who choose to work from home. Such advancements are projected to create a positive impact on the health and wellness market outlook.

The Elevating Incidences of Chronic Diseases And Disorders

As there is a growing occurrence of chronic diseases across the globe, as individuals do not have enough time to engage in physical activities, the need for providing education about nutrition, lifestyle choices, and fitness to prevent the onset of these chronic conditions becomes prevalent across the globe. For example, as per 2021 statistics published by the American Cancer Society, the global occurrence of cancer is projected to grow to 27.5 million new cases and 16.3 million cancer deaths by 2040. In addition, this has also created significant opportunities for companies across the globe to educate their employees regarding the effects of these chronic diseases and adhere to health and wellness programs. For instance, Mindhouse changed its branding to Shyft to highlight the focus of the company on offering a variety of health and wellness solutions for a wide array of chronic health conditions and issues. This, in turn, helped consumers in remission, reversal, and management of their health conditions.

Introduction Of Health Monitoring Tools and Devices

Key players across the globe are developing health monitoring tools, such as smartwatches, fitness trackers, health monitoring equipment, etc. These tools provide various advantages, including data on metrics like calories burned, sleep patterns, steps taken, etc., which is one of the significant factors in the health and wellness growth report. For instance, the wearable device introduced by Wu et al. monitors several physiological parameters, including electrocardiograph (ECG), body temperature (BT), heart rate (HR), etc. In addition, these physiological measurements can usually be wirelessly transmitted to a gateway using a BLE module, which will continue to augment the market growth over the foreseeable future.

The Rising Number of Companies Providing Health and Wellness Services

Numerous companies across the globe are making efforts to make health and wellness services available to all. They are recognizing the importance of preventive care in enhancing employee productivity and minimizing healthcare costs. For example, mHealth is a community-based wellness platform, which launched a holistic wellness community built for the C-suite. This corporate wellness startup promotes tasks, including daily nutrition and diet, fitness, emotional well-being, chronic care, etc. In line with this, mHealth helps in enhancing the community's physical, mental, and emotional wellness to provide comprehensive solutions to the CXOs and their families.

Health and Wellness Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global health and wellness market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and functionality.

Analysis by Product Type:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

Beauty and personal care products stand as the largest product type in 2024, holding around 33.9% of the market. The growing demand for organic and natural products, as individuals across the globe are engaging in beauty and personal care rituals for relaxation and stress relief. For example, Shiseido introduced a new skincare brand, Ulé that sourced pesticide-free botanicals from local vertical farms. The benefits associated with adopting natural skincare led consumers to use sustainable, eco-friendly, and natural skincare products that offer greater product ingredient transparency. Also, in April 2023, a personal care and beauty brand called The Body Shop developed its 'activist' product range in the Indian market. The new line enhanced the brand visibility and sustainable commitment in the country by introducing a selection of skin products and color cosmetics.

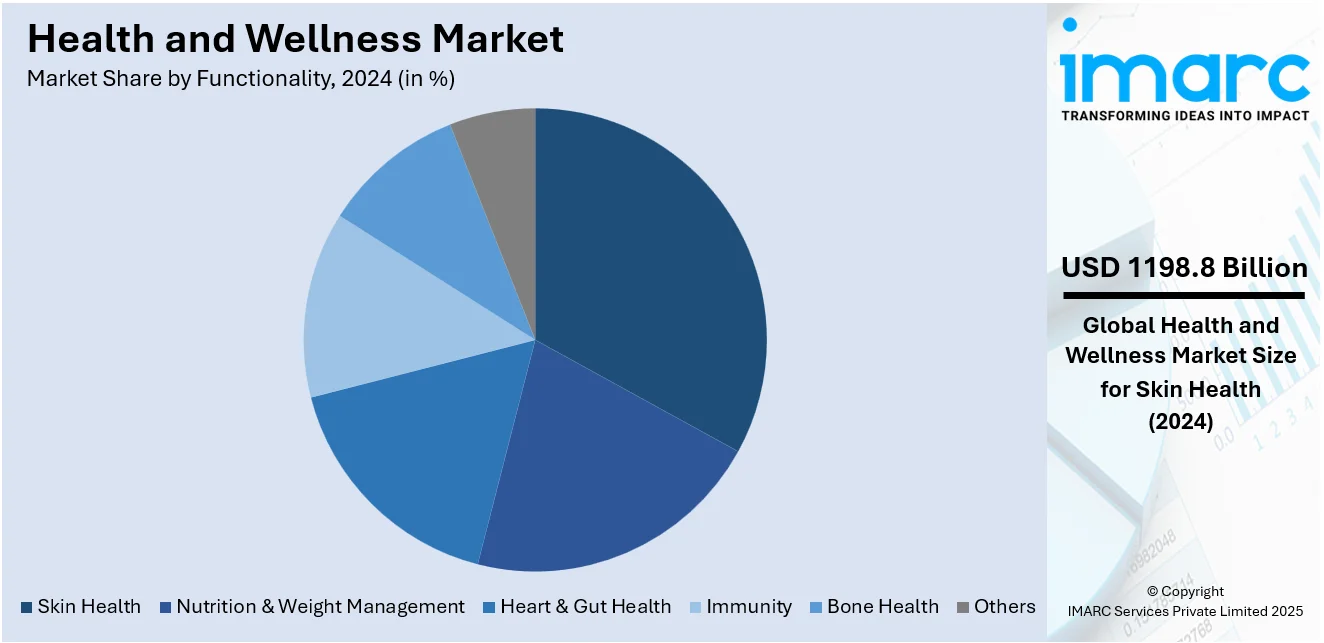

Analysis by Functionality:

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

Skin health leads the market with around 31.5% of market share in 2024. The increasing consciousness among individuals across the globe toward the importance of consuming a healthy diet and nutritious food is escalating the demand for healthy food and snack bar items, which is one of the most prominent consumer trends in the health and wellness market across the globe. For instance, CTRL, one of the fastest-growing meal replacement brands in the United States, introduced new meal on-the-go bars, thereby marking the expansion of the company into functional foods. In addition to this, according to the health and wellness market overview, the inflating popularity of vegan and plant-based products is primarily augmenting the market growth. For example, KaraMD introduced Pure Health Apple Cider Vinegar Gummies, which is a vegan gummy specifically designed to promote digestion regulation, ketosis in the body, weight management, support higher levels of energy, etc. Moreover, ZeoNutra further developed SlimPlus. It is a vegan weight management supplement containing SlimBiome. The product gained traction due to its easy availability on Amazon, Flipkart, ZeoNutra's Website, and healthcare sites, including PharmEasy and NetMeds.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of over 37.6%. The health and wellness demand in North America is positively influenced, owing to the inflating popularity of health and wellness treatment programs to improve the mental health of the employees. For instance, according to the data published by the APA, employees were twice as likely to be diagnosed with a mental health issue, and they received treatment from a mental health professional (34% vs. 12%). This bolstered the need for wellness programs in the workplace, thereby stimulating the market in North America. As such, the rising number of fitness centers, gyms, spas, etc., across the region will continue to fuel the market growth. For example, TRX, which is one of the global leaders in functional training products and world-class training content, launched TRX for Employee Wellbeing. It helped to provide access to subsidized memberships and fitness classes to employees at a minimal fee. Furthermore, the introduction of healthy product variants will continue to augment the market growth. For example, in August 2023, Chobani, LLC introduced Chobani Oatmilk Pumpkin Spice, a creamy and rich pumpkin spice-flavored oat drink manufactured from whole grain oats. This latest addition to the brand's pumpkin farm is considered a healthy source of calcium, vegan-friendly, dairy- and lactose-free, and suitable for individuals seeking fall beverages that don't skimp on quality or taste. Chobani Oatmilk Pumpkin Spice is currently available for a suggested retail price of 4.29 USD.

Key Regional Takeaways:

United States Health and Wellness Market Analysis

In 2024, the United States accounted for over 87.70% of the health and wellness market in North America. The market in the United States continues to expand, driven by increasing consumer health awareness and growing demand for preventive care. According to the Peterson-KFF Health System Tracker, health spending in the United States was projected to grow by 5% between 2023 and 2024, reaching USD 4.9 Trillion. This rising expenditure highlights the growing focus on preventive healthcare and wellness solutions. The shift toward organic, plant-based, and functional foods is gaining momentum, supported by a preference for clean-label products. Additionally, the fitness and mental wellbeing segments are experiencing strong growth, with digital health solutions and wearable technology playing a crucial role in consumer lifestyles. Telehealth services and personalized nutrition advancements are also contributing to market expansion. Regulatory initiatives aimed at promoting healthier lifestyles further enhance growth prospects. The market is highly dynamic and competitive, with innovation driving new product offerings and services. As consumers prioritize long-term health and wellness, the demand for sustainable, natural, and science-backed solutions is expected to increase. This ongoing evolution presents significant opportunities for businesses catering to the health-conscious population.

Europe Health and Wellness Market Analysis

Europe’s health and wellness market is experiencing steady growth, supported by strong consumer preferences for sustainable, organic, and functional products. Increasing focus on holistic wellbeing, including mental health and fitness, is driving demand for digital health solutions. The adoption of plant-based nutrition and clean-label foods continues to shape market trends. Innovations in preventive healthcare and personalized wellness solutions further fuel the market expansion. A key driver of digital health adoption is the European Commission’s Digital Decade e-Health target, which aims for 100% of EU citizens to have access to electronic health records by 2030. This initiative is accelerating the integration of telehealth, wearable technology, and AI-driven healthcare solutions. Regulatory frameworks encouraging healthier lifestyles and sustainable production practices also influence market dynamics. With rising consumer awareness and policy support, the region is witnessing continuous advancements in the health and wellness sector, reinforcing steady market growth.

Asia Pacific Health and Wellness Market Analysis

The Asia Pacific health and wellness market is experiencing rapid expansion, driven by increasing disposable incomes, urbanization, and growing health consciousness. The demand for natural, organic, and functional foods is increasing, along with a strong interest in traditional wellness practices. Digital health solutions, fitness technologies, and preventive healthcare are gaining traction, supported by government initiatives promoting healthier lifestyles. According to the India Brand Equity Foundation, India’s public expenditure on healthcare reached 1.9% of its GDP in FY24, reflecting a growing focus on improving healthcare infrastructure and accessibility. This increased investment aligns with the region’s broader trend of rising healthcare spending, fostering innovation in wellness solutions. Additionally, the market benefits from advancements in personalized nutrition, telehealth services, and regulatory measures encouraging sustainable and clean-label products. As consumer awareness continues to grow, the region presents significant opportunities for market players catering to evolving health and wellness preferences.

Latin America Health and Wellness Market Analysis

The Latin American health and wellness market is experiencing steady growth, driven by rising consumer awareness, urbanization, and improved access to health-related products. The demand for functional and organic foods continues to expand, alongside increasing interest in fitness and mental wellbeing segments. Digital health solutions and preventive healthcare are also gaining momentum, shaping market dynamics. According to the Global Wellness Institute, Brazil's beauty and personal care market alone is valued at USD 39 Billion as of 2024, highlighting the region’s strong focus on wellness-related products. Economic conditions and regulatory support play a significant role in influencing market trends, with governments promoting healthier lifestyles and wellness initiatives. Additionally, the shift toward sustainable and clean-label products is accelerating, further boosting market growth. The region’s evolving consumer preferences and advancements in digital health technologies present new expansion opportunities, positioning Latin America as a key player in the global health and wellness industry.

Middle East and Africa Health and Wellness Market Analysis

The Middle East and Africa health and wellness market is expanding, driven by increasing health consciousness and improved access to wellness products. Demand for organic, functional, and clean-label foods is rising. Digital health solutions and fitness trends are also gaining momentum. Economic diversification efforts and government initiatives promoting healthier lifestyles contribute to market growth, creating new opportunities across the region. Additionally, corporate wellness programs are gaining traction, as seen in Saudi Arabia, where the corporate wellness market reached USD 791.8 Million in 2024. According to IMARC Group, the market is projected to reach USD 1,426.2 Million by 2033, growing at a CAGR of 6.27% from 2025 to 2033. This reflects the region's increasing investment in workplace wellbeing and preventive healthcare solutions.

Competitive Landscape:

The health and wellness market is highly competitive and fragmented, with numerous global and regional players vying for market share. Major market players dominate with diversified portfolios across nutrition, personal care, fitness, and mental well-being. Startups and niche brands are gaining traction by focusing on organic, plant-based, and personalized wellness solutions. E-commerce and digital platforms are reshaping consumer engagement, allowing direct-to-consumer models to flourish. Innovation, brand trust, and sustainability are critical differentiators, as consumers increasingly prioritize clean labels, transparency, and ethical sourcing. Strategic collaborations, product launches, and acquisitions are common tactics to strengthen market presence and cater to evolving consumer preferences in the holistic wellness ecosystem.

The report provides a comprehensive analysis of the competitive landscape in the health and wellness market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Amway Corp.

- Bayer AG

- cult.fit

- Danone

- David Lloyd Leisure Ltd.

- Herbalife International of America, Inc.

- L’Oreal S.A.

- Letterone Holdings S.A.

- Nestle S.A.

- The Procter & Gamble Company

- Unilever PLC

- Vitabiotics Ltd.

Latest News and Developments:

- January 2025: Amway launched the Nutrilite™ Begin 30 Holistic Wellness Program, a 30-day journey focused on gut health. The program included supplements like GI primer, probiotic, and plant protein powder, supported by an interactive app.

- October 2024: Bayer launched the Bepanthen skincare brand in India, addressing dry skin conditions revealed by a 2024 Ipsos survey. The survey highlighted widespread dry skin and a knowledge gap in management. Bepanthen’s range includes moisturizers and cleansers for sensitive skin, clinically proven to manage eczema and dermatitis, and recommended by dermatologists.

- July 2024: Fitness First announced a strategic partnership with Innermost to offer members nutritional supplements and personalized guidance from internationally qualified trainers. This collaboration is aimed to enhance members' health and fitness goals by combining Fitness First's fitness expertise with Innermost’s innovative nutritional products.

- February 2024: Herbalife launched the GLP-1 Nutrition Companion, a range of food and supplement combos designed to support individuals on GLP-1 and other weight-loss medications. Available in the U.S. and Puerto Rico, the products aim to address nutritional gaps by providing protein, fiber, and essential nutrients to support long-term weight loss.

- April 2024: Naturacare showcased its full production capabilities and launched four new products at Vitafoods Europe 2024. The products included Vital Extend for vitality, Bacti Serenity for stress, Electrolytes for sports recovery, and Ovo Immune for immunity.

Health and Wellness Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition & Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Abbott Laboratories, Amway Corp., Bayer AG, cult.fit, Danone, David Lloyd Leisure Ltd., Herbalife International of America, Inc., L’Oreal S.A., Letterone Holdings S.A., Nestle S.A., The Procter & Gamble Company, Unilever PLC, Vitabiotics Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the health and wellness market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global health and wellness market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The health and wellness market was valued at USD 3,805.84 Billion in 2024.

The health and wellness market is projected to exhibit a CAGR of 3.51% during 2025-2033, reaching a value of USD 5,273.30 Billion by 2033.

Key factors driving the health and wellness market include growing awareness of preventive healthcare, rising chronic disease prevalence, increasing focus on mental well-being, and a shift toward organic and natural products. Technological advancements, personalized nutrition, fitness tracking, and social media influence also contribute to the market’s sustained global growth.

North America currently dominates the health and wellness market due to rising health consciousness, an aging population, chronic disease rates, fitness trends, and demand for organic, natural, and personalized wellness products.

Some of the major players in the health and wellness market include Abbott Laboratories, Amway Corp., Bayer AG, cult.fit, Danone, David Lloyd Leisure Ltd., Herbalife International of America, Inc., L’Oreal S.A., Letterone Holdings S.A., Nestle S.A., The Procter & Gamble Company, Unilever PLC, Vitabiotics Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)