Head-Up Display Market Size, Share, Trends and Forecast by Product Type, Conventional and Augmented Reality, Technology, Application, and Region, 2025-2033

Head-Up Display Market Size and Share:

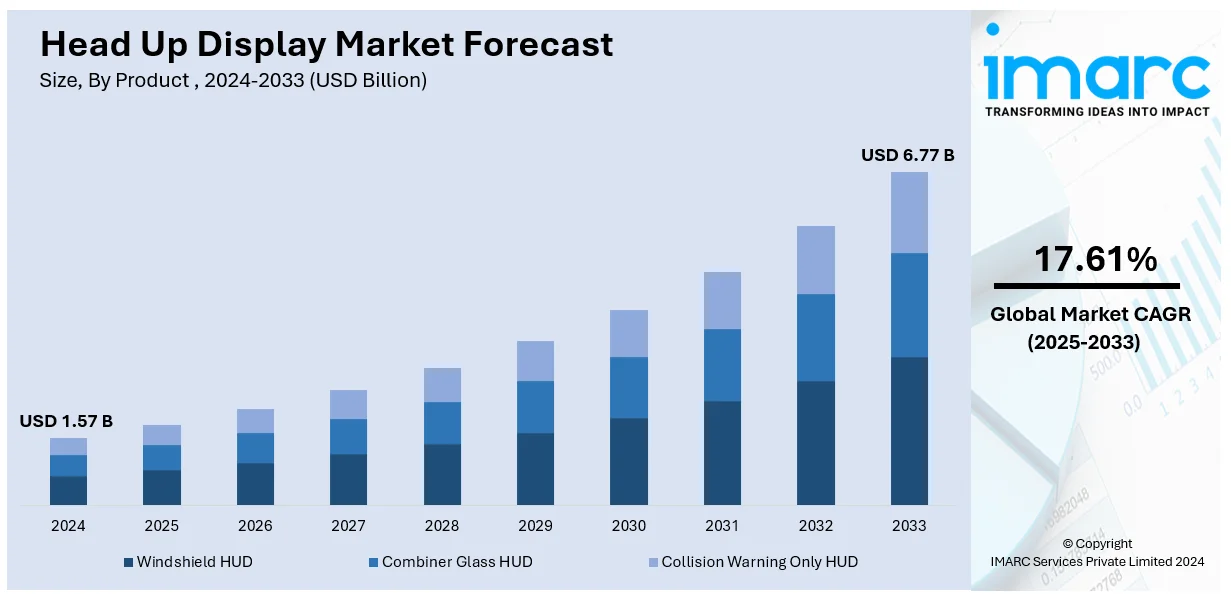

The global head-up display market size was valued at USD 1.57 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.77 Billion by 2033, exhibiting a CAGR of 17.61% from 2025-2033. North America currently dominates the market due to increasing public awareness about the benefits of Head Up Display (HUD) technology like better focus, rising emphasis on fuel efficient driving practices, and the growing number of older drivers are some of the major factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.57 Billion |

| Market Forecast in 2033 | USD 6.77 Billion |

| Market Growth Rate 2025-2033 |

17.61%

|

Increased penetration of advanced driver assistance systems (ADA)S in the vehicle as HUDs can now be more effectively integrated to provide non-intrusive, real-time information that enhances a driver's experience. More and more safety-related features that include adaptive cruise control, lane departure warning, collision alert, and so forth are driving up demand for these systems. Seamless visualization of the critical data supports the purpose of HUDs. Furthermore, with the advent of HUD and augmented reality (AR) technology, it is integrating into various applications across luxury vehicles, electric cars, and even aviation, thereby driving it further across the globe.

To get more information on this market, Request Sample

Besides this, in the United States, there is a rising demand for advanced safety features in automobiles. With increasing consumer awareness of road safety and stringent government regulations, automakers are incorporating HUD technology to provide critical driving information like speed, navigation, and collision warnings without distracting drivers. The U.S. market also benefits from a high adoption rate of luxury and high-end vehicles, where HUD systems are often included as standard or premium features. In addition to this, in 2023, electric vehicles (EVs) made up 12% of passenger vehicle sales in the U.S., signaling a notable shift toward more sustainable transportation. Besides this, the growing popularity of EVs and autonomous vehicles (AVs) in the U.S. accelerates the integration of HUDs, enhancing user experience.

Head-Up Display Market Trends:

Increase in safety concerns

One of the major drivers for demand in HUD technology is an emerging concern for road safety. While traditional dashboards require attention to be taken off the road, thus causing lapses in concentration and slower reactions, increased road accidents across the world are also bolstering demands for HUDs. For example, as estimated by WHO, it kills 1.35 Million people yearly through road traffic crashes. According to the estimates of WHO, injuries are the main cause of death for people between 5 and 29 years due to road traffic accidents. Moreover, according to the Bureau of Infrastructure and Transport Research Economics (BITRE), in 2021, there were 293 road deaths in New South Wales. Other than this, around 4,900 people lose their lives annually on U.S. roadways due to a truck-involved crash. Safety is one big concern related to truck operations, which may contribute to the adoption of HUD and hence is expected to fuel head-up display market demand. Besides, HUDs directly display crucial information within the line of sight of the driver. It is therefore easier to get critical information like speed, navigation, and warning signals without distracting attention.

Technological innovations

The head-up displays are experiencing continuous technological advancements, such as the incorporation of augmented reality features, like overlaying real-time navigation and traffic information onto the windshield, which is giving a positive outlook to the overall market. In addition, improvements in display resolution and brightness, which help project clearer and more detailed information, are also driving the increased adoption of HUDs. There is also a growing research and development investment by different manufacturers of head-up displays to increase HUDs with better generations. The May 2022 launch Ariya, by Nissan is, in fact, Nissan's sixth car model on its WS HUD by Panasonic that follows the Skyline, Rogue, Qashqai, Pathfinder and the QX60 models. The WS HUD is a system that provides a range of information like the speed of the car, navigation instructions, and information from the ProPILOT 2.0 driver assist to the driver's line of vision by projecting it onto the windshield. In addition to this, various car manufacturers are working towards embedding HUDs in budget friendly cars as well. For example, in early 2022, Maruti Baleno became the first model under Rs. 10 lakhs to get a heads-up display in India. Apart from this, AR implementation has made HUD a crucial part of Advanced Driver Assistance Systems (ADAS). Such innovations are estimated to strengthen the head-up display market share in the coming years.

Increasing product application in aviation

HUDs provide the essential flight parameters, navigation information, and cues directly in the pilot's field of vision so that the pilot never needs to glance down into the instruments for control over the aircraft. This can make precision more accurate with takeoff and landing or during maneuvers under adverse conditions or in poor visibility conditions. Additionally, the exponential growth in the aviation sector also fuels the need for modern technologically advanced HUDs. For example, India's commercial aviation market is expected to be one of the world's top three by 2041. Its fleet size is likely to nearly quadruple since 2019. South Asia is also expected to add more than 2,700 new airplanes over the next two decades, 90% of which are destined for India, based on a data report. In addition, head-up display market statistics by IMARC show that the global general aviation market size was USD 26.0 Billion in 2023. Looking ahead, IMARC Group states that the market is forecasted to reach USD 34.5 Billion with a growth rate (CAGR) of 3.1% during 2024-2032. Apart from that, HUDs can lay over imagery from synthetic vision systems or EVS into the view out, creating a clear display of the terrain, obstacles, and other aircraft within the region, even at low levels of visibility. This results in better situational awareness and better guidance for piloting in terms of finding one's way in night flight or other demanding environments. The growing demand for HUDs in the aerospace industry is estimated to lead to a significant increase in head-up display market size during the forecasted period.

Head-Up Display Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global Head-Up Display market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, conventional and augmented reality, technology and application.

Analysis by Product Type:

- Windshield HUD

- Combiner Glass HUD

- Collision Warning Only HUD

Windshield HUD stands as the largest component in 2024 owing to its ability to project critical driving information directly onto the windshield, enhancing safety and convenience for drivers. Windshield HUDs offer a seamless display of navigation, speed, and alerts within the driver’s line of sight, reducing distractions and fostering a more immersive driving experience. Advances in augmented reality and increased adoption of connected vehicles have further propelled the demand for these systems. Automakers' emphasis on integrating advanced driver-assistance systems (ADAS) and luxury features in vehicles has also contributed to the widespread implementation of windshield HUDs across premium and mid-segment models.

Analysis by Conventional and Augmented Reality:

- Conventional HUD

- Augmented Reality Based HUD

Conventional HUD leads the market due to their widespread adoption across various vehicle segments, offering a cost-effective solution for projecting essential driving information. These systems display critical data such as speed, navigation, and warnings onto a transparent screen or combiner, ensuring drivers can access information without diverting their gaze from the road. The dominance of conventional HUDs stems from their simplicity, reliability, and compatibility with a broad range of vehicles, including mid-range models. Automakers favor these systems for their ease of integration and ability to enhance driver safety and convenience without significant cost escalation. Additionally, advancements in display technologies and increasing consumer awareness of HUD benefits have further solidified the position of conventional HUDs in the market.

Analysis by Technology:

- CRT Based HUD

- Digital HUD

- Optical Waveguide HUD

- Digital Micromirror Device (DMD) HUD

- Light Emitting Diode (LED) HUD

- Others

In 2024, digital HUD accounts for the majority of the market due to their advanced capabilities and enhanced user experience. These systems project a wide array of data, including navigation, speed, and real-time vehicle information, onto a digital screen, offering greater clarity and customization compared to conventional HUDs. Digital HUDs are increasingly integrated with augmented reality (AR), enabling features like dynamic route guidance and obstacle detection, further improving driver safety. The growing adoption of connected and autonomous vehicles, along with the increasing demand for high-tech, interactive features, has boosted the popularity of digital HUDs. Additionally, advancements in display technology and the reduction in production costs have made digital HUDs more accessible across both premium and mid-range vehicles.

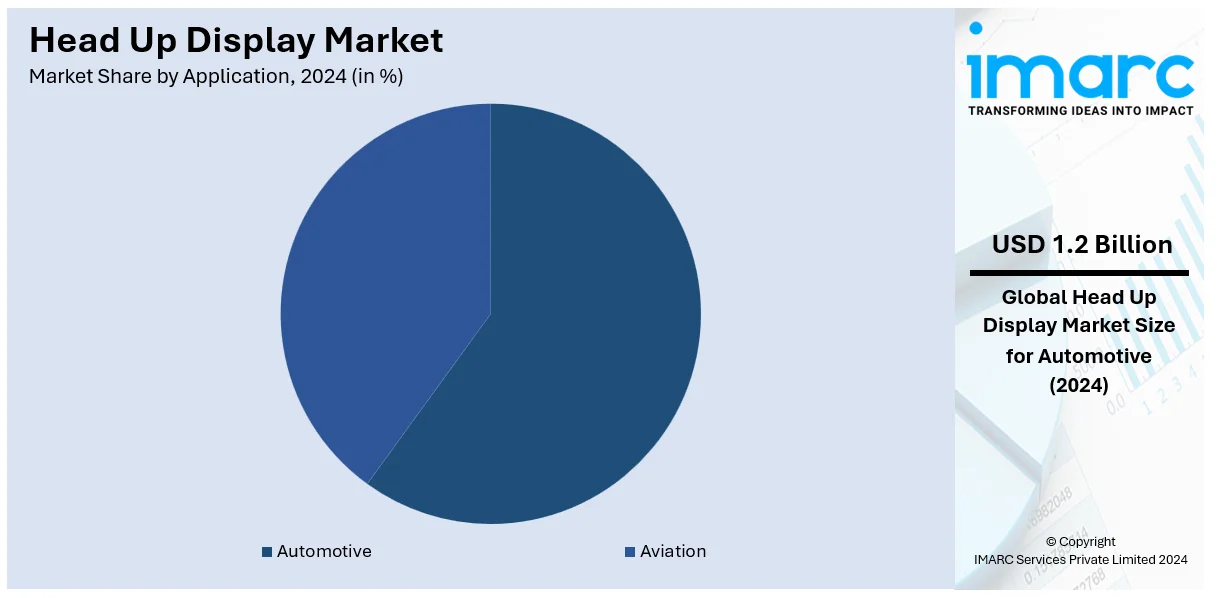

Analysis by Application:

- Aviation

- Automotive

Automotive represented the leading market segment due to the increasing demand for advanced driver assistance systems (ADAS) and in-vehicle technologies. HUDs enhance driver safety by projecting vital information, such as speed, navigation, and hazard alerts, directly onto the windshield or a transparent display, allowing drivers to maintain focus on the road. The growing adoption of premium features in both luxury and mainstream vehicles has driven the integration of HUDs into a broader range of models. Additionally, the rise of electric and autonomous vehicles, where advanced in-cabin technologies are essential, further accelerates HUD demand. Automakers are increasingly prioritizing digital and augmented reality-based HUDs to offer a more intuitive and immersive driving experience, making the automotive sector the dominant driver of HUD market growth.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Others

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market driven by the region's advanced automotive industry and high demand for innovative vehicle technologies. The widespread adoption of HUDs in both luxury and mainstream vehicles is fueled by the growing consumer preference for enhanced safety features and the desire for advanced driver assistance systems (ADAS). North American automakers are leading the integration of digital and augmented reality-based HUDs, offering features such as real-time navigation and hazard detection. Additionally, regulatory requirements focused on improving driver safety and reducing distractions have further bolstered HUD adoption. The presence of key automotive manufacturers and the region's focus on technological advancements in connected and electric vehicles make North America a dominant force in the global HUD market.

Key Regional Takeaways:

United States Head-up Display Market Analysis

The integration of advanced systems in aviation is a pivotal force behind the rising adoption of head-up displays. For instance, the growing number of U.S. airline flights, exceeding 26,000 daily with 2.6 Million passengers, highlights a booming aviation sector. Pilots benefit from head-up display significantly from augmented situational awareness, especially in low-visibility conditions or during critical manoeuvres. Enhanced functionality, including overlaying essential flight data onto the pilot's field of vision, has increased the efficiency and safety of operations. Aircraft retrofitting initiatives are creating substantial demand for these systems. Furthermore, ongoing advancements in augmented reality and holographic projections are influencing the adoption of immersive technologies. As air traffic volume continues to rise, the need for real-time navigation tools to support operational precision is surging. Training facilities are also incorporating these solutions into pilot instruction programs to align with modern cockpit standards. This trend is further fuelled by stringent regulations emphasizing safety across the sector. Expanding applications in private jets and rotorcraft underscore the growing market for compact, lightweight variants of these systems. Innovations tailored to enhance ease of installation are another driver, enabling their integration across a broader range of platforms. The increased reliance on digitalization and smart navigation solutions is steering growth. As the aviation industry evolves to meet new safety benchmarks and performance expectations, demand for these cutting-edge systems is poised to remain robust.

Europe Head-up Display Market Analysis

Europe's focus on improving vehicle safety standards has led to the increased deployment of head-up displays across various vehicle categories. These systems play a crucial role in enhancing driver awareness by projecting speed, navigation, and hazard warnings directly within the driver’s field of vision. The rise of connected car platforms has created demand for real-time data integration, making information accessibility seamless. For instance, road safety concerns are driving innovation, as the EU recorded 20,653 road accident fatalities in 2022, a 3.7% increase from 2021. This highlights the growing demand for head-up displays, enhancing driver awareness and reducing risks. With stringent safety protocols, augmented reality applications in displays are gaining traction, especially for early hazard detection on highways. Weather-adaptive displays that adjust visibility based on external conditions are also enhancing their functionality. Urban areas benefit significantly, where dense traffic and complex intersections necessitate minimal driver distraction. Vehicle manufacturers continue to integrate advanced visualization tools into high-performance models, ensuring compliance with emerging safety benchmarks. Furthermore, the expansion of electric and hybrid mobility solutions has introduced innovative opportunities for integrating intelligent display systems into future vehicles, supporting a safer driving ecosystem.

Asia Pacific Head-up Display Market Analysis

Asia-Pacific's automotive landscape is witnessing a surge in demand for head-up displays, driven by the rapid proliferation of advanced driver-assistance systems. According to India Brand Equity Foundation, the Indian automobile industry grew by 19% in FY24, reaching approximately USD 122.53 Billion, driven by increased domestic demand and robust exports. The emphasis on reducing distractions for drivers has bolstered the integration of these systems into mass-market and premium vehicles. The rise of hybrid and electric vehicles, known for incorporating cutting-edge digital interfaces, further promotes display adoption. Enhancements in augmented reality visualization enable seamless navigation and hazard detection, enriching the driving experience. Automakers are increasingly incorporating transparent data projections, emphasizing their utility in urban and suburban traffic conditions. As vehicle connectivity grows, display systems now deliver real-time traffic updates and route guidance, complementing infotainment offerings. Additionally, regulations encouraging advanced safety features in vehicles have catalysed innovations in driver-centric displays. The region’s growing middle-class consumer base, coupled with increasing disposable incomes, fosters demand for vehicles equipped with modern technological solutions. These developments underscore the transformative role of head-up displays in shaping the future of mobility.

Latin America Head-up Display Market Analysis

In Latin America, investments in advanced defense aerospace technology have significantly influenced the adoption of head-up displays. According to reports, Brazil's USD 23.7 Billion defense budget, with a 5.9% increase for 2025, boosts aerospace growth and procurement of helicopters, benefiting head-up display advancements for enhanced military operations. These systems are now integral to modern combat and reconnaissance aircraft, providing pilots with real-time operational data. Innovations in tactical overlays, target tracking, and navigation simplify complex missions, improving response times and precision. Training modules for defense aviation leverage simulation capabilities powered by advanced display technologies, enhancing pilot readiness. Additionally, strategic funding initiatives support the integration of augmented visualization systems into both military and experimental aircraft, marking a shift toward tech-driven aerospace advancements.

Middle East and Africa Head-up Display Market Analysis

In the Middle East and Africa, the rising preference for luxury automobiles has driven the incorporation of head-up displays into high-end vehicles. According to reports, the UAE luxury market reached USD 4.0 Billion in 2023 and is projected to grow to USD 6.7 Billion by 2032, with a CAGR of 5.8% from 2024 to 2032. These systems align with consumer expectations for innovative features, enhancing convenience and safety. With a focus on intuitive navigation and driver assistance, they elevate the appeal of premium vehicles. Projections of driving data within the line of sight cater to long-distance travel needs, particularly on expansive road networks. Technological advancements in augmented reality further refine display functionalities, ensuring seamless integration into sophisticated vehicle interiors while reinforcing their desirability among affluent buyers.

Competitive Landscape:

The competitive landscape of the HUD market is characterized by rapid technological advancements and increasing adoption across various industries, particularly automotive. Key players in the market are focusing on developing innovative solutions, such as digital and augmented reality-based HUDs, to cater to the rising demand for enhanced user experience and safety features. Companies are investing in research and development to integrate HUDs with ADAS and connected vehicle technologies. Competition is also driven by the need to reduce production costs while improving the functionality and reliability of HUD systems. Strategic coalitions, collaborations, and acquisitions are standard strategies to reinforce product portfolios and expand market presence. As the market evolves, companies are also searching opportunities in emerging sectors like aviation and consumer electronics, further intensifying the competition.

The report provides a comprehensive analysis of the competitive landscape in the head-up display market with detailed profiles of all major companies, including:

- BAE Systems Plc

- Collins Aerospace

- Continental AG

- Elbit Systems Ltd.

- E-Lead Electronic Co. Ltd.

- Hudway LLC

- Nippon Seiki Co. Ltd.

- Panasonic Automotive Systems Co., Ltd

- Thales Group

- Valeo

- YAZAKI Corporation

Latest News and Developments:

- In December 2024, Jaguar Land Rover (JLR) launched the 2025 Range Rover Sport, made in India, priced at approximately USD 1.74 Million . The luxury SUV, now about USD6,000 more expensive than the 2024 model, features updates like perforated semi-aniline leather upholstery, winged headrests, a massage function for front seats, and a new head-up display (HUD) as standard. The vehicle also boasts new digital LED headlights and upgraded body colour options.

- In December 2024, Eastman, Covestro, and Ceres partnered to advance holographic transparent displays, specifically for head-up display (HUD) systems in vehicles. Their collaboration focuses on a new laminated hologram solution that supports multiple HUDs within a single windshield. This innovation aims to overcome limitations in size and performance, offering a scalable solution for automotive displays. The technology will be showcased at CES 2025.

- In November 2024, Elbit Systems of America secured a contract with the U.S. Air Force to provide Wide-Angle Conventional Head-Up Display replacements for the F-16 Block 40/42. The contract, valued at up to USD 89 Million, includes deliveries through September 2027. The work will be carried out by the Talladega-based workforce, with the first order exceeding USD57.5 Million.

- In January 2024, Airbus secured a significant agreement with Air Canada, Canada's largest airline, to upgrade the cockpit and avionics systems of its A320 Family aircraft. The upgrade is actually to be comprised of EEIS2 program, enhanced by HUD and other features and functions across the full suite of its avionic set. Some 76 of these types are now flying, upgraded for enhancing safety and increasing operational efficiencies in the entire process. The package is aimed to modernize Air Canada's fleet and enhance the experience of flying for pilots and passengers. The collaboration is also strengthening Airbus's position in the airline technology sector.

- In January 2024, BMW confirmed the upcoming launch of the new iX3 electric vehicle, featuring the next-generation head-up display. The vehicle, set to debut in 2025, will be built on the innovative Neue Klasse platform, showcasing BMW's commitment to integrating advanced technology and sustainability in its luxury electric vehicles.

Head-Up Display Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Windshield HUD, Combiner Glass HUD, Collison Warning Only HUD |

| Conventional and Augmented Realities Covered | Conventional HUD, Augmented Reality Based HUD |

| Technologies Covered |

|

| Applications Covered | Aviation, Automotive |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | China, Japan, India, South Korea, United States, Canada, Germany, France, United Kingdom, Italy, Spain, Brazil, Mexico, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | BAE Systems Plc, Collins Aerospace, Continental AG, Elbit Systems Ltd., E-Lead Electronic Co. Ltd., Hudway LLC, Nippon Seiki Co. Ltd., Panasonic Automotive Systems Co., Ltd, Thales Group, Valeo, YAZAKI Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the head-up display market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global head-up display market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the head-up display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global head-up display market was valued at USD 1.57 Billion in 2024.

IMARC Group estimates the market to reach USD 6.77 Billion by 2033, exhibiting a CAGR of 17.61% from 2025-2033.

Key factors driving the global HUD market include the increasing demand for ADAS, growing consumer preference for enhanced safety and convenience, technological advancements in digital and augmented reality-based HUDs, and the rising adoption of luxury and connected vehicles with innovative in-cabin technologies.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global head-up display market include BAE Systems Plc, Collins Aerospace, Continental AG, Elbit Systems Ltd., E-Lead Electronic Co. Ltd., Hudway LLC, Nippon Seiki Co. Ltd., Panasonic Automotive Systems Co., Ltd, Thales Group, Valeo, YAZAKI Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)