Head and Neck Cancer Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

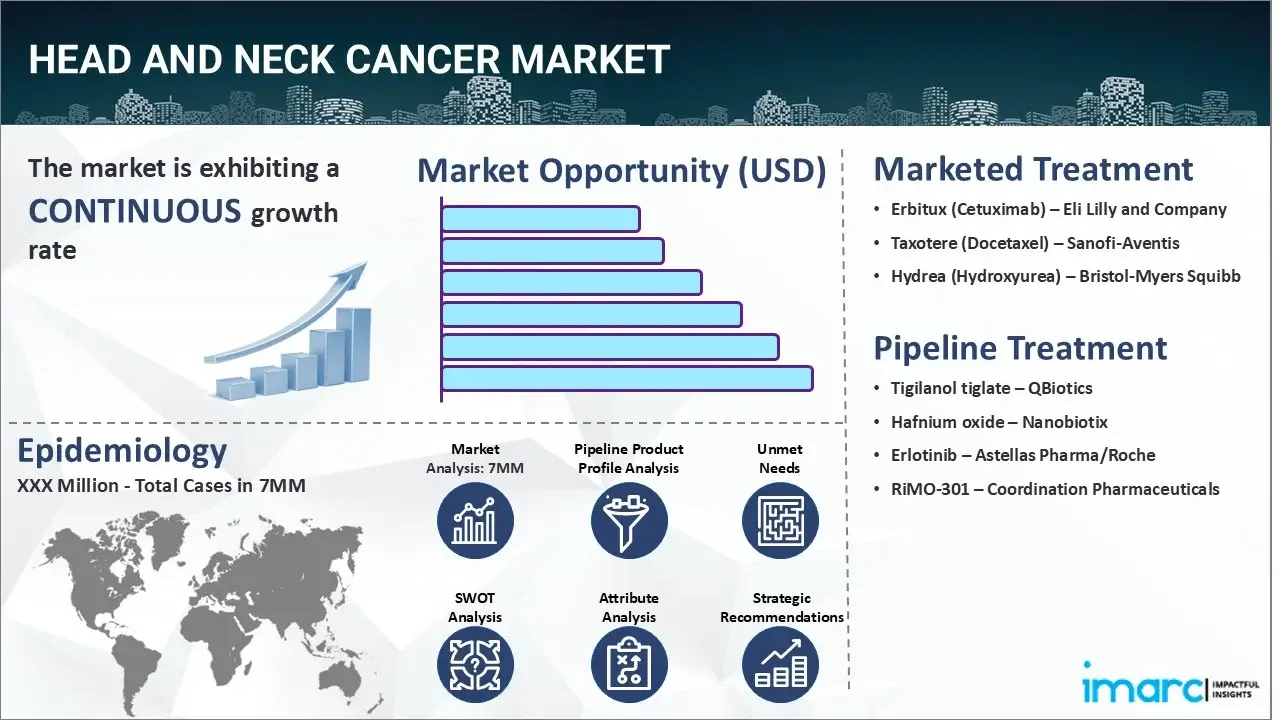

The head and neck cancer market reached a value of USD 3,499.5 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 8,228.2 Million by 2035, exhibiting a growth rate (CAGR) of 8.12% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year | 2024 |

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 3,499.5 Million

|

|

Market Forecast in 2035

|

USD 8,228.2 Million

|

|

Market Growth Rate 2025-2035

|

8.12% |

The head and neck cancer market has been comprehensively analyzed in IMARC’s new report titled “Head and Neck Cancer Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035”. Head and neck cancer refers to the term used to describe a variety of malignant tumors that develop in or around the throat, larynx, sinuses, nose, and mouth. Such forms of cancer are hard to diagnose, and the symptoms are very mild. These cancers can mimic less severe conditions such as cold and sore throat, and the symptoms may include a mouth or tongue sore that does not heal on its own, a white or a red patch on the gums, tongue, or the lining area of the mouth, a persistent sore throat, and hoarseness. Head and neck cancer can be hard to diagnose and early detection is necessary to successfully treat both cancers. Some of the techniques that are advised for diagnosing head and neck malignancies include a physical exam that may be used to check on the oral and nasal cavities, an endoscopic examination, and laboratory testing using blood, urine, and other body samples. Other tests include head and neck X-rays, CAT scans, MRIs, and PET scans to view images inside the neck and head. The two primary treatment modalities are surgery and radiotherapy. Clinical results have improved due to better surgical and radiation treatment approaches and the use of systemic medicines in curative therapy.

To get more information on this market, Request Sample

The increasing incidence of head and neck cancer on account of the rising consumption of alcoholic beverages and tobacco-based products is primarily driving the head and neck cancer market. In line with this, the growing incidences of infectious diseases (human papillomavirus/Epstein bar virus), nutritional deficiencies, and underlying genetic disorders are further augmenting the market growth. Moreover, the emerging popularity of cancer immunotherapy owing to the growing awareness regarding its efficacy and fewer side effects as compared to traditional chemotherapy is also creating a positive outlook for the market. Additionally, the introduction of advanced oncological imaging modalities and imaging technologies to detect infections with enhanced accuracy is further bolstering the global market. Besides this, several key players are making significant investments to produce cancer vaccines and novel biomarkers for the identification of potential tumors. This, in turn, is also acting as another growth-inducing factor. Moreover, the launch of favorable initiatives by various non-governmental organizations (NGOs) and healthcare practitioners to sensitize individuals about the benefits of early cancer diagnosis, including instant decision-making and consequent treatment, is further fueling the market growth. Numerous other factors, such as the increasing regulatory approvals for new cancer immunotherapy drugs, technological advancements in clinical therapies, and the emerging popularity of targeted molecular therapy, including gene therapy, monoclonal antibodies, antibody drug conjugates, etc., are expected to drive the global head and neck cancer market in the coming years.

IMARC Group’s new report provides an exhaustive analysis of the head and neck cancer market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for head and neck cancer and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario and unmet medical needs, etc. have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the head and neck cancer market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the head and neck cancer market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the head and neck cancer market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current head and neck cancer marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Erbitux (Cetuximab) | Eli Lilly and Company |

| Taxotere (docetaxel) | Sanofi-Aventis |

| Hydrea (Hydroxyurea) | Bristol-Myers Squibb |

| Tigilanol tiglate | QBiotics |

| Hafnium oxide | Nanobiotix |

| Erlotinib | Astellas Pharma/Roche |

| RiMO-301 | Coordination Pharmaceuticals |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the head and neck cancer market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the head and neck cancer across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the head and neck cancer across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of incident cases (2019-2035) of head and neck cancer across the seven major markets?

- What is the number of incident cases (2019-2035) of head and neck cancer by age across the seven major markets?

- What is the number of incident cases (2019-2035) of head and neck cancer by gender across the seven major markets?

- What is the number of incident cases (2019-2035) of head and neck cancer by type across the seven major markets?

- How many patients are diagnosed (2019-2035) with head and neck cancer across the seven major markets?

- What is the size of the head and neck cancer patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend head and neck cancer of?

- What will be the growth rate of patients across the seven major markets?

Head and Neck Cancer: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for head and neck cancer drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the head and neck cancer market?

- What are the key regulatory events related to the head and neck cancer market?

- What is the structure of clinical trial landscape by status related to the head and neck cancer market?

- What is the structure of clinical trial landscape by phase related to the head and neck cancer market?

- What is the structure of clinical trial landscape by route of administration related to the head and neck cancer market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)