Hazardous Location LED Lighting Market by Class (Class I, Class II, Class III), Device Type (Zone 0, Zone 20, Zone 1, Zone 21, Zone 2, Zone 22), End Use Industry (Oil & Gas, Petrochemical, Industrial, Power Generation, Pharmaceutical, Processing, and Others), and Region 2025-2033

Market Overview:

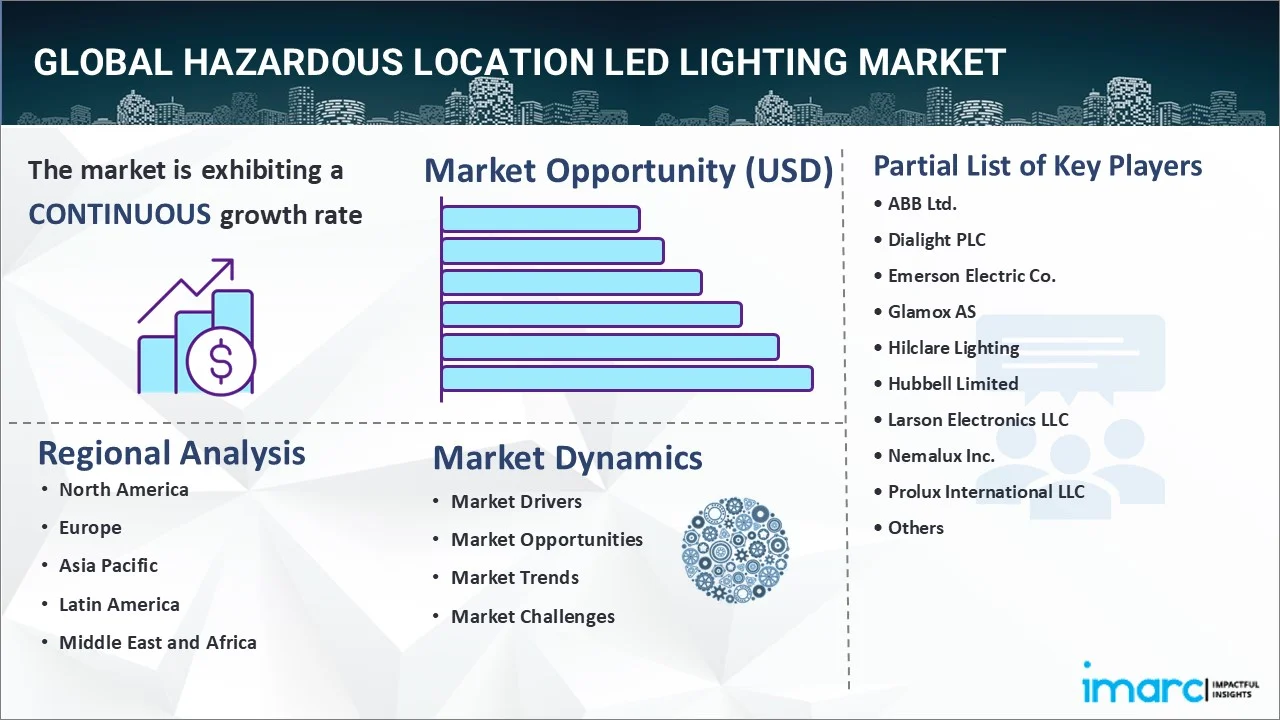

The global hazardous location LED lighting market size reached USD 505.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 808.1 Million by 2033, exhibiting a growth rate (CAGR) of 5.08% during 2025-2033. The strict safety regulations and standards for hazardous locations, the growing demand for energy-efficient lighting solutions, and the increasing awareness of workplace safety represent some of the key players driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 505.9 Million |

| Market Forecast in 2033 | USD 808.1 Million |

| Market Growth Rate (2025-2033) | 5.08% |

Hazardous location LED lighting refers to lighting fixtures designed for use in potentially explosive or flammable environments, such as chemical processing plants, oil refineries, and other hazardous locations. These lighting fixtures are specifically designed to prevent the ignition of flammable gases, vapors, or dust that may be present in the atmosphere. LED technology is preferred in hazardous locations because of its low energy consumption, long lifespan, and ability to produce bright light. These fixtures are designed with features such as explosion-proof casings, thermal management systems, and sealed electrical components to ensure they do not generate heat or sparks that could ignite explosive substances. In recent years, hazardous location LED lighting has gained popularity as the use of LED technology in these fixtures provides bright and energy-efficient lighting and also significantly reduces the risk of fire and explosions in these environments.

Hazardous Location LED Lighting Market Trends:

One of the primary factors driving the market is the growing demand for energy-efficient lighting solutions. Hazardous location LED lighting technology is highly energy-efficient and has a longer lifespan compared to traditional lighting technologies. This makes it an ideal lighting solution for hazardous locations where lighting fixtures may be required to operate for extended periods. Apart from this, the energy savings offered by LED lighting fixtures can significantly reduce the operating costs of hazardous location facilities, thus escalating the product demand. Additionally, the increasing awareness among the masses about workplace safety has encouraged employers to increasingly investing in high-quality LED lighting fixtures to ensure the safety of their workers and comply with strict safety regulations. This has led to increased adoption of hazardous location LED lighting, as they offer superior lighting quality and safety features compared to traditional lighting fixtures. Other than this, the rise in industrialization and infrastructure development across the globe represent other major growth-inducing factors. Besides this, the strict safety regulations and standards set by organizations, such as the National Electrical Code (NEC) and the Occupational Safety and Health Administration (OSHA), mandate that lighting fixtures used in hazardous locations must be explosion-proof and have other safety features to prevent ignition of flammable gases, vapors, or dust. This has resulted in increased adoption of high-quality, safety-compliant LED lighting fixtures in hazardous locations.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global hazardous location LED lighting market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on class, device type, and end use industry.

Class Insights:

- Class I

- Class II

- Class III

A detailed breakup and analysis of the hazardous location LED lighting market based on the class has also been provided in the report. This includes class I, class II, and class III.

Device Type Insights:

- Zone 0

- Zone 20

- Zone 1

- Zone 21

- Zone 2

- Zone 22

The report has provided a detailed breakup and analysis of the hazardous location LED lighting market based on the device type. This includes zone 0, zone 20, zone 1, zone 21, zone 2, and zone 22.

End Use Industry Insights:

- Oil & Gas

- Petrochemical

- Industrial

- Power Generation

- Pharmaceutical

- Processing

- Others

A detailed breakup and analysis of the hazardous location LED lighting market based on the end use industry has also been provided in the report. This includes oil and gas, petrochemical, industrial, power generation, pharmaceutical, processing, and others. According to the report, oil & gas accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for hazardous location LED lighting. Some of the factors driving the Asia Pacific hazardous location LED lighting market included the increasing demand for energy-efficient lighting solutions, strict safety regulations and standards, and rapid industrialization.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global hazardous location LED lighting market. Detailed profiles of all major companies have also been provided. Some of the companies covered include ABB Ltd., Dialight PLC, Emerson Electric Co., Glamox AS, Hilclare Lighting, Hubbell Limited, Larson Electronics LLC, Nemalux Inc., Prolux International LLC, R. Stahl Limited, Raytec Limited, Shenzhen CESP Co. Ltd., Worklite Lighting LLC, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Classes Covered | Class I, Class II, Class III |

| Device Types Covered | Zone 0, Zone 20, Zone 1, Zone 21, Zone 2, Zone 22 |

| End Use Industries Covered | Oil & Gas, Petrochemical, Industrial, Power Generation, Pharmaceutical, Processing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Dialight PLC, Emerson Electric Co., Glamox AS, Hilclare Lighting, Hubbell Limited, Larson Electronics LLC, Nemalux Inc., Prolux International LLC, R. Stahl Limited, Raytec Limited, Shenzhen CESP Co. Ltd., Worklite Lighting LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global hazardous location LED lighting market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global hazardous location LED lighting market?

- What is the impact of each driver, restraint, and opportunity on the global hazardous location LED lighting market?

- What are the key regional markets?

- Which countries represent the most attractive hazardous location LED lighting market?

- What is the breakup of the market based on the class?

- Which is the most attractive class in the hazardous location LED lighting market?

- What is the breakup of the market based on the device type?

- Which is the most attractive device type in the hazardous location LED lighting market?

- What is the breakup of the market based on the end use industry?

- Which is the most attractive end use industry in the hazardous location LED lighting market?

- What is the competitive structure of the global hazardous location LED lighting market?

- Who are the key players/companies in the global hazardous location LED lighting market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hazardous location LED lighting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global hazardous location LED lighting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the hazardous location LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)