Hardwood Flooring Market Report by End-Use Sector, Raw Material, and Region 2025-2033

Hardwood Flooring Market Size and Share:

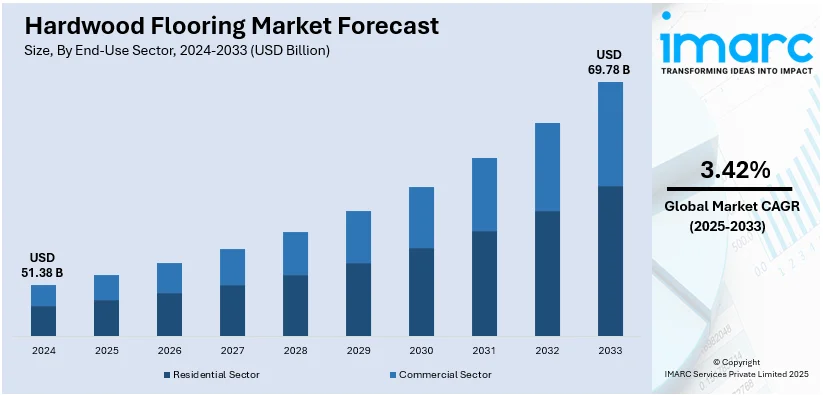

The global hardwood flooring market size was valued at USD 51.38 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.78 Billion by 2033, exhibiting a CAGR of 3.42% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.5% in 2024. The growing demand for aesthetically appealing products with improved durability, rising focus on eco-friendly and sustainable products, and increasing demand for premium interior finishes in living and working spaces are some of the major factors increasing the hardwood flooring market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 51.38 Billion |

|

Market Forecast in 2033

|

USD 69.78 Billion |

| Market Growth Rate (2025-2033) | 3.42% |

The hardwood flooring market growth is primarily driven by the increasing demand for aesthetically appealing, durable, and eco-friendly flooring solutions. Rising urbanization and growth in the construction and real estate sectors further boost market demand. Consumers' preference for premium interiors, coupled with advancements in manufacturing technologies offering enhanced durability and design options, contribute significantly. Government initiatives promoting sustainable and green building materials also support market growth. Additionally, the rising disposable incomes of consumers, especially in emerging economies, enable investment in high-quality flooring. However, the market faces challenges such as high costs and competition from alternative materials like vinyl and laminate. Despite this, home remodeling and renovations represent some of the key hardwood flooring market trends.

The hardwood flooring market forecast in the United States indicated significant growth due to the rising demand for premium, durable, and sustainable flooring options. The booming construction industry, fueled by urbanization and residential housing development, particularly in the emerging economies, are playing a pivotal role in driving the market growth. Consumers’ growing preference for eco-friendly materials aligns with hardwood’s natural and renewable qualities. Renovation and remodeling activities, driven by trends in modern interiors, further boost the hardwood flooring market demand. Technological advancements in engineered wood products, offering improved durability and affordability, also contribute to market growth. For instance, in July 2024, the National Hardwood Lumber Association (NHLA) and the Real American Hardwood Coalition (RAHC), in collaboration unveiled a new website at RealAmericanHardwood.pro. with the United States Forest Service. The website was created to present new and cutting-edge hardwood product technologies for the built environment, as well as to inform architects, interior designers, and construction professionals about the qualities of Real American Hardwoods. Additionally, increasing disposable income and a shift toward high-quality, long-lasting flooring solutions drive adoption.

Hardwood Flooring Market Trends

Increasing Demand for Engineered Wood

The rising demand for engineered wood is bolstering the market growth. The demand for engineered wood is likely to remain high during the projection period since it is a suitable substitute for concrete and hardwood. According to the U.S. Department of Agriculture (USDA), engineered wood products, such as plywood and oriented strand board (OSB), account for approximately 50% of all softwood and hardwood consumption in the U.S. construction industry. Architects, builders, code officials, and designers frequently employ engineered wood products. They also understand energy-efficient farming practices that save energy, speed up building, lower labor expenses, and reduce waste. The product demand is predicted to grow faster in North America and Europe due to higher disposable income and broad awareness of the benefits of engineered wood among the population. The engineered wood products can be tailored to the end user's needs and specifications, thereby accelerating its popularity and creating a positive hardwood flooring market outlook.

Rising Trend of Innovative Wood Flooring

The global market has been rapidly expanding due to changes in consumer preferences and the introduction of innovative products. Customers are increasingly seeking affordable, highly efficient, and environmentally friendly flooring materials, according to current market trends in the hardwood flooring industry. A survey conducted by the National Association of Home Builders (NAHB) in 2021 indicates that about 25% of new single-family homes in the U.S. were constructed using green building practices, which include the use of eco-friendly materials. As a result, this growing trend is not only significant in sustainable construction but also very popular because of the environmental benefits associated with the correct choice of products. The demand for hardwood or engineered wood is fast increasing in comparison to demand for luxury vinyl tiles. This is due to the additional advantages offered by the product, such as ease of cleaning, improved acoustics, a premium appearance, strength, durability, and a high level of indoor air quality. Hardwood floors are available in a variety of hues, styles, stains, and species. As a result, the market for hardwood flooring has significant opportunities for innovation, branding, and rebranding of new and enhanced flooring products.

Growing Demand for Consumer-friendly Building Designs

The rapid growth of the world's population has led to a significant need for housing options to meet the increasing demand. According to the United Nations, the global population is expected to reach 9.7 billion by 2050, escalating the need for sustainable housing solutions. When building or purchasing a home, consumers pay close attention to the design and interior of the building to improve their living experience. A product that frequently comes into contact with the human body for extended periods is flooring. Therefore, it is essential to choose an appropriate flooring option when planning the interiors of structures. Hardware flooring market research report states that food-based flooring not only satisfies requirements like strong impact & scratch resistance and good moisture handling abilities, but also boasts high durability and resistance to chemicals and spills. They also satisfy the consumers' need for natural visual and texture aesthetics, making them a great flooring option. Furthermore, by creating a variety of grades and styles of engineered wood floors that mirror the appearance of different trees and environmental elements, companies aim to appeal to new customers and drive growth in the wood flooring sector.

Hardwood Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2025-2033. Our report has categorized the market based on end-use sector and raw material.

Analysis by End-Use Sector:

- Residential Sector

- Commercial Sector

Commercial sector leads the market with around 67.7% of market share in 2024. Architects and interior designers are now using parquetry to create appealing interiors in commercial buildings, particularly in the hospitality and sports sectors. The growth of tourism and hospitality sectors in nations like India, Indonesia, the Philippines, France, Italy, and Brazil has increased the need for appealing flooring options for decorating hotels, eateries, and pubs. Moreover, wooden floors are commonly used to construct sports arenas and complexes for sports like basketball, badminton, gymnastics, and athletics. Due to these reasons, the commercial sector is projected to acquire a substantial portion of the market in the coming years.

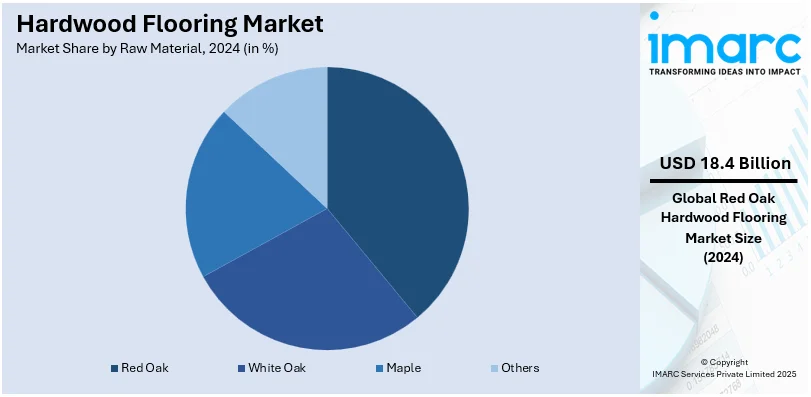

Analysis by Raw Material:

- Red Oak

- White Oak

- Maple

- Others

Red Oak lead the market with around 35.8% of market share in 2024. Red oak is a prominent raw material that is known for its appealing grain patterns and warm tones. It is a popular choice in both residential and commercial settings due to its distinct visuals. It is affordable as compared to some other hardwood species, which makes it accessible to a wide range of consumers. Moreover, its durability and resistance to wear makes it suitable for high-traffic areas. Apart from this, it can take stains and is easily customized that enhances its versatility.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.5%. North America held the biggest market share due to the increasing number of construction activities, along with the wide availability of timber resources. In addition, the rising adoption of advanced production techniques is bolstering the growth of the market in the North America region. Besides this, the growing demand for durable and aesthetically appealing flooring options among individuals is offering a positive market outlook. In line with this, the presence of established manufacturers is supporting the growth of the market in the region.

Key Regional Takeaways:

United States Hardwood Flooring Market Analysis

In 2024, the United States accounted for the largest market share of over 87.50% in North America. Robust growth in U.S. hardwood flooring is, to a significant extent, an offspring of the residential and commercial construction sectors, as these are considered the fastest growing in the industry. According to an industry report, the United States construction sector spent USD 2 trillion in 2023; this amounts to 4.4% contribution to the Gross Domestic Product. With 8 million people employed in the sector, 6.2 million of them in construction-specific occupations, demand for quality building materials, such as hardwood flooring, is continuously on the increase. In 2023, 1.5 million homes were built, further adding to the need for flooring solutions. Homebuyers and renovators are increasingly choosing hardwood flooring for its aesthetic appeal, durability, and sustainability. Environmental concerns also contribute to the growth of the market. Consumers increasingly demand FSC-certified wood and low-VOC finishes. Shaw Floors and Armstrong Flooring, industry leaders, have responded by launching innovative products designed to meet the evolving demands of the U.S. market.

Europe Hardwood Flooring Market Analysis

The hardwood flooring market in Europe continues to sustain growth, which is driven by increased demand for residential renovations and new construction projects across key countries such as Germany, the UK, and France. According to an industry report, the European construction industry valued at EUR 1.6 trillion (USD 1.65 trillion) in 2022 gave significant portions towards residential and commercial buildings. European consumers have now valued more on using natural and sustainably produced material; that would have really heightened the use of hardwood floor. Additionally, most people opt for FSC products; there's increased interest in engineered hardwood floors that prove more robust than conventional solid hardwood, especially if done professionally. To this end, companies like Tarkett and Parquet Flooring are expanding their product lines and innovating in finishes, design, and performance. Furthermore, the increased emphasis on eco-consciousness and sustainable building practices is driving the development of flooring solutions that meet environmental standards, further strengthening Europe's position in the global hardwood flooring market.

Asia Pacific Hardwood Flooring Market Analysis

The Asia Pacific hardwood flooring market is growing very fast, given the expansion in the construction industry and the disposable incomes of its people. According to an industrial report, construction in China represents about 6.8% of the nation's GDP in 2023, with over 50 million working in the construction industry. A large share in the economy generates a high demand for quality construction materials, and hardwood flooring is among them. Demand is rising, especially in countries such as Beijing and Shanghai due to growing urbanization. Even India, having a construction sector valued at USD 890 billion in the year 2023, has its headquarters in the construction arena. That's where up-scale residential properties look for hardwood flooring more than ever. Consumers are looking for engineered hardwood as well as sustainable products due to their durability and environmental benefits. Local manufacturers and international brands are targeting this growing market with innovative products tailored to regional preferences.

Latin America Hardwood Flooring Market Analysis

In Latin America, hardwood flooring has had growth because of the increasing urbanization, rising incomes of the middle class, and an absolute boom in housing. Going by the region's biggest economy, Brazil, the construction and engineering industry saw one of its greatest stakeholders, Odebrecht Engenharia e Construção (OEC), raising over four billion Brazilian reals (USD 0.6 Billion) in revenue in 2023. This surge in construction has had a very positive impact on demand for quality flooring materials, such as hardwood. According to an industrial report, in Brazil, sales of housing units increased by 35% in 2023 from the previous year, mainly on account of the success of the government-backed Casa Verde e Amarela program, which promotes low-cost housing and has led to a spate of home constructions, thereby boosting demand for hardwood flooring. Other countries in the region, such as Mexico and Colombia, are also coming to use premium flooring products more as those developing, middle-class affluence and urban developments are ramping up.

Middle East and Africa Hardwood Flooring Market Analysis

The hardwood flooring market in the Middle East and Africa is growing steadily due to urbanization and luxury construction projects. According to industrial reports, in the UAE, the construction industry is the third most important sector, after oil and trade, and is supported by around 6,000 companies, mainly located in Abu Dhabi. High-end residential and commercial properties, which focus on premium materials, have the highest demand for quality hardwood flooring. With ongoing investments in architectural development, especially large-scale projects in Dubai and Abu Dhabi, the demand for hard-wearing yet aesthetically pleasing flooring solutions is growing. Elsewhere in the region, for instance South Africa, demand is picking up as people move to towns, and rich customers seek good-quality flooring that gives them prestige. The market is gaining with both local producers and international brands making innovative, sustainable, and luxurious flooring choices in the face of the increasing need for quality building materials in the region.

Competitive Landscape:

Major manufacturers are investing in research and development (R&D) activities to introduce innovative products that cater to changing consumer preferences. This includes introducing new finishes, textures, and installation methods to enhance the visual appeal and durability of these flooring solutions. In line with this, many companies are adopting sustainable sourcing and manufacturing practices to address growing environmental concerns. They are obtaining certifications, such as Forest Stewardship Council (FSC), to assure consumers of their commitment to responsible sourcing and forest conservation. Apart from this, they are offering customization options that allow customers to choose from a wide range of wood species, stains, and finishes. It allows customers to create unique flooring solutions that align with their interior design preferences.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AHF

- LLC

- UNILIN

- Beaulieu International Group

- Classen

- FRITZ EGGER GmBH & Co. OG

- Formica Group

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Recent Developments:

- November 2024: Unilin Technologies received a patent allowance for its PET-based flooring technology, application US 18/450,106, November 12, 2024. The patents include flooring articles of PET polymers, such as PETG and R-PET, having locking system. This technology will exclusively be licensed for the production of PET-based flooring by Unilin.

- November 2024: The new flooring collection 25+ by EGGER will launch in January 2025, following two years of development. A global preparation meeting for the launch is planned at the Wismar plant in September. The company is credited with sustainable and innovative wood-based products and believes to be one of the leading brands in wood solutions for living and working.

- July 2024: AHF, LLC announced that it is closing its Warren, Arkansas facility and consolidating operations to better serve its customers. The company announced that the solid hardwood flooring manufacturing facility in Warren will be idled on September 27, 2024, with production being moved to the AHF Beverly, West Virginia facility—the largest solid hardwood flooring plant in North America—and the AHF West Plains, Missouri plant. This decision aligns with AHF’s vertical integration strategy, which includes its recent purchase of two sawmills in West Virginia. This move is part of the company's ongoing efforts to enhance its solid hardwood business.

- June 2024: Beaulieu International Group invested €5 million (USD 5.14 Million) to convert the Cushion Vinyl production facility, located in Wielsbeke, Belgium, from fossil-fuel-based to biomass-generated steam. This initiative will reduce its ecological footprint by 88% and enhance the energy efficiency profile, supporting a net-zero scenario by 2030. To this end, the company addresses sustainability by encouraging the use of recycled materials. It has thus launched the ReLive program for the recycling of PVC flooring.

- January 2024: Unilin announced the introduction of a groundbreaking technology: Lucent. This revolutionary innovation is set to redefine flooring aesthetics and performance standards. Lucent technology will be unveiled for the first time at the Unilin booth during Domotex Hannover, available on an invite-only basis. By offering a PVC-free and melamine/formaldehyde-free solution, Lucent technology also aligns with growing sustainability trends, potentially influencing consumer preferences and industry standards within the market.

Hardwood Flooring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| End-Use Sectors Covered | Residential Sector, Commercial Sector |

| Raw Materials Covered | Red Oak, White Oak, Maple, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AHF, LLC, UNILIN, Beaulieu International Group, Classen, FRITZ EGGER GmBH & Co. OG, Formica Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the hardwood flooring market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global hardwood flooring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the hardwood flooring industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hardwood flooring market was valued at USD 51.38 Billion in 2024.

IMARC estimates the hardwood flooring market to reach USD 69.78 Billion by 2033, exhibiting a CAGR of 3.42% during 2025-2033.

The global hardwood flooring market is driven by rising demand for durable, eco-friendly, and aesthetically appealing flooring solutions, urbanization, and growth in construction and renovation projects. Technological advancements in engineered wood products, increasing disposable incomes, and consumer preference for premium interiors further fuel market expansion, despite competition from alternative materials.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the hardwood flooring market include AHF, LLC, UNILIN, Beaulieu International Group, Classen, FRITZ EGGER GmBH & Co. OG, Formica Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)