Halal Cosmetics Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2025-2033

Halal Cosmetics Market Size and Share:

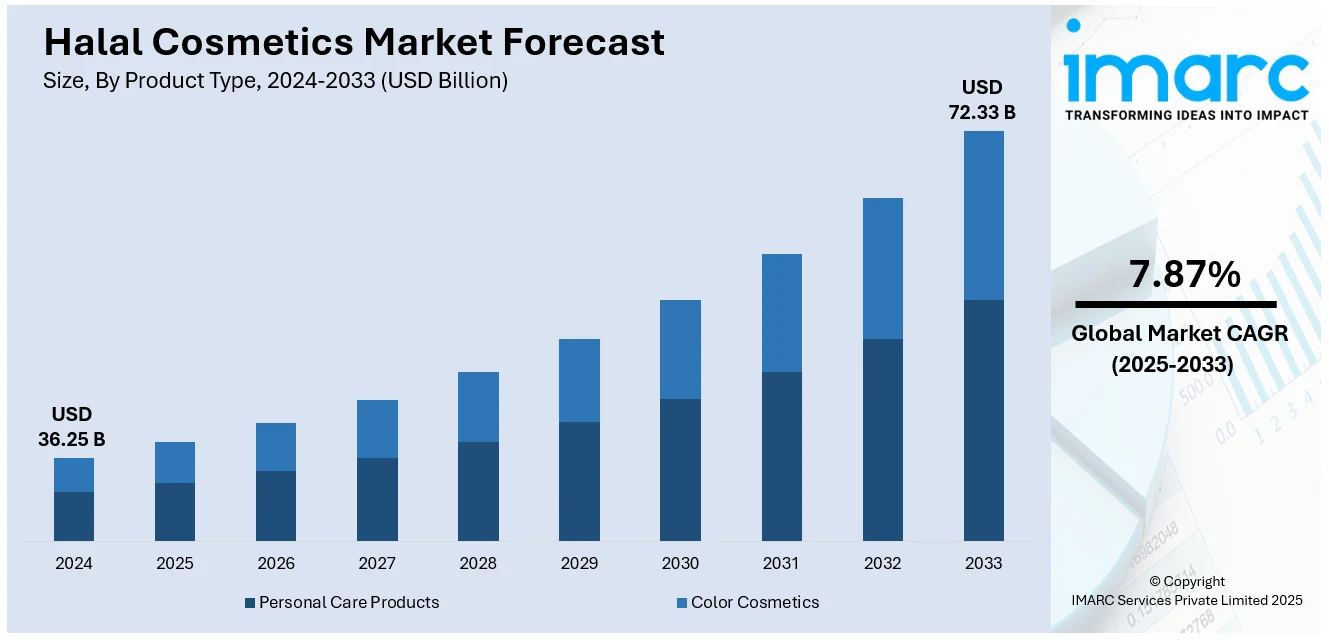

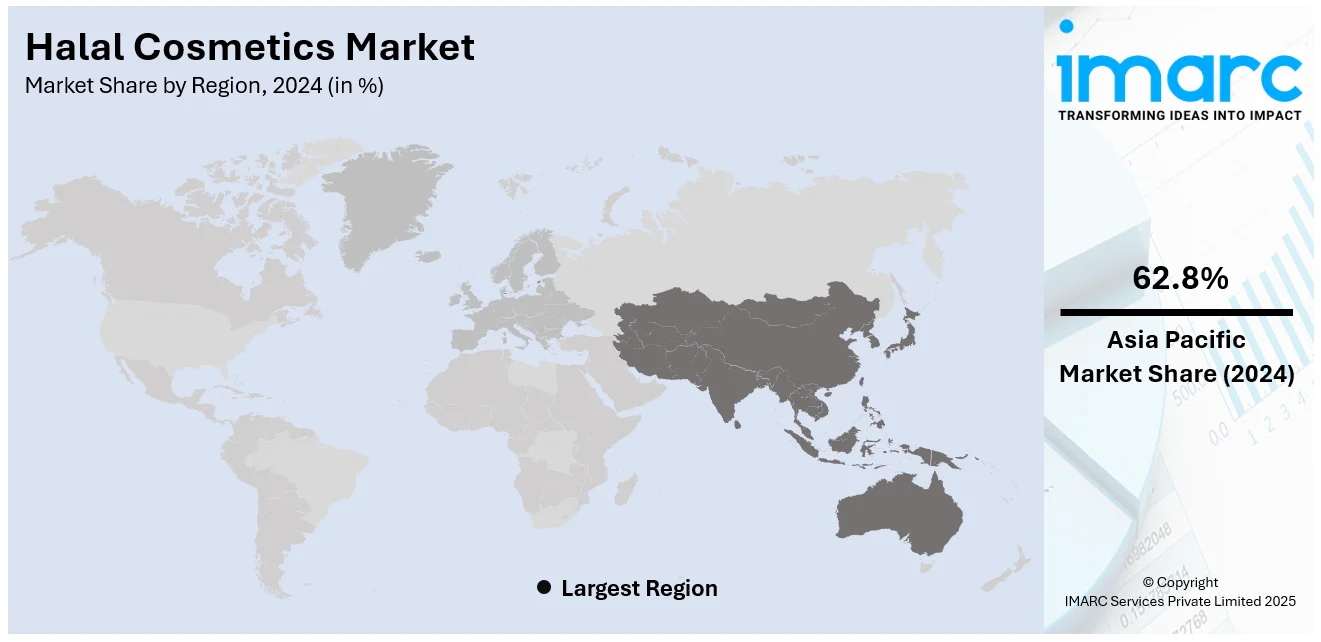

The global halal cosmetics market size was valued at USD 36.25 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.33 Billion by 2033, exhibiting a CAGR of 7.87% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 62.8% in 2024. The market is rapidly expanding, driven by a growing global Muslim population, increasing demand for ethically produced products, stringent Halal certification standards, and the effective use of digital marketing and online retail channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 36.25 Billion |

|

Market Forecast in 2033

|

USD 72.33 Billion |

| Market Growth Rate (2025-2033) | 7.87% |

Mass appreciation towards halal cosmetics is experienced due to quality and hygiene of ingredients in them. Ethical consumerism trends are the major halal cosmetics market growth drivers. In recent years, more people are becoming conscious regarding the products being bought; and people prefer that brand only, which suits to their way of life. Demand for halal cosmetics is not only on the rise among Muslim customers but also from non-Muslims who look for cruelty-free, environment friendly products without harming chemicals. Halal certification will guarantee customers that their products follow very high ethical standards, such as no animal testing, alcohol, or other non-halal ingredients.

A major reason why the United States is an important region in the halal cosmetics market is attributed to factors related to how discerning, urban Muslim populations have become when selecting cosmetics. This has inspired established brands of beauty products and newcomer firms to create halal cosmetic lines that meet the needs and preferences of Muslim customers. In addition to this, the growing influence of youths, especially millennials and Gen Z, who are always more vocal about their demands for the need for ethical and eco-friendly products, has also stimulated the halal cosmetics market revenue. Consequently, most leading market players are introducing a series of halal products frequently. For example, in 2024, Behalaal app launched in the US, which is a well-known marketplace for carious halal products, including skincare.

Halal Cosmetics Market Trends:

Growing trend of ethical consumerism and awareness of product ingredients

This increasing consciousness among the masses worldwide about the ingredients of their beauty products and their ethical implications is strengthening the halal cosmetics market demand, in particular, as they have strict requirements on purity of ingredients, animal welfare, and environmental friendliness. These cosmetics are free from harmful chemicals and instead contain natural and organic ingredients, appealing to health-conscious people who want safer and more natural alternatives. The availability of information and awareness about the content and manufacturing process of these products has also increased in the past, making a better-informed market. The overlap between the Halal principles and broader ethical customer values such as cruelty-free, vegan, and eco-friendly practices expands the appeal for cosmetics beyond the Muslim community. According to the IMARC Group, the global vegan cosmetics market is expected to grow with a CAGR of 5.4% in 2024-2032.

Increasing Muslim population and growing religious adherence

As adherence to Islamic teachings strengthens, so does the demand for Halal-certified products, which comply with Sharia law by avoiding haram substances, such as alcohol, pork derivatives, and certain animal-based ingredients. This religious adherence fosters a unique segment that is conscientious about the ethical and religious compliance of their cosmetics, making Halal products a necessity rather than a choice. The Halal certification acts as a guarantee of compliance, instilling trust and preference among Muslim customers. Additionally, the rising income levels among Muslims globally enable greater spending power for Halal beauty products, further fueling halal cosmetics market share. This demographic shift and increased religious adherence drive manufacturers to innovate and expand their Halal product lines to cater to this growing and increasingly influential market segment. According to updated demographic forecasts by the Pew Research Center's Forum on Religion & Public Life, the number of Muslims worldwide is expected to rise by around 35% over the next 20 years, from 1.6 billion in 2010 to 2.2 billion by 2030.

Enhanced regulatory framework and certification standards

It is the development of a more robust regulatory framework and standardization for Halal certification that has driven the global market. The regulations and standards will, in turn, give clear guidelines to manufacturers and reassure people about the authenticity and compliance of Halal products. This kind of regulatory environment mitigating concerns over cross-contamination with non-Halal substances during the manufacturing process, is ensuring the integrity and purity of the cosmetics, thereby positively influencing the halal cosmetics market outlook. According to the reports, as of 2023, nearly 2.7 Million halal-certified products are registered with the BPJPH. Approximately 1.5 million products are in the registration pool for the halal certificate, and about 450 thousand products are throughout the process of obtaining halal certificates. Due to this, people are more confident about these products, which increases demand. Moreover, standardizing Halal certification on a country-to-country basis made international trade in cosmetics a possibility and opened up new markets and expanded the global reach of the cosmetic products.

Halal Cosmetics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global halal cosmetics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and distribution channel.

Analysis by Product Type:

- Personal Care Products

- Skin Care

- Hair Care

- Fragrances

- Others

- Color Cosmetics

- Face

- Eyes

- Lips

- Nails

Personal care products (skincare, hair care, fragrances, and others) account for 67.1% of the share in the market. Such products are highly differentiated in terms of varieties that address the needs of users in their day-to-day hygiene and grooming. It includes shampoos, soap lotions, and dental care products some of which are produced in compliance with Shariah Law. The need for Halal personal care products is increasing due to the need of Muslims and followers of the Islamic faith, but also for people who want natural, ethical, and non-animal tested products. These products are free from haram substances, including alcohol and pig-derived ingredients, aligning with the ethical and health-conscious preferences of a broad customer base. Improving accessibility of halal personal care products. The e-commerce and digital platforms have revolutionized the availability of personal care products. Nowadays, online shopping is considered to be a major means for obtaining halal beauty products due to the convenience and wide range it offers.

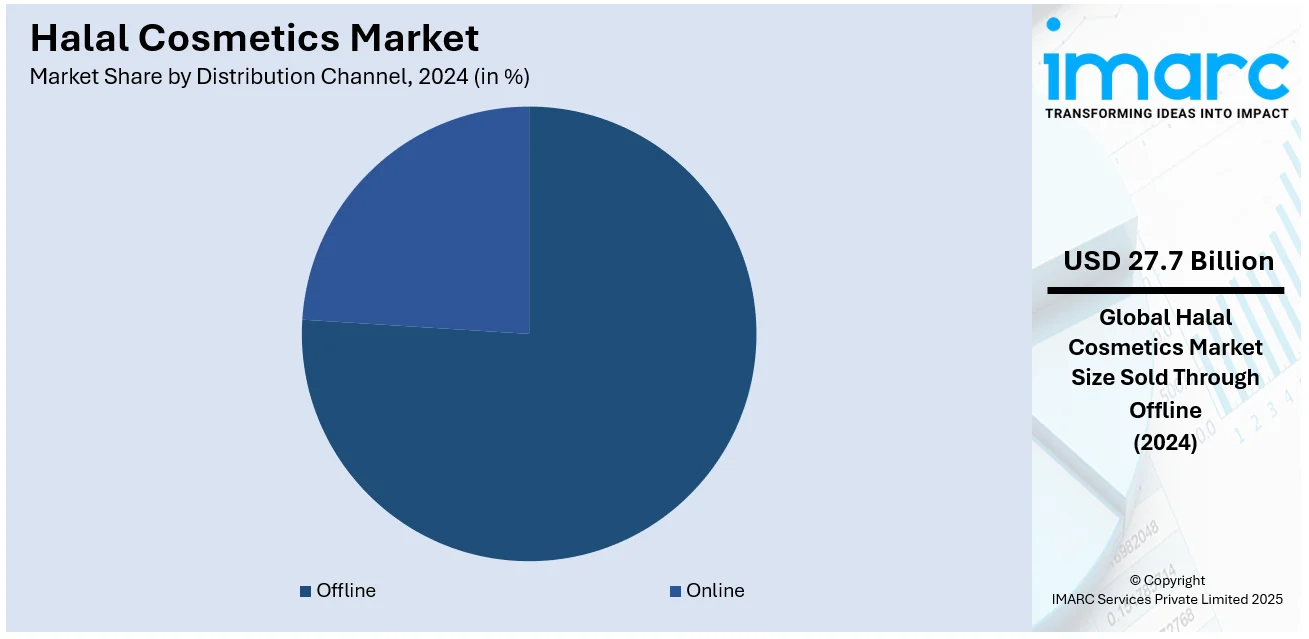

Analysis by Distribution Channel:

- Online

- Offline

The offline distribution channel makes up 76.4% of the market share in 2024, encompassing a wide range of formats that include supermarkets, hypermarkets, specialty stores, and beauty salons. Since it is a traditional retail approach where the customer interacts with a product, it enables contact and touch before buying. The fact that these cosmetics are sold from physical stores increases the exposure to and accessibility of these cosmetic products, especially for very large Muslim populations in geographies. Specialty stores are usually located in higher Muslim community concentration areas, and they bring in the tailored stock of Halal products for shoppers. Offline retail outlets have ways of providing personalized customer service that cannot be provided by e-commerce platforms. Sales associates can offer tailored advice based on individual needs, suggest complementary products, and answer queries in real time. This personal interaction often leads to a more satisfying and positive experience, increasing the likelihood of repeat purchases.

Regional Analysis:

- Asia Pacific

- Middle East and Africa

- Europe

- North America

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 62.8%, primarily due to large Muslim populations, especially countries like Indonesia and Malaysia. This region is not just a significant consumer of the Halal products but is also a major producer and has many local brands investing in Halal-certified manufacturing facilities, along with foreign companies. This cultural and religious convergence is complemented by rising disposable incomes and increased awareness of Halal products, which boost demand. Increasing halal certification availability has increased more brands' access to the growing halal market, giving them an opportunity to provide the diverse range of products necessary for individuals. As per halal cosmetics industry insights, the easy availability of trustworthy products to people is becoming easier since more beauty brands are obtaining the certification. This transparency is crucial in building brand loyalty and trust, as customers want to be assured that the products they are purchasing are ethically produced and free from harmful ingredients.The governments within this region are also promoting the Halal industries by creating a suitable market for the industries. For example, in 2024, The Indonesian Ministry of Religious Affairs' Halal Product Assurance Organizing Body (BPJPH) launched an online platform for overseas halal certificate registration (RSHLN) to facilitate the import and commerce of halal goods, including cosmetics, in the nation.

Key Regional Takeaways:

United States Halal Cosmetics Market Analysis

The market for halal cosmetics in the United States has grown significantly in recent years due to growing consumer demand for safe, clean, and ethically made cosmetics. People in the country are increasingly preferring skin care products owing to their changing lifestyles. As per a survey conducted in the US, around 75% of women and 60% of men have been reported to use skincare products regularly. Apart from this, Halal-certified cosmetic products cater to Muslim individuals seeking products that align with Islamic guidelines, avoiding ingredients like alcohol, animal fats, and other non-permissible substances. However, the appeal of these products extends beyond the Muslim demographic, resonating with a broader audience interested in sustainable and ethical practices. The growing customer preferences for natural and organic formulations are another factor driving the market. People are prioritizing transparency and ethical considerations, which is supporting the market growth. Brands in the country are responding by obtaining halal certification to ensure credibility and cater to the unique needs of individuals. Additionally, digital platforms and social media are essential for raising awareness about halal cosmetics. Influencers and brand campaigns highlight the quality and inclusivity of these products, broadening their reach and normalizing their presence in mainstream beauty spaces. Additionally, the thriving e-commerce sector is making halal cosmetics more accessible, thereby enabling smaller brands to gain visibility alongside established players.

Asia Pacific Halal Cosmetics Market Analysis

The growing demand for ethical, sustainable, and Shariah-compliant products among individuals is offering a favorable market outlook. This trend aligns with the region's growing Muslim population, which emphasizes the importance of halal-certified goods, including personal care and beauty products. As per the research report, the Muslim population in India is expected to reach around 204.8 Million in 2024. Alcohol, animal-derived materials, and other illegal substances are not present in halal cosmetics, which helps to satisfy the demands of both ethical and religious customers. The growing consumer awareness of the advantages of halal-certified products is a key driver of this market. This awareness extends beyond Muslim communities, as non-Muslim consumers are also drawn to halal products on account of their perception of being safer, cleaner, and eco-friendly. Apart from this, the growing influence of social media and beauty influencers among individuals is offering a favorable market outlook. Countries like Indonesia, Malaysia, and India are key players in the market, benefiting from supportive government regulations and certification processes that standardize halal compliance. In line with this, the rapid urbanization and inflating income levels of individuals is contributing to the market growth. Additionally, the rising demand for premium halal cosmetics, including skincare, makeup, and fragrances, is propelling the market growth.

Europe Halal Cosmetics Market Analysis

The European halal cosmetics market is experiencing significant growth on account of the increasing consumer awareness about halal-certified products and a rising Muslim population in the region. Halal cosmetics adhere to Islamic laws, ensuring they are free from alcohol, pork-derived ingredients, and other non-permissible substances, making them appealing not only to Muslim consumers but also to those seeking ethical, cruelty-free, and organic options. Apart from this, the growing demand for natural and organic ingredients is offering a favorable market outlook. European individuals are increasingly concerned about the environmental and health impacts of synthetic chemicals, making halal-certified products, which often align with these values, a preferred choice. Companies are taking advantage of this trend by adding eco-friendly and plant-based ingredients to their recipes. In addition, the adoption of halal certifications is becoming a critical strategy for manufacturers aiming to penetrate the European market. Regulatory bodies and certification organizations are providing clear guidelines, ensuring consumer trust and product authenticity. This is spurring the entry of both global and regional players, leading to an increasingly competitive market landscape. Additionally, the market expansion is being supported by the region's growing e-commerce industry. Customers can acquire a large range of halal items through online channels, frequently with comprehensive details about ingredients and certifications. According to the Council of the EU and the European Council, the share of e-shoppers grew from 53% in 2010 to 75% in 2023, an increase of 22 percentage points (pp) in the EU.

Latin America Halal Cosmetics Market Analysis

The market for halal cosmetics in Latin America is expanding significantly due to rising consumer awareness of halal-certified products and a growing need for safe and ethical beauty products. This trend is primarily driven by the growing Muslim population in countries like Brazil, Argentina, and Mexico, as well as by non-Muslim consumers seeking cruelty-free, natural, and ethically sourced products. Additionally, there is a rising awareness about the harmful chemicals in conventional cosmetics, leading many individuals to seek alternatives that align with halal standards, which emphasize purity, sustainability, and ethical practices. Apart from this, major global and local cosmetic brands are expanding their product lines to cater to this niche market, offering items, such as skincare, makeup, and hair care products that comply with halal certification. The expansion of e-commerce platforms and social media influence also plays a key role in boosting market visibility and sales in the region, making halal cosmetics increasingly accessible to a broader consumer base. According to reports, in January 2023, there were 152.4 million social media users in Brazil.

Middle East and Africa Halal Cosmetics Market Analysis

The growing Muslim population and rising consumer desire for natural, ethical, and clean beauty products are driving the Middle East and Africa's (MEA) halal cosmetics market's rapid expansion. Halal cosmetics, which comply with Islamic law by being free from alcohol, animal-derived ingredients, and harmful chemicals, is becoming a preferred choice in the region. As awareness about the benefits of halal-certified beauty products rises, consumers are shifting towards products that offer both purity and sustainability. The Middle East, with its large number of affluent consumers, and Africa, with its young and dynamic population, are key drivers of this trend. In line with this, international and local beauty brands are increasingly launching halal-certified products to cater to the diverse needs of this market. Besides this, the rise of e-commerce and social media platforms is facilitating better accessibility and marketing, contributing to the market's growth across the region. The IMARC Group reports that the Middle East e-commerce market reached USD 1,888 Billion in 2024.

Competitive Landscape:

Companies are using cutting-edge technologies like automation, cloud computing, machine learning, and artificial intelligence (AI) to improve decision-making, streamline operations, and cut expenses. These companies are utilizing AI-driven inventory management systems that can predict demand more accurately, thereby reducing stockouts and overstocking. Additionally, retailers are implementing ML algorithms to personalize customer recommendations, increasing sales and enhancing the shopping experience. Sustainability is becoming a key focus for many industry leaders, as people and stakeholders increasingly demand more environmentally responsible operations. Large companies are incorporating sustainable practices into their operations to lower their carbon footprint and support long-term environmental objectives.

The report provides a comprehensive analysis of the competitive landscape in the Halal cosmetics market with detailed profiles of all major companies, including:

- Clara International Beauty Group

- Halal Beauty Cosmetics

- INGLOT Cosmetics

- INIKA Organic

- IVY Beauty Corporation Sdn Bhd

- Martha Tilaar Group

- PHB Ethical Beauty Ltd

- Sampure Minerals

Latest News and Developments:

- May 2024: Halal Products Development Co. announced an investment in a fast-moving consumer products business based in Singapore. A legally binding agreement was signed by the Public Investment Fund-owned company and Believe, a business that specializes in halal cosmetics and personal care products. This aligns with the PIF-owned company's objective of bolstering the Saudi Arabian industry and providing superior products that adhere to Islamic norms.

- November 2024: The Malaysia International Halal Showcase (MIHAS) unveiled its inaugural overseas venture in Dubai, known as MIHAS@Dubai, marking a major milestone for Malaysia's halal industry and its goals to expand into the Middle Eastern market. This distinctive environment offers an engaging experience showcasing Malaysia’s various halal products in areas like food and drink, cosmetics and pharmaceuticals, as well as halal services including finance, franchising, and logistics.

Halal Cosmetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Clara International Beauty Group, Halal Beauty Cosmetics, INGLOT Cosmetics, INIKA Organic, IVY Beauty Corporation Sdn Bhd, Martha Tilaar Group, PHB Ethical Beauty Ltd, Sampure Minerals, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the halal cosmetics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global halal cosmetics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the halal cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The halal cosmetics market was valued at USD 36.25 Billion in 2024.

The halal cosmetics market is projected to exhibit a CAGR of 7.87% during 2025-2033, reaching a value of USD 72.33 Billion by 2033.

The market is driven by the growing Muslim population, increasing demand for ethically produced products, rising awareness of ingredient transparency, and a shift toward cruelty-free, sustainable cosmetics. The adoption of Halal certification standards and the expansion of online retail platforms further support this growth.

Asia Pacific currently dominates the halal cosmetics market, accounting for a share of 62.8% in 2024. The dominance is fueled by a large Muslim population, growing awareness of halal beauty products, increasing disposable income, and rising demand for ethical and natural beauty solutions in countries like Malaysia, Indonesia, and the UAE.

Some of the major players in the halal cosmetics market include Clara International Beauty Group, Halal Beauty Cosmetics, INGLOT Cosmetics, INIKA Organic, IVY Beauty Corporation Sdn Bhd, Martha Tilaar Group, PHB Ethical Beauty Ltd, and Sampure Minerals, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)