Grow Light Market Size, Share, Trends, and Forecast by Technology, Installation Type, Spectrum, Application, and Region, 2025-2033

Grow Light Market 2024, Size and Trends:

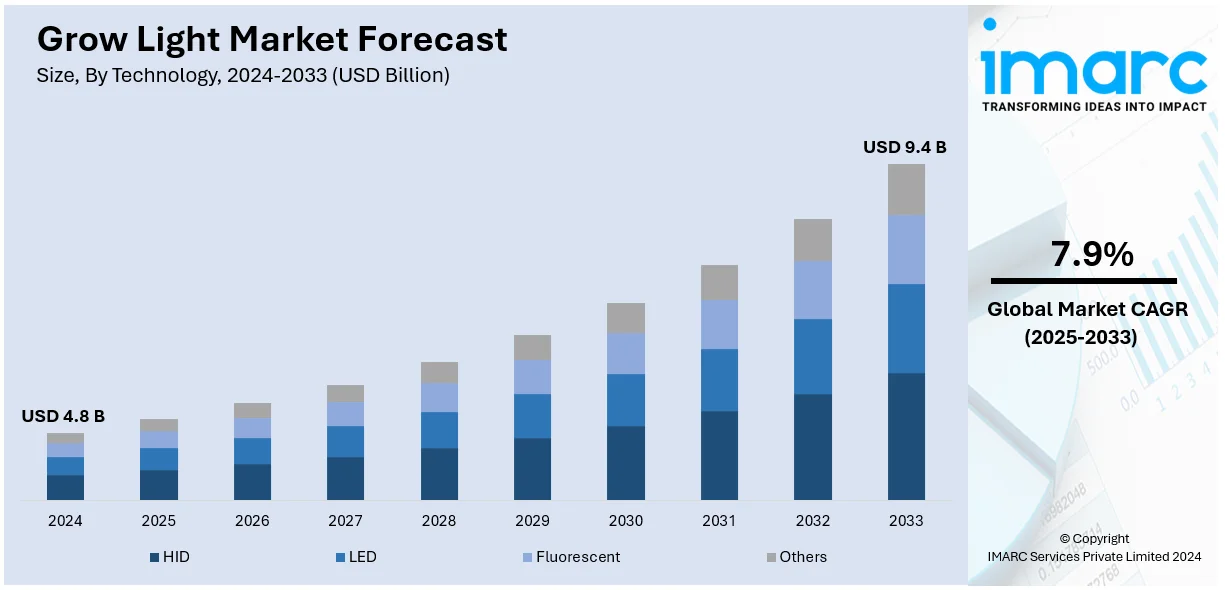

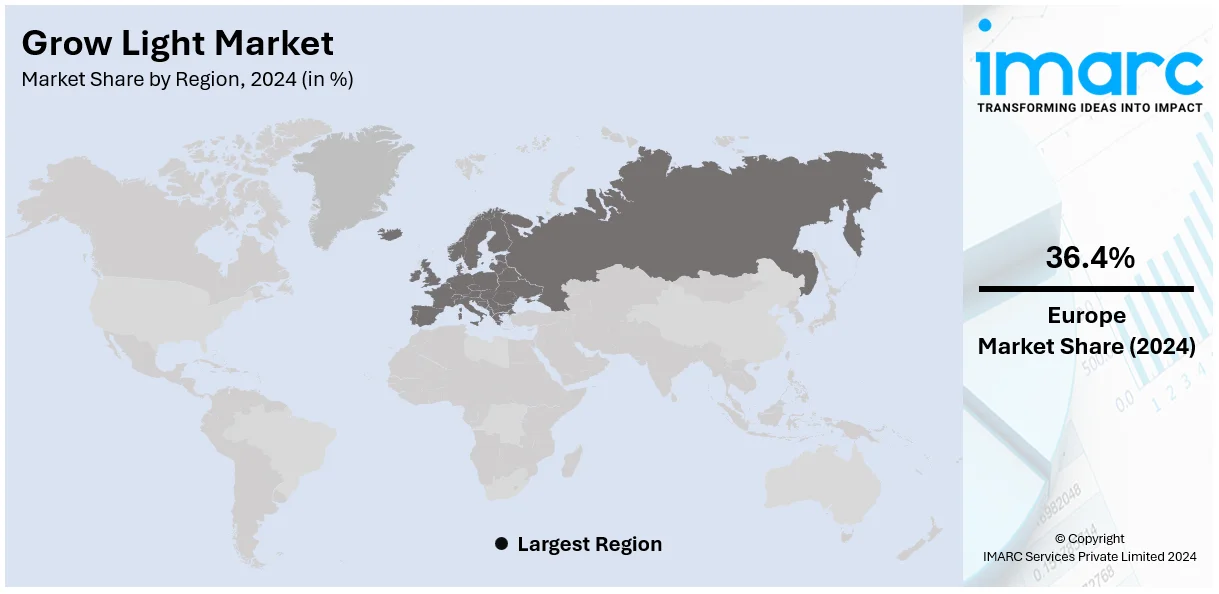

The global grow light market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.4 Billion by 2033, exhibiting a CAGR of 7.9% during 2025-2033. Europe currently dominates the market, holding a grow light market share of over 36.4% in 2024. The growing trend of indoor farming and urban gardening, the development of energy-efficient LED technology, the rising emphasis on sustainable practices in agriculture, and the integration of smart and automated technologies into grow light systems are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.8 Billion |

|

Market Forecast in 2033

|

USD 9.4 Billion |

| Market Growth Rate 2025-2033 | 7.9% |

Concerns about climate change and sustainability continue to grow, creating the need for energy-efficient solutions in various sectors, including agriculture. Grow lights, especially those using LED technology, are seen as an environmentally friendly alternative to traditional lighting systems. LEDs use up to 80% less energy than incandescent bulbs, making them a much more sustainable choice. Additionally, grow lights that use energy-efficient systems help reduce the carbon footprint of indoor farming operations, which is crucial as the agricultural sector faces growing pressure to adopt more sustainable practices. Moreover, in recent years, there has been a noticeable surge in home gardening as a way to reduce stress. This trend has led to a significant rise in do-it-yourself (DIY) gardening projects, particularly in urban areas where space is limited. As per an industry report, it has been revealed that about 55 percent of U.S. households have a garden; which denotes 71.5 million gardening households and 185.9 million people. People are now more inclined to grow their own herbs, vegetables, and flowers indoors. Grow lights have become a crucial tool in these home gardening setups, as they allow plants to thrive in environments with limited or no access to natural sunlight.

The United States stands out as a key market disruptor, with a market share of 85% in North America in 2024. As food security becomes a more pressing issue due to climate change, supply chain disruptions, and population growth, there is a greater focus on ensuring a stable and sustainable food supply in the country. Indoor farming, powered by efficient grow lights, plays a key role in this solution. In line with this, in July 2024, Nature's Miracle Holdings Inc announced that the company signed a $5.1 million sales order agreement with What Rebates LLC for use of indoor grow light products by the U.S. energy rebate market. Indoor farming allows for year-round food production, which can help stabilize local food supplies. With these lights, crops can also be grown in controlled environments that are less susceptible to weather-related challenges such as droughts, storms, or fluctuating temperatures.

Grow Light Market Trends:

Rising Trend of Indoor Farming

The increasing popularity of indoor farming, driven by urbanization and limited outdoor space, is a significant driver of the grow light market share. According to the United Nations, 55% of the world's population already resides in urban areas. However, this figure is projected to rise to 68% by 2050. Urbanization is growing at such a rate that indoor farming solutions are becoming more urgently required because they provide a plausible alternative for growing food within a highly populated area with little space. Grow lights enable plants to thrive in controlled environments, overcoming the challenges of weather variability and extending growing seasons. This trend caters to the demand for locally grown produce and supports year-round cultivation, which enhances food security and sustainability. In addition, programs like Horizon 2020, which invested over Euro 200 Million (USD 208 Million) in R&I to implement digital technologies in agriculture, are promoting the development of indoor farming technologies, including advanced grow lights. This is a combination of factors that is significantly boosting the grow light market demand.

Significant Advancements in Lighting Technology

The evolution of lighting technology, particularly the development of energy-efficient LED grow lights, is transforming the industry. LEDs offer precise control over light spectra and intensity, optimizing plant growth and minimizing energy consumption. Their longer lifespan and reduced heat emissions also contribute to their appeal, thus making them a preferred choice for both commercial and hobbyist growers. In line with this trend, Signify, the global leader in lighting, expanded its Smart Wi-Fi lighting range in India, with the introduction of two portable smart lamps namely Philips Smart LED Hero and Philips Smart LED Squire. These lamps, with their round shapes and plug-and-play features, are designed to be highly portable and versatile, making them easy to use anywhere in the house. Their innovative design and smart capabilities align with the growing demand for energy-efficient and adaptable lighting solutions, further promoting the adoption of LED technology in various applications, including indoor farming.

Increasing Cannabis Cultivation

The expanding cannabis industry, driven by legalization for medical and recreational use in various regions, heavily relies on specialized lighting solutions. This form of medical cannabis has been legalized in approximately 20 states within the U.S. While numerous countries now have laws regarding its legalization regarding its usage, Africa, Europe, Australia, and South America are among the few leaders of its legalization. The Cannabis Act (Bill C-45) in Canada legalized the cannabis use, and in 2017, the government initiated the Canadian Cannabis Survey (CCS), which has been annually conducted. In 2020, over 14% of 16+-year old participants shared that they adopted cannabis for medical reasons. Tailored lighting regimes influence plant development, affecting characteristics like flowering, potency, and resin production. As the cannabis market grows, the demand for efficient and effective grow lights continues to rise.

Grow Light Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global grow light market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology, installation type, spectrum, and application.

Analysis by Technology:

- HID

- LED

- Fluorescent

- Others

High-intensity discharge (HID) leads the market with 35.8% market share in 2024. HID lights remain the largest segment, particularly in commercial and large-scale indoor farming applications. These lights, including metal halide (MH) and high pressure sodium (HPS) lamps, are favored for their powerful output and ability to cover large growing areas effectively. They are known for producing a high intensity of light, which is beneficial for enhancing plant growth, especially during the flowering and fruiting stages. Despite the rise of more energy-efficient technologies like LEDs, HID lights still dominate the market due to their lower initial cost, long-standing industry use, and effectiveness in promoting robust plant yields in large commercial operations. HID technology’s ability to provide broad-spectrum light that mimics natural sunlight has made it a staple in both traditional and modern agricultural setups.

Analysis by Installation Type:

- New Installations

- Retrofit Installations

New installations lead the market in 2024. The adoption of new installations in the grow light market outlook is driven by several influential factors. Primarily, technological advancements are leading to the development of more efficient and effective lighting solutions, encouraging growers to upgrade their existing systems for improved performance and yield. The growing demand for sustainable and environmentally friendly agricultural practices is prompting the integration of energy-efficient lighting technologies. New installations often utilize LED systems, which consume less energy, produce minimal heat, and consist of longer lifespans as compared to traditional lighting. Moreover, the expansion of indoor and vertical farming operations requires the establishment of new lighting setups to support increased cultivation in limited spaces. These installations ensure optimal light distribution and coverage for different plant growth stages. Additionally, the increasing popularity of legalized cannabis cultivation necessitates advanced lighting installations to achieve desired yields and potency. Furthermore, government incentives and grants that promote sustainable agriculture and energy efficiency drive the adoption of new lighting installations.

Analysis by Spectrum:

- Full-Spectrum

- Partial Spectrum

Partial spectrum leads the market with 59.8% market share in 2024. The partial spectrum grow lights offer a balanced and cost-effective solution for a wide variety of plants. They typically provide a mix of blue and red wavelengths, which are essential for the key stages of plant growth—blue light supports vegetative growth, while red light aids in flowering and fruiting. This type of lighting is popular because it meets the essential needs of most plants without the high costs associated with full-spectrum systems, making it ideal for both commercial growers and home gardeners. Partial spectrum lights are particularly effective for crops that do not require precise light conditions and can thrive under a broader range of light conditions. Their versatility, affordability, and efficiency in delivering the necessary wavelengths make partial spectrum lights the go-to choice for many growers in the market.

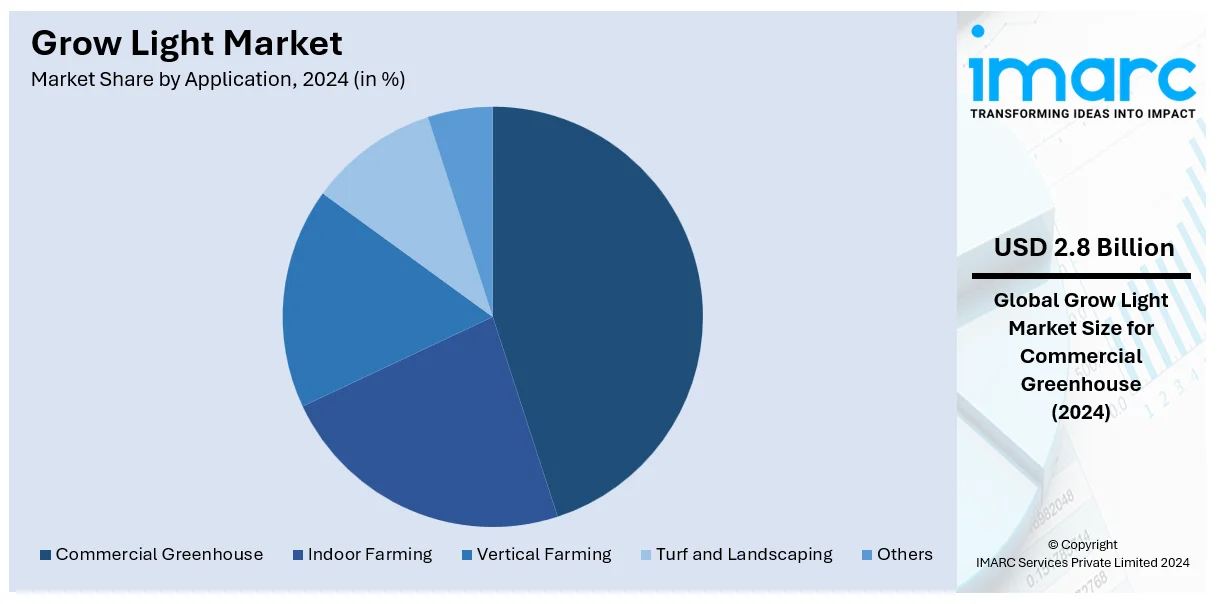

Analysis by Application:

- Indoor Farming

- Vertical Farming

- Commercial Greenhouse

- Turf and Landscaping

- Others

Commercial greenhouse leads the market with over 59% market share in 2024. Grow lights play a pivotal role in commercial greenhouse operations, contributing to enhanced crop production and year-round cultivation. In greenhouses, grow lights are used to supplement natural sunlight and extend the photoperiod, particularly during low light conditions, such as winter or cloudy days. Grow lights ensure consistent and optimized light levels for plants, promoting uniform growth, development, and yield across the greenhouse. They are especially valuable for high-value crops, early-season planting, and crop varieties that require specific light conditions. Additionally, in regions with limited sunlight or extreme weather conditions, grow lights provide a reliable solution for maintaining plant health and productivity. They enable growers to diversify crop portfolios and extend the availability of fresh produce to meet market demand throughout the year. Furthermore, the controlled environment of a greenhouse combined with artificial lighting allows for precision cultivation, enabling fine-tuning of growth parameters and accelerating plant growth cycles.

Analysis by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, Europe accounted for the largest market share of 36.4%. In Europe, the grow light market growth is driven by the increasing focus on sustainable agriculture, efficient resource utilization, and year-round crop production. The continent's variable climate and limited arable land have prompted the adoption of indoor and vertical farming methods, spurring demand for energy-efficient and customizable grow lights. Significant advancements in LED technology cater to the need for precise light spectra, while the emphasis on local food production aligns with efficient grow light solutions. Additionally, the expanding cannabis cultivation industry drives the demand for specialized lighting.

Key Regional Takeaways:

North America Grow Light Market Analysis

The grow lights market in North America is seeing an immense surge mainly because of the use of indoor farming and the increase in home gardening activities. The need for more sustainable practices in agriculture also proved to be one of the driving forces behind the demand for grow lights. In the United States, both commercial and residential sectors have witnessed a rapid rise in the use of grow lights, with the emergence of new technologies such as LED and HID lighting making the lights highly efficient and affordable. As urban farming and hydroponics gain popularity, grow lights are also expected to provide an essential component for producing crops all year round, especially in areas where growing seasons are harsh, or soil is not easily accessible. Another propeller is the promotion of energy-efficient solutions, as people are shifting from the traditional way of farming that use grow lights to those using LED technologies. Besides this, an increase in interest in organic food aside from locally grown foods has generated a hike in indoor farming systems. In this case, the market is further supported on account of increased governmental incentives and policies for sustainable agriculture. Alongside this, smart farming technology is proliferating, which aligns well with the market.

United States Grow Light Market Analysis

In 2024, United States held a market share of 85% in North America. The United States grow light market forecast is strongly driven by the expanding cannabis industry that recently got strengthened by legislative changes. According to an industrial report, federal law still prohibits the growth, sale, and consumption of cannabis, although 18 states have legalized cannabis use for recreational purpose. In October 2022, President Joe Biden pardoned thousands of Americans who were convicted of cannabis possession, further normalizing cannabis use in the U.S. This changing legal landscape is driving the growth of the cannabis market, which has a heavy reliance on specialty grow lighting solutions to produce high-quality cannabis with particular cannabinoid profiles and strong yields. As legalization continues to expand both for recreational and medical purposes, there will be an increase in demand for efficient and effective grow lights in the U.S., hence propelling the market for advanced lighting technologies.

Europe Grow Light Market Analysis

Changes in climate conditions and the increasing demand for greater control over crop-growing environments have led to rapid growth in commercial greenhouse cultivation across Europe. In 2018, Europe accounted for about 210,000 hectares (2,100 square kilometers) of greenhouses, with significant concentrations found in countries such as Spain (70,000 ha), Italy (42,800 ha), France, the Netherlands, and Central and Eastern Europe, as per an industry news. This growth in greenhouse agriculture is driving the demand for grow lights, as they will allow producers to optimize the light conditions and extend their growing seasons, especially in places with limited natural sunlight or unpredictable weather.

As greenhouse farming grows, energy-efficient lighting becomes a pressing need. Grow lights allow for the control of light intensity and spectrum, promoting optimal plant growth without wasting much energy. There is an increasing adoption of LED grow lights in commercial greenhouses due to their long lifespan, less energy costs, and ability to deliver precise light control. Such trends form a significant source of growth for the Europe grow lights market.

Asia Pacific Grow Light Market Analysis

Progressive policies and ambitious agricultural goals are driving the rapid growth of the Asia-Pacific grow lights market. In Thailand, medical marijuana has been legal since 2018, but decriminalization in 2022 marked a transformative moment when it removed the legal obstacles to growing and trading marijuana and hemp products. This, in turn, spurred controlled-environment agriculture, and grow lights were the key to optimizing cannabis for medicinal use.

Similar to this is Singapore's "30 by 30" vision under the Singapore Green Plan with the aim of locally sourcing 30% of the nutritional needs of the nation by 2030. Such a goal has hastened the development of indoor farming technologies, such as advanced grow lights, despite setbacks regarding space and resources. The energy-efficient and high-precision grow lighting demand will rise with governments in the Asia-Pacific region developing sustainable and innovative agricultural practices.

Latin America Grow Light Market Analysis

According to the United Nations report Regional Overview of Food Security and Nutrition 2023, 6.5% of the population in Latin America and the Caribbean, equivalent to 43.2 million people suffers from hunger. Such a high number calls for the immediate eradication of food insecurity across the region. Indoor farming supported by advanced grow light technologies is emerging as the vital solution to this challenge. Grow lights allow cultivation throughout the year in controlled environments where fresh produce is available season-independently and is not limited by climatic conditions.

Countries such as Mexico, Brazil, and Colombia are increasingly adopting indoor farming practices to enhance food production efficiency and quality. Urban farming initiatives in major cities are leveraging grow lights to maximize limited space for agriculture, while private investments in hydroponics and vertical farming systems are further driving market growth. These advancements position grow lights as a critical component in combating hunger and ensuring sustainable food security in the region.

Middle East and Africa Grow Light Market Analysis

Grow lights are becoming an essential part of the Middle East and Africa's agricultural landscape, especially as this region embraces vertical farming in response to challenges such as water scarcity and harsh climates. Vertical farming can decrease water usage by up to 90% compared with traditional farming methods, thus ensuring sustainability in food production. In the UAE, massive investment in agritech is the driving force behind grow light adoption, with Pure Harvest Smart Farms raising USD 180 Million in 2022 to expand its operations, as per industry news. Emirates has also partnered with US-based Crop One to launch Bustanica, the world's largest hydroponic farm, in Dubai. This suggests increasing demand for controlled environment agriculture, which finds its important role in optimized grow and year-round crops. Given the emphasis in these regions on food security as well as sustainability, markets in the Middle East and Africa are going to maintain this growth trajectory regarding growth lighting applications.

Competitive Landscape:

Key market players in the grow light market are actively engaged in various strategic initiatives to capitalize on the market's growth potential. They focus on research and development (R&D) to innovate lighting technologies that offer higher efficiency, optimized light spectra, and enhanced control for plant growth. These companies also emphasize sustainability, aiming to create energy-efficient solutions that reduce the environmental footprint of indoor farming. They collaborate with horticultural experts to understand plant needs and design lighting solutions that maximize yield and quality. Moreover, key players invest in educating growers about the benefits of different lighting technologies and their impact on crop productivity. They provide support services, technical assistance, and resources to help customers make informed decisions. Furthermore, partnerships with research institutions, universities, and agricultural organizations facilitate knowledge exchange and contribute to cutting-edge advancements in the field.

The report provides a comprehensive analysis of the competitive landscape in the grow light market with detailed profiles of all major companies, including:

- ams-OSRAM AG

- California LightWorks

- Epistar Corporation (Ennostar Inc.)

- Everlight Electronics Co., Ltd.

- Gavita International B.V.

- GE Lighting (Savant Systems Inc.)

- Heliospectra AB

- Hortilux Schréder (Dool Industries)

- Signify Holding

- Valoya Inc. (Greenlux Lighting Solutions)

Latest News and Developments:

- February 2024: AeroGarden introduced Harvest 2.0, the next evolution of the company's well-known Harvest unit. The new convenient and sleek indoor garden fits seamlessly and comes in white and black colors. The detachable full spectrum 15W LED grow light is equipped with an autotimer that helps grow plants at a faster rate than in soil offering gentle lighting and reduces light that is directed away from plants.

- January 2023: Polymatech Electronics, India's first semiconductor chip manufacturer specializing in Opto-semiconductors, announced the launch of its new horticulture LED products: Ravaye full-spectrum packages and modules, as well as monochromatic LEDs.

- December 2022: AeroGarden, the world's leading in-home, smart hydroponic garden brand, announced a new addition to their portfolio - Indoor Grow Lights for houseplants. This new product line expands AeroGarden's existing grow light offerings with three new unique models, which include enhanced design elements that integrate seamlessly anywhere in the home while supporting healthy houseplant growth year-round.

- November 2020: The New Town Kolkata Development Authority (NKDA) launched an urban gardening project using LED grow light technology for commercial cultivation of tuberose (Rajanigandha) and chrysanthemum (dalia) plants on a two-acre land near the Biswa Bangla Gate in New Town.

Grow Light Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | HID, LED, Fluorescent, Others |

| Installation Types Covered | New Installations, Retrofit Installations |

| Spectrums Covered | Full-Spectrum, Partial Spectrum |

| Applications Covered | Indoor Farming, Vertical Farming, Commercial Greenhouse, Turf and Landscaping, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | ams-OSRAM AG, California LightWorks, Epistar Corporation (Ennostar Inc.), Everlight Electronics Co., Ltd., Gavita International B.V., GE Lighting (Savant Systems Inc.), Heliospectra AB, Hortilux Schréder (Dool Industries), Signify Holding, Valoya Inc. (Greenlux Lighting Solutions), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the grow light market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global grow light market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the grow light industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The grow light market was valued at USD 4.8 Billion in 2024.

IMARC estimates the global grow light market to exhibit a CAGR of 7.9% during 2025-2033.

The key factors driving the global grow light market include the rise in indoor farming, urban agriculture, and home gardening, technological advancements in LED lighting, growing demand for energy-efficient and sustainable solutions, increasing focus on food security, and government support for agricultural innovation and sustainable practices.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global grow light market include ams-OSRAM AG, California LightWorks, Epistar Corporation (Ennostar Inc.), Everlight Electronics Co., Ltd., Gavita International B.V., GE Lighting (Savant Systems Inc.), Heliospectra AB, Hortilux Schréder (Dool Industries), Signify Holding, Valoya Inc. (Greenlux Lighting Solutions), etc.

Major drivers in the lights market include technological advancements in LED and smart lighting, energy efficiency demands, urbanization, government regulations, growing commercial and residential sectors, and the rise of smart homes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)