Greenhouse Horticulture Market Size, Share, Trends and Forecast by Material Type, Crop Type, Technology, and Region, 2025-2033

Greenhouse Horticulture Market Size and Share:

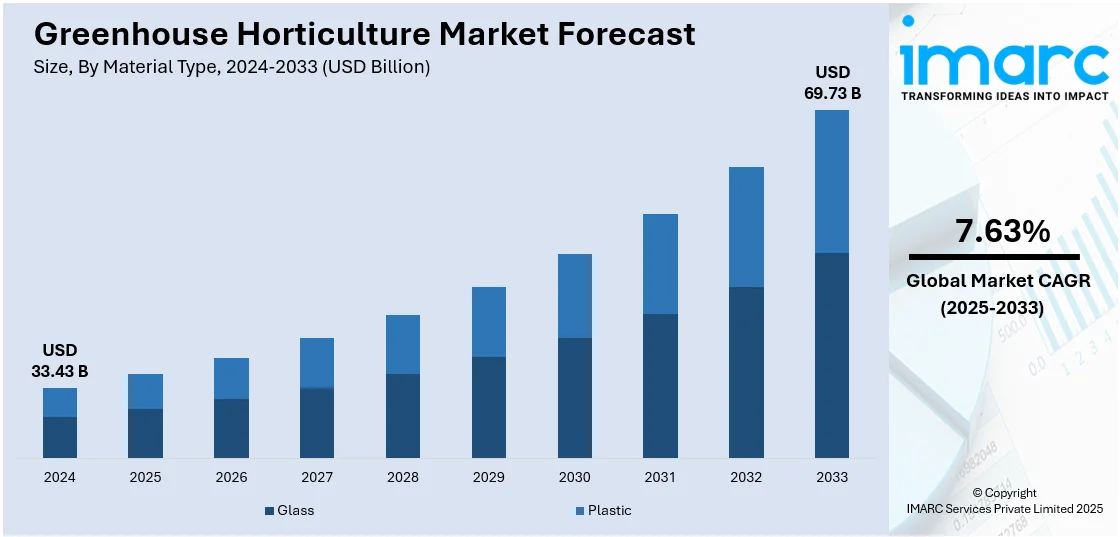

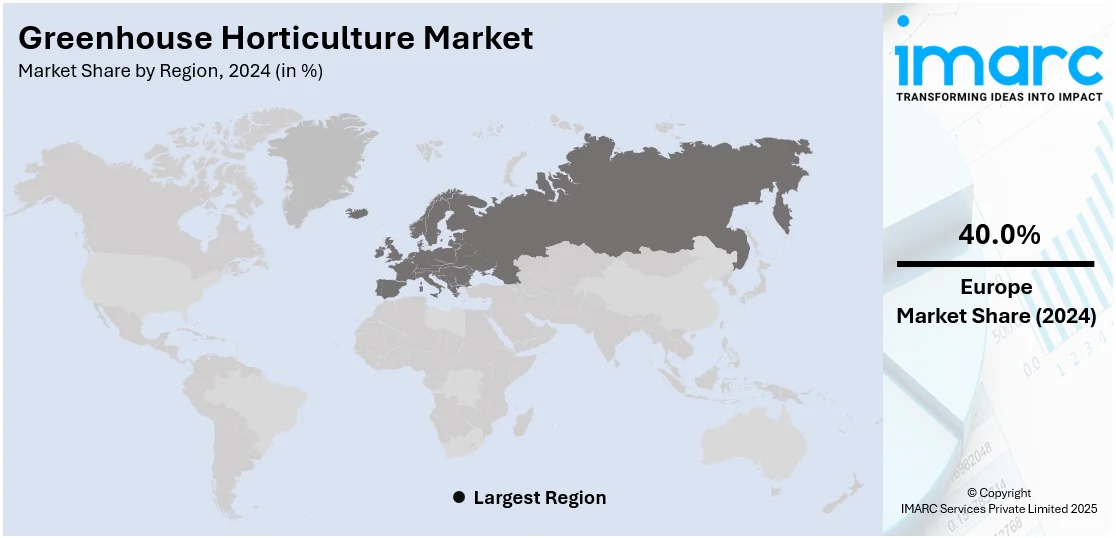

The global greenhouse horticulture market size was valued at USD 33.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 69.73 Billion by 2033, exhibiting a CAGR of 7.63% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 40.0% in 2024. The growing food security concerns and demand for fresh and high-quality produce year-round, increasing frequency of extreme weather events, rising water scarcity concerns, and rapid urbanization and land constraints are some of the major factors propelling the greenhouse horticulture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 33.43 Billion |

| Market Forecast in 2033 | USD 69.73 Billion |

| Market Growth Rate 2025-2033 | 7.63% |

The global greenhouse horticulture market is driven by increasing demand for year-round crop production, climate change challenges, and the need for sustainable farming practices. Rising population and food security concerns increase the adoption of controlled-environment agriculture to enhance yield and quality. Technological advancements, such as automation, hydroponics, and energy-efficient systems, further propel market growth. Government subsidies and incentives for modern farming techniques also play a key role. Under the Sub-Mission on Agricultural Mechanization, the UP (Indian) government introduced a 50% subsidy on modern agricultural machinery on 18th December 2024, including drones and crop residue management equipment. Farmers can apply at the website, and the token amounts will vary from ₹0 to ₹5,000 (USD 0 to 60.24) depending on the cost of the equipment, which will be distributed using an e-lottery system. The move is part of a larger push by the Indian government to promote technology-based and sustainable farming practices in the country and some of the trends of global greenhouse horticulture that focus on automation, precision agriculture, and carbon footprint reduction. Additionally, consumer preference for locally grown, pesticide-free produce drives market expansion. Urbanization and limited arable land encourage greenhouse farming, making it a viable solution for efficient resource utilization and higher productivity in agriculture.

The United States stands out as a key regional market, primarily driven by the growing consumer awareness of food safety and the benefits of fresh, high-nutrient produce. The legalization of cannabis cultivation in several states has influenced the demand for controlled-environment agriculture to optimize growth conditions. On 7th October 2024, Bright Green, one of the few companies licensed by the DEA, announced plans to invest USD 15 Million in the growing of cannabis and opium poppies at 70 acres of high-security greenhouses in New Mexico. The aim is to deliver FDA-approved pharmaceutical ingredients sourced from plants for the localized market. With concerns that just 28% of pharmaceutical ingredient production takes place in the United States, this initiative backs federal efforts to bolster medical supply chains. By late 2025, the project has the potential to generate up to USD 5 Million per month, indicating an increasing convergence between legalized cannabis production and the U.S. greenhouse horticulture sector. Besides this, labor shortages in traditional farming are accelerating automation adoption, improving efficiency in greenhouse operations. Retailers and restaurants increasingly source locally grown greenhouse produce to meet sustainability goals and reduce supply chain risks. Additionally, research in crop genetics and disease-resistant varieties enhances greenhouse viability. Investments from agribusinesses and venture capital in advanced greenhouse technologies further stimulate market growth, fostering innovation and scalability in indoor farming.

Greenhouse Horticulture Market Trends:

Rising Food Security Concerns

The escalating global population is accompanied by a rising demand for food, challenging traditional agricultural methods to meet these needs consistently. The Global Report on Food Crises (GRFC) 2024 highlighted the challenge of ending hunger by 2030. In 2023, about 282 Million individuals (21.5% of the assessed population across 59 regions) experienced acute food insecurity, requiring urgent aid. Greenhouse horticulture addresses this challenge by enabling year-round production of various crops, irrespective of external climate conditions. The controlled environment within greenhouses facilitates optimal growth parameters such as temperature, humidity, and light, resulting in predictable and increased yields. This consistent supply of fresh produce contributes significantly to food security, as consumers have access to nutritious food regardless of seasonal fluctuations or adverse weather events. Market research companies can emphasize the role of greenhouse horticulture in enhancing food security, showcasing its potential to stabilize supply chains and mitigate food scarcity concerns. The greenhouse horticulture market demand is expected to grow owing to heightened consumer preference for fresh, locally grown produce and advancements in controlled environment agriculture technologies.

Extreme Climate Change Resilience

The unpredictable impacts of climate change, including extreme weather events, droughts, and heatwaves, pose substantial risks to traditional agriculture. According to World Food Program USA, rising temperatures have driven a five-fold increase in extreme weather over 50 years. Climate disasters have affected 1.7 Billion individuals, causing destruction, displacement, and worsening hunger crises. Greenhouse horticulture acts as a shield against these vulnerabilities. By creating a controlled microclimate, greenhouses offer protection from sudden temperature changes, heavy rains, and other climate-related stressors. This resilience ensures that crops remain unaffected by adverse conditions, reducing the likelihood of yield losses. Market research firms can underscore the importance of greenhouse horticulture as a climate-smart solution, highlighting its capacity to mitigate the negative effects of climate change on crop production and foster agricultural sustainability. The greenhouse horticulture market forecast reveals growth driven by increasing demand for year-round produce and sustainable farming practices.

Growing Water Scarcity Concerns

At least 4 Billion individuals, or 50% of the global population, experience water shortages for at least one month annually. By 2025, 1.8 Billion individuals are expected to face absolute water scarcity as defined by the Food and Agriculture Organization (FAO). Greenhouse horticulture addresses this concern through its efficient water management practices. Advanced irrigation systems, such as drip irrigation and hydroponics, minimize water wastage by delivering precise amounts of water directly to the plant roots. Additionally, the enclosed environment of greenhouses reduces evaporation, further conserving water. By optimizing water usage, greenhouse cultivation aligns with water-saving goals and reduces the environmental impact of agriculture. Market research companies can spotlight how greenhouse horticulture's water-efficient methods contribute to sustainable water resource management, resonating with environmentally conscious consumers and industry stakeholders.

Greenhouse Horticulture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global greenhouse horticulture market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material type, crop type, and technology.

Analysis by Material Type:

- Glass

- Plastic

Plastic stands as the largest component in 2024, holding around 85.0% of the market. One of the primary factors is its exceptional versatility and adaptability. Plastic materials, such as polyethylene and polyvinyl chloride (PVC), are widely utilized for constructing greenhouse structures and covers. Their lightweight nature, durability, and cost-effectiveness make them favorable choices for creating enclosed growing spaces. Plastics offer superior light transmission, crucial for optimizing photosynthesis and plant growth, while also providing effective insulation to maintain controlled temperatures. Furthermore, plastic materials are resistant to corrosion and degradation caused by exposure to moisture, UV radiation, and other environmental factors. This longevity ensures that greenhouse structures endure over time, reducing the need for frequent replacements.

Analysis by Crop Type:

- Fruits and Vegetables

- Flowers and Ornamentals

- Nursery Crops

- Others

Fruits and vegetables lead the market with around 67.9% of the market share in 2024. Consumer preferences for fresh, nutritious, and locally sourced produce have driven the demand for fruits and vegetables. Greenhouse horticulture offers a controlled environment that ensures year-round production, enabling consistent availability of these essential food items even in regions with challenging climates. This segment encompasses a wide range of crops, including tomatoes, peppers, cucumbers, lettuce, berries, and more, catering to diverse dietary needs. From an economic perspective, fruits and vegetables have demonstrated strong market demand and profitability. Their relatively short growth cycles compared to other crops allow for quicker turnover and higher yields per square meter of greenhouse space. This efficiency appeals to growers and investors.

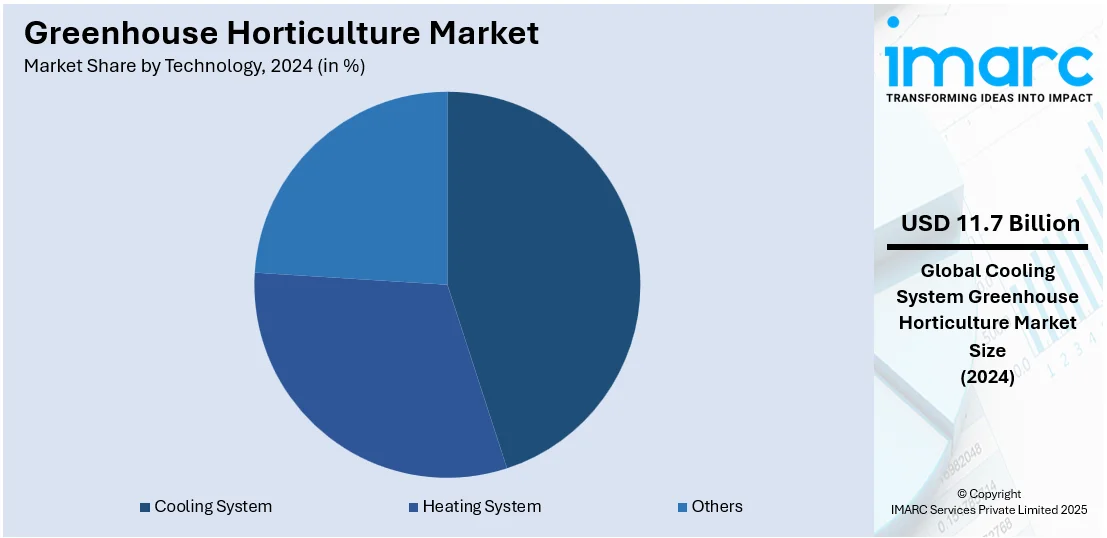

Analysis by Technology:

- Heating System

- Cooling System

- Others

Cooling system leads the market with around 35.0% of the market share in 2024. Greenhouses create controlled environments that can sometimes lead to heat buildup, especially in regions with high ambient temperatures. The cooling system addresses this challenge by regulating the internal climate, preventing excessive heat stress, and ensuring plants receive the ideal conditions for growth. Efficient cooling systems, such as evaporative cooling and fan ventilation, enhance air circulation and temperature moderation, preventing heat-related damage and enhancing photosynthesis. These systems effectively lower temperatures while managing humidity levels, reducing the risk of diseases and improving overall crop quality. Furthermore, as greenhouse horticulture expands into diverse climates, the demand for cooling technologies has grown significantly. The ability to tailor cooling systems to specific regional requirements has positioned them as indispensable components of modern greenhouse infrastructure, thereby propelling the greenhouse horticulture market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 40.0%. One key factor is the continent's highly variable climate, which necessitates innovative approaches to ensure consistent crop production. Greenhouse horticulture offers a solution by providing controlled environments that shield crops from unpredictable weather conditions, enabling year-round cultivation of a wide range of crops. Furthermore, Europe's population density and limited available arable land have prompted the adoption of intensive agricultural practices. Greenhouses enable efficient land use through vertical farming and optimized cultivation, maximizing crop yields in limited spaces. Stringent food safety and quality regulations in Europe align well with greenhouse horticulture's ability to reduce pesticide usage, control inputs, and ensure traceability. This resonates with consumers' demands for safe and sustainable produce, thereby offering a favorable greenhouse horticulture market outlook.

Key Regional Takeaways:

United States Greenhouse Horticulture Market Analysis

In 2024, the US accounted for around 87.50% of the total North America greenhouse horticulture market. The greenhouse horticulture market in the United States is expanding due to rising demand for fresh, locally grown produce and advancements in controlled-environment agriculture (CEA). In line with this, increasing consumer awareness of food safety, organic farming, and pesticide-free crops is fueling growth. According to USDA, certified organic cropland increased by 79% to 3.6 Million acres from 2011 to 2021. Certified organic farms also grew by over 90% to 17,445, with conventional grocery retailers, including club stores and supercenters, surpassing natural food stores by 2020, accounting for 56% of organic food sales. Furthermore, hydroponic and vertical farming techniques are gaining traction in the market as growers seek higher yields while conserving resources including water and land. Besides this, favorable government initiatives promoting sustainable agriculture and reducing carbon footprints further support market expansion. Moreover, continual technological advancements, including AI-driven climate control systems and LED lighting, are improving production efficiency and enabling year-round cultivation of crops such as tomatoes, cucumbers, leafy greens, and berries. However, challenges such as high initial investment costs and energy consumption persist, driving research into cost-effective, energy-efficient solutions to enhance greenhouse operations.

Europe Greenhouse Horticulture Market Analysis

Europe remains at the forefront of the greenhouse horticulture sector, supported by advanced infrastructure, strict pesticide regulations, and growing consumer demand for sustainably produced food. Furthermore, the domination of countries including the Netherlands, Spain, and Germany due to extensive greenhouse cultivation, automation, and high-tech climate control systems is propelling the market expansion. The Netherlands leads in greenhouse technology, leveraging hydroponic farms, precision agriculture, and energy-efficient greenhouse designs. Research shows that vertical farming with modern hydroponics in Dutch urban areas increases crop productivity by 40% while reducing water use by 60% compared to conventional farming. Additionally, increasing investments in smart greenhouses incorporating renewable energy, AI, and real-time monitoring continue to drive product efficiency and yield improvements. As such, in 2024, Berlin-based agtech hexafarms secured EUR 1.3 Million in pre-seed funding, bringing its total funding to over EUR 2.5 Million. Hexafarms uses AI to optimize greenhouse production, processing 9 Million kg of strawberries and tomatoes quarterly, with a goal to reduce variable costs by 30% and increase seasonal harvests by 30%. Apart from this, European Union policies promoting carbon-neutral and sustainable farming practices are shaping market trends, while challenges such as rising energy costs drive interest in geothermal heating and solar-powered greenhouses.

Asia Pacific Greenhouse Horticulture Market Analysis

The Asia Pacific market is growing rapidly, driven by population growth, urbanization, and increasing demand for high-quality food. The Population Reference Bureau reports that Asia, the world’s most populous region, will see its population rise 10% by 2050, reaching 5.3 Billion from 4.8 Billion in 2024. Countries such as China, Japan, South Korea, and India are heavily investing in greenhouse technologies to enhance food security and address land scarcity. In China, government initiatives support greenhouse farming as part of agricultural modernization, while Japan integrates robotics and AI into precision farming for optimized crop management. In India, unpredictable climate patterns and the demand for off-season crops are accelerating greenhouse adoption. Additionally, hydroponic farming is advancing in developed markets such as Australia and South Korea, though affordability remains a barrier for small farmers. Moreover, rising energy costs and limited access to technology challenge adoption in developing regions, though government subsidies and research initiatives are helping to close the gap.

Latin America Greenhouse Horticulture Market Analysis

Latin America's greenhouse horticulture market is steadily growing, propelled by high-value crop exports such as tomatoes, peppers, and berries to North America and Europe. In accordance with this, Mexico, Brazil, and Chile lead the sector, benefiting from favorable climates and increased foreign investments. Mexico's agriculture industry is expanding significantly which in turn is driving the market for greenhouse horticulture, as such Mexico is supplying fresh produce to the U.S., with 2024 tomato production projected at 3.30 Million metric tons (MMT), a 2% rise from 2023, according to USDA. The U.S. remains Mexico’s top export market, receiving 1.82 MMT of tomatoes worth USD 2.7 Billion in 2023. Around 66% of Mexico’s tomato production occurs in greenhouses. Similarly, advanced hydroponic and semi-automated greenhouse systems are gaining traction in the market, though economic instability and high costs pose challenges. Moreover, increasing demand for organic produce is driving eco-friendly solutions including water-efficient irrigation and solar-powered greenhouses.

Middle East and Africa Greenhouse Horticulture Market Analysis

The Middle East and Africa market is growing attributed to food security concerns, extreme climate conditions, and water scarcity. In 2023, an FAO report stated that 66.1 Million individuals in the Arab region faced hunger, while 186.5 Million experienced moderate or severe food insecurity. Furthermore, the UAE and Saudi Arabia are investing in hydroponic and climate-controlled greenhouses to reduce dependence on food imports and counter harsh desert conditions. Besides this, in Africa, greenhouse horticulture is expanding in Kenya and South Africa to support both domestic markets and exports. However, limited capital, high energy costs, and inadequate infrastructure remain challenges. Moreover, ongoing innovations in solar-powered and low-energy greenhouses, alongside growing government and private sector support, are driving market expansion.

Competitive Landscape:

Leading companies are investing significantly in research and development to innovate new greenhouse technologies, improved growing substrates, and advanced cultivation techniques. This fosters the development of more efficient, resource-conscious, and high-yield greenhouse systems. Additionally, key players are at the forefront of integrating automation, Internet of Things (IoT), and artificial intelligence (AI) technologies into greenhouse operations. These innovations allow for real-time monitoring, precise climate control, and data-driven decision-making, resulting in enhanced productivity and resource optimization. Other than this, numerous industry leaders prioritize sustainable practices by implementing energy-efficient designs, using renewable energy sources, and reducing water consumption. These initiatives resonate with consumers and align with global environmental goals. Besides this, key players are expanding the variety of crops grown in greenhouses, catering to changing consumer preferences. This diversification includes not only traditional fruits and vegetables but also herbs, ornamental plants, and specialty crops. In line with this, global greenhouse horticulture leaders are actively expanding their presence into emerging markets. By partnering with local growers, they contribute to technology transfer and knowledge exchange, fostering the adoption of modern greenhouse practices in new regions.

The report provides a comprehensive analysis of the competitive landscape in the greenhouse horticulture market with detailed profiles of all major companies, including:

- Agra Tech Inc.

- Argus Control Systems Limited

- Certhon

- Dalsem

- Heliospectra

- Industries Harnois

- Keder Greenhouse

- LOGIQS B.V.

- Netafim (Orbia)

- Priva

- Richel Group

- Ridder

Latest News and Developments:

- February 2025: Ledgnd opened a second office in Utrecht, expanding its role in greenhouse horticulture. MyLedgnd grew by 114% in 2024, integrating climate and plant feedback data. New functionalities include daily reports and plant condition sensors, enhancing yield optimization, cost reduction, and climate monitoring for growers.

- February 2025: BASF introduced industrial compostable plant clips made from ecovio® 60 IA 1552 for greenhouse horticulture. These clips biodegrade in industrial composting, reducing microplastic waste. Renewi’s tests confirm successful processing. The material offers durability, cost-effective disposal, and supports sustainable farming by integrating into organic recycling systems.

- September 2024: Inagro and Urban Crop Solutions launched a vertical farming tower at Agrotopia, integrating LED lighting and natural sunlight for greenhouse horticulture. The system optimizes space and supports urban agriculture. Ghent University will validate irrigation and lighting models, with initial trials on leafy greens, strawberries, and microgreens.

- June 2024: Albotherm and Lumiforte announced a collaboration to develop a heat-activated, seasonal shade coating for greenhouse horticulture. This smart material adjusts opacity with temperature, optimizing light and shade. Trials aim to validate performance, with past tests showing up to 34% yield increase and 18% higher light levels.

- March 2024: Kyushu University, Carbon Xtract, ZEN-NOH, Sojitz, and MUFG Bank partnered to implement m-DAC devices in greenhouse horticulture. These membrane-based DAC systems capture atmospheric CO2, enhancing crop yields and decarbonizing agriculture. Trials at ZEN-NOH aim to scale adoption across Japan while generating carbon credits.

Greenhouse Horticulture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered | Glass, Plastic |

| Crop Types Covered | Fruits and Vegetables, Flowers and Ornamentals, Nursery Crops, Others |

| Technologies Covered | Heating System, Cooling System, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agra Tech Inc., Argus Control Systems Limited, Certhon, Dalsem, Heliospectra, Industries Harnois, Keder Greenhouse, LOGIQS B.V., Netafim (Orbia), Priva, Richel Group, Ridder, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the greenhouse horticulture market from 2019-2033.

- The greenhouse horticulture market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the greenhouse horticulture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The greenhouse horticulture market was valued at USD 33.43 Billion in 2024.

IMARC estimates the greenhouse horticulture market to exhibit a CAGR of 7.63% during 2025-2033, reaching a value of USD 69.73 Billion by 2033.

The market is driven by rising food security concerns, climate change resilience, urban land constraints, technological advancements in controlled environment agriculture, and growing consumer demand for fresh, pesticide-free, and locally grown produce.

Europe currently dominates the greenhouse horticulture market, accounting for a share exceeding 40.0%. This dominance is fueled by climate variability, limited arable land, stringent food safety regulations, and consumer preference for sustainable farming practices.

Some of the major players in the greenhouse horticulture market include Agra Tech Inc., Argus Control Systems Limited, Certhon, Dalsem, Heliospectra, Industries Harnois, Keder Greenhouse, LOGIQS B.V., Netafim (Orbia), Priva, Richel Group, and Ridder, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)