Green Tea Market Size, Share, Trends and Forecast by Type, Flavor, Distribution Channel, and Region, 2025-2033

Green Tea Market Size & Share:

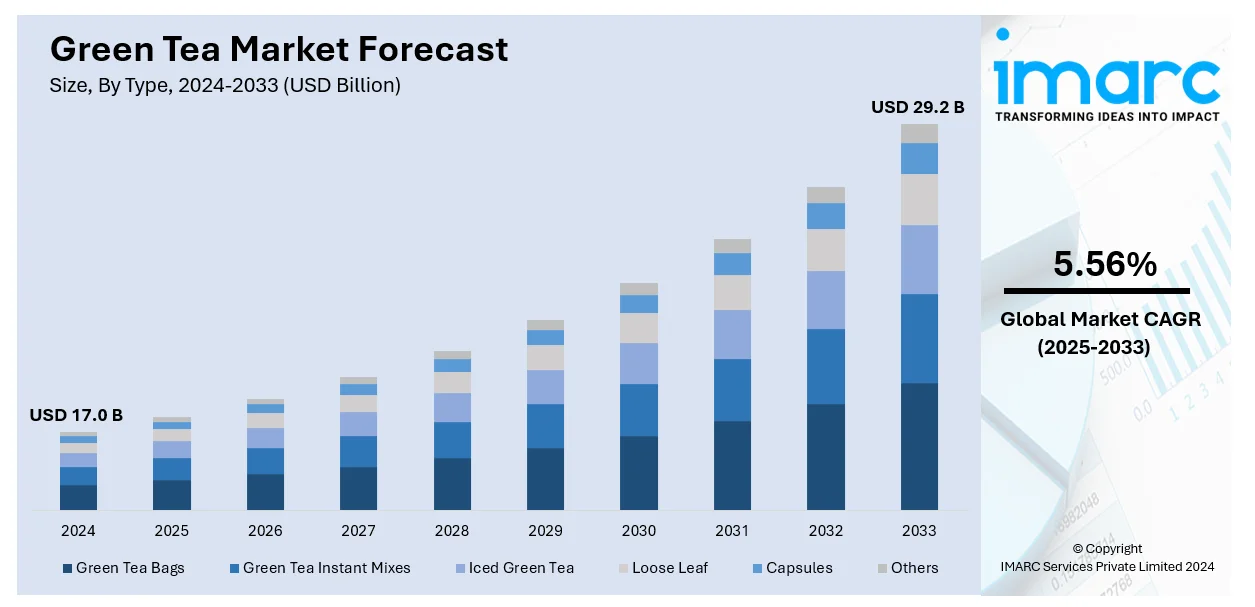

The global green tea market size was valued at USD 15.1 Billion in 2022. Looking forward, IMARC Group estimates the market to reach USD 29.2 Billion by 2033, exhibiting a CAGR of 5.56% from 2025-2033. Asia Pacific currently dominates the market in 2024. The green tea market share is growing due to the health and wellness trends, increased awareness about green tea benefits among consumers, recent product innovations, globalization of tea culture, and increased disposable incomes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.0 Billion |

|

Market Forecast in 2033

|

USD 29.2 Billion |

| Market Growth Rate 2025-2033 | 5.56% |

The green tea market is influenced by several key drivers, with health and wellness trends at the forefront. In a quest to live a healthier lifestyle, the consumption of green tea, associated with multiple perceived health benefits, has experienced significant growth as it is also full of antioxidants like catechins, attributed to metabolism increase, heart support, improved cognitive performance, and anti-inflammatory benefits. The growing preference for natural and organic products further supports the rise of green tea, since it is mostly perceived as a healthier alternative to sugary sodas or caffeinated drinks. Market innovations in terms of product offerings also drive this market. In today's fast-paced lifestyles, ready-to-drink green tea and convenient tea bags are increasing the green tea demand among consumers. Additionally, flavored green tea and organic and premium varieties appeal to a multitude of tastes. Growing consumer interest in sustainability and the environment has boosted demand for 'green' ethically sourced green tea, thereby expanding the green tea market value. Online shopping and healthy food stores' global expansion also made green tea more accessible for penetration into markets of all kinds around the world.

The United States emerged has a key regional market for green tea, owing to increasing consumer health-consciousness. Growing demand for the beverage has been registered with awareness about the health advantages such as metabolic enhancement, antioxidants, and cardiac support from the consumption of green tea. Increasing desire for natural organic, low-calorie beverages also enhances demand for green tea in the US market as an alternative to sugary drinks and sodas. Ready-to-drink green tea products, as well as flavored and organic offerings, are on the rise due to their convenience and diverse flavor profiles. Additionally, the culture of wellness, fitness, and sustainable products adds to the green tea market growth in the U.S., thus making it a staple in health-focused retail sectors.

Green Tea Market Trends:

Emerging health and wellness trends

Consumers are becoming more conscious of their diet and its impact on health, influencing the green tea market trend. In this regard, the high adoption of green tea, which is rich in antioxidants and bioactive compounds that improve brain function, aid in weight loss, reduce the risk of heart disease, and lower the risk of certain types of cancer, is boosting the market growth. For example, global tea consumption increased by 2.0% in 2022, primarily due to the rising demand for green tea. Additionally, the cumulative switch toward healthy lifestyles in which consumers are substituting old-fashioned drinks such as coffee and black tea with green tea is leading the market growth. Moreover, the rising lifestyle diseases, including obesity and diabetes, have encouraged consumers to switch to more healthy products like green tea. This in turn is creating an optimistic outlook for the market.

Increasing consumer awareness about green tea benefits

There is rising consumer awareness about the health benefits of green tea, which is being amplified by scientific research and in the media, as well as by marketing efforts, thereby increasing the green tea market share. Recent studies that specify the benefits of green tea have demonstrated its improved brain function, antioxidants that may show potential in reducing the risk of different cancers, a raised metabolic rate, and reduction of cardiovascular diseases, thus increasing the market. WHO has projected that the global cancer burden is likely to increase by 77%, and in 2050, more than 35 million new cases are expected, whereas in 2022, there will be only 20 million. Moreover, health blogs, wellness magazines, and social media have spread awareness about the potential health benefits of the product. Apart from this, aggressive marketing campaigns by green tea manufacturers, which are mainly focused on the natural and health-promoting characteristics of green tea, are also fueling the growth of the market.

Innovation in product offerings

Recent innovations in product offerings, such as the introduction of a range of natural flavors, including lemon, honey, mint, and jasmine, are also fueling the growth of the market. The development of RTD green tea beverages supports the growth in the market. This is further supported by a busy lifestyle coupled with the needs of consumers who are often out and about for healthy beverage choices. The innovations in products in the form of sweetened and unsweetened green teas and energy drinks based on green tea positively influence the market growth. Besides this, the high use of green tea-based products in the health and beauty industries is acting as another growth-inducing factor. Also, the production of organic and sustainably made green tea products, which cater to the rising demand for eco-friendly and morally produced products, is favoring the market growth.

Rapid globalization of tea culture

The globalization of tea culture across several reasons, that are increased travels in the modern world, increasing intercultural communications, the presence of Asians, and the spread of Asian-related customs in most Western countries and the like, continues to drive forward market growth. Increasing exposure in general to alternative food and drink (F&B) cultures, from the consumption customs around tea up to the beverage of green, which formerly wasn't familiar in those nations, is advancing market growth. Furthermore, the rising number of specialty tea shops and cafes, which offer a variety of green teas, introducing consumers to its diverse flavors and forms, is catalyzing market growth. According to reports, the growing number of tea shops reflects the expansion of the 523 coffee & tea production businesses operating as of 2023, highlighting increasing consumer demand. The evolution of Asian pop culture through films, television shows, and social media channels also pushes the market toward more extensive adoption as well as further interest in green tea.

Rising disposable incomes

The increase in disposable income has allowed more people to have better financial resources, which they can use to spend on less necessary goods like premium beverages such as green tea. For example, disposable incomes are expected to be up 2.6% globally in 2022 and are driving increased household spending and economic activity. In addition, the rapid pace of economic growth, which gives rise to an emerging middle class in regions that traditionally tea-consuming cultures supports the market growth. There is also a gradual shift toward premium green teas. Consumers increasingly are looking for products that give the impression of better status or convey perceived health benefits, thus further driving the growth of the market. Additionally, increasing disposable income allows consumers to try different kinds of green tea, such as organic and imported, which typically have a higher price point than basic black tea or lower-quality green teas.

Green Tea Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global green tea market, along with forecast at the global, and regional levels from 2025-2033. The market has been categorized based on type, flavor, and distribution channel.

Analysis by Type:

- Green Tea Bags

- Green Tea Instant Mixes

- Iced Green Tea

- Loose Leaf

- Capsules

- Others

Green tea bags hold the largest market share as they are convenient, easy to use, and allow the consumer to consume green tea without the hassle of measuring and steeping loose leaves. In addition, green tea bags are preferred for their consistency in quality and flavor, thereby ensuring a consistent experience with each cup. Besides this, the easy availability of organic and specialty green tea bags, which claim to offer superior health benefits and more refined flavors, is boosting the market growth. Additionally, the ease of distribution and storage, coupled with the long shelf life of green tea bags, which makes them a popular choice in both retail and online markets, is acting as another growth-inducing factor. Instant green tea mixes cater to customers wanting a more convenient version than the usual tea bags. They usually come in the form of powder or granules that can easily dissolve in hot or cold water to give a rapid green tea. Additionally, instant mixes can be added to smoothies and shakes and even into recipes as it is highly versatile. Iced green tea is a refreshing alternative to traditional hot tea and caters to a demographic seeking both hydration and the health benefits of green tea. It is available in various forms, including ready-to-drink (RTD) bottles, concentrates, and brew-it-yourself kits. Furthermore, the introduction of sparkling iced green teas and diced green tea-infused beverages is driving the market growth. The loose-leaf green tea is suitable for the traditionalists and enthusiasts of tea who would like to hold onto a more authentic experience of brewing the tea. It comes with many good quality green teas such as single-origin and artisanal blends. Loose-leaf green tea offers a more complete and richer flavor profile compared with tea bags or instant mixes as the leaves are allowed to fully expand and release the aroma and flavors to the fullest. Green tea capsules are a growing segment of health-conscious consumers looking for an easy way to add green tea benefits to their diet. These capsules consist of green tea extract and, in most cases, are promoted as dietary supplements, providing the consumer with a concentrated dose of the antioxidants that are found in green tea, such as catechins.

Analysis by Flavor:

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Wild Berry

- Jasmin

- Basil

- Others

Lemon green tea dominates the market as it is consumed for its refreshing taste and perceived health benefits. The zesty flavor of lemon nicely balances the bitter taste of green tea, combining to provide an appealing blend acceptable to many types of consumers. Additionally, lemons have many vitamin C elements and are thus associated with strengthening the immune system and detoxification, adding much to the product's health attraction. Apart from this, it comes in a variety of forms such as tea bags, loose leaf, and ready-to-drink (RTD) preparations that allow it to reach a wider consumer base. Furthermore, the awareness about the fact that lemon tea can be taken both hot and cold depending on the preferences and seasonal requirements is helping in strengthening green tea market growth. Aloe vera green tea is soothing and healing, especially for the skin and also in terms of digestion. It provides a refreshing flavor with potential wellness in the end. Furthermore, the aloe vera flavor specifically appeals to health-conscious consumers who know its medicinal properties. The flavor is a spicy, warming cinnamon combined with the fresh taste of green tea. It appeals to those who find enjoyment in a stronger and more aromatic tea experience. In addition, cinnamon has long been recognized as having potential health benefits, including blood sugar regulation and anti-inflammatory properties, providing further complementary health benefits to the antioxidant benefits present within green tea. The delighting smooth and sweet profile of vanilla with the natural earthiness of green tea endows a comforting yet sophisticated blend that appeals to those consumers with a preference for a milder, sweeter experience of tea, thereby serving as an introduction to green tea. Besides, this is a perfect choice for relaxation at any time in the afternoon or evening with a rather subtle, dessert-like flavor and without added calories. Wildberry green tea combines a mix of berry flavors, such as raspberry, blueberry, and blackberry, with green tea, resulting in a refreshing and antioxidant-rich beverage. Furthermore, the tart and sweet notes of the berries complement the natural astringency of green tea, creating a balanced and flavorful drink. It is widely popular among consumers looking for a refreshing and naturally sweet tea option. Jasmine green tea flavor is achieved by infusing green tea leaves with jasmine flowers, a process that imparts a subtle, sweet fragrance to the tea. It is highly regarded for its soothing properties and is often consumed for relaxation and stress relief. Moreover, the floral notes of jasmine create a luxurious and sensory tea-drinking experience, appealing to consumers who appreciate more refined and sophisticated flavors. Basil green tea is the refreshing taste of green tea blended with the aromatic and slightly sweet notes of basil. This brew offers anti-inflammatory and antibacterial properties and is therefore beneficial to health. It is one of the favorite flavors for people who love experimenting with different tastes and herbal teas.

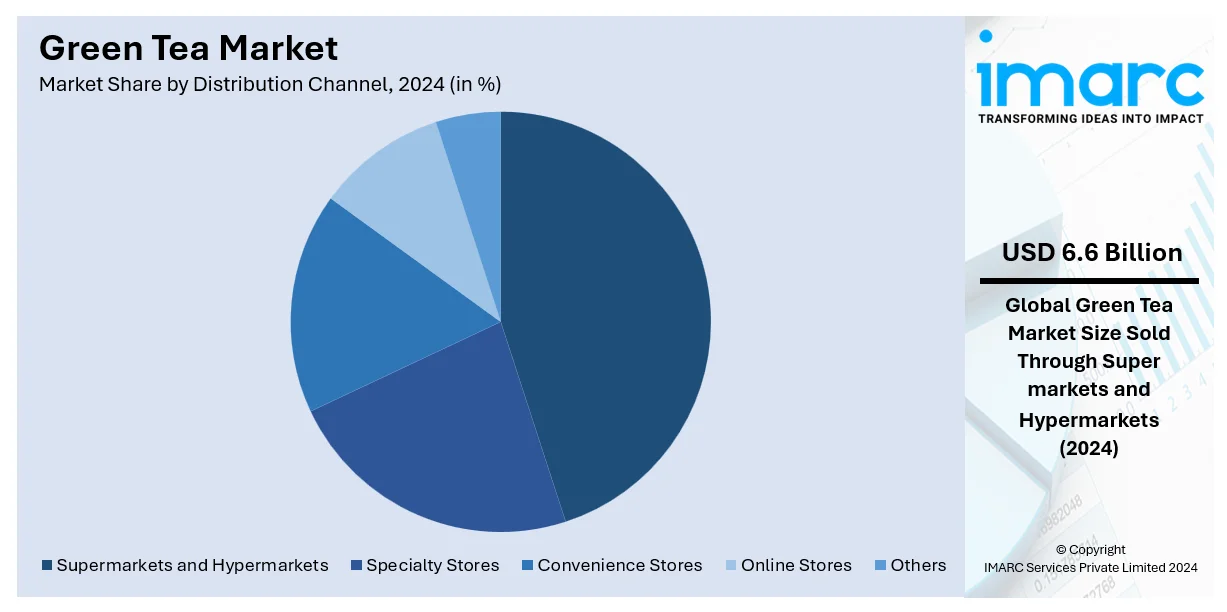

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets dominate the market as they provide one-stop destinations for consumers, which offer a wide range of green tea from low to high prices. They usually have a section for teas and healthy beverages that make it easy for consumers to find and discover different types of green tea. Furthermore, supermarkets and hypermarkets also benefit from economies of scale, enabling them to offer competitive pricing, discounts, and promotions, which are attractive to price-sensitive customers. Besides this, the presence of knowledgeable staff that can assist in guiding consumers, particularly those new to green tea, is bolstering market growth. Specialty stores are available for consumers looking for a more curated and premium tea experience. They specialize solely in tea and associated products and provide a range of high-quality, artisanal, and niche green tea varieties not typically found in mass retail environments. In addition, specialty stores are known for their expertise in tea, allowing customers to be richly educated through knowledgeable staff, tea tastings, and recommendations. Convenience stores are attractive to consumers who wish to quickly gain access to a product. They are also located in such areas as stations, streets within cities, and near offices to have easy access on the go, spontaneously, or when needed. Additionally, these convenience stores stock ready-to-consume green tea drinks, green tea bags, and instant tea mixes to provide for the impatient consumer who does not have ample time to indulge in the whole process. Online stores target tech-savvy customers who want to shop from the comfort of their homes or offices. They offer a wider range of green tea products daily brands to exotic and premium ones than that offered in the physical stores. Besides this, the convenience of easy browsing, comparison of products and prices, and reading customer reviews add to the appeal of online shopping.

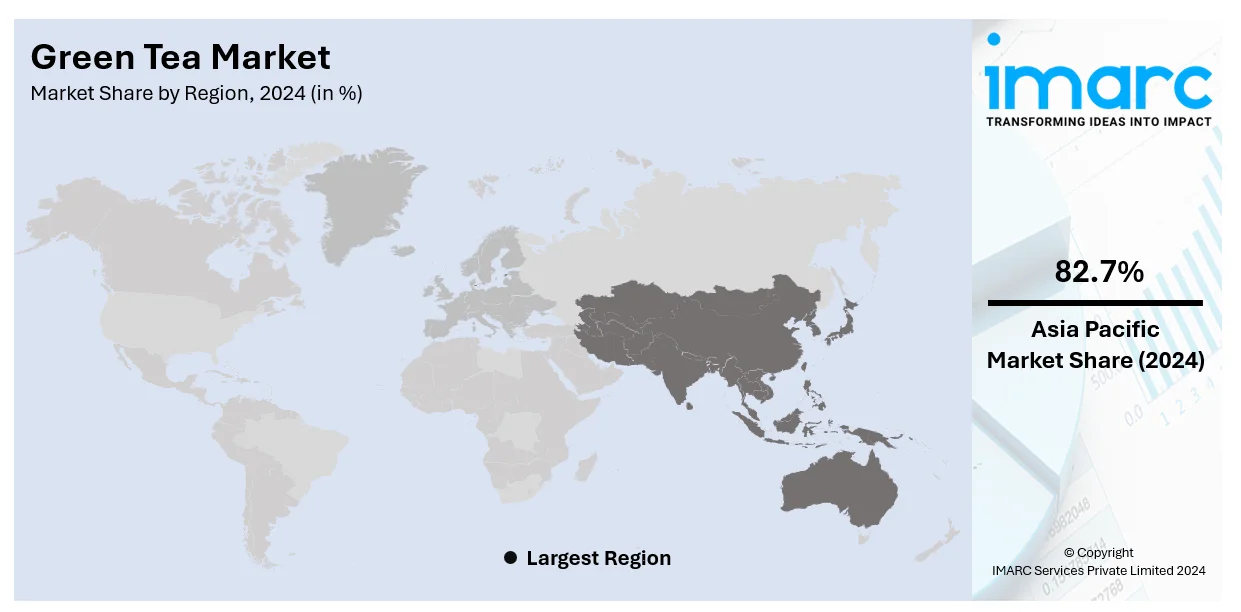

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific leads the market as it has a long tradition and cultural significance for green tea and is an added factor that considerably drives its high levels of consumption. Moreover, Asia Pacific is also the world's largest producer of green tea which supports local consumption along with substantial volumes exported. Apart from this, an increased awareness regarding the health advantages of green tea is driving the population in the Asia Pacific region toward healthy beverages and thereby fueling the market. Additionally, growth in disposable incomes is allowing customers to spend more on health-building products such as green tea and hence is fueling the growth of the market. Besides this, the ready availability of a broad range of green tea products in the region, from traditional loose-leaf teas to modern, flavored, and ready-to-drink formats, is further boosting market growth.

Green tea has recently gained much prominence in North America, due to increasing consumer awareness about its health benefits, including antioxidant properties, weight management, and improved heart health. This shift in preference is part of an overall trend toward healthier lifestyles and natural beverage preferences. As people increasingly look to alternatives to sweetened sodas and calorie-intensive drinks, ready-to-drink green tea in particular has increased in popularity. The trends are further compounded by innovations within flavored, organic, and functional green teas to position it as a go-to beverage in the health-conscious community.

Green tea markets are gaining ground in Europe due to consumer attraction toward more natural, wholesome beverage ingredients. This shift in eating and drinking healthier is propelling the demand for green tea with a premium, organic, and specialty angle. Consumers are developing an interest in unique green tea blends that combine flavors of jasmine, mint, and citrus. A well-identified emphasis on wellness and sustainability in the region is further nudging the use of green tea as a healthy, low-calorie alternative to sugary drinks. The increased availability of these products is also fueling the growing popularity of the same.

In Latin America, the market for green tea is experiencing gradual yet consistent growth as people within the region opt for a healthy lifestyle. Along with interest in wellness, weight management, and natural products, people are seeking the beverage green tea, known to boost metabolism and promote well-being. Awareness about the beverage's antioxidant properties is also causing the beverage to penetrate retail channels increasingly. In addition, the demand for organic and ready-to-drink green tea products increases, reflecting a trend toward more functional and natural beverages in the region. More health-conscious people will keep on this track and continue their desire for functional beverages.

The green tea market is growing at a moderate rate in the Middle East and Africa. Increasing health awareness and the need for natural, functional beverages are significant drivers for this trend. As consumers are becoming more health-conscious, green tea is gaining recognition for its various potential benefits, such as weight loss support, improved digestion, and enhanced immune function. Premium and flavored green tea products are also in demand in the region. Moreover, the popularity of herbal teas in traditional cultures is paving the way for the growth of green tea as part of the wellness-focused movement in the region.

Key Regional Takeaways:

United States Green Tea Market Analysis

The significance of health and wellness has further increased the demand for green tea, especially among customers seeking healthy remedies and functional beverages. In fact, according to reports, as 50 percent of Americans actively seek healthier eating habits, a more pronounced and evolving health and wellness trend is thus fueling the adoption of green tea, popular for health benefits such as antioxidants and metabolism support. The increased demand for antioxidant-rich beverages is in line with the consumer's desire to live healthier and reduce stress. Green tea is now consumed hot, iced, or even mixed into smoothies, making it accessible to a wide range of consumers. Wellness bloggers and fitness enthusiasts often promote green tea as a detoxifying agent, which increases its adoption rate. Cafes and restaurants are also introducing innovative green tea-based beverages to cater to the changing preferences of health-conscious customers. As lifestyle choices that benefit physical and mental well-being become increasingly important for consumers, green tea adoption will continue to be strong, thus becoming a must-have for healthy lifestyles.

Europe Green Tea Market Analysis

As green tea assumes the image of a functional drink, it could reduce the threat of chronic problems. Reports indicated that with 30% suffering from chronic allergies in the European Union, health benefits associated with green tea enable the adoption rate, giving them relief and more popularity in terms of chronic management. The bioactive compounds of the beverage, particularly catechins, are known for their antioxidative and anti-inflammatory properties that help improve heart health and protect cells. Public awareness campaigns focusing on preventive health measures have been the main factor in popularizing the inclusion of green tea in daily diets. Green tea-infused supplements and beverages that are marketed for their health benefits are available in health stores and wellness centers. These further cements its place in preventive care practices due to its role in holistic health regimes. With awareness about the potential of this beverage to mitigate diseases, it has been welcomed by those preferring long-term solutions for health instead of medication.

Asia Pacific Green Tea Market Analysis

E-commerce and online shopping have greatly revolutionized the accessibility of green tea and hence, increased its adoption greatly. For example, with 300 Million shoppers in India, the 2023 e-commerce platforms' growth has increased the adoption of green tea due to their increased access. Digital storefronts have made shopping easier and available for the many green tea options available which includes, loose leaves and sachets to matcha powders. Online retailers tend to describe the product in detail along with customer reviews that aid purchase decisions. Additionally, e-commerce retailers tend to offer subscription-based models and promo discounts to enhance consumption consistency. Social media campaigns and collaborations with influencers further enhance the visibility and awareness about green tea varieties. In these, consumers become more exposed to unique flavors and one-of-a-kind benefits. These ideas culminate in enhancing people's ability to try premium blends and international variants, enabling greater cultural acceptance of green tea. With an increasingly digitally connected world, the fluid nature of the availability of green tea continues to propel it into the habit of daily life.

Latin America Green Tea Market Analysis

Growing disposable incomes have led to increased consumption of green tea among premium and health-conscious beverage consumers. For example, disposable incomes in Latin America are likely to rise by nearly 60% in real terms from 2021 to 2040. The higher cash means that there is an opportunity for innovation in blending artisanal and high-quality tea for different tastes. Green tea is nowadays also a status symbol at social events where one showcases the taste for sophisticated and wellness-related products. Specialty tea houses and gourmet tea packages are on the up, as experienced purchasers put their money into experiential purchases. Such trends add value and broaden the horizons of green tea, helping bring it to everyday consumption.

Middle East and Africa Green Tea Market Analysis

Globalization of Tea Culture Green Tea Market Analysis Tourism, mainly, is another reason behind the increased adoption of green tea, as globalization has introduced the whole concept of tea culture to every tourist. For example, Dubai received an impressive 14.96 Million overnight visitors between January and October 2024, up 8% from the same period in 2023, which was indicative of tourism growth. Visitors are also introduced to cultural heritage sites, tea plantations, and wellness retreat experiences, where they get to see the local way of drinking tea and different types of green tea. These experiences usually become long-term consumption behaviors upon return. Green tea is widely exhibited in hotels, cafes, and gift shops. This kind of exposure increases interest and appreciation for green tea, making it an even more popular beverage that appeals to the whole world.

Competitive Landscape:

Green tea market players are actively engaging in several strategies to benefit from the rising demand and increase their market presence. One of the main activities is product innovation, which has been used to enhance the products and expand their range in terms of the varied preferences of consumers. Functional blends contain ginger or turmeric to offer additional health benefits. Organic and premium green tea is also the focus for health-conscious and eco-aware consumers. Another significant activity is the growth of ready-to-drink green tea products, which cater to the convenience-driven lifestyles of modern consumers. Major brands are investing in packaging innovations and creating eco-friendly, sustainable packaging to appeal to environmentally conscious buyers. In addition, market players are expanding their distribution networks by partnering with retail chains, health food stores, and e-commerce platforms to reach a broader customer base. In addition, the company is leveraging wellness influencers and health-focused campaigns to promote the benefits of green tea, thereby driving brand awareness and customer engagement. Sustainability and ethical sourcing are increasingly important in the strategies of leading green tea companies, focusing on transparent, fair-trade practices to attract a conscientious consumer base.

The report provides a comprehensive analysis of the competitive landscape in the green tea market with detailed profiles of all major companies, including:

- AMORE Pacific Corp

- Arizona Beverage Company

- Associated British Foods LLC

- The Coca-Cola Company

- Tata Global Beverages

- Unilever

- Cape Natural Tea Products

- Celestial Seasonings

- Finlays Beverages Ltd.

- Frontier Natural Products Co-Op.

- Hambleden Herbs

- Hankook Tea

- Honest Tea, Inc.

- ITO EN

- Kirin Beverage Corp.

- Metropolitan Tea Company

- Northern Tea Merchants Ltd

- Numi Organic Tea

- Oishi Group Plc.

- Oregon Chai Inc.

- Yogi Tea

Latest News and Developments:

- December 2024: Afghanistan reportedly opened a green tea plantation in Khost province to increase production in the country, according to the Bakhtar news agency. The pilot project in the Gurbuz district aims to decrease the country's annual $50 million imports of tea. Experts supervise cultivation and processing to support farmers and boost domestic tea production.

- December 2024: Zapp, the 60ml energy drink, has been launched in India, providing a new energy solution in a blend of green tea. This innovative product will tap into the growing demand for convenient, natural energy boosters. It is expected to revolutionize the energy drink market and appeal to health-conscious consumers.

- December 2024: Luxury French tea house Mariage Frères has launched a new selection of seasonal teas, among which is the Balthazar Tea, inspired by "king cake" flavors, and the Year of the Snake tea. The latter contains a combination of green tea, mint, licorice, rose petals, and Himalayan goji berries. Both come in special packaging and cost at least £28 for 100g.

- December 2024: Califia Farms, a plant-based beverage company, is launching single-serve options for its popular matcha almond latte and chai almond latte. The matcha almond latte features matcha green tea powder and almond milk, with 40% less sugar than average coffee and tea blends. With 13 grams of sugar per serving, it offers a healthier alternative for green tea lovers.

- June 2024: Lipton has unveiled a revitalized green tea portfolio, including five new reformulated blends with flavors such as lemon and honey ginger, which are now available in the United States. Drinking two cups of Lipton Green Tea daily promotes health by providing the same number of flavonoids found in 20 pounds of cooked broccoli. The initiative falls under the "2 Cups to Goodness" campaign, encouraging people to stay healthy through convenient and delicious options.

Green Tea Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Green Tea Bags, Green Tea Instant Mixes, Ice Green Tea, Loose Leaf, Capsules, Others |

| Flavors Covered | Lemon, Aloe Vera, Cinnamon, Vanilla, Wild Berry, Jasmin, Basil, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | AMORE Pacific Corp, Arizona Beverage Company, Associated British Foods LLC, The Coca-Cola Company, Tata Global Beverages, Unilever, Cape Natural Tea Products, Celestial Seasonings, Finlays Beverages Ltd., Frontier Natural Products Co-Op., Hambleden Herbs, Hankook Tea, Honest Tea, Inc., ITO EN, Kirin Beverage Corp., Metropolitan Tea Company, Northern Tea Merchants Ltd, Numi Organic Tea, Oishi Group Plc., Oregon Chai Inc., Yogi Tea, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the green tea market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global green tea market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the green tea industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The green tea market was valued at USD 17.0 Billion in 2024.

The green tea market is projected to exhibit a CAGR of 5.56% during 2025-2033, reaching a value of USD 29.2 Billion by 2033.

The market is driven by growing health awareness, rising demand for antioxidant-rich beverages, increasing prevalence of lifestyle diseases, expanding product innovation with diverse flavors and formats, and a shift toward natural and organic products. Marketing campaigns and e-commerce growth further boost market expansion.

Asia Pacific currently dominates the green tea market, accounting for a share of 82.7% in 2024. The dominance is fueled by the strong tea-drinking culture, growing health consciousness, increasing disposable incomes, and the rising popularity of antioxidant-rich beverages.

Some of the major players in the green tea market include AMORE Pacific Corp, Arizona Beverage Company, Associated British Foods LLC, The Coca-Cola Company, Tata Global Beverages, Unilever, Cape Natural Tea Products, Celestial Seasonings, Finlays Beverages Ltd., Frontier Natural Products Co-Op., Hambleden Herbs, Hankook Tea, Honest Tea, Inc., ITO EN, Kirin Beverage Corp., Metropolitan Tea Company, Northern Tea Merchants Ltd, Numi Organic Tea, Oishi Group Plc., Oregon Chai Inc., and Yogi Tea, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)