Green Preservatives Market Size, Share, Trends and Forecast by Type, End Use Industry, and Region, 2025-2033

Green Preservatives Market Size and Share:

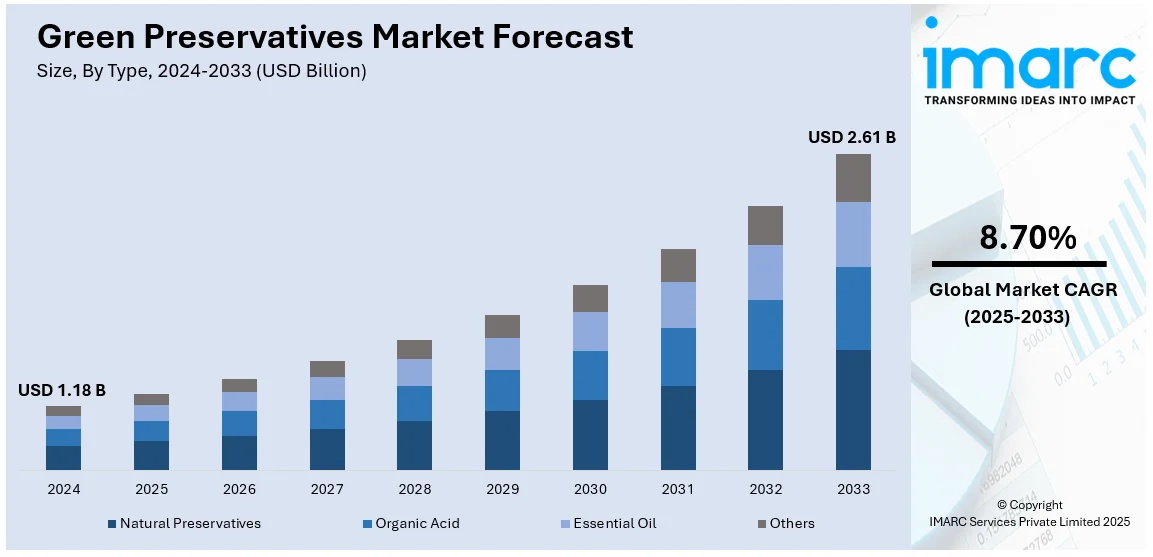

The global green preservatives market size was valued at USD 1.18 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.61 Billion by 2033, exhibiting a CAGR of 8.70% from 2025-2033. North America currently dominates the market. The increasing green preservatives market share in North America region is driven by the heightened focus on maintaining healthy eating patterns among people, rising demand for natural and sustainable ingredients in consumable items, and implementation of strict guidelines for synthetic preservative usage.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.18 Billion |

| Market Forecast in 2033 | USD 2.61 Billion |

| Market Growth Rate 2025-2033 | 8.70% |

The growing demand for non-toxic and natural ingredients in food products is pushing the market towards a brighter future. People are beginning to scrutinize product labels much more, seeking transparency over the origin of ingredients and what impact they may have on the environment and health. For this reason, manufacturers are also slowly gravitating towards clean label and plant-based or naturally derived preservation techniques and ingredients to serve these changing preferences. Alongside, food and beverage (F&B) sector is experiencing a heightened requirement of clean label products from the masses wherein green preservatives will ensure the shelf stability, thereby giving both safety and quality. Also, in the domain of cosmetics and personal care, brands are paying much attention to the application of natural antimicrobial agents that may be essential oils, organic acids, and botanical extracts so that the shelf life may get enhanced without dependency on synthetic chemicals.

The United States has become a significant area in the green preservatives sector owing to various reasons. To begin with, individuals in the nation are becoming aware of the negative effects associated with the use of synthetic preservatives in their everyday products and food items. The internet and government-organized campaigns serve as reliable sources that offer valuable insights and information on this topic. Moreover, individuals continuously seek transparency and straightforwardness in product formulations, favoring ingredients that are identifiable, natural, and devoid of synthetic chemicals. This trend is notably important in the F&B sector, where labels claiming "no artificial preservatives" or "crafted with natural ingredients" are becoming popular. Plant-derived green preservatives, including rosemary extract, tocopherols (natural Vitamin E), and organic acids like citric or lactic acid, are commonly utilized to meet this need. According to the projections of the IMARC Group, the food preservatives market in the United States is anticipated to hit USD 1,11.8 million by 2033. This will additionally heighten the demand for natural preservatives in the production of food products in the nation.

Green Preservatives Market Trends:

Increasingly High Consumer Desire for Products with Natural Ingredients and Clear Labeling

Demand for natural, clean-label products is supporting the growth of the market. With the increasing awareness about the potential health risks associated with synthetic preservatives, people are prioritizing products that use natural ingredients and are free from artificial additives. This trend is particularly pronounced in industries such as F&B, cosmetics, and personal care, where transparency and ingredient authenticity have become critical purchasing factors. In 2024, New Hope Network stated that 2023 sales of natural and organic products increased 4.8 percent to reach $209 billion. In response to this trend, companies actively launched products with green preservatives. For instance, in November 2023, Freund Corporation developed and launched the industry’s first eco-friendly food preservation Antimold-Mild® EF, made from biodegradable resin "BioPBS™". Similarly, in the cosmetics industry, AFFOREST launched India’s first jackfruit skincare range in 2024. The company manufactures each and every product with extracts from plants, herbs, and high performing plant-based alternatives. They avoid the inclusion of any byproduct of animals in their skincare items. These launches reflect how brands are leveraging green preservatives to enhance product appeal while addressing consumer concerns.

Stringent Regulatory Frameworks and Safety Concerns

The rising worries related to the use of synthetic preservatives and also the implementation of strict government regulations related to their usage are facilitating the spontaneous adoption of naturally derived green preservatives. Authorities like the U.S. Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) are tightening restrictions on synthetic preservatives such as parabens and formaldehyde-releasing agents due to their potential links to health issues such as endocrine disruption and carcinogenicity. These regulatory measures are requiring manufacturers to reformulate products with safer, eco-friendly alternatives. In 2024, Bayer launched Bepanthen’s product range in India, which is free from parabens and artificial fragrances. The product range comprises moisturizers and cleansers meant for both body and face. VLCC also launched India’s first serum facewash in 2024 with eight new serum variants. The products are dermatologically tested and also paraben-free. These examples highlight how compliance with safety standards is driving the green preservatives market forward.

Focus on Sustainability and Environmental Responsibility

The rising sustainability and environmental concerns are acting as a great catalyst for bolstering the green preservatives market growth. As people start gaining more understanding of climate change and ecological degradation, efforts are taken to minimize their ecological footprint. The synthetic preservatives, in most cases extracted from petrochemicals, pose a significant risk to the environment due to their inability to biodegrade and toxic byproducts. Besides this, green preservatives that are sourced from renewable sources are biodegradable and eco-friendly, which matches the vision of sustainable product development. As per a 2024 report by PwC, consumers are willing to spend 9.7% more on average for goods that are sustainably produced or sourced. This emerging consumer preference is pushing the industries to invest in green preservative solutions. For example, the cosmetics industry is increasingly sourcing preservatives from upcycled plant materials to ensure minimal waste. These launches highlight the fact that sustainability is now becoming a core driver for green preservative adoption.

Green Preservatives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global green preservatives market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, end use industry, and region.

Analysis by Type:

- Natural Preservatives

- Organic Acid

- Essential Oil

- Others

Natural preservatives come from natural sources and are utilized to prolong the shelf life of perishable items such as food, drinks, cosmetics, and other goods. These substances prevent deterioration from microbial growth, oxidation, or other forms of breakdown, ensuring products stay safe and appealing for consumption or use. Growing consumer desire for clean-label items, without artificial additives, is increasing the employment of natural preservatives in multiple sectors. Their use not just promotes healthier product recipes, but also conforms with increasing sustainability objectives in manufacturing. Progress in extracting and developing technologies is increasing the possibilities of natural substances, leading to new preservative solutions that meet the needs of today's consumers. The green preservatives market forecast suggests growth driven by the rising demand for natural and sustainable alternatives to synthetic preservatives, aligning with user preferences for cleaner, healthier products.

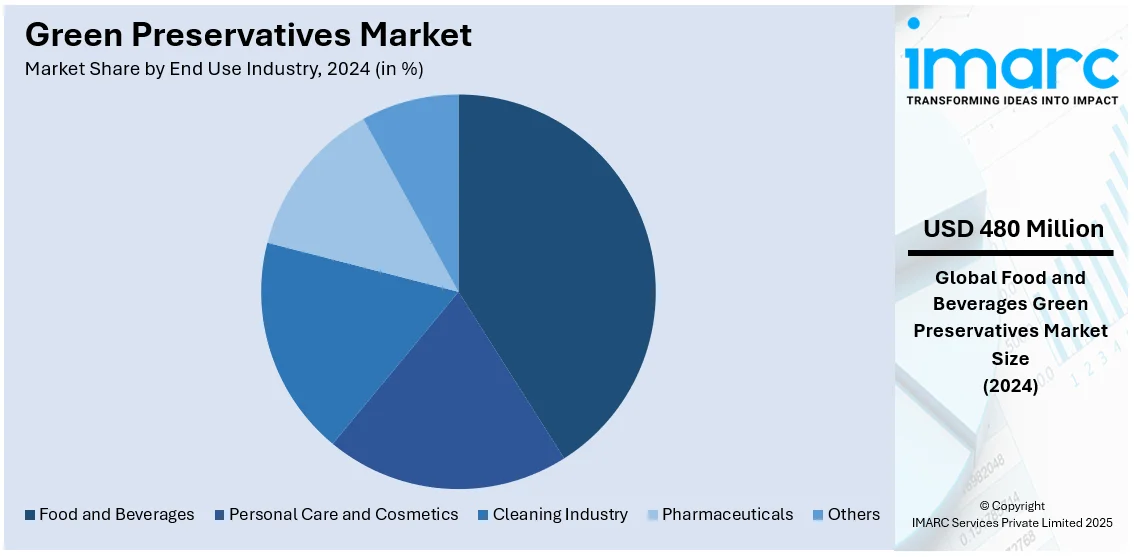

Analysis by End Use Industry:

- Food and Beverages

- Personal Care and Cosmetics

- Cleaning Industry

- Industrial Cleaning

- Household Cleaning

- Pharmaceuticals

- Others

The incorporation of green preservatives in food and beverages has become a notable trend in the market, fueled by increasing consumer demand for healthier, eco-friendly, and chemical-free options. Natural green preservatives, sourced from plants, microorganisms, and minerals, are gaining popularity as substitutes for synthetic additives. These natural options not only prolong the longevity of food and drinks, but also support clean-label efforts and sustainability goals. Consequently, green preservatives are increasingly embraced by producers looking to appeal to health-conscious and environmentally aware consumers. The use of green preservatives also applies to drinks, where natural antimicrobial substances such as citric acid and ascorbic acid (vitamin C) are commonly utilized to inhibit microbial spoilage and oxidation. Drinks such as juices, flavored waters, and plant-based beverages gain advantages from these additives, which assist in preserving freshness, color, and flavor for longer durations. Advancements in encapsulation and delivery methods are enhancing the efficacy of these natural preservatives, guaranteeing their stability and functionality in intricate food and beverage formulations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

The North American market is driven by the increasing demand for clean label and natural products among the masses. The change in user preferences is contributing to an increase in the adoption of natural preservatives such as plant extracts, essential oils, and organic acids instead of synthetic alternatives like sodium benzoate and potassium sorbate. As reported by C&EN, in 2024, the FDA revealed its intentions to implement a significant overhaul of its food division by revamping agency plans and placing a greater and more significant focus on the safety of chemicals incorporated into food products. Rules and food safety guidelines in North America are also crucial in enabling the rapid acceptance of eco-friendly preservatives. The FDA and various regulatory bodies are placing greater emphasis on the use of synthetic additives, prompting producers to investigate safer, natural options. Furthermore, rules regarding the labeling of food and drink items are heightening the focus on transparency. This prompts brands to transparently list ingredients and their sources on packaging, thus promoting the addition of familiar, user-friendly preservatives.

Key Regional Takeaways:

United States Green Preservatives Market Analysis

The United States green preservatives market is currently experiencing significant growth as consumer preferences are continuously shifting toward natural, clean-label products. Consumers are increasingly seeking food, beverages, and personal care items that are free from artificial additives and preservatives, driving manufacturers to adopt naturally derived preservation solutions. This trend is aligning with the broader movement toward healthier lifestyles and sustainable consumption patterns, creating a strong demand for plant-based, fermentation-derived, and mineral-based preservatives across various industries. Food and beverage manufacturers in the U.S. are focusing on incorporating natural preservatives like rosemary extract, citric acid, and essential oils to maintain product freshness while appealing to health-conscious consumers. The popularity of organic acids, such as lactic acid and ascorbic acid, is growing rapidly due to their dual role in improving safety and enhancing flavor. At the same time, plant-based preservatives like green tea extract and vinegar are gaining traction for their ability to provide antimicrobial and antioxidant benefits without altering the taste or nutritional profile of products. This is particularly evident in the rising adoption of natural solutions for beverages, snacks, and ready-to-eat meals. The regulatory environment in the US is also playing a key role in driving the adoption of green preservatives. The Food and Drug Administration (FDA) is encouraging the use of safe, "generally recognized as safe" (GRAS) ingredients, prompting manufacturers to replace synthetic chemicals with natural alternatives. Companies are also responding to increasing pressure for ingredient transparency by prioritizing clean, easily recognizable labels, which is boosting the use of green preservatives like vinegar, salt, and plant extracts.

Europe Green Preservatives Market Analysis

The green preservatives market in Europe is currently growing rapidly as user demand for clean-label, natural, and sustainable products continues to rise. Individuals across the region are increasingly prioritizing health-conscious choices and showing a preference for products that contain natural ingredients free from synthetic additives. This trend is influencing manufacturers in the food, beverage, cosmetics, and pharmaceutical industries to replace traditional chemical preservatives with natural alternatives such as plant extracts, organic acids, and fermentation-derived compounds. Food and beverage companies in Europe are focusing on using natural preservatives like rosemary extract, citric acid, and essential oils to enhance shelf life while maintaining product quality. These preservatives are being widely adopted in categories such as dairy products, baked goods, and ready-to-eat meals, as well as in beverages like fruit juices and plant-based drinks. The use of organic acids, such as lactic acid and acetic acid, is becoming more common due to their ability to inhibit microbial growth while preserving the natural taste and texture of products. At the same time, essential oils like thyme, clove, and oregano are gaining popularity for their antimicrobial and antioxidant properties, particularly in clean-label food formulations.

Asia Pacific Green Preservatives Market Analysis

The green preservatives market in the Asia-Pacific region is currently expanding as consumers across the region are increasingly demanding healthier and more natural products. Rising awareness about the harmful effects of synthetic additives is driving a shift toward clean-label food, beverages, cosmetics, and pharmaceutical products. This shift is influencing manufacturers to prioritize natural preservatives such as plant extracts, organic acids, and fermentation-based solutions to cater to the growing demand for sustainable and chemical-free options. In the food and beverage industry, companies in Asia-Pacific are focusing on integrating natural preservatives like citric acid, vinegar, and essential oils into their products to enhance shelf life while maintaining safety and quality. The use of green tea extract, rich in antioxidants, is growing in popularity due to its dual role as a preservative and a health-boosting ingredient, especially in beverages such as teas, juices, and plant-based drinks. Similarly, rosemary extract and turmeric are increasingly being used for their antimicrobial and antioxidant properties in packaged and ready-to-eat foods, aligning with the region’s preference for functional and natural ingredients.

Latin America Green Preservatives Market Analysis

The green preservatives market in Latin America is currently growing as consumers in the region are becoming more aware of the health risks associated with synthetic additives and are seeking natural, clean-label alternatives. This shift in consumer behavior is pushing manufacturers to adopt natural preservatives derived from plants, organic acids, and fermentation processes to meet the rising demand for healthier and more sustainable products. The trend is particularly strong in the food and beverage sector, where companies are reformulating products to align with evolving consumer preferences for transparency and safety.

Middle East and Africa Green Preservatives Market Analysis

The green preservatives market in the Middle East and Africa is currently growing as consumer awareness about the health and environmental impact of synthetic additives continues to rise. Increasing demand for clean-label, natural, and organic products is pushing manufacturers to adopt plant-based and sustainable preservation solutions. This trend is particularly prominent in food, beverages, and personal care products, where consumers are seeking healthier and safer options that align with their cultural preferences for natural ingredients.

Analysis Covered Across Each Country:

- Historical, current, and future market performance

- Historical, current, and future performance of the market based on type and end use industry.

- Competitive landscape

- Government regulations

Competitive Landscape:

Major market players are presently employing various strategies to reinforce their standing, improve their products, and take advantage of the increasing demand for natural and sustainable preservatives. These firms are concentrating on innovation, teamwork, regional growth, and funding in research and development (R&D) to satisfy the demands of consumers and sectors looking for healthier and environmentally friendly substitutes to synthetic additives. One of the key approaches adopted by leading firms is the ongoing investment in research and development to develop more efficient and adaptable green preservatives. Businesses are creating innovative technologies to enhance the stability, effectiveness, and scalability of natural preservatives, guaranteeing their performance is comparable to synthetic alternatives in antimicrobial and antioxidant characteristics. For example, they are utilizing encapsulation technologies to improve the stability of plant-derived preservatives such as essential oils and antioxidants, enabling these substances to retain their effectiveness for longer durations and in different processing environments. Moreover, R&D initiatives aim to discover new natural sources of preservatives, including bioactive compounds derived from algae, herbs, and fermentation methods, to expand product selections. In 2024, BASF SE launched its latest ingredient Emulgade® Verde 10 OL (INCI: Polyglyceryl-10 Oleate) which targets various emerging trends in the personal care sector. It can act as a one-time natural emulsifier for sprayable emulsions such as sun care sprays.

The report provides a comprehensive analysis of the competitive landscape in the green preservatives market with detailed profiles of all major companies, including:

- BASF SE

- Corbion N.V.

- DSM-Firmenich

- Givaudan

- International Flavors & Fragrances Inc.

- Kemin Industries, Inc

- Kerry Group plc

- Lanxess AG

- Symrise

Analysis Covered for Each Player:

- Market Share

- Business Overview

- Products Offered

- Business Strategies

- SWOT Analysis

- Major News and Events

Latest News and Developments:

- November 2024: Corbion N.V. announced its plan of presenting its latest nature-based preservative innovations at the Food Ingredients Europe. These preservatives can be tailored to the needs of meat, poultry, and plant-based alternatives.

- October 2024: Amerex launched a range of natural preservatives in its Biamex range. This latest innovation aims to prolong the expiration date of products nearing their best before date, offering enhanced defense against Listeria and stopping heterofermentation.

- September 2024: Syensqo introduced Riza, a natural, non-GMO preservative derived from rosemary, aimed at enhancing the shelf life and quality of food products such as meat, bakery items, and pet foods. The launch follows Syensqo’s acquisition of Moroccan rosemary extraction company Azerys, allowing them to offer sustainable, plant-based solutions for the growing demand for natural preservatives. Riza’s high carnosic acid content helps preserve food by stabilizing flavor, color, and nutritional value.

- April 2024: Activon launched Activonol Green-Hinocare, a natural preservative derived from Hinoki Cypress tree extract. This eco-friendly ingredient, utilizing hinokitiol, provided excellent preservative efficacy across a wide pH range, with additional antibacterial and skin-safe properties.

Green Preservatives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural Preservatives, Organic Acid, Essential Oil, Others |

| End Use Industries Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Corbion N.V., DSM-Firmenich, Givaudan, International Flavors & Fragrances Inc., Kemin Industries, Inc., Kerry Group plc, Lanxess AG, Symrise, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the green preservatives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global green preservatives market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the green preservatives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Green preservatives are naturally derived substances, such as plant extracts, organic acids, and essential oils, used to extend the shelf life of food, beverages, cosmetics, and pharmaceuticals. These preservatives prevent spoilage caused by microbial growth and oxidation while aligning with consumer demand for clean-label, non-toxic, and eco-friendly products.

The global green preservatives market was valued at USD 1.18 Billion in 2024.

IMARC estimates the global green preservatives market to exhibit a CAGR of 8.70% during 2025-2033.

The market is being driven by rising consumer demand for clean-label and sustainable products, growing awareness of the health risks associated with synthetic additives, and stricter regulatory guidelines promoting the use of non-toxic, naturally derived ingredients across food, beverages, cosmetics, and pharmaceuticals.

In 2024, natural preservatives represented the largest segment by type, driven by increasing consumer preference for clean-label products and the availability of sustainable preservation solutions.

Food and beverages lead the market by end-use industry owing to the growing demand for chemical-free, natural preservation solutions that ensure product safety and shelf stability while supporting sustainability.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global green preservatives market include BASF SE, Corbion N.V., DSM-Firmenich, Givaudan, International Flavors & Fragrances Inc., Kemin Industries, Inc., Kerry Group plc, Lanxess AG, Symrise, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)